Discover and read the best of Twitter Threads about #buybacks

Most recents (9)

#Bitcoin set to soar with projected target of $36,000 as technical breakout signals strong #rally amidst positive market outlook fueled by #stockbuybacks and #memecoins

🧵👇

Sub to our TG for the latest: t.me/matrixportupda…

🧵👇

Sub to our TG for the latest: t.me/matrixportupda…

1/10: #Bitcoin prices could be set to surge as the #cryptocurrency #trades within a narrowing triangle that is about to break to the upside, potentially projecting a move higher by around 6,100 points.

1) Bugün (bence net, ancak) çoğunluk için tartışmalı bir konu üzerine yazacağım. #PayGeriAlımı. (#Buybacks)

Aslında #Berkshire yıllık toplantısı için mektubunda Warren Buffett bu konuyu savunmuş, hatta aksi görüştekileri sert bir dille eleştirmişti.

ft.com/content/97b875…

Aslında #Berkshire yıllık toplantısı için mektubunda Warren Buffett bu konuyu savunmuş, hatta aksi görüştekileri sert bir dille eleştirmişti.

ft.com/content/97b875…

2) Açıklamanın pay geri alımlarına ilişkin vergi düzenlemesinin yürürlüğe girmesinin ardından gelmesi her ne kadar konuyu başka noktalara taşısa ve bunun ekonomiye ekileri düşük seviyede olsa da ben tartışmayı kurumsal finans düzleminde aktaracağım.

3) Merak edileni başta söyleyeyim:

Eğer pay geri alımlarının gerekçesi piyasada işlem gören hisselerin değerinin düşük olmasıysa buna %100 katılıyorum ki Buffett'ın da vurguladığı bu nokta bence itiraz içermiyor.

Ancak her geri alım (öyle dense de) bu nedenle yapılmaz.

Eğer pay geri alımlarının gerekçesi piyasada işlem gören hisselerin değerinin düşük olmasıysa buna %100 katılıyorum ki Buffett'ın da vurguladığı bu nokta bence itiraz içermiyor.

Ancak her geri alım (öyle dense de) bu nedenle yapılmaz.

🍎 #Apple releases results after markets close today

☎️ A conference call is scheduled for 1400 PT (1700 ET)

Here is a 🧵 of what to expect from the world's most valuable publicly-listed company...

☎️ A conference call is scheduled for 1400 PT (1700 ET)

Here is a 🧵 of what to expect from the world's most valuable publicly-listed company...

It was a tough quarter thanks to Covid-19 disruption in #China and softening demand

As a result, markets expect sales to drop for the 1st time in 3 years

That will be driven by lower #iPhone and #Mac sales 👇

As a result, markets expect sales to drop for the 1st time in 3 years

That will be driven by lower #iPhone and #Mac sales 👇

🛍️ That will mean it won't deliver growth over the Golden Quarter - the busiest period covering the holiday shopping season.

This raises the question of how many of these sales will be pushed into 2023 or lost entirely

This raises the question of how many of these sales will be pushed into 2023 or lost entirely

#WallStreet sees a public health crisis as an opportunity to profit, and it shows in the McConnell #bailout plan, a multi-trillion-dollar giveaway to corporate America that @GoldmanSachs may actually run! Check it out and fight back: THREAD 1/10 washingtonpost.com/business/2020/…

The plan envisions two pots of money for the bailout, $75 billion pot and a $425 billion pot. The smaller pot (for airlines and industries deemed important for national security) has some restrictions on it, but they are minimal 2/10

Executives couldn’t earn more than what they did the previous year (a record year for airline bosses) the restrictions last only 2 years, even though the loans from the $75 billion pot would last 5 years. No requirement to give taxpayers equity. Minimal buyback limitations 3/10

The #CoronaVirus or #Covid19 is a classic #BlackSwan event.

No one could see it coming. (Ok @BillGates did highlight risk of a pandemic - but realistically not many planned for this)

...

No one could see it coming. (Ok @BillGates did highlight risk of a pandemic - but realistically not many planned for this)

...

Such a chaotic event is catastrophic for those who are #Fragile,

A downturn for #Robust

Good for #Antifragile

(Channelling my inner NNT)

A downturn for #Robust

Good for #Antifragile

(Channelling my inner NNT)

What is fragility?

As per @nntaleb checklist

- too much concentration of power (can’t talk back to authority with honest feedback)

- one trick pony (export one commodity)

- too much leverage (financial or over optimised supply chain)

- experience of previous crisis

As per @nntaleb checklist

- too much concentration of power (can’t talk back to authority with honest feedback)

- one trick pony (export one commodity)

- too much leverage (financial or over optimised supply chain)

- experience of previous crisis

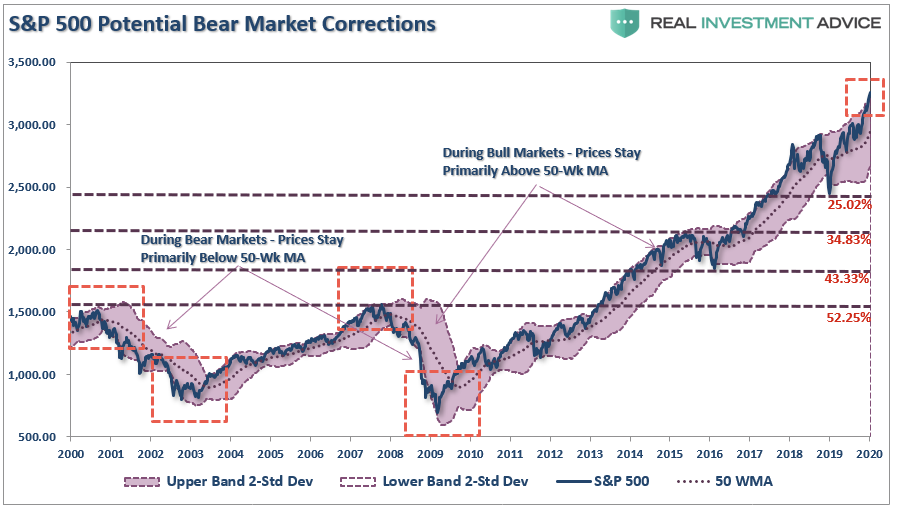

"Despite a few notable hiccups along the way, the bull market continues to prove insanely resilient.” @slangwise

What if? We explore what a 10-60% correction would do to investors and their #retirement. While this #TimeIsNotDifferent, you are.

realinvestmentadvice.com/market-downtur…

What if? We explore what a 10-60% correction would do to investors and their #retirement. While this #TimeIsNotDifferent, you are.

realinvestmentadvice.com/market-downtur…

@slangwise Looking at potential retracement levels, to the lows of 2018, or the highs of 2015-2016 would not be out of the ordinary. A mean reversion event would be the lows of 2016 to the highs of 2008.

realinvestmentadvice.com/market-downtur…

realinvestmentadvice.com/market-downtur…

@slangwise A problem with #market #corrections always overlooked by #mainstream #analysis.

If you need 6% per year to reach your goals, and suffer a 20% correction, it doesn't require JUST 25% to get back to even. You have to ALSO make up the 6%/year lost as well.

realinvestmentadvice.com/market-downtur…

If you need 6% per year to reach your goals, and suffer a 20% correction, it doesn't require JUST 25% to get back to even. You have to ALSO make up the 6%/year lost as well.

realinvestmentadvice.com/market-downtur…

Given the moderate #economic backdrop that we’ve outlined for 2020, can risk #assets continue to perform into next year? There are historical examples of strong back-to-back year repeat performance in #equities…

Current conditions differ from other periods, of course, but the massive #liquidity injections we’re witnessing (in the form of central bank policy, FX reserve growth and corporate share #buybacks), when combined with the low vol of #growth and inflation, suggests sustainability.

Further, there are some secular tailwinds to U.S. #growth that may help explain why its #economy has been pulling away from some of its developed market peers; with more favorable #demographic trends being a critical longer-term factor.

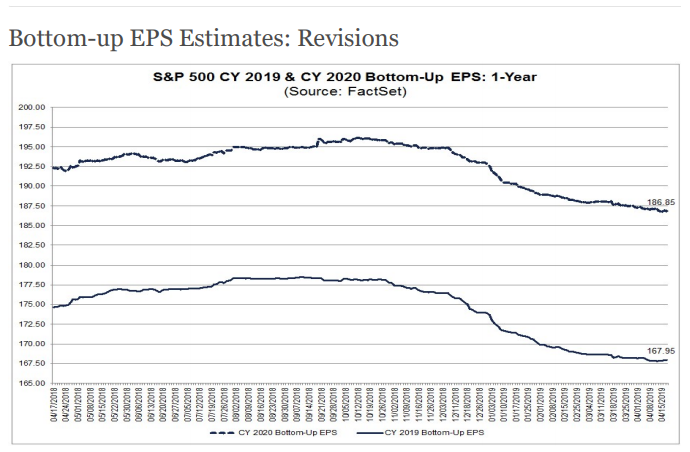

Q3-2019 EARINGS - The Good, Bad, & Ugly.

With the bulk of earnings in we can analyze just how "good" those earnings actually were, and what we should expect next. Also, what #profits are telling us. $SPY $TLT #Earnings #Profits #Recession #Reversion

realinvestmentadvice.com/fundamentally-…

With the bulk of earnings in we can analyze just how "good" those earnings actually were, and what we should expect next. Also, what #profits are telling us. $SPY $TLT #Earnings #Profits #Recession #Reversion

realinvestmentadvice.com/fundamentally-…

Earnings - The Good:

"With 73% of companies beating estimates, it certainly suggests that companies in the S&P 500 are firing on all cylinders, which should support higher asset prices."

However, as they say, the “Devil is in the details.”

"With 73% of companies beating estimates, it certainly suggests that companies in the S&P 500 are firing on all cylinders, which should support higher asset prices."

However, as they say, the “Devil is in the details.”

Earnings - The Bad

"In order for companies to achieve the 73% 'beat rate' - estimates had to be crushed to accommodate lower earnings."

realinvestmentadvice.com/fundamentally-…

"In order for companies to achieve the 73% 'beat rate' - estimates had to be crushed to accommodate lower earnings."

realinvestmentadvice.com/fundamentally-…

l'impulso dalla creazione di quasi 3Trilioni di $ di riserve non spinge in maniera coerente e costante l'elargizione di nuovo credito da parte delle banche US👉NON C'E' DOMANDA

la moneta creata non "gira" come potrebbe/dovrebbe e lo vedi su

-Linea Nera:Inflazione attesa 5y FWD

la moneta creata non "gira" come potrebbe/dovrebbe e lo vedi su

-Linea Nera:Inflazione attesa 5y FWD

...perché accade tutto questo?

perché da oltre 10 anno l'unico intento delle CBs è quello di salvaguardare il sistema finanziario come l'abbiamo sempre "conosciuto"...ma che è morto esattamente 11 anni fa...NON SIAMO MAI USCITI DALLA GFC 2008/09 e non usciremo mai in questo modo

perché da oltre 10 anno l'unico intento delle CBs è quello di salvaguardare il sistema finanziario come l'abbiamo sempre "conosciuto"...ma che è morto esattamente 11 anni fa...NON SIAMO MAI USCITI DALLA GFC 2008/09 e non usciremo mai in questo modo

...ed oggi vedremo quanto @potus è ricattabile...ha in mano il jolly per affondare EZ e lo DEVE giocare adesso...👽

ansa.it/europa/notizie…

ansa.it/europa/notizie…