Discover and read the best of Twitter Threads about #cre

Most recents (24)

“Bob” almost went broke in real estate during the Great Recession.

Then he bought a property, sold it, became the lender, and brokered it twice.

He was back on his feet.

Comeback story below:

#cre #retwit

Then he bought a property, sold it, became the lender, and brokered it twice.

He was back on his feet.

Comeback story below:

#cre #retwit

A single unit franchisee drive thru building hit the market for $350K.

Seller was willing to “carry back” a loan for $250K at 6% interest only, so Bob needed $100K for down payment.

Seller was willing to “carry back” a loan for $250K at 6% interest only, so Bob needed $100K for down payment.

Bob put the property in contract, brought in a friend for the $100K down payment, and closed on the property.

I’ve closed 110+ commercial transactions in just over 4 years. That’s roughly a deal every 15 days.

Here are 12 things I’ve learned about closing deals I wish I would have known on Day 1:

Here are 12 things I’ve learned about closing deals I wish I would have known on Day 1:

1 - If a retrade must happen, remove the mystery and avoid the squabbling by providing an exact invoice from a certified professional for the work needed.

I have found most people want to make a legitimate problem right.

I have found most people want to make a legitimate problem right.

2 - Co-brokering is actually more fun & leads to more connections.

Two active brokers, all things equal, can move four times (or more) as fast.

Two active brokers, all things equal, can move four times (or more) as fast.

Welcome to Part 3 of my series on #CRE Purchase and Sale Agreements (PSAs).

In this thread, we'll cover how to properly describe the property being purchased.

It's not as simple as just describing the land! Here are the key components 🔑

In this thread, we'll cover how to properly describe the property being purchased.

It's not as simple as just describing the land! Here are the key components 🔑

You can find Part 1 here if you missed it.

First is the "real property" which includes the following:

- the land (usually identified with a formal "legal description")

- the improvements located on the land

- the appurtenances (i.e. things like easements and rights of way associated with the land)

- the land (usually identified with a formal "legal description")

- the improvements located on the land

- the appurtenances (i.e. things like easements and rights of way associated with the land)

Get ready for Part 2 of the breakdown of #CRE Purchase and Sale Agreements (PSAs).

Today we'll do a deep dive into the burning issue all of #retwit has been waiting to understand: casualty and condemnation.

Today we'll do a deep dive into the burning issue all of #retwit has been waiting to understand: casualty and condemnation.

If you missed Part 1 - you can find it here to get an overview of #CRE PSAs.

Casualty and condemnation provisions address two critical yet unlikely situations that could arise before closing: (i) property damage, and (ii) eminent domain proceedings. Let's take a closer look at these concepts.

Lots of cold calling posts lately.

I am not a 100 calls/day caller. It's ok. If I make 5 calls/day average then jump to 30, big upside.

My thing? I count connections, not calls: meeting scheduled. 2nd call, market update/valuation, shared joke. However, I define it.

#cre

I am not a 100 calls/day caller. It's ok. If I make 5 calls/day average then jump to 30, big upside.

My thing? I count connections, not calls: meeting scheduled. 2nd call, market update/valuation, shared joke. However, I define it.

#cre

Scripts are good for cold calling. Better? Energy.

A monotone reading of a script doesn't engage.

Hesitancy doesn't engage, nor does steam rolling.

Use the old tricks to increase connection. 1.Stand up, jump around before a la Tony Robbins.

2. Smile while talking.

#coldcall #cre

A monotone reading of a script doesn't engage.

Hesitancy doesn't engage, nor does steam rolling.

Use the old tricks to increase connection. 1.Stand up, jump around before a la Tony Robbins.

2. Smile while talking.

#coldcall #cre

Now you've jumped around to pump your pre-calls energy, you are smiling on the phone. And NO One is taking your calls.

It's OKAY! A great note on this from @BobKnakal-If someone talks to you for 20 min, they're probably talking to everyone. Better to connect on 3rd-10th call

It's OKAY! A great note on this from @BobKnakal-If someone talks to you for 20 min, they're probably talking to everyone. Better to connect on 3rd-10th call

Today's #CRE term spotlight: Equity Multiple. It's a less common measure but an important counter to the typical IRR standard used in many real estate transactions. Let's dive in! #realestateinvesting

The Equity Multiple represents the gross return an investor receives compared to their initial investment, regardless of time. It's a simple way to gauge overall returns based on the total distributions received relative to capital invested.

Example: An investor seeking a minimum equity multiple of 1.50x on a $1,000,000 investment would require a return of $1,500,000. This indicates that for every dollar invested, they expect to get $1.50 back in gross returns. So why is this used?

1031 exchange buyer took this down, got debt from a life insurance company, and was a local buyer.

Rent was only $2/ft. annually, price per foot entry point was only $46 - outstanding intrinsic value.

Below is an incredible story thread about a great deal gone wrong.

In what used to be one of the best locations in the world.

And what it took to save the deal from disaster.

Goes a little something like this:

#retwit #cre

In what used to be one of the best locations in the world.

And what it took to save the deal from disaster.

Goes a little something like this:

#retwit #cre

The year is 2017 and the subject project is a leasehold interest shopping center with a strong tenant line up that includes Starbuck’s, Chase, Burger King, Subway, and other nationals backed by franchisees.

It is one of the most well known locations in America on Michigan Avenue in Chicago centered above Millennium Park, home of “The Bean” sculpture.

15 mistakes I made as a #cre broker that cost me money — and even worse — time:

1. Bounced around CRM’s looking for the magic pill.

The perfect system doesn't exist.

Marry one, upload accurate data, and don't look back.

The perfect system doesn't exist.

Marry one, upload accurate data, and don't look back.

2. Got stuck as a deal technician vs. new biz developer.

As your pipeline fills more closing skills are required, which eats up prospecting time, which empties your pipeline.

The cycle of death.

Time block peak hours for developing business no matter how busy you are.

As your pipeline fills more closing skills are required, which eats up prospecting time, which empties your pipeline.

The cycle of death.

Time block peak hours for developing business no matter how busy you are.

🧵Buckle in for this one! 2 for the price of 4!

In land assemblage, the whole is usually worth more than the sum of the parts. In these transactions, due to two unusually shaped properties and different zoning districts, the sum of the parts were worth more than the whole.

In land assemblage, the whole is usually worth more than the sum of the parts. In these transactions, due to two unusually shaped properties and different zoning districts, the sum of the parts were worth more than the whole.

2/12 Suggesting a tax lot subdivision, and a joint venture development strategy, which left one of the unwilling sellers with a retail condo interest, were keys to maximizing the value of all the component properties.

#cre #retwit #TestimonialTuesday

#cre #retwit #TestimonialTuesday

🧵Another in the series of "Thoughts for the Day":

What are you working on today?

Sunday, March 12, 2006

Our business is a busy one with many moving parts. We all have more on our plates than we can possibly accomplish, and new things pop-up all the time. #MondayMorning

What are you working on today?

Sunday, March 12, 2006

Our business is a busy one with many moving parts. We all have more on our plates than we can possibly accomplish, and new things pop-up all the time. #MondayMorning

2/10 How do you succeed? How do you cope? How do you achieve your goals? How do you not get caught up in the swirl of the daily whirlwind? I offer a couple of one-word answers: think, plan, discipline, focus.

#cre #retwit #MondayMotivation

#cre #retwit #MondayMotivation

3/10 “There is nothing so useless as doing efficiently that which should not be done at all.” – Peter Drucker

People who are not performing up to expectations are simply doing ineffective things all day.

#cre #retwit #MondayMotivation

People who are not performing up to expectations are simply doing ineffective things all day.

#cre #retwit #MondayMotivation

Thanks to @GeoffCutmore & @steve_sedgwick for the chat on #SquawkBox this morning!

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

First of all, it's #ValentinesDay and SOMEONE is going to get massacred today when the #CPI is released, so naturally:-

2/x

2/x

Roses are red, violets are blue,

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

No es alergia. Tampoco que vivas con gripa eterna. Es la contaminación ocasionada por la Termoeléctrica de #Tula. Por eso, desde el #CNLE impulsamos y presentamos un amparo. Abrimos hilo 👇🏻

Durante años, la Central Termoeléctrica Francisco Pérez Ríos, ubicada en #Tula, #Hidalgo, ha operado en pleno desacato de sus obligaciones en materia #ambiental.

• Esta Central, administrada por la @cfe_mx, se diseñó para producir electricidad a base de vapor que se puede obtener quemando combustóleo o Gas Natural.

I’ve seen a number of posts about cold calling. Some of these numbers astound me what people are doing. Kudos to them!

I’ve seen that the average cold call is 5-7 minutes long. And that overall conversion rates are 2%. #cre

I’ve seen that the average cold call is 5-7 minutes long. And that overall conversion rates are 2%. #cre

No doubt cold calling is a critical success factor early in your career. It’s hard to convert when you’re green in the biz, but there are a lot of ancillary skillets & benefits you gain while doing it.

But as you gain experience & track record and build some key relationships, there are better paths to success (and much higher success rates) than dialing for dollars.

When you learn how to leverage your knowledge/expertise as well as your relationships…

When you learn how to leverage your knowledge/expertise as well as your relationships…

Yesterday, @USTreasury alerted banks that sanctioned Russian 🇷🇺 elites are likely using US 🇺🇸 #CommercialRealEstate to evade sanctions.

fincen.gov/news/news-rele…

A couple of thoughts... 🧵

fincen.gov/news/news-rele…

A couple of thoughts... 🧵

First, it’s welcome that FinCEN has recognized the opacity risks of CRE and issued guidance on identifying risky transactions. 👏👏

Hopefully new rules to prevent #RealEstate #MoneyLaundering due in April will cover both commercial and residential properties.

Hopefully new rules to prevent #RealEstate #MoneyLaundering due in April will cover both commercial and residential properties.

Healthcare sale leasebacks are one of #CRE’s best kept secrets.

The upside potential is great, and achieving it is simple.

Best part, your tenant does all the work.

🧵

The upside potential is great, and achieving it is simple.

Best part, your tenant does all the work.

🧵

To understand this, let’s look at a couple trends in healthcare -

1) PE-backed groups are rapidly acquiring medical practices all over the country

2) Hospital system M&A activity hit an all-time high in 2022

Pretty much, hospitals and PE firms are on a buying spree!

1) PE-backed groups are rapidly acquiring medical practices all over the country

2) Hospital system M&A activity hit an all-time high in 2022

Pretty much, hospitals and PE firms are on a buying spree!

However doctors aren’t the only ones gaining from their hard work…

Real estate investors are too!

When a doc group sells their practice, the RE owner gets what’s called a “credit enhancement.”

Real estate investors are too!

When a doc group sells their practice, the RE owner gets what’s called a “credit enhancement.”

THREAD: The Best Way to Get Started in Cold Calling for Commercial Real Estate.

#ColdCalls #CRE #REtwit

(1/7)

#ColdCalls #CRE #REtwit

(1/7)

The best possible advice that I could give to a broker starting out is to get on the phone as much as possible. The more time you spend dialing has a direct correlation with the amount of money you are able to make. Here is how I would recommend that you get started.

(2/x)

(2/x)

First, you are going to need a way to access phone numbers. The best way to do this is through Costar and you will likely want to join a brokerage that provides these tools for you. Find your asset class and then find the 50 owners who own the most of your asset class.

(3/x)

(3/x)

THREAD: How to Reach Out to National Credit Retail Tenants and What I Send Them.

#Retail #RetailLeasing #ShoppingCenters #CRE #REtwit

(1/7)

#Retail #RetailLeasing #ShoppingCenters #CRE #REtwit

(1/7)

Retail tenant decision makers are constantly getting calls and emails for opportunities within and outside of their area. I am always respectful of their time and take any work off their plate whenever I can. Always get confirmation they handle the area prior to sending.

(2/x)

(2/x)

Email subject line must be clear and concise: “Opportunity for X in Y MSA | Z, TX” and email along the lines of “I have an opportunity in Z market. Are you the best site selection contact?” Make sure you know their closest location.

(3/x)

(3/x)

THREAD: Financials We Collect with LOI from Retail Tenants and Why.

#Retail #RetailLeasing #ShoppingCenters #CRE #REtwit #CommercialRealEstate

(1/16)

#Retail #RetailLeasing #ShoppingCenters #CRE #REtwit #CommercialRealEstate

(1/16)

Collecting thorough financials in retail leasing is crucial because you are starting a relationship for a minimum of 3 to 5 years and often longer if you are effective in your leasing and management processes.

(2/16)

(2/16)

There are two main types of inquiries on retail properties outside of national credit tenants; Existing Businesses and New Businesses.

(3/16)

(3/16)

1/16 THREAD: How my first cold call landed a 25,000 SF neighborhood strip center leasing and renewal client and made him $3.5MM of tax-free cash on a refinance after a 4-year hold. #ColdCalls #CRE #REtwit

2/16 I made my first cold call after placing a retail fitness tenant in a 2,550 SF end cap. I was fortunate to have a mentor who allowed me to show listings for him on tenants who did not have a broker so I could earn a commission in the event of lease.

3/16 The tenant moved from a nearby shopping center for more traffic and visibility to our listing that was anchored by Safeway and had many popular tenants. The transaction went well and he opened up quickly.

#QatarGate : La démagogie habituelle des encartés est grotesque!

Alors que cette affaire va dégueler sur TOUS leurs Partis de merde (pléonasme).

Surtout quand leurs "Groupes/Partis" sont pourtant les plus réfractaires aux Débat & Résolution de "SOUPÇONS de Corruption".

1/15

Alors que cette affaire va dégueler sur TOUS leurs Partis de merde (pléonasme).

Surtout quand leurs "Groupes/Partis" sont pourtant les plus réfractaires aux Débat & Résolution de "SOUPÇONS de Corruption".

1/15

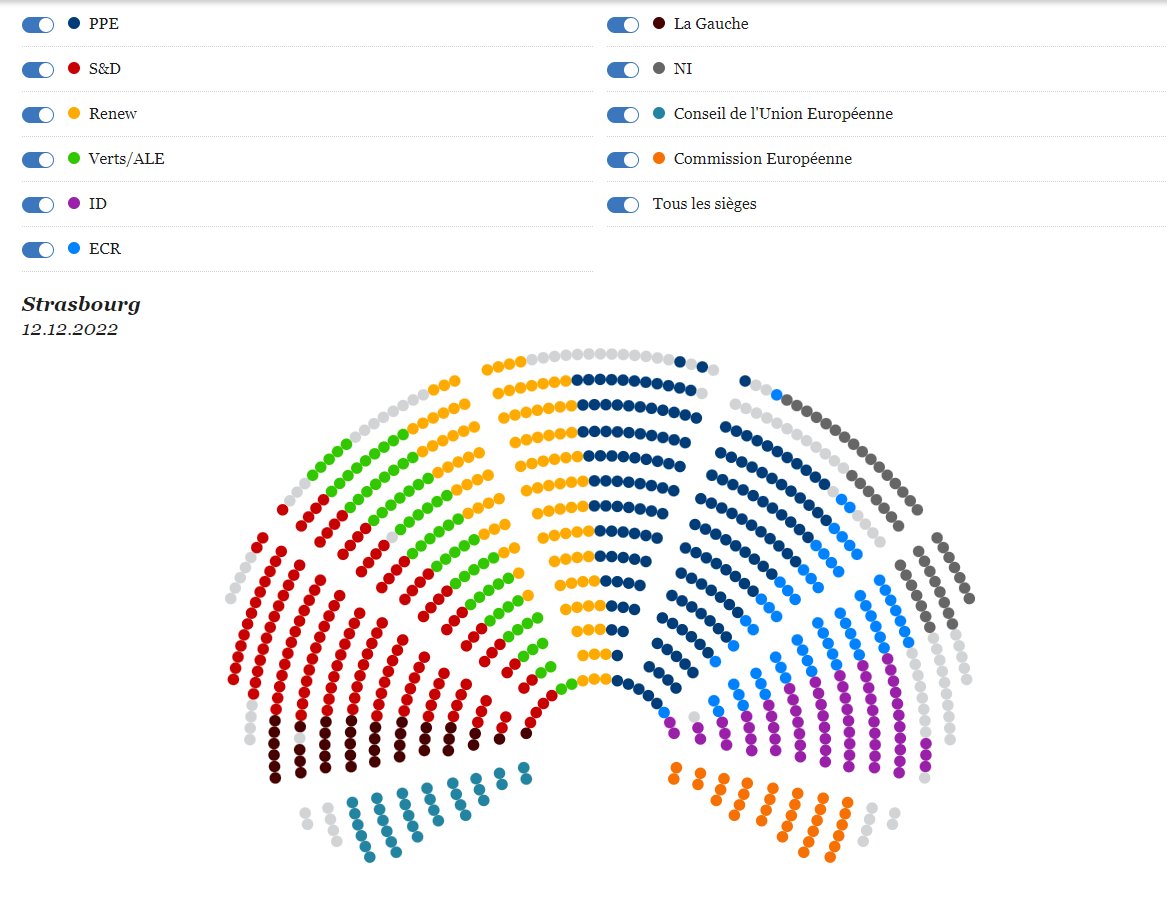

Débat & Résolution de "Soupçon de corruption…" #QatarGate demandés par #Aubry #GUE (Gôche Socialo-Communiste, Euro-Soviétique^^) & #Kanko #CRE (Drouate Conservatrice, Euro-Nationaliste) y ajoutant de parler de "Corruption manifeste" plutôt que "Soupçons" & un vote nominal.

2/15

2/15

"Débat" adopté par le parlement.

Débat #QatarGate fixé au Mardi 13 décembre après-midi.

366 POUR.

11 CONTRE : 1 #RenewEurope + 9 #CRE/ECR + 1 NI (Non Inscrits).

3 Abstentions : 2 Non-Inscrits + 1 CRE/ECR.

325 Absents (Essentiellement #PPE, CRE & #SD).

3/15

Débat #QatarGate fixé au Mardi 13 décembre après-midi.

366 POUR.

11 CONTRE : 1 #RenewEurope + 9 #CRE/ECR + 1 NI (Non Inscrits).

3 Abstentions : 2 Non-Inscrits + 1 CRE/ECR.

325 Absents (Essentiellement #PPE, CRE & #SD).

3/15

Thread on #office buildings:

Office remains the asset class with the least certain future. However, not all office space is created equal. For example, life science office is in a steadier position since lab work generally can't be performed remotely. 1/n

Office remains the asset class with the least certain future. However, not all office space is created equal. For example, life science office is in a steadier position since lab work generally can't be performed remotely. 1/n

Given persistent demand to lease life science office space, occupancy rates in this specialized asset class remain quite high. As one data point, Alexandria Real Estate, a publicly traded REIT that specializes in life science office space, reported... 2/n

...occupancy rates of 95% in their North American properties in 2Q of this year: sec.gov/ix?doc=/Archiv…

Another way to compare subcategories of office assets urban or central business district (CBD) vs suburban locations. Historically... 3/n

Another way to compare subcategories of office assets urban or central business district (CBD) vs suburban locations. Historically... 3/n

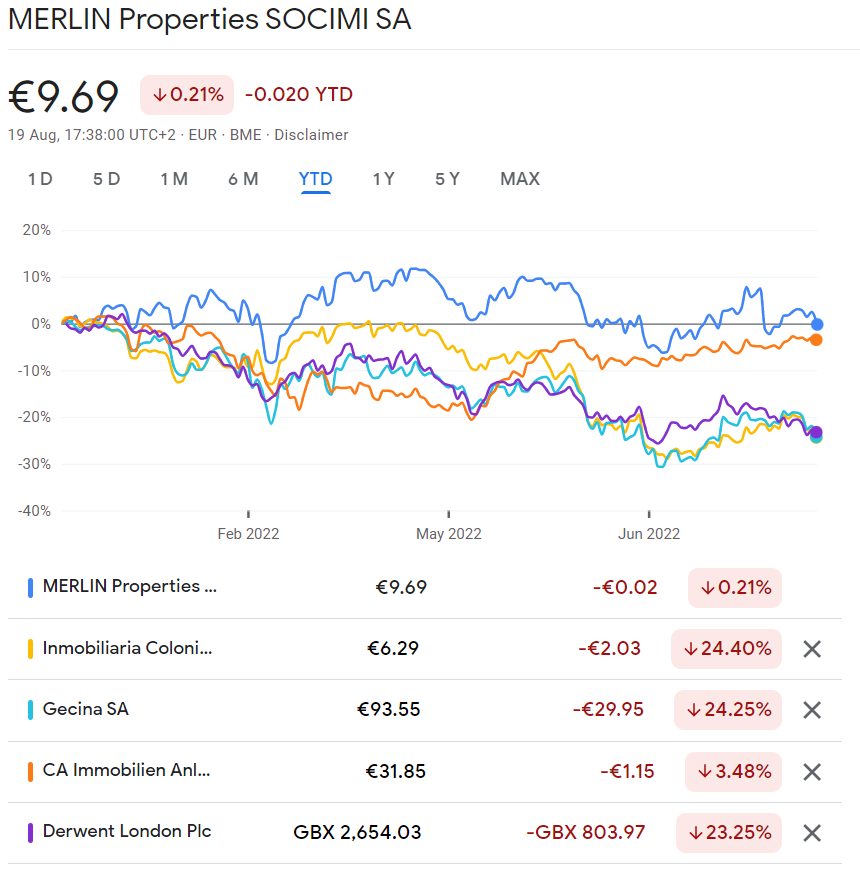

Nuevo ciclo económico. Mercado #Oficinas afronta 3 grandes desafios: financieros, inflación costes CAPEX y #WFH.

Incertidumbre reflejada en las valoración de los principales propietarios: -25% YTD, y consultores ~-20% YTD.

En ambos grupos, impactando de forma desigual.

1/9

Incertidumbre reflejada en las valoración de los principales propietarios: -25% YTD, y consultores ~-20% YTD.

En ambos grupos, impactando de forma desigual.

1/9

Financieros:

- subidas tipo interés,

- incremento diferenciales: ¡suponen ¾ del coste financiero!. Percepción de riesgo sobre el sector,

- Endurecimiento condiciones: credit crunch nueva financiación & ´pinch points will be refinancing moments´ #squeeze

2/9

- subidas tipo interés,

- incremento diferenciales: ¡suponen ¾ del coste financiero!. Percepción de riesgo sobre el sector,

- Endurecimiento condiciones: credit crunch nueva financiación & ´pinch points will be refinancing moments´ #squeeze

2/9

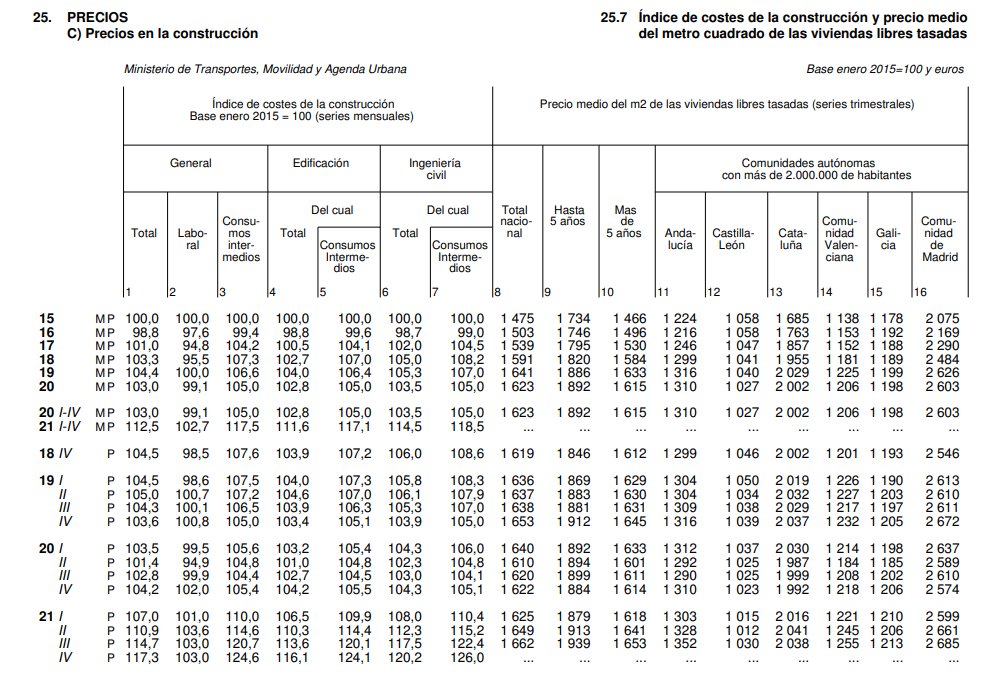

Inflación de costes CAPEX:

- construcción nuevos edificios/reformas existentes,

- adaptación edificios para mejora eficiencia energética,

- necesidad inversión en instalaciones generación energías renovables #PV

3/9

- construcción nuevos edificios/reformas existentes,

- adaptación edificios para mejora eficiencia energética,

- necesidad inversión en instalaciones generación energías renovables #PV

3/9