Discover and read the best of Twitter Threads about #BONDS

Most recents (24)

DoubleLine CEO Jeffrey Gundlach presents Total Return webcast "Dust in the Crevices" today at 1:15pm PT.

Stay tuned here for more.

#markets #macro #bonds

Stay tuned here for more.

#markets #macro #bonds

Jeffrey Gundlach: There is dust in the crevices of our financial institutions.

The debt ceiling has been raised 99 times since it started in 1913.

This method of getting along is getting pretty dusty.

The debt ceiling has been raised 99 times since it started in 1913.

This method of getting along is getting pretty dusty.

Gundlach: U.S. Federal Budget Balance as a percentage of GDP on a rolling 1-year basis: We've been in a trend toward worse and worse budget deficits as a percentage of GDP.

1. Through April, our systems place Real GDP growth at 1.37% versus one year prior. Below, we show our monthly estimates of Real GDP relative to the official data:

On Wages, Profits & Interest Expense

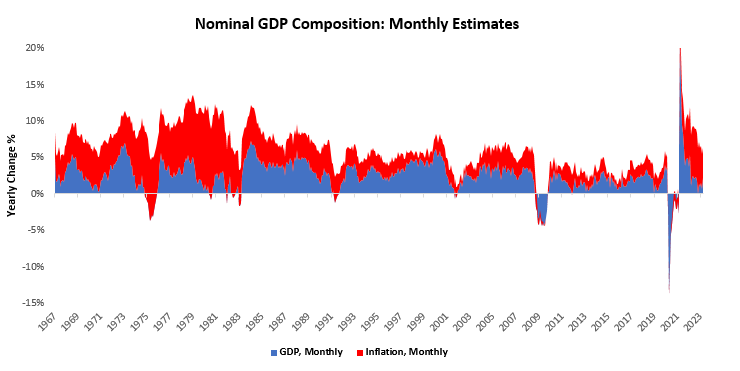

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

2. We think these dynamics will

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

3. Therefore, the key to understanding whether the Fed's hiking cycle has been adequate is

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

#ES close almost 4,149 resistance, $RSP $IWM improvements are key bullish achievements, but I doubt would be confirmed by rising #bonds.

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

2. "I'm ooking for a meaningful undershoot on Tuesday, especially in core #retailsales turning even slightly negative".

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

3. Looking at the relative $XLY direction, I'm afraid #discretionaries are starting to lose their leading shine.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

#MarketReport 2023/04

1) In this thread, I'll cover comparative performance of

📌 #Stock Indices

📌 #Exchange Rates

📌 Treasury #Bills and Government #Bonds

both for April and since pandemic.

1) In this thread, I'll cover comparative performance of

📌 #Stock Indices

📌 #Exchange Rates

📌 Treasury #Bills and Government #Bonds

both for April and since pandemic.

This is the start of Drip Drops Knowledge!

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

The first official Knowledge Drop. $GME reported earnings last night and is up over 50% this morning. A short float of 24% (as reported by #Ortex) might have something to do with that. Breakdown in slide, follow me for weekly Knowledge Drops!

#GME #ShortSqueeze

#GME #ShortSqueeze

Last week, I discussed the concept of a “short squeeze.” This week let’s look at the dynamics of dealer hedging and the concept of a “gamma squeeze.”

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

Here is why you should learn about functionality of risk-ON/risk-OFF in #markets no matter what asset class you decide to #trade:

1.

1.

It gives you foundations to good expectations. There is one pool of global capital that moves in and out of the risk offense or risk defense mode. You should know in what mode market is today to begin with and how it impacts your selected ticker of the day in focus.

2.

2.

For example, if you decide to long equity ticker under severe selling pressure like $FRC the risk-ON flows have to cooperate, else your chances of longs working are going to be by default much smaller. The riskier the asset and the more liquid the more you need risk-ON mode.

3.

3.

The biggest banking collapse since 2008 explained. And how it will impact the crypto markets.

Thread 👇

Thread 👇

#SiliconValleyBank ('SVB') was the 16th biggest bank in the US.

Primarily servicing US technology startups.

Primarily servicing US technology startups.

🏦"Everything You Need to Know About AT1 Bonds"

Bonds are like loans that people can give to companies or governments.

[THREAD🧵]👇

1) What are AT1 Bonds?

AT1 bonds are a type of investment that banks can use to raise money when they need it.

#bonds #Banking #banknifty

Bonds are like loans that people can give to companies or governments.

[THREAD🧵]👇

1) What are AT1 Bonds?

AT1 bonds are a type of investment that banks can use to raise money when they need it.

#bonds #Banking #banknifty

2) How AT1 Bonds are different from traditional Bonds?

a) Higher Risk

AT1 bonds are considered to be high-risk investments as they are designed to absorb losses in the event of a bank's financial distress.

a) Higher Risk

AT1 bonds are considered to be high-risk investments as they are designed to absorb losses in the event of a bank's financial distress.

Interest Payments in AT1 Bonds

AT1 bonds often have non-cumulative coupons, which means that if the bank misses an interest payment, it is not obligated to make it up in the future.

AT1 bonds often have non-cumulative coupons, which means that if the bank misses an interest payment, it is not obligated to make it up in the future.

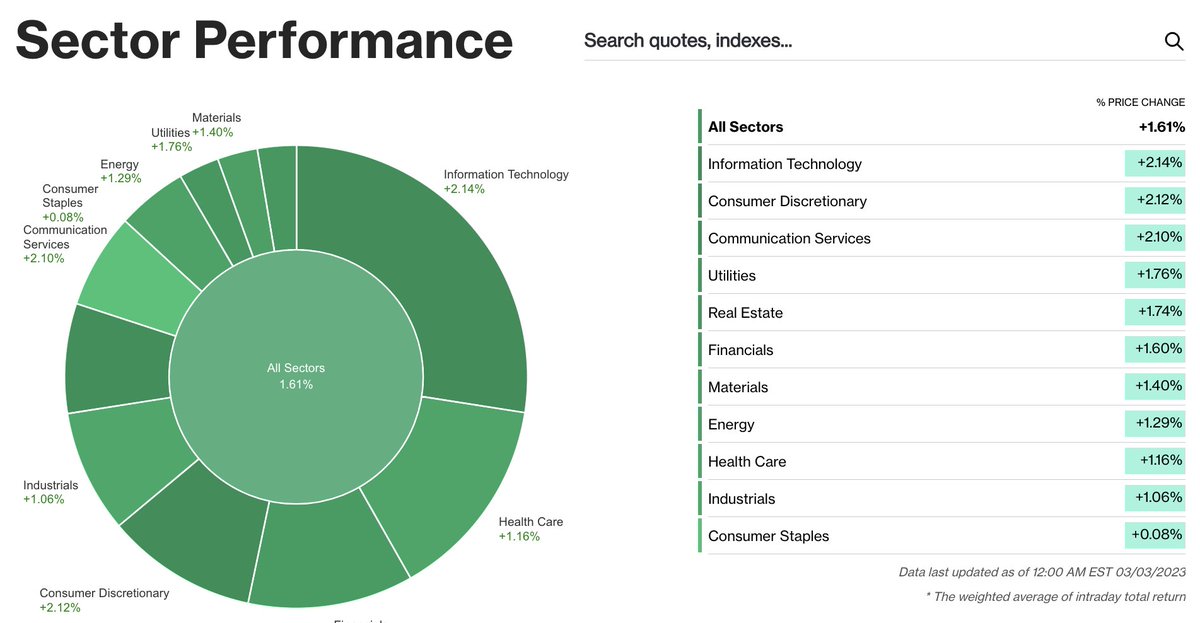

🗓 Daily #Macro & Market Recap 📰 Let's dive into a quick thread recapping some of today's market moving events 🗞, data 📝, & charts 📈📉 for Friday (03/03/23)… 🧵/👇🏼

$SPY $SPX ⬆️✅

$QQQ $NDX ⬆️✅

$DIA $DJIA ⬆️✅

$IWM $RUT ⬆️✅

#stocks #StockMarket #bonds #macro

$SPY $SPX ⬆️✅

$QQQ $NDX ⬆️✅

$DIA $DJIA ⬆️✅

$IWM $RUT ⬆️✅

#stocks #StockMarket #bonds #macro

1/🧵 Daily #StockMarket Sector Performance:

🍽 $XLP ⬆️✅

🏥 $XLV ⬆️✅

🏘 $XLRE ⬆️✅

📡 $XLC ⬆️✅

🛢 $XLE ⬆️✅

🏭 $XLI ⬆️✅

🤖 $XLK ⬆️✅

🏨 $XLY ⬆️✅

🏦 $XLF ⬆️✅

🪵 $XLB ⬆️✅

⚡️ $XLU ⬆️✅

🍽 $XLP ⬆️✅

🏥 $XLV ⬆️✅

🏘 $XLRE ⬆️✅

📡 $XLC ⬆️✅

🛢 $XLE ⬆️✅

🏭 $XLI ⬆️✅

🤖 $XLK ⬆️✅

🏨 $XLY ⬆️✅

🏦 $XLF ⬆️✅

🪵 $XLB ⬆️✅

⚡️ $XLU ⬆️✅

2/🧵 Daily 🇺🇸 🏦 Treasury Market & Currency Performance: 💵💴💶💷

$DXY ⬆️✅

$TLT ⬆️✅

$HYG ⬆️✅

3mo ⬆️✅

2yr ⬇️🔻

10yr ⬆️✅

30yr ⬆️✅

#bonds #interestrates #Currencies #macro

$DXY ⬆️✅

$TLT ⬆️✅

$HYG ⬆️✅

3mo ⬆️✅

2yr ⬇️🔻

10yr ⬆️✅

30yr ⬆️✅

#bonds #interestrates #Currencies #macro

Almost every millennial aspires to retire early. But most of the time, this goal seems almost impossible to achieve.

Well, let us tell you... it's NOT impossible! Welcome to the world of FIRE! (1/n)

#financialplanning #financialgoals #retireearly #thread

Well, let us tell you... it's NOT impossible! Welcome to the world of FIRE! (1/n)

#financialplanning #financialgoals #retireearly #thread

So, what is FIRE?

FIRE stands for Financial Independence Retire Early and it's all about achieving financial freedom so that you can retire early and live life on your own terms. (2/n)

#financialindependence #financialfreedom #retirementplanning

FIRE stands for Financial Independence Retire Early and it's all about achieving financial freedom so that you can retire early and live life on your own terms. (2/n)

#financialindependence #financialfreedom #retirementplanning

Can you achieve FIRE in India?

Yes, you can!

Firstly, you need to focus on your Savings Rate (SR). This means cutting back on unnecessary expenses and living below your means.

A high SR is key to achieving financial independence. (3/n)

#saving #investing #FinancialFreedom

Yes, you can!

Firstly, you need to focus on your Savings Rate (SR). This means cutting back on unnecessary expenses and living below your means.

A high SR is key to achieving financial independence. (3/n)

#saving #investing #FinancialFreedom

Here are some highlights from the Voices of Tomorrow Bangalore Chapter! (1/n)

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

Session #01

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

“We want to make Millennials as $ Millionaires – a well-managed wealth corpus for the 90’s born.” - @shyamsek on what ithought wants to accomplish.

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Here's a thread of (6) charts 📊 that are worth nothing from this last week's @MorganStanley Global Investment Committee (GIC) Weekly Report (01/30/23)... 🧵/👇🏼

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

1/🧵 "In the short run, flows, sentiment, positioning & technicals can be powerful drivers, while over the longer term, fundamentals like growth, profitability & productivity are critical, as are earnings surprises." @MorganStanley

#macro #earnings #stocks #StockMarket #bonds

#macro #earnings #stocks #StockMarket #bonds

2/🧵 "But sometimes, & for extended periods, markets can settle on one particular thesis, no matter how narrow or implausible." 📊h/t @MorganStanley @GoldmanSachs $MS $GS @Bloomberg

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

🇺🇸⚡️US Treasury Secretary Janet Yellen warned that a default in the US could lead to devastating consequences and a complete catastrophe in the economy.

1/6

#debt #usa #ukrainewar #inflation #debtceiling #default #economy #finance #dollar #ustreasury #janetyellen #bonds #fed

1/6

#debt #usa #ukrainewar #inflation #debtceiling #default #economy #finance #dollar #ustreasury #janetyellen #bonds #fed

She said that government spending would need to be cut to match tax revenues and that the spending of the population would also be reduced, leading to psychological consequences and further control of spending.

2/6

2/6

Yellen also stressed that it is the responsibility of US President Joe Biden and the leadership of Congress to find a way out of the situation and raise the national debt ceiling.

3/6

3/6

1/8 "#Ultraviolet #germicidal #irradiation (#UVGI) is known to #inactivate various #viruses and #bacteria, including #SARSCoV2, and is widely applied especially in #medical facilities."

#COVID19 #CovidIsNotOver #COVIDisAirborne

pubs.acs.org/doi/10.1021/ac…

An abstract thread 🧵...

#COVID19 #CovidIsNotOver #COVIDisAirborne

pubs.acs.org/doi/10.1021/ac…

An abstract thread 🧵...

2/8 "This #inactivation results from the #high #photon #energies causing #molecular #bonds to break, but when #nonpathogen #molecules are affected, #unwanted #effects may occur."

3/8 "Here, we explored the effect of a commercial high-intensity (∼2 kW) #UVC #disinfection device on the #composition and #concentration of #gases and particles in #indoor #air."

BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

I am on an email thread with some very savvy market observers. There is some discussion and consternation on the move in the equity market of late. A couple people think we are close to a turn in the economy & the mkt is looking through the bottom. I have respect for them

However, many others point to the falling new orders for ISM mfg & services, or the increase in continuing jobless claims, as a sign that we are in or about to be in a recession.

Ive done ya'll a horribe disservice - ima gun try to fix that.

#BONDS and #CURRENCIES thread.

I hope this helps.

🧵👇

#BONDS and #CURRENCIES thread.

I hope this helps.

🧵👇

jPan by far is the biggest holder of USA debt.

ticdata.treasury.gov/Publish/mfh.txt

yes other central banks can buy each others dog doo.

ticdata.treasury.gov/Publish/mfh.txt

yes other central banks can buy each others dog doo.

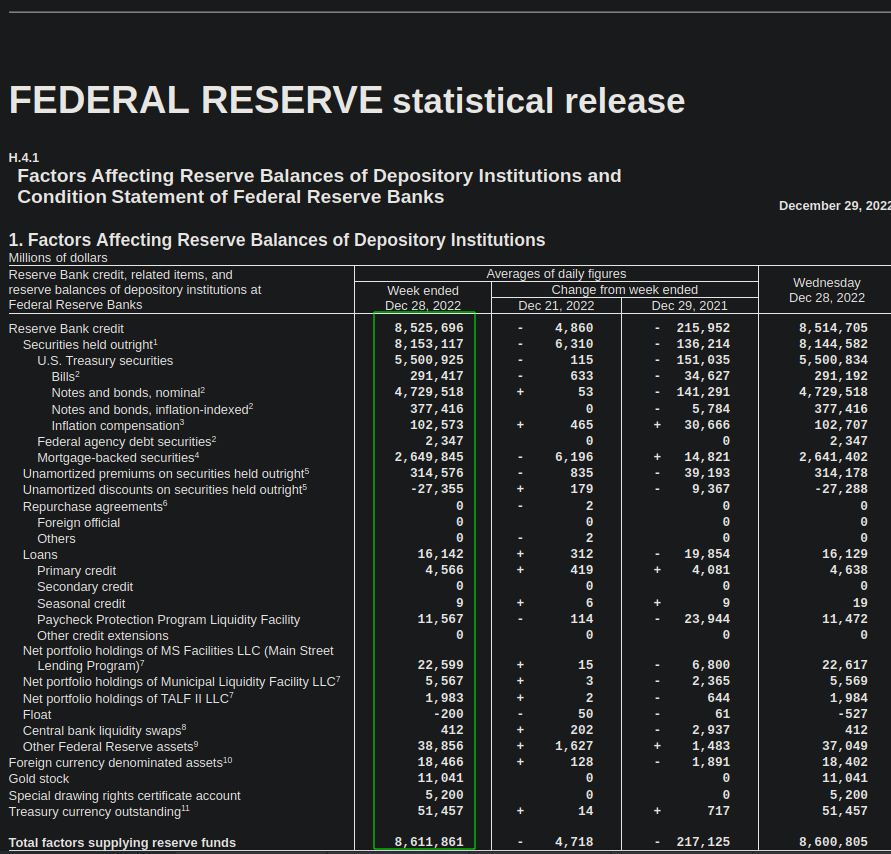

But central banks can also buy their OWN dog doo

When a CB buys its own dog doo its called "quantative easing" or QE

federalreserve.gov/releases/h41/2…

When a CB buys its own dog doo its called "quantative easing" or QE

federalreserve.gov/releases/h41/2…

As we kickoff 23', here's a thread w/ the latest data 🏦💵🖨 on #StockMarket liquidity, credit, & financial conditions within the broader markets... 🧵/👇🏼

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

1/🧵 One of the indicators we watch is the @federalreserve 'Net Liquidity' as this tracks the markets very closely....

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

2/🧵 In addition to this, investors also have to look past the @federalreserve as global Central Banks 🏦 have joined in QT against the #inflation backdrop...

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

The big, big risk is that (almost) every investor expects #equities AND #bonds to decline further due to ongoing tight monetary policy and a weakening global economy.

This significantly increases the odds that 2023 will play out differently.

This significantly increases the odds that 2023 will play out differently.

This does not automatically mean you must be contrarian (even though I like bonds better than most.) So far, this bear market is without capitulation and significant outflows, but with ‘all’ investors in the same boat, little is needed for markets to move in the other direction.

The beauty, of course, is that 2023 predictions are entirely arbitrary and that every sound investment framework should allow you to adjust based on new information. Sticking to your convictions without incorporating (enough) new information is an inferior investment strategy.

Buying the Dip will no longer work?

A big recession is coming?

According to @BlackRock's latest report, 2023 will require a whole new approach to investing in #stocks and #crypto

#BlackRock released their 2023 investment playbook, and I read it all so you don’t have to👇

1/n🧵

A big recession is coming?

According to @BlackRock's latest report, 2023 will require a whole new approach to investing in #stocks and #crypto

#BlackRock released their 2023 investment playbook, and I read it all so you don’t have to👇

1/n🧵

@BlackRock 2/n

In this thread we are going to cover the following interesting claims by #BlackRock:

- A new #investment playbook is needed for this new volatile market state

- “Old Playbook” strats like “buying the dip” may no longer work

In this thread we are going to cover the following interesting claims by #BlackRock:

- A new #investment playbook is needed for this new volatile market state

- “Old Playbook” strats like “buying the dip” may no longer work

3/n

- Central Banks are deliberately slowing down the markets

- Recession is all but certain

- And many more interesting #stock strategies than we can apply on #crypto

For reference, the full outlook is here: blackrock.com/corporate/lite…

- Central Banks are deliberately slowing down the markets

- Recession is all but certain

- And many more interesting #stock strategies than we can apply on #crypto

For reference, the full outlook is here: blackrock.com/corporate/lite…

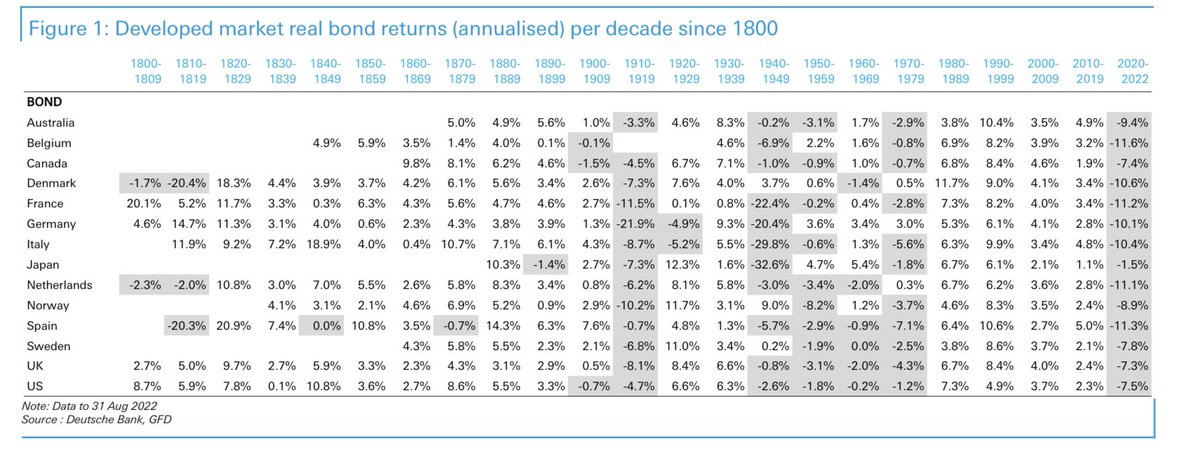

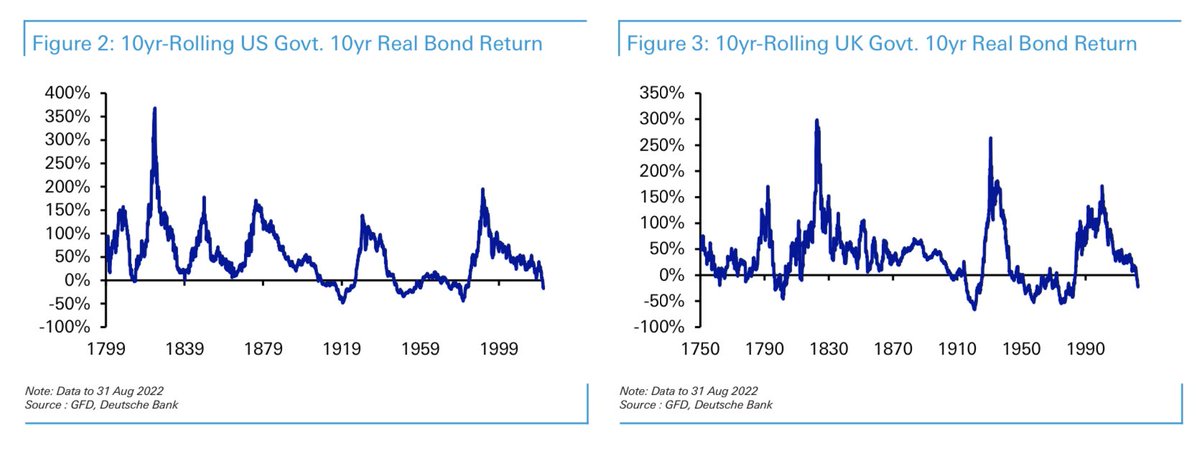

Long term charts vía DB. 2022 first global beat market in 70 years. Rollomt 10yr real government bond return for the US, UK, FR & DE. This year has turned negative for all of these countries for the first time since 1984, 1983, 1983, and 1958, respectively. #bonds #history

LT (over last 100 yrs) US returns:

– equities: +7.2% p.a. real) ****

– 10yr bonds/ +2.0% p.a.

– Corporate bonds: +2.7% p.a.

– T-bills (cash proxy): +0.4% p.a.

– gold: +1.6% p.a.

– oil: +0.5% p.a.

– US housing (prices only): +1.1% p.a.

#financial #markets #history

– equities: +7.2% p.a. real) ****

– 10yr bonds/ +2.0% p.a.

– Corporate bonds: +2.7% p.a.

– T-bills (cash proxy): +0.4% p.a.

– gold: +1.6% p.a.

– oil: +0.5% p.a.

– US housing (prices only): +1.1% p.a.

#financial #markets #history