Discover and read the best of Twitter Threads about #CryptoMarket

Most recents (24)

1/9 🧵@glassnode Insights: Stagnant digital asset prices and underlying indicators suggest a shift towards risk-off capital rotation, with an increasing preference for stablecoin capital. #CryptoMarket #RiskOff #Glassnode

Short summary of the Cake DeFi Twitter Space on 6 June: 1/11 📢 In a recent @cakedefi space, @julianhosp & @andreattafab discussed the current state of the #cryptocurrency industry. Key focus: the SEC's lawsuit against Binance and its impact on the crypto community. #CryptoNews

2/11 Notably, they shed light on the difference in allegations against #Coinbase and #Binance, suggesting the latter's case might be more severe. Discussion ensued about potential regulatory actions of the US government. #CryptoRegulations

3/11 The hosts also dove into the lawsuit implications for coins like ADA, SOL, and BNB. Despite some fear in the community, they reminded listeners that being classified as a security doesn't spell the end for a coin. #CryptoInvesting

Are you losing sleep over your investments?

Constantly checking prices and worrying?

That’s a sign that you’re probably overexposed and you’ve bitten more than you can chew.

You’ve invested more than you can handle.

These tips are for you 🧵👇

Constantly checking prices and worrying?

That’s a sign that you’re probably overexposed and you’ve bitten more than you can chew.

You’ve invested more than you can handle.

These tips are for you 🧵👇

I need to first make it clear that I’m not a financial advisor but a battle tested, seasoned investor with some life experience!

Rule number 1: Never invest more than you’re willing to lose

But if you have, here are some guidelines…

Rule number 1: Never invest more than you’re willing to lose

But if you have, here are some guidelines…

Reassess Your Risk Tolerance

Before deciding whether to sell or hold, it's important to reassess your risk tolerance. Ask yourself how much risk you're willing to take on and how much you can afford to lose. If you're feeling uneasy about your investment, it may be a sign that… twitter.com/i/web/status/1…

Before deciding whether to sell or hold, it's important to reassess your risk tolerance. Ask yourself how much risk you're willing to take on and how much you can afford to lose. If you're feeling uneasy about your investment, it may be a sign that… twitter.com/i/web/status/1…

𝐎𝐧𝐥𝐲 𝐬𝐨𝐦𝐞 𝐤𝐧𝐨𝐰. 𝐎𝐧𝐥𝐲 𝐚 𝐟𝐞𝐰 𝐜𝐚𝐧 𝐦𝐚𝐬𝐭𝐞𝐫 🧠 💰 🪴

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait”

Charlie Munger

1 SIMPLE STRATEGY 👇 🧵

#crypto #cryptomarket #financialeducation #financialliteracy

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait”

Charlie Munger

1 SIMPLE STRATEGY 👇 🧵

#crypto #cryptomarket #financialeducation #financialliteracy

Read…

BUY AT THE BOTTOM

WAIT PATIENTLY

SELL AT THE TOP

BUY AT THE BOTTOM

WAIT PATIENTLY

SELL AT THE TOP

Repeat!

BUY AT THE BOTTOM

WAIT PATIENTLY

SELL AT THE TOP

BUY AT THE BOTTOM

WAIT PATIENTLY

SELL AT THE TOP

🚀 𝐁𝐓𝐂 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 - 𝐍𝐞𝐰 𝐀𝐓𝐇

2023 will be a crab walk. Volatile, highs and lows.

Don’t get fooled by some thinking that we’ll see a #bullmarket this year, that’s pure Bullshit!

2024 is when the FUN begins. Until then, I’m stacking the lows and looking to sell at… twitter.com/i/web/status/1…

2023 will be a crab walk. Volatile, highs and lows.

Don’t get fooled by some thinking that we’ll see a #bullmarket this year, that’s pure Bullshit!

2024 is when the FUN begins. Until then, I’m stacking the lows and looking to sell at… twitter.com/i/web/status/1…

Why 2024?

That’s when the $BTC halving will take place and after every halving that’s when #Bitcoin goes parabolic and 🚀 to the 🌙

That’s when the $BTC halving will take place and after every halving that’s when #Bitcoin goes parabolic and 🚀 to the 🌙

I’m estimating that we will hit the new ATH about 540/550 days AFTER the $BTC halving.

When is the #Bitcoin halving?

According to @coingecko April 2024 (estimate), 355 days away.

When is the #Bitcoin halving?

According to @coingecko April 2024 (estimate), 355 days away.

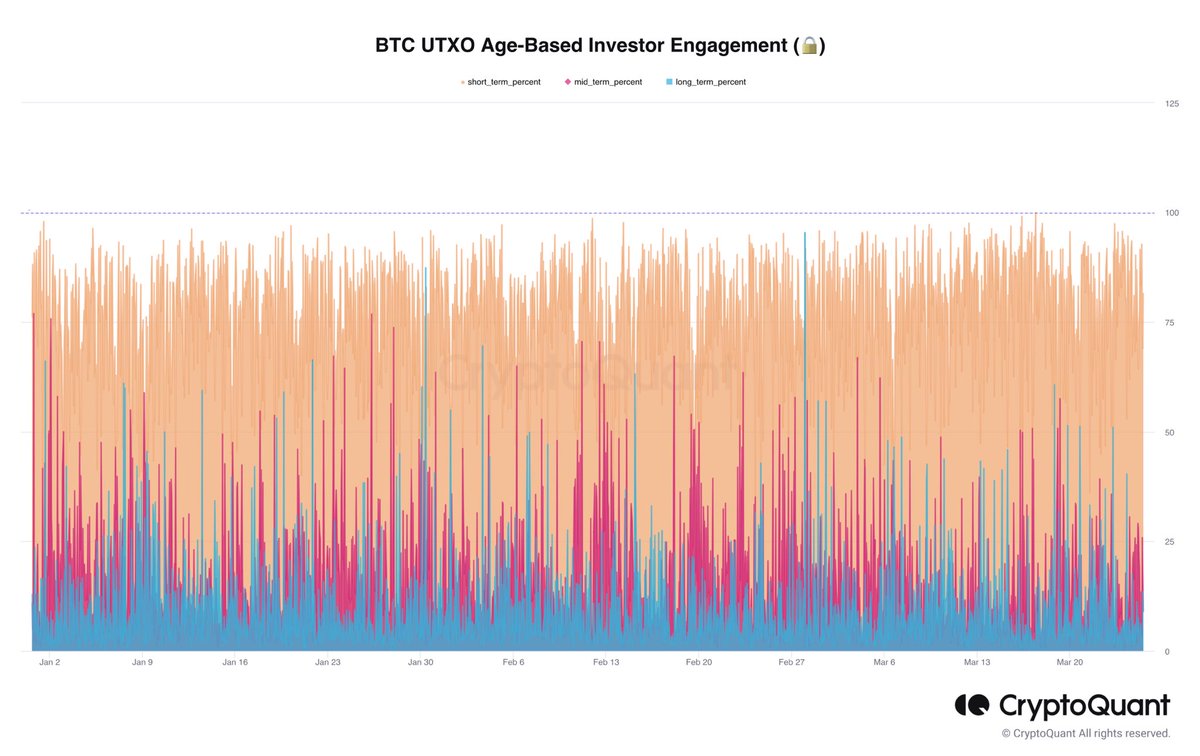

🧵 1/4 UTXO Age-Based Investor Engagement refers to how actively different investor groups interact with the market, including fund movements within the network, sending to or withdrawing from exchanges. Data is displayed from Jan 1, 2023 to today.

#Crypto #Investing

#Crypto #Investing

🧵 2/4 Current investor activity since the start of the year:

Short-term investors (UTXO age 0-1 month) = 76.19%

Mid-term investors (UTXO age 1 month-1 year) = 10.88%

Long-term investors (UTXO age >1 year) = 12.92%

#CryptoMarket #Trading

Short-term investors (UTXO age 0-1 month) = 76.19%

Mid-term investors (UTXO age 1 month-1 year) = 10.88%

Long-term investors (UTXO age >1 year) = 12.92%

#CryptoMarket #Trading

🧵 3/4 Short-term investors (76%) are the most active in the market, indicating that a significant portion of trading is speculative, aiming for quick profits. This activity can increase market volatility and create short-term price fluctuations.

#SpeculativeTrading #Volatility

#SpeculativeTrading #Volatility

MC of 4.5M & sitting at roughly .12 @DFXFinance has an insane amount upside. $DFX has big plans, great team, great partners, & is bringing foreign #stablescoins to the 🌍. DB is sold on the potential. See this YouTube vid on how the bonding curve works.

It’s a sign 👇🏻 $TEL $DFX we’re early 🤝

#bullishfam x #telfam x #DFXdragons

#Web3 #DeFi #altcoins #altcoin #1000xgem #100xgem #cryptomarket #Crypto #CryptoNews #Dao #TELx @DFXFinance #finance #staking @P4Cap @CotyKuhn @CKJCryptonews

#bullishfam x #telfam x #DFXdragons

#Web3 #DeFi #altcoins #altcoin #1000xgem #100xgem #cryptomarket #Crypto #CryptoNews #Dao #TELx @DFXFinance #finance #staking @P4Cap @CotyKuhn @CKJCryptonews

Wooooo $TEL sis coming through 🔥 número uno on the RT💯

@CKJCryptonews DM sent 🤝

#BTC #Ordinals. Invest or not to #invest. All you need to know about #BTCNFTs so far!

🧵4

#web3 #crypto #cryptomarket #blockchain #BTCordinals #cryptocurrency #Bitcoin

🧵4

#web3 #crypto #cryptomarket #blockchain #BTCordinals #cryptocurrency #Bitcoin

1/4 The first two #Ordinals marketplaces are now launched: @scarcedotcity and @OrdinalsMarket_ ⚡️ We can expect to see even more growth in this area.

#BTC #BTCNFTs #blockchain #BitcoinNFTs #BTCNFT #web3 #cryptocurrency

#BTC #BTCNFTs #blockchain #BitcoinNFTs #BTCNFT #web3 #cryptocurrency

You won't find a clearer thread about ZK than this!

Let's go! 9🧵

#ZK #ZKP #ZKPs #web3 #blockchain #crypto #cryptomarket #cryptonews #zeroknowledgeproof

Let's go! 9🧵

#ZK #ZKP #ZKPs #web3 #blockchain #crypto #cryptomarket #cryptonews #zeroknowledgeproof

1/9 Have you heard about Zero-Knowledge Proofs (ZKPs)? #ZKPs are becoming increasingly important for ensuring privacy and security in various industries.

2/9 One of the key benefits of #ZKPs is that they allow for verification of info without revealing the underlying data. This is especially crucial in situations where sensitive information needs to be kept confidential, such as financial transactions or personal identification.

1. Identify the trend: Look for a series of higher highs .

2. Plot the line: Connect two or more significant price points using a straight line tool.

$btc #bitcoin is suffering from a mini-dump this past couple of days.

ATM, we're trading above the $22,630 level.

On the 1D chart, though, it does not look like structure was broken.

Instead we're trading inside the range we've been in for the last 2 weeks or so

ATM, we're trading above the $22,630 level.

On the 1D chart, though, it does not look like structure was broken.

Instead we're trading inside the range we've been in for the last 2 weeks or so

Witam wszystkich, na początku chciałbym bardzo podziękować tym, którzy zrobili retwit mojego wczorajszego posta dzięki czemu tak wiele osób mogło dołączyć.

Dzisiaj powiemy sobie co to jest profil wolumenu z czego się składa oraz jak z niego korzystać w praktyce.

Dzisiaj powiemy sobie co to jest profil wolumenu z czego się składa oraz jak z niego korzystać w praktyce.

Profil wolumenu pokazuje jak zachodzi proces aukcyjny bazujący na wolumenie. Tworzy on tak zwany rozkład normalny. Jest to najważniejszy rozkład prawdopodobieństwa w statystyce (krzywa Gaussa)

Jego pierwowzorem jest profil rynkowy stworzony przez J.P Steidlmayera w połowie lat 80. Profil ten jest bliźniaczo podobny do wolumenowego rożni się tym że pokazuje proces aukcyjny z perspektywy czasu a nie wolumenu. (Opiszę to innym razem bo nie ma go na TradingV. (sierra, exo)

Time for another weekend analysis.

This time I want to start with $dxy

As we were expecting, $dxy looks like it finally found support and bounced

Here is the scenario we were looking for:

I still believe it's likely $dxy will rise towards the 107 area

This time I want to start with $dxy

As we were expecting, $dxy looks like it finally found support and bounced

Here is the scenario we were looking for:

I still believe it's likely $dxy will rise towards the 107 area

This rise in $dxy would, on average, be correlated with weakness in $spx and $btc

$spx had a bullish week, only to close bearish on Friday b/c of earning reports

ATM, I believe $4,200 is resistance for $spx

$4,100 is support

we may be in for ranging PA next week

$spx had a bullish week, only to close bearish on Friday b/c of earning reports

ATM, I believe $4,200 is resistance for $spx

$4,100 is support

we may be in for ranging PA next week

As we were expecting, $dji had a ranging week

between 34,364 and 33,792

ATM, until we confirm a break above 34,364 I think it's really like ranging PA will continue

between 34,364 and 33,792

ATM, until we confirm a break above 34,364 I think it's really like ranging PA will continue

#Bitcoin saw a tremendous surge in value in January) with an impressive 40% increase🚀

This marked a significant moment for the #cryptocurrency and reinforced its position as a leading asset in the financial world

Let's dive deeper and take a closer look at the chart🧵

This marked a significant moment for the #cryptocurrency and reinforced its position as a leading asset in the financial world

Let's dive deeper and take a closer look at the chart🧵

The Falling Wedge breakout was a major moment for Bitcoin, signaling a shift in market sentiment and paving the way for further gains.

#Bitcoin #Crypto #CryptoMarket #TechnicalAnalysis

#Bitcoin #Crypto #CryptoMarket #TechnicalAnalysis

Bitcoin is currently trading below the PREMIUM level and as the chart shows, it is an unusual occurrence for the cryptocurrency to trade under its long-term trendline. The market is currently encountering resistance at this level.

#Bitcoin #Crypto #TechnicalAnalysis

#Bitcoin #Crypto #TechnicalAnalysis

Morning update:

Yesterday, we saw a rally in the #stockmarket and this was expected. What was surprising is the fact that the #crypto market did not follow the move until major tech companies reported disappointing earnings results and we saw a drop📉

theguardian.com/technology/202…

Yesterday, we saw a rally in the #stockmarket and this was expected. What was surprising is the fact that the #crypto market did not follow the move until major tech companies reported disappointing earnings results and we saw a drop📉

theguardian.com/technology/202…

Yesterday proved to us that the market is becoming totally irrational. Bed Bath & Beyond failed to make interest payments on its bonds just weeks after the company warned it was considering filing for bankruptcy, yet the stock is surging higher🤦♂️ #BBBY

barrons.com/articles/bed-b…

barrons.com/articles/bed-b…

#BULLMARKET is here guys, we are finally getting that #BULLRUN we've been waiting for! #Capo was wrong, so let's go crazy #bullish

Waiiit a minute, is it true? What about #FOMO?

Here is what every #crypto trader/ investor should know about FOMO 👇

Waiiit a minute, is it true? What about #FOMO?

Here is what every #crypto trader/ investor should know about FOMO 👇

In this thread you'll learn:

• What is FOMO?

• How do you know that you got FOMO?

• What causes FOMO & what's the psychology behind it?

• Is FOMO always bad?

• What's happening now?

• What is FOMO?

• How do you know that you got FOMO?

• What causes FOMO & what's the psychology behind it?

• Is FOMO always bad?

• What's happening now?

What is FOMO in #cryptomarket?

It's a fear of missing out on a good investment opportunity.

e.g:

•The rapid fluctuation of #Bitcoin prices in 2017.

• Elon Musk's tweets about #Dogecoin causing a false bull market, it pumped then decreased by 30% in 24 hours.

It's a fear of missing out on a good investment opportunity.

e.g:

•The rapid fluctuation of #Bitcoin prices in 2017.

• Elon Musk's tweets about #Dogecoin causing a false bull market, it pumped then decreased by 30% in 24 hours.

[#CMC 2023 #crypto Playbook] - According to CMC 🚀

Using interesting findings from our data with collaborations from other research entities, we analyze what happened in 2022, and what the #crypto key theses are going into 2023.💪

<1/10>

coinmarketcap.com/alexandria/art…

Using interesting findings from our data with collaborations from other research entities, we analyze what happened in 2022, and what the #crypto key theses are going into 2023.💪

<1/10>

coinmarketcap.com/alexandria/art…

1⃣ #DeFi

Some themes to follow for the next year from @Uniswap & @TrustWallet

🔹How DeFi UX/UI improves to bring more new #crypto users into the sector

🔹How both education and infrastructure will grow

🔹Whether #DEXs can eat significantly into #CEXs market share.

<2/10>

Some themes to follow for the next year from @Uniswap & @TrustWallet

🔹How DeFi UX/UI improves to bring more new #crypto users into the sector

🔹How both education and infrastructure will grow

🔹Whether #DEXs can eat significantly into #CEXs market share.

<2/10>

2⃣ #NFTs & #GameFi

@Sfermion_ & @naavik_co look at what we can expect

from NFTs and GameFi in 2023.

For NFTs in particular, there is a movement towards greater adoption of #Layer2 ,as well as expectations of new integrations between AI and NFTs.

<3/10>

@Sfermion_ & @naavik_co look at what we can expect

from NFTs and GameFi in 2023.

For NFTs in particular, there is a movement towards greater adoption of #Layer2 ,as well as expectations of new integrations between AI and NFTs.

<3/10>

In the world of #DeFi yield protocols, developers and users typically need to make a choice:

Do you want high #yields 🍏?

OR

Do you want low #risk 🍎?

1/10🧵

Do you want high #yields 🍏?

OR

Do you want low #risk 🍎?

1/10🧵

🍏In most existing leveraged yield farms, higher yield comes from higher leverage and higher risk.

As a result, only users who do frequent position adjustments survive. Degen in, degen out. 😮💨

And those who don't manage their positions?

High chance of rektness.

2/10 🧵

As a result, only users who do frequent position adjustments survive. Degen in, degen out. 😮💨

And those who don't manage their positions?

High chance of rektness.

2/10 🧵

Increases in #Stablecoins Net Buy Value indicate traders are swapping #alts for safe-haven assets, which usually reflects the start of a crash.

🧵

Eg, $USDC & $USDT Net Buy on #Polygon simultaneously recorded buying power surges at 23:05 UTC. (P1/P2)

👇

bit.ly/USDC-Net-Buy-P…

🧵

Eg, $USDC & $USDT Net Buy on #Polygon simultaneously recorded buying power surges at 23:05 UTC. (P1/P2)

👇

bit.ly/USDC-Net-Buy-P…

At the same time, the number of $USDC & $USDT buyers on #Polygon increased sharply. (P1/P2)

Live Signals - Free to access this chart👇

bit.ly/USDC-Unique-Tr…

#crypto #TradingSignals

Live Signals - Free to access this chart👇

bit.ly/USDC-Unique-Tr…

#crypto #TradingSignals

Check the $WMATIC Net Buy Value Indicator

- a large red peak representing selling power showed at 23:05 UTC on Nov 27. (P1)

The #cryptomarket also retraced from then on. (P2)

Set up Alerts to monitor #cryptocrash signals👇

candlestick.io/alerts/

- a large red peak representing selling power showed at 23:05 UTC on Nov 27. (P1)

The #cryptomarket also retraced from then on. (P2)

Set up Alerts to monitor #cryptocrash signals👇

candlestick.io/alerts/

💻 "In code we trust" - Oanna Batran, Chainge CBO

🔥 In light of recent events, the rise of DeFi is imminent

🧵 We dedicate this thread to the impregnable @FUSIONProtocol tech powering the decentralized Chainge app

#DeFi #cryptomarket #blockchain #fintechnews #CHNG #FSN

🔥 In light of recent events, the rise of DeFi is imminent

🧵 We dedicate this thread to the impregnable @FUSIONProtocol tech powering the decentralized Chainge app

#DeFi #cryptomarket #blockchain #fintechnews #CHNG #FSN

🛡️ SECURITY

Never been hacked. Never will be.

Tip: Research those who worked on development

fusiondev.gitbook.io/fusion/learn/f…

Never been hacked. Never will be.

Tip: Research those who worked on development

fusiondev.gitbook.io/fusion/learn/f…

💪 CAPABILITY

The most comprehensive multi-cross-chain solution. Tip: Try cross-chain roaming in the Chainge app

fusiondev.gitbook.io/fusion/learn/f…

The most comprehensive multi-cross-chain solution. Tip: Try cross-chain roaming in the Chainge app

fusiondev.gitbook.io/fusion/learn/f…

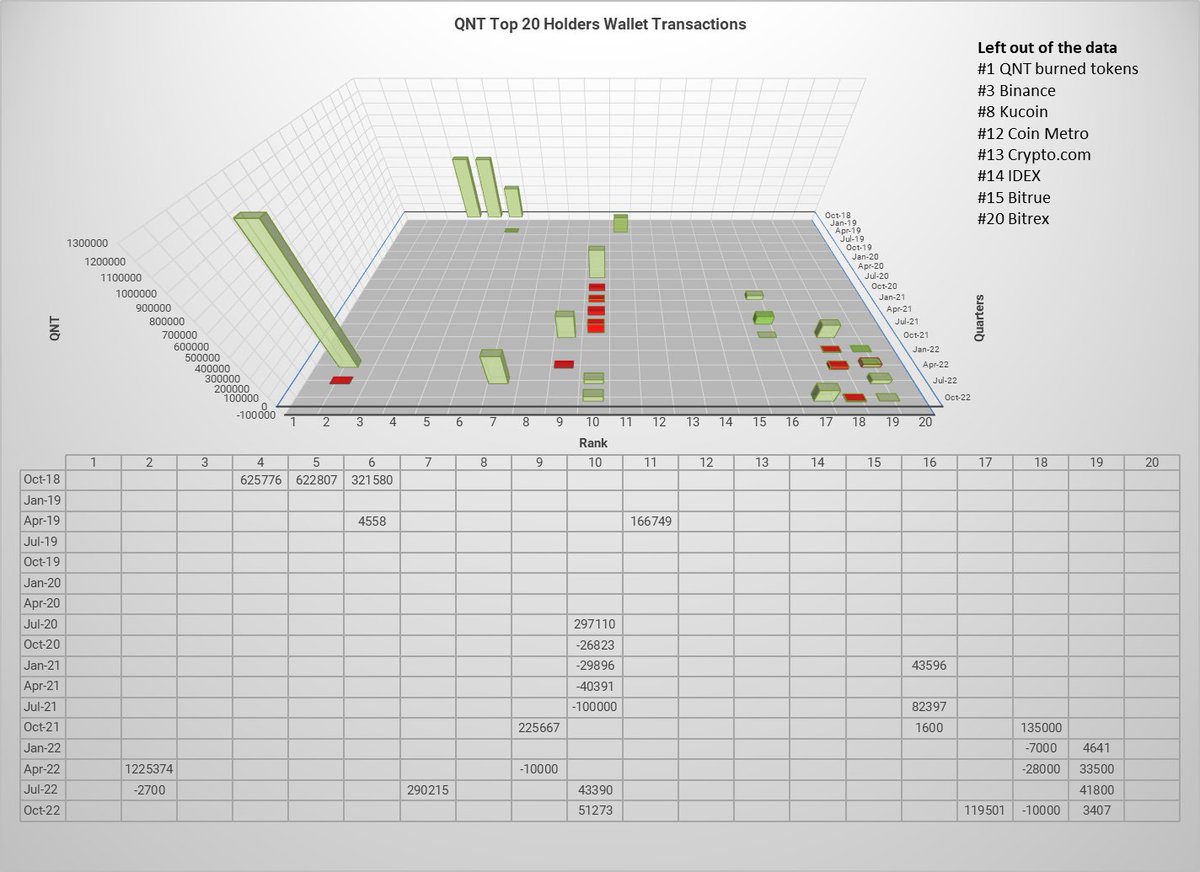

A thread on $QNT whale activity and macro performance. Below are the top 20 accounts on Etherscan. With exchange accounts removed they represent 34% of the total market cap. During this quarter a combined 164k QNT have been added.

#QNTTalent #cryptomarket

🧵1/7

#QNTTalent #cryptomarket

🧵1/7

Example of Scammers PUMP & DUMP coin with low liquidity (less money in any coin of market = easier to dump price up to -99%)

1) First they annouce BIG PUMP on any exchange

2) If they take attention can follow another step = slowly start buying

#scammer #BTC

1) First they annouce BIG PUMP on any exchange

2) If they take attention can follow another step = slowly start buying

#scammer #BTC

3) If people catches it they pump their bags by more buying coins (what is important = they need have more coins than participants, 80% would be enough from the last minutes transaction to pump price enough and be profitable for them)

4) Sellin theirs bags and leave people

4) Sellin theirs bags and leave people

*Transactions are done on LTF (Low Time Frame) which is a key for scammers to manipulate price and earn on it*

#cryptomarket

#cryptomarket

DISCLAIMER : This is for educational purpose and not financial advise.

Monthly market analysis Oct 31, 2022

#StockMarket #DowJones best month since 1976

Let's look at more closely 🧵👇

Monthly market analysis Oct 31, 2022

#StockMarket #DowJones best month since 1976

Let's look at more closely 🧵👇

1. After technical oversold and very negative sentiment in Sep month, #StockMarket was finally able to reverse direction this month. $DJIA had the best month since 1976 (+14%). $NDX was underperformed (5%) compared to $SPX (8.8%), $RUT(11%).

2. Let's look at US 10Y #Bond Yield price action. It was very volatile and tested 4.3% Jun'08 high before reversing -9.8% to the end of the month. This month it finished up 5.7%. RSI did not make new high at Oct 21 when it reached peak 4.33% (bearish reversal)

#StockMarket

#StockMarket