Discover and read the best of Twitter Threads about #DeDollarization

Most recents (20)

🧵 China’s Winning The Real Economic War

💪🇨🇳😈 Xi’s Masterplan Revealed

The real economic battle is in the war for commodities and China is winning it. From oil and gas to gold and grains, China is hoarding the world's commodities in their bid to compete with the US.

💪🇨🇳😈 Xi’s Masterplan Revealed

The real economic battle is in the war for commodities and China is winning it. From oil and gas to gold and grains, China is hoarding the world's commodities in their bid to compete with the US.

But the agenda goes deeper than that and we must understand China's moves to control the world's commodity supply!

According to the USDA China holds half of the world’s wheat reserves and 70% of its corn. After five consecutive record crops, India now has one-tenth of global wheat stockpiles. The U.S. has 6% and 12% of global wheat and corn reserves, respectively.

farrellymitchell.com/our-thinking/l…

farrellymitchell.com/our-thinking/l…

🧵 Saudi Arabia Just Changed The Game!

BRICS Expansion Coming 🇸🇦🥳

Saudi Arabia is moving to join the #BRICS bank. This is a big development that threatens to accelerate #Dedollarization, especially across the emerging markets.

BRICS Expansion Coming 🇸🇦🥳

Saudi Arabia is moving to join the #BRICS bank. This is a big development that threatens to accelerate #Dedollarization, especially across the emerging markets.

Coming just a few months before the BRICS summit, this could be a game changer that could see the Kingdom join the bloc as an official member. Here's what you must know!

Saudi Arabia in talks to join China-based ‘BRICS bank’

👉 Membership would strengthen Riyadh’s bonds with the BRICS countries at a time when Saudi Arabia, the world’s largest crude oil exporter, is also pursuing closer relations with China.

ft.com/content/45abe5…

👉 Membership would strengthen Riyadh’s bonds with the BRICS countries at a time when Saudi Arabia, the world’s largest crude oil exporter, is also pursuing closer relations with China.

ft.com/content/45abe5…

#DeDollarization

"Rogers proceeded to detail the reasons why countries are increasingly moving away from the U.S. dollar.

The first reason is that the U.S. is the largest debtor nation in the history of the world"

news.bitcoin.com/renowned-inves…

"Rogers proceeded to detail the reasons why countries are increasingly moving away from the U.S. dollar.

The first reason is that the U.S. is the largest debtor nation in the history of the world"

news.bitcoin.com/renowned-inves…

"Another major reason Rogers mentioned concerns sanctions."

"The world’s international currency is supposed to be completely neutral. Anybody can use it for anything you want. But now Washington is changing the rules. And if they get angry at you, they cut you off."

"The world’s international currency is supposed to be completely neutral. Anybody can use it for anything you want. But now Washington is changing the rules. And if they get angry at you, they cut you off."

"One of the initiatives aimed at challenging the U.S. dollar’s dominance is the proposed BRICS currency. The BRICS nations (Brazil, Russia, India, China, and South Africa)are collaborating to establish a common currency that would reduce their dependence on the U.S. dollar"

🌍 The End of the US Dollar? Consider #Bitcoin!

🔍 Discover the Future of Currency in this Captivating Thread!🧵

🔍 Discover the Future of Currency in this Captivating Thread!🧵

💰The US dollar's global reserve status is under threat, as countries seek alternatives and engage in de-dollarization.

Is it time to explore Bitcoin as a potential solution? Let's dive into the details. 👇🏻

Is it time to explore Bitcoin as a potential solution? Let's dive into the details. 👇🏻

💥 Doubts about the Dollar's Future:

➡️ Rampant inflation and massive debts raise concerns

➡️ The US is burdened with a staggering $32 trillion debt and increasing interest payments.

➡️ Rampant inflation and massive debts raise concerns

➡️ The US is burdened with a staggering $32 trillion debt and increasing interest payments.

#Dedollarization Continues

🇧🇩 & 🇮🇳 to trade in National Currencies

🇧🇩 & 🇮🇳 have decided to ditch the 🇺🇸 dollar & conduct bilateral trade settlements in their currencies, a 🇧🇩 Bank official told

🇧🇩 & 🇮🇳 to trade in National Currencies

🇧🇩 & 🇮🇳 have decided to ditch the 🇺🇸 dollar & conduct bilateral trade settlements in their currencies, a 🇧🇩 Bank official told

This decision was made due to foreign currency liquidity issues faced by 🇧🇩, which disrupt the flow of imports into the country.

The move would also cut a number of costs associated with using the US dollar, replacing it with Indian rupees & Bangladeshi taka.

The move would also cut a number of costs associated with using the US dollar, replacing it with Indian rupees & Bangladeshi taka.

Part of the cost-cutting benefits comes from avoiding currency conversions that has to be done several times in traditional settlements, said #MezbaulHaque, executive director of 🇧🇩 Bank

"Such a decision will cut the cost of biz, speed up transactions, & boost regional trading"

"Such a decision will cut the cost of biz, speed up transactions, & boost regional trading"

#China's GDP (in nominal terms) will never surpass the #US GDP.

For a long time, I have been sceptical of the forecasts that have predicted otherwise. I have been open to the possibility of a short-term situation in the mid-2030s, where it was temporarily higher.

#macro

For a long time, I have been sceptical of the forecasts that have predicted otherwise. I have been open to the possibility of a short-term situation in the mid-2030s, where it was temporarily higher.

#macro

🧵 Gold is underrated and could be pushed up by #Dedollarization, Bridgewater's Co-CIO said.

"This geopolitical turmoil is not going away. This is a slow-moving secular support for #gold," Karen Karniol-Tambour said.

👉 #Inflation will also keep interest in gold elevated as well.

"This geopolitical turmoil is not going away. This is a slow-moving secular support for #gold," Karen Karniol-Tambour said.

👉 #Inflation will also keep interest in gold elevated as well.

#Gold could be at the start of a lasting growth period as global #Dedollarization trends continue, Co-CIO of Bridgewater Associates Karen Karniol-Tambour said.

markets.businessinsider.com/news/currencie…

markets.businessinsider.com/news/currencie…

#Dedollarization is no longer a matter of if, but when, said International Crisis Group cochair Frank Giustra.

A sudden drop in dollar demand could lead to #hyperinflation and a debt crisis, he said.

A sudden drop in dollar demand could lead to #hyperinflation and a debt crisis, he said.

L’irruzione di Barack Obama e Hillary Clinton a Copenhagen, nel dicembre 2009, nella stanza in cui si erano riuniti i BRICS per discutere la creazione di una riserva valutaria che non dipendesse dal dollaro USA

- Thread 🧵

- Thread 🧵

2/ A Copenhagen, il primo ministro indiano Singh, il premier cinese Wen Jiabao e altri leader del neonato gruppo BASIC (con Brasile e Sud Africa - poi BRICS) erano seduti in una sala conferenze, negoziando una dichiarazione sul fallimento del vertice sul cambiamento climatico.

BRICS is getting stronger & stronger

#PetroDollar gets weaker & weaker

#PetroYuan gets stronger & stronger

Lots of countries showing interest to join the #BRICS+ alliance for trade

Western sanctions on Russia have zero negative effects, in fact they had positive effects pushing… twitter.com/i/web/status/1…

#PetroDollar gets weaker & weaker

#PetroYuan gets stronger & stronger

Lots of countries showing interest to join the #BRICS+ alliance for trade

Western sanctions on Russia have zero negative effects, in fact they had positive effects pushing… twitter.com/i/web/status/1…

Here’s a prev 🧵 on #BRICS strength

How to stop drinking milkshake?

Slowly then suddenly

So far this week

Kenya buy 🇸🇦 🇦🇪 oil in Kenyan Shillings

First Yuan LNG deal

🇨🇳 🇧🇷 trade in their currencies

ASEAN discussion on non-USD settlement

Only midweek 😁

#Dedollarization

Slowly then suddenly

So far this week

Kenya buy 🇸🇦 🇦🇪 oil in Kenyan Shillings

First Yuan LNG deal

🇨🇳 🇧🇷 trade in their currencies

ASEAN discussion on non-USD settlement

Only midweek 😁

#Dedollarization

Prestito storico in yuan tra Cina e Arabia Saudita

Il crollo del dollaro come valuta mondiale è sempre più evidente.

(segue)

actualite.housseniawriting.com/politique-et-g…

Il crollo del dollaro come valuta mondiale è sempre più evidente.

(segue)

actualite.housseniawriting.com/politique-et-g…

2/ Una prima assoluta per questo prestito in yuan tra la Export-Import Bank of China e la Saudi National Bank, che facilita il commercio bilaterale tra i due Paesi e dimostra il ruolo crescente dello yuan sulla scena internazionale.

3/ La China Export-Import Bank (China EximBank), la principale banca cinese per le politiche commerciali, ha annunciato martedì (14 marzo) di aver concluso la prima cooperazione di prestito con la Saudi National Bank, la più grande banca dell'Arabia Saudita, in yuan RMB,

While many are sharing the great news about India's #LithiumInIndia discovery, a very important element has been overlooked.

In this short thread I discuss what this means for India in terms of #Dedollarization, how this will affect Indian currency & also the upcoming politics.

In this short thread I discuss what this means for India in terms of #Dedollarization, how this will affect Indian currency & also the upcoming politics.

Firstly ranked below are the details of top 5 countries #Lithium reserves 2023 in Million metric tons

1. Chile - 9.3

2. India - 5.9 (just discovered)

3. Australia - 3.8

4. Argentina - 2.7

5. China - 2

With De-dollarisation, the currency will reflect the value of our resources

1. Chile - 9.3

2. India - 5.9 (just discovered)

3. Australia - 3.8

4. Argentina - 2.7

5. China - 2

With De-dollarisation, the currency will reflect the value of our resources

which means that this and any other discovery would result in dramatically appreciating our currency.

However, just because we have reserves doesn't mean we'll become producers. Mining, #Lithium extraction industry etc will have to set up and guess what this will result in?

However, just because we have reserves doesn't mean we'll become producers. Mining, #Lithium extraction industry etc will have to set up and guess what this will result in?

Quasi il 90% del mondo NON segue gli Stati Uniti sull'Ucraina

- non solo, “ci odiano pure” 🙄scrivono:

🇺🇸Michael Gfoeller, ambasciatore ed ex consigliere politico del Comando centrale degli Stati Uniti

🇺🇸David H. Rundell, capo missione dell'Ambasciata USA in Arabia Saudita

🧵

- non solo, “ci odiano pure” 🙄scrivono:

🇺🇸Michael Gfoeller, ambasciatore ed ex consigliere politico del Comando centrale degli Stati Uniti

🇺🇸David H. Rundell, capo missione dell'Ambasciata USA in Arabia Saudita

🧵

2/ “Il nostro familiare sistema di alleanze [sudditanze] politiche ed economiche globali sta cambiando e nulla ha reso più chiaro questo cambiamento delle diverse reazioni all'operazione militare speciale della Russia 🇷🇺 in Ucraina.”

3/ “Mentre gli Stati Uniti e i loro più stretti alleati in Europa e in Asia hanno imposto dure sanzioni economiche a Mosca, l'87% della popolazione mondiale ha rifiutato di seguirci.”

- Si stupiscono gli autori 🤦🏻♂️

- Si stupiscono gli autori 🤦🏻♂️

It seems that #Zoltan has been quite busy lately!

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

"... four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (..) in “macro-land” () where Great Powers were going “at it” in 2022:

"the G7’s financial blockade of Russia, Russia’s energy blockade of the EU, the U.S.’s technology blockade of China, China’s naval blockade of Taiwan, the U.S.’s “blockade” of the EU’s EV sector with the Inflation Reduction Act,

Just finished reading the new piece by #ZoltanPozsar "Oil, Gold, and LCLo(SP)R...Fascinating read (as always), here are some highlights:

"The SPR is like the o/n RRP facility. It can be tapped when oil levels are tight. But the SPR is finite, and recent releases have brough reserves down to levels

we haven’t been at since the 1980s. The 400 million barrels left in it isn’t much:

we haven’t been at since the 1980s. The 400 million barrels left in it isn’t much:

it could help police prices for a year if we released 1 million barrels per day (mbpd), half a year if we released 2 mbpd, and about four months if we released 3 mbpd."

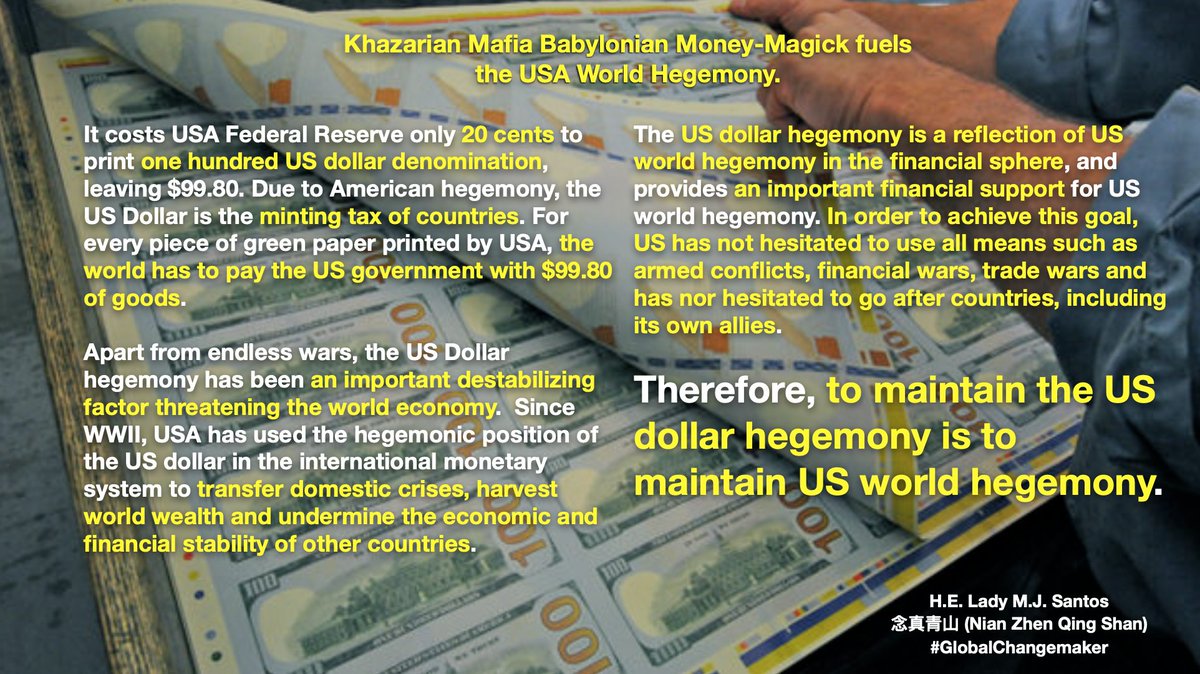

Since #WWII, #USA has used #USdollar hegemony to transfer domestic crises, harvest world #wealth and undermine the economic and financial stability of other countries through armed conflicts, financial wars, and trade wars. To maintain US dollar is to maintain US world hegemony.

Since March 2022, #FederalReserve has raised interest rates 6X. On 2 Nov, its 75-point rate hike and sharp #USdollar appreciation caused global #currency depreciation, capital outflows, rising debt servicing costs, hiked imported inflation and currency/debt crises of countries.

THREAD

The brilliance of Putin's "gas for rubles" order

First, the basics of how it works:

Customers from "unfriendly countries" must purchase natural gas from (state-owned) Gazprom in rubles. If the company doesn't have rubles on hand, it must set up an account at Gazprombank

The brilliance of Putin's "gas for rubles" order

First, the basics of how it works:

Customers from "unfriendly countries" must purchase natural gas from (state-owned) Gazprom in rubles. If the company doesn't have rubles on hand, it must set up an account at Gazprombank

As an example, a German company purchasing gas can fund their account with euros, but Gazprombank will immediately take that EUR and exchange it on the domestic currency market (Moscow Exchange) for rubles. Those rubles are what is available in the account to make the purchase

The brilliance of the decree is that it forces demand for rubles on the open market that previously did not exist *plus* it empowers Gazprom (majority owned by the Russian government) to set the rate at which it will do the exchange. We can bet theyll pay a premium for rubles.

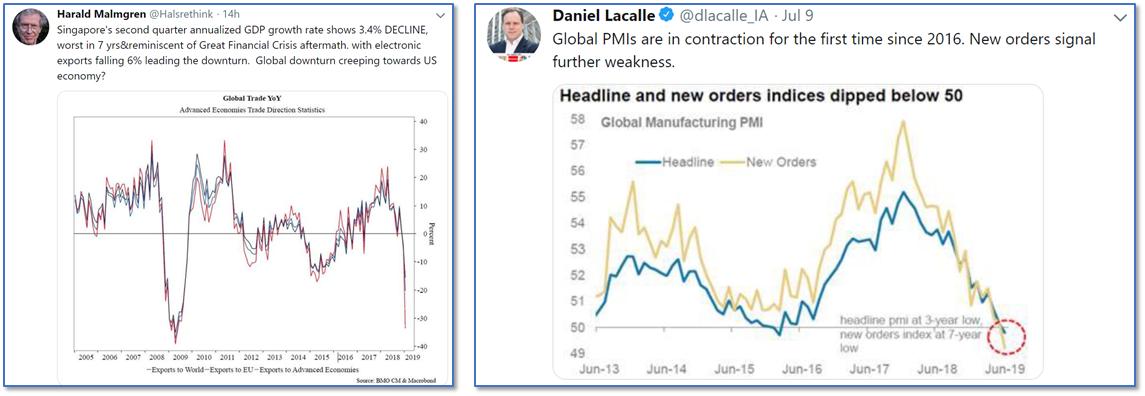

Dear all 🙂Hope you enjoy the weekend! We are still in the Twilight Zone. Despite continued deteriorating economic fundamentals across the globe, US stock market continues to rally. But for how long...? Stay tuned for some #HZupdates

Indicators and signals across the globe continue to suggest economic slowdown - which slowly but surely spreads to all geographical regions and industries. It is my firm belief, that US will not decouple and US #equities will realize this at some point #HZupdates

#WTI sends clear signal from major Ending Diagonal. We may rally further in wave (B) - but soon we will see a reversal, which will send #Oil towards its LT-target of <20USD #HZupdates

01. I usually avoid mainstream politics, but enjoy @ScottAdamsSays’s periscope videos. Yesterday he asked some interesting questions about socialism and capitalism and UBI, and the size of the US military.

Here’s a few things it could be useful for Scott Adams know:

Here’s a few things it could be useful for Scott Adams know:

02. Instead of =socialists= v =capitalists= it might be more useful to view the key

social/economic conflict being between between =producers= and =consumers=.

English-speaking nations are now the world’s biggest consumers.

social/economic conflict being between between =producers= and =consumers=.

English-speaking nations are now the world’s biggest consumers.

Another nail in the reserve currency coffin? sputniknews.com/news/201808211…