Discover and read the best of Twitter Threads about #Sentiment

Most recents (24)

1/6 #OrderBookAnalysis 🧵

TLDR: Liquidity=Sentiment

Liquidity placement in the order book reveals #Sentiment for a price range! 📊📈

💧 When more liquidity is concentrated around a particular price level, it indicates increased confidence or interest from #traders...

TLDR: Liquidity=Sentiment

Liquidity placement in the order book reveals #Sentiment for a price range! 📊📈

💧 When more liquidity is concentrated around a particular price level, it indicates increased confidence or interest from #traders...

2/6 Analyzing the order book with a #DataViz tool like #FireCharts helps you mitigate risk by replacing speculative decisions with data based decisions.

No reason to speculate when you can literally see where higher concentrations of liquidity mark resistance and support.

No reason to speculate when you can literally see where higher concentrations of liquidity mark resistance and support.

3/6 Knowing where liquidity ISN'T, is as important as knowing where it is. Thin liquidity indicates zones with greater potential for volatility since price moves through them with less friction.

But there is one more aspect of #OrderBookAnalysis I personally value the most...

But there is one more aspect of #OrderBookAnalysis I personally value the most...

From #bearish to #bullish: #crypto trends signal a potential buying opportunity at $27,500 for #Bitcoin and #Ethereum outperformance 🧵🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

#Crypto #sentiment has cooled off, with our #Bitcoin Greed & Fear Index dropping to 44 (for #Ethereum, 46). Buying half a position at $27,500 could be a good re-entry level, with the possibility of the price dropping to $25,000 for the second half.

The decline in #stablecoin #marketcap suggests money is leaving the ecosystem, with #USDC and #BUSD dropping below $30bn and $6.5bn, respectively. Negative #funding rates for #Binance #BNB could indicate potential negative news.

Today's #blog covers why the #pain #trade is likely higher over the next few weeks as #sentiment improves and too much money is offside.

realinvestmentadvice.com/the-pain-trade…

realinvestmentadvice.com/the-pain-trade…

#Bullish optimism is building around:

- #Fed cutting rates

- #Economy will avoid #recession

- #Employment remains strong.

- #Earnings have corrected enough

Risk to that view remains a recession.

realinvestmentadvice.com/the-pain-trade…

- #Fed cutting rates

- #Economy will avoid #recession

- #Employment remains strong.

- #Earnings have corrected enough

Risk to that view remains a recession.

realinvestmentadvice.com/the-pain-trade…

It is called the “#paintrade” because it is the opposite of how #investors are currently positioned. Investor sentiment remains historically #bearish despite improvement since the October lows.

realinvestmentadvice.com/the-pain-trade…

realinvestmentadvice.com/the-pain-trade…

1/ Negli ultimi giorni c’è molto timore dietro i token wrapped di Bitcoin. Ho già sollevato qualche qualche giorno fa la questione di wBTC, ma facciamo un piccolo recap perché ci sono delle cose che DEVI sapere!

🧵

🧵

2/ C’è una forte incertezza dietro al token #renBTC per via del suo legame con #alamedaresearch. Ma, a differenza di #wBTC possiamo vedere che il suo valore è ancora peggato, sostanzialmente perché c’è ancora il collaterale a sostenerne il prezzo

coingecko.com/it/monete/renb…

coingecko.com/it/monete/renb…

3/ La bancarotta di #alameda ha prosciugato le casse del team che sta dietro il progetto. Per questo chiuderà l’attuale versione di #ren in favore di una sorta di #renDAO. Qui @renprotocol ci spiega tutti i dettagli:

Sentiment is live on #Arbitrum ⚡️

@sentimentxyz is a liquidity protocol enabling on-chain permissionless undercollateralized borrowing. The protocol reached its $500,000 lending cap within 30 seconds of going live! 🎉

🪂 Like & RT

🧵 Thread 👇

1/

@sentimentxyz is a liquidity protocol enabling on-chain permissionless undercollateralized borrowing. The protocol reached its $500,000 lending cap within 30 seconds of going live! 🎉

🪂 Like & RT

🧵 Thread 👇

1/

@sentimentxyz is introducing a unique approach for lenders and borrowers to maximize the utility of their capital by enabling borrowing of up to 500% LTV through unique delegated ownership accounts.

2/

2/

Sentiment supports a wide range of lend/borrow token types and has integrated some of the most popular #DeFi protocols, and more protocols are going to be integrated soon.

3/

3/

The #BullBearReport is out.

The #market started with a strong #rally, then #stumbled into week's end. With #oversold conditions still intact and CPI next week, the #bulls have a shot at a rally if #inflation shows some signs of cooling.

realinvestmentadvice.com/market-rally-s…

The #market started with a strong #rally, then #stumbled into week's end. With #oversold conditions still intact and CPI next week, the #bulls have a shot at a rally if #inflation shows some signs of cooling.

realinvestmentadvice.com/market-rally-s…

Moving forward, YoY comparisons become more challenging at 0.9%, 0.7%, 0.6%, 0.6%, 0.8%, and 1.2% through March 2023. In August, #inflation will drop to 7.9% from 9% in June. Assuming an avg. 0.2% MoM increase, CPI hits the Fed’s 2% target in June 2023.

realinvestmentadvice.com/market-rally-s…

realinvestmentadvice.com/market-rally-s…

Despite Friday's rout, the #market did finish the week in positive territory. The deeply oversold indicators turned up and are close to triggering “buy signals.” The market is trading 2-standard deviations below the 50- WEEK moving average.

realinvestmentadvice.com/market-rally-s…

realinvestmentadvice.com/market-rally-s…

#RiskOn / #RiskOff Zde mé slíbené vysvětlení. Nevím co znamená RiskOn/Off pro jiné systémy nebo interpretace. Možná jsem mohl použít jiné názvy. Já to mám ale vžité už léta a prostě jsem to použil. Pokud se to používá i někde jinde, půjde na 100% o něco jiného než o co jde mě 1/n

Sledují mě tu stále nové a nové lidi a chápu, že to může působit možná až jako nějaké „čárymáry“. Že si tady tak zvesela měřím geo-politcké dění na SP500 a interpretuji to v grafech. Je to ale prostě úplně obráceně. Mě osobně přijde neuvěřitelné spíše to, že spousta 2/n

lidí/obchodníků něco střílí od boku jen na bázi toho, že si to myslí, že mají pocit. To mě k moodixu vlastně dovedlo. To nekonečné množství názorů, ego her. Vlastně hlavně ego her. Boj o to kdo trefí tohle dno, tuhle otočku, tenhle krach, tuhle rally a bude plácán po zádech. 3/n

1/ What up! 😆✌️ BULLISH #EGLD Market Update T.A. ⚡ @ElrondNetwork - Couple days ago U saw my market update with bearish perspectives, but U know my perma-bull never left! 👉 Balancing perspectives is key! 🔑 Expect downside yet maintain exposure to capture the upside! 🧠🔥🧵

2/ Before we get into it, some key elements to the plan for success: 📝💡

→ Capture the average

→ Make few trades

→ Maintain exposure

Your brain is a muscle, therefore I remind U the importance of muscle memory & that it applies to trading! Train regularly & consistently.

→ Capture the average

→ Make few trades

→ Maintain exposure

Your brain is a muscle, therefore I remind U the importance of muscle memory & that it applies to trading! Train regularly & consistently.

3/ When training 🏋️ it's vital to develop muscle memory with proper technique AND recovery! We must give our muscles the proper time ⌛ and nutrition 🥩🥗🥛🥔 to recover. 😴

In trading 📈 this equates to sitting on sidelines while volatility seeks to suck U in.

In trading 📈 this equates to sitting on sidelines while volatility seeks to suck U in.

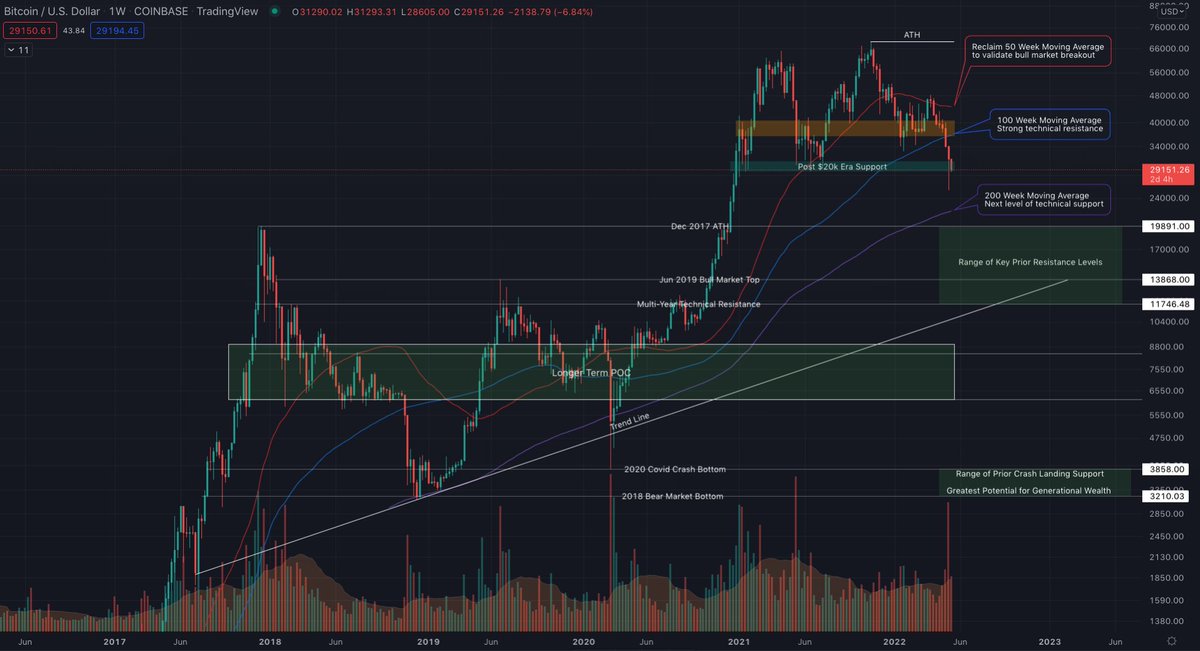

1/ Bear markets are notorious for brutal fakeouts, which is why it's critical to identify targets and invalidations.

Here are key levels to watch in both directions.📉📈

#BTC analysis 🧵

#NFA

More from Material Indicators here... mi1.pw/mitwmay

Here are key levels to watch in both directions.📉📈

#BTC analysis 🧵

#NFA

More from Material Indicators here... mi1.pw/mitwmay

2/In bear markets everyone is looking for a relief rally to exit or add short. Those are good strategies if you can tell the difference between a fakeout and a breakout. #FOMO + failure to identify invalidation levels are why so many people get rekt. #BullTrap #ShortSqueeze

3/ Identifying targets is easy. Determining breakout or fakeout is more challenging, and while there are no sure things, there are some things we can look at to help mitigate risk of getting trapped. To get some perspective, let's start with an ultra wide macro view of #BTC

1/ The recent survey of global fund managers by Merrill Lynch is quite interesting from a contrarian's perspective.

Over 300 money managers with circa trillion in assets under management very polled on the various portfolio, finance & economy questions.

#sentiment update 👇

Over 300 money managers with circa trillion in assets under management very polled on the various portfolio, finance & economy questions.

#sentiment update 👇

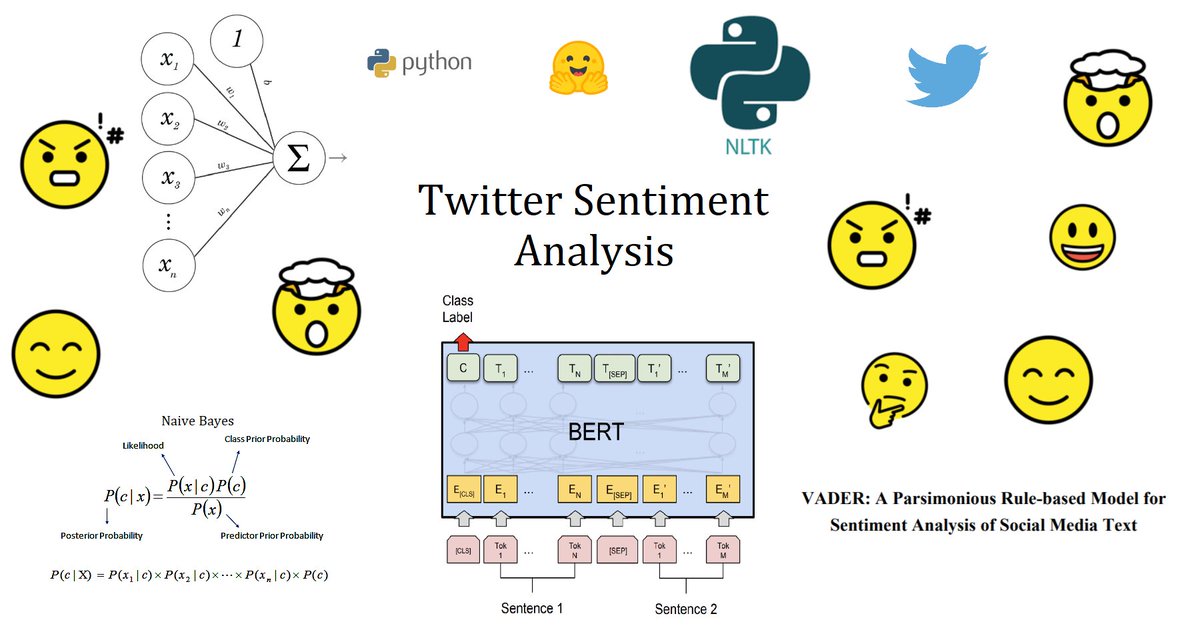

Can computational methods assess the #sentiment of complex texts? In an article with my fabulous colleagues from the @WZB_Berlin, @unipotsdam @LMU_Muenchen @JungeAkademie, we answer this question by applying #dictionary and #scaling methods on a sample of #literature reviews🧵

The article is also a practical #guide to help researchers select an appropriate #method and degree of preprocessing for their own data. Our #corpus consisted of 6.041 summaries of reviews of contemporary German #literature acquired from @perlentaucher00 (2/9)

The linguistic #complexity of #literature reviews differ from other texts with regard to their #language-- ambiguity, irony, metaphors, etc.-- are comparatively difficult to capture with #computational approaches. So how did our different methods fare? (3/9)

kategorisierungen.substack.com/p/stimmungsana…

Artikel über #Sentiment Analyse and #Meinungsforschung.

Artikel über #Sentiment Analyse and #Meinungsforschung.

another post, on #predictiveanalytics kategorisierungen.substack.com/p/pradiktive-a…

Hence the absolute need to get out of this voluntary submission system established for at least 300 years.

If you have any suggestions, put them below.

Be creative & let's brainstorm together to perhaps allow us to break these chains of oppression.

#Psychologicalreactance

⛎

If you have any suggestions, put them below.

Be creative & let's brainstorm together to perhaps allow us to break these chains of oppression.

#Psychologicalreactance

⛎

#Naturopathy

#Herbalism

#Phytotherapy

#Nutraceuticals

#AilanthusAltissima (Mill.) Swingle, 1916

False Japanese varnish, Ailante, Ailanth

« Dwarf Ailanthus is also sometimes nicknamed "the tree of hell" because of its invasive nature and the difficulty of eradicating it. »

#Herbalism

#Phytotherapy

#Nutraceuticals

#AilanthusAltissima (Mill.) Swingle, 1916

False Japanese varnish, Ailante, Ailanth

« Dwarf Ailanthus is also sometimes nicknamed "the tree of hell" because of its invasive nature and the difficulty of eradicating it. »

1. A thread on three #PBOC 2021 Q2 Macro sentiment surveys from Bankers (Sample 3200), Industrial Companies (5000) and Urban Bank Customers (20,000). Surveys data are considered less informative and need to be heavily discounted, but could be complimentary to other data source.

In August we saw #inflation growth moderate further, for the second consecutive month, at least relative to the impressive rate of growth in #prices witnessed around mid-year.

Core #CPI (excluding volatile food and energy components) came in at 0.10% month-over-month and 3.98% year-over-year, which was considerably less than the consensus forecast and was driven higher by #shelter components.

Meanwhile, headline #CPI data printed at a solid 0.27% month-over-month and came in at 5.20% year-over-year.

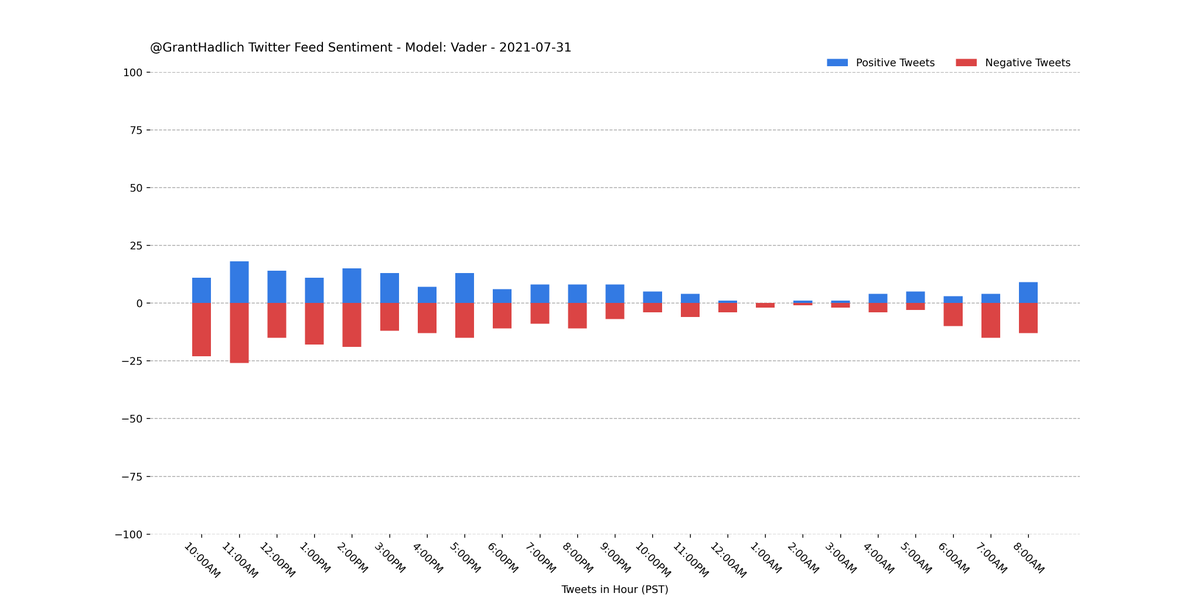

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 253 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (70.0%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 253 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (56.1%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

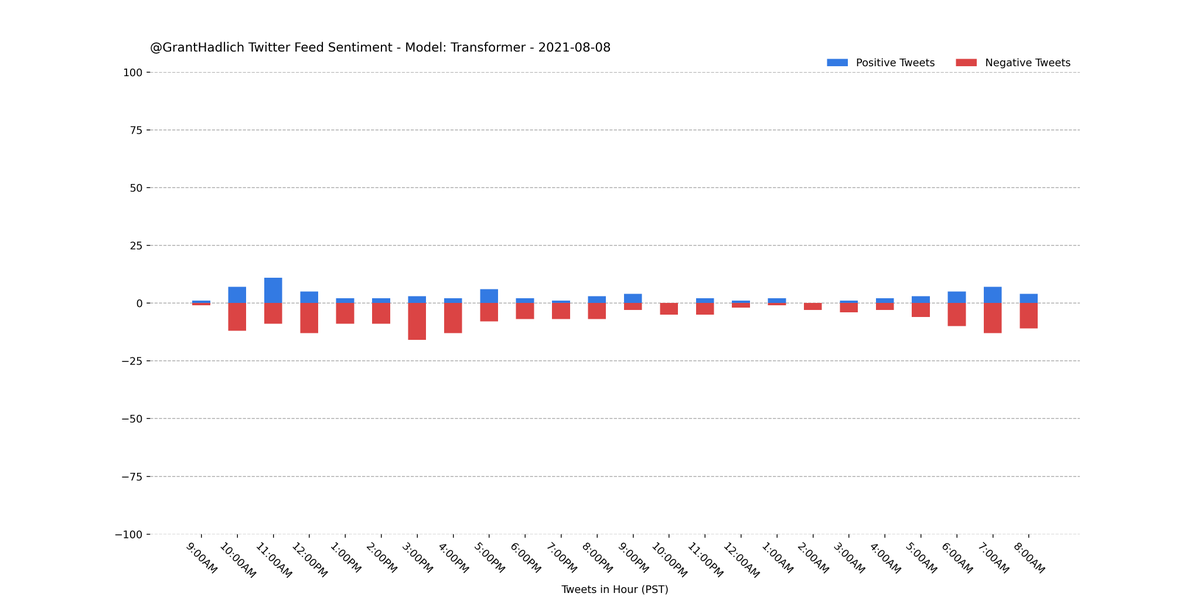

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 272 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (69.9%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 272 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (57.0%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 378 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (68.0%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 378 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (60.3%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 476 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (70.0%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 476 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (60.5%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 528 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (68.0%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 528 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (58.9%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 569 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (65.4%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 569 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (53.6%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 239 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (61.1%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 239 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (61.5%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 288 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (65.6%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 288 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (62.8%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

How negative was my Twitter feed in the last few hours? In the replies are a few models that analyze the sentiment of my home timeline feed on Twitter for the last 24 hours using the Twitter API.

GitHub: github.com/ghadlich/Daily…

#NLP #Python

GitHub: github.com/ghadlich/Daily…

#NLP #Python

I analyzed the sentiment on the last 412 tweets from my home feed using a pretrained #BERT model from #huggingface. A majority (67.5%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot

I analyzed the sentiment on the last 412 tweets from my home feed using a pretrained #VADER model from #NLTK. A majority (59.0%) were classified as negative.

#Python #NLP #Classification #Sentiment #GrantBot

#Python #NLP #Classification #Sentiment #GrantBot