Discover and read the best of Twitter Threads about #SMEs

Most recents (24)

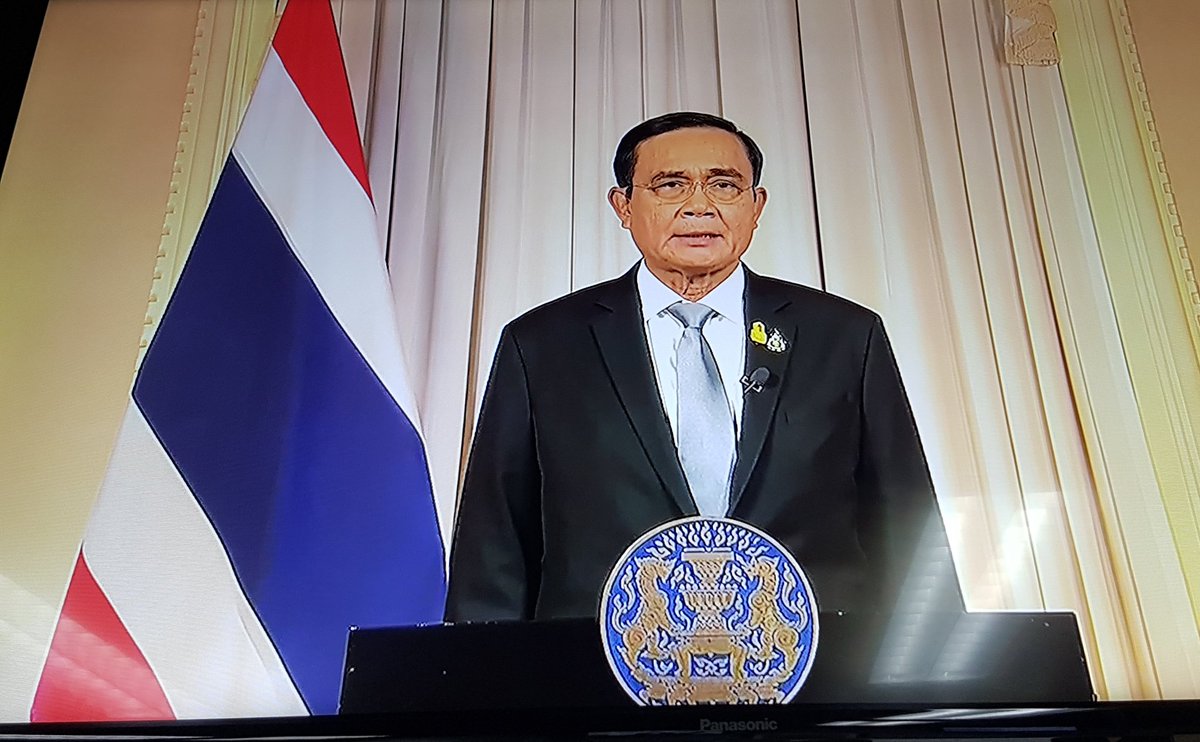

#BRILLIANT CHARTS showing India’s GDP Growth - A Notable #ACHIEVEMENT by #Modinomics

Let’s look at India's nominal GDP that matters to Households & Businesses

EXCLUDING government borrowing & spending) Indians Households & Business Experience ~ZERO GROWTH since 2014-22

Let’s look at India's nominal GDP that matters to Households & Businesses

EXCLUDING government borrowing & spending) Indians Households & Business Experience ~ZERO GROWTH since 2014-22

This contrasts with the period FY 2008-14 when non-government component of GDP accounted for 38% of nominal growth.

Economists believe these animal spirits to be a vital ingredient for high growth of #SMEs & #Businesses

Economists believe these animal spirits to be a vital ingredient for high growth of #SMEs & #Businesses

But you might argue that lots of STARTUPS have created jobs and lots of govt data shows lots of New Business Registrations since 2017

BOTH ARE TRUE but

During these yrs #Farmers, #Unorganised Biz & #SMEs LOST a total of #45-60 MILLION JOBS. So 1-2 Million Startup jobs is a drop

BOTH ARE TRUE but

During these yrs #Farmers, #Unorganised Biz & #SMEs LOST a total of #45-60 MILLION JOBS. So 1-2 Million Startup jobs is a drop

2008 PTSD VS THE GHOSTS OF THE 1970S. @darioperkins writes: While #SVB and its peers were uniquely exposed to COVID bubbles, this latest calamity has highlighted a broader problem in global banking – duration risk. At the start of the year, #centralbanks...

wanted to keep monetary policy “tighter for longer”, with the aim of bringing inflation down in a controlled and gradual manner. Right now, they seem to be losing control of that process. As tensions build, banks – particularly the smaller ones – will restrict credit in a way...

that could have a devasting impact on #SMEs, with powerful knock-on effects to aggregate demand. This will help the authorities to defeat inflation, but in a way that is uncontrolled and intractable, risking unnecessary hardship. Central banks are in a difficult position...

Looking forward to an august panel discussion on how the economy can be reshaped to help better deliver on our #NetZero and #LevellingUp agendas #NEFBriefing

.@Miatsf opens the panel by welcoming the progress that has been made to date in getting finance more interested in #NetZero & #LevellingUp, but there is still progress to be made - for example, low levels of investment in #SMEs despite them being drivers of growth #NEFBriefing

First speaker @JosephEStiglitz discusses how to use the credit system to accelerate a green transition. Says historically financial institutions have made "strong statements" about wanting a green portfolio, but critics fear this may just be "greenwashing" #NEFBriefing

I'm waking up at 5:45 tomorrow and gonna check this Webinar out.💪

Gotta do what you gotta do to get the scoop.

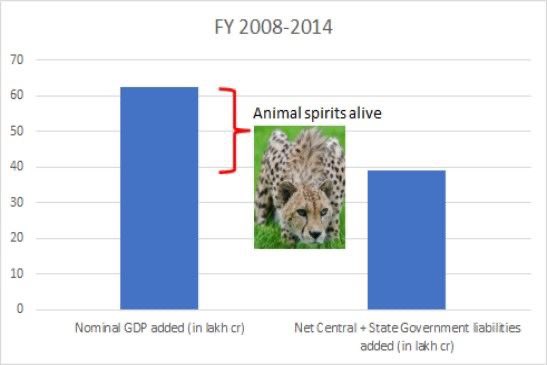

#MLETR #dDOC #ITFA $XDC #DNI_Initiative #TFD_Initiative #TradFi #RegTech #SMEs #UNCITRAL #digitalization #4IR #Trade

Gotta do what you gotta do to get the scoop.

#MLETR #dDOC #ITFA $XDC #DNI_Initiative #TFD_Initiative #TradFi #RegTech #SMEs #UNCITRAL #digitalization #4IR #Trade

Free deep knowledge for you all🌎🌱

#MLETR is a standard that is set by @UNCITRAL_RCAP for dDOC's globally which provides interoperability between SMEs & trade finance companies.

It allows ERC-20 @tradetrust & $XDC @XinFin_Official

dDOCs to interoperate flawlessly

#XDC #DLT

#MLETR is a standard that is set by @UNCITRAL_RCAP for dDOC's globally which provides interoperability between SMEs & trade finance companies.

It allows ERC-20 @tradetrust & $XDC @XinFin_Official

dDOCs to interoperate flawlessly

#XDC #DLT

The basics of #MLETR

It's the start of the standardization of the digital document revolution in the global trade finance/supply chain

It's boring & technical but if you want to understand the digital revolution, it's a good topic to research

@ITFAworldwide @tradetrust @iccwbo

It's the start of the standardization of the digital document revolution in the global trade finance/supply chain

It's boring & technical but if you want to understand the digital revolution, it's a good topic to research

@ITFAworldwide @tradetrust @iccwbo

#SriAgenda abt to start 💥 #Nov17 at 10am CET

🟢 Italian #SMEs and #sustainability #reporting | w/in #SettimanaSRI by @ItaSIF

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance #impinv @SRI_Natives @SriEvent_It @andytuit

🟢 Italian #SMEs and #sustainability #reporting | w/in #SettimanaSRI by @ItaSIF

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance #impinv @SRI_Natives @SriEvent_It @andytuit

@ItaSIF @SRI_Natives @SriEvent_It @andytuit #SriAgenda just started ⚡ #Nov17

about 700 people are attending this webinar, that proves today's topic is crucial, says @fbicciato1 Secretary General @ItaSIF in his opening remarks

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance

about 700 people are attending this webinar, that proves today's topic is crucial, says @fbicciato1 Secretary General @ItaSIF in his opening remarks

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance

@ItaSIF @SRI_Natives @SriEvent_It @andytuit @fbicciato1 congratulations for sharing the knowledge and raising awareness of #sustainablefinance, the 20th anniversary @ItaSIF is celebrating this year is impressive, says Ulla Hudina-Kmetic, Deputy Head of Unit, DG GROW

#SettimanaSRI #sri #esg #responsibleinvestment #greenfinance

#SettimanaSRI #sri #esg #responsibleinvestment #greenfinance

#SriAgenda starting now 💥 #July5 3pm CEST

What it means for corporations | 3rd in a series of 6 webinars (until #July19) by The EU Platform on #SustainableFinance

Hosted by @ClimateBonds

zoom.us/webinar/regist…

#eutaxonomy #sri #esg #climatecrisis @SRI_Natives @andytuit

What it means for corporations | 3rd in a series of 6 webinars (until #July19) by The EU Platform on #SustainableFinance

Hosted by @ClimateBonds

zoom.us/webinar/regist…

#eutaxonomy #sri #esg #climatecrisis @SRI_Natives @andytuit

@ClimateBonds @SRI_Natives @andytuit about 1,500 partcipants registered for today's webinar, says Mr #GreenBonds @seankidney in his opening remarks

#eutaxonomy #corporations #eupsf

#eutaxonomy #corporations #eupsf

@ClimateBonds @SRI_Natives @andytuit @seankidney the recording of the webinar will be soon available on @ClimateBonds' #Youtube channel, notes @seankidney

#eutaxonomy #corporations #eupsf

#eutaxonomy #corporations #eupsf

Opposition Day Debate - 'Local involvement in planning decisions' is about to start and can be watched, here: parliamentlive.tv/Event/Index/51…, as well as on the BBC Parliament channel.

A thread about what members have said (and some opinions)

#HousingCrisis

A thread about what members have said (and some opinions)

#HousingCrisis

Steve Reed MP is up, suggesting that local government and local people will lose the ability to object to planning applications (not true btw & nothing released yet).

An intervention sees Mr Reed cite 1million unbuilt homes. (he's wrong).

builtplace.com/digging-deeper…

An intervention sees Mr Reed cite 1million unbuilt homes. (he's wrong).

builtplace.com/digging-deeper…

Mr Reed is saying that the government will concrete over communities and developers who have contributed to the party and reform is a developers charter.

Tell that the 99.9% of builders classed as #SMEs, who dont get allocated by local councils (not the Government).

Tell that the 99.9% of builders classed as #SMEs, who dont get allocated by local councils (not the Government).

Today, would like to share the thought process and inspiration behind building the South Gujarat's first #Coworking @ikoverk

Coworking Spaces are Plug and Play offices for #Startups, #Freelances, #Consultants and #SMEs but we wanted to build something more- a Community (1/n)

Coworking Spaces are Plug and Play offices for #Startups, #Freelances, #Consultants and #SMEs but we wanted to build something more- a Community (1/n)

As you enter, you with find a Large Front desk with volunteers to guide you and onboard you for a 7 Days Free Trial amidst the aroma of Coffee and chirping of fellow coworkers discussing new ideas.

#Connect #Collaborate #Celebrate is the motto.

#Connect #Collaborate #Celebrate is the motto.

On the Front desk, you fill an intuitive Map of @ikoverk along with Sign which reads - "Remember, when you enter the door to the Right, you will enter the War Room" because everyone here is a hustler, an innovator and a true warrior.

The 2021 Africa's Business Heroes competition is open! #ABH aims to identify, support and inspire the next generation of African entrepreneurs who are making a difference in their local communities, working to solve the most pressing problems, and building a more sustainable

and inclusive economy for the future.

Applications are open in #English and #French to entrepreneurs from all African countries, all sectors, and all ages who operate businesses formally registered and headquartered in an African country, and that have a 3 year-track record.

Applications are open in #English and #French to entrepreneurs from all African countries, all sectors, and all ages who operate businesses formally registered and headquartered in an African country, and that have a 3 year-track record.

Finalists receive invaluable training and mentorship, and the opportunity to network with ABH’s growing community of talented and inspiring minds and will pitch their business to a global panel of legendary judges to win a share of the $1.5 million (USD) award.

We want to move @SafaricomPLC from being just a #telco with a #payment #platform #MoMo #mobilemoney #Mpesa to a #technology #company. Going into areas that are more #solutions oriented ... a #lifestyle brand for #individuals, and an empowering #brand for #SMEs – @PeterNdegwa_

The #agile way of working is not new since it has been implemented by global #media and #online companies such as @netflix #netflix and @amazon #amazon

“What we are doing now is to #scale. Not everyone will go fully #agile, since departments like #Finance will still operate largely in its traditional way. But those that will be affected will be in the #frontend side of the company such as the #marketing and #technology teams.

Financial development in China is ushering in a historical period of opportunities, said Fan Yifei, Deputy Governor of the PBOC, at the 2nd Bund Summit: 1/8

cf40.com/en/news_detail…

He explained in the following 4 perspectives:

cf40.com/en/news_detail…

He explained in the following 4 perspectives:

1. Dual circulation calls for high-quality financial development. The key to a smooth domestic economic cycle is a smooth supply-demand circulation and the release of internal forces. 2/8

The financial industry needs thorough digitization and independent innovation, with technologies driving qualitative growth, so as to help enterprises, particularly #SMEs, better connect to the domestic economic cycle. 3/8

10 measures proposed by Zhang Xiaohui, former assistant governor of the #PBC, to promote the #dualcirculation in financial services: mp.weixin.qq.com/s/tErN3tDdScZR…

1. Properly position the financial sector against the new backdrop featuring “dual circulation”. China’s financial system needs to step up a new wave of upgrade and reform. It should give direct #financing a bigger play based on technological innovations.

2. Financial supply-side structural reform shall continue to play a core role. China needs to improve twin-pillar regulatory framework (monetary¯oprudential policies) and make monetary policies more flexible; develop multi-tier capital market; boost #RMB internationalization.

China recently cut the upper limit on private lending interest rates protected by law,capping it at four times China’s one-year LPR.The efforts to lower maximum legal private lending interest rates need to respect market rules,said @YipingHuangPKU1: new.cf40.org.cn/uploads/202009… 1/5

Lowering the judicially protected ceiling would help drive down the interest rate in private lending and is in line with the policy goal of reducing costs of social financing. However, the ceiling should not be lowered by too much or too fast. 2/5

Efforts to adjust the cap on the interest rates need to strike a balance between lowering financing costs for SMEs and energizing private lending. At the end of the day, a basic condition for the financial system to work soundly is market-based risk pricing. 3/5

China’s industrial sector will likely see a surge as it is recovering more quickly than service sector. Three signs point to its likely occurrence, according to Xu Qiyuan:

new.cf40.org.cn/uploads/202008… 1/5

new.cf40.org.cn/uploads/202008… 1/5

Sign Ⅰ: The recovery of industrial production has been obviously better than that of service sector overall 2/5

Sign II: The performance of #SMEs shows that recovery of the industrial sector surpasses that of the service sector 3/5

The Chinese economy has significantly picked up, but different sectors have shown different performances: exports see stronger growth than domestic demands, production recovers better than demands, and the second industry is doing better than the tertiary industry...1/7

With the pandemic still posing risks, it is very likely that China’s net export will fall again in 2H20, while consumers are expected to remain cautious given the risk of virus striking back and income taking blows, future economic growth face mounting uncertainties...2/7

Three basic judgements on #China's macroeconomic data in Q2 by Gao Shanwen:

1. The industrial sector has basically recovered from the #pandemic's wounds, and economic activities have stabilized at a bit lower than the pre-pandemic level...1/4

1. The industrial sector has basically recovered from the #pandemic's wounds, and economic activities have stabilized at a bit lower than the pre-pandemic level...1/4

2. #SMEs still face difficulties in resuming their normal activities, while the #unemployment pressure sustains. The unemployment situation is especially worrisome in low-end labor-intensive sectors...2/4

Among the proofs are the negative yoy growth in the social retailing sales by businesses under designated scale, sluggish rebound in the consumer-oriented service sector, and the sharp fall in the growth rate of average monthly #income of rural migrant workers in Q2...3/4

#China stocks roar on, with #CSI300 up ~20% in little more than a week as (official) #margin debt climbs Y150bln to touch Y1.3 trillion - levels only seen in the peak months of 2015's madness.

Worth noting a rejection here could mean the Jan'19 formation is complete.

#SHFE #SHSZ

Worth noting a rejection here could mean the Jan'19 formation is complete.

#SHFE #SHSZ

Our Digital Conversation on the Future of #Fintech in Southeast Asia is co-hosted by @ASEAN_BAC in partnership with @cityoflondon to provide an understanding of the fintech landscape and the opportunities that lie ahead is now live. See: ukabc.org.uk/event/the-futu…

Baroness @LNevilleRolfe Chair of @UKASEAN in her welcome remarks notes the many opportunities for #fintech in #ASEAN

Dr Doan Duy Khuong, Chair @ASEAN_BAC delivers welcome remarks and highlights the ASEAN BAC recommendations to the Leaders in response to the crisis recommending the establishment of a High Level Special Commission to hear from business. #UKASEAN

[THREAD - KEY SUMMARY]

European Business in China - Business Confidence Survey 2020 by @EuropeanChamber

Summary based on the report and our #podcast interview with Charlotte Roule - Vice President of the European Chamber.

Podcast coming out June 11th.

European Business in China - Business Confidence Survey 2020 by @EuropeanChamber

Summary based on the report and our #podcast interview with Charlotte Roule - Vice President of the European Chamber.

Podcast coming out June 11th.

0/ SAMPLE

📍Company Size

~50% <250 employees

~30% >1k employees

~20% in between

JVs employees not counted

📍Sector

~30% professional services

~35% industrial goods

~21% consumer goods

Rest - specific (e.g. agriculture)

📍% in tweets refer to answers by the Chamber's members

📍Company Size

~50% <250 employees

~30% >1k employees

~20% in between

JVs employees not counted

📍Sector

~30% professional services

~35% industrial goods

~21% consumer goods

Rest - specific (e.g. agriculture)

📍% in tweets refer to answers by the Chamber's members

4 risks worth special attention in #China’s #economy and financial sector currently, said Liu Yuanchun:

1. Growing bad debts have placed greater strains on the capital replenishments of small and mid-sized financial institutions.

new.cf40.org.cn/uploads/202006…

1. Growing bad debts have placed greater strains on the capital replenishments of small and mid-sized financial institutions.

new.cf40.org.cn/uploads/202006…

2. The budgets of local governments are under huge pressure due to the pandemic, adding to the risks of ballooning government debts and implicit debts.

3. The macro leverage ratio may swell in the foreseeable future, so China needs to think about how to cushion its negative impacts and handle the consequent spike in the pressure to repay principals and interests.

Personal #tradeXpresso thread: Today is a special day, as it’s been more than 10 years since I’m doing my current job. Before turning a professional page, it’s time to look back at the difference the #ChiefEconomist team and I made in @Trade_EU. At least 10 things came to mind:

1. #SMEs were not seen as important. Now they are key for @Trade_EU! econpapers.repec.org/paper/risdgtce…

2. #Services trade data didn’t have #ModesOfSupply! Now they do! Thanks to @EU_Eurostat @wto @RBKoopman @riina_kerner trade.ec.europa.eu/doclib/docs/20…

#Thailand #PM @prayutofficial in televised speech insists he won't hasten to allow tourists back yet as nation needs to be absolutely sure in controlling virus 1st. Says must have balanced approach to tackling economic & health impact. Many have called for more easing of measures

#China’s economic recovery is about to break the ice. As external shocks loom large, it’s more urgent than ever for China to boost its demands with all means to resume and stabilize its economic cycle.

mp.weixin.qq.com/s/FSDA2NxawhgH…

mp.weixin.qq.com/s/FSDA2NxawhgH…

According to statistics for April, despite pickup in #demand side performance, it’s still 1.7-2.7% lower than the resumption of the #supply side, so the demand gap is evidently widening.

Besides, the further decline in #price parameter shows that insufficient demand is becoming more of a problem and the biggest obstacle to resuming economic activities.

1/4 Ministry of Finance and #SBP introduce risk-sharing mechanism to support bank lending to #SMEs and small businesses to avail SBP’s Refinance Facility to Support Employment. For details: sbp.org.pk/press/2020/Pr-…

2/4 Federal Government allocates Rs30 billion under a credit risk sharing facility for the banks spread over four years to share the burden of losses due to any bad loans in future.

3/4 Under this risk sharing arrangement, Federal Government will bear 40% first loss on principal portion of disbursed loan portfolio of the banks.