Discover and read the best of Twitter Threads about #cefi

Most recents (24)

🧵Thread Post : 15 @syscoin

Looking at the market pumping again on the hopeful news of @BlackRock #BITCOIN ETF approval, it is an apt time to bring to your notice a hidden Blue 🔵 💎 #syscoin which has been continuously building over the past 9 yrs

Hope you enjoy the 🧵$SYS

Looking at the market pumping again on the hopeful news of @BlackRock #BITCOIN ETF approval, it is an apt time to bring to your notice a hidden Blue 🔵 💎 #syscoin which has been continuously building over the past 9 yrs

Hope you enjoy the 🧵$SYS

95% of #Crypto project will not make it.

The 5% that will truly disrupt this world are the ones enabling mass adoption.

After researching 500+ hours here are my top 13 picks enabling mass adoption.

The growth of these projects will be INSANE

A thread 🧵👇

The 5% that will truly disrupt this world are the ones enabling mass adoption.

After researching 500+ hours here are my top 13 picks enabling mass adoption.

The growth of these projects will be INSANE

A thread 🧵👇

Every 15 or so years human kind goes through a technological revolution.

The biggest winners of all of these revolutions are businesses that are positioned for mass adoption.

In the Web2 space, this was Google, Facebook, Youtube etc.

Projects that onboarded the world.

The biggest winners of all of these revolutions are businesses that are positioned for mass adoption.

In the Web2 space, this was Google, Facebook, Youtube etc.

Projects that onboarded the world.

#THREAD $ROSN ROSEON Finance is a DeFi platform that aims to bring decentralized financial services to everyone. They are moving to @arbitrum, and the ticker is changing to #ROSX 1/7

The Story of ROSEON Finance - it was launched to bridge the gap between #Cefi & #Defi and now continues to broaden its horizons with the development of its GAMIFIED PERPETUAL DEX! #ROSX 2/7

The ROSEON ecosystem is growing! The native token is moving to @arbitrum $ROSX will be the new token of the platform, and it serves multiple purposes such as governance, fee payment, and rewards distribution. 3/7

1/25

Be sure to read each part of this thread it wont be short! hmm how to start some of the many thoughts I have on current matters...

Be sure to read each part of this thread it wont be short! hmm how to start some of the many thoughts I have on current matters...

2/25

Think I will start with an experience I had in 2016 into 2018 where I found myself following a guy that gained a lot of traction his name was clif high.

Think I will start with an experience I had in 2016 into 2018 where I found myself following a guy that gained a lot of traction his name was clif high.

3/25

He created a monthly report on crypto and vast topics called Alta report (web bots) that were claimed to be from things called spider bots that scanned the web for how humans were interacting with it via key words bit like google trends but would pull back data sets on each.

He created a monthly report on crypto and vast topics called Alta report (web bots) that were claimed to be from things called spider bots that scanned the web for how humans were interacting with it via key words bit like google trends but would pull back data sets on each.

DeFi 🚀🚀 reemplaza a CeFi 🏦 como favorito de VC. Tu de que eres de sector Defi o Cefi??

#hispacripto #metaverse #Crypto #NFTMarketplace #nftnews #Bitcoin #Ethereum #META #CeFi #Defi #VentureCapital te explicamos en el hilo esta nueva noticia buena para el sector 👇👇

#hispacripto #metaverse #Crypto #NFTMarketplace #nftnews #Bitcoin #Ethereum #META #CeFi #Defi #VentureCapital te explicamos en el hilo esta nueva noticia buena para el sector 👇👇

DeFi atrajo 41 veces más capital en 2022 que en 2020... y la tendencia continúa.

La mayor parte del efectivo de esta semana se destinó a finanzas descentralizadas (DeFi), infraestructura de cadena de bloques y empresas de NFT, una tendencia que ha sido constante durante el último año.

Finance and investing can be overwhelming, confusing and sometimes just mind-blowing.

One such concept recently on-trend was Rehypothecation.

So last week I spent some time learning about what it is, how it works and also some of the risks it imposes.

🧵 👇

0/44

One such concept recently on-trend was Rehypothecation.

So last week I spent some time learning about what it is, how it works and also some of the risks it imposes.

🧵 👇

0/44

1/

The goal of this thread is to highlight and simplify the concept of rehypothecation.

In comparison to other threads I've written, I found this one especially challenging due to its complexity, but learned a huge amount while researching which is always an amazing feeling.

The goal of this thread is to highlight and simplify the concept of rehypothecation.

In comparison to other threads I've written, I found this one especially challenging due to its complexity, but learned a huge amount while researching which is always an amazing feeling.

2/

A brief rundown of what we'll cover;

🔘 The concept of 'hypothecation'

🔘 Rehypothecation in TradFi

🔘 Rehypothecation in crypto

🔘 The risks and outlook

A brief rundown of what we'll cover;

🔘 The concept of 'hypothecation'

🔘 Rehypothecation in TradFi

🔘 Rehypothecation in crypto

🔘 The risks and outlook

that 15,427 page #GK8 document filled with #CelsiusNetwork's creditors personal detail is quite an amazing document.

i have so many questions, but let's start with:

1. Why are there an enormous numbers of creditors in countries GK8/Celsius aren't supposed to do business with?

i have so many questions, but let's start with:

1. Why are there an enormous numbers of creditors in countries GK8/Celsius aren't supposed to do business with?

@Frances_Coppola @ParrotCapital @ExkrementKoin @NingiResearch @jiaojiao_huobi @wowabirdtweets @DataFinnovation @ThegreatLambiny @ChazzonKe @CelsiusLoans @camcrews @MikeBurgersburg

Corporate entities in the #CelsiusNetwork / #GK8 / #GK8Limited bankruptcy, pt. II. Noticed:

➤ Ernst & Young (maybe?)

➤ #KPMG (#Wirecard's dad)

➤ @TheBlock__ ("journalism")

@AABerwick @kadhim @Frances_Coppola

➤ Ernst & Young (maybe?)

➤ #KPMG (#Wirecard's dad)

➤ @TheBlock__ ("journalism")

@AABerwick @kadhim @Frances_Coppola

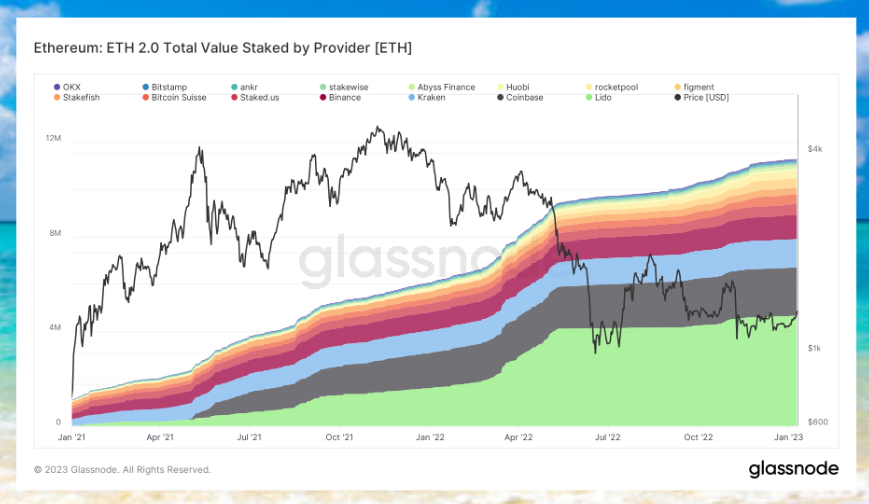

1/13 The bussin LSD Narrative: Will Lido's share of ETH stake skyrocket after the Shanghai upgrade?

What will happen to the withdrawn ETH? 🧵

What will happen to the withdrawn ETH? 🧵

2/13

A quick mention to @ViktorDefi for pointing out this narrative! 💪

Give it a read if you haven't yet 👇

A quick mention to @ViktorDefi for pointing out this narrative! 💪

Give it a read if you haven't yet 👇

1/21

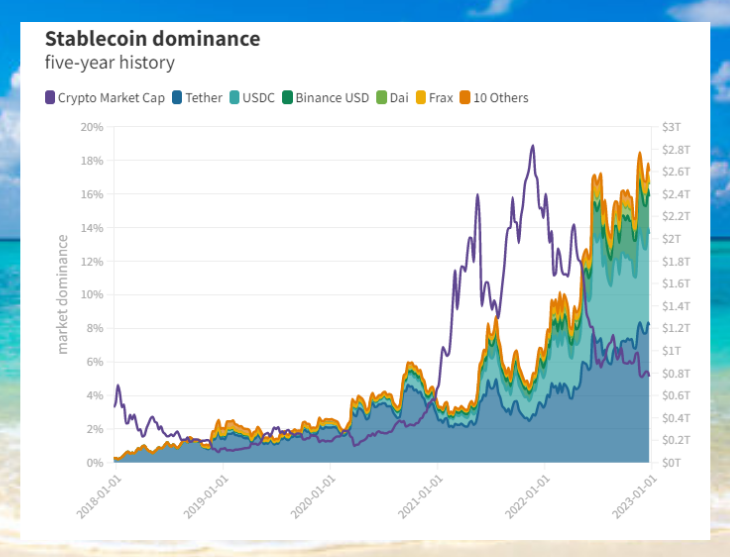

To find a glimmer of hope in the bear market, you need to follow stablecoin trends.

Following this trend will lead you to Y2K Finance (@y2kfinance)

The Ultimate Guide to Y2K Finance🧵

To find a glimmer of hope in the bear market, you need to follow stablecoin trends.

Following this trend will lead you to Y2K Finance (@y2kfinance)

The Ultimate Guide to Y2K Finance🧵

2/21

Before I dive in, a quick mention to @BanklessHQ since I wouldn't have found @y2kfinance and written this thread without them.

Here's what I'll cover:

- Stablecoin trends

- Overview of Y2K

- Thesis

Before I dive in, a quick mention to @BanklessHQ since I wouldn't have found @y2kfinance and written this thread without them.

Here's what I'll cover:

- Stablecoin trends

- Overview of Y2K

- Thesis

1/27 This top 10 TVL chain has been secretly BUIDLing since 2017🐱👤

NOBODY on CT is talking about the Mixin Network

So here's CT's very first DEEP DIVE into @Mixin_Network

🧵

NOBODY on CT is talking about the Mixin Network

So here's CT's very first DEEP DIVE into @Mixin_Network

🧵

2/27

Mixin has been working on exactly what Telegram is trying to achieve - Superapp status.

A quick primer on super apps:

Mixin has been working on exactly what Telegram is trying to achieve - Superapp status.

A quick primer on super apps:

In #Crypto, following the Smart Money means following Narratives

@MessariCrypto releases their #Crypto Market Theses (narratives) for 2023,

So read this Mega-🧵 to see where Smart Money will go this year🔥 & benefit from it

Thanks to @twobitidiot for this amazing work !

@MessariCrypto releases their #Crypto Market Theses (narratives) for 2023,

So read this Mega-🧵 to see where Smart Money will go this year🔥 & benefit from it

Thanks to @twobitidiot for this amazing work !

First of all, if you would like to read the full article, you can download it here: drive.google.com/file/d/1nHkQPn…

Instead of reading 168pages, here is a TL;DR of the most important things to learn 👇

But i added my 2cts on top of it !

Instead of reading 168pages, here is a TL;DR of the most important things to learn 👇

But i added my 2cts on top of it !

3. Top 10 trends in #CEFI

A summary of 2023 #crypto theses from @MessariCrypto

Despite being a #Defi maxi, #CeFi will continue to play a large role in institutions onboarding

A summary of 2023 #crypto theses from @MessariCrypto

Despite being a #Defi maxi, #CeFi will continue to play a large role in institutions onboarding

Remember all centralized places that fell down this year. A well made summary done by @cmsintern

Exchanges: The sole positive outcome from FTX explosion & contagion is the Proof-of-Reserves coupled with Proof-of-Liability that have been requested to Centralized Exchanges

Check this dashboard for POR of several CEX: dune.com/21shares_resea…

Check this dashboard for POR of several CEX: dune.com/21shares_resea…

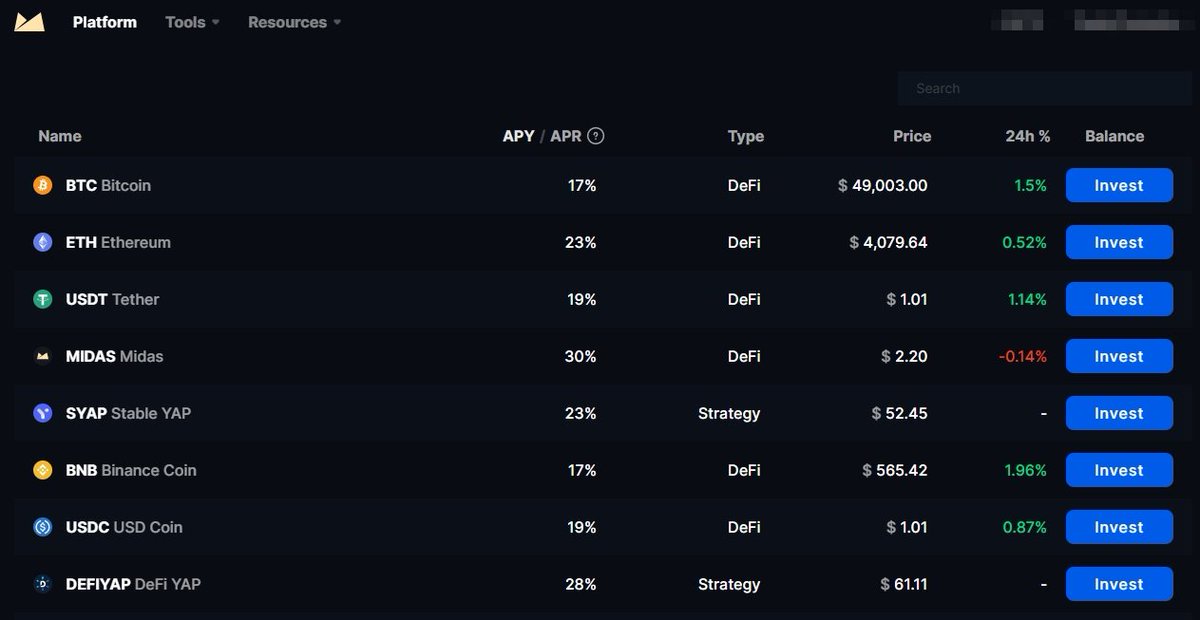

Another CeFi platform #Midas Investments @Midas_platform is shutting down with a $63.3 million hole in the balance sheet.

blog.midas.investments/midas-closure-…

Read the full thread about what happened:

#MidasInvestments

blog.midas.investments/midas-closure-…

Read the full thread about what happened:

#MidasInvestments

Huge news to the L2 Ecosystem: @Visa is proposing an automatic payments system on #Ethereum using @StarkNetEco! Let's break it down to understand how would that work 🧵🧵

1/ Blockchain adoption is increasing the demand for products with a great user experience and functionality that support real use cases. @Visa is proposing #AccountAbstraction to enable automated programmable payments through smart contracts.

So I decided to do a little thread about WOOFi 🙂

🧵 1/10

WOOFi is an open source multi-chain #DeFi platform.

It is a #DEX that features efficiently;

a). Cross-chain swaps with the lowest swap fees

b). High liquidity provision with single-sided staking.

🧵 1/10

WOOFi is an open source multi-chain #DeFi platform.

It is a #DEX that features efficiently;

a). Cross-chain swaps with the lowest swap fees

b). High liquidity provision with single-sided staking.

All this is at a #CeFi level Price execution.

As we all know; Trading Fees + Gas Fees across different networks can make trading on #DEX much higher

Are you ready for the future of trading?

Let’s discuss the Synthetix Perps V2, now #PoweredByPyth, on @OptimismFND 🔮

A quick 🧵👇

Let’s discuss the Synthetix Perps V2, now #PoweredByPyth, on @OptimismFND 🔮

A quick 🧵👇

2/

In light of recent events, decentralized smart contracts are more important than ever

However, DeFi apps need to match the performance of the legacy world, if not outpace it

Synthetix Perps on Optimism is a great way to engage in #DeFi while enjoying #CeFi-like benefits

In light of recent events, decentralized smart contracts are more important than ever

However, DeFi apps need to match the performance of the legacy world, if not outpace it

Synthetix Perps on Optimism is a great way to engage in #DeFi while enjoying #CeFi-like benefits

3/

For Synthetix Perps to take over the world, they would need features like:

1️⃣ Unconstrained open interest limits

2️⃣ Broader asset compatibility

3️⃣ Low fees

For Synthetix Perps to take over the world, they would need features like:

1️⃣ Unconstrained open interest limits

2️⃣ Broader asset compatibility

3️⃣ Low fees

1/ This November was the toughest for crypto fundraising in two years.

Total financing dropped by 84% year-over-year: $850M vs. $5.25B in Nov 2019.

A thread on crypto fundraising 🧵

Total financing dropped by 84% year-over-year: $850M vs. $5.25B in Nov 2019.

A thread on crypto fundraising 🧵

2/ First of all,

@WuBlockchain reported that there were 65 public raises in November, down 55% compared to the same period last year.

Web3 and Infrastructure fields saw the most deals with #DeFi accounting for only 11 of the deals.

@WuBlockchain reported that there were 65 public raises in November, down 55% compared to the same period last year.

Web3 and Infrastructure fields saw the most deals with #DeFi accounting for only 11 of the deals.

3/ In dollar terms, the Year-over-Year drop is even worse.

Financing dropped by 84%, from $5.25B to $840M last month.

Both the number of funds raised and the amount raised in November were the lowest in nearly two years—according to @WuBlockchain data.

Financing dropped by 84%, from $5.25B to $840M last month.

Both the number of funds raised and the amount raised in November were the lowest in nearly two years—according to @WuBlockchain data.

#CeFi was a stepping stone while the world wasn’t ready for decentralization

Let's look at why 👇

🧵

#FTX #Radix $ETH $SOL

Let's look at why 👇

🧵

#FTX #Radix $ETH $SOL

The world has had good reason not to be ready

#DeFi in its current form is fractured and hard to use

Do you agree?

#DeFi in its current form is fractured and hard to use

Do you agree?

Let’s take a cooking show as an example; competitors are given a time limit, and they run and frantically try to make a five-star meal with scavenged and limited ingredients. Rarely is the end product actually five stars

Why has @defichain's dUSD been DEPEGGED for more than 5 months?

1/19 🧵 on the Top10 TVL chain that CT doesn't talk about

1/19 🧵 on the Top10 TVL chain that CT doesn't talk about

@CMEGroup CEO Terry Duffy called Sam Bankman Fried…

"You're a fraud. You're an absolute fraud." He recalls his encounter with Sam Bankman-Fried last March.

"You're a fraud. You're an absolute fraud." He recalls his encounter with Sam Bankman-Fried last March.

GM!🗿Welcome to Carbon, a new form of on-chain liquidity designed for personalized trading and market-making strategies.

Deploy strategies composed of multiple on-chain limit & range orders for any given token pair, with each order represented by a unique bonding curve.

👇

Deploy strategies composed of multiple on-chain limit & range orders for any given token pair, with each order represented by a unique bonding curve.

👇

2/ Trading strategies that have historically been prohibitively expensive or downright missing on DEXs will be universally available on Carbon.

Automated ‘buy low, sell high’ strategies, ‘average-in’ orders, limit orders that don’t reverse when markets retrace. Carbon does it.

Automated ‘buy low, sell high’ strategies, ‘average-in’ orders, limit orders that don’t reverse when markets retrace. Carbon does it.

3/ Want to trade a crabby market?

Set a strategy that buys ETH between 1200 & 1300 USDC & sells ETH between 1500 & 1600 USDC. ETH accumulated in the first order becomes instantly available to sell for USDC as prices move into the second range.

No oracles or keepers required.

Set a strategy that buys ETH between 1200 & 1300 USDC & sells ETH between 1500 & 1600 USDC. ETH accumulated in the first order becomes instantly available to sell for USDC as prices move into the second range.

No oracles or keepers required.

🧵1/Ω

The Seven¹ Seals of #TheCryptocalypse

The signs are all around us. Read on below.

Have doubts? At least make sure you know what's actually happening out there.

RT/QT for great justice.

🂇 🂁 🔜 🁡 🁡 🁡

¹ maybe more than 7

📜👇Ω👇📜

cryptadamus.substack.com/p/the-seven-se…

The Seven¹ Seals of #TheCryptocalypse

The signs are all around us. Read on below.

Have doubts? At least make sure you know what's actually happening out there.

RT/QT for great justice.

🂇 🂁 🔜 🁡 🁡 🁡

¹ maybe more than 7

📜👇Ω👇📜

cryptadamus.substack.com/p/the-seven-se…

🧵2/Ω

I. @GenesisTrading, by far the biggest portal between Wall St. money and the crypto verse and the biggest trading desk handling the off market trading of very large amounts of money for very large amounts of crypto, is going to declare bankruptcy on Monday at 10 A.M.

I. @GenesisTrading, by far the biggest portal between Wall St. money and the crypto verse and the biggest trading desk handling the off market trading of very large amounts of money for very large amounts of crypto, is going to declare bankruptcy on Monday at 10 A.M.

Die #FTX-Pleite und die Machenschaften von Sam Bankman-Fried (#SBF) ziehen immer weitere Kreise. Es geht um #China, das #WEF, den Krieg in der #Ukraine und die US-Präsidentschaftswahlen. Eine Übersicht der kursierenden Theorien 👇🧵

Vorab: #SBF hat Kunden um mindestens zehn Milliarden US-Dollar betrogen. Es ist der vielleicht größte Betrug der Finanzgeschichte. Was geschehen ist, findest Du hier: blingbling.substack.com/p/sam-bankrun-…

Theorie 1: Sam Bankman-Fried ist Sohn zweier Professoren und ist bestens vernetzt in der amerikanischen Elite - insbesondere unter den Demokraten. Mit seinen Spenden soll er für den Wahlsieg von Joe #Biden verantwortlich sein

FTX’s collapse can be thought of as the “Lehman Brother’s moment” of crypto.

Why?

This is one of the largest centralized exchanges collapsing in the history of crypto.

BUT…

This strengthens the ground for decentralized finance.

Why?

This is one of the largest centralized exchanges collapsing in the history of crypto.

BUT…

This strengthens the ground for decentralized finance.

#FTX is a centralized exchange.

Unlike #DeFi, #CeFi has no obligations for transparent transactions.

No one knew of the excess leverage #FTX was holding until the recent liquidity rush.

Why?

Unlike #DeFi, #CeFi has no obligations for transparent transactions.

No one knew of the excess leverage #FTX was holding until the recent liquidity rush.

Why?

What happens in a centralized exchange is that they are the custodian of your money.

If you want to liquidate your holdings, they need to give you PERMISSION to withdraw. Much like a bank.

If you want to liquidate your holdings, they need to give you PERMISSION to withdraw. Much like a bank.