Discover and read the best of Twitter Threads about #oilprice

Most recents (24)

#BREAKING US oil contract WTI slides to 15-month low under $70

#BREAKING Dow index opens 1.5% lower as US banking shares tumble

#BREAKING US oil contract WTI widens losses, plunges 5%

EIA came out with their Short Term Energy Outlook

- These are the largest revisions in key data points impacting oil markets today. Although many of the adjustments are small, it shows the directional bias the EIA sees with its forecast models - a thread

#oott #oilandgas #WTI

- These are the largest revisions in key data points impacting oil markets today. Although many of the adjustments are small, it shows the directional bias the EIA sees with its forecast models - a thread

#oott #oilandgas #WTI

With China showing more signs of opening, oil demand was revised up 1% (160 mb/d). Is there more oil demand revisions to come? Possibly. Expected crude demand in 2023 is still only up 5% to 15.8 mln b/d (from 14.4 mln b/d in 2020) #oott

U.S. oil production in 2024 was lowered 1.4% (150 mb/d) - with much of this oil supply decline near the back-end of the year. As earning season progresses (and capex budgets are revised), we may see more estimate revisions to come #crude #permian #eagleford #midland #bakken

Soaring Food Prices Prompt Eurasian Nations To Ban Food Exports | OilPrice.com oilprice.com/Latest-Energy-… #oilprice Food has always been a weapon of war. See below @OilandEnergy 1/

2/ The harshest winter since 2008 is contributing to shortages of staple vegetables across Central Asia and sending prices north in a region still suffering from COVID-induced food inflation.

3/ In Uzbekistan, record frosts have highlighted the shortcomings of the national energy system as even residents of the capital spent days on end without power. But the cold has also hammered the agriculture sector in the region’s most populous country.

🚨 USA Shale 🚨

My latest math & model

Like & share please #OOTT #COM #oilprice #GasPrice

This model is via EIA DPR.

It's based on averages and therefor is an estimate.

Let's dive in! The EIA has the Drilling Productivity Report at 9 million barrels oil per day ...continued 1/8

My latest math & model

Like & share please #OOTT #COM #oilprice #GasPrice

This model is via EIA DPR.

It's based on averages and therefor is an estimate.

Let's dive in! The EIA has the Drilling Productivity Report at 9 million barrels oil per day ...continued 1/8

🧵(1/ 20) Thoughts on the #US / #Saudi relationship ILO @OPECSecretariat decision: There’s a marked elite / citizenry divide in the US over the relationship: popular opinion is asserting itself in a way neither side wants.

(2/20) First, important to note that no-one in the #USA who doesn’t work on #saudi issues has been positive towards the regime there. It’s a monarchy, it denies basic human rights, it is based on extracted wealth (discovered by Americans).

(3/20) Pick your reason why: racism, Protestant Work Ethic, dissimilar political systems, diff. values. Any explanation works equally well. (I discussed in a chapter here.) Bottom Line: there is no reservoir of good will for KSA in USA. routledge.com/The-Arab-Gulf-…

What really causes inflation? 🧵

[a thread for normies - like me]

[a thread for normies - like me]

2/ The problem with #inflation is that it's a very personal experience.

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

3/ Price inflation and monetary inflation have different definitions:

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

Meine These weshalb die Ukraine auf der Speisekarte Russlands steht. Es ist nicht #NATO Einkreisung, nicht #Denazifizierung und es sind auch auch keine #Biowaffen...es geht viel tiefer...Wirtschaft und Demographie! Ein langer über #UkraineRussianWar /1

Wirtschaft: Russland zählt zu den größten Energieproduzenten der Welt. Die starke Abhängigkeit vom Öl- und Gasgeschäft ist die strukturelle Schwäche der russischen Wirtschaft. /2

Nicht nur der Profit der russischen #Oligarchen auch der Lebensstandard der

durchschnittlichen Bürger – und indirekt auch die Popularität von #Putin - steht in direkter Abhängigkeit von den Rohstoffeinnahmen. Ist der #Oilprice hoch geht es #Russia gut. /3

durchschnittlichen Bürger – und indirekt auch die Popularität von #Putin - steht in direkter Abhängigkeit von den Rohstoffeinnahmen. Ist der #Oilprice hoch geht es #Russia gut. /3

#Asian #shares climb, oil drops ahead of Russia-Ukraine peace talks | 20 min ago

- #Trading has remained choppy as investors try to gauge what’s next for inflation and the global economy as the repercussions of Russia-Ukraine conflict continue to play out.

trtworld.com/business/asian…

- #Trading has remained choppy as investors try to gauge what’s next for inflation and the global economy as the repercussions of Russia-Ukraine conflict continue to play out.

trtworld.com/business/asian…

Russian #Crude Continues To Flow Despite Harsh Sanctions | Mar 28

- Buyers in #China and #India have found ways to circumvent Western sanctions

- Russia continues to make a large profit per barrel, even with a $30 per barrel discount on its crude

oilprice.com/Energy/Crude-O… #oilprice

- Buyers in #China and #India have found ways to circumvent Western sanctions

- Russia continues to make a large profit per barrel, even with a $30 per barrel discount on its crude

oilprice.com/Energy/Crude-O… #oilprice

Chevron told Biden they could produce 800,000 barrels a day from Venezuela, replacing 100% of Russia’s oil exports to the US. But the plan's being blocked by Debbie Wasserman Schultz and Bob Menendez, tweedle corrupt and tweedle corrupter —via @KPFARadio kpfa.org/episode/flashp…

And, of course, Charles Koch is using his influence to oppose the plan too, supporting the embargo of Venezuela, but not Russia. #Ukraine #UkraineWar #UkraineRussiaWar #Russia #RussianInvasion #RussianOil #Putin #Venezuela #OilPrice #OilPriceHike

gregpalast.com/when-you-corro…

gregpalast.com/when-you-corro…

And, weirdly, some greens, like Bill McKibben, are saying no to Venezuelan oil — as if the alternative right now was solar powered cars. Bill’s been a great voice for warning us about climate change. But this is about right now. soundcloud.com/gregpalast/fla…

#UkraineRussia

Local media reports that the UAF troops from the territory of Ukraine launched a rocket at #Belgorod, which is a Russian city near the border with Ukr. It was reportedly shot down

Local media reports that the UAF troops from the territory of Ukraine launched a rocket at #Belgorod, which is a Russian city near the border with Ukr. It was reportedly shot down

#UkraineRussia

The Rus Army captured a large UAF field camp in the #Kherson region with large quantities of supplies and equipment

The Rus Army captured a large UAF field camp in the #Kherson region with large quantities of supplies and equipment

A thread on my piece around fuel price hikes. Come 10th March, sharp fuel price hikes are coming. How sharp ? $1 increase in Crude leads to a 50 – 60 paisa/ litre increase in retail fuel prices. Total increase could be as high as Rs 10/ litre. 1/7

scroll.in/article/101748…

scroll.in/article/101748…

Govt & Oil Companies say they're protecting consumers. Guess what ? April '20 -Crude fell as low as $9.12/ barrel. What did Oil firms do ? Stopped price revisions for *82 days*. In May 21, we saw 16 fuel price hikes. Consumers were hit by no benefit & then record high prices 2/7

Any relief ? Yes. In November last year, a sizeable Rs 5/ltr cut in excise duty on petrol and a Rs 10/ltr cut in excise duty on diesel. But fuel earnings for the Govt have been frankly, great - A robust ₹ 4 lakh crores this year and ₹3.35 lakh crores project next year. 3/ 7

Global oil majors are back in the black—but for how long?

Something is different about this #oilprice spike. Instead of rushing to drill, oil companies are cutting their capex, reducing debt and paying more to shareholders.

What’s going on here? 🧵

Something is different about this #oilprice spike. Instead of rushing to drill, oil companies are cutting their capex, reducing debt and paying more to shareholders.

What’s going on here? 🧵

Former sources of value have become vehicles for destroying value. Investors—and, we suspect, even company management—understand that more drilling and expensive acquisitions are a bad bet.

High oil prices mean renewable energy, EVs and the variety of industrial moves to decarbonize are incentivized. Even volatility, the short-term problem caused by rising prices, is sufficient to drive calls for more rapid adoption of alternative fuels. ieefa.org/ieefa-u-s-pric…

"We're hearin about #Lebanon's economic situation.

Vs.

We're seein a crazy clubbin nightlife on social media.

How r people goin out & spendin given the disastrous Lebanese situation?" @TheRealTahinis

Ali asked me this Q yesterday on Clubhouse, and I answered briefly:

⫸Thread⫷

Vs.

We're seein a crazy clubbin nightlife on social media.

How r people goin out & spendin given the disastrous Lebanese situation?" @TheRealTahinis

Ali asked me this Q yesterday on Clubhouse, and I answered briefly:

⫸Thread⫷

- Lebanon's post-war era (1990-Present) vs. the three main sectors of the economy (Agriculture, Manufacturing & Services) that haven't been built neither for self-sufficiency nor for export.

- How lively Lebanese are by nature.

- How luxurious cars in Leb are bought on credit.

- How lively Lebanese are by nature.

- How luxurious cars in Leb are bought on credit.

- How Lebanese like to enjoy life at the expense of being realistic sometimes.

- How most Lebanese families in Lebanon have family members that are abroad working as expats worldwide. These Lebanese expats do send hard currencies to their families.

- How most Lebanese families in Lebanon have family members that are abroad working as expats worldwide. These Lebanese expats do send hard currencies to their families.

#1 Thread| #Tanzania, Uganda Finalize Oil Pipeline Deal | OilPrice.com oilprice.com/Latest-Energy-… #oilprice

#2 The 1923 letter by the Commissioner of Mines at Entebbe, E.F Wayland referencing the Anglo-French Middle East Development Corporation doing investigations into oil in Bunyoro, 98 years ago today.

#3 E.S Wayland proposed a policy of the (colonial) government staying concessions for oil exploration in Bunyoro until the government had done its own work. This policy would hold until the 1990’s.

#MCPro: Saudi Arabia’s voluntary production cut may temporarily stabilise oil prices, but the cracks in OPEC+ seem to have deepened.

#OilPrice #SaudiArabia #OilPrices

moneycontrol.com/news/opinion/i…

#OilPrice #SaudiArabia #OilPrices

moneycontrol.com/news/opinion/i…

#MCPro: The sparkle is back on Titan. Its business update for the Dec 2020 quarter has come ahead of Street expectations.

#Titan #Business #DStreet

moneycontrol.com/news/business/…

#Titan #Business #DStreet

moneycontrol.com/news/business/…

#MCPro: The @WorldBank’s estimate of India’s real GDP growth in 2020-21 is much worse than the @RBI. Why is it so cautious?

#WorldBanks #RBI #Economy

moneycontrol.com/news/opinion/w…

#WorldBanks #RBI #Economy

moneycontrol.com/news/opinion/w…

French and Dutch securities watchdogs urge crackdown on "greenwashing" | Dec 15

- "The proposed framework is aimed at preventing misallocation of investments, greenwashing, and ensuring investor protection," the regulators said.

marketscreener.com/news/latest/Fr…

- "The proposed framework is aimed at preventing misallocation of investments, greenwashing, and ensuring investor protection," the regulators said.

marketscreener.com/news/latest/Fr…

Upheaval In Big Oil’s Board Rooms

- In some instances, (of corporate “greenwashing”), the corporate board and its senior exec feel compelled by public opinion to pay lip service to a transformation they do not believe in.

OilPrice.com oilprice.com/Energy/Energy-… #oilprice

- In some instances, (of corporate “greenwashing”), the corporate board and its senior exec feel compelled by public opinion to pay lip service to a transformation they do not believe in.

OilPrice.com oilprice.com/Energy/Energy-… #oilprice

'Net Zero Underwriting Alliance': Axa boss proposes new climate alliance for insurance sector

"Net zero commitments by 2050 must include an immediate end to insuring new oil and gas production projects on top.., or they risk being seen as greenwashing."

businessgreen.com/4024915/

"Net zero commitments by 2050 must include an immediate end to insuring new oil and gas production projects on top.., or they risk being seen as greenwashing."

businessgreen.com/4024915/

1. Are the U.S. and France headed for conflict over policy in the Mediterranean & Middle East?

Read the thread:

Read the thread:

2. France has historically claimed primacy in the Mediteranean region. This has been true since Napoleon & grew stronger as France acquired colonies in North Africa and the Levant.

Turkey is now challenging France for primacy in the East Med.

Turkey is now challenging France for primacy in the East Med.

Il y a une semaine, le prix du pétrole devenait négatif aux Etats-Unis

Qu'en penser ? Bonne ou mauvaise nouvelle pour le climat ? Doit-on laisser aux marchés (mal)-gérer le trop plein de pétrole ?

Voice une note produite avec @nicohaeringer

#OilPrice

static.mediapart.fr/files/2020/04/…

Qu'en penser ? Bonne ou mauvaise nouvelle pour le climat ? Doit-on laisser aux marchés (mal)-gérer le trop plein de pétrole ?

Voice une note produite avec @nicohaeringer

#OilPrice

static.mediapart.fr/files/2020/04/…

Voici une image emblématique de la situation : des tankers, chargés de brut dont personne ne veut, mouillent près des côtes, ici californiennes, sans destination : veut-on laisser des marchés prétendument auto-régulés gérer la situation ?

(vidéo piquée à @tomkucharz)

(vidéo piquée à @tomkucharz)

Cette note, co-écrite avec @nicohaeringer, reprend donc nos threads et réponses aux médias de la semaine passée, en essayant d'expliciter les enjeux et en quoi cet effondrement des prix est une opportunité historique majeure !

Bonne lecture.

#OilPrice

Bonne lecture.

#OilPrice

My take on the week that was, and what’s next. #OOTT #EFT #shale #OilPrice #crudeoil #OPEC

When oil became waste: a week of turmoil for crude, and more pain to come reut.rs/2xYTiFz

When oil became waste: a week of turmoil for crude, and more pain to come reut.rs/2xYTiFz

So a bit more on this. A lot right now rests on what happens next, both in terms of various economic regions trying to recover a bit and find ways to do a bit more business - and whether that's possible. #OOTT #OPEC

After all it's not often you see a nation like Azerbaijan tell a BP-led consortium that yes, you have to stop producing. Usually the big oil companies are exempt from this sort of thing. #OOTT #OPEC

Not anymore. @dmitryZ_reuters

Not anymore. @dmitryZ_reuters

#BeyondHeadlines: There are not-so-obvious global reasons why the #OilMarketCrash is NOT good for #India.

Heavy #QE/ currency pressure + Intense #geopolitical tension

= #India, importer & friend to all oil producers, in the crosshairs.

Thread on these impacts of #OilPrice 👇

Heavy #QE/ currency pressure + Intense #geopolitical tension

= #India, importer & friend to all oil producers, in the crosshairs.

Thread on these impacts of #OilPrice 👇

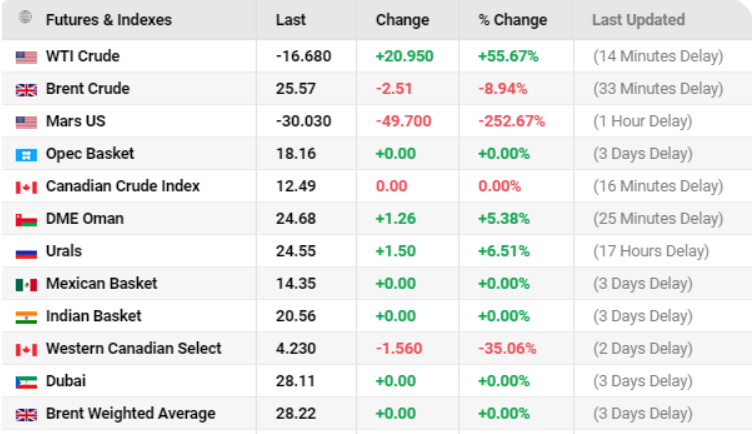

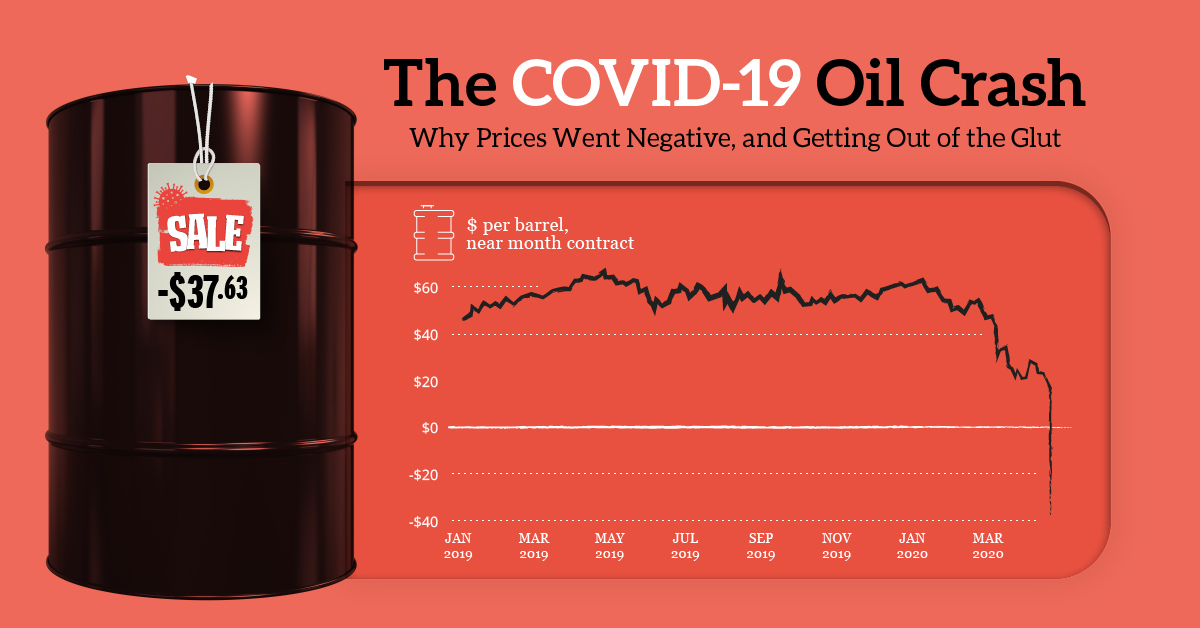

US #oilprice crashed negative for the 1st time in history. West Texas Intermediate (a US crude) traded as low as -$40.32 a barrel. So far the bulk of the losses are in US crude, -200 to -1000%! Global (Brent) crude has not gone down as much because global storage still exists.

[Prix du pétrole]

J'ai répondu à @MassiotAude pour @libe : ce faible prix va réduire massivement les investissements dans le secteur. C'est une bonne nouvelle. Charge aux pouvoirs publics d'obliger les majors à investir dans la transition

#OilPrice

liberation.fr/planete/2020/0…

J'ai répondu à @MassiotAude pour @libe : ce faible prix va réduire massivement les investissements dans le secteur. C'est une bonne nouvelle. Charge aux pouvoirs publics d'obliger les majors à investir dans la transition

#OilPrice

liberation.fr/planete/2020/0…

«Les milliards d’euros d’investissements qui ne seront pas mis dans l’exploration de nouveaux gisements peuvent être redirigés vers une transition écologique du secteur»

#OilPrice

#OilPrice

«Les majors ont accumulé d’énormes quantités de liquidités depuis de nombreuses années. Nous avons besoin que les pouvoirs publics entrent enfin dans un rapport de force avec ces pétroliers pour les forcer à utiliser ces liquidités pour investir dans la transition écologique.»

#Thread

Will Oil become Valueless

Social media Idiots 👇 went crazy the moment the news about Alberta oil going into negative hit the headlines. While this is one of the rare events when a theoretical concept has come true.

#OilPrice

#Petrol

#OilCrash

Will Oil become Valueless

Social media Idiots 👇 went crazy the moment the news about Alberta oil going into negative hit the headlines. While this is one of the rare events when a theoretical concept has come true.

#OilPrice

#Petrol

#OilCrash

All crude oils are not same — there is West Texas Intermediate (WTI), Brent, Dubai CrudCrude at the end of the day is a physical commodity that is traded on exchanges or Over-The-Counter (OTC) but delivered at a physical location (Cushing in Oaklahoma is where WTI is delivered.

1. Most popular grades of oil quality are West Texas Intermediary (WTI) & Brent North Sea Crude (Brent) (sourced from US from Permian basin)

It’s a benchmark for North America

It’s a benchmark for North America

2. Brent is a blend from of 15 oil fields n other in the North Sea. It's 2/3rds of world production. Benchmark for Africa, Europe + Middle East

Je vois tout le monde s'exciter sur le prix du baril de pétrole. Alors

1⃣ce qui est à -37$ ce soir est le prix du baril US pour livraison en mai

2⃣ce même baril pour livraison en juin est à 22$

3⃣le baril de Brent pour livraison en juin, coté à Londres, est à 26€

1/

1⃣ce qui est à -37$ ce soir est le prix du baril US pour livraison en mai

2⃣ce même baril pour livraison en juin est à 22$

3⃣le baril de Brent pour livraison en juin, coté à Londres, est à 26€

1/

Ce qui dévisse est donc le prix d'un contrat (ie d'un titre financier) qui sert d'indicateur, en temps normal, pour réguler une partie des marchés pétroliers.

Ce n'est donc pas le prix d'un baril physique. A très court terme, c'est une énorme différence.

2/

Ce n'est donc pas le prix d'un baril physique. A très court terme, c'est une énorme différence.

2/

Pourquoi ce contrat, cet actif financier, dévisse ?

Parce que de nombreux investisseurs disposant de ce type de contrat ne trouvent pas d'acheteur, alors que ce contrat expire mardi soir

Bref, c'est un krach : il n'y que des vendeurs. Et zéro acheteur. La bourse dévisse

3/

Parce que de nombreux investisseurs disposant de ce type de contrat ne trouvent pas d'acheteur, alors que ce contrat expire mardi soir

Bref, c'est un krach : il n'y que des vendeurs. Et zéro acheteur. La bourse dévisse

3/