Discover and read the best of Twitter Threads about #carbonfree

Most recents (23)

If you've heard about a global #Nuclear #energy resurgence⤴️⚛️👂🐦 driving demand for #Uranium that's in a deep supply deficit⤵️⛏️ and wonder how U can invest💵🤔 in this tiny #mining #stocks sector famous for spectacular gains🎆💰😃 here's a🧵 on the various ways U can play.🤠👇

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

1/ Energy Fuels $UUUU closed the sale of Alta Mesa today for $120M ($60M cash + $60M conv. note). We now believe our current #uranium & #RareEarths plans are fully-funded thru 2024, including Energy Fuels' investing in 4 mines to boost uranium production.

prnewswire.com/news-releases/…

prnewswire.com/news-releases/…

2/ You may have missed it, but $UUUU also resumed #uranium production in Q4-2022. 162,000 lbs. of U3O8, or over 90% of US production. We're hiring/investing at our mines/mill to boost production & we plan to keep our position as the #1 US #uranium miner. #nuclear #carbonfree

3/ Today's sale also provides the CAPEX needed to install 'light' #rareerths separation at our mill in #Utah. We plan to be in production of refined #NdPr oxide by the end of this year or early next. In high demand by #ElectricVehicles, #RenewableEnergy & #defense companies.

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

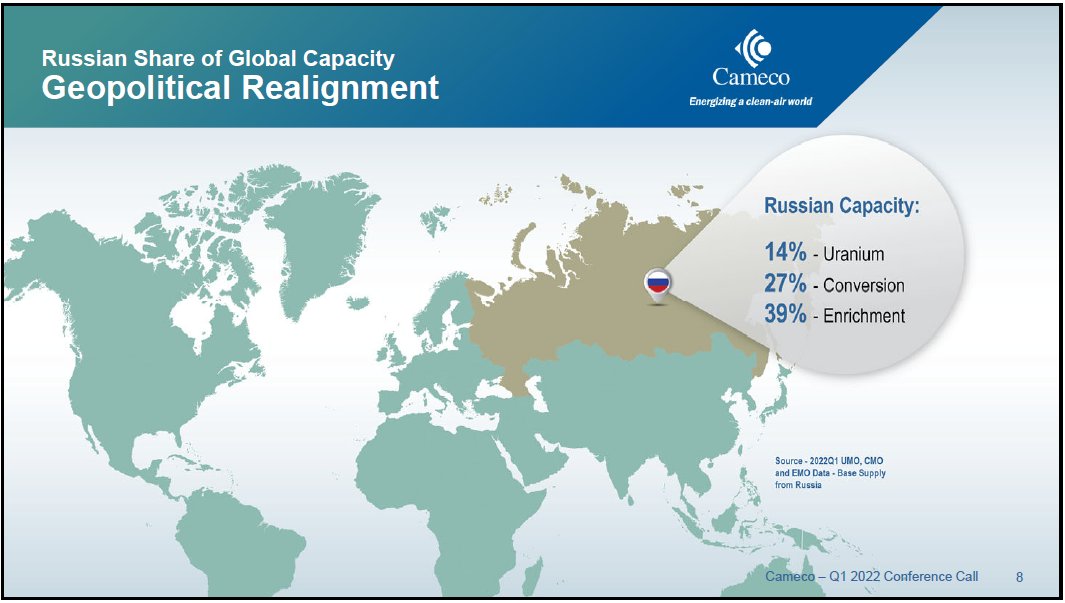

1)#Russia's war on #Ukraine🪖 led to prices for #Uranium Conversion & Enrichment SWU more than doubling in 2022⏫ in a price wave🌊 cascading down #Nuclear fuel cycle towards mined #U3O8⛏️ as per Cantor Fitzgerald👇 as enrichers switch to "overfeeding".🍼🍼 A thread for U!👨🏫🧵👇2

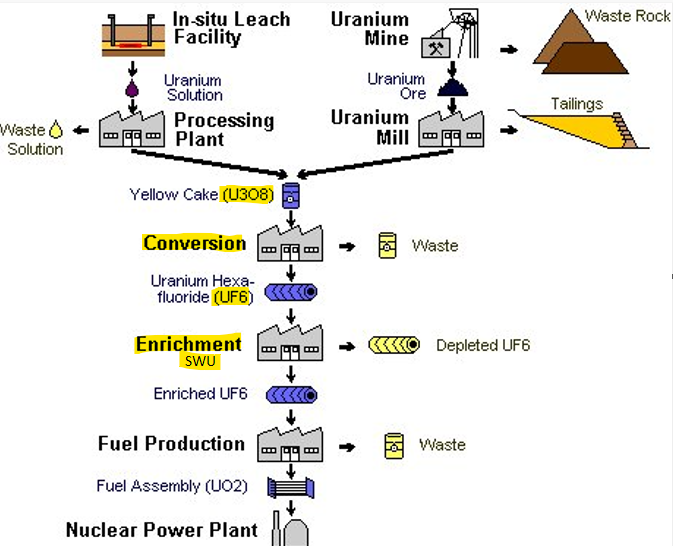

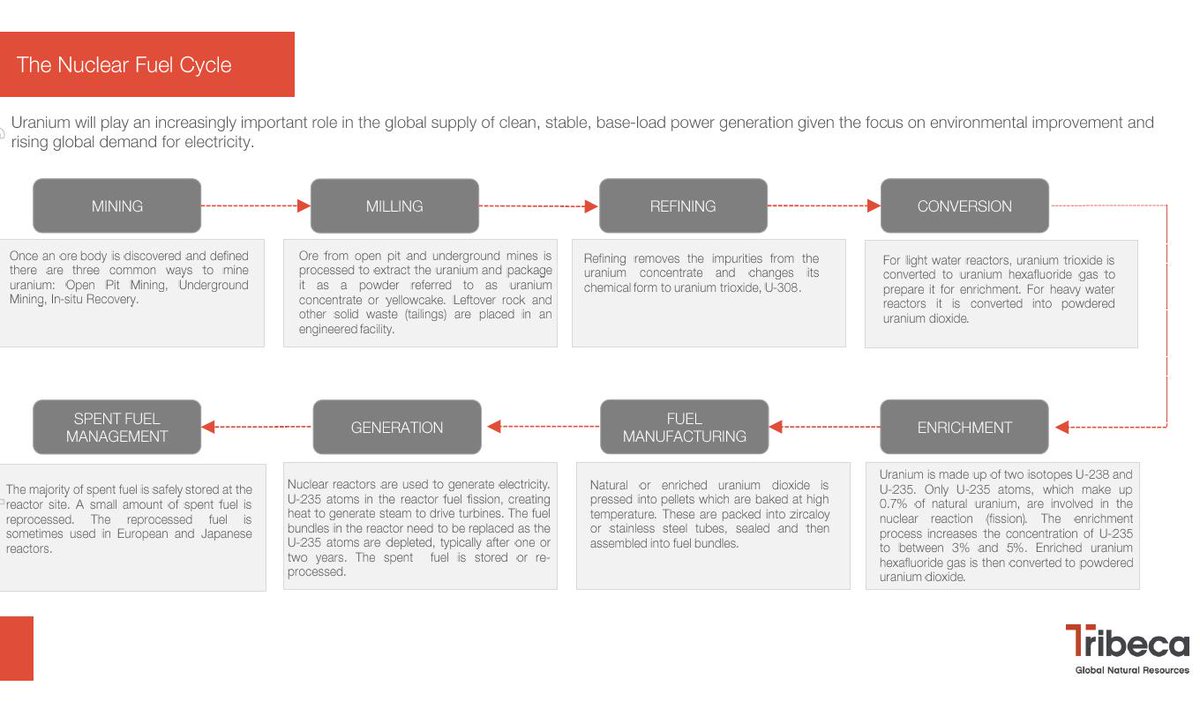

2)#Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

1) While market meltdowns🫠 & #Ukraine war FUD😱 may be raining on #Uranium for now⛈️ a huge Shockwave💥 dubbed 'overfeeding'🍼 is already crashing thru the seemingly calm #Nuclear fuel market.🌀⚛️⛏️ I've created a Tutorial👨🏫🧵 to help prepare U to ride the coming wave.🌊🏄💰👇2

2) #Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇3

1/14)#Uranium #mining #stocks have been thrashed by global market meltdown⏬ but U #investing thesis👨🏫 is most bullish in 4 decades!🤠🐂 This🧵will bring U up to speed🏇 on how a record U supply deficit⤵️⛏️ is colliding💥 with a global #Nuclear #Energy Renaissance⤴️🌞🏗️⚛️ 🌊🏄♀️👇2

1/19) #Uranium - a Tutorial👨🏫 walking U thru the #Nuclear fuel cycle, what it is, the stages & issues involved, so U can understand the term that has every Uranium investor smacking their lips today: Overfeeding!😋 Here's a thread that I hope gives U some key insights.🌞⚛️⛏️🧵👇2

2) #Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then loaded into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇3

1)The #Uranium #mining #stocks #investing thesis👨🏫 in May 2022 is now the most bullish it's been in 4 decades!🤠🐂 Here's a thread to bring you up to speed🏇 on how a record Uranium supply deficit⤵️⛏️ is colliding💥 with a global #Nuclear #Energy Renaissance.⤴️🌞🏗️⚛️ 🌊🏄♀️🧵4U👇2

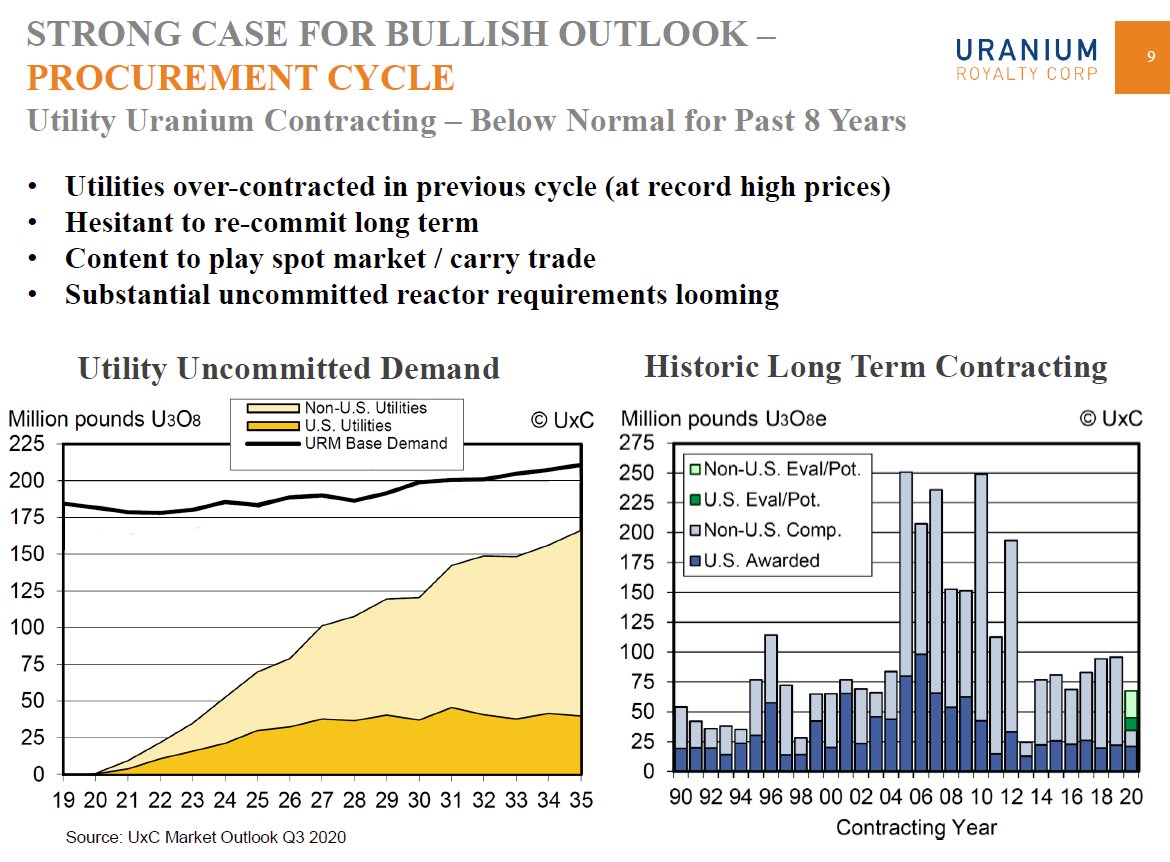

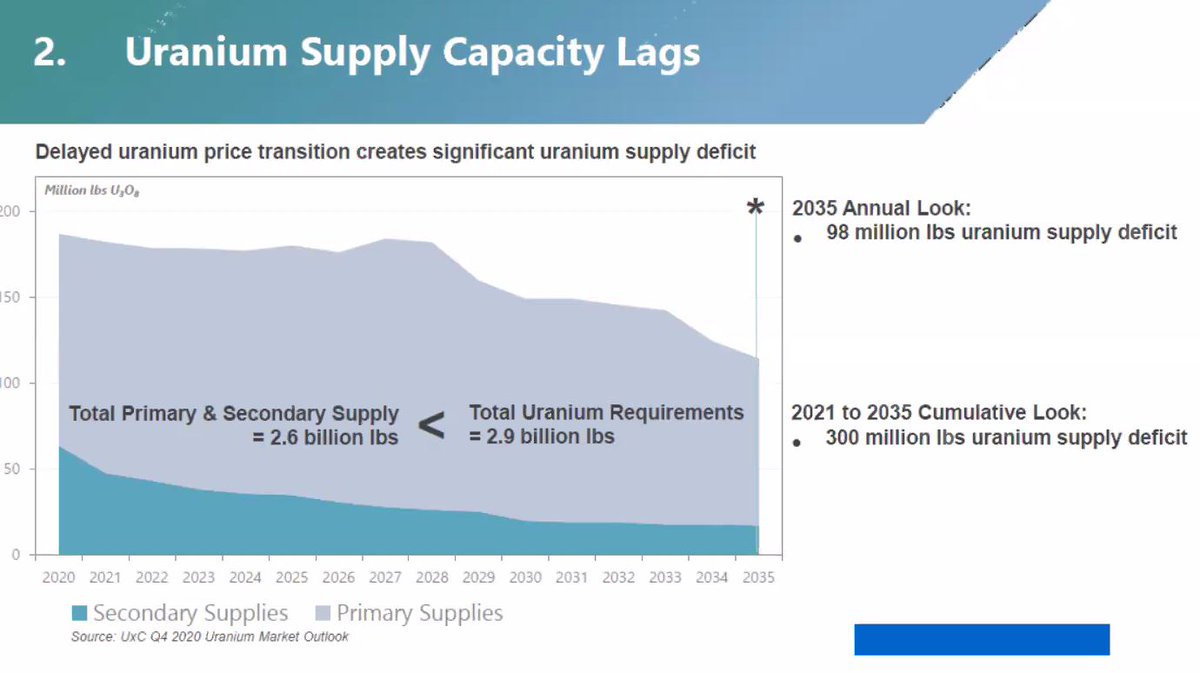

1/10) Prior to last week's #Uranium sector retreat😱 #Nuclear fuel consultants UxC & TradeTech forecasted deep multi-year U supply deficits with 200M lbs demand vs 135M lbs mined #U3O8 supply + 25M lbs of Secondary Supply that will be dropping due to pivot from #Russia⚠️ A🧵4U👇2

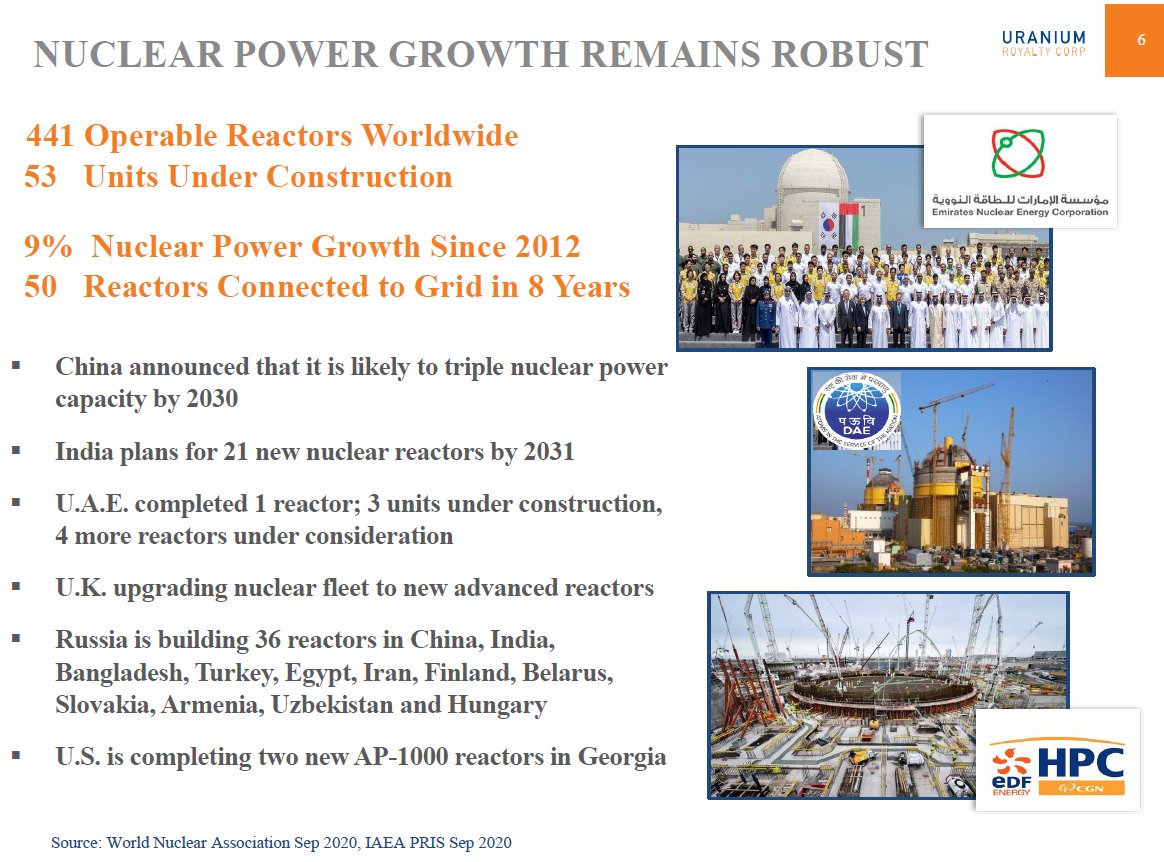

2) World #Nuclear Association was reporting 439 operable reactors (392 GW) + 56 more under construction (62GW)⚛️🏗️ with 26 expected to come online this year & next.⚡️🌞 96 more in advanced planning/ordered + 325 proposed🧾 for projected +2.6%/yr growth rate↗️🏗️🤠🐂 #Uranium🧵👇3

3) On Monday #Pakistan announced that a new 1100MW 'Hualong One' #Nuclear reactor built with #China had begun commercial operation⚛️⚡️ which will consume circa 0.5Million lbs of #U3O8 #Uranium per year delivering #CarbonFree #electricity for the next 60+ years.🌞🇵🇰⛏️🤠🐂 🧵👇4

In 2021 @Google granted the @energywebx and became partner.

Do you know what are they working on? Let's look closely to one of the biggest projects on $EWT ⚡

⬇️⬇️

#Crypto #Web3 #CarbonFree #CleanEnergy #blockchain Google

#cryptocurrency #CryptoNews

Do you know what are they working on? Let's look closely to one of the biggest projects on $EWT ⚡

⬇️⬇️

#Crypto #Web3 #CarbonFree #CleanEnergy #blockchain Google

#cryptocurrency #CryptoNews

1) Google announced in 2021 that they are working on projects for Time-based Energy Attribute Certificates #TEACs solutions to achieve 24/7 CFE goals ➡️ cloud.google.com/blog/topics/su…

++

++

2) In March 2022 Google released the update about their progress ➡️ cloud.google.com/blog/topics/su…

They announced the four pilot program they are running. In two of these, Google works directly with $EWT validators and partners. @ACCIONA @AES_Andes @flexidao & I-REC Standart

++

They announced the four pilot program they are running. In two of these, Google works directly with $EWT validators and partners. @ACCIONA @AES_Andes @flexidao & I-REC Standart

++

1) Long before #Russia, world's main enriched #Uranium supplier, sent shock waves thru #Nuclear fuel markets😱 by invading #Ukraine🪖 mined #U3O8 was already in a sustained deficit⬇️⛏️ with demand for #CarbonFree Nuclear surging.⬆️🏗️⚛️ A Uranium #investing thesis thread 4U🤠🐂👇2

U may feel sucker-punched🥊 or prayers answered😇 or got stopped out🤨 by broad market downturn that hammered #Uranium #mining #stocks🔨 but we still have a #U3O8 supply deficit⏬⛏️ vs surging #CarbonFree #Nuclear demand⚛️⏫ with fundamentals stronger than they've ever been!🏋️♂️👇

Regardless of where share prices of #Uranium #stocks may be🤿 there's still a growing fleet of #Nuclear reactors demanding far more #U3O8 fuel than is being mined🔀⛏️ with #China #India #UK #France #Canada & other nations planning to build many more.🏗️⚛️⏫

In just the past few months we've seen a major shift towards embracing #CarbonFree #Nuclear #energy🤗⚛️ as once again key to achieving global #NetZero emissions goals🌞 reducing air pollution🏭☠️ & decarbonizing industry in electrifying 'everything'⚡️🔌🌏

1/13) #Uranium #mining #stocks are blessed with increasingly bullish fundamentals🤠🐂 as surging demand for #CarbonFree #Nuclear #energy for #NetZero🌞⚛️🏗️⬆️ collides with a sustained #U3O8 supply deficit.💥⛏️⬇️ Here's a thread 4U that explores the Uranium #investing thesis💰🧵👇

Daily Bookmarks to GAVNet 11/10/2021 greeneracresvaluenetwork.wordpress.com/2021/11/10/dai…

‘Last, best, and final offer’ from Deere to UAW members

kwqc.com/2021/11/03/las…

#ContractNegotiations #ContractProposal

kwqc.com/2021/11/03/las…

#ContractNegotiations #ContractProposal

We’re Heading Straight for a Demi-Armageddon

theatlantic.com/science/archiv…

#ClimateChange #mitigation #consequences

theatlantic.com/science/archiv…

#ClimateChange #mitigation #consequences

1/13 #Uranium #mining #stocks are blessed😇 with incredibly bullish fundamentals🤠🐂 as surging demand for #CarbonFree #Nuclear #energy⚛️🏗️⬆️ for #NetZero🌞 collides💥 with a sustained #U3O8 supply deficit.⛏️⬇️ Here's a thread 4U that explores the Uranium #investing thesis 💰🧵👇

1/11) @Sprott's Physical #Uranium Trust🏦 has poured gas on a fire🔥 that was already burning under #Uranium #mining #stocks📈 due to incredibly bullish fundamentals💪 of surging #CarbonFree #Nuclear demand🏗️⚛️↗️ vs tanking #U3O8 supply⛏️⤵️ & strengthening daily.🏋️♂️ Here's a🧵4U👇

U may feel sucker-punched🥊 or prayers answered😇 or got stopped out🤨 by correcting #Uranium #mining #stocks📉 but 1 thing's 4 certain... #U3O8 supply⛏️⏬ vs #Nuclear demand⚛️🏗️↗️ fundamentals are getting stronger every day🏋️♂️ with even better (re)entry prices now.🛒 A🧵4U👇 ../2

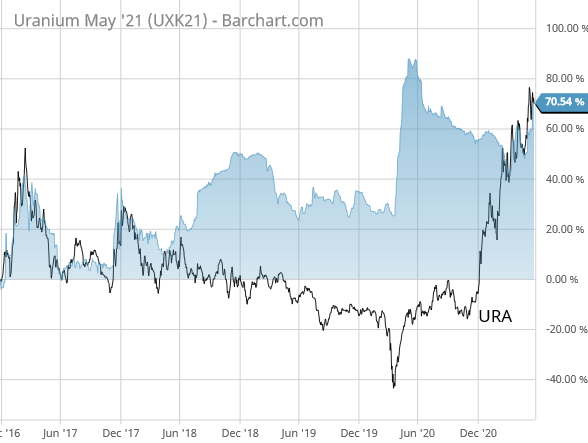

Q: Are #Uranium #stocks overvalued vs Spot #U3O8 price?🤔 A: No. Global X ETF $URA used to track lock-step with Spot U but decoupled in 2018 after $URA changed from 100% to 50% U stocks.⤵️ Now, $URA has recovered to match the >70% rise in Spot U since November 2016 bottom⤴️ .../2

If you're new to #Uranium & #mining #stocks in general👼 then I hope this thread will help you to understand why this mined commodity⛏️ used for #nuclear reactor fuel⚛️🌞 is famous for delivering extraordinary life-changing returns when it enters, as it is now, a boom cycle🚀...2

2/ #Uranium is a cyclical commodity🔃 that goes through boom & bust cycles based on supply vs demand imbalances⚖️ magnified to extremes by supply security fears😨 as there is no available substitute fuel for #nuclear reactors & production is concentrated in so few countries .../3

3/ Like other commodities, #Uranium rises in value when supply is scarce🏜️ which in turn triggers more production to meet demand⛏️ but because its the most regulated mined metal📚 subject to the greatest environmental scrutiny,🧐 bringing new mines online is costly & slow🐌 .../4

#Uranium Alert!🔔 For 1st time in months, Uranium space was hot topic today in a Wall Street chat group of over 450 institutional portfolio managers & very bullish on $CCJ & $U.🐂 "If the mad-mob trading FCEL and other #ESG names gets a hold of uranium... Watch out." ⤴️👇 1/3...

2/3 The January Bull Case for #Uranium... is the U sector about to explode?💣🚀 👇 #U3O8 #mining #stocks #nuclear #CarbonFree #EnergyTransition #NetZero #ESG #SupplyDeficit #NuclearWave 🌊🏄

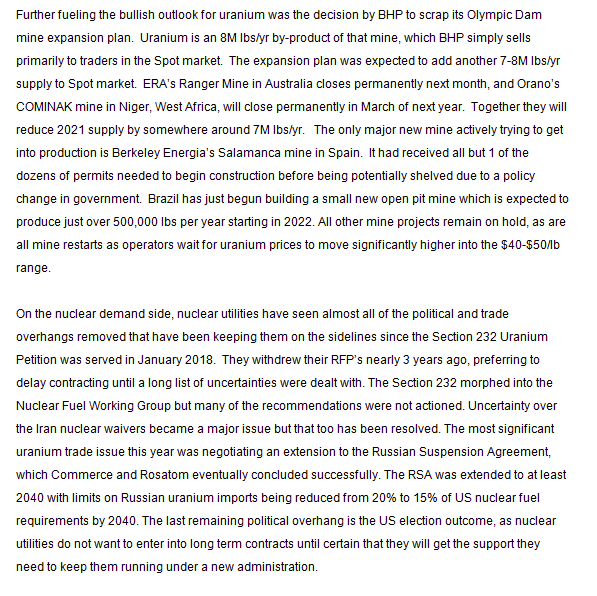

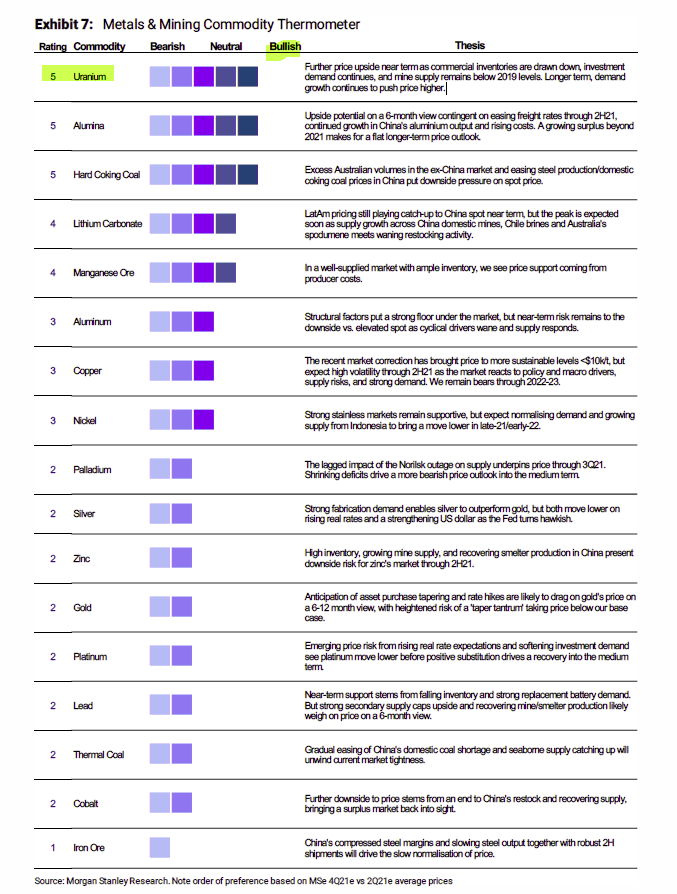

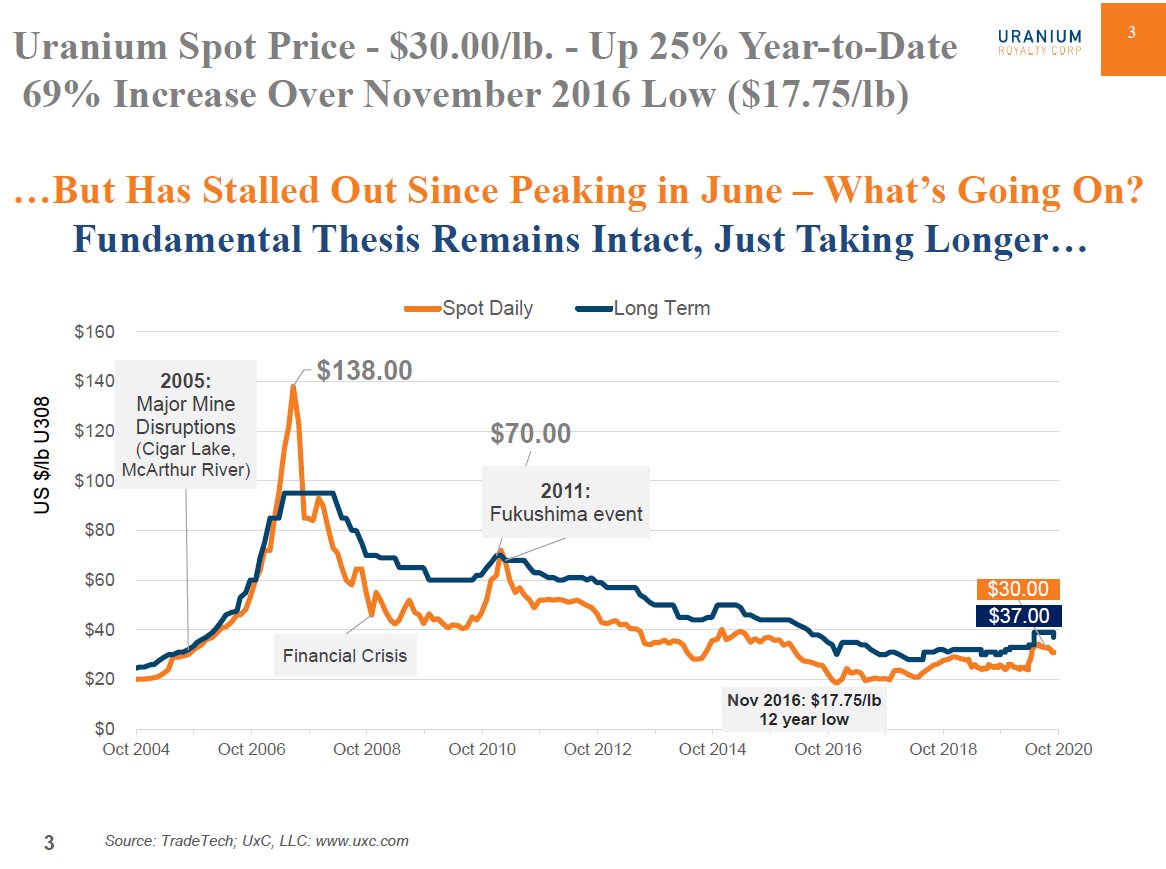

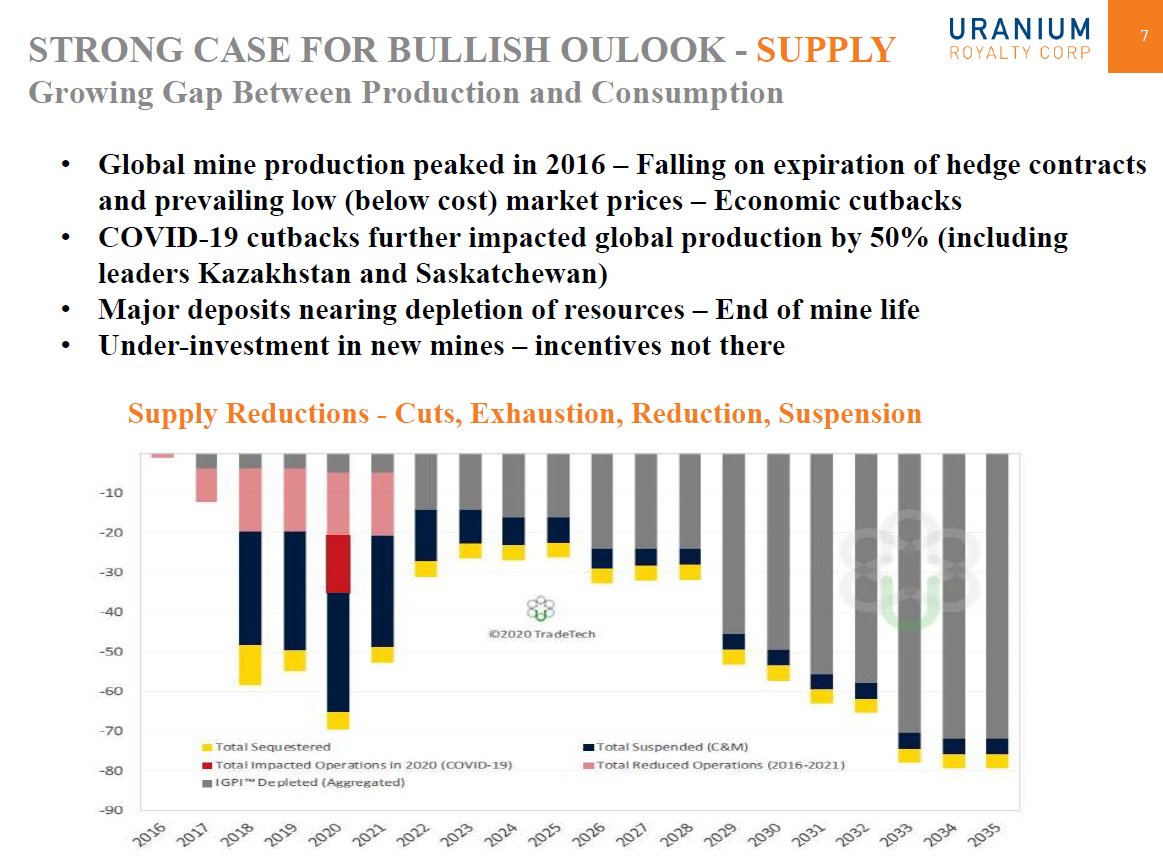

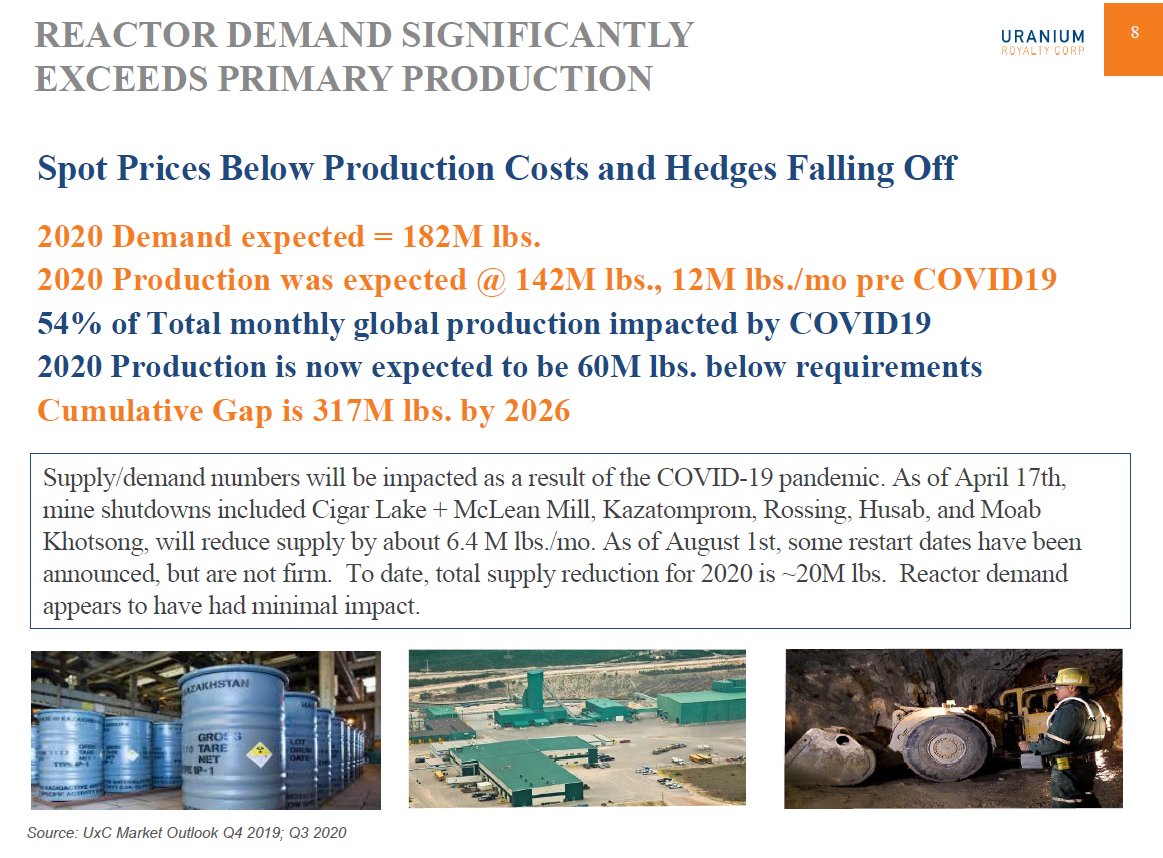

#Uranium Market Update in a nutshell🥜 #U3O8 continues to be a best performing commodity of 2020, up 25% YTD, up 69% from its bottom in November 2016.🐂📈 #Nuclear power growth remains robust ⚛️🏗️↗️ Demand at 182M lbs/yr & rising, Supply deficit ~60M lbs, -317M lbs by 2026⛏️⏬🗜️

1) On 25 July, Tribeca's Commodity Trading Specialist Guy Keller gave an excellent presentation outlining their #bullish #Investment case for #Uranium, expecting to increase their exposure to #U3O8 sector over rest of 2019 as #nuclear demand grows... asx.com.au/asxpdf/2019072…

2) Summary: drivers for higher #uranium prices include growing #demand for #nuclear #energy, #China reactor builds, recent #U3O8 supply cuts & long lead times to recover, mines unprofitable without 50% U price rise, inventories down as contracts roll off, 232 uncertainty gone...

3) #Uranium will play an increasingly important role in global supply of clean, stable, #nuclear base-load power generation given today's focus on environmental improvement amid rising global demand for #CarbonFree low emissions #electricity...

Cameco $CCO $CCJ Conference Call is now over. Here are a few tidbits:

Purchases have increased to 21-23M lbs #uranium for 2019 calendar year. 12.7M lbs committed purchases so far. Will also begin purchasing for 2020 needs later this year. 70% of buying will be in Spot market...

Purchases have increased to 21-23M lbs #uranium for 2019 calendar year. 12.7M lbs committed purchases so far. Will also begin purchasing for 2020 needs later this year. 70% of buying will be in Spot market...

Increase of 2M lbs in contracts was due to clients wishing to add some lbs to existing deliveries. Off-market discussions increasing with utilities on term contracting. Definite rise in #nuclear utility interest since 232 removed border trade issue...

Cameco says still lot of undisciplined producers/sellers in both Spot and Term markets keeping prices from recovering, but volumes of material dropping. Also took a shot at developers who are promising to bring on supply even tho unrealistic at current prices, not helping...