Discover and read the best of Twitter Threads about #TSLA

Most recents (24)

#TSLA

Per 10-Q Tesla did incorporate IRA battery credits into COGS. As expected. Gross automotive margin would have been worse otherwise.

Per 10-Q Tesla did incorporate IRA battery credits into COGS. As expected. Gross automotive margin would have been worse otherwise.

Tesla has been paying below 10% in taxes since it became profitable. I would expect Tesla to be subject to the special alternative minimum corporate tax contained in the IRA bill. They just say they are watching it. Next year Tesla's special low tax rate in China should increase.

Long-lived assets in Germany are up to 3.85 billion vs China's 3 billion. For a factory that is making maybe 1/3rd the number of cars. There is no possibility that Berlin will even approach Shanghai's margins. Labor costs are notably higher, as are inputs.

So.. a Hyundai employee just borrowed my 2022 Tesla Model 3 LR (FSD) for a week for “Driving locally”. I kept getting Notifications that all my doors were left open for several days. I was curious so i accessed the Live cam. This is what i see.

@elonmusk @WholeMarsBlog @Tesla

@elonmusk @WholeMarsBlog @Tesla

Upon return i asked the person, I’m curious why did you have the car just sitting with doors/trunks opening/closing? He smirked and said “Training”. Then he said at Hyundai.

I didn’t mention i already looked at it’s whereabouts. 🥸

I didn’t mention i already looked at it’s whereabouts. 🥸

I Pushed for more information and then he finally opened up and said, I’m not really supposed to say but it was being used for Research and Training purposes for benchmarking against the Hyundai Ionic 6 prior to it’s release. He didn’t want me backing out 🫤

1/ I asked GPT-4 to write 10 tweets about Tesla STOCK for me to post on twitter.

Here they are:

$TSLA

Here they are:

$TSLA

2/ 🚀 #TSLA soaring to new heights! With their latest innovation in battery tech, it's no wonder investors are betting big on @Tesla. The future is electric! ⚡️🔋 #TeslaStock

테슬라가 4680 배터리의 양산에 성공했다고 발표하였다.

200만대 가량의 물량을 직접 생산할 수 있다고 한다.

올해 테슬라 전기차의 예상 생산량이 약 200만대라는 점에서 테슬라 전기차는 전부 4680배터리로 채울 수 있게 된 것이다.

4680은 기존 배터리와는 비교할 수 없을 정도의 경쟁력을 보인다.

200만대 가량의 물량을 직접 생산할 수 있다고 한다.

올해 테슬라 전기차의 예상 생산량이 약 200만대라는 점에서 테슬라 전기차는 전부 4680배터리로 채울 수 있게 된 것이다.

4680은 기존 배터리와는 비교할 수 없을 정도의 경쟁력을 보인다.

에너지 밀도가 5배 높으며, 비용도 훨씬 저렴하다.

뺄 수 있는 모든 것들을 제외시켜 비용을 최소화하였다.

Simple is best

테슬라의 모토이기도 하다.

자율주행에서 다른 자동차 기업들이 레이더 라이더 등을 덕지덕지 붙여서 테스트하는 데 반해 테슬라는 오로지 카메라만 활용하여 테스트한다.

뺄 수 있는 모든 것들을 제외시켜 비용을 최소화하였다.

Simple is best

테슬라의 모토이기도 하다.

자율주행에서 다른 자동차 기업들이 레이더 라이더 등을 덕지덕지 붙여서 테스트하는 데 반해 테슬라는 오로지 카메라만 활용하여 테스트한다.

배터리도 크게 다르지 않다.

배터리에 들어가는 팩과 모듈을 싹 다 없애고, 이 자리를 소재로 꽉꽉 채워 넣어 비용을 절감하고, 효율을 극대화 하였다.

기존 배터리보다 월등한 효율을 뽐내는 4680 배터리를 앞에 두고 자동차 기업들은 표정을 감추지 못하고 있다.

배터리에 들어가는 팩과 모듈을 싹 다 없애고, 이 자리를 소재로 꽉꽉 채워 넣어 비용을 절감하고, 효율을 극대화 하였다.

기존 배터리보다 월등한 효율을 뽐내는 4680 배터리를 앞에 두고 자동차 기업들은 표정을 감추지 못하고 있다.

Hi brothers and sisters,

Happy LORD’S DAY!

🧵for the upcoming week:

1/

Recap last week-

Two of the S&P 500 giants reported < than stellar earnings/guidance (MSFT & TSLA). That could even be a vast understatement to some.

Fundamentally, it seemed the stocks would ⬇️.

Happy LORD’S DAY!

🧵for the upcoming week:

1/

Recap last week-

Two of the S&P 500 giants reported < than stellar earnings/guidance (MSFT & TSLA). That could even be a vast understatement to some.

Fundamentally, it seemed the stocks would ⬇️.

2/

But what ended up happening?

-For #MSFT stock price dropped Jan 25th AM, found a triple bottom (from Jan 11 and 19) ~ $230/share and rocketed upwards to close just shy of previous day's close.

-For #TSLA it just simply gapped up the next day & we all know about Friday.👀

But what ended up happening?

-For #MSFT stock price dropped Jan 25th AM, found a triple bottom (from Jan 11 and 19) ~ $230/share and rocketed upwards to close just shy of previous day's close.

-For #TSLA it just simply gapped up the next day & we all know about Friday.👀

3/

Fundamental/Macro furus on FinTwit were in absolute shambles and in dismay.

Some called the price action (PA) a joke!

They'd tweet:

"This market's broken."

Comments in those same threads echoed the same sentiment. By this, you could tell who was offside in positioning.

Fundamental/Macro furus on FinTwit were in absolute shambles and in dismay.

Some called the price action (PA) a joke!

They'd tweet:

"This market's broken."

Comments in those same threads echoed the same sentiment. By this, you could tell who was offside in positioning.

Just had our first run in with the "#TSLA Fan Boy Club" after posting a high-level back-of-the-envelope comps analysis to see what a reasonable valuation could look like.

Boy was that enough to set them off.

We found that there are 5 distinct types of Fan Boys, listed below👇

Boy was that enough to set them off.

We found that there are 5 distinct types of Fan Boys, listed below👇

1) The ones who have clearly never seen nor even heard of 'valuation' or have any idea of how to derive it in the real world. Usually, they've done just enough Investopedia browsing to type words like 'margin' and 'growth', but that's it - these are the toughest type to deal with

2) The ones who may understand the basics, but who simply deny that Tesla has any competitors. They believe Tesla is the only auto co. on the planet and that any other view is so incredibly out of touch with reality, that ad hominem attacks are the only correct course of action

Inferno #Tesla, è panic selling. Problema Cina ma anche problema credibilità Elon Musk, che aveva detto che avrebbe smesso di usare TSLA come bancomat e che invece ha continuato a farlo. Non solo certezza. Ai mercati - Italia docet - piace la credibilità bit.ly/3jDc50M

1/"Un anno fa, #Musk era un eroe e su #Tesla c'era panic buying – ha commentato il fondatore di EMJ Capital Eric Jackson in un'intervista rilasciata alla @CNBC – In questo momento, è panic selling". #28dicembre #trading #TSLA @EMJCapital

#Tesla si appresta a concludere l'anno peggiore della sua storia. Fuga dal titolo anche oggi, con rumor Cina. Elon Musk preso più da #Twitter che dalle auto elettriche. Cosa dicono gli esperti? BlackRock tra gli azionisti bruciati bit.ly/3WIOh9R #27dicembre #TSLA #COVID

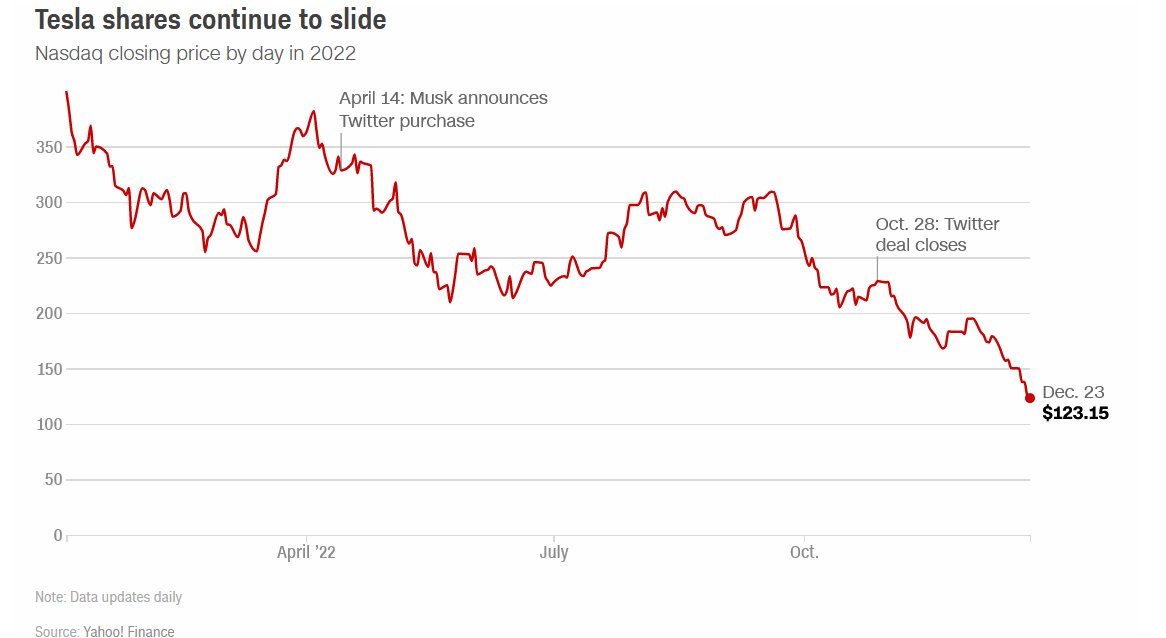

1/Il grafico dell'annus horribilis di #Tesla del Wall Street Journal VIA @WSJ In questo caso il titolo dice tutto. "Tesla Shares Head for Worst Year Ever as Elon Musk focuses on Twitter" Crollo #TSLA YTD di oltre -60%

wsj.com/articles/tesla…

wsj.com/articles/tesla…

2/Cosa è successo al titolo Tesla da quando Elon Musk, fondatore e ceo del colosso EV, ha annunciato l'acquisto di Twitter VIA @CNN

edition.cnn.com/2022/12/23/inv…

edition.cnn.com/2022/12/23/inv…

Who could forget the C-Suite high jinks when Elon and CFO Zach Kirkhorn invested $1.5 billion in Bitcoin and added the titles "Technoking of Tesla" and "Master of Coin?" Since the March 15, 2021 rebranding, Tesla and Bitcoin are down 48% and 70%, respectively. Great fun.🎄 1/

While the Bitcoin position and the Tesla outside shareholders have suffered mightily, how have the INSIDERS fared? If you guessed considerably better you are correct. Collectively the brass at Tesla appear to have unloaded 126 million Tesla shares for more than $41 billion. 2/

While Elon's sales are the preponderance of that, selling at an average share price of $325 is pretty good when measured against the present $123.15 price. That's a current bid 62% below the average sale. Nearly all shares were gifts from the board, not bought out of pocket. 3/

TODAY IN THE MARKETS

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

@SEC_Investor_Ed, since you’ve been on a roll with your rubric of Investor Edu, please educate the investing public about the phenomenon of “Stock Tokens” traded on @FTX_Official & @BittrexExchange which are supposedly backed 1:1 by the stock in custody of CME-Equity #AMC #GME

@SEC_Investor_Ed @SECGov – we’d like to get to the bottom of the fairly new phenomenon of “Stock Tokens,” which started trading on crypto exchanges as early as Jan27, ‘21 & on others on Jun 6-7, ‘21. Why are the underlying stocks of those tokens overly shorted stocks? #AMC #BBBY

@SEC_Investor_Ed @SECGov – we have noticed that those “Stock Tokens” only exist for a select few stocks, which have in common overwhelming short interest, & large number of unsettled synthetic (longs & shorts). SEC Investor Edu, what is the purpose of such instrument? #AMC #TSLA

And as of now, the more we use Twitter, the poorer we make him.

Y'all get this simple thing, right? It costs him 5 million a day to keep the servers going. But his ad revenue has plummeted.

The more you tweet, at least currently, the poorer he gets. 😁

Y'all get this simple thing, right? It costs him 5 million a day to keep the servers going. But his ad revenue has plummeted.

The more you tweet, at least currently, the poorer he gets. 😁

If Elon manages to monetize disinformation like FB did years ago and turns a profit, I will stop tweeting, mainly because I'll be too busy battling the flying pig menace to tweet.

Bro, you are the problem.

Heh, predictably, #TSLA stock started tanking after his tweet. Remember that Twitter is effectively a $44bn division of Tesla. And he's tweeting that the revenue has dropped drastically, but he has no plans but to scold advertisers.

Dumbest richest guy ever

Dumbest richest guy ever

Wow 🤩 my #Tsla is skyrocketing today too 🚀🚀🚀

米国株最初だけでその後は下がってきてしまって、寝たんだけど、朝起きたら、my #NFLX がskyrocketingしていた😀 みんなサブスクの強さを舐めすぎている。

僕はNetflix株は高すぎて買えなかったんだが600ドル→210ドルまで暴落した時に買ったら、そこから180ドルまで下がりやがって、仕方ないからずっと待ってたら220ぐらいに戻ってきて、そこでちょっと売ってしまった。売るんではなかった。まだだいぶロングだが。

note.com/kazu_fujisawa/…

note.com/kazu_fujisawa/…

A lot of the inflated #TSLA valuation rests on their order backlogs. Which means people waiting to buy cars but production just can't keep up.

Notice how that metric has been dropping consistently since Elon went full Lex Luthor in April with the Twitter stunt & liberal bashing.

Notice how that metric has been dropping consistently since Elon went full Lex Luthor in April with the Twitter stunt & liberal bashing.

You'll see a lot of unnecessarily wordy and aggressively boring explanations for this from analysts and institutional investors and financial media and others who really need TSLA to keep going up up up for them to keep having jobs. So they try to distract from demand issues.

But those of us who aren't in this pump and pump and pump and pump game like to look at the fundamentals.

Sure, you buy tsla at 250 hoping it will go to 300.

But remember FIN101. It's all still an NPV of future profits. From actual sales. Of products. Not just stock returns.

Sure, you buy tsla at 250 hoping it will go to 300.

But remember FIN101. It's all still an NPV of future profits. From actual sales. Of products. Not just stock returns.

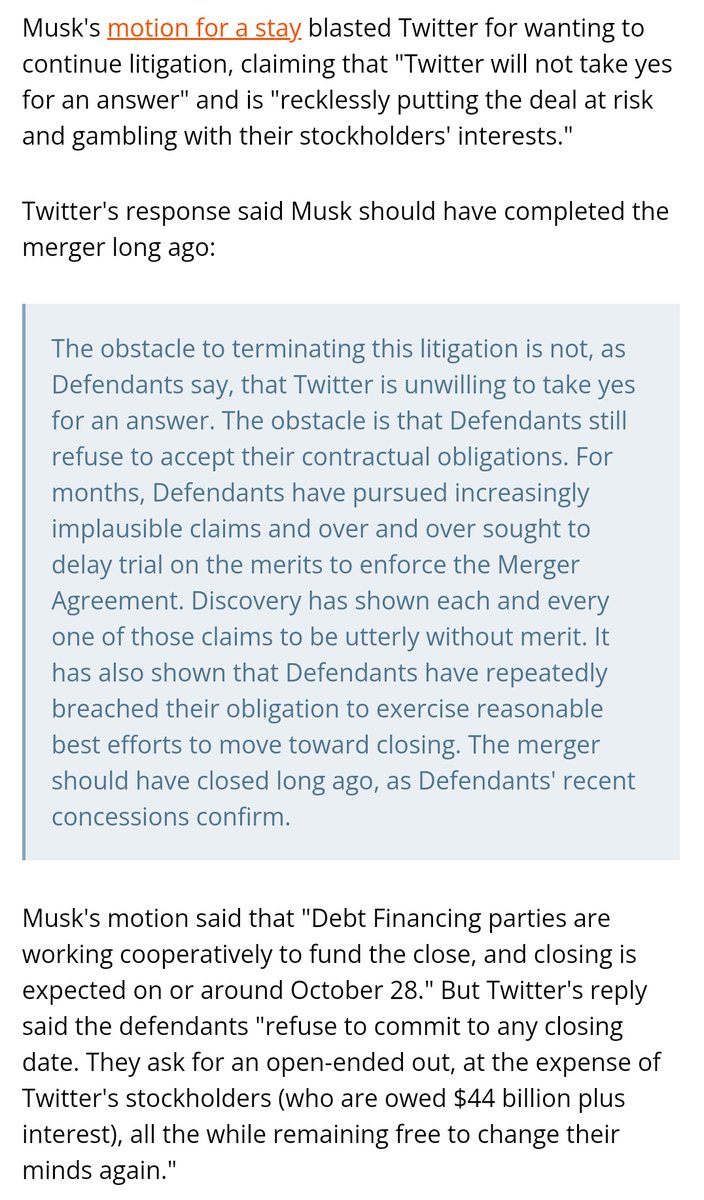

Heh, Twitter filing in the court today said pretty much what I said in this thread.

And why the judge has set up Oct 28 as a deadline to complete the merger if he's really serious, or trial starts in November.

It ain't over until the fat laddie pays up.

And why the judge has set up Oct 28 as a deadline to complete the merger if he's really serious, or trial starts in November.

It ain't over until the fat laddie pays up.

The path from here is clear.

Either Musk throws another tantrum and invents some new excuse to drag it out.

Or he swallows a $44 bn loss, cos no way any serious banker believes he can actually make Twitter profitable, so heavy #TSLA collateral. And he shuts Twitter down.

Either Musk throws another tantrum and invents some new excuse to drag it out.

Or he swallows a $44 bn loss, cos no way any serious banker believes he can actually make Twitter profitable, so heavy #TSLA collateral. And he shuts Twitter down.

The real question is whether October Musk is actually willing to cash the check that April Musk wrote. Of paying $44 bn of his own money (banks ain't stupid) to take over what will NEVER be a company profitable enough for a real leveraged buyout. Just to shut it down.

#TSLA is now 20% down from its 200 day moving average. The Chinese are truly going to take over the world in terms of EVs. @DillonLoomis22 from Electrified breaks it down better than most.

My thoughts are similar.

A thread...

My thoughts are similar.

A thread...

1/ Time to panic?

You're starting to see peak fear in the market now. Every other YouTuber is telling you the world is ending. Should you panic sell?

I dont have a crystal ball. Every couple months since I started investing, there have been Market Crash videos.

You're starting to see peak fear in the market now. Every other YouTuber is telling you the world is ending. Should you panic sell?

I dont have a crystal ball. Every couple months since I started investing, there have been Market Crash videos.

$QQQ is the 2nd most traded ETF in the U.S., it tracks the Nasdaq-100 Index & contains some of the most innovative companies.

40% of $QQQ is made up of 5 stocks:

13.5% Apple $AAPL

10.5% Microsoft $MSFT

7% Amazon $AMZN

7% Google $GOOG

4.5% Tesla $TSLA

Let’s discuss each stock:

40% of $QQQ is made up of 5 stocks:

13.5% Apple $AAPL

10.5% Microsoft $MSFT

7% Amazon $AMZN

7% Google $GOOG

4.5% Tesla $TSLA

Let’s discuss each stock:

$QQQ includes the 100 largest non-financial companies on the Nasdaq. Let’s also look at other popular holdings:

3% $META

2.5% $NVDA

2% Costco $COST

2% Broadcom $AVGO

1.5% Cisco $CSCO

1% Qualcomm $QCOM

1% Paypal $PYPL

1% $AMD

Let's use Prospero.AI to analyze each:

3% $META

2.5% $NVDA

2% Costco $COST

2% Broadcom $AVGO

1.5% Cisco $CSCO

1% Qualcomm $QCOM

1% Paypal $PYPL

1% $AMD

Let's use Prospero.AI to analyze each:

1/ When @elonmusk had the vision for EVs at Tesla, he told the world what to expect, the timeline, & how it was going to be done. A complete roadmap was laid out for the world to see. People laughed & ridiculed. Yet, even with this roadmap, somehow people r shocked & bewildered

2/ by how Tesla got to where it is today. Today, Tesla is about to break 1 million EVs in a year. They r the safest vehicles on the road with unrivaled performance & ever-increasing quality in the build of their EVs. They r also on the brink of delivering FSD to all.

3/3 History is repeating. The Optimus vision has been laid out, along with the roadmap, with an ever increasingly capable & talented team at Tesla, lead by Elon, to get the job done. Laughter, ridicule, & disbelief abounds again. Again, Tesla will have the last laugh. $TSLA #TSLA

Warren Buffett, the 4th richest American (worth $100 Billion) recommends investing in an S&P 500 Index Fund

Over 20% of the S&P 500 is made up of 5 stocks:

7.3% Apple $AAPL

5.7% Microsoft $MSFT

3.6% Google $GOOG $GOOGL

3.3% Amazon $AMZN

2.5% Tesla $TSLA

Let’s discuss each:

Over 20% of the S&P 500 is made up of 5 stocks:

7.3% Apple $AAPL

5.7% Microsoft $MSFT

3.6% Google $GOOG $GOOGL

3.3% Amazon $AMZN

2.5% Tesla $TSLA

Let’s discuss each:

Also, the S&P 500 is America's largest companies, and returned ~11% each year on average, over the last 96 years

Let’s also look at other popular holdings:

1%- NVidia $NVDA

1% JPMorgan $JPM

1% Mastercard $MA

1% Costco $COST

1% Walmart $WMT

1% Disney $DIS

Let’s discuss all:

Let’s also look at other popular holdings:

1%- NVidia $NVDA

1% JPMorgan $JPM

1% Mastercard $MA

1% Costco $COST

1% Walmart $WMT

1% Disney $DIS

Let’s discuss all:

#التحوط او #الهيدج او #التطويق كلها مسميات لي

#استراتيجه جدا مهمه 👌

لها شهره واسعه واستخدام جدا كبير في التدوالات

هدف هذه الاستراتيجه هي

1- الحمايه ( وقف الخسارة )🔩

2- الربح 🏌️

من اهم الادوات الماليه اللي تندرج تحت اداره المخاطر ✔️

#استراتيجه جدا مهمه 👌

لها شهره واسعه واستخدام جدا كبير في التدوالات

هدف هذه الاستراتيجه هي

1- الحمايه ( وقف الخسارة )🔩

2- الربح 🏌️

من اهم الادوات الماليه اللي تندرج تحت اداره المخاطر ✔️

/1st Principles argument for investing in #Tesla. A thread on how I model #tsla at 3k by 2025 and 6k by 2030.

My objective is not to maximize Tesla but to look at it in the most conservative way to see if it's worth the risk reward. See thread.

My objective is not to maximize Tesla but to look at it in the most conservative way to see if it's worth the risk reward. See thread.

2/ First, what is the question. @elonmusk always said, asking the right question is the hard part.

So,my question for myself and people I recommend to Tesla is this.

What is the risk reward? Remember if you're diversifying and only investing in 1 company, you better be right.

So,my question for myself and people I recommend to Tesla is this.

What is the risk reward? Remember if you're diversifying and only investing in 1 company, you better be right.

3/ So, once I understood the problem, the solution is simple. There is no point drawing the most rosy picture. Because when you maximize everything, chances of being wrong is high. So, I want to take a very conservative approach.

What do I know for sure?

What do I know for sure?

resurrected an old tweet to share some thoughts on hedging strategies ...Elon has hands full and is in it or the long haul with regard to #TSLA, but in taking down #TWTR, even someone of his wealth can benefit from "locking in" value of shares.

the "zero cost collar" does this...at start of Jan'21, with TSLA at 735 per share, Elon could have bought the Jan'23 expiry 530 put and fully funded the protection by selling the Jan'23 1425 call! The put protects shares 28% below 735 price then.

the call is struck so high that he'd get to realize gains in the stock 94% above that 735 level! pretty attractive! makes the big quarterly SPX collar look bad by comparison, but why? the tweet back then was based on the incredible bid to long-dated vol in TSLA.

How to Read my Chart:

E = Early Entry

S = Safer Entry

D = Daily Entry (Previous Day High / Low)

Wk = Weekly Entry (Previous Week High / Low)

BF = Broadening Formation

D/UTL = Down/Up Trendline

IB = Inside Bar1⃣

OB = Outside Bar3⃣

FTC = Full Time Frame

#StocksafterDark #SADTips

E = Early Entry

S = Safer Entry

D = Daily Entry (Previous Day High / Low)

Wk = Weekly Entry (Previous Week High / Low)

BF = Broadening Formation

D/UTL = Down/Up Trendline

IB = Inside Bar1⃣

OB = Outside Bar3⃣

FTC = Full Time Frame

#StocksafterDark #SADTips

#SADnation - You do NOT need to trade every Day. You do NOT need to hit the🌙on each trade. You do NOT need to go ALL in. You do NEED a plan & CONSISTENCY is🔑

2022 has 251 days:

$100/D = $25.1K

$500/D = 125.5K

$1K/D = 251K

$5K/D = $1.25M

2023 = 250D

#SADucation #SADtips

1⃣

2022 has 251 days:

$100/D = $25.1K

$500/D = 125.5K

$1K/D = 251K

$5K/D = $1.25M

2023 = 250D

#SADucation #SADtips

1⃣

#SADnation Have you gone 🟢➡️🔴?

Have a 🎯 & 🛑 in mind before entering into a trade.

Learn to scale out of your positions & adjust your 🛑Where you place them is your personal Risk➡️Reward tolerance.

Learn to get ⬆️ & walkaway when you’re🟢.

5% > -1%

Wins compound.

2️⃣

Have a 🎯 & 🛑 in mind before entering into a trade.

Learn to scale out of your positions & adjust your 🛑Where you place them is your personal Risk➡️Reward tolerance.

Learn to get ⬆️ & walkaway when you’re🟢.

5% > -1%

Wins compound.

2️⃣