Discover and read the best of Twitter Threads about #Squeeze

Most recents (14)

So a friend & fellow #gTiiPig 🐷 (wishes to remain Anon) had a lengthy & informative conversation with #ChatGPT, discussing the $gTii & Alpine Saga set to begin unfolding this week, starting with the NSCC/SEC judgement on 3/29.

This thread is simply the Q & A’s untouched.

Enjoy!

This thread is simply the Q & A’s untouched.

Enjoy!

2- OP begins the dialogue by asking AI to describe everything it knows about $gTii, Alpine Securities and Toxic Lending.

Also asks hypothetically, what would happen if the company PAID-OFF a Toxic Debenture (Note/Loan), if the Lender could end up ‘trapped’ and the implications.

Also asks hypothetically, what would happen if the company PAID-OFF a Toxic Debenture (Note/Loan), if the Lender could end up ‘trapped’ and the implications.

3- WHO is on the hook if the Toxic Lending Thugs cannot realistically settle the $gTii trades and cover their massive (alleged/estimated 300 Million #nakedshorted) position? Who’d be liable if the Broker ended insolvent/bankrupt?

#China will now open up and ramp up its #economic output and send #commodities higher. Likely many will make new highs in the next couple years. Their are also going to support for their #housing #market. twitter.com/i/web/status/1…

The USA and Canada are bother going to continue to see housing market weakness and along with Europe banks will begin to struggle with bad loans. Companies like $CS are in trouble and the #FED and #ECB are will have to slow rate hikes and reverse course next year

The western economies are going to need central bank liquidity injections to prevent implosion. Negative wealth effect combined with increased interest rate expenses take a few months to trickle through. And trust me they pain is coming.

$gTii in < 2 years…

▪️purchased Picasso & Warhol to digitize & fractionalize as a dividend

▪️Dividend 1- Warrants issued; MANY ‘undelivered’ to SH’s

▪️beyondblockchain.us; Fabian Alsultany

▪️authorized share count (never released; FINRA Investigation?)

1/3

▪️purchased Picasso & Warhol to digitize & fractionalize as a dividend

▪️Dividend 1- Warrants issued; MANY ‘undelivered’ to SH’s

▪️beyondblockchain.us; Fabian Alsultany

▪️authorized share count (never released; FINRA Investigation?)

1/3

▪️Dividend 2- #SHIB Digital dividend; DENIED by FINRA & DTCC

▪️Brokers calling SH’s to loan shares/RegSho List

$gTii IS trying…driving blind into new territory, getting pushback & learning on the fly. Attempting to Draw a blueprint. Many attempts. No success… yet.

2/3

▪️Brokers calling SH’s to loan shares/RegSho List

$gTii IS trying…driving blind into new territory, getting pushback & learning on the fly. Attempting to Draw a blueprint. Many attempts. No success… yet.

2/3

Let them dot the I’s & cross the T’s, at THEIR pace, and get this 3rd Dividend done RIGHT, so we don’t need a 4th.

For TWO YEARS & with NO 💲, $gTii has attempted to force settlement of a TRAPPED 🩳’s trades & #squeeze them out. And they’ll continue on… w/ or w/o you.

3/3

For TWO YEARS & with NO 💲, $gTii has attempted to force settlement of a TRAPPED 🩳’s trades & #squeeze them out. And they’ll continue on… w/ or w/o you.

3/3

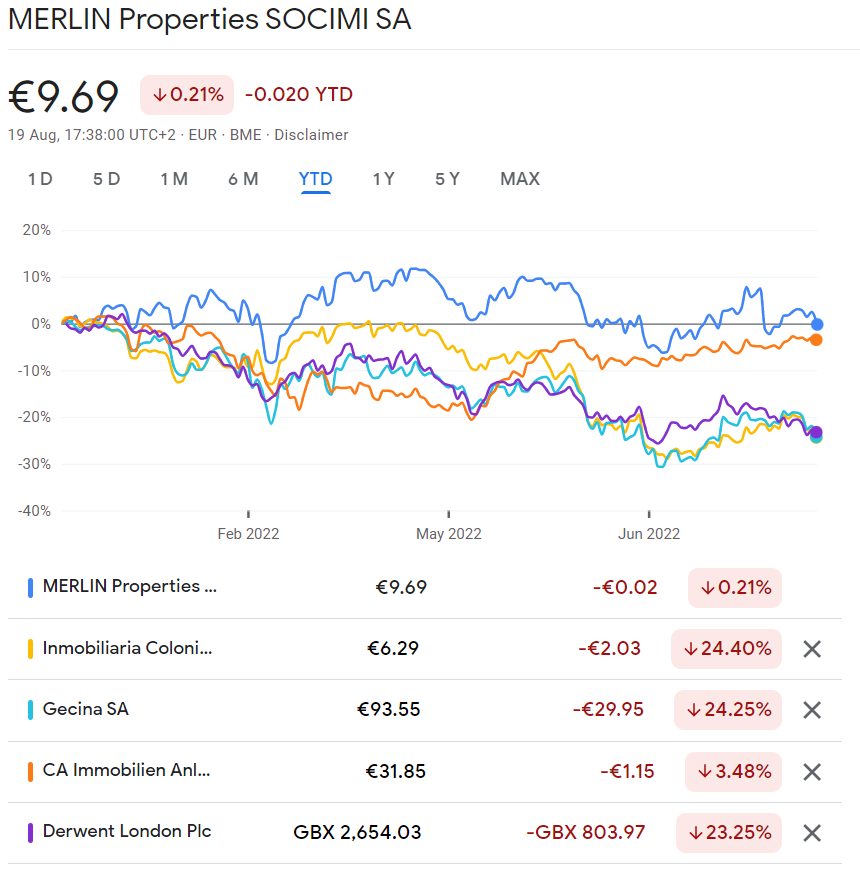

Nuevo ciclo económico. Mercado #Oficinas afronta 3 grandes desafios: financieros, inflación costes CAPEX y #WFH.

Incertidumbre reflejada en las valoración de los principales propietarios: -25% YTD, y consultores ~-20% YTD.

En ambos grupos, impactando de forma desigual.

1/9

Incertidumbre reflejada en las valoración de los principales propietarios: -25% YTD, y consultores ~-20% YTD.

En ambos grupos, impactando de forma desigual.

1/9

Financieros:

- subidas tipo interés,

- incremento diferenciales: ¡suponen ¾ del coste financiero!. Percepción de riesgo sobre el sector,

- Endurecimiento condiciones: credit crunch nueva financiación & ´pinch points will be refinancing moments´ #squeeze

2/9

- subidas tipo interés,

- incremento diferenciales: ¡suponen ¾ del coste financiero!. Percepción de riesgo sobre el sector,

- Endurecimiento condiciones: credit crunch nueva financiación & ´pinch points will be refinancing moments´ #squeeze

2/9

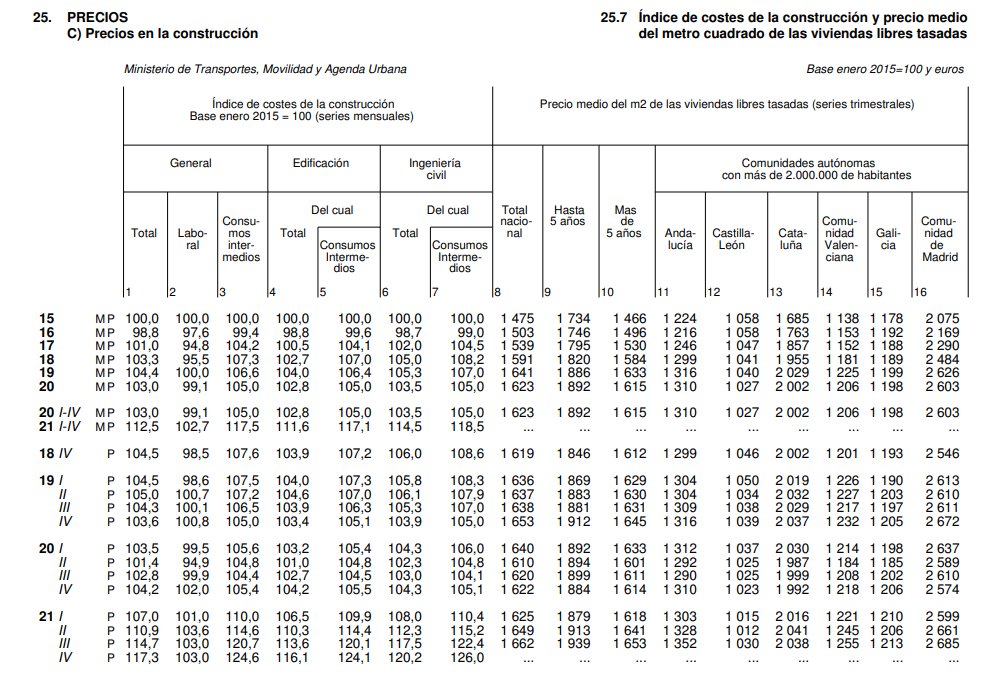

Inflación de costes CAPEX:

- construcción nuevos edificios/reformas existentes,

- adaptación edificios para mejora eficiencia energética,

- necesidad inversión en instalaciones generación energías renovables #PV

3/9

- construcción nuevos edificios/reformas existentes,

- adaptación edificios para mejora eficiencia energética,

- necesidad inversión en instalaciones generación energías renovables #PV

3/9

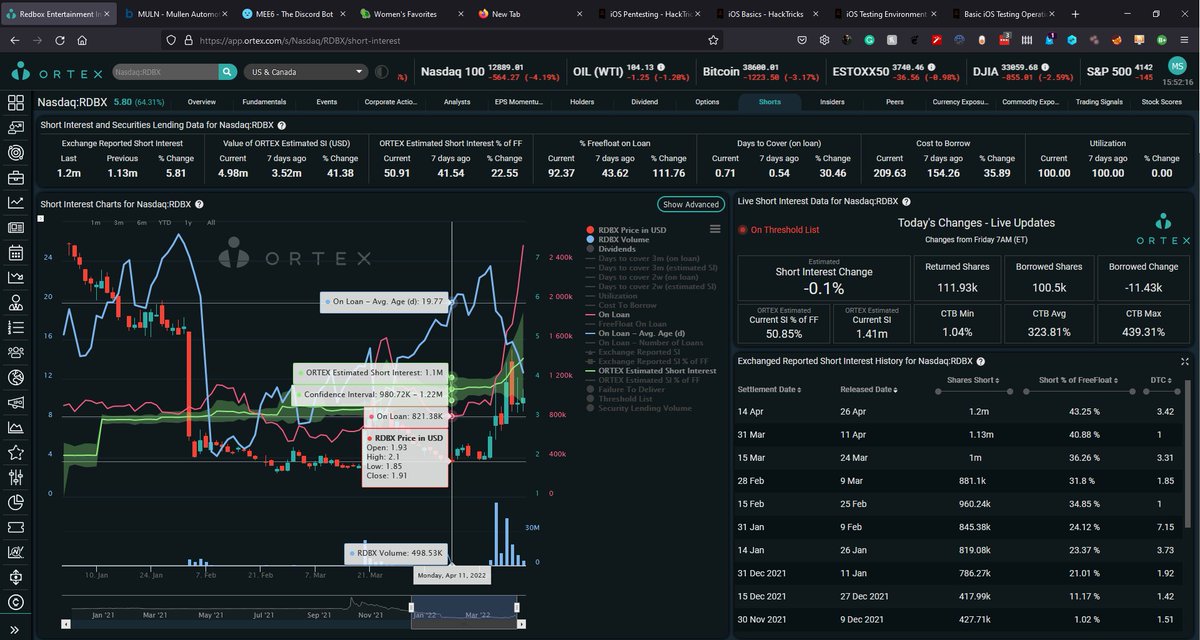

#HellsTradingFloor is currently up ~100% on $RDBX #squeeze thanks to the call out from @dmcalls. Thanks for being a part of the community and keeping your 👀 open for runners.

Retail is rapidly soaking up this micro-float like a sponge, hence I feel this is just the beginning.

Retail is rapidly soaking up this micro-float like a sponge, hence I feel this is just the beginning.

@ORTEX data shows that 50% of all shorts entered (at best) at $11.00 or lower. The other 50% of all 1.41m shares sold short entered below $3.00 and are deep in the red.

All this adds up to old-shorts losing out on their gains, and new ones rapidly losing equity on their margin.

All this adds up to old-shorts losing out on their gains, and new ones rapidly losing equity on their margin.

$CEI had a mini-squeeze. $MULN... mini-squeeze. As you see, MM’s are in control. They create shares out of thin air & mark fraud trades as ‘long’ to avoid ‘Margin’. Wash trades and many other tactics, unbeatable W/O exposing the SETTLEMENT SYSTEM. This is the 🔑. cont’d... $gTii

A DIGITAL, fractionalized #NFTdividend, ala the $OSTK Blueprint, solves this problem. UNTIL your fav CEO decides to force a TRUE share count using Blockchain tech, BYPASSING the corrupt & complicit brokerages.... you’ll NEVER SEE a REAL #ShortSqueeze. cont’d... $gTii

Do your DD & Bring some of that MEME-Stock Power volume over to the ONLY PLAY working towards FORCING a TRUE #shortsqueeze against the ONE SINGLE Toxic Lending scumbag they’ve got TRAPPED 100+MILLION shares underwater... $gTii the ONLY thing missing is BUY PRESSURE.

Weekly Global Macro Review 10/07/21

1/15

@hedgeye calls it #Quad2 reflation, but I rather prefer @jam_croissant’s colorful description of “endless gamma squeezes” oh so reminiscent of 🎉🍾🥳 like it’s 1999!

Let’s dig into the macro 🧮 for the week

1/15

@hedgeye calls it #Quad2 reflation, but I rather prefer @jam_croissant’s colorful description of “endless gamma squeezes” oh so reminiscent of 🎉🍾🥳 like it’s 1999!

Let’s dig into the macro 🧮 for the week

2/15

A 🕊 #FOMC on Wednesday and a 💪🏼 #NFP report on Friday with underlying wage #inflation of 4.9% y/y was enough to ignite a rally in the $UST market ↗️

WTF, you say?

A 🕊 #FOMC on Wednesday and a 💪🏼 #NFP report on Friday with underlying wage #inflation of 4.9% y/y was enough to ignite a rally in the $UST market ↗️

WTF, you say?

3/15

Indeed, the MOVE 66.30 ↘️ from 78.34 on Tuesday as the 10/2s curve remained 🥞 at 105

2Y .405 -9.6 bps

5Y 1.056 -12.9 bps

10Y 1.455 -10.6 bps

30Y 1.888 -5.1 bps

Chart: Despite a strong #NFP, the $TNX ↘️ -10.6 BPS to 1.455 and at critical support

Indeed, the MOVE 66.30 ↘️ from 78.34 on Tuesday as the 10/2s curve remained 🥞 at 105

2Y .405 -9.6 bps

5Y 1.056 -12.9 bps

10Y 1.455 -10.6 bps

30Y 1.888 -5.1 bps

Chart: Despite a strong #NFP, the $TNX ↘️ -10.6 BPS to 1.455 and at critical support

Time for a thread 🧵

$VIH we all know it’s the #1 trending stock on #fintwit @Twitter and @Stocktwits due to squeeze potential

But do you know what @Bakkt is or what they do ?

This is how it started from @BCalusinski and @gurgavin tweet 👇🏻

bakkt.com

$VIH we all know it’s the #1 trending stock on #fintwit @Twitter and @Stocktwits due to squeeze potential

But do you know what @Bakkt is or what they do ?

This is how it started from @BCalusinski and @gurgavin tweet 👇🏻

bakkt.com

2) $VIH the next great squeeze

What is @Bakkt?

Founded in 2018

Began as a #cryptocurrency exchange and has evolved into a digital ecosystem

2.1 billion valuation

207m #spac

325m pipe

Projected 9million users end of 2021, 31 million by 2025

Going live 2021

What is @Bakkt?

Founded in 2018

Began as a #cryptocurrency exchange and has evolved into a digital ecosystem

2.1 billion valuation

207m #spac

325m pipe

Projected 9million users end of 2021, 31 million by 2025

Going live 2021

3) $VIH the next great squeeze

Who are they backed by ?

@Microsoft $MSFT

@BCG

@Starbucks $Sbux

@PayUCorp

@ICE_Markets $ICE owner of @Bakkt at 65%+ long term hold

Who are they backed by ?

@Microsoft $MSFT

@BCG

@Starbucks $Sbux

@PayUCorp

@ICE_Markets $ICE owner of @Bakkt at 65%+ long term hold

$AMC - #Squeeze

(Part 1) The best poetic justice of retail investors against Wall Street.

In the 2008 financial crisis, many middle class workers have lost their homes following defaulted mortgage payments.

(Part 1) The best poetic justice of retail investors against Wall Street.

In the 2008 financial crisis, many middle class workers have lost their homes following defaulted mortgage payments.

(Part 2) Institutions and banks have tricked them into a world of spending where they stole every penny from their wallets. The COVID financial correction was not so different.

(Part 3) In post-squeeze, many retail investors will rejoice themselves buying the dip of the upcoming crash.

#AMC #GME #TSLA #OCGN #SOS - below is your ortex information for the morning: Here is the Cost to Borrow as we go into regular trading hours: Daily Max is listed first then daily avg:

AMC: 259.81%, 133.41%

GME: 5.44, 1.89

TSLA: 4.48%, 0.65%

OCGN: 9.60%, 6.49%

SOS: 25.2%, 14.83

AMC: 259.81%, 133.41%

GME: 5.44, 1.89

TSLA: 4.48%, 0.65%

OCGN: 9.60%, 6.49%

SOS: 25.2%, 14.83

My thoughts as we go into the morning: I hope and entrust you all have had a wonderful morning. I also hope that you all enjoyed that little after hours bump yesterday. It was pretty nice to watch. Now I know many of you who are holders of AMC are also worried about other stocks.

#AMC #GME #TSLA #KOSS #NOK welcome to sundays looking forward statements. We have so much going on right now but we must not lose site of the goal, the battle remains outside against the HF and MM and we need all hands on deck. This week is a big week and we have a busy schedule

Monday morning will come in like a wrecking ball in a good way. I’m hoping it’ll work in our favor as I suspect HF and MM will try to deal with other areas of the market. Tuesday is AMCs shareholder meeting bigs ups to the team their at AMC & @CEOAdam I know your team

Is working tirelessly to help us all even when folks don’t realize it. Two days later we have the SEC (@SEC_News) closed door meeting to discuss different topics but I surmise and I’m hoping it’s about our rules followed by the House financial committee meeting witnesses on deck:

#AMC #GME #Stonks #Market #TSLA #wallstreetbets #mooning #squeeze #OCGN Alright, good morning everyone I hope and trust you all have had a wonderful morning thus far. Lets get into this new SR-DTC-2021-007 rule shall we. Today's Recap is about "Going Digital"

So this whole rule in a nutshell is that DTCC is going to an automated system called ClaimConnect for the following reasons:

1. Manual adjustments are not subject to the DTC's risk Management Controls, which can unexpectedly put the receiving party at risk.

2. It lacks a unique

1. Manual adjustments are not subject to the DTC's risk Management Controls, which can unexpectedly put the receiving party at risk.

2. It lacks a unique

identifier or way to track the adjustment.

3. no automated notification process, so you can see where and what's happening to the adjustments as they are being made or accepted by either party.

4. No platform exists where you can see the work being detailed out.

3. no automated notification process, so you can see where and what's happening to the adjustments as they are being made or accepted by either party.

4. No platform exists where you can see the work being detailed out.

#AMC #GME #TSLA #KOSS #OCGN #MEMESTOCK #MOONING #L2BU Alright folks, so the moment you've all pretty much been waiting for the the SR - OCC - 2021 - 801 rule as it stands IF THEY HAVE "SKIN-IN-THE-GAME"

There is so much to unpack here and I'm going to solely cover one part of the rule. I will also post the video on this after this is posted. So here we go. Basic Structure we need to understand is that the SEC is at the Head of the two organizations sitting underneath it.

On one side you have the OCC and the other side you have the NSCC. We've talked about and discussed for months the NSCC rules and how they apply to securities. We've gone through the NSCC 801, 005, 004, and the 003 rules. Now we're getting to the point that the other branch of

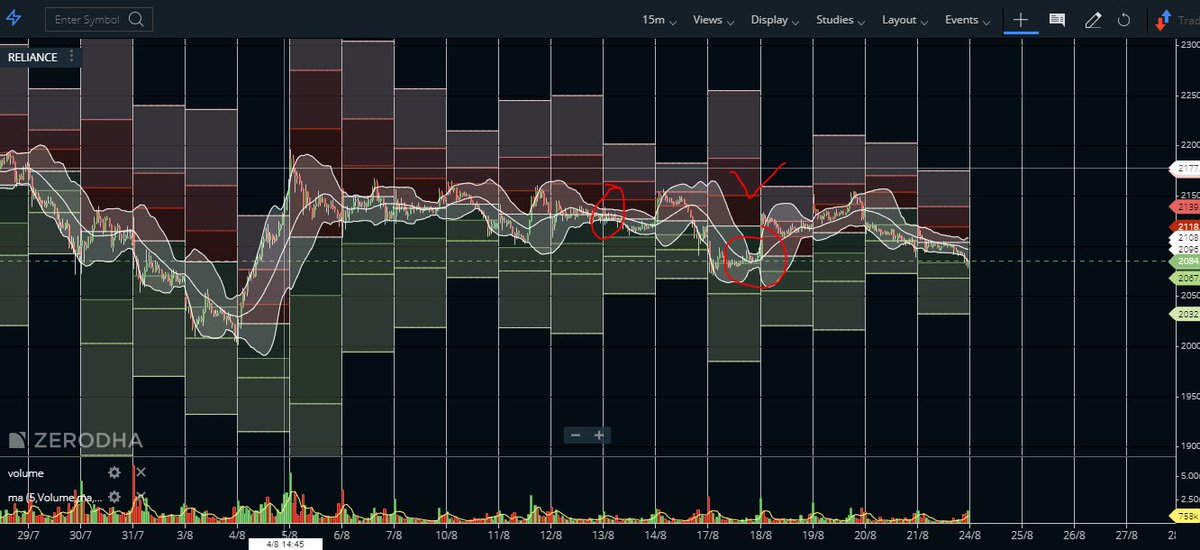

#Bollingerbands (Threads to understand & It's actual use)

( Practical use)

*We all know that #BB is give us volatility of stock.

* It works on standard deviation principle

* Price always wave between Upper and Lower band.

( Practical use)

*We all know that #BB is give us volatility of stock.

* It works on standard deviation principle

* Price always wave between Upper and Lower band.

* It is always said that use #volatility contraction .

*After Volatility contraction price , move in quicker way.

* To identify this #volatility contraction, we use #BB

Examples show that round is volatility contraction. Price stuck in range and volatility is cooled off.

*After Volatility contraction price , move in quicker way.

* To identify this #volatility contraction, we use #BB

Examples show that round is volatility contraction. Price stuck in range and volatility is cooled off.

but , how to identify that volatility is really contracted?

many false signal will be generated.

So here is the secret.

Dont just trap in just #Bollingerbands

I am sharing secret to use it with #ketlner Channel

many false signal will be generated.

So here is the secret.

Dont just trap in just #Bollingerbands

I am sharing secret to use it with #ketlner Channel