Discover and read the best of Twitter Threads about #CURRENCIES

Most recents (24)

1) The #Hungarian #Pengo has experienced the most serious #hyperinflation in the history of #currencies. This note is a 1 billion-billion Pengo note that became worthless in the matter of weeks. While it seems like history, hyperinflation is real and possible today. 👇

2) The Hungarian economy could only be stabilized by the introduction of a new currency, and therefore, on 1 August 1946, the Forint was reintroduced at a rate of 400 000 000 000 000 000 000 000 000 000 (400 octillion) = 4×10^29 Pengo, dropping 29 zeros from the old currency. 👇

Are you looking to expand your NFT payment options? We have the solution!

You should really consider accepting various currencies on your MINT PAGE or through your marketplace Buy Now buttons like #ETH #BNB #POLY #AVAX & more to increase growth and appeal to your customer base.

You should really consider accepting various currencies on your MINT PAGE or through your marketplace Buy Now buttons like #ETH #BNB #POLY #AVAX & more to increase growth and appeal to your customer base.

Don't limit yourself and your community's potential by swimming in the same pool of customers every day. Diversify your payment options and reach a broader audience.

If your #marketplace supports multiple chains, but you silo payment methods for each chain, you risk losing out on potential revenue from customers who want the #NFT but don't want to bridge or learn.

🗓 Daily #Macro & Market Recap 📰 Let's dive into a quick thread recapping some of today's market moving events 🗞, data 📝, & charts 📈📉 for Friday (03/03/23)… 🧵/👇🏼

$SPY $SPX ⬆️✅

$QQQ $NDX ⬆️✅

$DIA $DJIA ⬆️✅

$IWM $RUT ⬆️✅

#stocks #StockMarket #bonds #macro

$SPY $SPX ⬆️✅

$QQQ $NDX ⬆️✅

$DIA $DJIA ⬆️✅

$IWM $RUT ⬆️✅

#stocks #StockMarket #bonds #macro

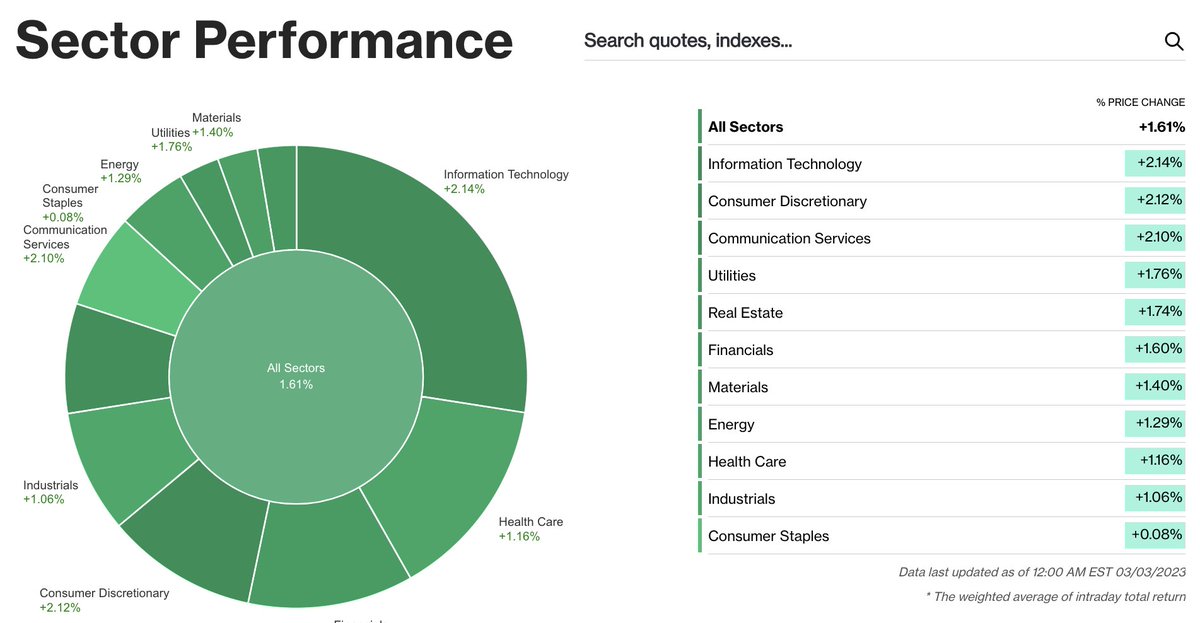

1/🧵 Daily #StockMarket Sector Performance:

🍽 $XLP ⬆️✅

🏥 $XLV ⬆️✅

🏘 $XLRE ⬆️✅

📡 $XLC ⬆️✅

🛢 $XLE ⬆️✅

🏭 $XLI ⬆️✅

🤖 $XLK ⬆️✅

🏨 $XLY ⬆️✅

🏦 $XLF ⬆️✅

🪵 $XLB ⬆️✅

⚡️ $XLU ⬆️✅

🍽 $XLP ⬆️✅

🏥 $XLV ⬆️✅

🏘 $XLRE ⬆️✅

📡 $XLC ⬆️✅

🛢 $XLE ⬆️✅

🏭 $XLI ⬆️✅

🤖 $XLK ⬆️✅

🏨 $XLY ⬆️✅

🏦 $XLF ⬆️✅

🪵 $XLB ⬆️✅

⚡️ $XLU ⬆️✅

2/🧵 Daily 🇺🇸 🏦 Treasury Market & Currency Performance: 💵💴💶💷

$DXY ⬆️✅

$TLT ⬆️✅

$HYG ⬆️✅

3mo ⬆️✅

2yr ⬇️🔻

10yr ⬆️✅

30yr ⬆️✅

#bonds #interestrates #Currencies #macro

$DXY ⬆️✅

$TLT ⬆️✅

$HYG ⬆️✅

3mo ⬆️✅

2yr ⬇️🔻

10yr ⬆️✅

30yr ⬆️✅

#bonds #interestrates #Currencies #macro

[1/🧵] @DigiEuro interviewed @moderndosh and @AntonyWelfare on the @Ripple #CBDC-Manager software.

The underlying private #CBDC-ledger based on #XRPL was also heavily discussed.

I summarized the most of the interview for you, along with my personal comments. 🧵👇

The underlying private #CBDC-ledger based on #XRPL was also heavily discussed.

I summarized the most of the interview for you, along with my personal comments. 🧵👇

[2/19] To begin, if you are completely unfamiliar with #CBDCs and the #Ripple solution, here is a nice place to start:

[3/19] One important reason for using a private version of the public #XRPL is that a central #bank needs to be able to control the #money supply.

Why use a private ledger ❓

▶️ Central banks and #governments must be able to mint and destroy #currencies.

Why use a private ledger ❓

▶️ Central banks and #governments must be able to mint and destroy #currencies.

With the US Fed & Major Central Banks increasing their interest rates across the globe, we all see notable fluctuations in forex prices before & after these major events. Forex is the most liquid market on the planet, let's discuss about what moves the currencies

#currencies

1/8

#currencies

1/8

Amongst many theories of forex pricing, the most basic & one of the earliest developed theories were the "Mint Par Theory" & "Purchasing Power Theory". Come let's explore these theories

#forex #forextrading #forexmarkets #currencies

2/8

#forex #forextrading #forexmarkets #currencies

2/8

Now, let's move on to a very interesting concept that many market participants scrutinize, the #BigmacIndex. Further, let's discuss the "Balance of Payments Theory"

#forex #forextrading #forexmarkets #currencies

3/8

#forex #forextrading #forexmarkets #currencies

3/8

This is going to hurt your brain.

#Currencies

Why did EUR get stronger? Cause they bought bonds from somewhere else (or an opposing currency devalued by printing money)

🧵👇

USDEUR

#Currencies

Why did EUR get stronger? Cause they bought bonds from somewhere else (or an opposing currency devalued by printing money)

🧵👇

USDEUR

Ive done ya'll a horribe disservice - ima gun try to fix that.

#BONDS and #CURRENCIES thread.

I hope this helps.

🧵👇

#BONDS and #CURRENCIES thread.

I hope this helps.

🧵👇

jPan by far is the biggest holder of USA debt.

ticdata.treasury.gov/Publish/mfh.txt

yes other central banks can buy each others dog doo.

ticdata.treasury.gov/Publish/mfh.txt

yes other central banks can buy each others dog doo.

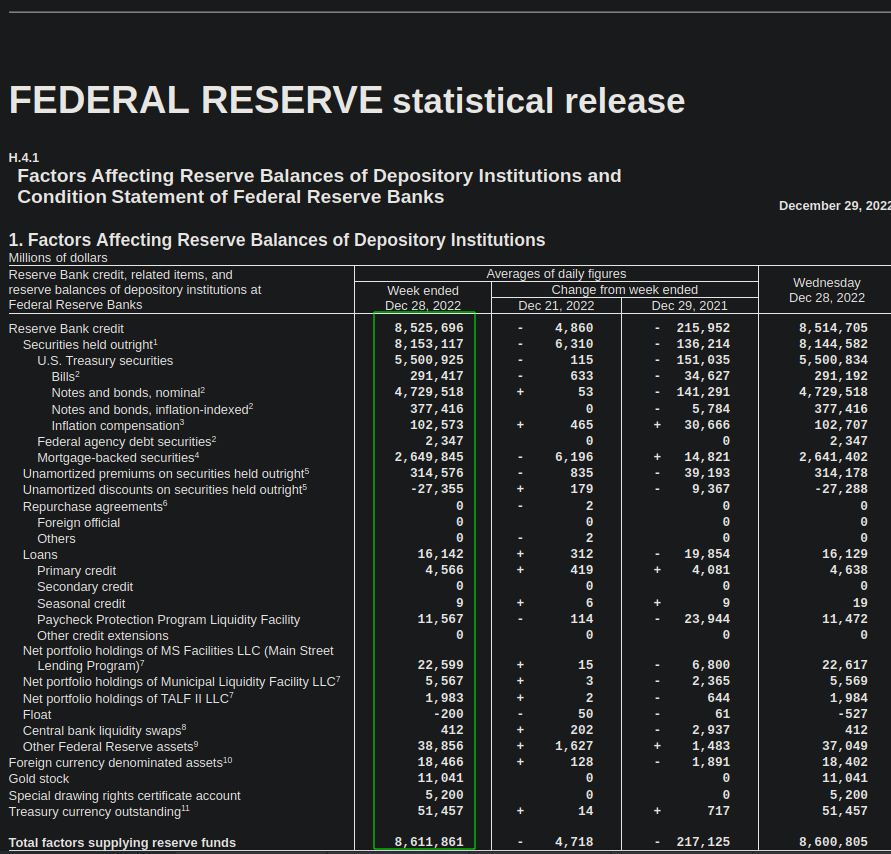

But central banks can also buy their OWN dog doo

When a CB buys its own dog doo its called "quantative easing" or QE

federalreserve.gov/releases/h41/2…

When a CB buys its own dog doo its called "quantative easing" or QE

federalreserve.gov/releases/h41/2…

India is emerging as one of the relatively better-off economies in the post-COVID world.

#indianeconomy

(2/n)

#indianeconomy

(2/n)

Looking closely, we find that India’s inflation is well controlled, ATH FX reserves have acted well as a shock absorber against volatility, and our GDP growth expectations is one the highest in the world!

#inflation #volatility #GDP

(3/n)

#inflation #volatility #GDP

(3/n)

📢#MiCA is complete!

The landmark #crypto regulation sets out uniform 🇪🇺 requirements for offerors of #cryptoassets and service providers (#CASPs) to apply for authorisation in the Single Market.

👀🧵for a full dive on #MiCA and what it means for the #cryptoindustry.

1/22

The landmark #crypto regulation sets out uniform 🇪🇺 requirements for offerors of #cryptoassets and service providers (#CASPs) to apply for authorisation in the Single Market.

👀🧵for a full dive on #MiCA and what it means for the #cryptoindustry.

1/22

Even though a better agreement was close last week, 🇫🇷 vetoed it during the 🇪🇺 MS intervention period & raised concerns on USD-denominated #stablecoins used as a "means of #exchange", suggesting a return to their restriction when used for #settlement purposes ❗️

2/22

2/22

The compromise was to at least clarify that USD-#stablecoins used for spot #trading would NOT be captured.

The final text was approval by #COREPER yesterday and @EP_Economics will do it on 10/10. Final adoption by Ministers and the Parliament’s Plenary will be end of Oct.

3/22

The final text was approval by #COREPER yesterday and @EP_Economics will do it on 10/10. Final adoption by Ministers and the Parliament’s Plenary will be end of Oct.

3/22

GTON Capital: reimagining the #utility and #scalability of #Web3

1/⚜️ The @GtonCapital team is building an ecosystem of innovative web3 infrastructure and products by synergizing the best achievements of decentralized web technology

1/⚜️ The @GtonCapital team is building an ecosystem of innovative web3 infrastructure and products by synergizing the best achievements of decentralized web technology

2/⚜️ The vision of the $GTON team presents a new phase in the evolution of the #cryptocurrency landscape, with decentralized #stablecoins and scalable #smartcontract execution layers at its core, enabling millions of #dApps to improve the lives of billions of users

3/⚜️ We are currently facing a "Cambrian explosion" of alt-L1 and L2 protocols, #DeFi dApps and #NFT, #GameFi and X2Earn business models, and #Metaverses

$APTY “#Stablecoins are a type of #cryptocurrency linked to an asset like the #US dollar that doesn’t change much in value.” popsci.com/technology/how…

$APTY “#Stablecoin market to have hit $1T by 2025, Unstoppable Domains CEO predicts” cointelegraph.com/news/stablecoi… via @Cointelegraph

“A member of the Board of Governors of the Federal Reserve System is sharing his thoughts on the advantages of using private #stablecoins over central bank digital currencies (CBDCs).” $APTY #gold #Spera

dailyhodl.com/2021/08/06/sta…

dailyhodl.com/2021/08/06/sta…

Is Everything a Bubble❓Part 2 Recap 🔥

Most seem to think so... but don't take our word for it.

Have a look for yourself 👇 as we take you into the lions den to hear from the lions themselves.

Most seem to think so... but don't take our word for it.

Have a look for yourself 👇 as we take you into the lions den to hear from the lions themselves.

🔥Adapting to New Market Nuances and the Golden Age of Macro🔥@JulianMI2

Are we in a bubble❓

“Yes, but it's somewhat nuanced. There's unquestionably single assets that are bubbles."

"There's groups of assets which are arguably excessively valued."

Are we in a bubble❓

“Yes, but it's somewhat nuanced. There's unquestionably single assets that are bubbles."

"There's groups of assets which are arguably excessively valued."

1. Hello again! I've been thinking for a while to write this thread and this is time!

My thoughts about #crypto ecosystem, what it looks like to me and what can happen in the future! It's gonna be huge thread, so fasten your belts!

$ftm

My thoughts about #crypto ecosystem, what it looks like to me and what can happen in the future! It's gonna be huge thread, so fasten your belts!

$ftm

2. I previously wrote a thread about #ren, and how it is similar to silk road 1500 years ago. And it feels like we are building cities. But not as traditional cities, we are building cities on internet.

3. In those cities we have our own #currencies, our own #governance, our own #banking systems, our own economical features, our own communities. And with the development of internet, we don't need land or place for social gatherings.

Daily Bookmarks to GAVNet 02/05/2021 greeneracresvaluenetwork.wordpress.com/2021/02/05/dai…

Oil: Shell reports sharp drop in full-year profit, raises dividend

cnbc.com/2021/02/04/oil…

#oil #dividend #profit

cnbc.com/2021/02/04/oil…

#oil #dividend #profit

The need for the U.S. to improve data on the COVID pandemic

usatoday.com/story/opinion/…

#pandemic #COVID19

usatoday.com/story/opinion/…

#pandemic #COVID19

#Ripple, a leading #Crypto fintech company, is going forward to bring the #XRP Ledger to central banks

#Ripple announced via a job listing site that it was looking to hire three central bank technical partner managers – one for each of its offices in #London, #SanFrancisco, and New York

#ICYMI Ep. 1416 The Real Story Behind What Soros Is Up To - The Dan Bongino Show® @dbingino George Soros Funding DA Elections, Secretary of State Elections, Ukraine Do Not Prosecute List, Soros Controls Streets & Elections, & More! rumble.com/vbxwvz-ep.-141…

Order Dan Bongino’s @dbongino #1 Best Seller “Follow the Money: The Shocking Deep State Connections of Anti-Trump Cabal” for account of troubling connections between the anti-Trump lunatics. amzn.to/2UBPORt @dbongino #BestSeller #ObamaGate #DrainTheSwamp #MAGA2020 #Ad

Backed by Soros Cash, Radical District Attorneys Take Control in DC Suburbs

#Investor #Shorting #Stocks #Currencies #Manipulates #Crime #Levels #Manipulating #DA #Elections

dailysignal.com/2019/11/14/bac…

#Investor #Shorting #Stocks #Currencies #Manipulates #Crime #Levels #Manipulating #DA #Elections

dailysignal.com/2019/11/14/bac…

The turn of the calendar year invites the temptation to prognosticate regarding the course of the year ahead for the #economy and for #markets, and not being immune to that impulse, here are our views on the “11 themes to consider as we look toward 2021:” bit.ly/386mb0r

In preview, one key theme is that 2021’s nominal #GDP growth is likely to surprise many skeptics with its strength. The sources of upside surprise can be found in: 1) the new #fiscal #stimulus combined with structural budget #deficits…

And in 2) the @federalreserve’s ongoing asset purchases and 3) the impressive #economic momentum that is still broadly underestimated, as a post-election, and #pandemic-recovering world can catalyze 2020/21’s monetized #stimulus (more than 15% of GDP) into impressive NGDP growth.

Our CEO discovered #Bitcoin in 2009 on @HackerNews and became quickly fascinated by it through his interests in peer-to-peer technologies and finance. He started trading #Bitcoins in 2010 and implemented his own #Bitcoin client not much later to understand the protocol in detail

Since then, he has been following it for more than 10-years through three distinct periods he calls; “Ealy stages (2009–2013)”, “Becoming Mainstream (2014–2017)”, and “#Altcoin Explosion (2018 -2020)”

The #deficit #myth #deficitmyth by @StephanieKelton #MMT modern monetary theory

Myth N. 1: The #state should budget like a #household

#RealityCheck : unlike a household, a #SovereignNation, which owns its national #centralbank, issues the #currency it spends

Myth N. 1: The #state should budget like a #household

#RealityCheck : unlike a household, a #SovereignNation, which owns its national #centralbank, issues the #currency it spends

Myth N. 2: #deficit is evidence of #overspending

#RealityCheck: look to #inflation for evidence of over spending

#RealityCheck: look to #inflation for evidence of over spending

The purpose of #taxes is not to pay for #government expenditures but to help rebalancing the #wealth distribution #MMT

4 suggestions for #China in building a global center for financial asset allocation by Xiao Gang:

lnkd.in/gzQyA44

lnkd.in/gzQyA44

1. Speed up market-oriented financial reforms. Build a more market-based, rule-based, international financial sector. Remove redundant administrative controls so that the #market can play a decisive role in resource allocation.

2. Press ahead with #RMB internationalization. Explore the possibility of building a pool for cross-border funds of both RMB and foreign #currencies, upgrade its #forex management, and encourage transnationals to establish global or regional centers for fund management in China.

Let us briefly #Reflect on the #SARB's first #MPC #Meeting of 2020 and their #MonetaryPolicy decision to cut rates by 25bps from 6.5% to 6.25%...

Everyone with some interest in such matters is without a doubt already aware that the #SouthAfricanReserveBank's #MonetaryPolicyCommittee cut its key #PolicyRate, the #Repo by 25 basis points from 6.5% to 6.25%. The move can perhaps best be summarised by the following statement:

It is clear from the statement above that the SARB moved on the back of a growth story. They would want to see the level of #inflation creep closer to 4.5% but they didnt tighten to achieve this end. Rather, they provided more accommodation for growth & inflation might pick up...

Digital currencies are mostly just a new type of money’s carrier, which has no influence on money’s credit. If the People’s Bank of China issues digital legal tender, it’s still the central bank - the state – credit, said CF40 member Zhong Wei, 1/6. cf40.org.cn/uploads/newsle…

Digital #currencies are mostly targeted at individuals and the retail business and it replaces M0; it has hardly any influence on the wholesale industry, institutions or real-time transactions in large amounts. 2/6

Rabobank 1/4: Expectations that the Federal Reserve is on the brink of cutting interest rates combined with forecasts that the Fed funds rate could be significantly lower by the end of the last year have unsurprisingly knocked the USD in recent weeks.

Rabobank 2/4: That said, the outlook for the greenback is complicated by a number of other factors. Firstly other major central banks are also pursuing accommodative policy settings. This should dilute the impact of lower Fed rates on the USD.

Rabobank 3/4: Additionally, slowing world growth and geopolitical risks are likely to stymie appetite for risky emerging market assets. As long as confidence in EM is shaky, there is good reason to expect the USD to find solid support.