Discover and read the best of Twitter Threads about #PBOC

Most recents (24)

1/15: I was recently called a “China Macro Tourist”, so I decided to do the following and give a chance to everyone to find out about China’s Macro reality for themselves.

Since the best way of learning is by doing, I will set a few questions so that everyone who doubts to find… twitter.com/i/web/status/1…

Since the best way of learning is by doing, I will set a few questions so that everyone who doubts to find… twitter.com/i/web/status/1…

2/15 a: We start from the GDP: China’s GDP is an input number and not an output figure like in Western economies. National accounts are based on data collected by local governments, which are rewarded for meeting growth targets; hence, local governments are incentivised to skew… twitter.com/i/web/status/1…

2/15 b: The Brookings Institution, in a research paper published in March 2019, estimated that China's GDP growth from 2008-2016 could be 1.7% (annually) lower than publicly acknowledged. I am confident China did not stop there. What happens if China’s GDP is 20% lower than most… twitter.com/i/web/status/1…

LA NUEVA MONEDA DIGITAL DE CHINA (DCEP):

Digital Currency For Electronic Payment. El Yuan Digital emitido por el Banco Popular de China (PBoC).

¿Qué es? ¿Cuál es su propósito? ¿Qué tanto ha avanzado?

¿Qué tiene de malo o bueno?

#PBOC #eRMB #DCEP #eRMB #CBDC

[Hilo] 🧵

1/12

Digital Currency For Electronic Payment. El Yuan Digital emitido por el Banco Popular de China (PBoC).

¿Qué es? ¿Cuál es su propósito? ¿Qué tanto ha avanzado?

¿Qué tiene de malo o bueno?

#PBOC #eRMB #DCEP #eRMB #CBDC

[Hilo] 🧵

1/12

China venía trabajando bajo perfil en esta moneda desde el 2014, pero fue en el 2020 que oficialmente lanzaron la noticia y que estaría anclada 1:1 con el Renminbi/Yuan.

No es una moneda estable y mucho menos una criptomoneda, si no una Central Bank Digital Currency CBDC.

2/12

No es una moneda estable y mucho menos una criptomoneda, si no una Central Bank Digital Currency CBDC.

2/12

No es una criptomoneda porque aunque está basada en una combinación de tecnologías digitales con criptografia, es 100% centralizada. Viene siendo algo así como el fracasado #Petro, pero más organizado y sofisticado.

Por cierto, el Petro no es una criptomoneda ni de cerca.

3/12

Por cierto, el Petro no es una criptomoneda ni de cerca.

3/12

Many have asked us to step in to clarify what's really going on across #China's faltering economy.

As @michaelxpettis notes, the critical issue is "stimulus" vs loan demand.

But @ChinaBeigeBook data over past 6+ mos show there is much more here than meets the eye.

*THREAD*

1/

As @michaelxpettis notes, the critical issue is "stimulus" vs loan demand.

But @ChinaBeigeBook data over past 6+ mos show there is much more here than meets the eye.

*THREAD*

1/

For virtually all of 2021, credit was extremely tight, w/uptake at corporates at, or hovering near, all-time @ChinaBeigeBook lows. Combination of constricted [govt dictated] supply & putrid levels of loan demand.

2/

bloomberg.com/news/articles/…

2/

bloomberg.com/news/articles/…

Very end of '21 we saw a curious change in the data.

While borrowing remained tight & firms STILL not applying for new loans, our pent-up loan demand gauges started to rise. 4 straight months into April, loan demand rose...meaningfully.

3/

While borrowing remained tight & firms STILL not applying for new loans, our pent-up loan demand gauges started to rise. 4 straight months into April, loan demand rose...meaningfully.

3/

🇨🇳 #NPC Meeting Debrief (1) | The 5.5% GDP target (upper range of expectations) signals an intent to limit downward pressures from the #property slump, zero-#Covid strategy and #Ukraine war (affecting foreign demand).

*Note: China 2021 GDP growth was 8.1%

*Note: China 2021 GDP growth was 8.1%

🇨🇳 #NPC Meeting Debrief (2) | The fact that officials opted for the upper range of expectations looks very encouraging.

*There is a significant risk of missing this goal the year of Xi re-election.

*There is a significant risk of missing this goal the year of Xi re-election.

🇨🇳 #NPC Meeting Debrief (3) | The fiscal support could be much stronger than indicated by the headlines as the government will use unused resources from last year (above-budget income as well as below-budget spending)

*Link: bit.ly/3sHrZZL

*Link: bit.ly/3sHrZZL

🇨🇳Key takeaways of 2022 #China Government Work Report:

🔸2022 GDP growth target at about 5.5%

🔸2022 CPI growth target at about 3%

🔸Budget deficit at 2.8% of GDP vs 3.2% 2021

🔸Add 11 million urban jobs in 2022 vs 11 mln 2021.

🔸Plans 3.65 tln yuan special gov bond sales

1/n

🔸2022 GDP growth target at about 5.5%

🔸2022 CPI growth target at about 3%

🔸Budget deficit at 2.8% of GDP vs 3.2% 2021

🔸Add 11 million urban jobs in 2022 vs 11 mln 2021.

🔸Plans 3.65 tln yuan special gov bond sales

1/n

🔸2022 surveyed jobless rate at within 5.5%

🔸Ensure grain and energy securities

🔸Strengthen prudent monetary policy #PBOC

🔸Tax cut and rebate at 2.5 tln yuan

🔸To use reserves policy tools in time

🔸To stabilize land and home price

🔸Yuan to be kept basically stable $CNY

2/n

🔸Ensure grain and energy securities

🔸Strengthen prudent monetary policy #PBOC

🔸Tax cut and rebate at 2.5 tln yuan

🔸To use reserves policy tools in time

🔸To stabilize land and home price

🔸Yuan to be kept basically stable $CNY

2/n

🔸Maintains current wording on monetary and fiscal policies

🔸To set up a financial stability guarantee fund

🔸More than 2 trillion yuan of fiscal spending in 2022 vs 2021

🔸To ensure supply chain safe and stable

🔸Risks and challenges for development rise significantly

3/n 🇨🇳

🔸To set up a financial stability guarantee fund

🔸More than 2 trillion yuan of fiscal spending in 2022 vs 2021

🔸To ensure supply chain safe and stable

🔸Risks and challenges for development rise significantly

3/n 🇨🇳

China equities: A look under the hood (thread)

Monetary easing and rising credit impulse are positive for equities. Valuations are low but technicals

mixed.

Key drags incl Common Prosperity/Internet regulations on $MCHI (not econ) and #Fed hikes.

#China

h/t @jpmorgan

1/

Monetary easing and rising credit impulse are positive for equities. Valuations are low but technicals

mixed.

Key drags incl Common Prosperity/Internet regulations on $MCHI (not econ) and #Fed hikes.

#China

h/t @jpmorgan

1/

Past instances of monetary easing and broad credit growth were positive for equities and economy.

No longer as crystal clear for equities with Common Prosperity "guidance" on index heavy-weight

Internet/tech sector - 32% in just top 10 of $MCHI.

h/t @jpmorgan @iShares

2/

No longer as crystal clear for equities with Common Prosperity "guidance" on index heavy-weight

Internet/tech sector - 32% in just top 10 of $MCHI.

h/t @jpmorgan @iShares

2/

Regulatory tightening on Internet/tech continues, with the eventual scale and timeline is unknown.

Privately-owned enterprises (POE) in social

sectors, which includes Internet/tech, are of highest risk.

wsj.com/articles/meitu…

h/t @GoldmanSachs

3/

Privately-owned enterprises (POE) in social

sectors, which includes Internet/tech, are of highest risk.

wsj.com/articles/meitu…

h/t @GoldmanSachs

3/

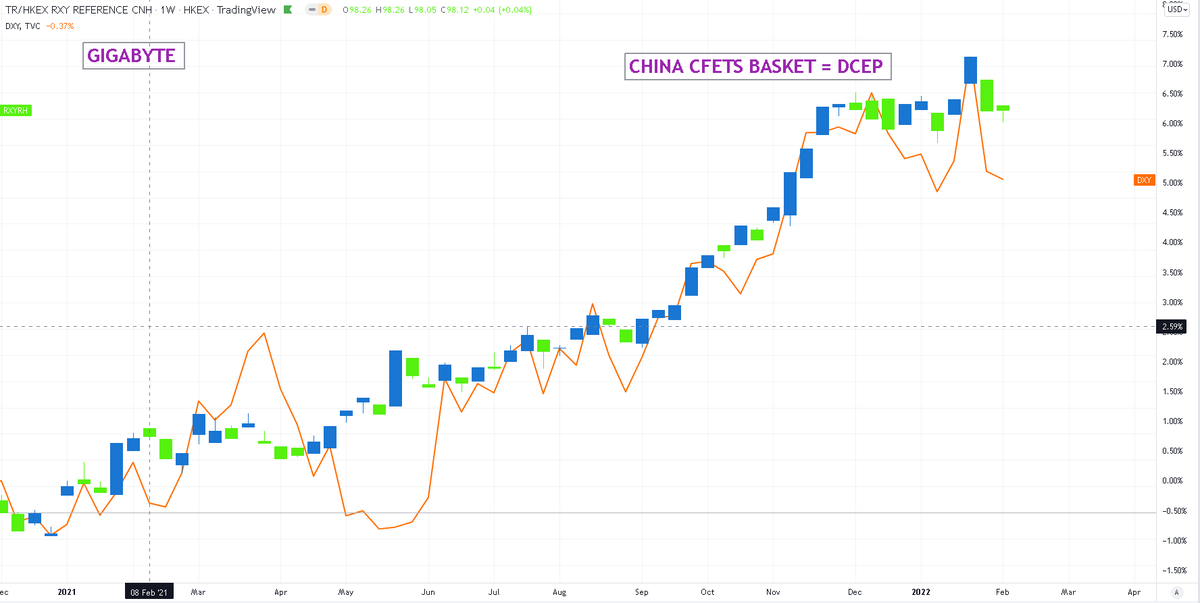

WEAK DOLLAR KEY

last Friday, China launched DCEP, ECB turned hawkish. Add rocketing US rates driven by huge NDP, AHE & CPI, Yet #Dollar down*. We know a weaker dollar is supportive 'risk'. IMV its driven by #PBOC selling dollars. China's #CFETS basket at 2 Year highs correlates

last Friday, China launched DCEP, ECB turned hawkish. Add rocketing US rates driven by huge NDP, AHE & CPI, Yet #Dollar down*. We know a weaker dollar is supportive 'risk'. IMV its driven by #PBOC selling dollars. China's #CFETS basket at 2 Year highs correlates

🇨🇳 #China #Macro Update (1) | Economic data point to a slowdown and even a contraction in several sectors in November.

*Restrictions linked to #Covid_19 affected activity (same as August) as suggested by Airportia data.

*Link: bit.ly/3CUNAjo

*Restrictions linked to #Covid_19 affected activity (same as August) as suggested by Airportia data.

*Link: bit.ly/3CUNAjo

🇨🇳 #China #Macro Update (2) | On a YoY basis, the expected slowdown in Nov. could be amplified by a calendar effect given that October figures were artificially boosted by one more business day (compared to Oct. 2020).

🇨🇳 #China #Macro Update (3) | On the positive side, over the quarter, the bottom is probably behind us as the latest #Covid_19 wave seems to be under control.

*Link: bloom.bg/3r6hcIe

*Link: bloom.bg/3r6hcIe

Narrative No. 1: Behind every China celebrity scandal, there is an unsavory social news(perhaps the peasant killing a neighbor's family news?) from which attention needs to be diverted.

Don't know whether that is true, but widely believed, or joked.

Don't know whether that is true, but widely believed, or joked.

Narrative No. 2: #PBOC never wants to be seen doing bidding of the market. If the market calls for a RR/rate cut, it will not, as long as annual growth >5%. That's why all big heads say there is enough liquidity for real estate sector.

Again, narrative, hard to backtest though.

Again, narrative, hard to backtest though.

Narrative No 3: If English news says Xi facing resistance in implementing property tax/policies, good indicator these policies are coming.

Again, narrative economics that can't be backtested.

Again, narrative economics that can't be backtested.

1. A thread on three #PBOC 2021 Q2 Macro sentiment surveys from Bankers (Sample 3200), Industrial Companies (5000) and Urban Bank Customers (20,000). Surveys data are considered less informative and need to be heavily discounted, but could be complimentary to other data source.

1/12 A thread on #ANT and how to read #China #PBOC Governor speech on Fintech(#ANT) yesterday. The headline says only FinTech, but Wink Wink, ANT is all over. Get strapped because I will sprinkle some wide guesses and rumors in the end. pbc.gov.cn/goutongjiaoliu…

2/12 My quick take on Fintech (Ant) SINS: 1. Monopoly power 2. Winner takes all 3. Payment system seeping into finance, insurance, small loan and asset mgt. 4. FIN must be separated from Tech, Payment from FIN. 5. Data Security 6. Global Coop on Fintech regulation

3/12 Points 3, 4, 5 has been addressed! I'v written on ANT credit scoring JV+ SASAC take stakes in the three private credit scoring companies. And Alipay has been ordered to be separated from financial services, because FinTech is more Finny than Techy!

1/5 #China YOY Aug #retail #sales actual 2.5% vs expected7.4%. Said repeatedly here/clients that growth is the No. 1 risk but everyone loves to talk Regulation/ WAR. Going forward, count on continued monetary support #PBOC, #growth could even surprise on the positive side soon.

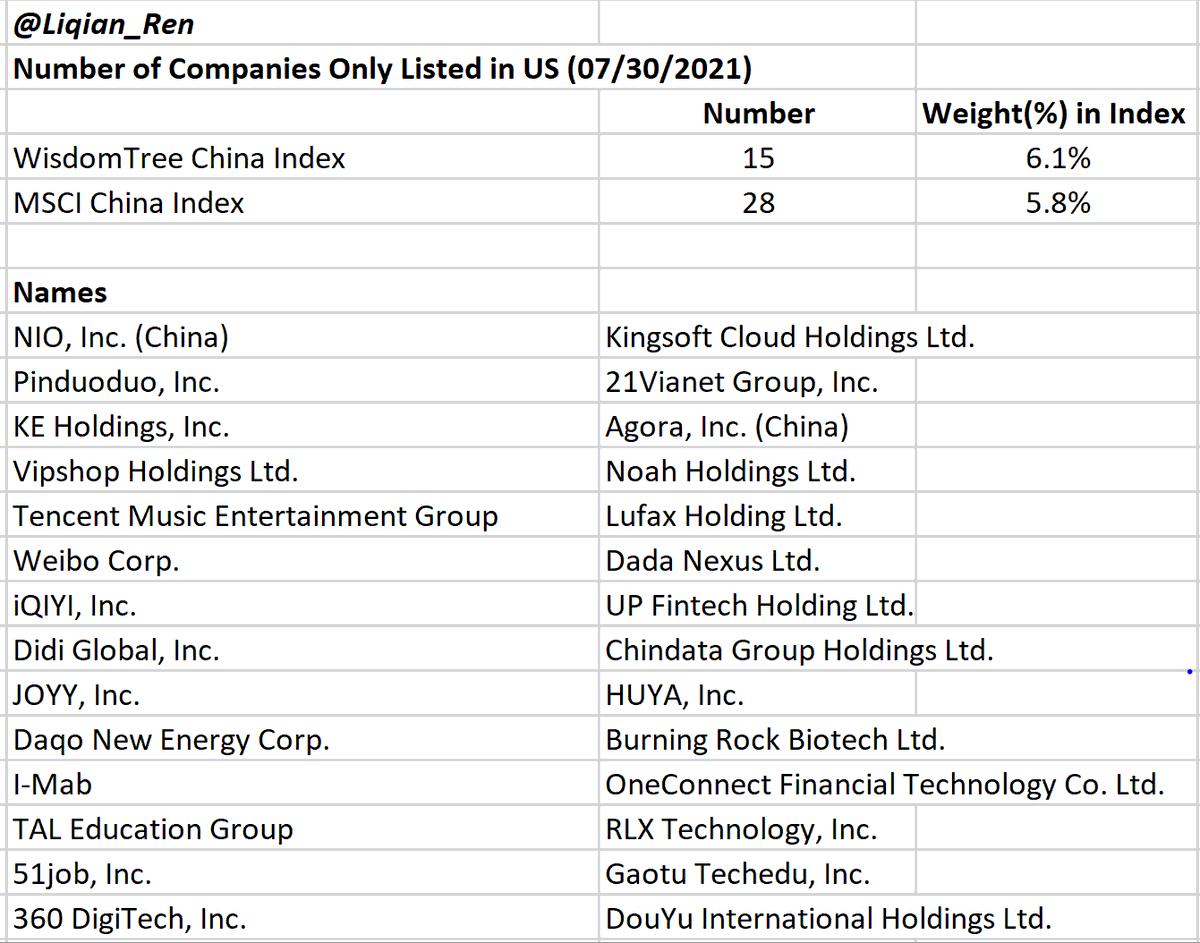

2/5 About Delisting risk, did you know that among large/mid BROAD #China universe, only about 6%, or 28 companies that are only listed in the US, after a barrage of companies like @NetEase_Global dual listed in HK? Below is the details. The key is Broad Universe, of course.

3/5 Hard to write something that has shelf life. The focus of future is really HK EX and Shanghai STAR board. 1 yr later, likely 5-7 comp. would sole US listed among large/mid cap. Chinese companies know both US and China didn't want them to list in US. wisdomtree.com/blog/2020-12-1…

1/21 A long thread of local context for Ant Financials’ Credit Scoring Joint Venture and Chinese state ownership. There has been significant recent news of Chinese SOEs taking stakes in private companies. #PBOC #BABA #China #Ant #Didi #ByteDance #Hefei #ZheJiang #Evergrand

2/21 How to make sense of this trend? ONE: the government’s goal is to take enough equity to acquire a seat in the board, bail out a locally troubled company, or pure investment return, not necessarily ownership and control per se.

3/21 Taking state ownership means government needs to pony up significant capital. In BOE Tech deal, Hefei city put in more than $2 billion. It had four more investment deals with >$1 billion. Many numerous deals like PuDao Credit, the Beijing-affiliated SOE put up $52.5million.

INTERACTIVE BROKERS PUTS SOME OPTION TRADING INTO LIQUIDATION - Bloomberg

*Market participants wisely moving ahead of the regulatory sword.

Very important read, new updates here:

thebeartrapsreport.com/blog/2021/01/2…

*Market participants wisely moving ahead of the regulatory sword.

Very important read, new updates here:

thebeartrapsreport.com/blog/2021/01/2…

*ROBINHOOD RESTRICTING TRANSACTIONS FOR GME, AMC, BB, OTHERS - Bloomberg

(2)

(2)

*SENATE PANEL TO HOLD HEARING ON CURRENT STATE OF STOCK MARKET - Bloomberg

*more macropru pressure on Powell. China has more interest in systemic risk reduction than Federal Reserve right now? See #PBOC actions.

cc @steveliesman @jturek18 @GabyHeffesse

thebeartrapsreport.com/blog/2021/01/2…

*more macropru pressure on Powell. China has more interest in systemic risk reduction than Federal Reserve right now? See #PBOC actions.

cc @steveliesman @jturek18 @GabyHeffesse

thebeartrapsreport.com/blog/2021/01/2…

IMPORTANT THREAD RE: CHINA 1/n

Back in March, near the beginning of the US lockdown, I warned those predicting a US economic "supply shock," stemming the fall in exports by China not to count China out. That China would battle back with a vengeance,...

Back in March, near the beginning of the US lockdown, I warned those predicting a US economic "supply shock," stemming the fall in exports by China not to count China out. That China would battle back with a vengeance,...

2/n

...using every tool at its disposal, including currency devaluation, industrial subsidies and household support - in addition to its overwhelming attack on #COVID19. I said then that China would be playing an aggressive game of economic "catch-up. >>

...using every tool at its disposal, including currency devaluation, industrial subsidies and household support - in addition to its overwhelming attack on #COVID19. I said then that China would be playing an aggressive game of economic "catch-up. >>

3/n

And China has done exactly that, with astounding success in terms of restoring growth to its economy:

"With Covid-19 Under Control, China’s Economy Surges Ahead" reported by @KeithBradsher

>>

nyti.ms/2T8bkMG

And China has done exactly that, with astounding success in terms of restoring growth to its economy:

"With Covid-19 Under Control, China’s Economy Surges Ahead" reported by @KeithBradsher

>>

nyti.ms/2T8bkMG

Herinnert u zich nog de laatste reportage over Jemen? #niet_in_journaal #nieuwsuur #1V #OP1 #bbvpro #NPORadio1 #Yemen #civil_war uk.reuters.com/article/uk-yem…

#niet_in_journaal #nieuwsuur #1V #Op1 #bbvpro #NPOradio1 #cybersecurity #cybercrime #Slothfulmedia securityaffairs.co/wordpress/1090…

Herinnert u zich nog de laatste reportage over een militair strategische kwestie? #niet_in_journaal #nieuwsuur #1V #Op1 #bbvpro #NPOradio1 #US #Russia #China #irregular_warfare asiatimes.com/2020/10/us-pre…

China bank failure fires warning shot at financial markets

Liquidation of the municipal lender raises borrowing costs for small peers and push more of them on the brink

#Economy still wobbling, it’s a risky time to cleanse the system

#China #recession

reuters.com/article/us-chi…

Liquidation of the municipal lender raises borrowing costs for small peers and push more of them on the brink

#Economy still wobbling, it’s a risky time to cleanse the system

#China #recession

reuters.com/article/us-chi…

PBOC’s Attempt to Exit Crisis Mode Faces a $500 Billion Test

#China’s banks need $500 billion in fresh #liquidity this month to roll over existing #debt and buy government bonds, complicating the PBOC’s efforts to exit crisis measures.

#recession

bloomberg.com/news/articles/…

#China’s banks need $500 billion in fresh #liquidity this month to roll over existing #debt and buy government bonds, complicating the PBOC’s efforts to exit crisis measures.

#recession

bloomberg.com/news/articles/…

China’s central bank is buying government debt?

Clearing data suggest that central bank bought sovereign bonds. #PBOC hasn’t spelled out its intentions on government debt.

#China #recession #debt

bloomberg.com/news/articles/…

Clearing data suggest that central bank bought sovereign bonds. #PBOC hasn’t spelled out its intentions on government debt.

#China #recession #debt

bloomberg.com/news/articles/…

With a strong stimulus package and a contained virus, #China’s growth prospects for 2020 are not yet lost, said Yu Yongding via East Asia Forum:

eastasiaforum.org/2020/04/22/chi…

eastasiaforum.org/2020/04/22/chi…

In real terms, China’s 2019 #GDP was 19.7 trillion RMB in 2019 Q1 and 69.45 trillion RMB in the remaining 3 quarters. Official figures place China’s GDP at 18.4 trillion RMB in 2020 Q1.China’s GDP grew 6.1% in 2019.

Assuming that China maintains a real growth rate of 6% in the remaining 3 quarters of 2020, the annual growth rate will be about 3.2%. But the #COVID19’s unpredictability makes any economic forecasts problematic. China also has to be vigilant against a resurgence of the virus.

Silver > Gold, the beating continues, or you could say, playing “catch up.”

(3)

(3)

*JAPAN'S ABE SAYS RULING PARTY BACKS $988 BILLION STIMULUS

Boom...

Boom...

Abe to Kuroda over breakfast:

"If debt to GDP of 250% didn't work, let us try 300.."

(2)

"If debt to GDP of 250% didn't work, let us try 300.."

(2)

BOOK: Local Financial Supervision in the Era of Fintech by CF40 member Sun Guofeng, director of monetary policy department at #PBOC: mp.weixin.qq.com/s/VD6yTKgj_22h… #fintech

In this book, the author suggests:

In this book, the author suggests:

① Improve the coordination mechanism for local financial regulation, including the coordination between the central and local regulatory systems, the coordination among local financial regulators, and the coordination between fintech and traditional financial regulations.

② Clarify the responsibilities and position of local financial regulators, especially in non-traditional financial areas where fintech is widely used, so as to avoid regulatory gap and overlapping.

On Re-starting RMB Internationalization by Guo Kai from the #PBOC, in which he addresses why it is required by #China’s high-quality development goal, and its relationship with capital account opening: cf40.org.cn/uploads/newsle…

RMB internationalization and the orderly opening of the capital account can go hand in hand. The fluctuation of capital flows was not caused by the internationalization of RMB, but the tension within the policy framework.

The key to capital account liberalization is to implement unified management of domestic and foreign currencies and short-term capital flow.

Central banks should further coordinate and cooperate to tackle challenges brought by the rise of digital currencies, impact of cross-border capital flows, and spillover effects of monetary policy of one country, said former #PBOC governor Zhou Xiaochuan: mp.weixin.qq.com/s/rzlaDJqp4GjZ…

Most digital currencies were initially designed to address weaknesses in global financial infrastructure, especially in cross-border payments, but they have also brought challenges associated with proper management and the role central banks.

One example of spillover effects of an individual country’s monetary policy on other countries is the quantitative easing policy introduced by the US Fed to fight the GFC and its subsequent cycle of rate hikes which has now given way to a cycle of rate cuts.

"The significance of Digital Currency Electronic Payment lies in that it's not the digitization of existing currency,but replacement of M0. It greatly reduces the dependence of trading process on accounts,which is conducive to the circulation and internationalization of #RMB. ...

... At the same time, DCEP can achieve real-time collection of data related to money creation, bookkeeping, etc, providing useful reference for the provision of money and the implementation of monetary policies. ...

... #PBOC has been studying #DCEP for five or six years, and is likely to be the first central bank in the world to launch a digital currency," said Huang Qifan, Vice President of #China Center for International Economic Exchanges, in #BundSummit #stablecoin #digitalcurrency