Discover and read the best of Twitter Threads about #OilAndGas

Most recents (24)

We would love to sit in privately held #coal companies getting 50% plus dividend yields for the next 20-30 years.

$500k investment and $250k dividends annually is a great pension annuity

$SBER < 50c DR entry (March 2022) equated to around a 300% dividend yield through 2026, likely payable for the next 50 years, capital gains >50x.

Mis-priced high dividend assets are great compounders.

Mis-priced high dividend assets are great compounders.

Recent events suggest changing geopolitical environment.

America has no permanent friends or enemies, only interests. — Kissinger

This kissiger statement is not applicable to america only which can be seen in recent events.

#SaudiArabia

#China

#fed

#USA #America

America has no permanent friends or enemies, only interests. — Kissinger

This kissiger statement is not applicable to america only which can be seen in recent events.

#SaudiArabia

#China

#fed

#USA #America

1) 🇸🇦 Saudi Arabia enters trade alliance with China, Russia, Pakistan, and four Central Asian nations to step further away from reliance on the US dollar.

2) Association of Southeast Asian Nations considers dropping the US dollar, euro, yen, and British pound for local #Dollar

2) Association of Southeast Asian Nations considers dropping the US dollar, euro, yen, and British pound for local #Dollar

Here's my LIKELY SCENARIO 🧵:

1/3 S&P eventually breaks the trend line as yields and the $DXY rise, stocks dip to S&P 4K, hold moving average support, pay Mr. Icahn, carve the 3rd higher low, and rally again. $SPY @Carl_C_Icahn

1/3 S&P eventually breaks the trend line as yields and the $DXY rise, stocks dip to S&P 4K, hold moving average support, pay Mr. Icahn, carve the 3rd higher low, and rally again. $SPY @Carl_C_Icahn

2/3 Dollar Index $DXY wants to retrace toward 106.50. Keep commodities $BCOM in a slow moving down trend and weighs on natural resource stocks. 106.50 is Fibo 38.2 resistance and the 100 day crossing 200 day. I'd bet a @gibsonguitar the dollar fails that and dumps.

3/3 And if anyone wants to talk about the fact that WTI just swallowed a 26M SPR release, a 16M bbl inventory build, and didn't even belch - I'd love to. #oilandgas $USO #WTI

Oilytics Weekly Chart of the Day recap: Week 6

The risk factor with energy investments continues to drop. The combined loan book by Canada's 6 big banks shows a 92% decrease in impaired loans to Oil & Gas (to $230 mln). What are the additional implications? -a thread #oott #energy #oilandgas

EIA came out with their Short Term Energy Outlook

- These are the largest revisions in key data points impacting oil markets today. Although many of the adjustments are small, it shows the directional bias the EIA sees with its forecast models - a thread

#oott #oilandgas #WTI

- These are the largest revisions in key data points impacting oil markets today. Although many of the adjustments are small, it shows the directional bias the EIA sees with its forecast models - a thread

#oott #oilandgas #WTI

With China showing more signs of opening, oil demand was revised up 1% (160 mb/d). Is there more oil demand revisions to come? Possibly. Expected crude demand in 2023 is still only up 5% to 15.8 mln b/d (from 14.4 mln b/d in 2020) #oott

U.S. oil production in 2024 was lowered 1.4% (150 mb/d) - with much of this oil supply decline near the back-end of the year. As earning season progresses (and capex budgets are revised), we may see more estimate revisions to come #crude #permian #eagleford #midland #bakken

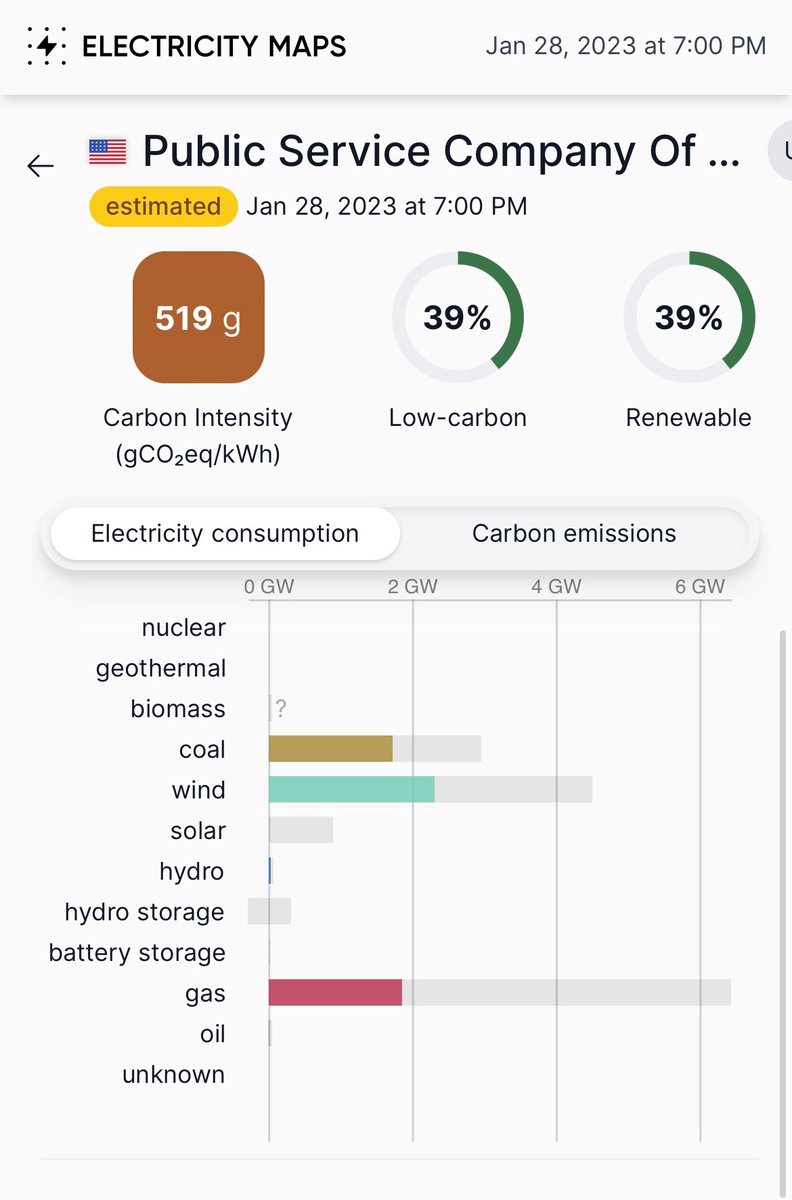

A quick thread about electricity. Saturday night, when freezing temps began to hit Denver, about 39 percent of the area’s electricity was provided by renewables, mostly wind, according to Electricity Maps. 1/6

But by Sunday morning, when the wind died down, only 5 percent was provided by renewables. Natural gas and coal kept our houses warm and the power on. #oilandgas #energy 2/6

A thread on how: Nigeria’s oil bid process leaves investors in doubt

Sixteen years after the last bid for big oilfields, Nigeria is offering seven deepwater offshore blocks to investors but...

#oilandgas #oilinvestors #petroleum #oilproduction #crudeoil #businessday

Sixteen years after the last bid for big oilfields, Nigeria is offering seven deepwater offshore blocks to investors but...

#oilandgas #oilinvestors #petroleum #oilproduction #crudeoil #businessday

old problems involving regulatory concerns have investors worried.

It is the first bid round since the passage of the Petroleum Industry Act (PIA) – a law that Nigeria is yet to fully implement its ...

#oilandgas #oilinvestors #petroleum #oilproduction #crudeoil #businessday

It is the first bid round since the passage of the Petroleum Industry Act (PIA) – a law that Nigeria is yet to fully implement its ...

#oilandgas #oilinvestors #petroleum #oilproduction #crudeoil #businessday

provisions or develop enough regulations to form a coherent policy.

The proposed 2023 mini-bid round aimed at spurring new exploration and drilling activities in Nigeria’s deepwater is coming at a time

#oilandgas #oilinvestors #petroleum #oilproduction #crudeoil #businessday

The proposed 2023 mini-bid round aimed at spurring new exploration and drilling activities in Nigeria’s deepwater is coming at a time

#oilandgas #oilinvestors #petroleum #oilproduction #crudeoil #businessday

THREAD 🧵

Africa's Emerging Energy Producers

Significant oil and gas discoveries in Africa could soon see big money coming the continent’s way.

#oilandgas #gas #Africa #energy

Africa's Emerging Energy Producers

Significant oil and gas discoveries in Africa could soon see big money coming the continent’s way.

#oilandgas #gas #Africa #energy

Africa already boasts major producers like Nigeria, Algeria and Libya. But new players are poised to join the party.

#oilandgas #Oil #Africa #Europe #Nigeria #Algeria #Libya

#oilandgas #Oil #Africa #Europe #Nigeria #Algeria #Libya

Senegal’s potential is huge. It recently found reserves of more than 1bn barrels of oil and 40tn cubic feet of gas.

#Oil #Senegal #oilandgas #Africa

#Oil #Senegal #oilandgas #Africa

Ian Affleck for Croplife Canada forgets what #CEPA stands for & makes a case for pesticide manufacturers, commodification of food, reduced environmental & human protections. #dckurek more of a comment than a question guy simping for #BigAg #oilandgas 🧵 parlvu.parl.gc.ca/Harmony/en/Pow…

Increased yields do not equate increased nutrition. Increased yields, increased profits? #volume

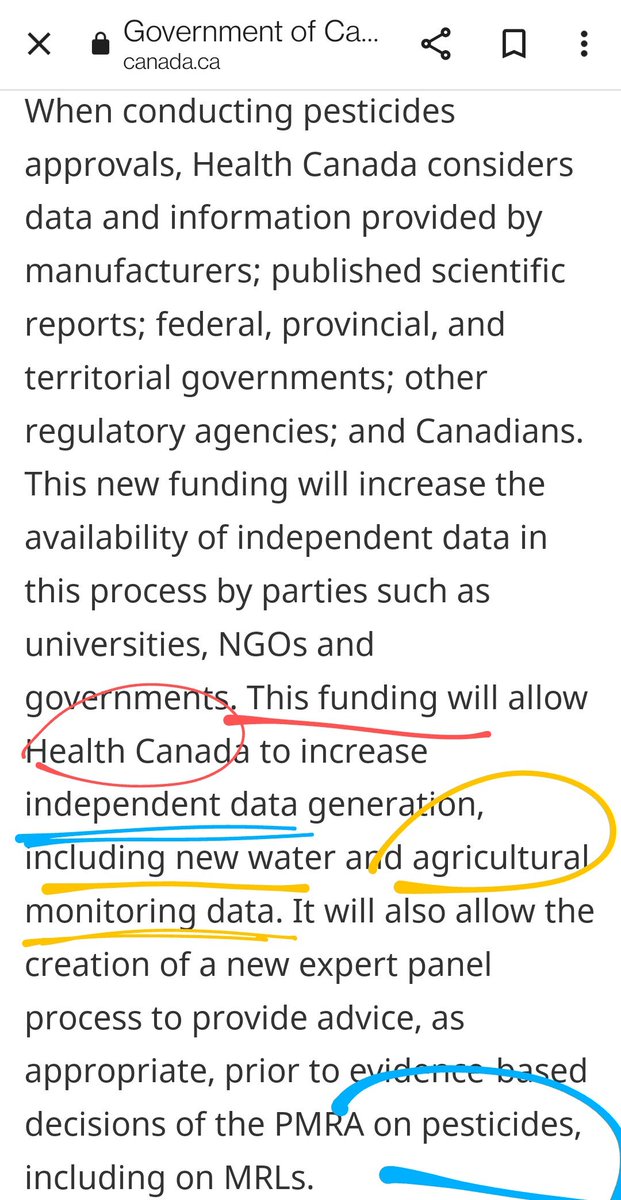

The fact that GoC wants more agricultural/water monitoring is consistent w academic research showing harm to aquatic species, bodies of water, whole ecosystems canada.ca/en/health-cana…

The fact that GoC wants more agricultural/water monitoring is consistent w academic research showing harm to aquatic species, bodies of water, whole ecosystems canada.ca/en/health-cana…

1/9 $PANR $PTHRF #Alaska #Oilandgas

My 2 cents.

Interesting last few days with the "shorts," fake documents, FUD, accusations of #fraud and a comment "too good to be true." IMHO, The Pantheon discoveries are too enormous to fail." Pantheon has followed industry practices 100%.

My 2 cents.

Interesting last few days with the "shorts," fake documents, FUD, accusations of #fraud and a comment "too good to be true." IMHO, The Pantheon discoveries are too enormous to fail." Pantheon has followed industry practices 100%.

2/9 👉Perfect location, TAPS, State Lands, etc etc etc. Just suppose a Large Independent(s) or a Major(s) is looking at Pantheon, and they are, does anyone honestly think the professional staff of any of those companies would for one minute care about the assessments of a ...

3/9 non-industry group like Muddy Waters? Would ExxonMobil's exploration and development departments resort to Muddy Waters, and others, to arrive at an investment decision in Pantheon? Would ConocoPhillips Alaska? No way, nada, and never !! When Pantheon opens their Data Room,

1/4 #Oilandgas #gas ASX Announcement ASX: $IVZ OTCQB: $IVCTF 14 November 2022 Mukuyu-1 drilling update – Total Depth reached with additional zones of elevated gas and fluorescence 📈

Announcement Link: invictusenergy.com/wp-content/upl…

HIGHLIGHTS

• Total Depth of 3,618mMD reached

Announcement Link: invictusenergy.com/wp-content/upl…

HIGHLIGHTS

• Total Depth of 3,618mMD reached

2/4 • Multiple zones encountered with fluorescence and elevated gas shows (up to 135 times

above background levels) in Upper Angwa primary target

• Working conventional hydrocarbon system confirmed in Cabora Bassa Basin

above background levels) in Upper Angwa primary target

• Working conventional hydrocarbon system confirmed in Cabora Bassa Basin

3/4 • Preparing to run wireline logging tools to evaluate multiple zones of interest.

Additional information at: reddit.com/r/invictusener…

Additional information at: reddit.com/r/invictusener…

A 🧵of new reports before #COP27

🇪🇬 @UNFCCC #NDCs synthesis report

🌍 @UNEP #EmissionsGap report

⚠️@WMO Greenhouse Gas Bulletin

🪫@IEA World Energy Outlook

📋@ClimateActionTr #StateOfClimateAction

🌡️@IISD_Energy Navigating Energy Transitions

⚕️@LancetCountdown #LancetClimate22

🇪🇬 @UNFCCC #NDCs synthesis report

🌍 @UNEP #EmissionsGap report

⚠️@WMO Greenhouse Gas Bulletin

🪫@IEA World Energy Outlook

📋@ClimateActionTr #StateOfClimateAction

🌡️@IISD_Energy Navigating Energy Transitions

⚕️@LancetCountdown #LancetClimate22

2/9 🇪🇬@UNFCCC #NDCs synthesis report:

📈The combined climate pledges of 193 Parties under the #ParisAgreement could put the world on track for around 2.5°C of warming by 2030.

💥#LossAndDamage escalates with with every increment of global warming💥

🔗unfccc.int/news/climate-p…

📈The combined climate pledges of 193 Parties under the #ParisAgreement could put the world on track for around 2.5°C of warming by 2030.

💥#LossAndDamage escalates with with every increment of global warming💥

🔗unfccc.int/news/climate-p…

For the first time in its history, the @IEA sees #fossilfuel demand peaking across all of its projections including the “business as usual” (STEPS) scenario. What does it mean for geoeconomics & geopolitics of the global #energytransition? A🧵1/13 iea.org/reports/world-…

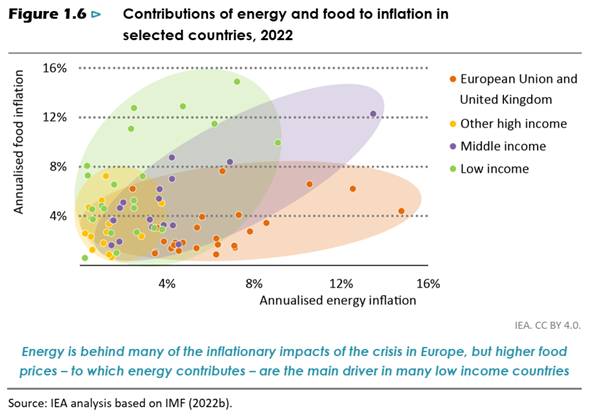

The dependency on #fossilfules is a risk to economic resilience & energy security inherent to the currently dominant economic models. High #coal, #oil and #gas prices have knock-on effects beyond energy systems reliability & fuel the global #polycrisis. 2/13

#EU, #UK, #Japan and others embedded a fatal vulnerability into their growth models as they bet on boosting #gas intensity of their economies post Global #Oilcrisis in the 1970s. Now they are forced to pay a high price for this oversight. 3/13

.@ABDanielleSmith's #RStarScam pet Kris Kinnear is pushing #RoyaltyBunk:

"These benchmarks combined have made capital availability to #oilandgas producers next to extinct."

In reality, it's lack of profit in #abpoli o&g since '09 & insolvency since '05:

saenetwork.ca/royal-line-of-…

"These benchmarks combined have made capital availability to #oilandgas producers next to extinct."

In reality, it's lack of profit in #abpoli o&g since '09 & insolvency since '05:

saenetwork.ca/royal-line-of-…

Accidental truth:

"a co’s income changing month-month...is affected as much if not [>prices+demand than] by production decline + operational failure."

See:

economicsfromthetopdown.com/2022/02/10/a-c…

+

economicsfromthetopdown.com/2022/09/24/how…

"a co’s income changing month-month...is affected as much if not [>prices+demand than] by production decline + operational failure."

See:

economicsfromthetopdown.com/2022/02/10/a-c…

+

economicsfromthetopdown.com/2022/09/24/how…

More accidental truth:

"In a price environment such as Western #cdnpoli’s [in 2021],for many #abpoli #oilandgas producers...“breakeven”now either requires low capital ops yielding production increase, or requires a significant commodity price increase."

[i.e. they're #insolvent]

"In a price environment such as Western #cdnpoli’s [in 2021],for many #abpoli #oilandgas producers...“breakeven”now either requires low capital ops yielding production increase, or requires a significant commodity price increase."

[i.e. they're #insolvent]

“The #oilandgas industry...has never been a free-market capitalistic enterprise. #JohnDRockefeller built his oil empire on the legendary monopolistic fraud, deception, & anticompetitive conspiracies of #StandardOil.” #abpoli

(Black /Internal Combustion/ St. Martin’s 2006:p.271)

(Black /Internal Combustion/ St. Martin’s 2006:p.271)

In 1938, Standard Oil interests organized AB's first o&g regulator. Its first order of business was strangling local production, which it halved--sparking the creation of a Royal Commission into AB oil.

The 1940 report,drafted by chief justice of AB's supreme court is brilliant.

The 1940 report,drafted by chief justice of AB's supreme court is brilliant.

"The [1940 McGillivray] Commission’s review & findings regarding conservation...emerged from the only substantive provincial review of the Conservation Board that has ever been undertaken."

(Breen /Alberta’s Petroleum Industry & the Conservation Board/ UofA + ERCB 1993:p.172)

(Breen /Alberta’s Petroleum Industry & the Conservation Board/ UofA + ERCB 1993:p.172)

'“#RStarScam is a pilot project that incentivizes [sic--fully/doubly subsidies] the clean-up & reclamation of #oilandgas wells,& in doing so, it creates a royalty credit for future @abpoli drilling [& related #UnfundedOilfieldCleanup]” #ableg energy minister.@PeterGuthrie99 said'

1/ Little energy pf weekend update: Now sitting at roughly 78% #uranium and 22% #oilandgas. 12 u names and 4 O&G names. Pf leverage is 19%, toward the high end for me but not all in.

2/ #oilandgas names by pf %: $ITE 7.4%, $ROK 5.8%, $PTAL 4.9%, $GTE 4.2%

3/ #uranium names by pf % : $U.UN 20.1%, $UEC 9.9%, $DNN 8.6%, $EU 6.5%, $GLO 6.1%, $NXE 5.7%, $URG 5.2%, $FIND 4.8%, $LEU 4%, $92E 3%, $CVVUF 2.1%, $GXU 1.5%

This is an ominously disappointed signal from .@RachelNotley's .@abndpcaucus.

In a previous life, Hirsch was think-tanker attacking .@ParklandInst researchers & offering apologetics for deficit-creating royalty cuts...(CH 22/4/95:A5)

#ableg #abpoli #RedWater #Spyglass #Trident

In a previous life, Hirsch was think-tanker attacking .@ParklandInst researchers & offering apologetics for deficit-creating royalty cuts...(CH 22/4/95:A5)

#ableg #abpoli #RedWater #Spyglass #Trident

Despite admitting he doesn't understand bank-originated money/credit, Hirsch was at.@atbfinancial when they tanked #RedWater 7 days after Notley elected.

ATB then tanked #Spyglass in the middle of the NDP's royalty review.

ATB welcomed .@jkenney to office by tanking #Trident...

ATB then tanked #Spyglass in the middle of the NDP's royalty review.

ATB welcomed .@jkenney to office by tanking #Trident...

Those 3 co's represent a very sizeable proportion of the Orphan Well Association's current inventory.

That photo of Notley + Hirsch + Phillips signals something very disappointing about #abpoli's #ableg opposition & the complete lack of an alternative for AB #oilandgas policy.

That photo of Notley + Hirsch + Phillips signals something very disappointing about #abpoli's #ableg opposition & the complete lack of an alternative for AB #oilandgas policy.

1/7

A 🧵...cause I'm getting worried...

It's noteworthy that this @Sprott offering, so germane to the current #ESG zeitgeist, was cancelled. Market sentiment + a general lack of knowledge due to institutional collapse threatens us all.

#BatteryMetals

A 🧵...cause I'm getting worried...

It's noteworthy that this @Sprott offering, so germane to the current #ESG zeitgeist, was cancelled. Market sentiment + a general lack of knowledge due to institutional collapse threatens us all.

#BatteryMetals

🧵2/7

The total annihilation of the #MSM lies at the heart of resource ignorance. @RealClearNews makes an effort, but it's difficult to think outside your tribe if you don't already possess general knowledge about natural resources.

The total annihilation of the #MSM lies at the heart of resource ignorance. @RealClearNews makes an effort, but it's difficult to think outside your tribe if you don't already possess general knowledge about natural resources.

🧵 3/7

The average person is informed by #MSM who takes its cue from #politicians who are strong on virtue signalling and weak on policymaking.

Clean air and extra 💸 in your bank account - who wouldn't like that? Sign me up @JustinTrudeau ! 👇

The average person is informed by #MSM who takes its cue from #politicians who are strong on virtue signalling and weak on policymaking.

Clean air and extra 💸 in your bank account - who wouldn't like that? Sign me up @JustinTrudeau ! 👇

In the last 16 months we’ve experienced a heat dome, an atmospheric river, and record breaking wildfires and droughts.

At the same time the @bcndp meets with #oilandgas lobbyists as often as 80 times a month. 1/ #bcpoli #ClimateEmergency

At the same time the @bcndp meets with #oilandgas lobbyists as often as 80 times a month. 1/ #bcpoli #ClimateEmergency

The @bcndp don’t just meet with oil and gas lobbyists. They’re embedded right into their party. They aren’t just acquaintances, they aren’t just friends. They’re family. 2/ #bcpoli

This government’s regular political pundit Moe Sihota is a lobbyist for Woodfibre LNG. The Minister of Health’s former Chief of Staff and the Minister of Jobs’ former campaign manager, Stephen Howard, is a fossil fuel lobbyist. 3/ #bcpoli

Let's set the record straight about @AngeliqueAshby @AshbyForSenate's #lies and disinformation campaign against @CA_DaveJones:

1. Taking away #Medicare (FALSE): Dave is endorsed by @CalNurses, the leading advocate for #MedicareForAll for ALL Californians.

1. Taking away #Medicare (FALSE): Dave is endorsed by @CalNurses, the leading advocate for #MedicareForAll for ALL Californians.

@AngeliqueAshby @AshbyForSenate @CA_DaveJones @CalNurses 2. Raising car insurance rates (FALSE): Dave saved #California consumers and businesses over $3.11 billion in premiums, by regulating rates for auto, homeowners, and other property and casualty insurance.

@AngeliqueAshby @AshbyForSenate @CA_DaveJones @CalNurses 3. Sued by wildfire victims for failing to protect them from out-of-state insurers - The case was filed by two Sonoma County residents in 2018 and ultimately dismissed as "moot" by the Superior Court of #California, as well as the First District Court of Appeals, in 2020.

Could we see a NYMEX natural gas price spike this winter? The U.S. just might not be able to rely on 'cheap' Canada natgas imports w/ western CDN storage near record lows (at only 71% full).

A thread on CDN natural gas dynamics #AECO #oilandgas #LNG #alberta

A thread on CDN natural gas dynamics #AECO #oilandgas #LNG #alberta

A number of issues why CDN natgas storage is low, but we've already begun to see a reversal, with AECO difs improving dramatically over the last week (now at US$2.50/mcf). Last time storage was at current levels, the differential went on to reach $0.50/mcf a year later; 2/ #NYMEX

Skoro jeszcze nie ma porozumienia to dlaczego te syjonistyczno 7ydowskie parchy już sobie kłada łapy tam?

chyba coś nie halo

żeby nie było że w innym miejscu jakiś konflikt będzie żeby odciągnąć uwagę od poczynan izraela

chyba coś nie halo

żeby nie było że w innym miejscu jakiś konflikt będzie żeby odciągnąć uwagę od poczynan izraela

Izrael to chyba szuka zaczepki i pretekstu żeby nalozono sankcje na Iran i przeszkodzic w porozumieniu nuklearnym Iran-USA🤔

JEŚLI #Izrael spróbuje odejść z naszymi polami #Libanese #Karish #oilandgas, wszystkie społeczności #Liban będą bronić naszych morskich nieruchomości. NIE #negocjacje morskie na północ od linii 29.