Discover and read the best of Twitter Threads about #TradFi

Most recents (24)

Alright, here's my tl;dr thread on the extremely bullish latest Partnerships meeting with the $CHEQ team.

If you don't know them yet, well done on finding this thread. They are a #cosmos project focused on #DigitalID, like #PolygonID or #worldcoin (but way less dystopian.

If you don't know them yet, well done on finding this thread. They are a #cosmos project focused on #DigitalID, like #PolygonID or #worldcoin (but way less dystopian.

The recent meeting was held with Head of Partnerships Tobias Halloran and @OfMiklos - a $QNT legend who truly gets the $CHEQ value proposition.

@cheqd_io are a #DiD project focused on creating #TrustedDataMarkets - that is, creating a way to monetize the enforced changes being brought in by the EU's #eIDAS legislation.

The new model of #DigitalID mandates the use of data wallets in which users maintain their control.

The new model of #DigitalID mandates the use of data wallets in which users maintain their control.

The #DeFi space is constantly evolving and a hot sector recently has been stable coin farming.

One protocol offers competitive stable coin yields without competing with any of the other protocols, @Stablzone 🧠

$STBLZ is revolutionizing stable coin farming, a 🧵 👇

One protocol offers competitive stable coin yields without competing with any of the other protocols, @Stablzone 🧠

$STBLZ is revolutionizing stable coin farming, a 🧵 👇

@Stablzone . @Stablzone is a stable coin farming protocol built on top of popular yield farms such as Curve | $CRV

$STABLZ is not competing with but enhancing other yield protocols.

Being built on protocols such as Curve, $STABLZ can manage users' yield farming and offer a range of perks

$STABLZ is not competing with but enhancing other yield protocols.

Being built on protocols such as Curve, $STABLZ can manage users' yield farming and offer a range of perks

@Stablzone Using their own smart contracts users staking through @Stablzone can protect their funds with:

🔸 Depeg protection

🔸 Emergency Withdrawals

🔸 Periodic Autoclaim

🔸 Depeg protection

🔸 Emergency Withdrawals

🔸 Periodic Autoclaim

I've not removed funds from #Celsius, since early 2021.

I completely, reject this insidious and threatening legal over-reach. The committee's and its council's job, is to protect creditors, not set the dogs on them!

This gives precedent to attack other #Celsius creditors.

I completely, reject this insidious and threatening legal over-reach. The committee's and its council's job, is to protect creditors, not set the dogs on them!

This gives precedent to attack other #Celsius creditors.

You don't protect creditors by attacking other creditors. (ponzi)

If it happens once, it will happen again. (if one asset is revalued, others will follow)

Kelvin showed there is no need for clawbacks, therefore this is a calculated legal maneuver. (precedent)

If it happens once, it will happen again. (if one asset is revalued, others will follow)

Kelvin showed there is no need for clawbacks, therefore this is a calculated legal maneuver. (precedent)

1: This one time I was in a 7/11 when it got robbed, and they didn't catch the owner/gunman, but they arrested me, because I was a customer of the store.

With promising new projects promising cross-chain capabilities, many people overlook the OGs in the space and what they're doing: Enter @chainlink, building #CCIP.

And they've already got a major player using it: @swiftcommunity

Here's how it'll be a game changer 👇

1/🧵

And they've already got a major player using it: @swiftcommunity

Here's how it'll be a game changer 👇

1/🧵

#CCIP stands for Cross-Chain Interoperability Protocol, and it allows developers to build Omnichain-capable dApps.

This means that the days of having to integrate every single chain individually are over.

2/🧵

This means that the days of having to integrate every single chain individually are over.

2/🧵

It opens up a myriad of possibilities for users too! All the hassle of having to use unsafe bridges/shady CEXes just to get into a new chain? Gone.

Here are some examples of how it'll completely change user experience in #DeFi:

3/🧵

Here are some examples of how it'll completely change user experience in #DeFi:

3/🧵

1/

#TradFi systems are based on outdated solutions.

They're slow, expensive, restrictive and fail to meet the needs of the world today.

@veloprotocol addresses these issues by merging the #TradFi infrastructure with #Web3 technology.

Let's take a closer look.

$VELO 🧵

#TradFi systems are based on outdated solutions.

They're slow, expensive, restrictive and fail to meet the needs of the world today.

@veloprotocol addresses these issues by merging the #TradFi infrastructure with #Web3 technology.

Let's take a closer look.

$VELO 🧵

2/

It needs to be said that completely uprooting the current financial system would bring more harm than good.

#VELO chooses to improve the existing infrastructure, make it more accessible, rather than attempt to overthrow it.

Cooperation over competition. Sensible and mature.

It needs to be said that completely uprooting the current financial system would bring more harm than good.

#VELO chooses to improve the existing infrastructure, make it more accessible, rather than attempt to overthrow it.

Cooperation over competition. Sensible and mature.

3/

What solutions does #VELO intend to bring to the table?

1. #Decentralized settlement network

A secure and fast way for people to transfer value directly to each other without intermediaries or centralized control, which offers greater security, transparency, and speed.

What solutions does #VELO intend to bring to the table?

1. #Decentralized settlement network

A secure and fast way for people to transfer value directly to each other without intermediaries or centralized control, which offers greater security, transparency, and speed.

1/23 It's easy to find bullish and bearish elements in the charts to fit you bias, but being a maxi can be risky. Remember:

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset.

3/23 The #GoldenCross printed and the #DeathCross between the 200 & 50 WMA's is coming on the next candle. Knowing why we have conflicting signals isn't as critical as knowing how price will react, but if I had to guess, I'd say, short term manipulation.

#1 RWA have traditional financial assets as their underlying with a focus on yield assets (bonds, real estate, bond investment funds, ETFs, etc.)

#2 RWA will contribute to improve financial inclusion.

#2 RWA will contribute to improve financial inclusion.

#3 RWA will bring #DeFi and #Cryptos to the next level of adoption. @matthew_sigel , head of crypto research at @vaneck_us expects that #RWA grow to $10bn market in 2023.

🧵 Things are hotting up for @FactorDAO. The public sale on @CamelotDEX is coming up fast in 5 weeks (announcement soon!).

Here's a recap on what $FCTR is all about and some sneak peaks into what's going on behind the scenes (plus some alpha if you read to the end) 👀 1/14

Here's a recap on what $FCTR is all about and some sneak peaks into what's going on behind the scenes (plus some alpha if you read to the end) 👀 1/14

❓ Let's simplify exactly what @FactorDAO is!

It's bringing the multi-trillion $ asset management sector on-chain for #DeFi.

No code vault creation utilizing any asset to create any type of strategy.

One click deposit and passive #realyield generation for investors. 2/14

It's bringing the multi-trillion $ asset management sector on-chain for #DeFi.

No code vault creation utilizing any asset to create any type of strategy.

One click deposit and passive #realyield generation for investors. 2/14

🕴️ In #TradFi the average person does not have the time or knowledge to invest effectively.

Instead they invest in indices, or ETFs, or give their money to an asset manager or hedge fund.

The objective is to deposit money, let a professional manage it, and receive returns. 3/14

Instead they invest in indices, or ETFs, or give their money to an asset manager or hedge fund.

The objective is to deposit money, let a professional manage it, and receive returns. 3/14

Crypto #options must overcome a massive demand gap for it to be a meaningful on-chain sector, and we are nowhere near there.

Here is a simple mental model to ponder over the demand for crypto options. 🧵 👇

/1

Here is a simple mental model to ponder over the demand for crypto options. 🧵 👇

/1

#Options have traditionally played second fiddle to the spot and futures market in crypto.

However, we are witnessing an increase in interest in options lately as protocols like @dopex_io @ribbonfinance @lyrafinance @opyn_ @PremiaFinance are gaining traction within CT.

/2

However, we are witnessing an increase in interest in options lately as protocols like @dopex_io @ribbonfinance @lyrafinance @opyn_ @PremiaFinance are gaining traction within CT.

/2

In the world of #DeFi yield protocols, developers and users typically need to make a choice:

Do you want high #yields 🍏?

OR

Do you want low #risk 🍎?

1/10🧵

Do you want high #yields 🍏?

OR

Do you want low #risk 🍎?

1/10🧵

🍏In most existing leveraged yield farms, higher yield comes from higher leverage and higher risk.

As a result, only users who do frequent position adjustments survive. Degen in, degen out. 😮💨

And those who don't manage their positions?

High chance of rektness.

2/10 🧵

As a result, only users who do frequent position adjustments survive. Degen in, degen out. 😮💨

And those who don't manage their positions?

High chance of rektness.

2/10 🧵

1/ How do you build resilience as a stablecoin protocol?

Peg stability, sound monetary policy, and ample liquidity.

What if you could algorithmically program these characteristics AND survive a $900M supply shock?

@fraxfinance did. Here’s how ⬇️

Peg stability, sound monetary policy, and ample liquidity.

What if you could algorithmically program these characteristics AND survive a $900M supply shock?

@fraxfinance did. Here’s how ⬇️

2/ To understand the intricacies of @fraxfinance’s monetary policy, we must first understand the basics of $FRAX as a stablecoin.

3/ $FRAX is a fractional algorithmic stablecoin pegged to USD. It is minted/redeemed through a combination of $USDC and $FXS, @fraxfinance’s governance token.

Crypto Has A Bad Name Because:

1. 99% of #DLT Tokens Are Scams W/ No Utility🚨

2. 79% of Crypto Influencers Are💰Motivated & Invest On Hype

3. Mainstream Media Says It's💩

This Should NOT Distract You From The Technology Transformation Currently Taking Place.

-A 🧵 of Threads-

1. 99% of #DLT Tokens Are Scams W/ No Utility🚨

2. 79% of Crypto Influencers Are💰Motivated & Invest On Hype

3. Mainstream Media Says It's💩

This Should NOT Distract You From The Technology Transformation Currently Taking Place.

-A 🧵 of Threads-

1/ The world's largest crypto lender is collapsing.

Genesis, under DCG, is ironically the latest victim of the FTX contagion after publishing Alameda Research's balance sheet via Coindesk (DCG's subsidiary).

The contagion has come full circle. Here's what you need to know ⬇️

Genesis, under DCG, is ironically the latest victim of the FTX contagion after publishing Alameda Research's balance sheet via Coindesk (DCG's subsidiary).

The contagion has come full circle. Here's what you need to know ⬇️

2/ The parent company of @Grayscale & @GenesisTrading, @DCGco, is having liquidity issues & seeking a $1B emergency loan.

Before we dive into the details & ramifications, we must understand who’s involved & what their roles are.

Before we dive into the details & ramifications, we must understand who’s involved & what their roles are.

1/ Want top-tier insight minus the top-tier effort?

These analytics tools will tell you about #cryptos in macro perspective, DeFi protocols & asset management🧵

#Web3 #DeFi #Blockchain #Crypto

These analytics tools will tell you about #cryptos in macro perspective, DeFi protocols & asset management🧵

#Web3 #DeFi #Blockchain #Crypto

1/ @nansen_ai

As the leading #blockchain analytics platform, Nansen enriches on-chain data with wallet labels.

Key tools include portfolio tracking, smart money dashboard, institutional money transfer, smart alerts & more in the field of blockchains, DeFi, #stablecoins & #NFTs.

As the leading #blockchain analytics platform, Nansen enriches on-chain data with wallet labels.

Key tools include portfolio tracking, smart money dashboard, institutional money transfer, smart alerts & more in the field of blockchains, DeFi, #stablecoins & #NFTs.

Check out the thread by @blocksaurus1152 to learn about the features of Nansen.

🧵 👇🏻👇🏻👇🏻

1/ Our global financial market infrastructure (FMI) is underpinned by a number of systems that are the glue that holds our financial markets together.

2/ The #FED reserve defines them as the "multilateral systems among participating financial institutions, including the system operator, used for the purposes of clearing, settling, or recording payments, securities, derivatives, or other financial transactions."

1/ In less than 3 mos., @WombatExchange firmly sits at #3 in the list of DEXes on #BNBChain, with an ATH TVL of US$220m.

A $10m swap only incurs $4.7k slippage vs $2.5m on #Pancakeswap.

How is this possible?

🧵A thread on how Wombat is re-engineering the stableswap experience

A $10m swap only incurs $4.7k slippage vs $2.5m on #Pancakeswap.

How is this possible?

🧵A thread on how Wombat is re-engineering the stableswap experience

2/ What is @WombatExchange?

Wombat is a low slippage, hyper efficient stableswap built on #BNBChain. Its TVL currently sits at US$178m, comprised of stablecoins and $BNB liquid staking derivatives.

Wombat is a low slippage, hyper efficient stableswap built on #BNBChain. Its TVL currently sits at US$178m, comprised of stablecoins and $BNB liquid staking derivatives.

We’re constantly thinking about how to increase #TradFi to #DeFi adoption.

Adoption which benefits not only $REBUS holders but also the #Cosmos ecosystem as a whole.

Introducing LUDUS, a token dedicated to the emerging P2E scene and our partners 🧵 ↓

medium.com/@RebusChain/lu…

Adoption which benefits not only $REBUS holders but also the #Cosmos ecosystem as a whole.

Introducing LUDUS, a token dedicated to the emerging P2E scene and our partners 🧵 ↓

medium.com/@RebusChain/lu…

Gaming is a revolution that started back in the 80's.

It's since exploded into a multi-billion dollar industry and with the rise of Play-to-Earn, it's coming to Web3.

To capitalize on this emerging market, we created LUDUS, a token dedicated to the upcoming genre.

It's since exploded into a multi-billion dollar industry and with the rise of Play-to-Earn, it's coming to Web3.

To capitalize on this emerging market, we created LUDUS, a token dedicated to the upcoming genre.

LUDUS is a governance token capped at 21,000 supply, which allows easy access to our Play-to-Earn content on the platform.

Advantages include early access to sales and drops of upcoming games.

Governance votes from LUDOS holders will directly effect platform development.

Advantages include early access to sales and drops of upcoming games.

Governance votes from LUDOS holders will directly effect platform development.

Bonds are very simple #debt instruments, yet they

account for a whopping $120T market size globally and are being bridged to DeFi at a jaw-dropping speed.

A 🧵on everything you need to know about on-chain bonds and how to invest in them.

(Not Financial Advice.)

account for a whopping $120T market size globally and are being bridged to DeFi at a jaw-dropping speed.

A 🧵on everything you need to know about on-chain bonds and how to invest in them.

(Not Financial Advice.)

Warm-up: What is a bond?

A #bond is a debt instrument that allows the issuer (borrower) to raise money from investors (lenders) willing to lend them money for a certain amount of time.

A #bond is a debt instrument that allows the issuer (borrower) to raise money from investors (lenders) willing to lend them money for a certain amount of time.

Three main types of bonds are:

◦ Corporate bonds, issued by companies.

◦ Municipal bonds, issued by states and municipalities.

◦ Government (sovereign) bonds such as those issued by the U.S. Treasury or other forms of sovereign debt.

◦ Corporate bonds, issued by companies.

◦ Municipal bonds, issued by states and municipalities.

◦ Government (sovereign) bonds such as those issued by the U.S. Treasury or other forms of sovereign debt.

Ready to start earning from trading even in bad market conditions?

@0xpolysynth has an all-weather solution that #degens will love. More on this innovative project in this thread... 🧵

#Polysynth @0xPolysynth

@0xpolysynth has an all-weather solution that #degens will love. More on this innovative project in this thread... 🧵

#Polysynth @0xPolysynth

This thread will cover but not be excluded to the following scope:

1/ What is #Polysynth?

2/ Structured Products ( FCN )

3/ Why invest in FCNs?

4/ My closing thoughts

1/ What is #Polysynth?

2/ Structured Products ( FCN )

3/ Why invest in FCNs?

4/ My closing thoughts

1️⃣ Polysynth protocol is a Defi Options Vault (DOV) protocol powered by #Ethereum

Can you imagine making 30%+ APY on your stablecoins? You read that right....

Can you imagine making 30%+ APY on your stablecoins? You read that right....

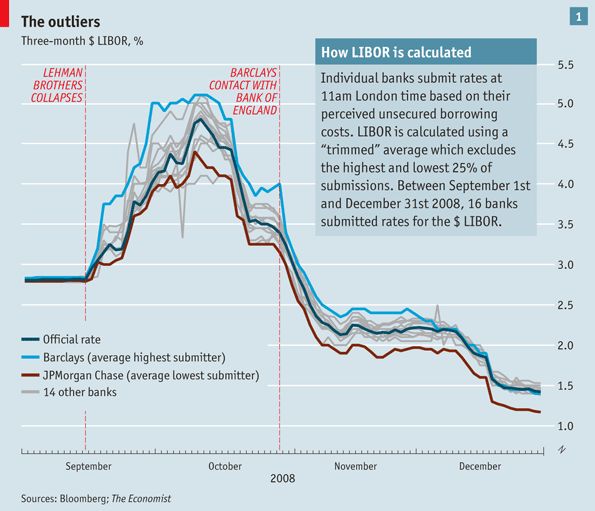

"The most important number in #finance", the London Interbank Offered Rate (#LIBOR), died a shameful death at the age of 52.

The interest rate benchmark underpinned more than $300 trillion in financial contracts before being marred in a scandal that lasted ~ a decade.

A short🧵

The interest rate benchmark underpinned more than $300 trillion in financial contracts before being marred in a scandal that lasted ~ a decade.

A short🧵

2/ The scandal came into the limelight in 2008 but there is evidence that collusion between banks was going on since 2003.

🤥 “We know that we’re not posting, um, an honest” rate, a Barclays employee told a New York Fed official in April 2018.

How was it done?

🤥 “We know that we’re not posting, um, an honest” rate, a Barclays employee told a New York Fed official in April 2018.

How was it done?

The $REBUS Public Coin Distribution is almost upon us!

It's a chance for everyone to get their hands on the future of #TradFi → #DeFi

But our products don't launch until 2023, so why should you care about our PCD?

Let us tell you 👇 🧵

It's a chance for everyone to get their hands on the future of #TradFi → #DeFi

But our products don't launch until 2023, so why should you care about our PCD?

Let us tell you 👇 🧵

Our Public Coin Distribution is the first time $REBUS will be available to the public.

It's your chance to hedge on the future of TradFi investment; DeFi.

However, to understand why our PCD is a great opportunity, you need to understand Rebus' vision.

It's your chance to hedge on the future of TradFi investment; DeFi.

However, to understand why our PCD is a great opportunity, you need to understand Rebus' vision.

The $REBUS token acts as a regulatory vehicle for TradFi investors, the catalyst for DeFi adoption.

Behind the investors are their asset managers, in charge of trillions of dollars waiting for diversification

The Rebus platform captures those managers, with $REBUS the spearhead

Behind the investors are their asset managers, in charge of trillions of dollars waiting for diversification

The Rebus platform captures those managers, with $REBUS the spearhead

0/ like #TradFi companies, #DeFi protocols should be profitable & generate more revenue than cost (token emissions), while accruing value to token holders📈

base your investment decisions on fundamental analysis!📚🔍

🧵 investor's guide on #DeFi profitability (0/45)📊👇

base your investment decisions on fundamental analysis!📚🔍

🧵 investor's guide on #DeFi profitability (0/45)📊👇

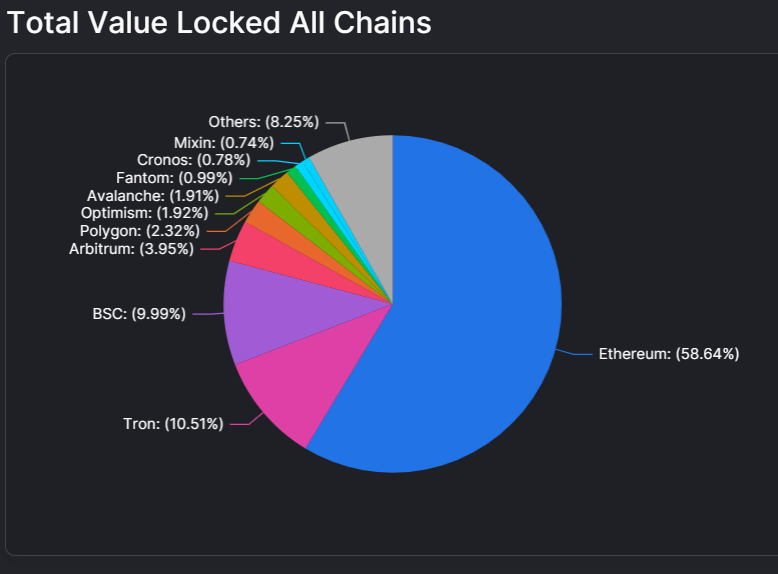

1/ #DeFi has grown to become a multi-billion-dollar industry, consisting of a multitude of highly specialized blockchains and entire ecosystems of composable, decentralized finance protocols that are built on top of various smart contract blockchains

2/ like traditional financial services companies, these protocols provide users with a broad array of financial services. #DeFi services today range from payments and non-custodial swaps to lending & on-chain derivatives and are continuously expanding

1/ Our goal is to build the future of global credit markets 🌎

Over the last 10 months we've worked with our ecosystem to bootstrap Credix, originating over 23M USDC 📈

Today we're exciting to announce our 11.25M USD Series A, led by @motive_partners and @paraficapital! 🧵

Over the last 10 months we've worked with our ecosystem to bootstrap Credix, originating over 23M USDC 📈

Today we're exciting to announce our 11.25M USD Series A, led by @motive_partners and @paraficapital! 🧵

2/ Since our launch, #fintechs like A55 (revenue-based financing), Tecredi (car loans), Descontanet (SME financing), Provi (student loans), Adiante (SME financing), and Divi Bank (SaaS financing) raised debt financing on @Credix_finance 🙌

3/ Because of Credix’s strong focus on risk management & underwriting we have onboarded over 25 #crypto & #tradfi funds such as @RBF_cap, MGG Investment Group, Almavest, @AddemCapital, and @Caurisfinance