Discover and read the best of Twitter Threads about #CDSL

Most recents (22)

Hi i am adding some recent example of #climax bar for more clarity all credit @iManasArora as i learning from him only

This study will save you many times if you will apply it properly

#cdsl

This study will save you many times if you will apply it properly

#cdsl

15 Stock Catch up with Janak - 31 Oct'22. 🧵 Covered:

1. #HeroMotocrop

2. #DRL

3. #Olectra Greentech

4. #HFCL

5. #Centrum

6. #CDSL

7. #Satia

8. #Tatapower

9. #Sonablw

10. #SolarInd

11. #JSWEnergy

12. #Laurus

13. #Datamatics

14. #Maruti

15. #Intellect

Disc: Not a reco

1. #HeroMotocrop

2. #DRL

3. #Olectra Greentech

4. #HFCL

5. #Centrum

6. #CDSL

7. #Satia

8. #Tatapower

9. #Sonablw

10. #SolarInd

11. #JSWEnergy

12. #Laurus

13. #Datamatics

14. #Maruti

15. #Intellect

Disc: Not a reco

1. #HeroMotoCorp: Company saw growth of 20% over the corresponding festive period of FY22 (Positive)

2. #DrReddy Q2: PAT at Rs 1,112.8 cr: poll saw cons PAT at Rs 819 cr. Sales at Rs 6,305.7 cr: poll saw cons sales at Rs 5,780 cr (Positive)

2. #DrReddy Q2: PAT at Rs 1,112.8 cr: poll saw cons PAT at Rs 819 cr. Sales at Rs 6,305.7 cr: poll saw cons sales at Rs 5,780 cr (Positive)

My understanding of #CDSL #IEX and #Saregama & #Tips 🎵🔌⚡💻

Can #CDSL & #IEX reinvest the earnings in the business ? These businesses won't need much cash to grow.

#CDSL have market linked revenue so business will have some cyclicality. Opportunity size is huge

Can #CDSL & #IEX reinvest the earnings in the business ? These businesses won't need much cash to grow.

#CDSL have market linked revenue so business will have some cyclicality. Opportunity size is huge

#IEX

1. Revenues are not linked to market.

2. Excellent business model with super high margins and ROCE and it don't need any capital to grow.

3. But govt regulation can be a double edged sword which keeps the competition away but also can kill you.

1. Revenues are not linked to market.

2. Excellent business model with super high margins and ROCE and it don't need any capital to grow.

3. But govt regulation can be a double edged sword which keeps the competition away but also can kill you.

#CDSL Q3 2022 ConCall Highlights

Like & Retweet for better reach !

Numbers Update-

1. Demat accounts across both the depositories stands at 8.4cr,

2. CDSL has 70% of the share at 5.8 cr accounts.

Like & Retweet for better reach !

Numbers Update-

1. Demat accounts across both the depositories stands at 8.4cr,

2. CDSL has 70% of the share at 5.8 cr accounts.

3. The revenue for the Q3 was 151 cr up by more than 50% YoY

4. Number of Demat AC opened as of Dec 21 is more than 29 Lakhs.

5. EBITDA for the quarter stood at 87.42 cr and PAT stood at 63.76 cr

6. The revenue from transaction charges stood at 52.7 cr

4. Number of Demat AC opened as of Dec 21 is more than 29 Lakhs.

5. EBITDA for the quarter stood at 87.42 cr and PAT stood at 63.76 cr

6. The revenue from transaction charges stood at 52.7 cr

7. CVL contributed 33.6 cr of the revenues

8. IPO charges contributed 23.41 cr of revenues

9. Annual issuer charges contributed around 28.98 cr of revenues

10. The 9M debtors provisions stands around 8 cr compared to 7.34 cr previous year.

8. IPO charges contributed 23.41 cr of revenues

9. Annual issuer charges contributed around 28.98 cr of revenues

10. The 9M debtors provisions stands around 8 cr compared to 7.34 cr previous year.

Mutual Fund & Investment Basic- Part 2

Part - 1 இங்க படிங்க: tamilhollywoodreviews.com/2021/11/mutual…

இந்த முறை Direct #MutualFund வாங்குவது எப்படி என்பதை பற்றிய போஸ்ட் போடலாம் என நினைத்தேன்

ஆனால் மார்க்கெட் மற்றும் அதைப் பற்றிய அடிப்படை விஷயங்களை தெரிந்து கொள்ளாமல்

#MutualFundsSahiHai

Part - 1 இங்க படிங்க: tamilhollywoodreviews.com/2021/11/mutual…

இந்த முறை Direct #MutualFund வாங்குவது எப்படி என்பதை பற்றிய போஸ்ட் போடலாம் என நினைத்தேன்

ஆனால் மார்க்கெட் மற்றும் அதைப் பற்றிய அடிப்படை விஷயங்களை தெரிந்து கொள்ளாமல்

#MutualFundsSahiHai

நேரடியாக இன்வெஸ்ட்மென்ட் செய்ய ஆரம்பிப்பது நல்லது கிடையாது. அதுக்கு முன்னாடி கொஞ்சம் அடிப்படை விஷயங்களை தெரிந்து கொள்ளலாம்.

எப்பவுமே உங்களுடைய #stocks and #MutualFund unit களை #DEMAT அக்கௌன்ட்ல வைப்பது நல்லது. ஆனால் #stocks வாங்கனும்னா கண்டிப்பாக #DEMAT account இருக்க வேண்டும்.

எப்பவுமே உங்களுடைய #stocks and #MutualFund unit களை #DEMAT அக்கௌன்ட்ல வைப்பது நல்லது. ஆனால் #stocks வாங்கனும்னா கண்டிப்பாக #DEMAT account இருக்க வேண்டும்.

#MutualFund ஆரம்பிக்க #DEMAT அக்கௌன்ட் அவசியம் இல்லை .

ஆனால் நான் #Zerodha வில் அக்கௌன்ட் வைத்து உள்ளேன் மற்றும் #MutualFund களை அதனுடைய #coin App வழியாக வாங்குவதால் நேரடியாக #DEMAT account ல் கிரடிட் ஆகிவிடும். மற்ற ஆஃப்கள் எப்படி என்று தெரியவில்லை.

ஆனால் நான் #Zerodha வில் அக்கௌன்ட் வைத்து உள்ளேன் மற்றும் #MutualFund களை அதனுடைய #coin App வழியாக வாங்குவதால் நேரடியாக #DEMAT account ல் கிரடிட் ஆகிவிடும். மற்ற ஆஃப்கள் எப்படி என்று தெரியவில்லை.

Swing Trading Strategy

That can help you generate 3 to 5% Monthly

A thread 📕

Using RS , MACD , 21 EMA and Price Action

All Concepts Explained !

RETWEET AND SHARE !

#StockMarket

@kuttrapali26 @ArjunB9591

1/n

That can help you generate 3 to 5% Monthly

A thread 📕

Using RS , MACD , 21 EMA and Price Action

All Concepts Explained !

RETWEET AND SHARE !

#StockMarket

@kuttrapali26 @ArjunB9591

1/n

🌟Looking forward to #MuhuratTrading?

🙌Check out this thread to see what #Trinkerr Experts chose as their top #DIWALIPICKS! ✨

#StockMarket #stocks

🙌Check out this thread to see what #Trinkerr Experts chose as their top #DIWALIPICKS! ✨

#StockMarket #stocks

✨@MoneyMystery's #DIWALIPICKS for #MuhuratTrading🎁

🌟#InoxLeisure

💫Checkout his complete #Trinkerr portfolio: trin.kr/RwuX

🌟#InoxLeisure

💫Checkout his complete #Trinkerr portfolio: trin.kr/RwuX

✨ @MarketScientist's #DIWALIPICKS for #MuhuratTrading🎁

🌟#ACE

🌟#Borosil

🌟#JBMGroup

🌟#GNFC

🌟#westlife

🌟#AssociatedBreweries

💫Checkout his complete #Trinkerr portfolio: trin.kr/pwiC

🌟#ACE

🌟#Borosil

🌟#JBMGroup

🌟#GNFC

🌟#westlife

🌟#AssociatedBreweries

💫Checkout his complete #Trinkerr portfolio: trin.kr/pwiC

When will PPFAS will launch a new scheme?

Only if, PPFAS is excited about putting their own money & can add value to investors

Right now, there is no plan to cut any more expense ratio.

#PPFAS

#NewFundoffer? nops

Only if, PPFAS is excited about putting their own money & can add value to investors

Right now, there is no plan to cut any more expense ratio.

#PPFAS

#NewFundoffer? nops

Sharing 50+ colorful charts as I promised in this thread.

#Breakout stocks

#ASALCBR

#SPECIALITY

#KAMATH

#HCC

1/n

#Breakout stocks

#ASALCBR

#SPECIALITY

#KAMATH

#HCC

1/n

My core portfolio and business tracking thread...

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

IT Service oriented

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

Platform

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

Low-risk, High-return stocks are what we look for relentlessly

But many of them we know but ignore

some of them don't grab financial headlines

Here are 10 low-risk, high return stocks (that we ignore):

But many of them we know but ignore

some of them don't grab financial headlines

Here are 10 low-risk, high return stocks (that we ignore):

What I mean by “high-return”?

These stocks have OUTPERFORMED the market:

💹Chart with upwards trend Since IPO

💹Chart with upwards trend Over the last 5 Years or since IPO

These are all long-term winners that will keep on winning

These stocks have OUTPERFORMED the market:

💹Chart with upwards trend Since IPO

💹Chart with upwards trend Over the last 5 Years or since IPO

These are all long-term winners that will keep on winning

What do We Mean by “low-risk”?

A combination of:

❣️Great management

❣️Broad moat

❣️Financially strong

❣️High ROCE

❣️Low Disruption/Dilution/Volatility

❣️Consistent Organic Growth

❣️Assorted Customers/Suppliers

❣️Low debt

A combination of:

❣️Great management

❣️Broad moat

❣️Financially strong

❣️High ROCE

❣️Low Disruption/Dilution/Volatility

❣️Consistent Organic Growth

❣️Assorted Customers/Suppliers

❣️Low debt

1/ About the Company

CDSL is one of the two securities depository in India

A depository is a facilitator for holding of securities in the dematerialised form and an enabler for security transactions

BSE Ltd is the promoter of the company and owns 20% of the company

CDSL is one of the two securities depository in India

A depository is a facilitator for holding of securities in the dematerialised form and an enabler for security transactions

BSE Ltd is the promoter of the company and owns 20% of the company

2A/ Number crunching

Annual Issuer Charges for FY21 – INR 861M (+11.6% YoY)

CAGR 13.7% FY17-21

5% CAGR in no. of securities

8% CAGR in folio charges

1.23Crores Demat accounts added during FY21

First Indian Company to reach 3 Cr. Demat accounts

Annual Issuer Charges for FY21 – INR 861M (+11.6% YoY)

CAGR 13.7% FY17-21

5% CAGR in no. of securities

8% CAGR in folio charges

1.23Crores Demat accounts added during FY21

First Indian Company to reach 3 Cr. Demat accounts

Small info about #CDSL business Model which will tell why price turned 4X after march

Data Source: Annual Report Finology Blog and Google

CDSL is one of the two security depositories which holds securities in an electronic form, same like a bank account which holds our money

Data Source: Annual Report Finology Blog and Google

CDSL is one of the two security depositories which holds securities in an electronic form, same like a bank account which holds our money

2.

In Securities market investors needs to go through an intermediary known as DP (Known as Broker)

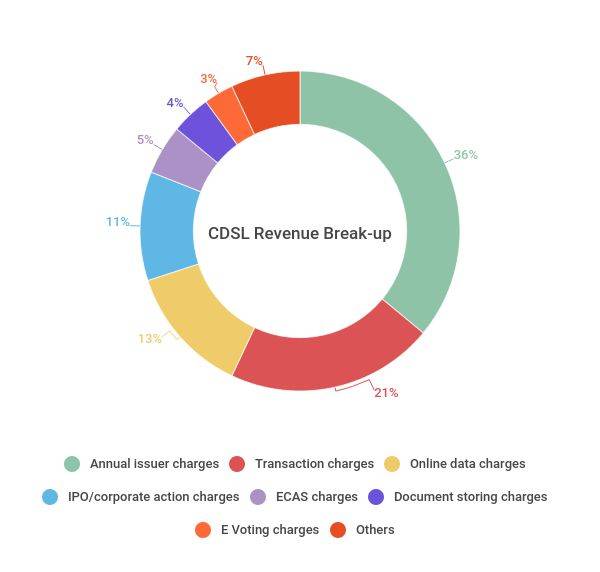

Revenue Source

•Annual issuer charge: Every issuer (Listed securities) is required to pay an annual fee to the depositor, which is decided by the market regulator

In Securities market investors needs to go through an intermediary known as DP (Known as Broker)

Revenue Source

•Annual issuer charge: Every issuer (Listed securities) is required to pay an annual fee to the depositor, which is decided by the market regulator

3.

Transaction Charges: holdings r kept by the Depository, but transaction is carried through the broker, any transaction done by an investor, the broker has to pay a fixed amount.

Online data charges:CDSL is engaged in KYC services through its subsidiary CDSL Ventures Ltd (CVL)

Transaction Charges: holdings r kept by the Depository, but transaction is carried through the broker, any transaction done by an investor, the broker has to pay a fixed amount.

Online data charges:CDSL is engaged in KYC services through its subsidiary CDSL Ventures Ltd (CVL)

#lauruslabs 401

#api is the game in town

IT,Steel also firing

#cdsl is lockdown stock

#specialitychemicals everything on fire

#Q4updates🐝

#api is the game in town

IT,Steel also firing

#cdsl is lockdown stock

#specialitychemicals everything on fire

#Q4updates🐝

#CDSL Thread 💰

India’s only listed and largest(no. of accounts) securities depository

Current BO Accounts: 2.89 Cr

BO accounts grew at a CAGR of 19% from 1.08 cr in FY 2015-16 to 2.12 cr in FY 2019-20

@Atulsingh_asan @caniravkaria @Coolfundoo @saketreddy @Jitendra_stock

India’s only listed and largest(no. of accounts) securities depository

Current BO Accounts: 2.89 Cr

BO accounts grew at a CAGR of 19% from 1.08 cr in FY 2015-16 to 2.12 cr in FY 2019-20

@Atulsingh_asan @caniravkaria @Coolfundoo @saketreddy @Jitendra_stock

#CDSL (2/n)

ROCE 5Yr -22.7 %; ROE 5Yr -17.0 %

CDSL market share of investor accounts stands at 54% in FY20

CDSL incremental market share stands at 78% for FY20

Works similar to a bank but holds stocks and securities, not money

@vetris_stocks @ThetaVegaCap

ROCE 5Yr -22.7 %; ROE 5Yr -17.0 %

CDSL market share of investor accounts stands at 54% in FY20

CDSL incremental market share stands at 78% for FY20

Works similar to a bank but holds stocks and securities, not money

@vetris_stocks @ThetaVegaCap

#CDSL (3/n)

~35% of the revenue is an annuity in nature and ~45% is market-linked (Transaction, IPO/corporate action, and KYC)

Aadhaar based e-KYC for account opening, which will further boost CVL-KYC volumes.

28 lakh accounts added in last quarter alone

~35% of the revenue is an annuity in nature and ~45% is market-linked (Transaction, IPO/corporate action, and KYC)

Aadhaar based e-KYC for account opening, which will further boost CVL-KYC volumes.

28 lakh accounts added in last quarter alone

#CDSL 👨💻

(#TechnoFunda Analysis)

Please Read Fully Thread..🧵🙏🤞

~ CDSL Incorporated in 1999 under Depositories act,1996 with Some Unique Business Model..🤩

~ Almost Recession Free Business is Key Factor...🔆🌟

~ Provide Depositories (Opening DEMAT) Related Services.

(1/n)

(#TechnoFunda Analysis)

Please Read Fully Thread..🧵🙏🤞

~ CDSL Incorporated in 1999 under Depositories act,1996 with Some Unique Business Model..🤩

~ Almost Recession Free Business is Key Factor...🔆🌟

~ Provide Depositories (Opening DEMAT) Related Services.

(1/n)

It seems Inter-depository off-market transfer (IDT) of Sovereign Gold Bond (#SGB) from #NSDL to #CDSL is a cumbersome process.

A Thread:

A Thread:

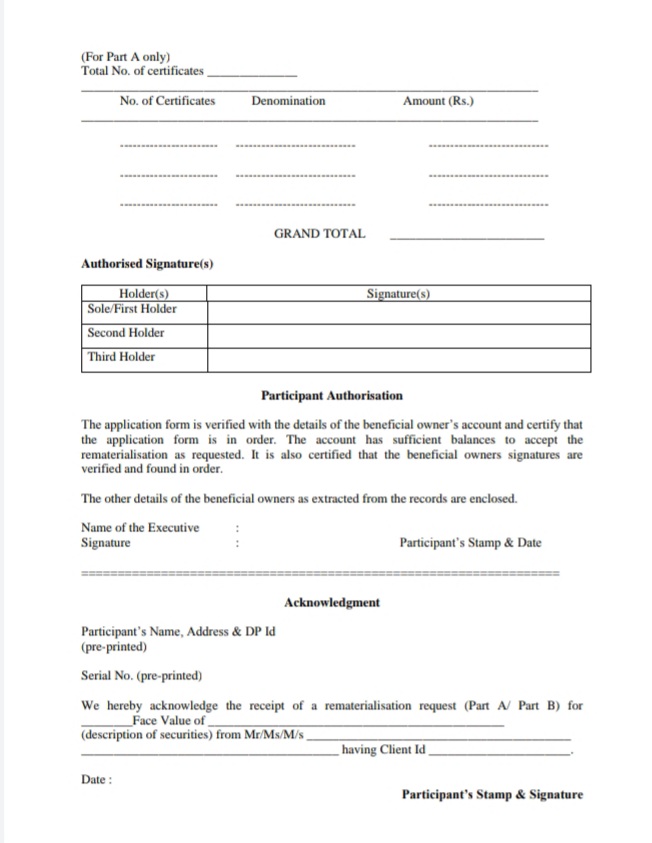

The client need to submit duly filled Rematerialisation Request Form for Government Securities’(RRF-GS) along with a ‘Request Letter for Inter SGL Transfer for Rematerialisation to your #NSDL DP where the govt Bonds are held.

Simultaneously,client are also requested to submit DEMAT req to the respective DP under #CDSL. Based on the REMAT req received,ur DP will generate remat req in NSDL depository system&will provide details of remat req generated to NSDL via email at ipay@nsdl.co.in.

One line thesis for top momentum stocks:

#ADANIGREEN - Largest govt contracts

#LAURUSLABS - Superb Q results, CDMO, Sector Tailwinds

#ALKYLAMINE - Duopoly, Proxy to Pharma(60%) and agroChem(40%) boom

#GMMPFAUDLR - Market leader, MNC, Pharma Proxy

(1/n)

#ADANIGREEN - Largest govt contracts

#LAURUSLABS - Superb Q results, CDMO, Sector Tailwinds

#ALKYLAMINE - Duopoly, Proxy to Pharma(60%) and agroChem(40%) boom

#GMMPFAUDLR - Market leader, MNC, Pharma Proxy

(1/n)

#GRANULES - Pharma boom, API, Cos Moving from China to India for APIs.

#DCAL - CDMO business

#BSOFT - Big wins from the likes of Microsoft, Oracle, etc

#DIXON - Marquee clients like Samsung, Philips, Xiaomi, Proxy to electronics consumption theme in India

(2/n)

#DCAL - CDMO business

#BSOFT - Big wins from the likes of Microsoft, Oracle, etc

#DIXON - Marquee clients like Samsung, Philips, Xiaomi, Proxy to electronics consumption theme in India

(2/n)

#TATACOMM - New investments from FIIs, WFH, Few players left, INet growth

#DHANUKA - Agrochem boom, Asset light business, collaboration with innovators

#AFFLE - Digital consumption growth

#INTELLECT - Financial platform, new product financial services-ready public cloud

(3/n)

#DHANUKA - Agrochem boom, Asset light business, collaboration with innovators

#AFFLE - Digital consumption growth

#INTELLECT - Financial platform, new product financial services-ready public cloud

(3/n)

Did a 11 years #dataanalysis to find out what are some of the well known brands that has gone for #IPO and what would have been the returns if we have bought them on listing day instead of IPO, and hold onto it for a month. #IRCTC #ipoinvestment #investment #nifty #stockstowatch

And here's the list of IPOs and its monthly returns sorted based on recent listing period. #INDIGO #DMART #RBLBANK #INDIAMART #PNB #CDSL #THYROCARE

The detailed article can be accessed from this link squareoff.in/single-post/Bi…

#TweetStorm - Expensive or deserves to be Expensive ? 1)One thumb rule for screening expensive companies is Market Cap to Sales or Enterprise Value to Sales. A 10x or more is generally expensive unless the company can grow sales rapidly or has extremely high Net Profit Margins.

2)Another way to look at expensive is if the Market Cap is equal to the Total Sales of the Addressable Market Size. This would lead to company having to launch different products in the future.

3)May not be the approach to take a Sell Decision or a Short Sell Decision. Very few companies can command such high valuations. Thumb Rule is just to review the investment thesis and the quality of the business. If doubts on quality , get out.