Discover and read the best of Twitter Threads about #tin

Most recents (24)

1/n A lot happened this week in #tin land. Got to admit, I was resigned to waiting for semis to turn (and that will probably be a minute) - 2024+ theme is my guess. But, as @respeculator reminded everyone… dis function on the supply side is THE thesis.

2/n one of those not if, but when things to those watching closely. Great to see @TraderPamplona making an appearance this week. Nobody banged the drum harder on Myanmar than him.

3/n think of the Myanmar news as you choose. Operations there are not well documented. What we have known for a while is they have been running out of open pit, alluvial, high grade reserves.

Thought of the day: How many don't understand they own #cyclical equities? And the cycle peaked out in 2022 for 90% and contagion is the order of the day in 2023? #natgas #lumber #coal #oil #uranium #ironore #tin #nickel

#cyclical means you exit as the cycle matures .....that was 2022 if not 2021 for 80% of #commodities. Then 60% will experience a 55-75% fall in spot prices. Then one revisits in 2H 2023 or 2024 for reentry. If one holds through the cycle they don't understand what they own.

Thought of the day: Fighting #commodity price tops will just result in 75% plus stockprice retracements, #cyclicality music always stops, grab a chair early to avoid serious regrets and portfolio destruction. Easy clue to follow, is 65-80% margins above cost curves are peakish.

Those #commodities that are currently near bottoming (0-20%) for the next up cycle 2H2023-2025....

#tin -65%

#ironore -66%

#nickel -60% (moving up)

#Lumber -72%

#zinc -40%

#HRCSteel -67%

Know where you are in the cycle....

#tin -65%

#ironore -66%

#nickel -60% (moving up)

#Lumber -72%

#zinc -40%

#HRCSteel -67%

Know where you are in the cycle....

1st Quartile candidates for the next cycle...

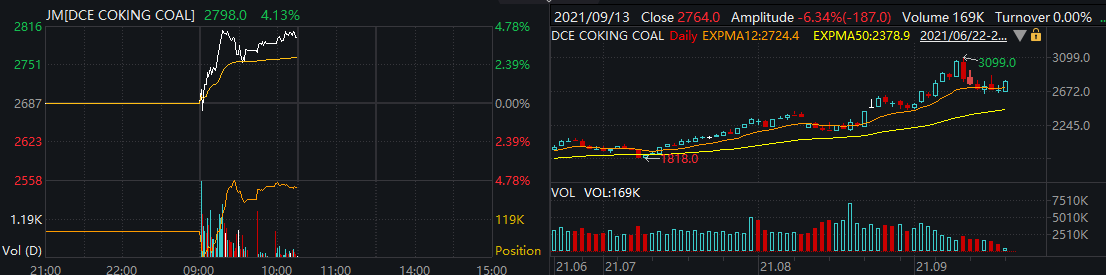

China's most-traded #IronOre futures plunge 5.9% at night open, coke down 4.8%, coking #coal down 2.8%, hot rolled coils down 2.7%, #SteelRebar down 1.8%.

Benchmark Dalian #IronOre futures extend losses to 6.8% at 669 yuan/ton amid property sector turmoil.

⚡China's most-traded coking coal, coke, iron ore futures extend declines at night opening. Coking coal down 4.3%, coke down 3.8%, iron ore down 3.7%.

#coal #ironore #CoalTwitter #China

#coal #ironore #CoalTwitter #China

⚡Shanghai low sulfur fuel oil futures dop 1.7%, fuel futures down 1.6%, crude oil futures down 1.4%. #OOTT

De elektrische wagen is niet zo schoon als de #autobouwers beweren. Olie is geschrapt en zeldzame metalen zijn in de plaats gekomen. Zeldzame metalen zijn minder aanwezig op deze aarde. Het gaat om goud, zilver, tin, platina, europium, samarium, gadolinium, neodymium, koper. 1/25

Deze heb je nodig om een elektrische #wagen te laten rijden. Zonder #neodynium zou een elektrische wagen gewoonweg niet rijden. Het wordt gebruikt om #magneten te maken voor elektrische motoren. Ze zetten elek. energie om in mechanische energie, zodat de wagen vooruit gaat. 2/25

Last day of the month & like clockwork, I bought some more $TUN.L 😤

Next month I'll probably add First Tin #1SN to my compounder list, as I continue my no-brainer strategy of betting on the GOAT @METhompson72 leading me to generational wealth.

Next month I'll probably add First Tin #1SN to my compounder list, as I continue my no-brainer strategy of betting on the GOAT @METhompson72 leading me to generational wealth.

@METhompson72 #1SN starts trading the 8th, so I might miss out on the IPO pump but I'm sure it will be fine as tin is heading to +$100k within a year or two.

Will be damn interesting to see if my dollar cost averaging strategy will outperform my regular portfolio!

Will be damn interesting to see if my dollar cost averaging strategy will outperform my regular portfolio!

@METhompson72 PS: I won't tweet regularly about these picks as I compound away, nor include them in my weekly updates. This portfolio is a long-term buy & hold, as I've done my DD & know that +$100k #tin prices is a question about WHEN, not IF.

I want to hammer one thing home on #tin demand - and that is the answer to “Why has solder demand been static for ten years or so?”This is because linear miniaturisation needed less tin per circuit board, and this offset exponential unit growth.

We have now passed the inflection point where exponential is beating linear, and demand growth for #tin is accelerating.

The World has committed $600bn to new semiconductor factories - but <$100m to new tin mines.

The World has committed $600bn to new semiconductor factories - but <$100m to new tin mines.

When there is no deficit and supply = demand because there is no inventory to pull down on, and demand is highly, highly in elastic, economics 101 tells you what happens: the price will go to the required level to destroy enough demand to balance the market.

+$100k #tin is coming

+$100k #tin is coming

Ayer tuve el honor y el placer de estar en @MomentumFinanc3 con @The_Godas. A parte del link del video os dejo un hilo sobre de lo que charlamos!🧵

Hice una pequeña presentación sobre los diferentes periodos inflacionarios y de subidas de tipos y como afectan a los metales.

Delante de un periodo inflacionario como el actual y una inminente subida de tipos, es muy interesante saber como protegernos dichos acontecimientos económicos.

I’ve been warning people about the cross over investments that tech and crypto investors have in the #uranium market.

My researching crypto and warning of its collapse and the tech bull market ending is due to my concerns of a liquidity down draft spill over effect in uranium

My researching crypto and warning of its collapse and the tech bull market ending is due to my concerns of a liquidity down draft spill over effect in uranium

I expect that this will be a continued theme with commodity markets pulling back at times with the broader market but I expect will continue to show relative strength and rebound to new highs in time.

The same thing happened in 2000-2002 as the nasdaq fell apart and the bull market in commodities running from 2000-2010 (depending on the commodity)

Capital will keep leaving the over valued tech and crypto sectors but it will continue to flow to and grow in commodity markets

Capital will keep leaving the over valued tech and crypto sectors but it will continue to flow to and grow in commodity markets

Macro shorts commodities on 1bps of inflation deceleration. Mind u though: demand is half the story nor the real story!

Years of underinvestment should make shorting oil, EU/A gas or metals risky business this time & in absence of a deep recession due to Fed mistake.

Thread

Years of underinvestment should make shorting oil, EU/A gas or metals risky business this time & in absence of a deep recession due to Fed mistake.

Thread

Nickel - the battery metal - first. If you short Nickel, you deserve to lose all your capital. Reason: ignorance!

#Peru #copper # tin #zinc #lead

So I tweeted a thread a couple of months back on how the election of a Communist President of Peru would seriously deter future mining investment, and put at risk existing production levels.

So I tweeted a thread a couple of months back on how the election of a Communist President of Peru would seriously deter future mining investment, and put at risk existing production levels.

I have quietly watched developments since, including the burning of mining camps, road blockades and this week's uncertainty on maybe cancelling some mine permits. Sadly for the long-term prosperity of the Peruvian people my fears are playing out.

Investors crave certainty - there is currently none. #Peru is now uninvestible for new foreign Western World capital going in.

So what is the Govt's game plan here? Here is what I think they are doing / will be doing:

So what is the Govt's game plan here? Here is what I think they are doing / will be doing:

Thread on Curve Structure for LME Metals

This is complicated, so do feel free to tweet any questions!

First up some terms:

Contango: when the forward price is above the current spot price

Backwardation: when the forward price is below the current spot price

This is complicated, so do feel free to tweet any questions!

First up some terms:

Contango: when the forward price is above the current spot price

Backwardation: when the forward price is below the current spot price

When a market is well supplied or in surplus it tends to be in contango. The normal state of metal markets is to be in contango from the cash date, but with the contango becoming less as you go further forward.

This is because there is a limit to how big this contango can be as otherwise there would be an arbitrage in buying metal today, storing it, and then selling it at a future date at a profit. This concept is called “full finance contango”.

Everything that is happening to the #tin price would have happened 8 years ago if Myanmar had not come along and gone from 2kt to 60kt of production overnight.

Market demand is 30% higher today, and Myanmar production in terminal decline as all the rich pickings are depleted.

Who can fill This void in the short or medium term? Only artisanal producers in DRC and Indonesia - but little sign of that at the moment.

Long term we need new, large hard rock mines. But there are very few known assets that can add more than one or two thousand tonnes of supply

Long term we need new, large hard rock mines. But there are very few known assets that can add more than one or two thousand tonnes of supply

#China's most active manganese-silicon futures contract and ferrosilicon futures contract in Zhengzhou open 8% higher and hit the limit-up.

#Ferro #silicon

#Ferro #silicon

#Stainlessteel futures open 2% lower in Shanghai, #Hotrolledcoil futures down 1.36%, following the weak performance yesterday after @business 's exclusive report.

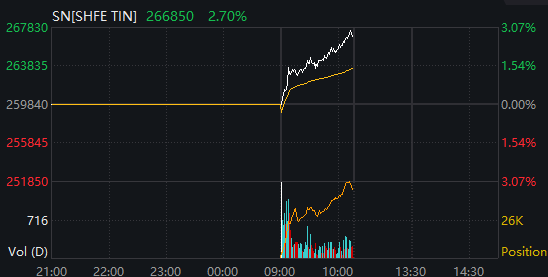

The most active #silver and #tin futures contracts are down 1.3%.

#China #futures #Commodities

The most active #silver and #tin futures contracts are down 1.3%.

#China #futures #Commodities

#China's #coke futures and coking coal futures in Dalian increase by 1.5% and 1.6% irrespectively.

#cokingcoal #futures #Commodities

#cokingcoal #futures #Commodities

The main contract of manganese silicon futures in Zhengzhou extends gains to about 4% at morning close.

#China #futures #commodities #Silicon

#China #futures #commodities #Silicon

A #TinBaron’s take on $AFM 1Q2021

Hats off to @Boris_Kamstra @AlphaminR for the continued value delivery. A string of consistent solid milestones knocked out of the park while the underlying #tin price is knocking on all time historical highs. Thread on 1Q2021 results. $AFMJF

1/n

Hats off to @Boris_Kamstra @AlphaminR for the continued value delivery. A string of consistent solid milestones knocked out of the park while the underlying #tin price is knocking on all time historical highs. Thread on 1Q2021 results. $AFMJF

1/n

Processed LG Ore and bulked up numbers with leftover from 2020 = Set yourself up for success by pulling from LG and leaving yourself HG available. Great time to strategically knock out some opportune maintenance on equip. as well. 2/n

Instead of just plowing through and high grading your available reserves, AFM team is strategically setting themselves up for continued delivery. No flash in the pan blow out quarter here followed by draught. You will see this long view them reoccur throughout. 3/n

#copper #tin

This thread will talk about the huge issues facing consumers from a finance perspective. This is a bigger problem than availability of metal or the price being paid.

This thread will talk about the huge issues facing consumers from a finance perspective. This is a bigger problem than availability of metal or the price being paid.

Exponential price rises are creating huge headaches for consumers - both in terms of price paid, availability of metal and in finance. Of these finance is probably the biggest issue.

Metal supply chains have multiple points: from metal to shapes to intermediate products to final products. For example for copper consumption in an A/C unit it goes from cathode to plate and wire rod, to tube and wire, to heat exchanger and copper flex. Then final product.

#mining #copper #tin

I have been asked by several people now about how to evaluate the management team for a project and what to look for and what to avoid. This thread hopefully will provide some good pointers.

I have been asked by several people now about how to evaluate the management team for a project and what to look for and what to avoid. This thread hopefully will provide some good pointers.

Truth Number One:

A mediocre project with good management is a better investment than a great project with mediocre management.

A mediocre project with good management is a better investment than a great project with mediocre management.

Truth Number Two:

There is no such thing as a bad project with good management: good people just don't get involved with bad projects.

There is no such thing as a bad project with good management: good people just don't get involved with bad projects.

#tin

Tin is the 49th most abundant element within the Earth and has the chemical symbol Sn, which is derived from the Latin word “Stannum”. Crustal abundance is only 2 parts per million (“ppm”) compared with 75 ppm for zinc, 50 ppm for copper, and 14 ppm for lead.

Tin is the 49th most abundant element within the Earth and has the chemical symbol Sn, which is derived from the Latin word “Stannum”. Crustal abundance is only 2 parts per million (“ppm”) compared with 75 ppm for zinc, 50 ppm for copper, and 14 ppm for lead.

#tin Tin mining dates back at least 4000 years to the Bronze Age, when tin was alloyed with copper to make bronze. Tin does not occur as the native element but must be extracted from oxide ores. Cassiterite (SnO2) is the only commercially important source of tin.

#tin Cassiterite is insoluble in water and erosional processes of deposits often results in placer deposits. Maybe 70% of all historic tin production has come from hydraulic mining or dredging of these alluvial type deposits, where grades as low as 0.015% tin can be economic.

#Tin

The secret to tin investment is easy if you focus on 3 things: mineralogy, mineralogy and mineralogy.

The secret to tin investment is easy if you focus on 3 things: mineralogy, mineralogy and mineralogy.

#tin Cassiterite is THE ONLY commercially valuable tin mineral. Most hard rock tin deposits contain some stannite (tin sulphide) and tin silicates. Look at the cassiterite grade, NOT tin grade.

#tin Alluvial deposits are more attractive generally than hard rock as they are 100% cassiterite. Cassiterite is dense with a specific gravity of 7 so water action concentrates it in placer type deposits.

Investing in #Tungsten

I start off each series on investing in a different metal talking about mineralogy – this will be no different! There are 2 commercially valuable mineral types in tungsten – scheelite (calcium tungstate) and the wolframite series (iron-manganese tungstate.)

I start off each series on investing in a different metal talking about mineralogy – this will be no different! There are 2 commercially valuable mineral types in tungsten – scheelite (calcium tungstate) and the wolframite series (iron-manganese tungstate.)

Scheelite is generally speaking easier and cheaper to recover than wolframite, mainly because it is recoverable via gravity and flotation means whereas wolframite only by gravity. Scheelite fluoresces which can make a trip to an underground #tungsten mine very interesting!

Both scheelite and wolframite are brittle meaning that they are liable to produce unrecoverable slimes during processing. These #tungsten minerals have a very high specific gravity though, of 6 g/cm3 and 7 g/cm3 respectively, making gravity separation relatively simple.

Cheers from TIN Factory, #Bangalore. 👍

•Barricades up

•Piling Rig machine back in action

•Pillars and steel are coated with some chemical/paint

21/08/20

@TheMetroRailGuy @ChristinMP_TOI @Naveen_MIRROR @Lolita_TNIE @tinucherian @sandeeprrao1991 @bengalurutrains @KARailway

•Barricades up

•Piling Rig machine back in action

•Pillars and steel are coated with some chemical/paint

21/08/20

@TheMetroRailGuy @ChristinMP_TOI @Naveen_MIRROR @Lolita_TNIE @tinucherian @sandeeprrao1991 @bengalurutrains @KARailway

•Similar set up was done few months ago too n everything disappeared after few days. Feared if it would happen again

•But No, this time work is SET TO START at #TIN Factory #Bangalore

•At 5:00PM, rebar cages have arrived and rig machine is in action 👍(video)

@TheMetroRailGuy

•But No, this time work is SET TO START at #TIN Factory #Bangalore

•At 5:00PM, rebar cages have arrived and rig machine is in action 👍(video)

@TheMetroRailGuy

Some people have been buying extra canned food lately. Here is a quick history of tin cans!

The #tin can had its origins in the perennial problem of how to feed an army on-the-move...

#nspoli #cbpoli #novascotia #capebreton

The #tin can had its origins in the perennial problem of how to feed an army on-the-move...

#nspoli #cbpoli #novascotia #capebreton