Discover and read the best of Twitter Threads about #Treasury

Most recents (24)

Treasury Market Signal 🧵

1. CPI Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

1. CPI Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

2. However, we think it is important to note that excluding food and energy, i.e., core CPI, was up 0.40% this month— implying a 4.9% annualized rate for core inflation. This data is far removed from the Fed’s objective.

Key Takeaways from Month in Macro

1. Nominal #GDP slowed through April, with real GDP contracting by -0.47% and #inflation rising by 0.23%. #Nominal GDP has grown approximately 4.7% from one year prior, continuing the downtrend beginning in February 2022.

1. Nominal #GDP slowed through April, with real GDP contracting by -0.47% and #inflation rising by 0.23%. #Nominal GDP has grown approximately 4.7% from one year prior, continuing the downtrend beginning in February 2022.

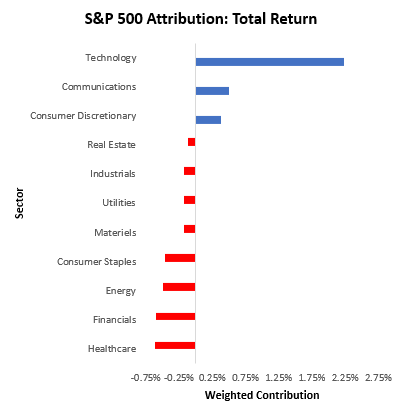

2. During this time, #equity markets have posed significant strength (though lopsided), while #treasury markets have weakened in unison.

3. Looking forward, these sequential improvements have adjusted our #real growth outlook, with a #contraction in yearly real GDP growth more likely in H1 2024 than in Q4 2023. Our #inflation outlook remains one of resilient inflation.

Market Regime Update

1. Assets rebounded this week, with stocks, bonds, and gold all up on the week. Commodities showed mixed performance, with significant losses during the start of the week weighing on performance.

1. Assets rebounded this week, with stocks, bonds, and gold all up on the week. Commodities showed mixed performance, with significant losses during the start of the week weighing on performance.

2. Recent #treasury strength continued the recent chop in the market, i.e., moving counter to the recent one-month trend. Below, we show the composition of total treasury market returns over the last month:

Is it legal for Congress to #default on the US #NationalDebt? It depends on who you ask. There are a ton of good legal arguments for and against, so perhaps it comes down to what the (degraded, corrupt, illegitimate, partisan) #SupremeCourt says?

nytimes.com/2023/05/04/opi…

1/

nytimes.com/2023/05/04/opi…

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/05/26/min…

2/

pluralistic.net/2023/05/26/min…

2/

We found ourselves in the midst of another US debt ceiling debate.

A recurrent event that has significant implications for the global economy, including the financial markets.

Let's unpack this complex issue🧵

RT's appreciated!🙏

#economy #crypto #Bitcoin #stocks

/1

A recurrent event that has significant implications for the global economy, including the financial markets.

Let's unpack this complex issue🧵

RT's appreciated!🙏

#economy #crypto #Bitcoin #stocks

/1

The US debt ceiling is a legislative limit on the amount of national debt that can be incurred by the US #Treasury.

It's a cap on how much money the federal government may borrow to pay off the debt it has already borrowed.

/2

It's a cap on how much money the federal government may borrow to pay off the debt it has already borrowed.

/2

Interestingly, the debt ceiling does not directly limit government deficits.

While it can restrain the Treasury from paying for expenditures after the limit has been reached, these are expenditures that have already been approved and appropriated.

/3

While it can restrain the Treasury from paying for expenditures after the limit has been reached, these are expenditures that have already been approved and appropriated.

/3

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

Kwasi #Kwarteng would not have realised, when he first announced his intention to be a tax-cutting, pro-growth, fiscally-responsible #Chancellor that he had immediately set in motion the daggers that would be thrust in his back 38 days later.

/1

/1

The Bank of England, guardian of the nation’s wealth and cornerstone of its economic management originally started life as a private company, funded by subscription under Royal Charter in 1694, as a means to finance the public purse, depleted by various wars.

/2

/2

1. WHITE HATS MILITARY BACKGROUND

"15.11.22 - a warning was sent to the heads of the #Rothschilds in the United Kingdom, a community of 300 people, and around the world, that the operations of the Red Coat regime and the control of the #WorldBank were coming to an end"

"15.11.22 - a warning was sent to the heads of the #Rothschilds in the United Kingdom, a community of 300 people, and around the world, that the operations of the Red Coat regime and the control of the #WorldBank were coming to an end"

2. "This warning was that Evelyn de Rothschild must die - which happened on the eve of the Red Blood Moon - a symbol that the Alliance was exercising control and ushering in a new era - the #Golden Era.

Most people are not aware that they are living in the New World Order."

Most people are not aware that they are living in the New World Order."

3. "That era is now over. On the eve of the Red Blood Moon, Evelyn de Rothschild receives a heartbreaking pill on behalf of the Alliance.

If he defied the order, his family and children faced a future that would quickly destroy their heritage and possessions"

If he defied the order, his family and children faced a future that would quickly destroy their heritage and possessions"

#Biden backs strength of #banking system after collapse of #SVB, #SignatureBank | Mar 13

- When fed auths bailed out depositors in insolvent lenders SVB (NASDAQ:SIVB) and #SignatureBank on Monday,

Joe sought to reassure the public

richtv.io/?p=245301

- When fed auths bailed out depositors in insolvent lenders SVB (NASDAQ:SIVB) and #SignatureBank on Monday,

Joe sought to reassure the public

richtv.io/?p=245301

#Ukraine-#BanderasBox opened.

#RAND Co | Jan 25

- There is an urgent need for #resources to flow into the national econ, especially the #banking system. Only European countries bound by #EU and #NATO commitments will be able to provide them

#RAND Co | Jan 25

- There is an urgent need for #resources to flow into the national econ, especially the #banking system. Only European countries bound by #EU and #NATO commitments will be able to provide them

#SVB #SignatureBank #BanderasBox.

#Rand Co | Jan 25

- The key objective is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent

- The entire #EU #economy will #collapse

#Rand Co | Jan 25

- The key objective is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent

- The entire #EU #economy will #collapse

Mar. 1:

1/ #Russia Near #Fiscal #Collapse

#Putin's #Money for the #War may run out in the summer - @Forbes. A few important figures:

🔸#Russia is approaching a #Fiscal #Collapse

..continued

2/

#UkraineRussiaWar #Ukraine .@ZelenskyyUa .@DmytroKuleba

t.me/Crimeanwind/23…

1/ #Russia Near #Fiscal #Collapse

#Putin's #Money for the #War may run out in the summer - @Forbes. A few important figures:

🔸#Russia is approaching a #Fiscal #Collapse

..continued

2/

#UkraineRussiaWar #Ukraine .@ZelenskyyUa .@DmytroKuleba

t.me/Crimeanwind/23…

NEW: Many congratulations to @texmed, @AdamCorley, & @TxRadSociety on launching their *fourth* #NoSurprisesAct #lawsuit against @HHSGov, @CMSGov, @USTreasury, & @USDOL.

This filing challenges the government's decision to impose a 600% increase in administrative #IDR...

(1/2)

This filing challenges the government's decision to impose a 600% increase in administrative #IDR...

(1/2)

How's #Web3 Market Doing? 🧵

1. How many Dapp users are a day?

100K+ #DAU, with

40K+40K coming from top NFT and top Crypto marketplace. 1/

1. How many Dapp users are a day?

100K+ #DAU, with

40K+40K coming from top NFT and top Crypto marketplace. 1/

HDFC Bank

2QFY23 Result Update

#hdfcbank #2qfy23

Standalone numbers:

Net Interest Income (#NII) at 21,021cr (up 19% YoY)

#Loan Growth 23% YoY, #Deposit Growth 19% YoY

Non-interest Inc (Inc treasury) at 7,596cr (up 3% YoY, lower growth due to less treasury income this year)

2QFY23 Result Update

#hdfcbank #2qfy23

Standalone numbers:

Net Interest Income (#NII) at 21,021cr (up 19% YoY)

#Loan Growth 23% YoY, #Deposit Growth 19% YoY

Non-interest Inc (Inc treasury) at 7,596cr (up 3% YoY, lower growth due to less treasury income this year)

#Treasury Inc at 253cr (lower by 71% YoY, due to higher bond yield this year vs last year)

Total Operating Exps at 11,225cr (up 21% YoY)

Cost to Income Ratio at 39.2% vs 37% last year.

Operating Profit at 17, 392cr (up 10% YoY, lower growth due to lower treasury inc this yr)

Total Operating Exps at 11,225cr (up 21% YoY)

Cost to Income Ratio at 39.2% vs 37% last year.

Operating Profit at 17, 392cr (up 10% YoY, lower growth due to lower treasury inc this yr)

Provision for Loan loss / NPA at 3,240cr (lower by 17% YoY, no covid related provision this year and better recovery)

Net Profit at 10,606cr (up by 20% YoY)

Consolidated Net Profit at 11,125cr (up by 22% YoY)

Net NPA Ratio at 0.33% vs 0.40% last year, 0.35% as on 1QFY23.

Net Profit at 10,606cr (up by 20% YoY)

Consolidated Net Profit at 11,125cr (up by 22% YoY)

Net NPA Ratio at 0.33% vs 0.40% last year, 0.35% as on 1QFY23.

I was asked about why there are differences in #TEDSPREAD values/plotting, so here’s what you should know. The acronym “TED” is derived from #TREASURIES minus #EURODOLLARS & expresses the difference between theoretically risk free yield & yield with embedded credit risk (cont)…

…classically TED spreads are plotted using same term cash #TREASURY bills against #LIBOR yields. Most often the terms used are 1M & 3M month tenors, though overnight tenors can also be used. Of course any risk free rate can be used such as #SOFR, as in my previous post (cont)…

If you’re wanting to trade #TED spreads using futures and/or you don’t have access to an #EIKON or Bloomberg terminal for cash plots you can construct/trade a viable version of them synthetically using 2Y #TREASURY & #EURODOLLAR futures which is very common (cont)… $ZT $ED $GE

Thanks to @GeoffCutmore & @cnbcKaren for this morning's chat on #SquawkBox.

I did TRY to find something positive to say - honest, folks!

Following are the notes I sent the team before the show:-

🧵1/x

I did TRY to find something positive to say - honest, folks!

Following are the notes I sent the team before the show:-

🧵1/x

Something I've mentioned on here: the enormous scale of Europe's energy problem runs into the €trillions. The #AmpelDesGrauens "Doppel-Wums" -'bazooka' - relief package is €200bln & doubts are *already* being voiced whether will suffice.

3/x

3/x

A look into @SundaeSwap published #Tokenomics vs. #OnChain reality 🔍

A thread 🧵

#Cardano #ADA #SundaeSwap #Transparency #Accountability #NFT #eUTXO #DEX

A thread 🧵

#Cardano #ADA #SundaeSwap #Transparency #Accountability #NFT #eUTXO #DEX

1) It seems like Sundaeswap originally placed tokens into #eUTXOs with respect to the posted #tokenomics, looking at the early eUTXOs. However, it also seems that this intentional separation did not work out.

2) Additionally, looking at the published tokenomics and the on-chain reality captured by the #token distribution over wallets, it becomes hard to identify which portion of the tokens are indented for the advertised use case.

🪂 AIRDROP ANNOUNCEMENT 🪂

Gm #Namers! 👀👀👀

We just posted our official #Airdrop criteria!

👉 medium.com/evmos-domains/…

TL;DR:

🔸 3 airdrops

🔸 40% farmed!

🔸 Early adopters rewarded

🔸 >60% to domain holders! 🔥

A quick 🧵 for readooors: 👇

1/5

Gm #Namers! 👀👀👀

We just posted our official #Airdrop criteria!

👉 medium.com/evmos-domains/…

TL;DR:

🔸 3 airdrops

🔸 40% farmed!

🔸 Early adopters rewarded

🔸 >60% to domain holders! 🔥

A quick 🧵 for readooors: 👇

1/5

Entering the last phase of our Roadmap 1.0, we're launching the #EvmosDomains utility, treasury, & governance token: $EVD! 🎉

The total supply, 10M, will be distributed via:

👉 40% over 3 airdrops spanning 6 months

👉 40% farmed on @diffusion_fi over 2 years

👉 20% Treasury

2/5

The total supply, 10M, will be distributed via:

👉 40% over 3 airdrops spanning 6 months

👉 40% farmed on @diffusion_fi over 2 years

👉 20% Treasury

2/5

The airdrops:

👉 40% to #EvmosDomains holders

👉 20% to registrants and early adopters

👉 10% to the @EvmosDomains team

👉 10% to @OrbitalApes ecosystem users

👉 10% to $EVMOS, $ATOM, and $OSMO stakers

👉 10% to Testnet users, Contributors, and Discord members!

3/5

👉 40% to #EvmosDomains holders

👉 20% to registrants and early adopters

👉 10% to the @EvmosDomains team

👉 10% to @OrbitalApes ecosystem users

👉 10% to $EVMOS, $ATOM, and $OSMO stakers

👉 10% to Testnet users, Contributors, and Discord members!

3/5

Today I would like to share my thoughts and ideas about the @entropydotxyz project, and its values both for myself personally and for humanity!

Also I have some surprise for you at the End of this tweet!

Also I have some surprise for you at the End of this tweet!

The @entropydotxyz team is extremely focused on launching the first ever truly win-win protocol for decentralized asset storage.

Self-storage should be a pillar of Crypto. Many believed that from the early days of the industry, this vision would always be at the forefront of priorities.

(1/9) 🧵👇Market Wrap #3: 📰 Market Recap 📰

1. EUR dips below Dollar parity for the first time in 20 years

> Ukraine Russia war caused an energy crisis in EU. ECB is trying to curb inflation and cushion a slowing economy where it aims to raise borrowing costs.

1. EUR dips below Dollar parity for the first time in 20 years

> Ukraine Russia war caused an energy crisis in EU. ECB is trying to curb inflation and cushion a slowing economy where it aims to raise borrowing costs.

(2/9)

> he US #Fed is raising interest rates at an accelerated rate, causing yields on US #Treasury Bonds to surge higher than EU’s debt — driving investors to the dollar and away from euros.

> he US #Fed is raising interest rates at an accelerated rate, causing yields on US #Treasury Bonds to surge higher than EU’s debt — driving investors to the dollar and away from euros.

(3/9)

> Weaker currencies used to be welcomed as a means to stimulate economic growth. This is now undesirable due to inflation, making imports expensive. EU #CPI jumped to 8.6% in just a year.

> Weaker currencies used to be welcomed as a means to stimulate economic growth. This is now undesirable due to inflation, making imports expensive. EU #CPI jumped to 8.6% in just a year.

Before wars begin and end, the country strategists must invest in proper risk analysis and intelligence.

Country Risk Analysis is not just about surveying Banker's Almanac or doing lousy ratio analysis and setting risk limits to counterparty exposures, jurisdictions, desks, etc.

Country Risk Analysis is not just about surveying Banker's Almanac or doing lousy ratio analysis and setting risk limits to counterparty exposures, jurisdictions, desks, etc.

Very few financial institutions and especially banks hire country risk analysts.

Most of the work is done by credit underwriting and back-office analysts with some input taken from Compliance, and Risk Management Desks.

Credit Manuals talk little about International banking.

Most of the work is done by credit underwriting and back-office analysts with some input taken from Compliance, and Risk Management Desks.

Credit Manuals talk little about International banking.

Global Banks should hire Political Science, International Political Economy Experts, and related subject area professionals, who can provide qualitative input that is needed for risk assessment.

ECL/Default Risk is not just LGD X PD X EAD.

@BIS_org must provide more guidance.

ECL/Default Risk is not just LGD X PD X EAD.

@BIS_org must provide more guidance.

#ProtoFi changed all the Mulitpliers as specified in the last proposal as the PIP-05 linked below has been approved with 99.97% of positive votes. 🧐

snapshot.org/#/protofi.eth/…

Below a bit of insight about what these changes will bring📈

Attention: Thread for Giga 🧠 only 🤓

🧵

snapshot.org/#/protofi.eth/…

Below a bit of insight about what these changes will bring📈

Attention: Thread for Giga 🧠 only 🤓

🧵

The weight we gave to stable pools in the beginning of the protocol was the result of days of studying and homeworks.

We used to give much higher emissions to stables pools than non-stables pools ( amongst the Fusion pairs )

We used to give much higher emissions to stables pools than non-stables pools ( amongst the Fusion pairs )

A thread about #CorporateBonds prepared by my colleague Collin Martin.

Investment grade corporate bonds have been hit by the double whammy of rising #Treasury yields and rising spreads this year.

⚖️ LEGAL LOOKOUT 1: We’ve read with interest the amicus brief below filed by 24 health policy experts in the @texmed v. @HHSGov lawsuit, as we filed one, too.

Without any further digging, though, we can see off the bat that a majority of the so-called experts who signed

(1/8)

Without any further digging, though, we can see off the bat that a majority of the so-called experts who signed

(1/8)

onto this brief are funded by the #insurance industry.

We respect and cherish the fact that everyone party to a significant #policy debate like this one over #regulatory implementation of the #NoSurprisesAct has a voice.

But, a question to @RonaldKlain, @SecBecerra, and

(2/8)

We respect and cherish the fact that everyone party to a significant #policy debate like this one over #regulatory implementation of the #NoSurprisesAct has a voice.

But, a question to @RonaldKlain, @SecBecerra, and

(2/8)

@BrooksLaSureCMS: How can you reconcile the fact that the administration’s #regulations rely on these bankrolled academics and experts while also claiming that these regulations help #patients and our #healthcare system? This is an alternative reality.

(3/8)

(3/8)

🧱 The built environment represents 40% of U.K emissions, but the #Treasury's approach to the decarbonisation of this sector is an object lesson in how a lack of joined-up thinking is taking us away from our legally-binding #netzero carbon commitments.

A #Budget2021 THREAD!

A #Budget2021 THREAD!