Discover and read the best of Twitter Threads about #Forex

Most recents (24)

This is one of my favorite #forex and day trading patterns (I also use in stocks).

It occurs nearly every day on the 1-minute chart and it often occurs multiple times within a 1.5 to 2-hour time period (or however long you opt to #daytrade).

Get in and Get Out.

Learn it 👇

It occurs nearly every day on the 1-minute chart and it often occurs multiple times within a 1.5 to 2-hour time period (or however long you opt to #daytrade).

Get in and Get Out.

Learn it 👇

I call these RTs or RBs, which stands for Rounded Top and Rounded Bottom. The pattern requires specific criteria, but if you practice them, you'll see them almost every day.

I daytrade them on the 1-minute chart, but I also trade them on other time frames and various markets...

I daytrade them on the 1-minute chart, but I also trade them on other time frames and various markets...

First, let's look at the patterns, and then I'll provide some context as to when to trade them, when not to, position-sizing, leverage, and other details...

#Genius #MasterStroke 81,000 Cr LOSS/yr

CANNOT MAKE THIS SHIT UP!

Govt Introduces a #POLICY estm to SAVE Rs 36,000 Cr/Yr in #Forex

BUT To SAVE Rs 36000 Crore, the Govt & Indian Public are SPENDING 300% or 117000 Crores more 😳

= 81,000 Cr LOSS/yr

#Thread on A #MasterStroke

CANNOT MAKE THIS SHIT UP!

Govt Introduces a #POLICY estm to SAVE Rs 36,000 Cr/Yr in #Forex

BUT To SAVE Rs 36000 Crore, the Govt & Indian Public are SPENDING 300% or 117000 Crores more 😳

= 81,000 Cr LOSS/yr

#Thread on A #MasterStroke

#Modinomics decided in 2020/21 to Introduce the 20% #Ethanol Blending (Petrol) Policy.

Intention of the Policy designed by the @NITIAyog was to save India Rs36,000 in FOREX & help the Environment

Link to the document niti.gov.in/sites/default/…

Intention of the Policy designed by the @NITIAyog was to save India Rs36,000 in FOREX & help the Environment

Link to the document niti.gov.in/sites/default/…

ICT Silver Bullet 2023 GEM

Live examples 🧵

#ict #silverbullet #nwog #ndog #forextrading #forextrader #indices

Live examples 🧵

#ict #silverbullet #nwog #ndog #forextrading #forextrader #indices

The CPR is a popular intraday indicator that traders use daily.

A thread 🧵 on CPR trading strategy.

TG: t.me/thetradingcirc…

Retweet ♻ if you find it useful

Course Worth: 20-25K

@Stocktwit_IN @kuttrapali26 @KommawarSwapnil @caniravkaria

#StockMarket #nifty #forex

A thread 🧵 on CPR trading strategy.

TG: t.me/thetradingcirc…

Retweet ♻ if you find it useful

Course Worth: 20-25K

@Stocktwit_IN @kuttrapali26 @KommawarSwapnil @caniravkaria

#StockMarket #nifty #forex

📍What is CPR?

The Central Pivot Range is widely known as CPR. Traders can use it for intraday, swing, or positional trading

The CPR levels help traders to foresee the movements in stock prices & to predict the trend and also provide us with major support and resistance levels

The Central Pivot Range is widely known as CPR. Traders can use it for intraday, swing, or positional trading

The CPR levels help traders to foresee the movements in stock prices & to predict the trend and also provide us with major support and resistance levels

📍How is CPR calculated?

The three levels of the CPR indicator and the formula for calculating them are listed below.

Pivot point = (High + Low + Close) / 3

Top Central Pivot Point (TC) = (Pivot – BC) + Pivot

Bottom Central Pivot Point (BC) = (High + Low) / 2

The three levels of the CPR indicator and the formula for calculating them are listed below.

Pivot point = (High + Low + Close) / 3

Top Central Pivot Point (TC) = (Pivot – BC) + Pivot

Bottom Central Pivot Point (BC) = (High + Low) / 2

Asian & London Session Will can help you to prepare for the New York session.

> If Asian Session is Ranging then London will be Manipulating and New York Will be expansion (Reversal)

Thread 🧵

> If Asian Session is Ranging then London will be Manipulating and New York Will be expansion (Reversal)

Thread 🧵

> If Asian Session is Expansion then London will be consolidation and New York Will be Continuation of Asian

> If Asian Session is accumulating then London will be Expansion and New York Will be Consolidation

> If Asian Session is accumulating then London will be Expansion and New York Will be Consolidation

1/ Hey frends! Have you heard the news? @PythNetwork is now officially live on the @injective #mainnet, bringing a whole new level of possibilities for #dApps and the #Injective community!

Let's dive into what this integration means and how it impacts the world of #DeFi🌐

#INJ

Let's dive into what this integration means and how it impacts the world of #DeFi🌐

#INJ

2/

Pyth is an #oracle network that revolutionizes the way real-world data is brought #onchain

Through its innovative low-latency pull oracle design, Pyth publishes continuous real-world #data, inc. prices, for various markets spanning equities, #commodities, forex pairs & #crypto

Pyth is an #oracle network that revolutionizes the way real-world data is brought #onchain

Through its innovative low-latency pull oracle design, Pyth publishes continuous real-world #data, inc. prices, for various markets spanning equities, #commodities, forex pairs & #crypto

3/

With this integration, #Injective #dApps now have seamless access to #Pyth's #onchain #data, empowering #developers and users alike to leverage real-world #asset information within the #blockchain environment. This is a game-changer for Injective's #ecosystem! 🆙

With this integration, #Injective #dApps now have seamless access to #Pyth's #onchain #data, empowering #developers and users alike to leverage real-world #asset information within the #blockchain environment. This is a game-changer for Injective's #ecosystem! 🆙

Levels to be aware of for a bounce are:

164.97354

163.672682

163.301436

TP stands at 162.265

#GBPJPY

#trading #forex #stocks #market

164.97354

163.672682

163.301436

TP stands at 162.265

#GBPJPY

#trading #forex #stocks #market

#interbank_open

4/Apr/2023

10:20 am

@usd_pkr

#USD_PKR #daily_update

#Pakistan #CurrencyWatchlist #live #Trading #ExchangeRate #USDPKR #Dollar $ #Rupee #forex #KSE100 #pkr #interbank

#انٹربینک

286.20

4/Apr/2023

10:20 am

@usd_pkr

#USD_PKR #daily_update

#Pakistan #CurrencyWatchlist #live #Trading #ExchangeRate #USDPKR #Dollar $ #Rupee #forex #KSE100 #pkr #interbank

#انٹربینک

286.20

287.75

288

+3

+3

#interbank_open

3/Apr/2023

9:50 am

@usd_pkr

#USD_PKR #daily_update

#Pakistan #CurrencyWatchlist #live #Trading #ExchangeRate #USDPKR #Dollar $ #Rupee #forex #KSE100 #pkr #interbank

#انٹربینک

283.70

3/Apr/2023

9:50 am

@usd_pkr

#USD_PKR #daily_update

#Pakistan #CurrencyWatchlist #live #Trading #ExchangeRate #USDPKR #Dollar $ #Rupee #forex #KSE100 #pkr #interbank

#انٹربینک

283.70

284.50

Change +0.50

Are you a profitable #trader but struggle with low account balance? Prop firms are the way to go! But since there is so many out there to pick from I decided to give you my top 4 list with positives and negatives. Let's start! #forex #propfirm #funded

True Forex funds

Positives:

Best spreads in the game

Reliable payouts

Free retry

Offers crypto & fx

Incredible customer support

Lower profit target compared to many firms

Allows

Negatives:

Smaller accounts are more expensive then some firms

Link:

trueforexfunds.com/#a_aid=11554

Positives:

Best spreads in the game

Reliable payouts

Free retry

Offers crypto & fx

Incredible customer support

Lower profit target compared to many firms

Allows

Negatives:

Smaller accounts are more expensive then some firms

Link:

trueforexfunds.com/#a_aid=11554

2 FTMO

Positives:

Good spreads but not as good as True forex funds

One of the oldest firms

Even paid out $1m+

Good customer support

Scaling up to $2m

Negatives:

More expensive than other firms

Higher profit target

Link:

ftmo.com

Positives:

Good spreads but not as good as True forex funds

One of the oldest firms

Even paid out $1m+

Good customer support

Scaling up to $2m

Negatives:

More expensive than other firms

Higher profit target

Link:

ftmo.com

Beautiful Delivery on DJ in the AM session!

Market sweeps the pDH during NYKZ and where i see the Unicron model forming. That was the first entry!

Before the 9.30 open market left the FVG and created BSL. At the open Tapped in there and a quick drop to that EQLs.

Market sweeps the pDH during NYKZ and where i see the Unicron model forming. That was the first entry!

Before the 9.30 open market left the FVG and created BSL. At the open Tapped in there and a quick drop to that EQLs.

The third entry was During the Macro and you can see after taking out the 9.30 open price dropped and consolidate in the breaker block and not a single candle closed above MT. What does that mean? Quick drop right? And then directly to SSL

Forex'te neden başarı oranı bu kadar düşük?

Brokerlar neden %90 zarar eden yatırımcı bildiriyor?

Grafik, formasyon, trend, ortalamalar, indikatörler; bunları öğrenmek bu kadar zor mu?

Hayır tabii ki değil, sadece yanlış yere odaklanıyorsunuz.

+

#forex

Brokerlar neden %90 zarar eden yatırımcı bildiriyor?

Grafik, formasyon, trend, ortalamalar, indikatörler; bunları öğrenmek bu kadar zor mu?

Hayır tabii ki değil, sadece yanlış yere odaklanıyorsunuz.

+

#forex

Eğip bükmeden, lafı uzatmadan sebebini söyleyeyim:

Psikolojiniz buna müsade etmiyor.

Bilginiz, tecrübeniz size bu piyasada yüzde 20 avantaj sağlar.

Geriye kalan yüzde 80 ise: "TRADE PSİKOLOJİSİ"dir.

Bu psikolojiye sahip değilseniz yolunuzun sonu hep "TRADER DUASI"na çıkar.

+

Psikolojiniz buna müsade etmiyor.

Bilginiz, tecrübeniz size bu piyasada yüzde 20 avantaj sağlar.

Geriye kalan yüzde 80 ise: "TRADE PSİKOLOJİSİ"dir.

Bu psikolojiye sahip değilseniz yolunuzun sonu hep "TRADER DUASI"na çıkar.

+

İstediğiniz kadar grafiklere hakim olun, istediğiniz kadar yüksek yüzdeli işlemlere sahip olun, ilk ters harekette, yapacağınız belki de ilk inatta hesabınızı kucağınızda büyük bir enkaz halinde görebilirsiniz.

Forex'deki 500 kaldıraç ışık hızında yıkıma sahiptir.

+

Forex'deki 500 kaldıraç ışık hızında yıkıma sahiptir.

+

Haftasonu için VDS kiralama, MQL5 sitesi üzerinden veya harici programlarla kopyalama yapma tekniğiyle ilgili twit dizisi sözüm vardı.

Önce teknik kısmı, sonra tavsiyelerimi aktararak sözümü tutmuş olayım.

Başlıyoruz +

Önce teknik kısmı, sonra tavsiyelerimi aktararak sözümü tutmuş olayım.

Başlıyoruz +

Önceklikle ihtiyacımız olanları paylaşayım,

- VDS (aylık max 150-200 TL)

- MQL5 hesabı (bedava)

- Meta Trader 5 yazılımı (bedava)

- Forex Copier 3.0 (bedava)

- Kredi kartı (sanal da olur)

- Biraz da sabır (kimisinde pahalı)

+

- VDS (aylık max 150-200 TL)

- MQL5 hesabı (bedava)

- Meta Trader 5 yazılımı (bedava)

- Forex Copier 3.0 (bedava)

- Kredi kartı (sanal da olur)

- Biraz da sabır (kimisinde pahalı)

+

MQL5'deki kopyalama işlemlerinizde açık bir bilgisayar bulundurmak zorundasınız. Cepten olmaz.

Cep telefonu bir "web terminali" değildir.

İşlem kopyalama yeteneği yoktur.

Cep telefonunu işlem açmak ve başkasının açtığı işlemleri izlemek için kullanacağız.

+

Cep telefonu bir "web terminali" değildir.

İşlem kopyalama yeteneği yoktur.

Cep telefonunu işlem açmak ve başkasının açtığı işlemleri izlemek için kullanacağız.

+

With the US Fed & Major Central Banks increasing their interest rates across the globe, we all see notable fluctuations in forex prices before & after these major events. Forex is the most liquid market on the planet, let's discuss about what moves the currencies

#currencies

1/8

#currencies

1/8

Amongst many theories of forex pricing, the most basic & one of the earliest developed theories were the "Mint Par Theory" & "Purchasing Power Theory". Come let's explore these theories

#forex #forextrading #forexmarkets #currencies

2/8

#forex #forextrading #forexmarkets #currencies

2/8

Now, let's move on to a very interesting concept that many market participants scrutinize, the #BigmacIndex. Further, let's discuss the "Balance of Payments Theory"

#forex #forextrading #forexmarkets #currencies

3/8

#forex #forextrading #forexmarkets #currencies

3/8

I've been #daytrading the $EURUSD for 14 years.

Here are 10 key day trading insights that have kept me in the game.

Including strategies, ways to improve, position-sizing, making rapid trades on the fly, and more.

A thread👇

Here are 10 key day trading insights that have kept me in the game.

Including strategies, ways to improve, position-sizing, making rapid trades on the fly, and more.

A thread👇

1. When day trading #forex, I only trade the EURUSD.

It has enough movement, the smallest spread, and the biggest volume (which translates to less slippage on orders).

No need to waste time or effort on anything else.

Specialize and get good at one thing.

It has enough movement, the smallest spread, and the biggest volume (which translates to less slippage on orders).

No need to waste time or effort on anything else.

Specialize and get good at one thing.

2. Use an ECN broker for day trading.

The spread should be under 0.5 pips & the commissions under $5/standard lot.

$0 to $3 commissions and under 0.4 pip spread is much better.

Bigger spreads and commissions create a disadvantage...

The spread should be under 0.5 pips & the commissions under $5/standard lot.

$0 to $3 commissions and under 0.4 pip spread is much better.

Bigger spreads and commissions create a disadvantage...

If you are interested in Forex, you need to read this:

Fxview is a broker that can help you become immersed in the forex industry.

It has ethical products that will cater to the needs of new age investors and help them invest wisely with their decades worth of experience in technology and financial services.

It has ethical products that will cater to the needs of new age investors and help them invest wisely with their decades worth of experience in technology and financial services.

It offers over 500+ trading instruments including Forex, stock CFDs, crypto CFDs, commodities and indices.

Here are some of the perks that it has:

Here are some of the perks that it has:

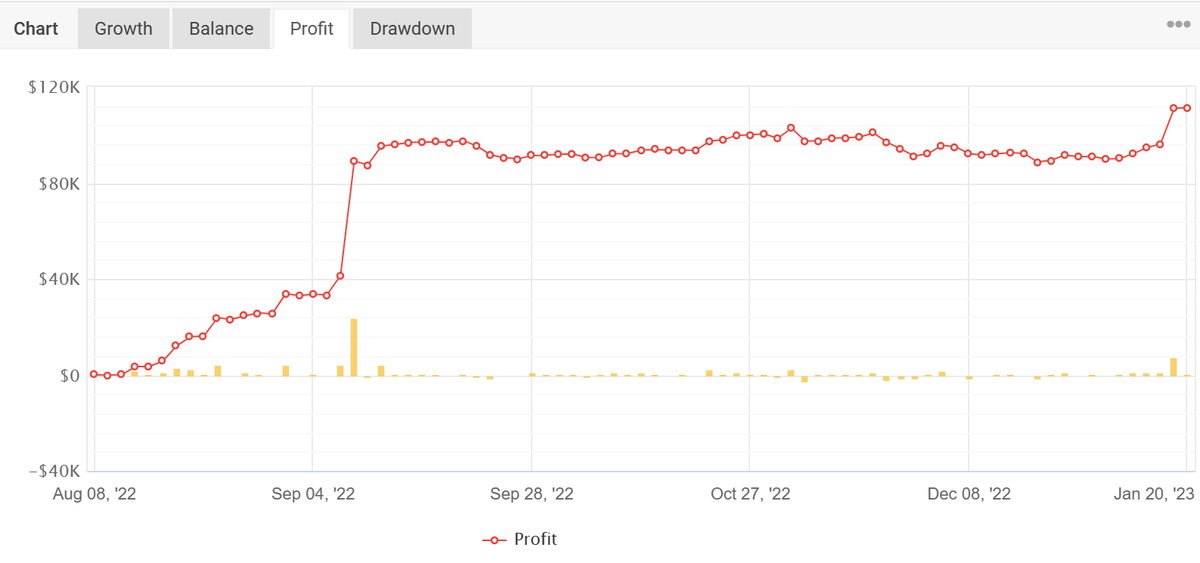

🚀Degen Strategy🚀

💰How I turned $2048 into $100,000 in 1 month, and NOT losing it all back.

👉 No bullshit, at the end of the thread, there is a link for you guys to verify trade record on @Myfxbook

🆘This is NOT AN EASY STRATEGY.🆘

#forex #crypto

💰How I turned $2048 into $100,000 in 1 month, and NOT losing it all back.

👉 No bullshit, at the end of the thread, there is a link for you guys to verify trade record on @Myfxbook

🆘This is NOT AN EASY STRATEGY.🆘

#forex #crypto

1⃣ A High Conviction View.

$DXY (USD Index) was trading around 105, a hard support, which if it holds, I have high conviction it will bounce to 110 in a short time, aka, bullish continuation bias.

With that view, I chose to short #EURUSD and Long #USDJPY

$DXY (USD Index) was trading around 105, a hard support, which if it holds, I have high conviction it will bounce to 110 in a short time, aka, bullish continuation bias.

With that view, I chose to short #EURUSD and Long #USDJPY

2⃣ Money Management (MM) is 🔑

I deposited $2048 on 08.08.2022, with that fund, I can trade up to 100 lot #EURUSD. But my trade size is only 0.1 to 0.5 lot.

First trade was a loss, neverminded, I tried again the next day and started making some small wins.

I deposited $2048 on 08.08.2022, with that fund, I can trade up to 100 lot #EURUSD. But my trade size is only 0.1 to 0.5 lot.

First trade was a loss, neverminded, I tried again the next day and started making some small wins.

EURUSD High Probability Trades - A Thread 🧵

We are going to have a look at how we can identify:

1. The correct days to look for a trade

2. The direction we should trade in

3. Where to look for entries on a set and forget basis

4. Where to look for the high r/r trades

#eurusd

We are going to have a look at how we can identify:

1. The correct days to look for a trade

2. The direction we should trade in

3. Where to look for entries on a set and forget basis

4. Where to look for the high r/r trades

#eurusd

The Rupee is in a free fall against the US Dollar.

However, the RBI is intervening to cushion INR's fall.

Ever wonder how the RBI does it?

Let's learn it here:

#USDINR #USD #forex #India #Rupee

However, the RBI is intervening to cushion INR's fall.

Ever wonder how the RBI does it?

Let's learn it here:

#USDINR #USD #forex #India #Rupee

First, let's understand why RBI intervenes to defend the rupee in the first place.

A weak currency worsens our fiscal deficit, fuels inflation and slows down international trade.

Clearly, RBI has a mandate to improve the situation on behalf of the GoI and the citizens of India.

A weak currency worsens our fiscal deficit, fuels inflation and slows down international trade.

Clearly, RBI has a mandate to improve the situation on behalf of the GoI and the citizens of India.

Forex market is highly volatile and a breeding ground for speculators. This is why the FX market is the most liquid in the world with around $7.5 trillion (with a T!) in daily turnover.

So, RBI has to control speculation in the USDINR segment to ensure stability of the Rupee.

So, RBI has to control speculation in the USDINR segment to ensure stability of the Rupee.

The US Dollar stands at INR 82.82 as of today.

Ever wonder why the Rupee always depreciates against the Dollar?

Let’s find out in a 🧵:

#USD #Dollar #forex #investing

Ever wonder why the Rupee always depreciates against the Dollar?

Let’s find out in a 🧵:

#USD #Dollar #forex #investing

One of the major reasons for INR depreciation is India’s massive exposure and dependence on one single commodity:

OIL.

Almost 70% of our imports in value is just crude oil, as we’re the third-largest consumer globally.

There are two ways this affect our economy and currency.

OIL.

Almost 70% of our imports in value is just crude oil, as we’re the third-largest consumer globally.

There are two ways this affect our economy and currency.

1. Global crude oil market is denominated in USD.

This means we have to sell INR to buy USD in the Forex market first, and then pay the same to OPEC to import oil.

As demand for USD rises, and supply being controlled by The Fed, its value too rises against the INR.

#oilprices

This means we have to sell INR to buy USD in the Forex market first, and then pay the same to OPEC to import oil.

As demand for USD rises, and supply being controlled by The Fed, its value too rises against the INR.

#oilprices

🧵 Before I traded #crpyto I traded #forex (poorly).

Exploring deploying my algos on on-chain forex and discovered @handle_fi

The pitch: the global #DeFi forex protocol to trade/convert/borrow multi-currency #stablecoins backed by #ETH and more.

On #Arbitrum (💙,🧡 ) 1/18

Exploring deploying my algos on on-chain forex and discovered @handle_fi

The pitch: the global #DeFi forex protocol to trade/convert/borrow multi-currency #stablecoins backed by #ETH and more.

On #Arbitrum (💙,🧡 ) 1/18

💱 With Handle, users can leverage trade, swap, borrow, and earn from multi-currency stablecoins they call fxTokens.

fxTokens are collateral backed #stablecoins soft pegged to a range of currencies like the $AUD (fxAUD), $GBP (fxGBP), $CAD (fxCAD) and others. 2/18

fxTokens are collateral backed #stablecoins soft pegged to a range of currencies like the $AUD (fxAUD), $GBP (fxGBP), $CAD (fxCAD) and others. 2/18

💱 I like forex as it is highly liquid and offers untapped crossover opportunity for #DeFi.

On average $6.6T trades daily on the global forex market. $30B faily volume on #stablecoins

But DeFi has little issuance of other decentralized stablecoin currencies besides $USD. 3/18

On average $6.6T trades daily on the global forex market. $30B faily volume on #stablecoins

But DeFi has little issuance of other decentralized stablecoin currencies besides $USD. 3/18

Fon yönetiminde kullandığım R/R için bir yazı paylaşacağımı söylemiştim. Kimsenin anlamayacağı garip kelimelerden oluşan bir flood yerine, sade görsel olarak paylaşmayının daha uygun olacağını düşündüm. Benimsediğim sistem tam olarak bu, şimdi ufak detaylarını anlatacağım.

Öncelikle sistemi anlatan görseli 10.000$'lık bir @FTMO_com fon kurallarına göre hazırladığımı belirteyim. Şimdi geri kalan detayları anlatacağım kısımlara geçebiliriz.

Fon yönetirken en önemli detay bu nokta❗️Sizin bakiyeniz aslında fon boyutunuz değil, size tanınan günlük ve aylık maksimum kayıp sınırlarınız. Kendimize öyle bir sistem kurmamız gerekiyor ki, ayın her günü işlem açsak dahi fonu kaybetmemek gerekiyor.

Herkese merhaba, sizlerle fon firmalarından alınan hesapları yönetirken yapılan bazı hatalardan bahsetmek istiyorum. Bu detayları atlamadan yönetilen fonların başarı olasılığı genel olarak daha yüksek olmakla beraber risk algısı daha net anlaşılır oluyor.