Discover and read the best of Twitter Threads about #Revenues

Most recents (10)

The Weekly Recap (12.06.23 ~ 16.06.23) 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

#MacroMonday #market

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

#MacroMonday #market

Mar. 1:

1/ #Russia Near #Fiscal #Collapse

#Putin's #Money for the #War may run out in the summer - @Forbes. A few important figures:

🔸#Russia is approaching a #Fiscal #Collapse

..continued

2/

#UkraineRussiaWar #Ukraine .@ZelenskyyUa .@DmytroKuleba

t.me/Crimeanwind/23…

1/ #Russia Near #Fiscal #Collapse

#Putin's #Money for the #War may run out in the summer - @Forbes. A few important figures:

🔸#Russia is approaching a #Fiscal #Collapse

..continued

2/

#UkraineRussiaWar #Ukraine .@ZelenskyyUa .@DmytroKuleba

t.me/Crimeanwind/23…

🚨 Less than usual proportion of cos are beating earnings estimates. 👇

#earnings #stocks #STR #estimates

$SPY $QQQ $WMT $TSLA $GME

#earnings #stocks #STR #estimates

$SPY $QQQ $WMT $TSLA $GME

The #JobsReport came in at 372,000 jobs gained, the #unemployment rate at 3.6%, which was coupled with #wage growth of 5.1% year-over-year: all solid numbers in a historic context.

Still, when taken in the context of much of the #economic data coming in, last week’s #employment report reemphasized two key tenets of the economy and consequently of #investment markets: 1) the U.S., and indeed the global economy, is tangibly slowing…

…and 2) we are probably past the #employment peak and will likely witness #LaborMarket slowing in the back half of the year.

[ thread 🧵 on the NOC’s LFB account ]

In late May 2019, Belqacem Haftar visited DC in a bid to secure U.S. assistance in setting up a mechanism meant to deposit $$$ proceeds from #oil exports into a special account in lieu of sending them straight to the CBL in Tripoli.

In late May 2019, Belqacem Haftar visited DC in a bid to secure U.S. assistance in setting up a mechanism meant to deposit $$$ proceeds from #oil exports into a special account in lieu of sending them straight to the CBL in Tripoli.

The next year, in the summer of 2020, the US & the UN endorsed the idea of preventing oil $$$ proceeds from being funneled directly & systematically to the CBL in Tripoli.

But the rationale now promoted was not the one advocated by Haftar & his associates.

But the rationale now promoted was not the one advocated by Haftar & his associates.

In 2020, international diplomats began suggesting the formation of a special #committee overseeing the equitable & transparent distribution of oil #revenues among the three provinces, & among essential #budget categories.

Said #committee would be above the govt & above the CBL.

Said #committee would be above the govt & above the CBL.

Read this book at the time of #CAMS #IPO.

A brilliant read to know about the #growth trajectory of the #company & why it's only starting.

@YMehta_ @finthusiasts @nid_rockz @manurishiguptha @MadrasMobile @MarketScientist

@AnyBodyCanFly @ipo_mantra

Thread coming.👇

A brilliant read to know about the #growth trajectory of the #company & why it's only starting.

@YMehta_ @finthusiasts @nid_rockz @manurishiguptha @MadrasMobile @MarketScientist

@AnyBodyCanFly @ipo_mantra

Thread coming.👇

Foreword by- Mr. Deepak Parekh, Chairman @HomeLoansByHDFC

He writes about India's #economy post #Liberalization & how #companies that have come up have one thing in common- #knowledge.

2/n

He writes about India's #economy post #Liberalization & how #companies that have come up have one thing in common- #knowledge.

2/n

#CAMS began as a #software development & #computer education firm, moved to share registry services handling #IPO's, later became a Registrar & Transfer Agent (#RTA). It now also handles documentation requirements in #banking, #insurance & #microfinance.

3/n

3/n

It's finally out ! With Alex Gohin (@SmartLereco), we have a new paper in @AnnalsOf in which we measure the market and environmental impacts (noinpoint source pollutions, imported deforestation, carbon emissions) of French #pesticide policies:

jstor.org/stable/10.1560…

👇

jstor.org/stable/10.1560…

👇

What did we do on this paper?

First, we conducted a structural econometric estimation of the impact of output and input prices on the farmers' production decisions, including land-use decisions and pesticide applications.

First, we conducted a structural econometric estimation of the impact of output and input prices on the farmers' production decisions, including land-use decisions and pesticide applications.

What's new there?

Well, we used a detailed database from @InseeFr where all farming types (including vineyards and fruit production, which use many pesticides, but also breeding farms) are included for the whole France from 1990 to 2015.

Basically, we have all french farmers.

Well, we used a detailed database from @InseeFr where all farming types (including vineyards and fruit production, which use many pesticides, but also breeding farms) are included for the whole France from 1990 to 2015.

Basically, we have all french farmers.

#Coronavirus hysteria is prolonged by #TheLeft. Sep2019 #UN #WHO #WorldBank 'Global Preparedness Monitoring Board wrote 'A World At Risk' threat of pandemic diseases (respiratory pathogen) with

potential to kill millions

disrupt economies

destabilise national security

1▪︎

potential to kill millions

disrupt economies

destabilise national security

1▪︎

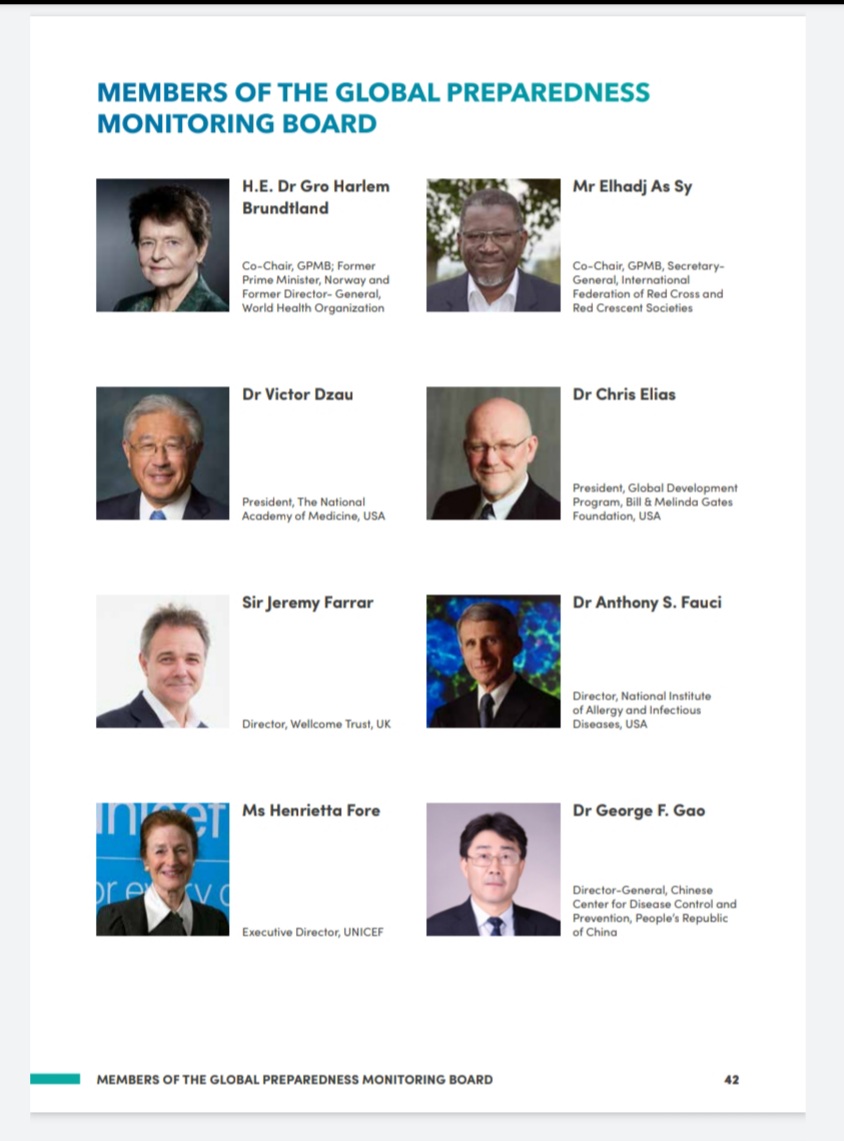

#TheLeft 2019 GPMB Board Members incl.

co-chair WHO, Red Cross

Wellcome Trust UK

Melinda Bill Gates Fnd. US

UNICEF

& oth disease prevention control members: CCP, Russian Fed, Rwanda, The Netherlands, Japan, India, Chile, Norway, Switz

2▪︎

co-chair WHO, Red Cross

Wellcome Trust UK

Melinda Bill Gates Fnd. US

UNICEF

& oth disease prevention control members: CCP, Russian Fed, Rwanda, The Netherlands, Japan, India, Chile, Norway, Switz

2▪︎

This thread is about understanding Lebanon’s #budget in few questions.

Another thread will explain #Citizen_Budget 2020.

@OpenBudgets 👇

Another thread will explain #Citizen_Budget 2020.

@OpenBudgets 👇

What is the #Budget?

Article 3 of the "Public Accounting Law" defines #budget as “a legislative instrument in which national #revenues & #expenditures are estimated for the upcoming year & by which #tax collection & spending are allowed”.

Article 3 of the "Public Accounting Law" defines #budget as “a legislative instrument in which national #revenues & #expenditures are estimated for the upcoming year & by which #tax collection & spending are allowed”.

State #budgets have evolved to become a tool of #foresight, #planning and #accountability based on programs and #performance assessments.

bit.ly/2JKN0LV

bit.ly/2JKN0LV

Lets talk about #Oil and why the price of the #US benchmark #WTI West Texas Intermediate has turned negative FOR THE FIRST TIME EVER...

Some of you are waking up to what might read or sound like another disaster. Just when you were learning how to deal with #COVID19, you hear about a so called plunge in the #Price of #Oil. But what does it mean to have oil in negative territory & why is that the case? Lets see...

In the main we will talk a bit about simple matters of #supply & #demand while touching on the #future as far as #consumer outlooks & #perception / #confidence are concerned. I would like us to start in 2016, a quick recap...what happened to #Oil?