Discover and read the best of Twitter Threads about #financialCrisis

Most recents (19)

We found ourselves in the midst of another US debt ceiling debate.

A recurrent event that has significant implications for the global economy, including the financial markets.

Let's unpack this complex issue🧵

RT's appreciated!🙏

#economy #crypto #Bitcoin #stocks

/1

A recurrent event that has significant implications for the global economy, including the financial markets.

Let's unpack this complex issue🧵

RT's appreciated!🙏

#economy #crypto #Bitcoin #stocks

/1

The US debt ceiling is a legislative limit on the amount of national debt that can be incurred by the US #Treasury.

It's a cap on how much money the federal government may borrow to pay off the debt it has already borrowed.

/2

It's a cap on how much money the federal government may borrow to pay off the debt it has already borrowed.

/2

Interestingly, the debt ceiling does not directly limit government deficits.

While it can restrain the Treasury from paying for expenditures after the limit has been reached, these are expenditures that have already been approved and appropriated.

/3

While it can restrain the Treasury from paying for expenditures after the limit has been reached, these are expenditures that have already been approved and appropriated.

/3

Starting 2-weeks ago #SVB, #CreditSuisse & a few other smaller US banks failed. Whilst this is yet to become a #FinancialCrisis on the scale of ’08, it is also not certain that such a crisis hasn’t already begun. Join us for a thread of the best analysis so far!

First up, let’s acknowledge last year's release of @stefeich's – The Currency of Politics, and this interview in @thenation prior to the SVB collapse. His work provides important background understanding on the nature of money, banking and monetary policy.

thenation.com/article/econom…

thenation.com/article/econom…

What are the telltale signs that your biz is going the downward spiral? When biz is going the downward trajectory, there are usually early warning signals to look out for & can help you deal with the matter before it gets out of hand!

#Entrepreneur

#businessgrowth

Courtsey image

#Entrepreneur

#businessgrowth

Courtsey image

1/11 When you realize customers complaints are on the increase, your are dealing with length queues, and worst case, you have lost some of your key customers that you heavily relied on. This is detrimental to the business cashflow!

#entrepreneurship

#businessgrowth

#business

#entrepreneurship

#businessgrowth

#business

2/11 Your sales are steadily declining, hence affecting your profitability. This is is a clear sign that things are not going well!

#businessgrowth

#Entrepreneur

#businessowner

#salestips

@PSF_Uganda

@newsUMA

@USSIAssociation

@UNCCI_UG

@UMIUganda

@UWEAL_Ug

#businessgrowth

#Entrepreneur

#businessowner

#salestips

@PSF_Uganda

@newsUMA

@USSIAssociation

@UNCCI_UG

@UMIUganda

@UWEAL_Ug

🆘SVB Financial $SIVB collapse explained 🥵

~ Just 24 hours ago $SIVB was trading at over $260/share it hit a low of $33.40 today

~ It is currently halted after being shut down by regulators & taken over by the FDIC

~ Largest bank failure since 2008

#banks #financialcrisis

🧵⤵️

~ Just 24 hours ago $SIVB was trading at over $260/share it hit a low of $33.40 today

~ It is currently halted after being shut down by regulators & taken over by the FDIC

~ Largest bank failure since 2008

#banks #financialcrisis

🧵⤵️

🚨 What happened? Here's the $SIVB story

~ Silicon Valley Bank parent company SVB Financial Group has collapsed after disclosing large losses from securities sales & a stock offering meant to provide a boost to its balance sheet

#BankCrash

🧵⤵️

~ Silicon Valley Bank parent company SVB Financial Group has collapsed after disclosing large losses from securities sales & a stock offering meant to provide a boost to its balance sheet

#BankCrash

🧵⤵️

⏺️ $SIVB helps fund technology startups backed by venture-capital firms

~ Rising interest rates, fears of a recession & a slowdown in the market for initial public offerings has made it harder for early-stage companies to raise cash

~ This led firms to draw down on their deposits

~ Rising interest rates, fears of a recession & a slowdown in the market for initial public offerings has made it harder for early-stage companies to raise cash

~ This led firms to draw down on their deposits

#G20 #WorldLeaders #FinancialCrisis #Corruption

1/4

What became of the G20 leaders who met in 2008 to avert financial crisis?

A look at their fortunes and how their countries coped with the worst financial collapse since the 1930s

(info from: The Guardian 2018)

1/4

What became of the G20 leaders who met in 2008 to avert financial crisis?

A look at their fortunes and how their countries coped with the worst financial collapse since the 1930s

(info from: The Guardian 2018)

Good morning. Hedge funds have lined up the biggest bet against Italian government bonds since the global #financialcrisis on concerns over political turmoil in Rome and the country’s dependence on Russian #gas imports.

The total value of Italy’s bonds borrowed by investors to wager on a fall in prices hit its highest level since January 2008 this month, at more than €39bn, according to data from S&P Global Market Intelligence.

The rush to wager against Italy comes as the country faces rising economic headwinds from surging European natural gas prices prompted by Russia’s supply cuts and a fraught political climate, with elections looming in September.

Daily Bookmarks to GAVNet 02/13/2022 greeneracresvaluenetwork.wordpress.com/2022/02/13/dai…

By focusing on outputs, rather than people, we misunderstand the real impact of research. | Impact of Social Sciences

blogs.lse.ac.uk/impactofsocial…

#ResearchImpact, #SocialSciences, #ComplexProblems, #HumanExpertise

blogs.lse.ac.uk/impactofsocial…

#ResearchImpact, #SocialSciences, #ComplexProblems, #HumanExpertise

Michael Pettis on Twitter and ThreadReader

threadreaderapp.com/thread/1492132…

#GenevaReports, #WorldEconomy, #CostOfDebt, #FinancialCrisis

threadreaderapp.com/thread/1492132…

#GenevaReports, #WorldEconomy, #CostOfDebt, #FinancialCrisis

To understand the infrastructure cycle, we go back in time and look at our previous super Capex cycle, which started from 2003 to 2012

#capex #Markets

2/19

#capex #Markets

2/19

We saw that the commodity prices were increasing, reforms such as the Electricity Act came into play and government spending grew at a rapid pace of 23% CAGR. This led to overall growth in the capital cycle

#commodity #economy

3/19

#commodity #economy

3/19

Daily Bookmarks to GAVNet 03/21/2021 greeneracresvaluenetwork.wordpress.com/2021/03/21/dai…

Debunking Piketty and the Left's Celebrity Economists | Mises Wire

mises.org/wire/debunking…

#Piketty #debunk

mises.org/wire/debunking…

#Piketty #debunk

How a Small Rise in Bond Yields May Create a Financial Crisis | Mises Wire

mises.org/wire/how-small…

#FinancialCrisis #bond

mises.org/wire/how-small…

#FinancialCrisis #bond

This is a thread about a disgraced Trumpian mayor who is running for re-election in California, in the city where the @Apple headquarters is located.

You may remember Steven Scharf calling to build a wall around #Cupertino and have (28% Latino) San Jose pay for it.

1/15

You may remember Steven Scharf calling to build a wall around #Cupertino and have (28% Latino) San Jose pay for it.

1/15

One of Scharf’s worst acts as Cupertino mayor has been his continued support for Planning Commissioner R Wang, who has been accused of sexual harassment, identify theft, and stalking a former Redwood City planning commissioner & city councilmember.

2/15

2/15

R Wang is accused of impersonating a former Redwood City planning commissioner & city councilmember, stealing her identity, and signing her up for pornographic websites. He did this just because he disagreed with her over a water recycling policy.

3/15

defeatscharfandmoore.com/r-wang/

3/15

defeatscharfandmoore.com/r-wang/

This has clearly been a challenging time in markets but more importantly in life. I shared this note with our investment team over a week ago. I encouraged everyone to keep a journal to document their behaviour and emotions. I’m sure @farnamstreet has more to add! 1/n

I imagine each of you experienced a roller coaster of emotions over the past couple of weeks as markets gyrated. This is normal for times like this. But it does present a good opportunity to learn about our emotional behaviour in times like this...2/n

It can help us to improve our #decisionmaking when the next #financialcrisis hits us. I would encourage everyone to keep a #journal of their emotions, observations & conclusions. “Today feels like the bottom”....

How to understand panic? mp.weixin.qq.com/s/TswuZ7IM6frm…

Under normal circumstances, panic among investor will cause #Sheep-FlockEffect, resulting in the #marketslump in a short period of time, such as the 2008 #financialcrisis and the 2015 stock crash in China.

Usually the uncertainty about future is key in exacerbating the economic downturn or the financial crisis.

BOOK REVIEW

on Fire Fighting: The Financial Crisis And Its Lessons mp.weixin.qq.com/s/pCDlzaPkfDiT…

on Fire Fighting: The Financial Crisis And Its Lessons mp.weixin.qq.com/s/pCDlzaPkfDiT…

Huang Yiping, Chairman of the Academic Committee of CF40, served in Citigroup during the US #financialcrisis, the largest financial institution of the United States back then, and witnessed the whole process.

In his opinion, the three authors of Fire Fighting, Ben S. Bernanke, Timothy F. Geithner and Henry M. Paulson Jr. ,are a match made in heaven in dealing with the crisis.

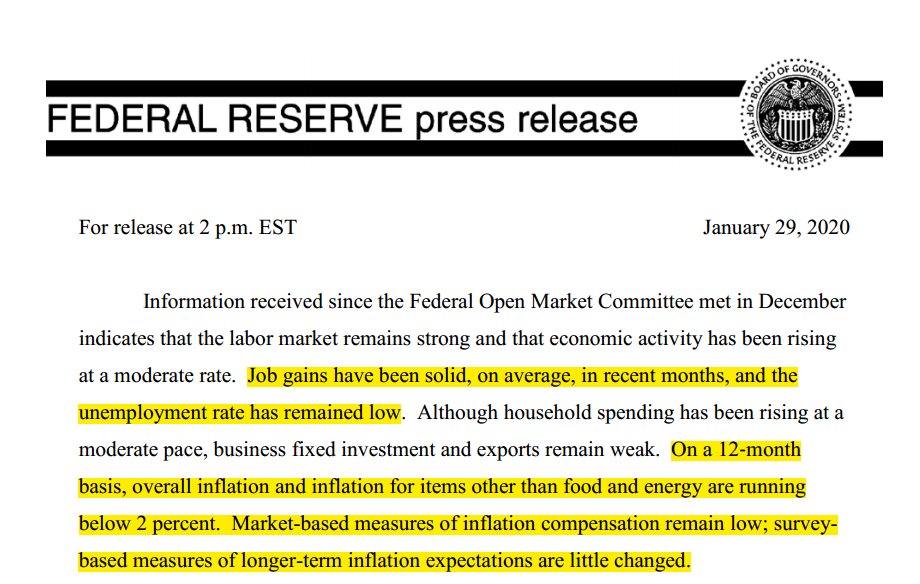

Let us talk about the #FED #FOMC's 1st #MonetaryPolicy meeting of 2020. Specifically, let us talk about the puzzle that is a flatter #PhillipsCurve...

The #FederalOpenMarketCommittee (#FOMC) of the #FederalReserveBank (#FED) of the #US concluded its 1st meeting of 2020 on the 29th January 2020. As expected, the FED did not change rates but left the #KeyPolicyRate, the #FederalFundsRate (#FFR) in the 1.5%-1.75% range...

Indeed, if one considers the #FED #Dotplot of December 2019, the decision to keep rates unchanged would not come as a surprise. What I wanted to focus on today is some key passages in the statement, highlighted in yellow in the screenshot below...its all #PhillipsCurve...

Lets talk about how important it is to frequently #Review #CentralBank #MonetaryPolicy #Frameworks...

I will set things off by pointing out that the various facets of #BusinessCycles (early, mid, late / boom & busts) consistently keep reminding us that what goes up, must come down. We might find ourselves in a prolonged #expansion, but eventually it decelerates into a #recession

As part of #Macroeconomic management (counter cyclical), a #CentralBank's objective (through its #MonetaryPolicy) is to maintain #PriceStability & #FinancialStability & in other cases, to promote #FullEmployment. It does this hand in hand with #FiscalPolicy...

While opening up can help improve financial sector's efficiency, it could also increase fluctuations. It’s important to maintain macroeconomic stability during the process of financial opening up, said Huang Yiping, Chairman of CF40 Academic Committee:

mp.weixin.qq.com/s/8z8vsLL5aDhe…

mp.weixin.qq.com/s/8z8vsLL5aDhe…

Financial opening up can even trigger #financialcrisis without proper management of fluctuations. The biggest problem many emerging economies face following financial opening-up is the sudden stop of capital flows, leading to deterioration in the national balance sheet.

Monetary policy,by making counter-cyclical adjustment, can help buffer the shock resulting from sudden stop of flow. Besides, as macro-prudential policy can further enhance stability, the two should be combined during financial opening up, the so called “two-pillar macro policy.”

While opening up can help improve financial sector’s efficiency, it could also increase fluctuations. It’s important to maintain #macroeconomic stability during the process of financial opening up, said Huang Yiping, Chairman of CF40 Academic Committee:

mp.weixin.qq.com/s/8z8vsLL5aDhe…

mp.weixin.qq.com/s/8z8vsLL5aDhe…

Financial opening up can even trigger #financialcrisis without proper management of fluctuations. The biggest problem many emerging economies face following financial opening-up is the sudden stop of capital flows, leading to deterioration in the national balance sheet.

Monetary policy by making countercyclical adjustment can help buffer shock caused by sudden stop of flow. Besides,as macro-prudential policy can further enhance stability, these two policies should be combined during financial opening up, the so called “two-pillar #macro policy.”

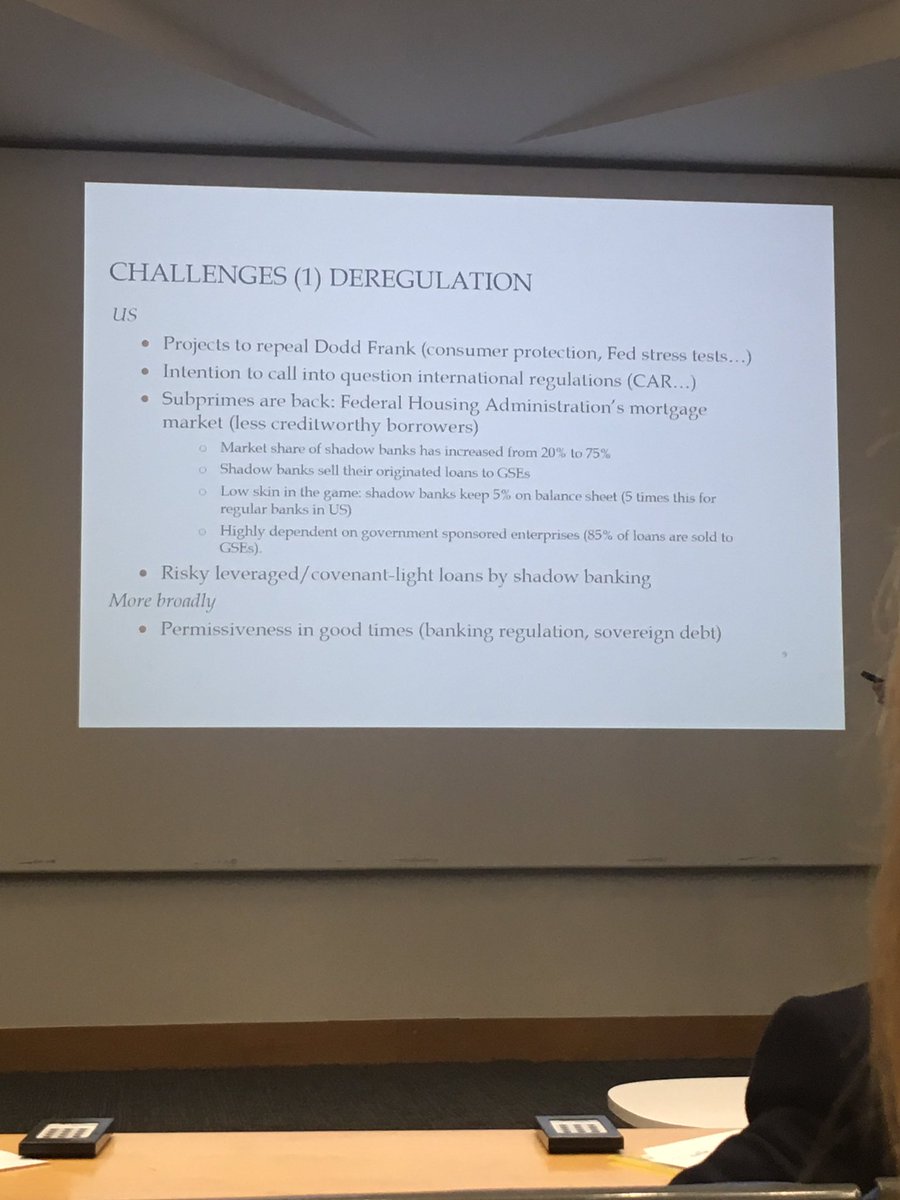

Thread: Nobel Jean #Tirole gave a public lecture at UCL tonight: 10 years after the #financialcrisis where do we stand. Key points:

1)#Finance is good if used and regulated properly. We seem to be making the same mistakes of 10 years ago. #Subprimes are up again in US. 1/

1)#Finance is good if used and regulated properly. We seem to be making the same mistakes of 10 years ago. #Subprimes are up again in US. 1/

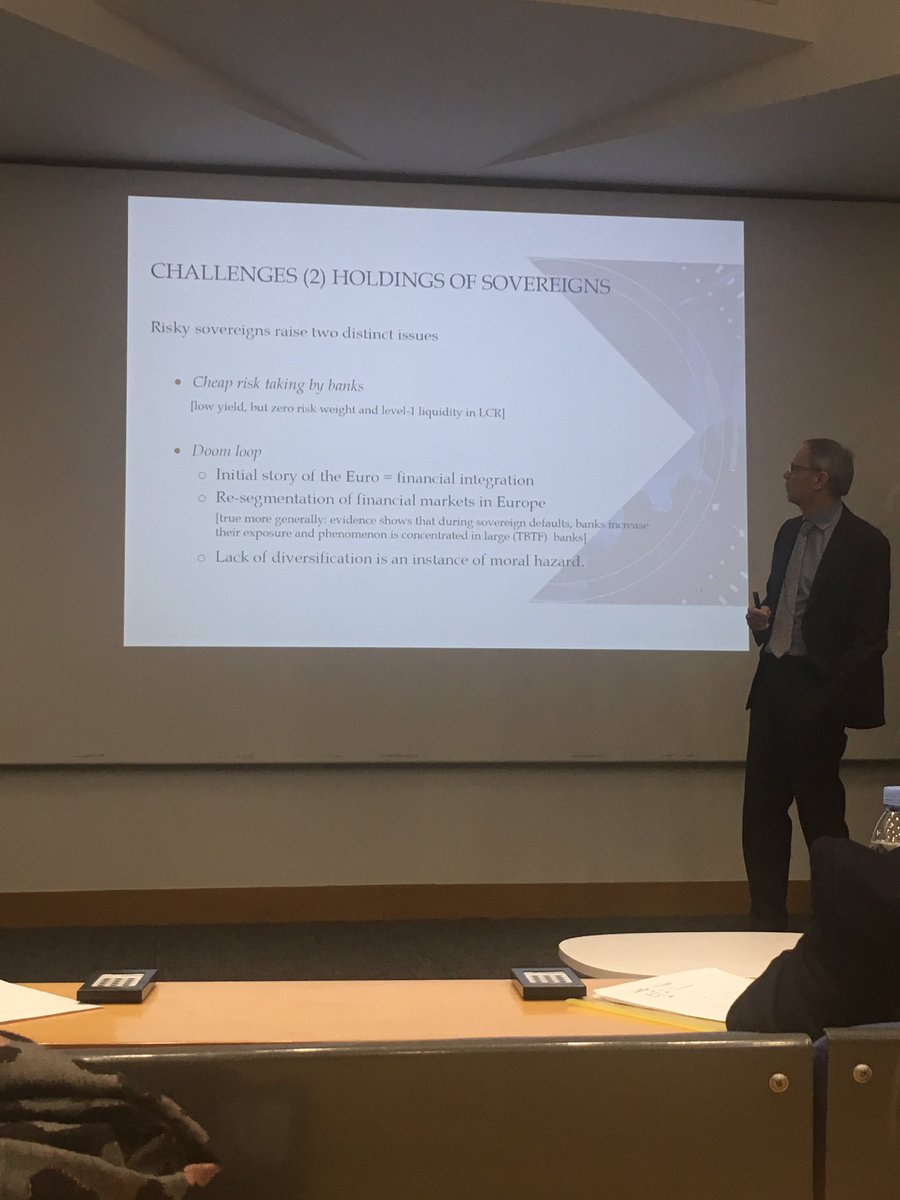

2) Its crazy for banks to hold a lot of their nation’s sovereign bonds. It creates a #doomloop. a bank fails>government needs more debt to bail it>brings down sovereign bond prices and more banks under stress> more public money needed. And yes he used Italy as an example.2/

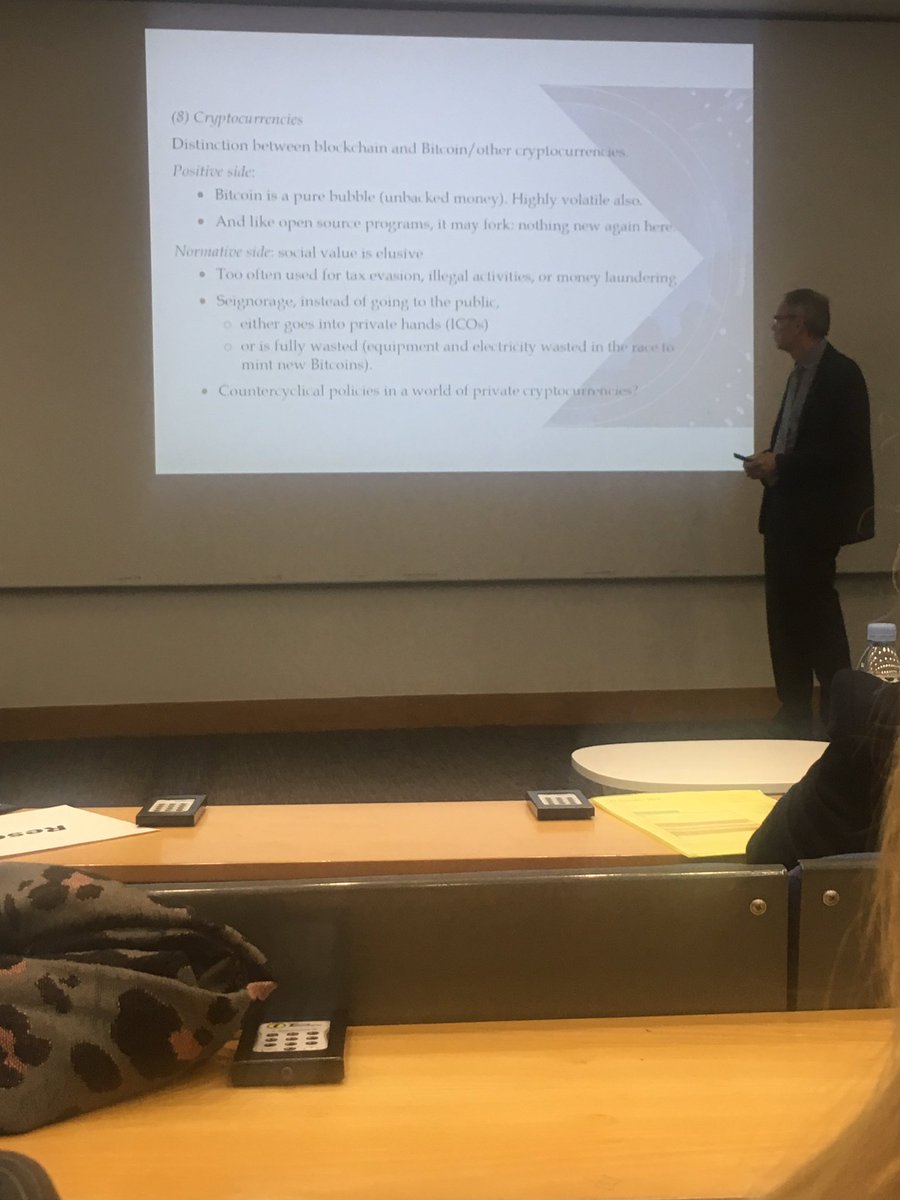

3) #cryptocurrencies are a bubble. Fiat money and central banks have worked quite well in developed economies in the last 30 years. And with cryptocurrencies seignorage goes into private hands and not to the goverment.

3/

3/

In realtà la maggioranza delle persone, anche nel sondaggio offline, risponde non so. Risposte: lo #stato conia le #monete che solo solo lo 0,3% del valore totale... nel #bilancio #bancadItalia le #banconote sono solo il 8% scarso del totale #massa #monetaria #M2 in #Italia...