Discover and read the best of Twitter Threads about #Valuations

Most recents (23)

Byju’s. Ola. Oyo. Swiggy- Why have investors slashed their valuations like crazy? 📛📛

Why should this be taken seriously? And why were they valued so high before?

Here’s why these questions deserve more attention! 👇

Why should this be taken seriously? And why were they valued so high before?

Here’s why these questions deserve more attention! 👇

👉 @BYJUS

Before: $22.5bn

Now (As per Prosus): $5.9bn

Now(BlackRock): $11.5bn

Cut down twice.

👉 @Swiggy

Jan 22: $10.7bn

Now (Invesco): $5.5bn

Cut down twice.

👉 @Olacabs

Before: $7.4bn

Now (Vanguard): $4.8bn

Cut down thrice.

👉 @oyorooms

Before: $10bn

Now (Softbank): $2.7bn

Before: $22.5bn

Now (As per Prosus): $5.9bn

Now(BlackRock): $11.5bn

Cut down twice.

👉 @Swiggy

Jan 22: $10.7bn

Now (Invesco): $5.5bn

Cut down twice.

👉 @Olacabs

Before: $7.4bn

Now (Vanguard): $4.8bn

Cut down thrice.

👉 @oyorooms

Before: $10bn

Now (Softbank): $2.7bn

But, why should these be taken seriously?

🔆 SoftBank Group Corp. is $60bn Japanese tech giant operating 2 Vision Funds cumulatively holding startup assets worth ~$130bn

🔆 SoftBank Group Corp. is $60bn Japanese tech giant operating 2 Vision Funds cumulatively holding startup assets worth ~$130bn

Here is this Week’s Market Wrap 'FOMO & False Starts' written by @shyamsek

A Thread (1/n)

#stockmarket #investing #personalfinance #FOMO #marketwrap

A Thread (1/n)

#stockmarket #investing #personalfinance #FOMO #marketwrap

The markets go up too quickly when people are least prepared for it. That setting is perfect for us to get that fear of missing out. We call it the FOMO feeling. (2/n)

#stockmarket

#stockmarket

But the markets also have an equally strong way of reversing direction. Either in stock price or in a broader market context. (3/n)

#stockmarketindia #stocks #equity

#stockmarketindia #stocks #equity

1/19 @ttmygh of the wonderful Things That Make You Go HMMMM newsletter just wrote a scathing piece on the emerging #pension fund disaster in lagged marks from private #equity.

loom.ly/YyomXW4

loom.ly/YyomXW4

2/19 As he explains:

#PrivateEquity is taking down Pension Funds as they struggle to keep the game of hot-potato going. “Hot potato” being the business practice of selling slices of companies back and forth to one another at ever higher #valuations.

#PrivateEquity is taking down Pension Funds as they struggle to keep the game of hot-potato going. “Hot potato” being the business practice of selling slices of companies back and forth to one another at ever higher #valuations.

3/19 The “solution” appears to be PE firms building funds to buy #assets from themselves at possibly fraudulent valuations set by themselves.

@shyamsek The ithought Way - Our Investment Philosophy

#TruBluPMS #theITHOUGHTway #ithought #investing

#TruBluPMS #theITHOUGHTway #ithought #investing

Here are some highlights from the Voices of Tomorrow Bangalore Chapter! (1/n)

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

Session #01

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

“We want to make Millennials as $ Millionaires – a well-managed wealth corpus for the 90’s born.” - @shyamsek on what ithought wants to accomplish.

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Flipkart.

Burns through $3.7 billion in one year.

That's approximately ₹30,000 crores.

₹82.2 crores a day, every day.

₹3.42 crores an hour, every hour of the year.

15 years and not a single naya paisa, dhela, pai, in profits. Ever.

#valuations

Burns through $3.7 billion in one year.

That's approximately ₹30,000 crores.

₹82.2 crores a day, every day.

₹3.42 crores an hour, every hour of the year.

15 years and not a single naya paisa, dhela, pai, in profits. Ever.

#valuations

We have a winner here.

"Five-year-old OkCredit spends ₹297 to earn a rupee in FY22"

Revenue from operations: ₹39 lakh

Total expenses: ₹115 crores

BTB, income from interest & investments: ₹1.93 crores

🤡💸

@entrackr

entrackr.com/2022/12/five-y…

"Five-year-old OkCredit spends ₹297 to earn a rupee in FY22"

Revenue from operations: ₹39 lakh

Total expenses: ₹115 crores

BTB, income from interest & investments: ₹1.93 crores

🤡💸

@entrackr

entrackr.com/2022/12/five-y…

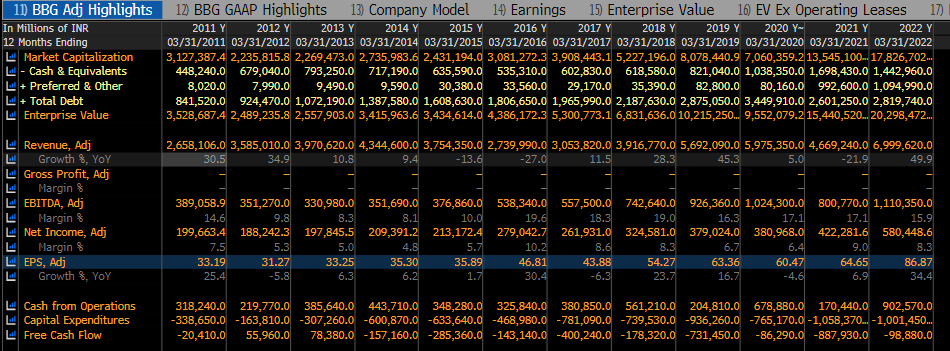

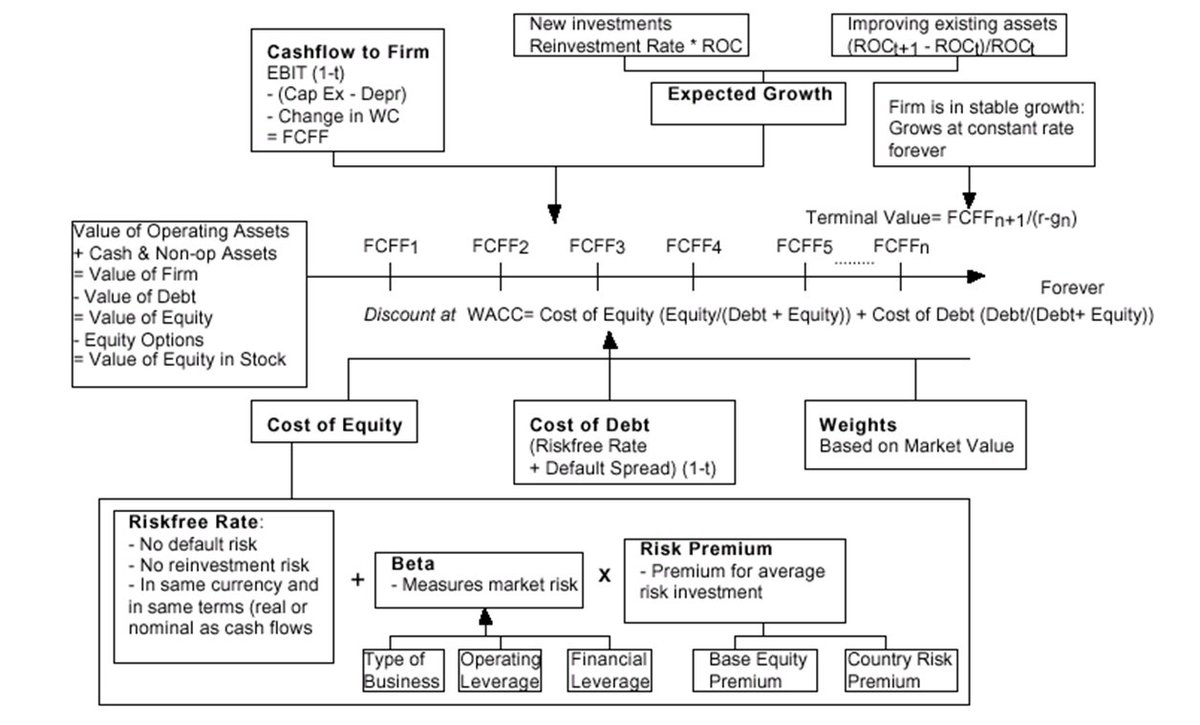

#MustRead #NIFTY #CostOfCapital

How Does #Rising #InterestRates/ #CostOfCapital/#DiscountingRate Impact Stock #Valuations. A STUDY of large Cap INDIAN Stocks

A long THEAD, pls stay with me...Exercise Shows a #StockWise Impact of Higher Discounting Rates & Implied Long Term Growth

How Does #Rising #InterestRates/ #CostOfCapital/#DiscountingRate Impact Stock #Valuations. A STUDY of large Cap INDIAN Stocks

A long THEAD, pls stay with me...Exercise Shows a #StockWise Impact of Higher Discounting Rates & Implied Long Term Growth

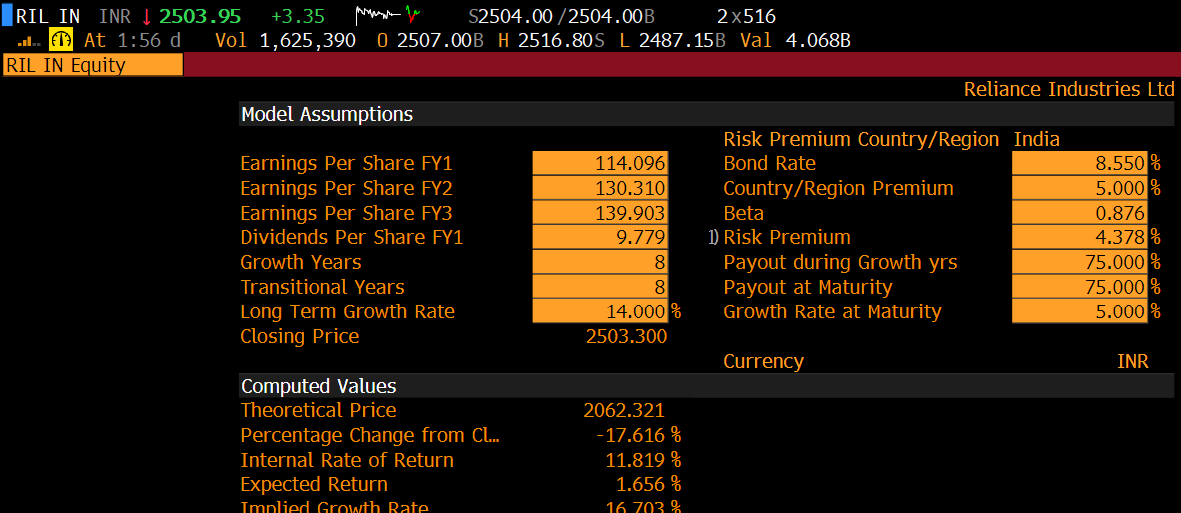

Exercise based on Div Discounting Model (DDM) for Current GSEC vs 8.5% GSEC (Every Justification for it to be 9%).

Starting with #Reliance

Tab 1: Stk px implies 14% CAGR LT Growth (8yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (14% CAGR) @ 8.55% GSEC

=>18% Lower Fair Value(Rs2062)

Starting with #Reliance

Tab 1: Stk px implies 14% CAGR LT Growth (8yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (14% CAGR) @ 8.55% GSEC

=>18% Lower Fair Value(Rs2062)

1/n #RED #ALERT !! This has to REACH MAXIMUM people so people #RETWEET. You will Understand ONLY when you have read it. I have been talking about the Impact of Interest Rates on #AssetAllocation. There could be NOBODY ELSE world-over who understands this, better than #LarryFink

2/n In response to a question potential for client rebalancing into fixed income just as rates and markets eventually stabilize.

ANSWER: “Traditional 60-40 allocations are certainly at a balance, and portfolio liquidity profiles have also been impacted.”

ANSWER: “Traditional 60-40 allocations are certainly at a balance, and portfolio liquidity profiles have also been impacted.”

3/n “for the first time in years, investors can actually earn very attractive yields without taking much duration or credit risk. Just a year ago, the U.S. two-year treasury notes were yielding 25 basis points”

Lot of #AMCs come up with different ideas, themes, sectors.

These are demands from #Investors as they have done well in recent past.

AMCs are manufacturers & will offer what is in demand.

Final choice to say YES or NO lies entirely with Investors based on their #NEEDs

These are demands from #Investors as they have done well in recent past.

AMCs are manufacturers & will offer what is in demand.

Final choice to say YES or NO lies entirely with Investors based on their #NEEDs

What should investors choose and what should they ignore. A point by point guide on where and why to invest in certain #themes, #MarketCap bias, #Sectors, #AssetClasses etc.

What should be criteria for these selections and what should guide them to resist from Investing?

What should be criteria for these selections and what should guide them to resist from Investing?

Lets start with #Debt:

Keep enough money as 1 year of your expenses as #EmergencyFunds in #LiquidSchemes

You already have enough exposure to debt as:

1. #PPF

2. #TaxFreeBonds

3. #FDs

No need for separate debt allocation if you are investing thru #AssetAllocation (AA) or #DAAF

Keep enough money as 1 year of your expenses as #EmergencyFunds in #LiquidSchemes

You already have enough exposure to debt as:

1. #PPF

2. #TaxFreeBonds

3. #FDs

No need for separate debt allocation if you are investing thru #AssetAllocation (AA) or #DAAF

From Jan 2018 to peak of #EquityMarkets on 18th Oct 2021, #SmartInvesting of @IamMisterBond underperformed #BuyAndHold only against #NIFTY50 but beat NIFTY Mid and Small Cap 100 by a big margin.

Post that, markets have been #volatile with downward bias

Post that, markets have been #volatile with downward bias

Results of Smart Investing v/s Buy & Hold under all Market Caps is for all to see - with 1) lower volatility, 2) beating results of Buy & Hold by big margins

#SmartInvesting switched to Equity in Mar 20 after downside protection and switched back to DAAF by Jul 20

#SmartInvesting switched to Equity in Mar 20 after downside protection and switched back to DAAF by Jul 20

3) Values under Buy & Hold have gone down substantially from Oct 2021 to Feb 2022 v/s values going down marginally under Smart Investing due to being in #DAAF, 4) Smart Investing portfolios better placed at current juncture to take advantage of market #volatility v/s Buy & Hold

1/ Here's my 2022 and beyond #investing outlook (mostly covering #stocks) and general thoughts on the #macro backdrop, #markets, #valuations and #risk. Lot's of good analysis is publicly available, so will try to keep this brief and different.

"Navigating the Low Tide"

"Navigating the Low Tide"

1/

A short thread on the boom in startups and their valuations:

Interest rates have been low in the US for more than 10 years. The Fed Funds rate has been at 0.25% since 2008, except for a few years during the Trump administration when they rose to 2%. They are back to 0.25% now.

A short thread on the boom in startups and their valuations:

Interest rates have been low in the US for more than 10 years. The Fed Funds rate has been at 0.25% since 2008, except for a few years during the Trump administration when they rose to 2%. They are back to 0.25% now.

2/

Quantitative Easing (QE) has pumped in trillions of dollars into the US economy.

Clearly, the money has to go somewhere and VCs need returns.

Startups is where some of that money has gone.

Quantitative Easing (QE) has pumped in trillions of dollars into the US economy.

Clearly, the money has to go somewhere and VCs need returns.

Startups is where some of that money has gone.

3/

The startup party has never had it so good.

Companies with zero profits, no business plan or hope in hell of ever getting profitable, became "unicorns", making their founders, funders, and some employees rich beyond imagination.

Good.

The startup party has never had it so good.

Companies with zero profits, no business plan or hope in hell of ever getting profitable, became "unicorns", making their founders, funders, and some employees rich beyond imagination.

Good.

#Pharmeasy - Health Tech #unicorn – to acquire Majority stake (66%) in #Thyrocare. Open offer for an additional 26% stake at Rs1300/sh. With this diagnostics bet, it completes its exhaustive portfolio of "Wholistic Outpatient Healthcare Ecosystem". (1/9)

Gujju Gang from Ghatkopar (as founders call themselves) make it big in what is first-ever acquisition of publicly listed firm by the unicorn. New funding tied up at #valuations of USD4bn. Promoters of Thyrocare will also be investing in Pharmeasy for 5% stake. (2/9)

Pharmeasy founders started as venture called dialhealth.com (2012-13) which failed, followed by Dial Health chain of retail stores which also failed. After 2 failed ventures, they moved to distribution business (& B2B) that was a success (2015). (3/9)

Thanks for sharing 🙏. Loved it. Much to learn from both camps.

Reminds me of an anecdote which happened recently. Wanted to share some knowledge on how I value #lauruslabs

#Valuations by their nature are subjective so some of these will be opinions.

Reminds me of an anecdote which happened recently. Wanted to share some knowledge on how I value #lauruslabs

#Valuations by their nature are subjective so some of these will be opinions.

Someone recently asked me following:

#lauruslabs has publicly stated guidance of doing 1B$ revenue in Fy23, with 30% EBITDA margins. They calculated profits to be 2340cr in Fy23. So P/E based on Fy23 earnings would be 14.

Question: Is this cheap?

#lauruslabs has publicly stated guidance of doing 1B$ revenue in Fy23, with 30% EBITDA margins. They calculated profits to be 2340cr in Fy23. So P/E based on Fy23 earnings would be 14.

Question: Is this cheap?

My Answer (Rest of the thread):

Philosophical: Valuations lie in the eyes of the beholder & are most difficult part of any investment thesis; personally. There is no single “valuation”. Each investor must make their own decision on how to value, what's cheap, what is expensive.

Philosophical: Valuations lie in the eyes of the beholder & are most difficult part of any investment thesis; personally. There is no single “valuation”. Each investor must make their own decision on how to value, what's cheap, what is expensive.

Thread 🧵#StockMarket #Tips For Beginners 🇮🇳

In this thread find some stock market tips for beginners, especially those who have joined market recently during #COVID19 #lockdown and have only seen one-sided rally.

(If you like then please re-tweet to maximize reach)

#BSE #NSE

In this thread find some stock market tips for beginners, especially those who have joined market recently during #COVID19 #lockdown and have only seen one-sided rally.

(If you like then please re-tweet to maximize reach)

#BSE #NSE

1⃣ Save Regularly & Initially Invest Small Amounts 👇

#Investing in #StockMarket is comparatively risky as compared to investing in other avenues. Hence start with small amount and it should ideally be the amount which you can afford to loose.

#BSE #NSE

#Investing in #StockMarket is comparatively risky as compared to investing in other avenues. Hence start with small amount and it should ideally be the amount which you can afford to loose.

#BSE #NSE

2⃣ Initially invest via #MutualFunds 👇

It is the best thing to do initially, if you lack knowledge about #StockMarket #investing, start investing via mutual funds and only after learning the basics slowly jump to direct equity investing.

#MutualFundsSahiHai #MF

It is the best thing to do initially, if you lack knowledge about #StockMarket #investing, start investing via mutual funds and only after learning the basics slowly jump to direct equity investing.

#MutualFundsSahiHai #MF

Recently, Dr. Shiller suggested that #valuations really aren't that high once you fall in the #Fed trap of using #earnings #yields and #low #rates to justify it. The problem is it is a #rationalization to justify overpaying for #assets.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

The main problem in using low-interest rates as a rationalization to overpay for assets is that you have to also discount #future #cashflows for lower inflation and rates as well.

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

"As low-interest rates went lower, the dynamic changed from using debt productively to using debt for non-productive purposes such as dividend issuance, share buybacks, and, in some cases, offsetting negative cash flows."

realinvestmentadvice.com/shiller-ecy-ju…

realinvestmentadvice.com/shiller-ecy-ju…

#Goal Based Investing vs #PortfolioProtection Debate: Sharing my response to that debate: 👇

I have a totally different take in this Goal based investing and communication with Investors.

I have a totally different take in this Goal based investing and communication with Investors.

My 35 years of experience is showing me totally diametrically opposite conclusion to this. Only my observations, please ignore if you do not agree:

My belief is that Goal based investing is only good on paper and may be to get some discipline in Investment habits.

My belief is that Goal based investing is only good on paper and may be to get some discipline in Investment habits.

But unfortunately most Investors do not follow it. For example at current juncture, when they have existential crisis, how many will continue on the path of goal based investing? Many have stopped SIPs, many have withdrawn and redeemed.

What happens to their Goals now??

What happens to their Goals now??

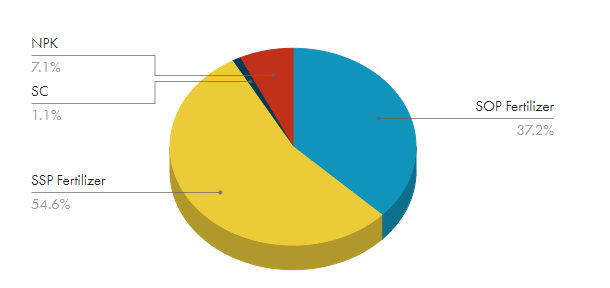

#Shree Pushkar Chemicals & Fertilizers

Shree Pushkar #Chemicals & #Fertilizers Ltd is engaged in the business of manufacturing and trading of chemicals, #dyes and dyes intermediate, cattle feeds, fertilizers and soil conditioner.

Shree Pushkar #Chemicals & #Fertilizers Ltd is engaged in the business of manufacturing and trading of chemicals, #dyes and dyes intermediate, cattle feeds, fertilizers and soil conditioner.

Let’s have a look at the company’s business as well how well they have diversified. They have a well diversified business which is growing on all fronts.

Here is a breakdown of their #Fertilizer products as well.

#Whattay Series. In this #tweet thread will keep adding a lot of #stock price moves, #valuations where you end up saying #WHAT. No Reco just ?? Do comment 1) #Relaxo Footwear - just 10% away from highs. Market Cap = 18319 cr Sales 2500 cr #Bata -18419 cr Sales = 3056 cr !! PE ?

No Effect of #Corona on this #RealEstate Company. A 30% rally from the lows in May June.Low delivery volumes and almost same volumes and a weird chart.. Anyways its an avoid so not naming it.

Another craziness in gone stocks - #Educomp , #OptoCircuits are up 5x from the lows of March. Another stock which has zero effect of #covid19 and does low delivery volumes.

Biggest #COVID19 casualty

Post Jan2020, the #crudeoil prices collapsed 60-70%. The company has major dependence on global oil & gas players for its order book.

Post Jan2020, the #crudeoil prices collapsed 60-70%. The company has major dependence on global oil & gas players for its order book.

However, we feel Welspun Corp’s strong cash & investment position in the #balancesheet and very low #longtermdebt will help the company withstand the current turmoil and bounce back stronger.

#valuations #GodrejProp

Godrej Properties, Consol. Networth

March 2009 Rs 299 cr,

March 2019 Rs 2469 cr

change Rs 2170 cr

Securities Premium (on account of capital raised)

March 2009 Rs 148 cr

March 2019 Rs 2695 cr

Change Rs 2547 cr

Godrej Properties, Consol. Networth

March 2009 Rs 299 cr,

March 2019 Rs 2469 cr

change Rs 2170 cr

Securities Premium (on account of capital raised)

March 2009 Rs 148 cr

March 2019 Rs 2695 cr

Change Rs 2547 cr

In 10 years, Networth change < Capital raised, meaning company has lost money for 10 years. It has reported profit every year but then there are adjustments to PAT! Net effect - negative earnings for 10 years.

Not paid dividend after March 2015. Has raised capital every 2 years. I havent included the latest raise of Rs 2100 cr in June 2019.

Yet trades at mind numbing valuations of almost Rs 24k crores.

Yet trades at mind numbing valuations of almost Rs 24k crores.

Já aconteceu isso com vocês? Você em t0 avalia uma empresa e no final (t1) não bate! Isso ocorre na maioria das vezes. Alguns fatores podem explicar isso: i) mercado realizou ganhos; ii) algum evento externo; iii) resultados de estatísticas oficiais (PIB, Inflação..); iv)...

...iv) manipulação/ajustes contábeis que reduziram lucros p/ abaixo do esperado (um dos pontos que mais gosto de analisar); v) mudança na governança (diretoria ou conselheiros de administração, fiscal ou comitê de auditoria); vi) conflitos entre controladores e minoritários;...

...vii) companhia resolve parar de publicar o guidance; viii) reformas equivocadas do governo; ix) piora do disclosure; x) twitt de Presidentes; xi) a lista não tem fim... Só alguns pontos para não ficarem decepcionados(as) com seus #valuations #valuation #contabilidade