Discover and read the best of Twitter Threads about #IWM

Most recents (15)

🧵 How I mastered 90% win rate option trading.

DJ Khaled - They don’t want you to win.

Success is not given overnight , it is a mindset.

Basic overview, strategies & guidance , most common mistakes!

Education ⬇️

DJ Khaled - They don’t want you to win.

Success is not given overnight , it is a mindset.

Basic overview, strategies & guidance , most common mistakes!

Education ⬇️

Gamma: (GEX) , which is a dollar-denominated measure of option market-makers' hedging obligations.

Things to remember/bookmark:

▪️High GEX env = lot of hedging needed = liquidity is added(+ GEX) or subtracted (- GEX)

▪️+ GEX = + gamma = Long calls go 1.0(delta) as they… twitter.com/i/web/status/1…

Things to remember/bookmark:

▪️High GEX env = lot of hedging needed = liquidity is added(+ GEX) or subtracted (- GEX)

▪️+ GEX = + gamma = Long calls go 1.0(delta) as they… twitter.com/i/web/status/1…

Delta: Measurement of change in option price as stock moves ⬆️ or ⬇️

▪️Between -1 and 1 for every option

▪️-1 to 0 for Puts

▪️0 to 1 for Calls

▪️More “in the money” the strike moves to option, more value it gains, closer it gets to -1 for Puts or +1 for Calls

▪️>90% options… twitter.com/i/web/status/1…

▪️Between -1 and 1 for every option

▪️-1 to 0 for Puts

▪️0 to 1 for Calls

▪️More “in the money” the strike moves to option, more value it gains, closer it gets to -1 for Puts or +1 for Calls

▪️>90% options… twitter.com/i/web/status/1…

Interested in learning about a new BACKTESTED metric with an edge?

We've produced one at GammaEdge (GE) we know you'll like.

Our traders think it's one of the most powerful & actionable metrics we provide.

Ready to learn how it can make you money?

Let's get to work🧵👇

We've produced one at GammaEdge (GE) we know you'll like.

Our traders think it's one of the most powerful & actionable metrics we provide.

Ready to learn how it can make you money?

Let's get to work🧵👇

1/ Before we get going, here is what you'll be able to answer by the end:

· What is Gamma?

· What is Gamma Exposure (GEX)?

· What is the GammaEdge GEX Ratio (GR)?

· How is the GR different from Put-Call Ratio (PCR)?

· How to make the GR actionable?

Sound good? 👇

· What is Gamma?

· What is Gamma Exposure (GEX)?

· What is the GammaEdge GEX Ratio (GR)?

· How is the GR different from Put-Call Ratio (PCR)?

· How to make the GR actionable?

Sound good? 👇

2/ A common gauge of fear in the market is the Put-Call Ratio (PCR).

However, this gauge is flawed.

Why?

Because it does not have a time component.

However, this gauge is flawed.

Why?

Because it does not have a time component.

If you haven't read it

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

" #DJT made an excellent breakout and closed above 20 and 100DMA. It closed right at its 50DMA. Bullish action from a leading indicator. $DJT will have to surpass the conjunction of 50DMA and 200DMA next week, in order to validate more upward moves"

It did that yesterday

#ES_F

It did that yesterday

#ES_F

$QQQ

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

$SPX has been trapped in a Noise Box for the past 14 days

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

TODAY IN THE MARKETS

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

Today in the markets

$SPX

An unexpected rally pushed #SPX 50 points higher today on increased volume

We can say it was a successful retest or bounce from the 100DMA

It closed at 20DMA and is now in the "pinch". Tomorrow we'll know which side #SPX is going to come out on

#SPX

$SPX

An unexpected rally pushed #SPX 50 points higher today on increased volume

We can say it was a successful retest or bounce from the 100DMA

It closed at 20DMA and is now in the "pinch". Tomorrow we'll know which side #SPX is going to come out on

#SPX

$DIA

Another rally on higher volume

Today closed above the 20DMA, somewhat bullish if it is able to hold that ground.

Big impulsive green candle, indicating further upside

$DJI #DIA #DIJ $DJIA #industrial $SPX #SPX

#DowJones

Another rally on higher volume

Today closed above the 20DMA, somewhat bullish if it is able to hold that ground.

Big impulsive green candle, indicating further upside

$DJI #DIA #DIJ $DJIA #industrial $SPX #SPX

#DowJones

1/

The US market's rigged.

It'll go way higher until the entire United States collapse.

You're better off being a perma-bull than a perma-bear.

#SPX #NDX #IWM #BTC #ETH 🧵

The US market's rigged.

It'll go way higher until the entire United States collapse.

You're better off being a perma-bull than a perma-bear.

#SPX #NDX #IWM #BTC #ETH 🧵

At age eighteen, Princess Elizabeth watching British parachutists before D-Day 1944: #IWM

Sixteen-year-old Princess Elizabeth [right] and her family with Eleanor Roosevelt, Buckingham Palace, 1942, during World War II: #Beaton

Queen Elizabeth at Balmoral Castle in Scotland with Prince Philip and President Eisenhower, Princess Anne and Prince Charles, 1959: #AP

I've been saying this since March 2022.

#Bitcoin has been following the small cap indexes such as #IWM and #Russell2000 very closely since September 2021.

They are the first ones to get hit.

Large caps #SPX #QQQ got hit later.

🧵/1

#Bitcoin has been following the small cap indexes such as #IWM and #Russell2000 very closely since September 2021.

They are the first ones to get hit.

Large caps #SPX #QQQ got hit later.

🧵/1

Good Morning!

If youve checked out my blog then you know I use What I call 'The neutral Strategy for ETF's.

I'm still very intrigued by the strength of $IWM.

Notice the Blueprint I put together on 9/26 and the results

If youve checked out my blog then you know I use What I call 'The neutral Strategy for ETF's.

I'm still very intrigued by the strength of $IWM.

Notice the Blueprint I put together on 9/26 and the results

Price pushed into T2 to the upside and rejected and then dropped to lower T1 and supported. Remember levels to the upside are resistance and levels to downside are support. At the end of the week price closed right in the neutral and is getting very tight.

From a #Fibonacci perspective you can see price is still below the 618, the golden fib. Why is this a big deal? A move above the 618 signals a break in trend of the measured range.

Bulls need above 224.41 and a close on the weekly above this would be instrumental

Bulls need above 224.41 and a close on the weekly above this would be instrumental

Charts Time!

Follow the thread

$SPY $SPX $QQQ $JETS $NVDA $AMZN $XLE $XLF $PLTR $IWM $TRAN $MJ

Follow the thread

$SPY $SPX $QQQ $JETS $NVDA $AMZN $XLE $XLF $PLTR $IWM $TRAN $MJ

$QQQ

#QQQ similar on weekly, if it dips anywhere close towards 320, buy weeklies and monthlies as its gonna go right back up, below this line though we'll see what happens

#QQQ similar on weekly, if it dips anywhere close towards 320, buy weeklies and monthlies as its gonna go right back up, below this line though we'll see what happens

Charts Time!

Follow the thread

$SPY $SPX $QQQ $JETS $NVDA $AMZN $XLE $XLF $PLTR $IWM $TRAN $MJ

Follow the thread

$SPY $SPX $QQQ $JETS $NVDA $AMZN $XLE $XLF $PLTR $IWM $TRAN $MJ

$QQQ

#QQQ similar on weekly, if it dips anywhere close towards 320, buy weeklies and monthlies as its gonna go right back up, below this line though we'll see what happens

#QQQ similar on weekly, if it dips anywhere close towards 320, buy weeklies and monthlies as its gonna go right back up, below this line though we'll see what happens

Financial Stress Index ticks up to 0.1029 in the week ended Oct. 30 (0=normal)

see previous market corrections right after Financial Stress Index rising above 0 at rapid speed while $SPX $NDX were super bullish, complacent & FOMO

Feb 2018

Dec 2018

Sep 2019

Feb 2020

and Now?🧐

see previous market corrections right after Financial Stress Index rising above 0 at rapid speed while $SPX $NDX were super bullish, complacent & FOMO

Feb 2018

Dec 2018

Sep 2019

Feb 2020

and Now?🧐

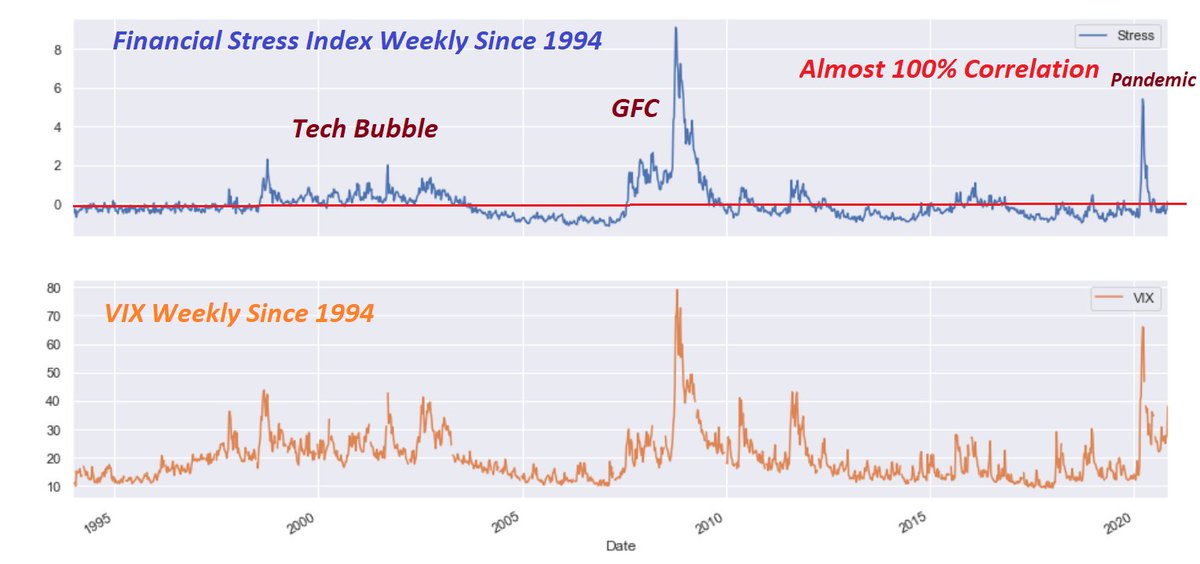

Shocking correlation between

1 St. Louis Fed Financial Stress Index and

2 VIX

Since 1994: amzing

To be exact: 26-year correlation = 85%

1 St. Louis Fed Financial Stress Index and

2 VIX

Since 1994: amzing

To be exact: 26-year correlation = 85%

Quiz 🧐

Super-duper leading indicator

1 want to predict #SPX levels & supply/demand zones?

2 below magic leading indicator would show you the way, along with other leading indis & clustering Algo

Jaws -> converge

hint: another great input to the Deep Learning Neurons

Quiz😉

Super-duper leading indicator

1 want to predict #SPX levels & supply/demand zones?

2 below magic leading indicator would show you the way, along with other leading indis & clustering Algo

Jaws -> converge

hint: another great input to the Deep Learning Neurons

Quiz😉

monitor below chart closely.

$NQ just re-tested the lower support level

$NQ low = 11,598

they can't allow to plunge below 11,600 level.

otherwise, tomorrow bloodbath.

see below Support & Resistance levels

super accurate😉

stop-run levels on both sides: bulls & bears👇

$NQ just re-tested the lower support level

$NQ low = 11,598

they can't allow to plunge below 11,600 level.

otherwise, tomorrow bloodbath.

see below Support & Resistance levels

super accurate😉

stop-run levels on both sides: bulls & bears👇

Analysis: #NYSEArca $IWM

Case 461 #iSharesRussell2000ETF IWM

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#IWM 1/4

Case 461 #iSharesRussell2000ETF IWM

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#IWM 1/4

Chart 1

Monthly Chart: The huge down move seen in Mar. 2020 was halted at the Aug. 2013 #pivot and #SMA 200 via long term demand. Price has bounced back up but is struggling to break above Sept. 2018 #trendline .....

IWM 2/4

Monthly Chart: The huge down move seen in Mar. 2020 was halted at the Aug. 2013 #pivot and #SMA 200 via long term demand. Price has bounced back up but is struggling to break above Sept. 2018 #trendline .....

IWM 2/4

..... #resistance. Aggregated sales are seen at 164.92, 170.03 then heavy at 176.70 and 181.86. A close/hold above 193.85 will target 219.63

IWM 3/4

IWM 3/4