Discover and read the best of Twitter Threads about #liquidstaking

Most recents (19)

1/ Liquid staking has gained significant attention in the crypto space, and @CroutonDigital has introduced a fascinating derivative called Stader ETHx, which stands for Liquid Staking Derivative (LSD). Let's explore its features and potential benefits. #Crypto #LiquidStaking

Arthur Hayas recently published an essay ahead of the upcoming Shanghai conference, which emphasized the significance of decentralization.

Here are some insights about LSD, Lido, and the future of liquid staking. 🧵

#Ethereum #LiquidStaking

1/8

Here are some insights about LSD, Lido, and the future of liquid staking. 🧵

#Ethereum #LiquidStaking

1/8

Hayes emphasizes the fundamental principle to remember is: "Not your keys, not your crypto."

He warns that any form of centralization or quasi-decentralization poses significant risks.

I wrote a thread about this.

2/8

He warns that any form of centralization or quasi-decentralization poses significant risks.

I wrote a thread about this.

2/8

Once again, it's worth noting that around 75% of ETH liquid stacking is under the control of a single project, which poses a significant risk.

3/8

3/8

1/7 Today, we're going to take a deep dive into Liquid Staking. 👂Have you heard of it?

🧐Liquid Staking is a technique that allows users to obtain liquidity while participating in the #staking process of #cryptocurrencies.

Follow this thread to learn more! 🧵👇

🧐Liquid Staking is a technique that allows users to obtain liquidity while participating in the #staking process of #cryptocurrencies.

Follow this thread to learn more! 🧵👇

2/7 Traditionally, staking requires users to 🔒lock up their funds in a staking network for a set period.

#liquidstaking, on the other hand, allows users to obtain fungible tokens 🔐that represent their staked funds, which can be traded on the market.

#liquidstaking, on the other hand, allows users to obtain fungible tokens 🔐that represent their staked funds, which can be traded on the market.

3/7 By depositing 📥their staked tokens in a custodial vault, users receive a 🪙fungible token that can be 🔁 traded on cryptocurrency exchanges or used as collateral for loans or other financial transactions.

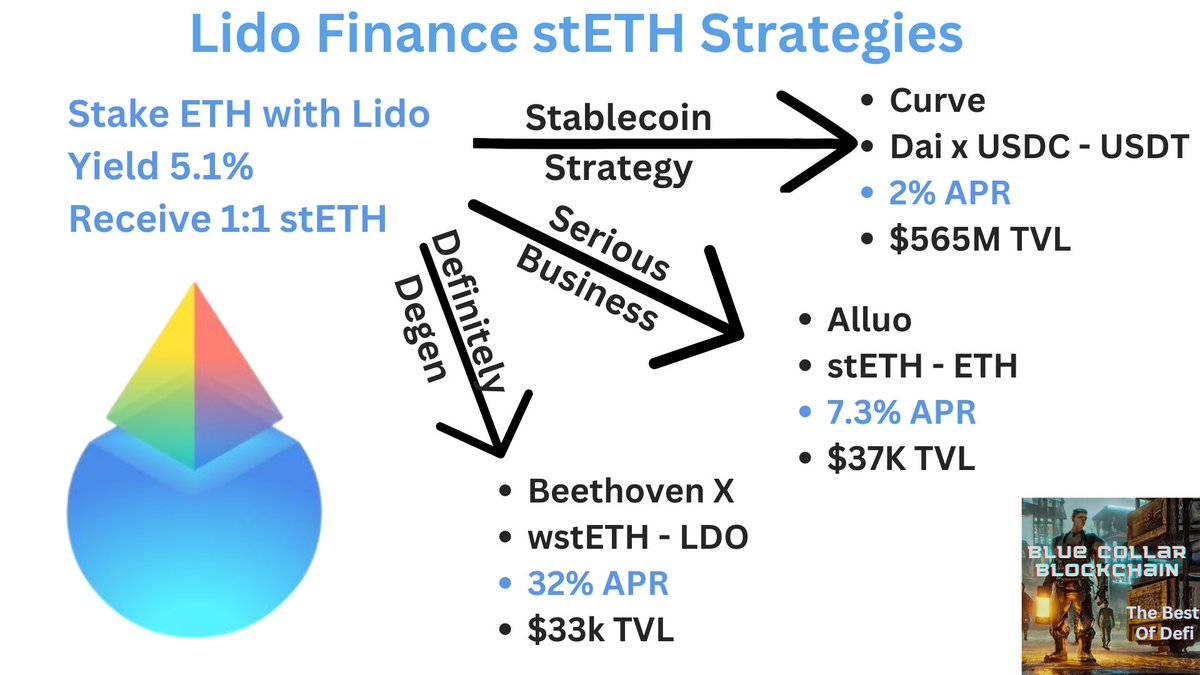

How can you unlock more yield with your #ETH?

12 Liquid Staking Strategies from top protocols

Read to the end for links to all farms/pools mentioned!

12 Liquid Staking Strategies from top protocols

Read to the end for links to all farms/pools mentioned!

Earlier today I tweeted I had come across a coin "that imo is almost guaranteed to 5-10x in the short-medium term regardless of what BTC does due to the narrative". I genuinely believe this. The narrative is #LiquidStaking #LSD & the coin is....Time for a thread 🧵

1/21

1/21

First of all, what is #LSD or the Liquid Staking Derivatives narrative & why should you care?

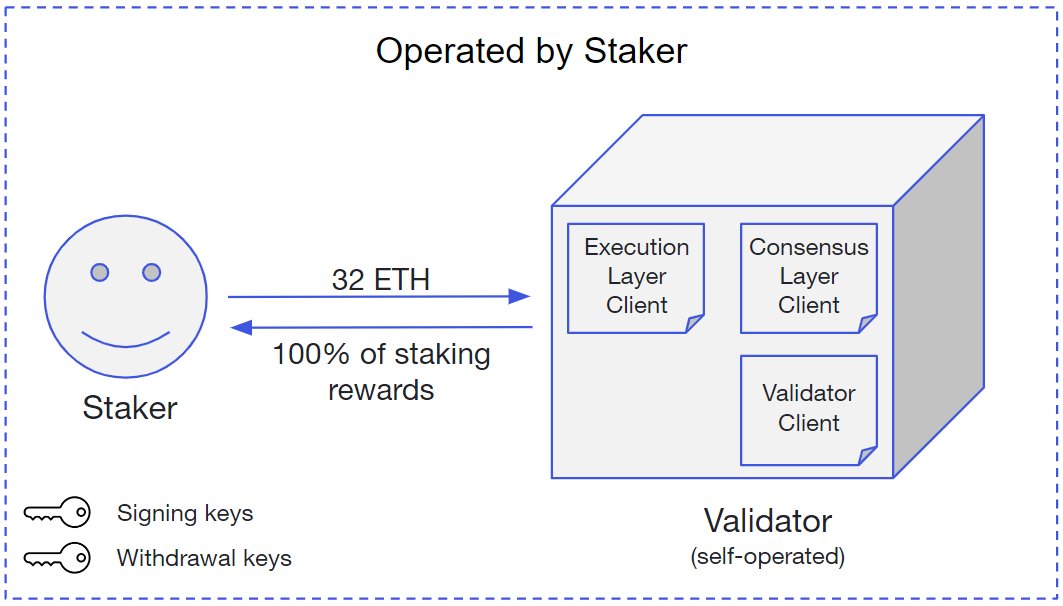

To understand LSD you must first understand native staking on $ETH. Eths move to PoS means holders can now stake their tokens, validate transactions & earn $ETH rewards for it.

2/21

To understand LSD you must first understand native staking on $ETH. Eths move to PoS means holders can now stake their tokens, validate transactions & earn $ETH rewards for it.

2/21

BREAKING 📢The launch of #Quicksilver on Cosmos has just been announced!

1/ @quicksilverzone will launch on December 16th with 100 Genesis Validators, among whom we are honored to participate 🤝

Looking forward to seeing $QCK going LIVE!🚀

1/ @quicksilverzone will launch on December 16th with 100 Genesis Validators, among whom we are honored to participate 🤝

Looking forward to seeing $QCK going LIVE!🚀

2/ On December 22nd, the Cosmos Hub is expected to be supported on Quicksilver, so get your $ATOM ready if want to mint $qATOM with @quicksilverzone!

🚀 #LiquidStaking

🚀 #LiquidStaking

3/ Want to refresh your memory? Here's a complete thread about @quicksilverzone, the fully decentralized Liquid Staking zone on Cosmos 👇🧵

We are excited to announce Liquid Finance!💧

Liquid Finance is a non-custodial liquid staking protocol focused on unlocking liquidity within the @archwayHQ ecosystem - built by @lydia_labs

1/6

Liquid Finance is a non-custodial liquid staking protocol focused on unlocking liquidity within the @archwayHQ ecosystem - built by @lydia_labs

1/6

By participating in Liquid Finance, users no longer need to calculate the tradeoff between securing the Archway Network or participating in Archway DeFi

2/6

2/6

Through the use of $sARCH holders are able to secure the Archway Network (earning inflationary rewards) while having a token that represents their underlying share of staked $ARCH

$sARCH will be able to be used freely within the broader ecosystem - specifically within DeFi

3/6

$sARCH will be able to be used freely within the broader ecosystem - specifically within DeFi

3/6

1/ @fraxfinance’s staked $ETH performance has been nothing short of spectacular in the past 30 days.

~500% TVL growth. 9.3% APR (vs 3% on @LidoFinance). All this during one of the worst months in crypto history.

Here’s how they did it.

#FraxFinance #LiquidStaking #Ethereum

~500% TVL growth. 9.3% APR (vs 3% on @LidoFinance). All this during one of the worst months in crypto history.

Here’s how they did it.

#FraxFinance #LiquidStaking #Ethereum

2/ @FraxFinance launched its $ETH liquid staking protocol in Oct 2022.

To understand the basics of its mechanism, check out my tweet below ⬇️

To understand the basics of its mechanism, check out my tweet below ⬇️

What do you know about @quicksilverzone? It is a new Liquid Staking protocol in the #CosmosEcosystem

Let’s take a deep dive to know more about it... #Thread 🧵👇

Let’s take a deep dive to know more about it... #Thread 🧵👇

@quicksilverzone 1/ Let's start by understanding how does #LiquidStaking work?

In LS, users can access their staked tokens without waiting for the regular unbonding period like in the traditional PoS #staking by giving the user a token that is pegged 1:1 with their initial staked token

In LS, users can access their staked tokens without waiting for the regular unbonding period like in the traditional PoS #staking by giving the user a token that is pegged 1:1 with their initial staked token

@quicksilverzone 2/ This liquid token can be used freely in the ecosystem 🌐

Check out our Liquid Staking post to keep learning about the fundamentals of Liquid Staking! 👇

Check out our Liquid Staking post to keep learning about the fundamentals of Liquid Staking! 👇

📣Juno Weekly News, August15-21 📰

What happened last week to @JunoNetwork ❓

👉Answer: #BUIDLing 🚀

Let's have a look at #JUNO 's recent activity through @coinhall_org 's article and the picture below👇

#Junonauts $JUNO

What happened last week to @JunoNetwork ❓

👉Answer: #BUIDLing 🚀

Let's have a look at #JUNO 's recent activity through @coinhall_org 's article and the picture below👇

#Junonauts $JUNO

@JunoNetwork @coinhall_org 1. What are you awaiting?

$JUNO Token Halving Will Begin in Approximately 10 Weeks.

Countdown👇

countingdownto.com/countdown-page…

For more information, read these tweets 👇

And👇

#Junonauts

$JUNO Token Halving Will Begin in Approximately 10 Weeks.

Countdown👇

countingdownto.com/countdown-page…

For more information, read these tweets 👇

And👇

#Junonauts

@JunoNetwork @coinhall_org 2. This is #DeFi news

@Levana_protocol Launching Their Options Protocol on Testnet.

1) What are Options

2) How to learn to use them

3) Put Options & how they can be used similar to insurance

Learn more👇

#realyield #JUNO #Junonauts #IBC #Options

@Levana_protocol Launching Their Options Protocol on Testnet.

1) What are Options

2) How to learn to use them

3) Put Options & how they can be used similar to insurance

Learn more👇

#realyield #JUNO #Junonauts #IBC #Options

1/ Eli5DeFi is a collaborative effort to educate people about #DeFi, #Cryptocurrency and #Blockchain with infographics and visual guides.

Our #Notion page is a one-stop place for curated DeFi information and resources

bit.ly/3zQHouR

Our #Notion page is a one-stop place for curated DeFi information and resources

bit.ly/3zQHouR

2/ To find our unrolled #infographics🧵, you can check our @typefully page below:

typefully.com/eli5_defi

typefully.com/eli5_defi

3/ Our first #visualguide is about @CurveFinance Primer, including @ConvexFinance and #CurveWars narration. Check the🧵for more details!

$CRV $veCRV $CVX $crvCVX

#Curve #Convex #DeFi #YieldFarming

$CRV $veCRV $CVX $crvCVX

#Curve #Convex #DeFi #YieldFarming

#GM!

1/ There have been many amazing #threads about $stETH and $ETH, to complement that we will uncover the basis of #liquidstaking in our latest #visualguide

#DeFi #Crypto #Cryptocurrency #Bitcoin #Ethereum #staking #ETH #BTC #AVAX #BNB #SOL #NFT #Lido #LDO #trading #merge

1/ There have been many amazing #threads about $stETH and $ETH, to complement that we will uncover the basis of #liquidstaking in our latest #visualguide

#DeFi #Crypto #Cryptocurrency #Bitcoin #Ethereum #staking #ETH #BTC #AVAX #BNB #SOL #NFT #Lido #LDO #trading #merge

2/ #LiquidStaking is one of the ways to generate a #yield from an asset by utilizing the #composability of liquid staking derivative (LSD) #tokens

#DeFi #Crypto #Cryptocurrency #Bitcoin #Ethereum #staking #ETH #BTC #AVAX #BNB #SOL #NFT #Lido #LDO #trading #merge

#DeFi #Crypto #Cryptocurrency #Bitcoin #Ethereum #staking #ETH #BTC #AVAX #BNB #SOL #NFT #Lido #LDO #trading #merge

3/ #LiquidStaking is needed to reduce the barrier to become #validator and indirectly to increase #liquidity across the networks.

#DeFi #Crypto #Cryptocurrency #Bitcoin #Ethereum #staking #ETH #BTC #AVAX #BNB #SOL #NFT #Lido #LDO #trading #merge

#DeFi #Crypto #Cryptocurrency #Bitcoin #Ethereum #staking #ETH #BTC #AVAX #BNB #SOL #NFT #Lido #LDO #trading #merge

🧵 $30B in TVL wiped out by the $LUNA and $UST collapse. Total #DeFi TVL slashed in half over the last month.

What does the future hold for DeFi on the major #Layer1 chains and protocols? My thoughts in 10 tweets. 1/10

What does the future hold for DeFi on the major #Layer1 chains and protocols? My thoughts in 10 tweets. 1/10

#DeFi exploded from $19B TVL at the start of 2021 to $280B by the end of 2022, holding steady until April of this year.

It now stands at $128B with the majority of that over 50% drop coming in the last month as investors rush for the exits. 2/10

It now stands at $128B with the majority of that over 50% drop coming in the last month as investors rush for the exits. 2/10

Why? A negative global macro outlook with inflation and rising interest rates leading to sell off in traditional markets.

The knock on effect on $BTC compounded by the shock from the $LUNA and $UST fallout has nervous investors going risk off. 3/10

The knock on effect on $BTC compounded by the shock from the $LUNA and $UST fallout has nervous investors going risk off. 3/10

#LiquidStaking Week 1

Liquid Staking is one of the most innovative developments in #DeFi. This week we explore it with @ClayStack_HQ.

Read through to explore revenue-generating opportunities!

A thread (🧵)

[1/5]

Liquid Staking is one of the most innovative developments in #DeFi. This week we explore it with @ClayStack_HQ.

Read through to explore revenue-generating opportunities!

A thread (🧵)

[1/5]

What is #LiquidStaking?

Staking in its current form requires users to lock their tokens for a certain period of time, due to which they lose much-needed #liquidity. Liquid staking protocols enable the issuance of liquid tokens to solve this problem.

[2/5]

Staking in its current form requires users to lock their tokens for a certain period of time, due to which they lose much-needed #liquidity. Liquid staking protocols enable the issuance of liquid tokens to solve this problem.

[2/5]

Why do you need liquid tokens?

These tokens (csMATIC in the case of @ClayStack_HQ) are #yield-generating #tokens that represent the underlying stake.

So users get the dual benefit of staking rewards and also the opportunity to compound their yields on #Polygon's DeFi.

[3/5]

These tokens (csMATIC in the case of @ClayStack_HQ) are #yield-generating #tokens that represent the underlying stake.

So users get the dual benefit of staking rewards and also the opportunity to compound their yields on #Polygon's DeFi.

[3/5]

GM #IBC Gang! We have your morning reading material from The Coffeehouse!

*Sips Coffee*

Quicksilver is a coming #LiquidStaking protocol for the #Cosmos.

*ALERT* There will be #Airdrops - AND - Test Net Incentives!

Let’s Dive In!

1/x 🧵☕️👇

*Sips Coffee*

Quicksilver is a coming #LiquidStaking protocol for the #Cosmos.

*ALERT* There will be #Airdrops - AND - Test Net Incentives!

Let’s Dive In!

1/x 🧵☕️👇

Quicksilver is a sovereign IBC chain aiming to allow LIQUID staking of ANY #IBC ASSET in one place across the #IBC ecosystem.

Along with giving the users more opportunities, this also gives the networks more security by having more assets staked and securing the chain.

2/x

Along with giving the users more opportunities, this also gives the networks more security by having more assets staked and securing the chain.

2/x

How:

🥄The Liquid Staking Module (LSM) will become a core Cosmos-SDK module. It enables tokenization of staked positions without unbonding

🥄qAssets will be minted against the original staked asset and provided as a tool to utilize DeFi and Liquidity from your locked funds

3/x

🥄The Liquid Staking Module (LSM) will become a core Cosmos-SDK module. It enables tokenization of staked positions without unbonding

🥄qAssets will be minted against the original staked asset and provided as a tool to utilize DeFi and Liquidity from your locked funds

3/x

This is a follow up to a post I made back in 2021, there've been a lot of folks that’ve been asking about quality fundamentals posts and how some of these block chain technologies stack up in the real world, it certainly feels like the right time to talk about $ATOM.

I've been listening to all of the @cosmos_voice podcasts since the beginning and taking notes, I went back and read all of the old @Cosmos blogs, posts and articles, accumulating information on the Telegram groups, Discord channels, Reddit, Githubs, Mediums.

Piecing together pieces from Conversations with @Jack_Zampolin and @chjango's Interchain.FM, every gem that’s ever been dropped from @Cryptocito, @L1am_Crypto, @Wickex2, @ConeyDaddy, @ZoltanAtom, @Adriana_Kalpa, @johnniecosmos. It became quite fun.

1/11 Today in @cosmos:

✅👨🚀Cosmonauts, @cosmoshub Roadmap 2.0 is here 🎉

♾ Cross-Chain Protocols Bringing #DeFi to Cosmos

🔗 Interchain Staking to Secure New Chains

🎗 NFTs

👥 Interchain Accounts

...and more in @shahankhatch article:

blog.cosmos.network/the-cosmos-hub…

#todayincosmos $ATOM

✅👨🚀Cosmonauts, @cosmoshub Roadmap 2.0 is here 🎉

♾ Cross-Chain Protocols Bringing #DeFi to Cosmos

🔗 Interchain Staking to Secure New Chains

🎗 NFTs

👥 Interchain Accounts

...and more in @shahankhatch article:

blog.cosmos.network/the-cosmos-hub…

#todayincosmos $ATOM

2/11 Today in @cosmos:

✅💫 @cosmossdk is the world’s most popular blockchain framework with an ecosystem of $75B+ of value.

🔌 Developers, discover @getstarport, the easiest way to build your @cosmos blockchain!

💡Starport: Your Blockchain in minutes.

blog.cosmos.network/build-your-blo…

✅💫 @cosmossdk is the world’s most popular blockchain framework with an ecosystem of $75B+ of value.

🔌 Developers, discover @getstarport, the easiest way to build your @cosmos blockchain!

💡Starport: Your Blockchain in minutes.

blog.cosmos.network/build-your-blo…

3/11 Today in @cosmos

⚗️ @osmosiszone has launched!

osmosis.zone

Try the first IBC-enabled DEX for @cosmos-based chains 👉 app.osmosis.zone

👩🔬Welcome to the #IBCgang👨🔬

Catch up with the #OSMOLP launch party

📹

⚗️ @osmosiszone has launched!

osmosis.zone

Try the first IBC-enabled DEX for @cosmos-based chains 👉 app.osmosis.zone

👩🔬Welcome to the #IBCgang👨🔬

Catch up with the #OSMOLP launch party

📹

1. Let me organize the threads more to spread the word of $ftm and #DeFi! In here you can find all the threads that i wrote. There are more to come!

Firstly this:

Firstly this:

1. Last thread for today. It’s about #liquidstaking. @FantomFDN brought an amazing idea, but the market didn’t respond accordingly in my opinion. So let’s show some love! $ftm

2. You want to secure the network? Stake your tokens. But why should i secure it? Because you’ll earn rewards. If there wasn’t an incentive, noone would do it for free.