Discover and read the best of Twitter Threads about #CHF

Most recents (12)

𝗦𝘁𝗮𝘁𝗶𝗻𝘀 destroy your skeletal muscle, why would they be any good for your 𝗵𝗲𝗮𝗿𝘁?

This 🧵 dives deep into mechanisms underlying statin induced cardiomyopathy.

#statins #cardiomyopathy #CHF #heartfailure #health #bigpharma

This 🧵 dives deep into mechanisms underlying statin induced cardiomyopathy.

#statins #cardiomyopathy #CHF #heartfailure #health #bigpharma

Over 64 million people suffer from heart failure worldwide.

To what extent is statin therapy contributing to the epidemic of congestive heart failure (CHF) worldwide?

Statin cardiomyopathy is a complication that can occur in 1-3% of people.

To what extent is statin therapy contributing to the epidemic of congestive heart failure (CHF) worldwide?

Statin cardiomyopathy is a complication that can occur in 1-3% of people.

M𝗶𝘁𝗼𝗰𝗵𝗼𝗻𝗱𝗿𝗶𝗮 are once again the linchpin linking statins to CHF.

Nie znam się to się wypowiem, czyli mój prywatny wąteczek o #TSUE i #CHF.

1. O ile dobrze rozumiem, dzisiaj sądy uwalają te umowy ze względu na abuzywnosć klauzul dot. stosowanych kursów chfpln. Nie tego, że chf wzrósł, nie tego że wzrosła wartość kredytu w zł, nie tego, że...

1. O ile dobrze rozumiem, dzisiaj sądy uwalają te umowy ze względu na abuzywnosć klauzul dot. stosowanych kursów chfpln. Nie tego, że chf wzrósł, nie tego że wzrosła wartość kredytu w zł, nie tego, że...

... kredytobiorca nie był świadomy ryzyka, tylko dlatego, że była tam dowolność w tablicach kursowych. To, że "chodziły" one zgodnie z oficjalnym kursem NBP to nieważne, były wysokie spready, sąd uznał, że było tam nadużycie ze strony banków, ok.

2. To czego nie rozumiem, to...

2. To czego nie rozumiem, to...

... jak można w systemowej sprawie stwierdzić: skoro abuzywna, no to wykreślamy. De facto kredyt w złotych po Liborze (albo w ogóle). Rozumiem, taka jest litera prawa. Pewnie rozumiałbym w jednostkowych przypadkach (znaleźli się pojedynczy cwaniacy, co okiwają system, trudno)...

🧵THREAD - PERTE COLOSSALE POUR LA BANQUE NATIONALE SUISSE

132 milliards de francs suisses #CHF se sont évaporés en 2022. 💸

C'est sa plus grosse perte en 115 ans d'histoire 👇

132 milliards de francs suisses #CHF se sont évaporés en 2022. 💸

C'est sa plus grosse perte en 115 ans d'histoire 👇

Fin avril 2022, la Banque nationale #suisse disposait de 177 milliards de dollars d'avoirs en actions américaines.

Un record quand on sait qu'en 2014, elle n'en avait que 27 milliards.

Mais depuis les choses ne se sont pas passées exactement comme prévu...

Un record quand on sait qu'en 2014, elle n'en avait que 27 milliards.

Mais depuis les choses ne se sont pas passées exactement comme prévu...

Wer hört auch zu? 😉

"Global Public Pensions 2022 launch: Investing in a new world order"

omfif.org/live/

"Global Public Pensions 2022 launch: Investing in a new world order"

omfif.org/live/

@Fame21Moore 👀🤔

Empagliflozin is now my go-to SGLT2i for pts with #diabetes and #CKD or #CHF, over cana or dapa or ertu.

Why?

A: EMPA-KIDNEY: nejm.org/doi/full/10.10…

and EMPEROR-Reduced and EMPEROR-Preserved

1/

Why?

A: EMPA-KIDNEY: nejm.org/doi/full/10.10…

and EMPEROR-Reduced and EMPEROR-Preserved

1/

EMPA-KIDNEY is unique because it enrolled GFR 20-45 *without* proteinuria whereas others (DAPA CKD, CANVAS) enrolled pts with CKD+proteinuria, though DAPA-CKD conducted a subgroup analysis for UACR < and > 1000

The primary outcome was a composite of progression of #kidney disease (defined as #ESRD, a sustained decrease in eGFR to <10, a sustained decrease in eGFR of ≥40% from baseline, or death

from #renal causes) or death from #cardiovascular causes

from #renal causes) or death from #cardiovascular causes

PPFAS agm2022

A thread

*Views are personal. Retweet if you like. Mute if you don't like. ;)

#onefund #ppfas

A thread

*Views are personal. Retweet if you like. Mute if you don't like. ;)

#onefund #ppfas

Neil, talks about value of cash and how fund is absolutely fine holding cash. Had 28% cash almost in 2018.

The returns would be lumpy. Minimum 5 years if not more

Underperformance is guaranteed in short term, so is volatility.

Over long term, the returns are satisfactory

The returns would be lumpy. Minimum 5 years if not more

Underperformance is guaranteed in short term, so is volatility.

Over long term, the returns are satisfactory

Do you have a process or plan to invest. The fund prefers to follow their own plan. Circle of competence about 500 stocks.

Can't Chase / pick up all opportunity.

I recall, last few years their were question on some Spanish companies like Zara or Chinese companies.

Can't Chase / pick up all opportunity.

I recall, last few years their were question on some Spanish companies like Zara or Chinese companies.

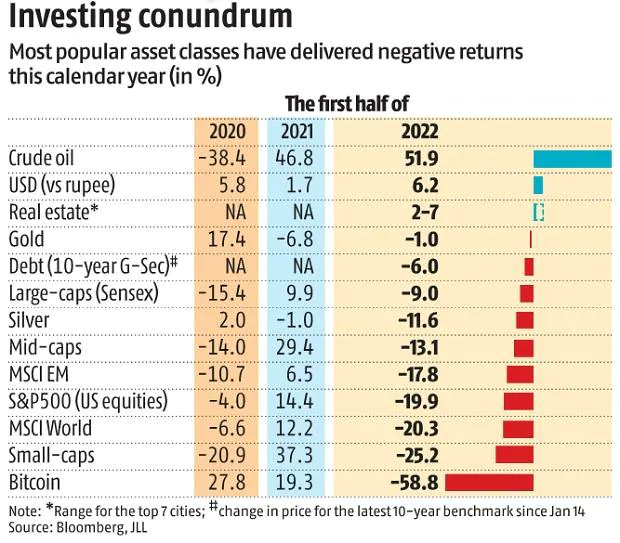

Macro Analysis of FX. Putting my erstwhile FX trader hat on to analyze what is happening with global markets.

I see the #CrudeOil move, #EURUSD move as a flight to safety move into USD.

I'm trying to explain the causation of flow in below thread 🧵

1/n

I see the #CrudeOil move, #EURUSD move as a flight to safety move into USD.

I'm trying to explain the causation of flow in below thread 🧵

1/n

1) Welcome to a new #accredited #tweetorial, Prevention and Management of Heart Failure in T2 Diabetes: The Cardiologist’s Perspective! Our expert author is Giuseppe Galati MD, MMSc in Heart Failure, @GiuseppeGalati_ , Consultant #Cardiologist #HeartFailure & #Cardiomyopathies

2) @GiuseppeGalati_ is at San Raffaele Research Hospital, Milan 🇮🇹 @SanRaffaeleMI. This program is intended for #healthcare professionals & is accredited for 0.75h CE/#CME credit for #physicians #physicianassistants #nurses #nursepractitioners #pharmacists 🇺🇸🇨🇦🇬🇧🇪🇺.

3) @cardiomet_CE is supported by educational grants from AstraZeneca, Bayer, Boehringer Ingelheim Pharmaceuticals Inc. and Eli Lilly Company, & Chiesi. Earn credit from archived programs at cardiometabolic-ce.com. Disclosures at cardiometabolic-ce.com/disclosures/.🙏 FOLLOW US !

1/16 Inspired by #NephMadness, let’s briefly touch on:

💢Role of kidney biomarkers in patients with CHF

💢‘Worsening kidney function’ in heart failure

💢Permissive hypercreatininemia

💢Handling RAASi and SGLT2i in heart failure

#NephTwitter #MedTwitter

ajkdblog.org/2022/03/01/nep…

💢Role of kidney biomarkers in patients with CHF

💢‘Worsening kidney function’ in heart failure

💢Permissive hypercreatininemia

💢Handling RAASi and SGLT2i in heart failure

#NephTwitter #MedTwitter

ajkdblog.org/2022/03/01/nep…

2/16 Let’s have a poll.

Forward failure, characterized by decreased kidney perfusion, is the main determinant of kidney dysfunction in acute decompensated heart failure. Is this true or false?

Forward failure, characterized by decreased kidney perfusion, is the main determinant of kidney dysfunction in acute decompensated heart failure. Is this true or false?

World class @ClevelandClinic Hospital Medicine Grand Rounds - Update in #HospitalMedicine by Dr. Jessica Donato! A rising star! @BIDMC_IM @HarvardHospMed @CWRUSOM @SocietyHospMed

Is postop #afib associated w increased risk for CVA/TIA?

Rabobank 1/9: #CFTC Commitment of Traders Report

Speculators’ net #USD positions held in positive territory for the 4th consecutive week, though overall size dropped moderately along with the softer tone of the greenback in the spot market. Previous to this the market had not had

Speculators’ net #USD positions held in positive territory for the 4th consecutive week, though overall size dropped moderately along with the softer tone of the greenback in the spot market. Previous to this the market had not had

Rabobank 2/9: a run of net long positions since June 2020. The USD has been one of the best performing G10 currencies this year reflecting reflation optimism and a shift in expectations regarding Fed rates policy.

#EUR net longs dropped to their lowest level since March 2020.

#EUR net longs dropped to their lowest level since March 2020.

Rabobank 3/9: Concerns about the speed of the vaccine roll-out programme in #Eurozone have been constraining expectations regarding the economic recovery in the region as fears about a third wave spread. ECB has brought forward bond purchases to push down the level of bond yields

Rabobank 1/8: #CFTC #CommitmentofTraders Report:

Net #USD short positions were little changed last week though a modest increase was recorded. Net shorts remain near recent highs and are therefore not reflecting this year’s improved performance of the USD in the spot market.

Net #USD short positions were little changed last week though a modest increase was recorded. Net shorts remain near recent highs and are therefore not reflecting this year’s improved performance of the USD in the spot market.

Rabobank 2/8: Focus is on the size of the Biden fiscal giveaway and the relative success of vaccine roll-out programmes. Rising inflation expectations appear out of kilter with the Fed’s very cautious tone.

#EUR net longs dropped back sharply. In spot market it appears that

#EUR net longs dropped back sharply. In spot market it appears that

Rabobank 3/8: the EUR is being undermined by the slow vaccine roll-out programme in the EU. This is supporting talk that the region could fall behind in the reflation trade.

Net #GBP long positions edged higher but remain below recent highs.

Net #GBP long positions edged higher but remain below recent highs.