Discover and read the best of Twitter Threads about #demographic

Most recents (24)

We’ve seen the pace of #payroll gains decelerate to roughly the monthly trend pace from the last expansion; consensus has been waiting for this moment and expected a 195,000 job gain in May, but the data printed considerably stronger at 339,000 #jobs gained.

The three-month moving average of #nonfarm payrolls sits at 283,000, down from 334,000 jobs at the start of the year, but what the #LaborMarket imbalance needs is more supply and more slack.

The #unemployment rate ticked up to 3.65%, close to its 12-month average level, and average hourly #earnings (a volatile figure) gained 0.33% month-over-month and 4.3% on a year-over-year basis.

#Financial #Literacy begins at home.

Teach your children to save coins, and small notes, inside a locker, or some other toy which imitates a treasure chest.

Once they do that, they will be careful with spending and saving for the rest of their lives.

Awareness matters!

Teach your children to save coins, and small notes, inside a locker, or some other toy which imitates a treasure chest.

Once they do that, they will be careful with spending and saving for the rest of their lives.

Awareness matters!

When I was a kid, I remember banks visiting my school to open student #savings accounts.

They used to give students #passbooks, which operated as cheque books.

Parents were cosignatories.

That is how I developed a passion for saving money.

They used to give students #passbooks, which operated as cheque books.

Parents were cosignatories.

That is how I developed a passion for saving money.

#Read this new #Report while there’s still time to act!

bakerinstitute.org/research/us-ch…

“US-#China Competition Enters the Decade of Max Danger: #Policy Ideas to Avoid Losing the 2020s”

My latest with Gabe Collins @BakerInstitute!

@RiceUniversity

@RiceUNews

@CES_Baker_Inst

#Xi

#Taiwan

bakerinstitute.org/research/us-ch…

“US-#China Competition Enters the Decade of Max Danger: #Policy Ideas to Avoid Losing the 2020s”

My latest with Gabe Collins @BakerInstitute!

@RiceUniversity

@RiceUNews

@CES_Baker_Inst

#Xi

#Taiwan

As #PRC/#CCP power peaks over this decade, #Xi may seek #Taiwan as historic prize.

To protect their security & rules-based order, US/Allies must mobilize immediately to deter aggression.

The mission is vital, the stakes are high, & the clock is ticking.

bit.ly/PLA2027

To protect their security & rules-based order, US/Allies must mobilize immediately to deter aggression.

The mission is vital, the stakes are high, & the clock is ticking.

bit.ly/PLA2027

US/Allies/#Taiwan now face “#DecadeOfDanger” w/ peaking #Xi/#CCP/#PRC as #China has extreme version of “S-Curved #slowdown.”

Xi’s risk acceptance will likely be amplified by his track record of largely-uncountered revisionist actions vs. neighbors & RBO.

bakerinstitute.org/research/us-ch…

Xi’s risk acceptance will likely be amplified by his track record of largely-uncountered revisionist actions vs. neighbors & RBO.

bakerinstitute.org/research/us-ch…

Thread 1/8 With #China so topical, I often say people dont see the wood for the trees...or more appropriately, they fail to read the 'tea leaves'. I have written about China quite a bit on my blog and in this thread, I will highlight the articles as well as more recent content

Thread 2/8 This piece from last year highlighted not only #China's role in the world but also some interesting learnings from an investor trip I took there a few years back.

moe-knows.com/2020/11/19/chi…

moe-knows.com/2020/11/19/chi…

The turn of the calendar year invites the temptation to prognosticate regarding the course of the year ahead for the #economy and for #markets, and not being immune to that impulse, here are our views on the “11 themes to consider as we look toward 2021:” bit.ly/386mb0r

In preview, one key theme is that 2021’s nominal #GDP growth is likely to surprise many skeptics with its strength. The sources of upside surprise can be found in: 1) the new #fiscal #stimulus combined with structural budget #deficits…

And in 2) the @federalreserve’s ongoing asset purchases and 3) the impressive #economic momentum that is still broadly underestimated, as a post-election, and #pandemic-recovering world can catalyze 2020/21’s monetized #stimulus (more than 15% of GDP) into impressive NGDP growth.

Honored to offer #PolicyRecommendations w/ Gabe Collins @RiceUniversity @BakerInstitute—

#HoldTheLine through 2035:

A #Strategy to Offset #China’s Revisionist Actions & Sustain a Rules-Based Order in the #AsiaPacific

bit.ly/HoldTheLINE

#USA #PRC

andrewerickson.com/2020/11/hold-t…

#HoldTheLine through 2035:

A #Strategy to Offset #China’s Revisionist Actions & Sustain a Rules-Based Order in the #AsiaPacific

bit.ly/HoldTheLINE

#USA #PRC

andrewerickson.com/2020/11/hold-t…

Between now & 2035, imposing costs on strategically unacceptable PRC actions + pursuing defense diplomacy offers a sustainable path to influence PRC behavior & position #IndoAsiaPacific for continued prosperity & growth under a #RulesBased regional system.

bakerinstitute.org/media/files/fi…

bakerinstitute.org/media/files/fi…

The United States should resist yielding strategic principles & position to a People’s Republic of China (#PRC) that is facing increasing constraints on its economic potential, national power growth, & prioritization of competition over citizens’ welfare.

bakerinstitute.org/research/hold-…

bakerinstitute.org/research/hold-…

The CBO has dropped the '2020 long-term budget outlook' - It's not pretty...cbo.gov/system/files/2… #US #USeconomy #Debt #FiscalMonetaryMelt #Macro #Risk Some take aways...(1/5)

The #FOMC today began the process of “operationalizing” the average inflation targeting framework that Chair #Powell first laid out in his Jackson Hole, WY, Economic Policy Conference speech: including new guidance on how long #policy rates can be expected to remain near zero.

Specifically, policy #rates will remain at current levels “until #labor market conditions have reached levels consistent with the Committee's assessments of maximum #employment and #inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.”

Still, we’re skeptical about the achievability of this #inflation goal when the #disinflationary influences of technological #innovation and the #demographic trend of #population aging arguably hold a greater impact on the rate of inflation than central bank #policy does.

.#ConsumerPriceIndex data for the month of August revealed further recovery - like a lot of #macro data in recent months: core #CPI (excluding volatile food and #energy components) came in at 0.4% month-over-month and 1.7% year-over-year.

Overall, we think 2020’s broadly #deflationary influences may well lead to somewhat higher rates of #inflation by mid-2021, yet importantly, we do not expect this to reach excessive levels.

Those fearing increasingly greater risks of high #inflation stemming from #crisis rescue measures are misguided, in our view, and underestimate the continued secular headwinds to excessive #price increases…

📌The countdown has begun..💫We are just about to take you off on a marathon of tweets with our Hon’ble Minister @drharshvardhan as part of the track 1 #consultations of #STIP2020 🎉

#sciencepolicy #scipol #science #ScienceRising #ScienceTwitter #Science4Policy

#AdvancingSciPol

#sciencepolicy #scipol #science #ScienceRising #ScienceTwitter #Science4Policy

#AdvancingSciPol

Tighten your seatbelts we are going LIVE in 3⃣,2⃣,1⃣….. Here we go!

#ChatWithDrHarshVardhan on

@mygovindia @IndiaDST@PrinSciAdvGoI @Ashutos61 @guptaakhilesh63@ChagunBasha@nimita_pandey

#ChatWithDrHarshVardhan on

@mygovindia @IndiaDST@PrinSciAdvGoI @Ashutos61 @guptaakhilesh63@ChagunBasha@nimita_pandey

Good afternoon everyone! 🌞🌦️

Welcome to In Conversation with Dr. Harsh Vardhan @drharshvardhan, Hon’ble Minister of S&T @MoHFW_INDIA @moesgoi

Please post your recommendations, comments with #ChatWithDrHarshVardhan

Welcome to In Conversation with Dr. Harsh Vardhan @drharshvardhan, Hon’ble Minister of S&T @MoHFW_INDIA @moesgoi

Please post your recommendations, comments with #ChatWithDrHarshVardhan

_

Investing for retirement?

•

You’ll want to have read this & underlying paper by Kopecky & Alan Taylor

•

@RobinBHarding #pension #equitypremium #demographic #bonds

Investing for retirement?

•

You’ll want to have read this & underlying paper by Kopecky & Alan Taylor

•

@RobinBHarding #pension #equitypremium #demographic #bonds

After recent declines in both headline and core #inflation, we saw today’s #CPI data stabilize somewhat with modest gains of 0.6% and 0.2% month-over-month in headline and core CPI, respectively.

We think 2020’s broadly #deflationary influences may well lead to somewhat higher rates of #inflation in 2021, but we’re likely to see year-over-year growth in core #CPI around or below the 1% level for several quarters.

As both #inflation data and #employment numbers begin the process of carving out a bottom in the coming months and slowly begin to recover, we think it will continue to be critical for the @federalreserve to focus on bolstering its lending and stabilizing initiatives.

My notice to @NICMeity for compliance of legal provisions in #PrivacyPolicy of @SetuAarogya . #NIC as #bodycorporate must ensure #dataprotection & strict liability. #datasecurity as per IT Act & Rules must be updated in Policy before making #AarogyaSetu mandatory 1/10 @viraggupta

In #PrivacyPolicy of @SetuAarogya as per cl. 2(a) & 2(c usage of data restricted for Government of India. However, cl 2(b) & 2(d), having no mention of GOI. Due to this lapse, if #data goes to foreign #TechGiants, it may create big risk to #nationalsecurity #RighttoLife 2/10

As per clause 3(b) of the Privacy Policy, data will be retained on #mobile device. Hence, data can also be accessed by Mobile cos. As per cl. 1(b), the @SetuAarogya will use #Bluetooth and #location data. So, such data can also be accessed by #Telecom companies. 3/10 @TRAI

And while #coronavirus spread and #election jitters will likely hold the attention of policymakers and #markets for some time, my remarks were centered on a number of key structural influences that act as the critical backdrop to policy today and in the decades ahead.

Specifically, the #demographic trend of population aging, transformative #technological innovations and the long-term evolution of the #economy from manufacturing and goods production/consumption toward #services, all hold monumental influences for policy evolution.

We’ll engage this theme in the days to come, but to begin we’d make the point that both #economic growth and #inflation (and hence monetary policy) operate with a stronger correlation to the #demographic curve than generally assumed; and that curve is pointing to secular slowing:

1/

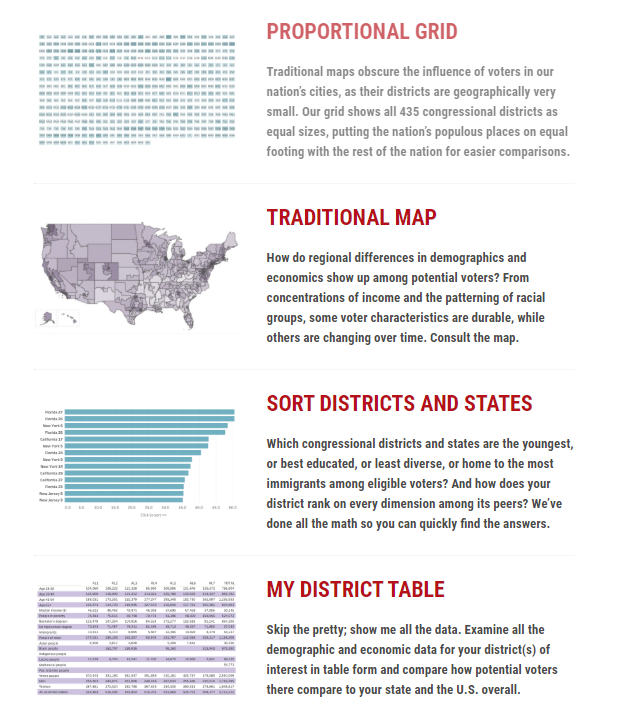

Hey folks: I wanted to share something @apmresearch just released that I’m very proud of:

Our VOTER PROFILE TOOLS, as part of our broader #RepresentingUS project. (Read: A wealth of data to understand the US electorate in interactive @tableau tools.)

apmresearchlab.org/representingus…

Hey folks: I wanted to share something @apmresearch just released that I’m very proud of:

Our VOTER PROFILE TOOLS, as part of our broader #RepresentingUS project. (Read: A wealth of data to understand the US electorate in interactive @tableau tools.)

apmresearchlab.org/representingus…

@APMResearch @tableau 2/

We at @apmresearch released these tools on #IowaCaucus day, but expect that they will be valuable up until the #2020election & beyond—to understand how eligible voters differ—often dramatically—from state to state & in each congressional district.

apmresearchlab.org/representingus…

We at @apmresearch released these tools on #IowaCaucus day, but expect that they will be valuable up until the #2020election & beyond—to understand how eligible voters differ—often dramatically—from state to state & in each congressional district.

apmresearchlab.org/representingus…

@APMResearch @tableau 3/

Already I’ve read numerous #media stories about the #IowaCaucuses & #NewHampshirePrimary saying those states don’t reflect the nation’s #demographics, but the #journalists didn’t include any data as to HOW they differed and to what degree.

Already I’ve read numerous #media stories about the #IowaCaucuses & #NewHampshirePrimary saying those states don’t reflect the nation’s #demographics, but the #journalists didn’t include any data as to HOW they differed and to what degree.

With my colleagues Russ Brownback and Trevor Slaven, we contend that eight major #market influences are likely to dominate the #investment environment in the year ahead and that a proper #portfolio mix is instrumental to delivering a successful outcome: bit.ly/2U4sn3J

Over the next week we’ll be looking at these eight themes in more detail, beginning with the first two today: 1) The importance of aggregate global #liquidity and 2) the yawning supply/demand imbalance in #yielding global #assets.

In our view, changes to the level of aggregate global #liquidity is one of the most dominant, yet still underappreciated, influences in contemporary #macro analysis. Central #banks allowed liquidity to contract in 2018 and early-2019 but have pivoted sharply since then.

Given the moderate #economic backdrop that we’ve outlined for 2020, can risk #assets continue to perform into next year? There are historical examples of strong back-to-back year repeat performance in #equities…

Current conditions differ from other periods, of course, but the massive #liquidity injections we’re witnessing (in the form of central bank policy, FX reserve growth and corporate share #buybacks), when combined with the low vol of #growth and inflation, suggests sustainability.

Further, there are some secular tailwinds to U.S. #growth that may help explain why its #economy has been pulling away from some of its developed market peers; with more favorable #demographic trends being a critical longer-term factor.

1/6 As Powell puts in his recent speech, we are “in a world of slow global growth, low inflation, and low interest rates…" and "fac[ing] heightened risks of lengthy, difficult-to-escape periods in which our policy interest rate is pinned near zero.”

2/6 CF40 member Miao Yanliang mentioned in his book that, under a #fiscal policy framework, the #demographic change and pessimistic anticipation collectively contribute to the world characterized by LOW #inflation, LOW #growth and LOW interest rate.

mp.weixin.qq.com/s/6q8SJ9RHmrKh…

mp.weixin.qq.com/s/6q8SJ9RHmrKh…

3/6 After the global financial #crisis in 2008, major developed countries faced pressure to reduce #deficits, #debt, and private sector #deleveraging. In this context, the macro-policy has shifted from the former #monetary dominance to #fiscal dominance. #macroeconomics

My colleagues and I are very pleased to be meeting with many of our institutional clients today, at the inaugural @blackrock Fixed Income Summit!

We’ll discuss how the fixed #income universe has dramatically changed in recent years, where we think it’s heading in the years to come, and how best to structure more #resilient-portfolios for the period ahead; some thoughts, in preview:

Due to the #demographic revolution underway across the globe, as well as massive growth in pension, insurance and central bank assets, there is roughly 3X as much capital that needs to be #invested today as was the case in the early-2000s.

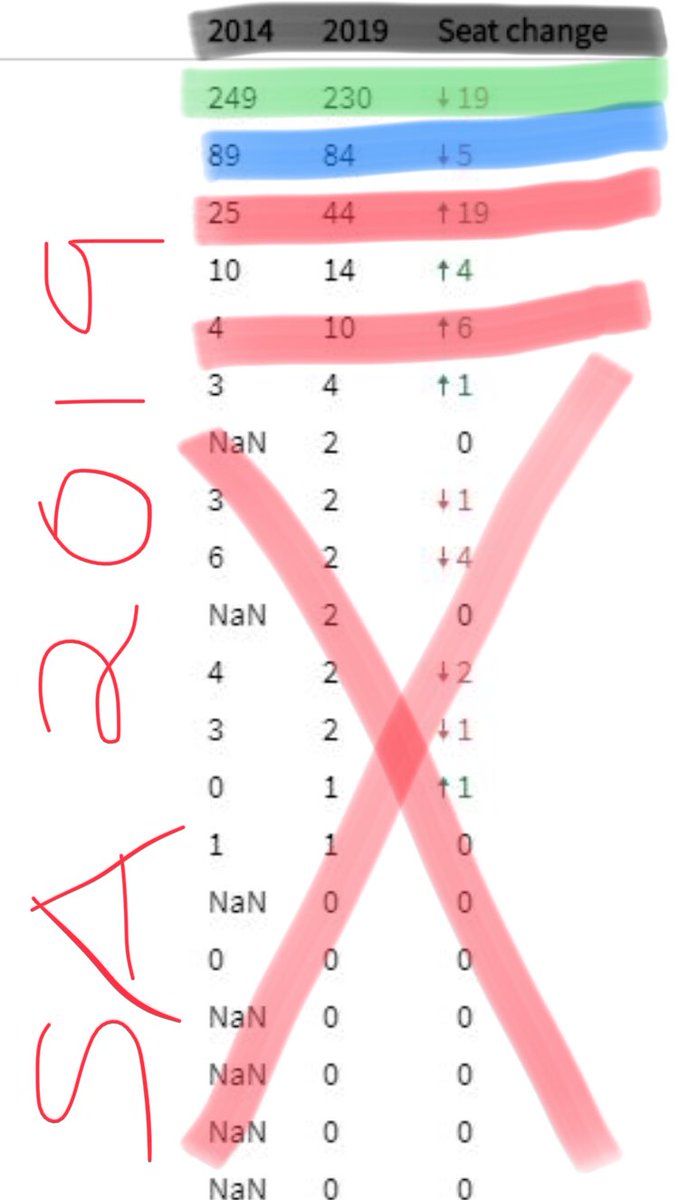

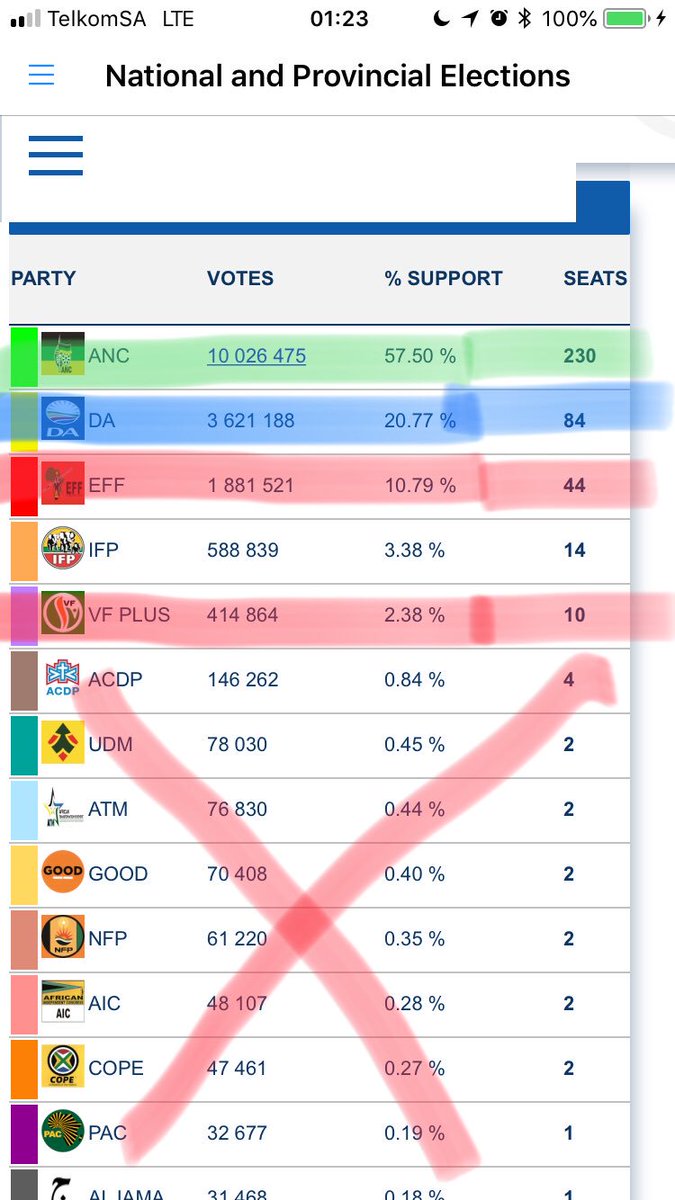

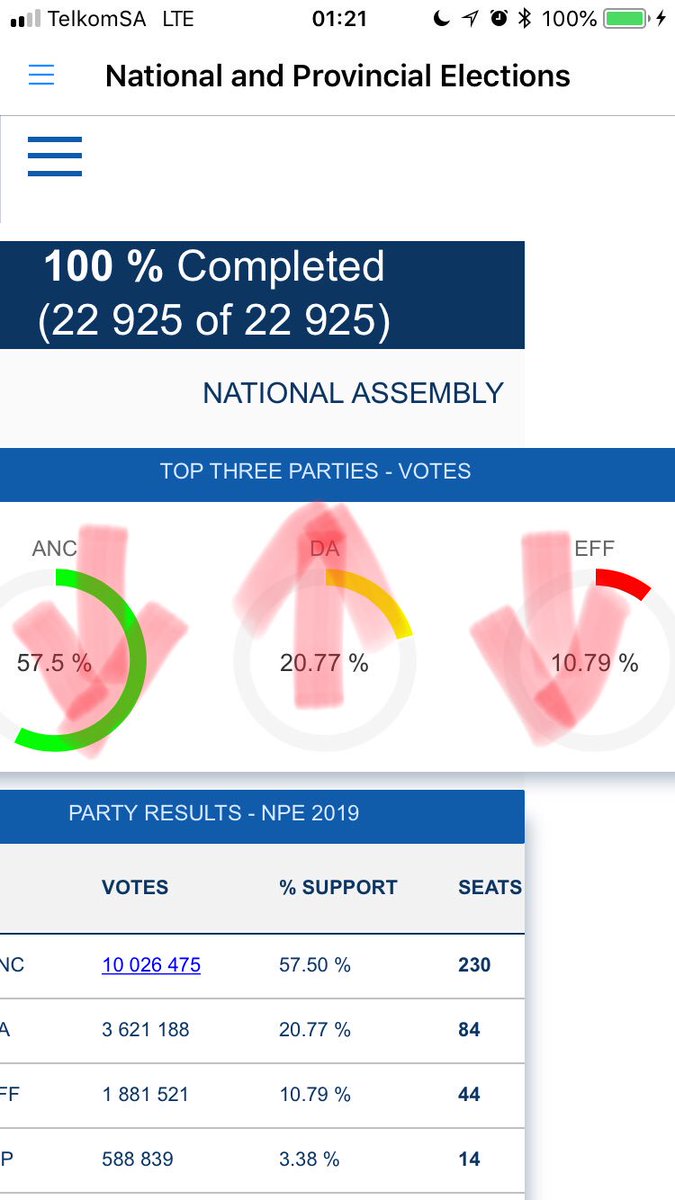

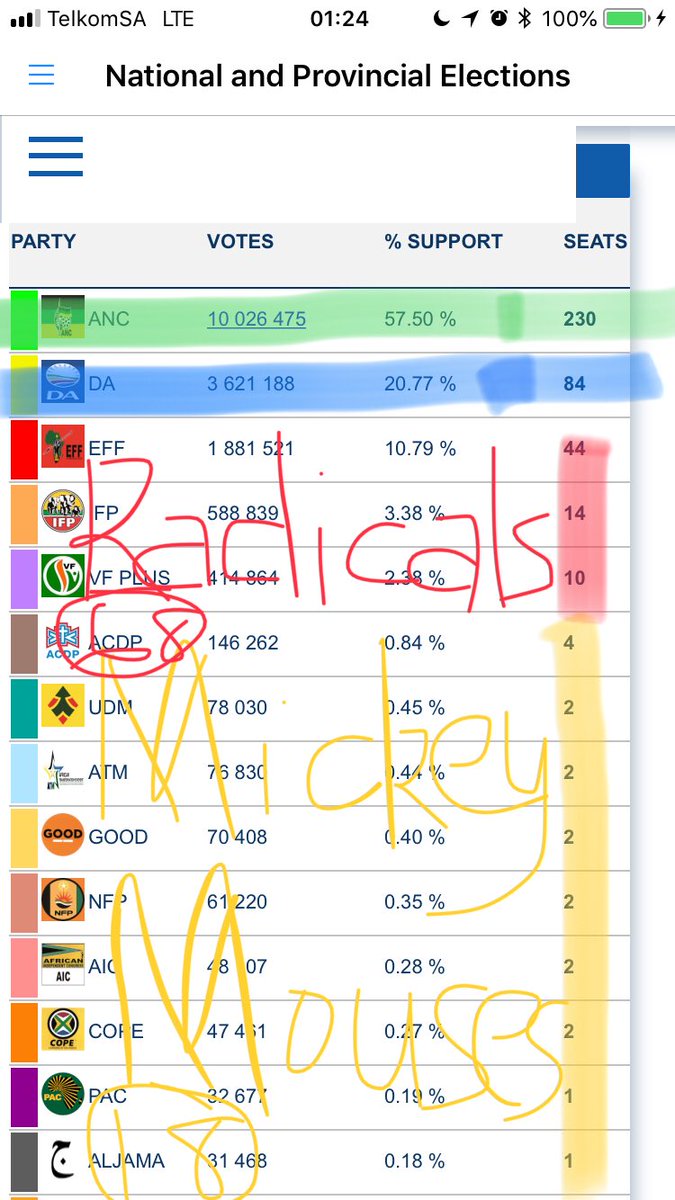

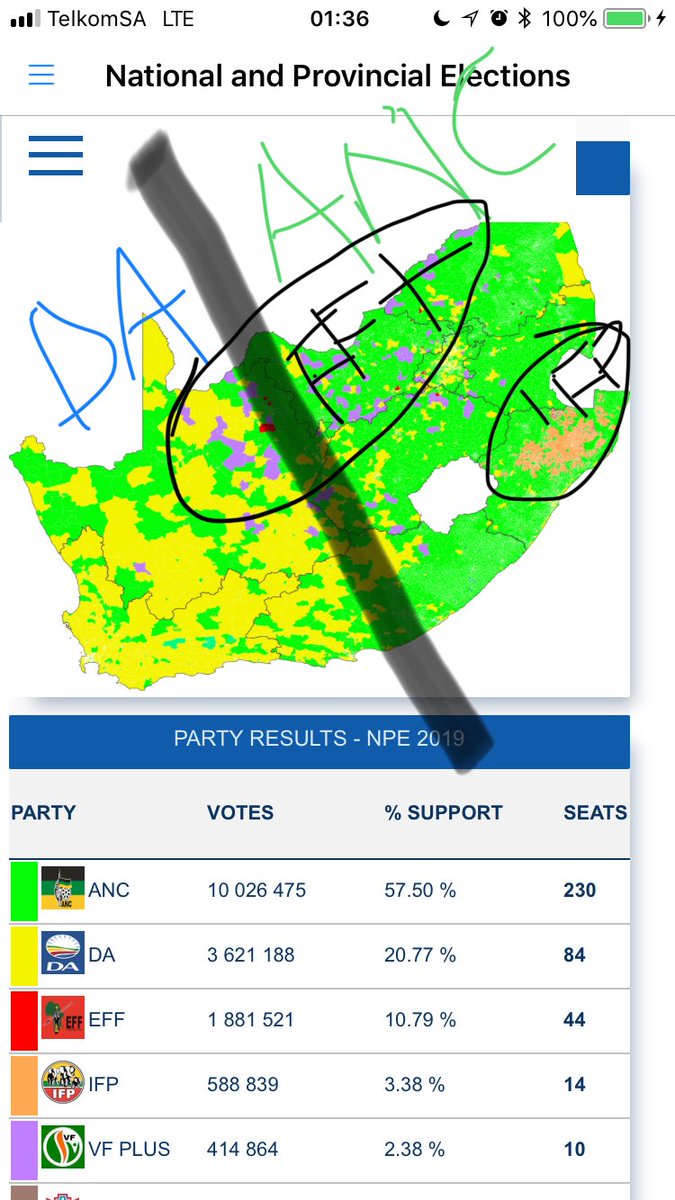

With the resurgence of the mad boys and girls in red berets and red overalls it looks like all the inroads we had made upto now towards a #TwoPartyState is starting to be eroded.

#SADecides2019

#SADecides2019

The Radicals in @EFFSouthAfrica and the Nationalists in @VFPlus (both with 68 seats) gained much ground here plus the accumulated votes of the Mickey Mouse Parties (18 seats) didn't do any good to the beloved @Our_DA losing in total 88 seats combined.

SAD 😔!

SAD 😔!

Also exposed was the fact that we are not as such an equal society as we thought we are

The @IECSouthAfrica #ElectionNight Map shows how divided our society still is with @Our_DA more prevalent in colored communities as whilst @MYANC strong as expected in predominantly BlackAreas

The @IECSouthAfrica #ElectionNight Map shows how divided our society still is with @Our_DA more prevalent in colored communities as whilst @MYANC strong as expected in predominantly BlackAreas

And just as monetary policy in the U.S. considers the weakest links in the global economic chain, we expect the #ECB to stay on a path of easy policy as they set out to accommodate the weakest links in the #Eurozone.

Vizek: "Very strong public sector, lot of informal economy. Croatia experienced slow growth before, so new normal not really new. But political willingness to reform very low."

Zubovic: positive trends in #Serbia: - rapid #growth in #IT sector over last 3/4 years w/ 3% to 6% share of GDP - Huge Chinese #investments, but with #externalities - Macroeconomic #stability, no fiscal #deficit anymore - foreign #debt declining - Substantial growth of #GDP

The demand for high-quality, income-generating assets has never been greater, especially as the world faces an aging #demographic that is approaching #retirement.

Generation Z will outnumber Millennials by 2019 weforum.org/agenda/2018/08… via @wef

As per the report "#India's Gen Z population rise to 472 million next year, 51 percent more than #China’s projected 312 million"

"Key differentiating factor between #GenZ versus #millenials is an element of self-awareness versus self-centeredness"

GenZ naturally seek their own solutions and can quickly detect whether or not something is relevant to them. #selfaware, #selfreliant #innovative

GenZ naturally seek their own solutions and can quickly detect whether or not something is relevant to them. #selfaware, #selfreliant #innovative