Discover and read the best of Twitter Threads about #EuroZone

Most recents (24)

[1/🧵] A short synopsis of Joachim Nagel's most recent speech on the future of #economic and #monetary union, presented and released by @OMFIF (@OMFIFDMI). 👇

[2/7] Joachim Nagel, a member of the @bundesbank's Executive Board, discusses:

🔸 #Inflation

🔸 #Monetary policy

🔸 #Fiscal development, ...

... among other topics.

🔸 #Inflation

🔸 #Monetary policy

🔸 #Fiscal development, ...

... among other topics.

[3/7] According to Nagel, the ongoing #energy #crisis in #Ukraine has resulted in:

🔸 Greater #inflation

🔸 Higher #energy prices ...

... influencing:

🔸 #Industrial costs

🔸 #Financial insecurity.

🔸 Greater #inflation

🔸 Higher #energy prices ...

... influencing:

🔸 #Industrial costs

🔸 #Financial insecurity.

How is the #UkraineRussiaWar affecting the #EU's prospects? Its economy? Its place in the world?

▫️ Zhang Jian (张健): "It will further weaken the 🇪🇺's strength and int. influence and accelerate its marginalisation in the global geopolitical landscape."

sinification.substack.com/p/the-future-o…

▫️ Zhang Jian (张健): "It will further weaken the 🇪🇺's strength and int. influence and accelerate its marginalisation in the global geopolitical landscape."

sinification.substack.com/p/the-future-o…

🔹The author: Zhang Jian (张健) is the director of the Institute of European Studies at China Institutes of Contemporary International Relations (CICIR) – an influential think tank linked to China’s Ministry of State Security.

cicir.ac.cn/NEW/expert.htm…

cicir.ac.cn/NEW/expert.htm…

🔹Some context: Zhang’s assessment is more pessimistic than some in China, but several of his arguments are in line with those made by other Chinese analysts: e.g. the negative impact that the #war has had on the EU’s quest for #StrategicAutonomy. This is bad news for #China.

The Nomad Scam ⚠️

A Thread 🧵 by and Airline Pilot 🛩 with a 37,000ft view ⛅️

A Thread 🧵 by and Airline Pilot 🛩 with a 37,000ft view ⛅️

Don’t go burning that Passport just yet 🔥

If you’ve spent any time doing deep dives in #fintwit or on YouTube, you’ve likely come across a few people offering you the service of separating you from your money and your US citizenship.

If you’ve spent any time doing deep dives in #fintwit or on YouTube, you’ve likely come across a few people offering you the service of separating you from your money and your US citizenship.

The prominent players in this space use some kind of take on the words #nomad & #Sovereign They boast lavish lifestyles in Banana Republics were you can escape the regime of the United States Government and its tax code.

Donnerstag ist sommerliche Bescherung: #EZB erhöht den #Realzins auf minus 7.5% (und soll damit- so die Kritiker- die #Eurozone in die #Rezession stürzen, als käme die nicht eh) und verkündet ihr „Anti-Fragmentierungs-Programm“, was normale Menschen #Zins Subvention nennen 1/2

#Italien hat sich nicht nur auf über 150% vom #BIP verschuldet, sondern auch noch die #Target II Karte mächtig gezogen (628 Milliarden/30% vom BIP) und das vor allem bei uns Deutschen. Womit das #Erpressung Szenario klar ist. Dabei… 2/3

Brauchen die Italiener uns nicht zu erpressen, weil unsere Regierung schon kapituliert hat bevor es losgeht (siehe #Wahlprogramm #Gruene #SPD , #FDP sträubt sich, wird aber wieder umfallen) 3/4

It is impossible to disentangle Italian debt sustainability from the scope, size and design of the @ecb’s market operations.

Italy’s debt is sustainable if #ECB deems it so through its actions. It is not, if #ECB expresses doubts about its sustainability

A circular question!

Italy’s debt is sustainable if #ECB deems it so through its actions. It is not, if #ECB expresses doubts about its sustainability

A circular question!

Put differently, the ECB and Italy are pathologically co-dependant.

Now that Italy is in the #Eurozone, it’s future depends on the @ECB.

At the same time, an #ECB that out of neglect and inaction, or something worse, sows doubts about #Italy, will bring about its own demise!

Now that Italy is in the #Eurozone, it’s future depends on the @ECB.

At the same time, an #ECB that out of neglect and inaction, or something worse, sows doubts about #Italy, will bring about its own demise!

The @ecb is not your normal #OECD country central bank.

It has a formal “price stability” (#inflation) mandate. But the informal mandate to “hold the #eurozone together” is arguably even more important.

Whenever there is a clash between the two goals, the second will triumph!

It has a formal “price stability” (#inflation) mandate. But the informal mandate to “hold the #eurozone together” is arguably even more important.

Whenever there is a clash between the two goals, the second will triumph!

A few months ago, #markets expected U.S. #inflation to peak by mid-2022 at around 7% to 8% at the headline level and then anticipated that generalized #price gains would decline into year end, closing the year around 4%.

However, the tragic war now unfolding with Russia’s attack upon Ukraine has not only sent #energy prices skyrocketing but it has led to much greater uncertainty over #economic growth and #MonetaryPolicy reaction functions, in Europe and indeed around the world.

Understanding the #Russia #sanctions debate in brief!

Financial and Economic Sanctions against #Iran cutting it off from global finance and trade rank 9/10

#Russian sanctions only 5/10 for now.

A lot of room to tighten the noose, of which cutting off #SWIFT is only one part

Financial and Economic Sanctions against #Iran cutting it off from global finance and trade rank 9/10

#Russian sanctions only 5/10 for now.

A lot of room to tighten the noose, of which cutting off #SWIFT is only one part

Was bedeutet der #UkraineKonflikt für die #Weltwirtschaft ? Thesen in einem Thread:

1. Der Konflikt trifft auf eine fragile Weltwirtschaft.

2. Diese hat sich von #Corona dank massiver staatlicher Hilfen und #Liquiditätsflutung durch die maßgeblichen Notenbanken deutlich erholt.

1. Der Konflikt trifft auf eine fragile Weltwirtschaft.

2. Diese hat sich von #Corona dank massiver staatlicher Hilfen und #Liquiditätsflutung durch die maßgeblichen Notenbanken deutlich erholt.

3. Was aber angesichts der weiter vorhandenen Angebotsstörungen und der schon seit Jahren zu geringen Investitionen in die Erschließung neuer fossiler Energiequellen (auch aufgrund des Drucks in der Klimapolitik) zu Inflationsdruck geführt hat. 2/3

The first day of the #InDivEU Final Conference 'A differentiated future for the European Union?' has just begun🙌

Join Lucia Mokrá (@tepsaeu) and Frank Schimmelfennig (@ETH_en) now for some welcome words!

LIVESTREAMING📹

/🧵

#DifferentiatedIntegration

Join Lucia Mokrá (@tepsaeu) and Frank Schimmelfennig (@ETH_en) now for some welcome words!

LIVESTREAMING📹

/🧵

#DifferentiatedIntegration

.@EnricoLetta, President of the Jacques Delors Institute and former Prime Minister of Italy, will now give the keynote speech covering 3 main topics

✅Timeliness of the discussion

✅The contribution of #Brexit

✅Two examples of successful #DifferentiatedIntegration

/2

✅Timeliness of the discussion

✅The contribution of #Brexit

✅Two examples of successful #DifferentiatedIntegration

/2

#Brexit and the results from the negotiations completely changed the discussion on #DifferentiatedIntegration. Now, there is no more a multi-destination Europe, only a multi-speed Europe.

- @EnricoLetta at #InDivEU Final Conference

Watch live ➡️

/3

- @EnricoLetta at #InDivEU Final Conference

Watch live ➡️

/3

#Italy's Draghi cannot pass promised reforms, says League's Salvini

- Draghi will not be able to enact key reforms demanded by the European Union because his unity government is too divided over the issues, rightist leader Matteo Salvini said on Saturday

in.news.yahoo.com/italys-draghi-…

- Draghi will not be able to enact key reforms demanded by the European Union because his unity government is too divided over the issues, rightist leader Matteo Salvini said on Saturday

in.news.yahoo.com/italys-draghi-…

#Italy’s premier cannot pass promised reforms – rightist leader | May 15, 2021

- “In any case, it won’t be this government that reforms the justice and tax system,” #Salvini told La Repubblica daily,

today.ng/news/world/ita…

- “In any case, it won’t be this government that reforms the justice and tax system,” #Salvini told La Repubblica daily,

today.ng/news/world/ita…

Italy's #Draghi cannot pass promised reforms, says Salvini | May 15

- Draghi has promised Brussels that he will push through an ambitious reform drive to secure more than €200B from the EU recovery fund, aimed at helping countries overcome the coronavirus

reuters.com/world/europe/i…

- Draghi has promised Brussels that he will push through an ambitious reform drive to secure more than €200B from the EU recovery fund, aimed at helping countries overcome the coronavirus

reuters.com/world/europe/i…

ING Bank 1/5: Latest #eurozone production figures are weak, but the future looks bright

Industrial production in the eurozone is being held up by input shortages at the moment. This will lead to weaker growth in the first quarter, but underlying demand is strong and that makes us

Industrial production in the eurozone is being held up by input shortages at the moment. This will lead to weaker growth in the first quarter, but underlying demand is strong and that makes us

ING Bank 2/5: upbeat about prospects for the bloc as it reopens later in the year.

February industrial production showed a decline of 1% compared to January. Production had fully recovered to pre-pandemic levels at the start of the year but dipped back later.

February industrial production showed a decline of 1% compared to January. Production had fully recovered to pre-pandemic levels at the start of the year but dipped back later.

ING Bank 3/5: The decline will mean that the manufacturing contribution to GDP may disappoint a bit given the strong performance seen in the fourth quarter, adding to our view of another GDP contraction in 1Q before the economic rebound starts.

ING Bank 1/4: #Eurozone: Waiting for the European phoenix

1Q21 will not be remembered as the finest hours of European politics. The glacial roll-out of vaccination programmes and the ‘crown jewel’ of the EU’s fiscal stimulus – the EU’s €750bn Recovery Fund –

1Q21 will not be remembered as the finest hours of European politics. The glacial roll-out of vaccination programmes and the ‘crown jewel’ of the EU’s fiscal stimulus – the EU’s €750bn Recovery Fund –

ING Bank 2/4: is gathering dust in a Karlsruhe courtroom stand in stark contrast to the achievements in the US. Yet all is not lost. European manufacturing is holding up well and there are signs of life in the EU vaccine roll-out.

Rabobank 1/9: #CFTC Commitment of Traders Report

Speculators’ net #USD positions held in positive territory for the 4th consecutive week, though overall size dropped moderately along with the softer tone of the greenback in the spot market. Previous to this the market had not had

Speculators’ net #USD positions held in positive territory for the 4th consecutive week, though overall size dropped moderately along with the softer tone of the greenback in the spot market. Previous to this the market had not had

Rabobank 2/9: a run of net long positions since June 2020. The USD has been one of the best performing G10 currencies this year reflecting reflation optimism and a shift in expectations regarding Fed rates policy.

#EUR net longs dropped to their lowest level since March 2020.

#EUR net longs dropped to their lowest level since March 2020.

Rabobank 3/9: Concerns about the speed of the vaccine roll-out programme in #Eurozone have been constraining expectations regarding the economic recovery in the region as fears about a third wave spread. ECB has brought forward bond purchases to push down the level of bond yields

Please tell me if I get the big picture on #Eurozone #QuantitativeEasing right.

1. The EU is a historical political project

2. The #ECB is a child of that project and understandably protects it until its last breath

3. Protecting it means

a) ensuring no member to go bust

1. The EU is a historical political project

2. The #ECB is a child of that project and understandably protects it until its last breath

3. Protecting it means

a) ensuring no member to go bust

On today's Money Talk; President Xi has praised #Shenzhen as an economic miracle & given it the task of leading growth & innovation across the GBA. He called upon young Hong Kongers to work, study & live in mainland #China to “revitalise” ‘one country, two systems.’

1/14

1/14

The #US State Department yesterday formally warned international financial institutions doing business with individuals deemed responsible for undermining #HongKong's autonomy that they could soon face sanctions.

2/14

2/14

#US officials are calling for Ant Group to be blacklisted ahead of its $35bn IPO in Hong Kong & Shanghai. China hardliners in the Trump administration want to deter US investors from taking part in the IPO & say buying shares in the company could expose them to fraud.

3/14

3/14

September #PMI thread (August in brackets) 1/8

🇪🇺 #Eurozone

🇩🇪 #Germany

🇫🇷 #France

🇮🇹 #Italy

🇪🇸 #Spain

🇬🇧 #UK

+ Note on how to read PMI

#economy #recession

🇪🇺 #Eurozone

🇩🇪 #Germany

🇫🇷 #France

🇮🇹 #Italy

🇪🇸 #Spain

🇬🇧 #UK

+ Note on how to read PMI

#economy #recession

🇪🇺 Eurozone PMI 2/8

“With the eurozone economy having almost stalled in September, the chances of a renewed downturn in the fourth quarter have clearly risen"

Composite 50.4 (51.9)

Services 48.0 (50.5)

#Eurozone #PMI

markiteconomics.com/Public/Home/Pr…

“With the eurozone economy having almost stalled in September, the chances of a renewed downturn in the fourth quarter have clearly risen"

Composite 50.4 (51.9)

Services 48.0 (50.5)

#Eurozone #PMI

markiteconomics.com/Public/Home/Pr…

🇩🇪 Germany PMI 3/8

"Growth in the German service sector slowed to a crawl in September, as the rebound in activity from the COVID-19 lockdown continued to lose steam"

Services 50.6 (52.5)

Composite 54.7 (54.4)

#Germany #PMI

markiteconomics.com/Public/Home/Pr…

"Growth in the German service sector slowed to a crawl in September, as the rebound in activity from the COVID-19 lockdown continued to lose steam"

Services 50.6 (52.5)

Composite 54.7 (54.4)

#Germany #PMI

markiteconomics.com/Public/Home/Pr…

🇪🇺 Eurozone #Manufacturing #PMI

#Eurozone manufacturing growth strongest for over two years, 53.7 (August 51.7)

🇩🇪 #Germany 56.4

🇮🇹 #Italy 53.2

🇳🇱 #Netherlands 52.5

🇦🇹 #Austria 51.7

🇫🇷 #France 51.2

🇪🇸 #Spain 50.8

🇬🇷 #Greece 50.0

🇮🇪 #Ireland 50.0

markiteconomics.com/Public/Home/Pr…

#Eurozone manufacturing growth strongest for over two years, 53.7 (August 51.7)

🇩🇪 #Germany 56.4

🇮🇹 #Italy 53.2

🇳🇱 #Netherlands 52.5

🇦🇹 #Austria 51.7

🇫🇷 #France 51.2

🇪🇸 #Spain 50.8

🇬🇷 #Greece 50.0

🇮🇪 #Ireland 50.0

markiteconomics.com/Public/Home/Pr…

🇩🇪 #Germany #Manufacturing #PMI

Sharp increases in output and new orders at end of third

quarter. Job shedding slows, but stocks show further steep declines.

September Manufacturing PMI 56.4 (August 52.2)

markiteconomics.com/Public/Home/Pr…

Sharp increases in output and new orders at end of third

quarter. Job shedding slows, but stocks show further steep declines.

September Manufacturing PMI 56.4 (August 52.2)

markiteconomics.com/Public/Home/Pr…

🇫🇷 #France #Manufacturing #PMI

Business conditions improve amid faster rise in

production. Fractionally quicker increase in new orders

supported by export growth.

September Manufacturing PMI 51.2 (August 49.8)

markiteconomics.com/Public/Home/Pr…

Business conditions improve amid faster rise in

production. Fractionally quicker increase in new orders

supported by export growth.

September Manufacturing PMI 51.2 (August 49.8)

markiteconomics.com/Public/Home/Pr…

September 2020 flash PMI in one thread, in following order

#US 🇺🇸

#UK 🇬🇧

#EuroZone 🇪🇺

#Germany 🇩🇪

#France 🇫🇷

#Japan 🇯🇵

#Australia 🇦🇺

+Note on diffusion indexes like the purchasing managers indexes, or #PMIs.

#economy #recession #recovery

#US 🇺🇸

#UK 🇬🇧

#EuroZone 🇪🇺

#Germany 🇩🇪

#France 🇫🇷

#Japan 🇯🇵

#Australia 🇦🇺

+Note on diffusion indexes like the purchasing managers indexes, or #PMIs.

#economy #recession #recovery

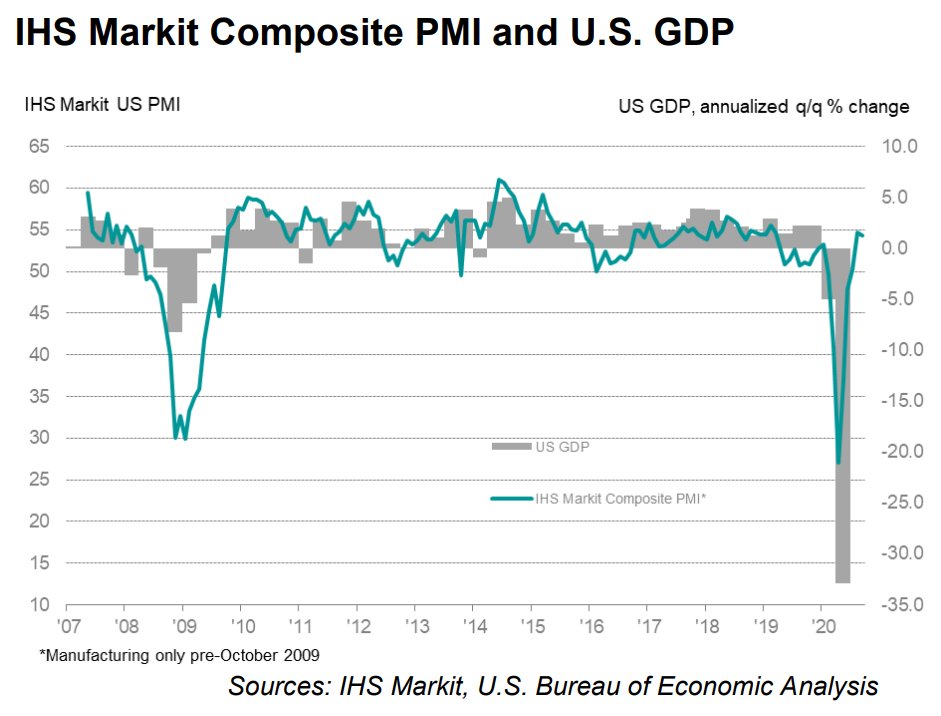

🇺🇸 #US #PMI September 2020 (August)

Solid rise in private sector business activity in September

Composite Output 54.4 (54.6)

Services Business Activity 54.6 (55.0)

Manufacturing PMI 53.5 (53.1)

Manufacturing Output 53.3 (52.7)

markiteconomics.com/Public/Home/Pr…

Solid rise in private sector business activity in September

Composite Output 54.4 (54.6)

Services Business Activity 54.6 (55.0)

Manufacturing PMI 53.5 (53.1)

Manufacturing Output 53.3 (52.7)

markiteconomics.com/Public/Home/Pr…

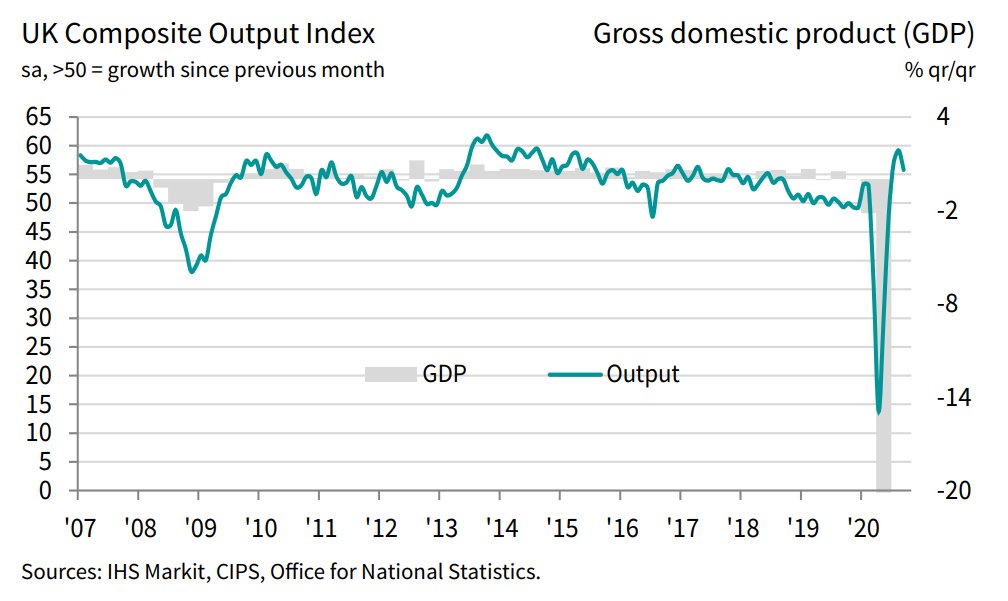

🇬🇧 #UK #PMI September 2020 (August)

Recovery loses momentum and business outlook drops to its weakest since May

Composite Output 55.7 (59.1)

Services Business Activity 55.1 (58.8)

Manufacturing Output 59.3 (61.0)

Manufacturing PMI 54.3 (55.2)

markiteconomics.com/Public/Home/Pr…

Recovery loses momentum and business outlook drops to its weakest since May

Composite Output 55.7 (59.1)

Services Business Activity 55.1 (58.8)

Manufacturing Output 59.3 (61.0)

Manufacturing PMI 54.3 (55.2)

markiteconomics.com/Public/Home/Pr…

The #deficit #myth #deficitmyth by @StephanieKelton #MMT modern monetary theory

Myth N. 1: The #state should budget like a #household

#RealityCheck : unlike a household, a #SovereignNation, which owns its national #centralbank, issues the #currency it spends

Myth N. 1: The #state should budget like a #household

#RealityCheck : unlike a household, a #SovereignNation, which owns its national #centralbank, issues the #currency it spends

Myth N. 2: #deficit is evidence of #overspending

#RealityCheck: look to #inflation for evidence of over spending

#RealityCheck: look to #inflation for evidence of over spending

The purpose of #taxes is not to pay for #government expenditures but to help rebalancing the #wealth distribution #MMT

Recent PMI data in one thread

🇪🇺 Eurozone

🇺🇸 US

🇯🇵 Japan

🇩🇪 Germany

🇬🇧 UK

🇫🇷 France

🇦🇺 Australia

#EuroZone #US #Japan #Germany #UK #France #Australia #PMI #economy #recession

🇪🇺 Eurozone

🇺🇸 US

🇯🇵 Japan

🇩🇪 Germany

🇬🇧 UK

🇫🇷 France

🇦🇺 Australia

#EuroZone #US #Japan #Germany #UK #France #Australia #PMI #economy #recession

🇪🇺 Eurozone growth loses momentum in August

PMI Composite 51.6 (54.9 in July)

Services PMI 50.1 (54.7)

Manufacturing PMI Output 55.7 (55.3)

Manufacturing PMI at 51.7 (51.8)

#EuroZone #PMI #recession

markiteconomics.com/Public/Home/Pr…

PMI Composite 51.6 (54.9 in July)

Services PMI 50.1 (54.7)

Manufacturing PMI Output 55.7 (55.3)

Manufacturing PMI at 51.7 (51.8)

#EuroZone #PMI #recession

markiteconomics.com/Public/Home/Pr…

🇺🇸 US August data pointed to further improvement in

business conditions across the private sector

Composite Output 54.7 (50.3 July)

Services Business Activity 54.8 (50.0)

Manufacturing PMI 53.6 (50.9)

Manufacturing Output 53.9 (51.7)

#US #PMI #recession

markiteconomics.com/Public/Home/Pr…

business conditions across the private sector

Composite Output 54.7 (50.3 July)

Services Business Activity 54.8 (50.0)

Manufacturing PMI 53.6 (50.9)

Manufacturing Output 53.9 (51.7)

#US #PMI #recession

markiteconomics.com/Public/Home/Pr…

First leg #GDP results:

🇬🇧 #UK -20.4

🇪🇸 #Spain -18.5

🇫🇷 #France -13.8

🇮🇹 #Italy -12.4

🇪🇺 #EuroZone -12.1

🇩🇪 #Germany -10.1

🇺🇸 #US -9.5

🇸🇪 #Sweden -8.6

🇫🇮 #Finland -3.2

#recession

ec.europa.eu/eurostat/docum…

🇬🇧 #UK -20.4

🇪🇸 #Spain -18.5

🇫🇷 #France -13.8

🇮🇹 #Italy -12.4

🇪🇺 #EuroZone -12.1

🇩🇪 #Germany -10.1

🇺🇸 #US -9.5

🇸🇪 #Sweden -8.6

🇫🇮 #Finland -3.2

#recession

ec.europa.eu/eurostat/docum…

Euro area sheds half of jobs created since last recession

“...Bet vast sums on a swift economic recovery drawing furloughed employees back to work. Latest data show that progress is slowing, raising the prospect of mass lay offs...”

#EuroZone #recession

bloomberg.com/news/articles/…

“...Bet vast sums on a swift economic recovery drawing furloughed employees back to work. Latest data show that progress is slowing, raising the prospect of mass lay offs...”

#EuroZone #recession

bloomberg.com/news/articles/…

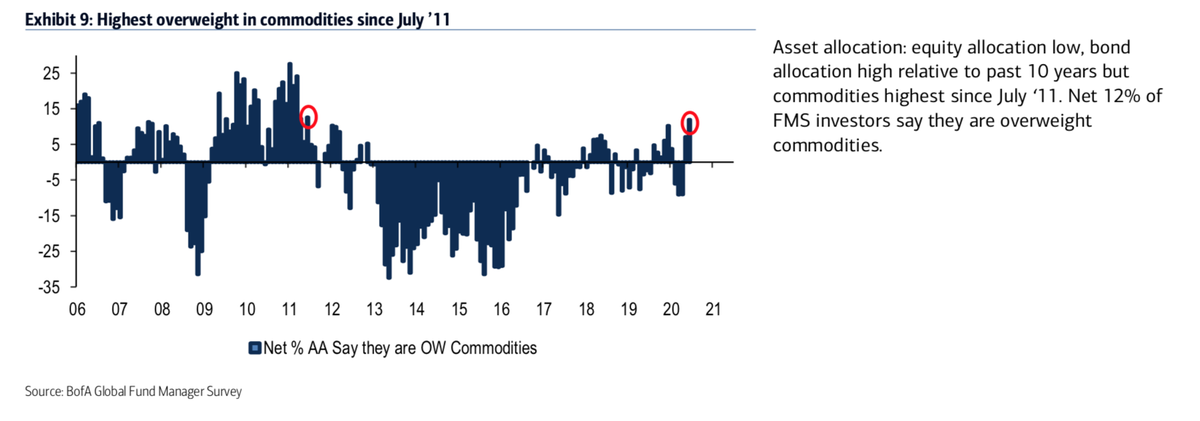

Some take aways from the BoA 'Global Fund Manager Survey'...(1/5) HT @MillennialMacro

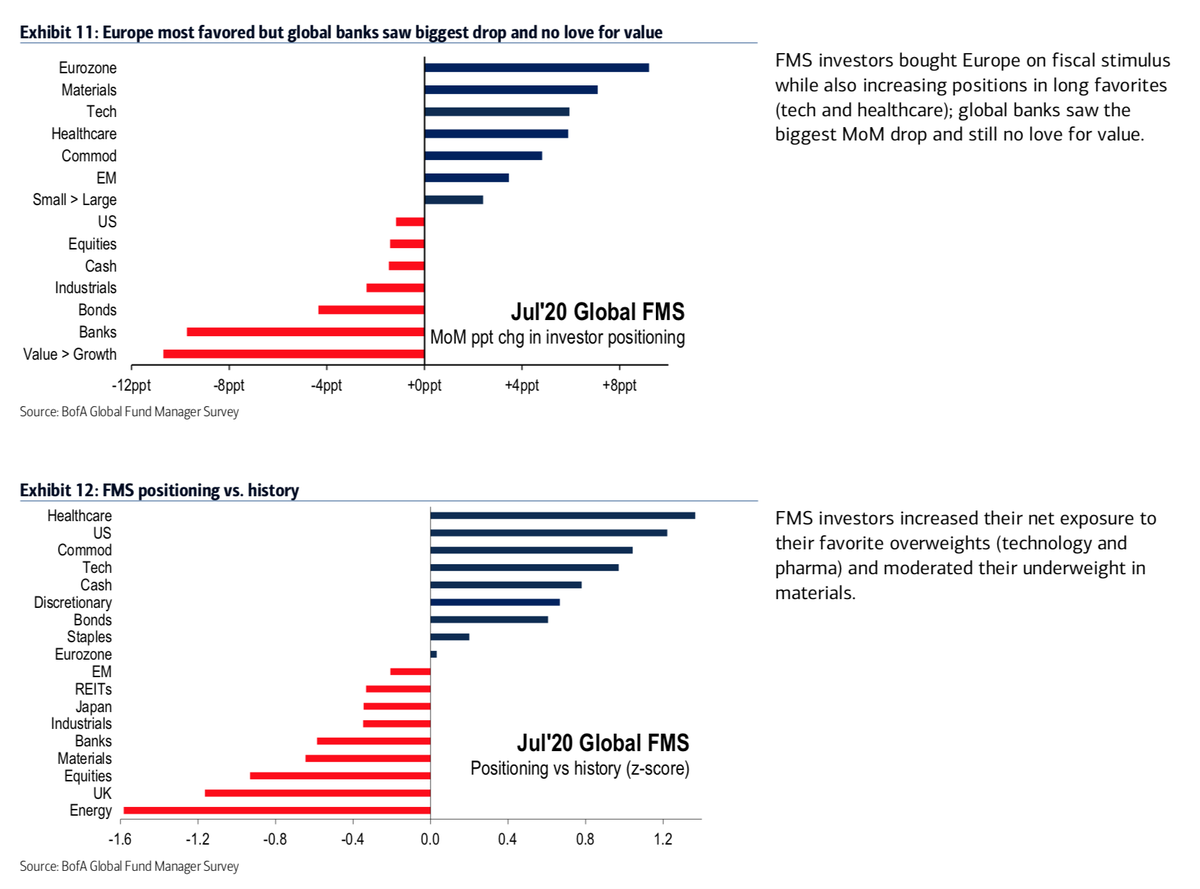

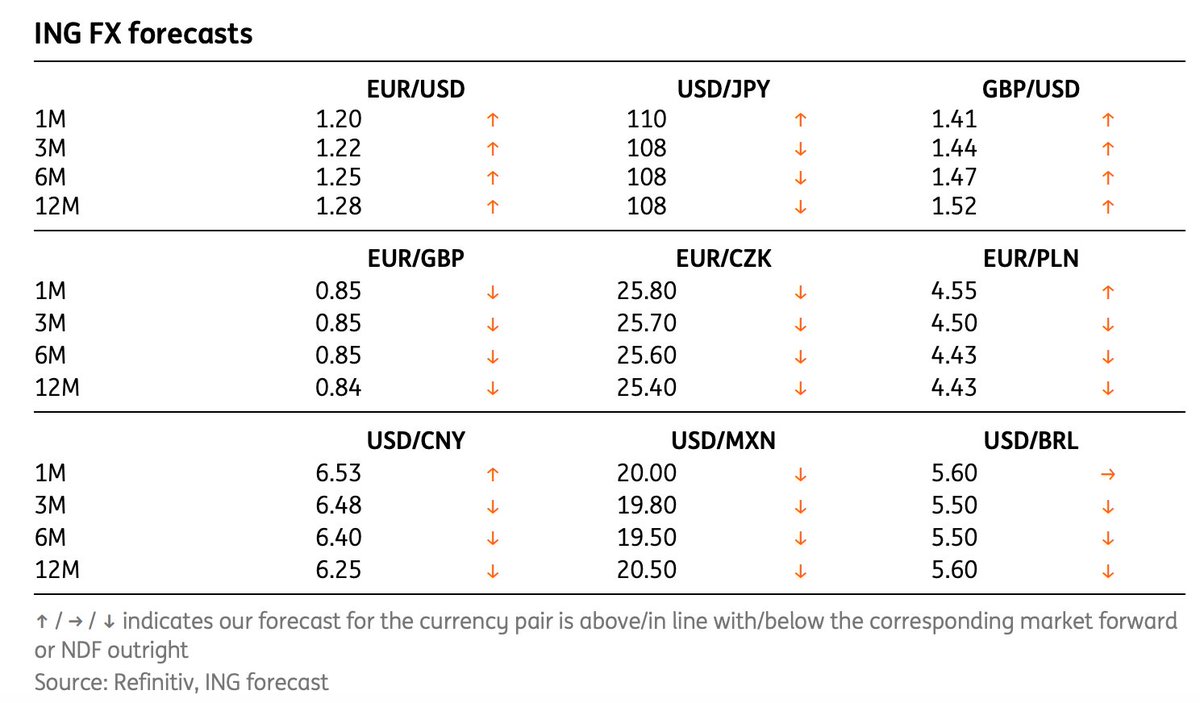

2/5 Global fund manager survey key takeaways...71% think the stock market is overvalued...While still heavily allocated to #US markets, the #EU is most favoured regional equity long & Euro expected to appreciate...#Investing #Macro

3/5 Global funds managers #commodities allocation is the "highest overweight since July 2011"...Most favoured: #Eurozone, #Materials, #Tech, #Healthcare...Not Favoured: 'Value', Global #Banks, #Bonds, #UK & #Energy...#Investing #Macro #AssetAllocation