Discover and read the best of Twitter Threads about #Shale

Most recents (24)

YPF and Malaysia's Petronas plan to build a $10 billion LNG export terminal along Argentina's Atlantic Coast

Details from @jongilbert9 on the Terminal at bit.ly/3q5hxt8

#LNG #ONGT #NatGas #Shale #OOTT #VacaMuerta #Argentina #Malaysia

Details from @jongilbert9 on the Terminal at bit.ly/3q5hxt8

#LNG #ONGT #NatGas #Shale #OOTT #VacaMuerta #Argentina #Malaysia

Argentina will be able to export LNG due to the Nestor Kirchner Pipeline, which will move natural gas from the Vaca Muerta shale play

Argentine President Albert Fernandez's comments at recent signing ceremony for pipeline at bit.ly/3cJ2fHy

#LNG #VacaMuerta #Argentina

Argentine President Albert Fernandez's comments at recent signing ceremony for pipeline at bit.ly/3cJ2fHy

#LNG #VacaMuerta #Argentina

UPDATE: The initial stage of Argentina's proposed LNG export project is targeting 5 mtpa of production

Details at bit.ly/3B78K05

#LNG #ONGT #NatGas #Shale #OOTT #VacaMuerta #Argentina #Malaysia

Details at bit.ly/3B78K05

#LNG #ONGT #NatGas #Shale #OOTT #VacaMuerta #Argentina #Malaysia

NextDecade flipped a 1 mtpa HOA with China's Guangdong Energy into a 20-year SPA for its proposed Rio Grande LNG

Project total sold remains at 7.75 mtpa. The company needs to reach 11 mtpa for a final investment decision on the first two trains.

#LNG #ONGT #NatGas #Shale #RGV

Project total sold remains at 7.75 mtpa. The company needs to reach 11 mtpa for a final investment decision on the first two trains.

#LNG #ONGT #NatGas #Shale #RGV

Correction: Project total sold is now at 7.25 mtpa.

Footnote: Rio Grande LNG faces a large coalition of opponents

New Fortress Energy had three announcements this morning involving three projects in Mexico 🇲🇽

1) Offshore LNG project in Veracruz

2) Offshore LNG project in Tamaulipas

3) Sale of a power plant / natural gas deal in Baja California Sur

#LNG #NatGas #ONGT #Shale #OOTT #MXEnergy

1) Offshore LNG project in Veracruz

2) Offshore LNG project in Tamaulipas

3) Sale of a power plant / natural gas deal in Baja California Sur

#LNG #NatGas #ONGT #Shale #OOTT #MXEnergy

The first announcement involved a deal with Mexico's state-owned oil company Pemex to develop the offshore Lakach Field near Coatzacoalcos, Veracruz

The deepwater natural gas field will supply the domestic market and be used for LNG exports

Details at bit.ly/3aedNkC

The deepwater natural gas field will supply the domestic market and be used for LNG exports

Details at bit.ly/3aedNkC

The second announcement involved a deal with Mexico's state-owned electricity company CFE

CFE will supply natural gas for an offshore LNG project near Altamira, Tamaulipas

Details at bit.ly/3bQ39B4

CFE will supply natural gas for an offshore LNG project near Altamira, Tamaulipas

Details at bit.ly/3bQ39B4

Afternoon folks. Hard to tweet while putting out headlines on the wire itself, editing articles and running from spot to spot here. Were I not an editor! But still, a long thread on #CERAWeek

We’re in a growing energy crisis that seems like it’s going to get worse – I’ll get to that later. The tenor of the conference here has been a combo of some dread – the reality of the surge in oil prices, emerging shortages in fuel and unfinished oils, and rising natgas prices.

The original plan was to do a lot of talk of renewables and transition – even though the usual first couple days would have been dominated by oil. But that’s not how it turned out, of course, and the conference organizers recognized that shift. #OOTT

reuters.com/business/energ…

reuters.com/business/energ…

1.

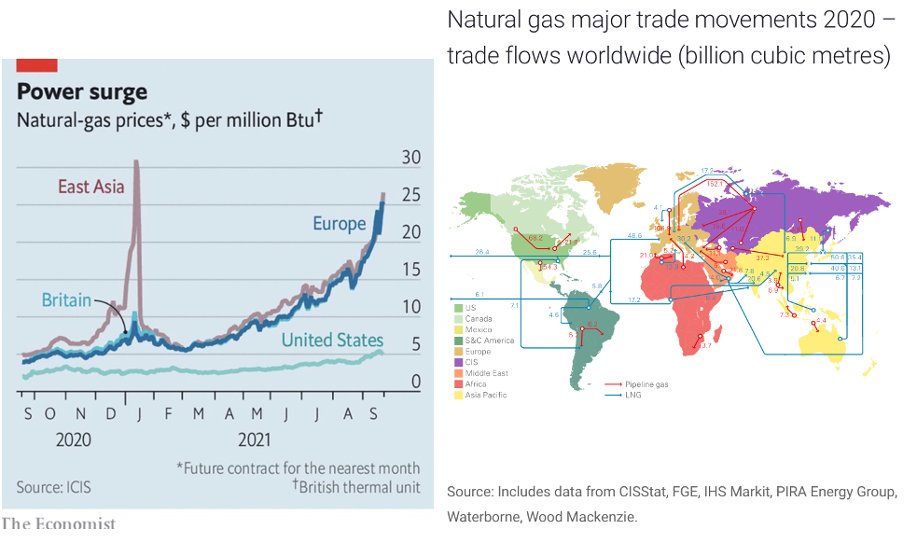

Graph on left (from Economist) is used by minority who want UK to copy US #fracking. But it actually tells a different story, linked to map on right (by BP).

Key point: US is connected to global #gas market, but is cushioned by geography that cannot apply to UK.

THREAD

Graph on left (from Economist) is used by minority who want UK to copy US #fracking. But it actually tells a different story, linked to map on right (by BP).

Key point: US is connected to global #gas market, but is cushioned by geography that cannot apply to UK.

THREAD

2.

If you think about it, the implication made by some about US shale is obviously mistaken. In reality, US gas producers would sell into EU and Asian market if they could because the price is higher. And this would push up the price that US customers had to pay - it already has.

If you think about it, the implication made by some about US shale is obviously mistaken. In reality, US gas producers would sell into EU and Asian market if they could because the price is higher. And this would push up the price that US customers had to pay - it already has.

3.

To sell into European and Asian markets, US gas producers have to use #LNG trade that links regional markets into a quasi-global market. Limited LNG capacity means that sales from US to Europe and Asia are low – and not likely to become substantial.

To sell into European and Asian markets, US gas producers have to use #LNG trade that links regional markets into a quasi-global market. Limited LNG capacity means that sales from US to Europe and Asia are low – and not likely to become substantial.

Thread: General comments & forecasts for the global oil market in 2022. Constructive comments are welcome. If comments don't fit your books, just ignore them.

1-13 The oil market will be tighter than forecasts, especially relative to OPEC’s forecast. No major inventory build.

1-13 The oil market will be tighter than forecasts, especially relative to OPEC’s forecast. No major inventory build.

2- The biggest surprise might come from increased demand for oil in the oil-producing countries themselves. That is a double-edged sword; BULLISH.

On the other side, if #COVID19 & its varients come back with vengeance: lockdowns, inventory build, etc.. OPEC+ is expected to react

On the other side, if #COVID19 & its varients come back with vengeance: lockdowns, inventory build, etc.. OPEC+ is expected to react

Thread on why I am bullish on oil in the long run:

1- In all outlooks, the largest decrease in global oil demand comes from the massively improved efficiency in ICE vehicles. That is massively exaggerated.

2- Do the numbers! The impact of #ElectricVehicles is exaggerated!

1- In all outlooks, the largest decrease in global oil demand comes from the massively improved efficiency in ICE vehicles. That is massively exaggerated.

2- Do the numbers! The impact of #ElectricVehicles is exaggerated!

3- The outlooks ignore the global shift in consumer taste from small cars to crossovers, SUVs, and trucks.

4- All those who are bearish on oil are looking at a static picture. The world is dynamic. If oil prices collapse, oil will be too cheap to ignore by all groups.#oil #OPEC

4- All those who are bearish on oil are looking at a static picture. The world is dynamic. If oil prices collapse, oil will be too cheap to ignore by all groups.#oil #OPEC

5- The outlooks ignore the new consumers of energy as they did in the past with Bitcoin and data centers. That creates competition for electricity, and that leads to fuel switching and private generation.

#Bitcoin #Datacenters

#Bitcoin #Datacenters

Thread of 8 Charts on the oil politics between the Biden Administration and OPEC! Looks like a story!

#Oil #OPEC #Biden #OOTT #COP26

1-8 I am using IEA demand numbers so no one can say OPEC numbers are self-serving.

#Oil #OPEC #Biden #OOTT #COP26

1-8 I am using IEA demand numbers so no one can say OPEC numbers are self-serving.

2-8

Notice that the demand gap shown in the IEA chart above is bigger than the OPEC production gap!

#OPEC #Oil

Notice that the demand gap shown in the IEA chart above is bigger than the OPEC production gap!

#OPEC #Oil

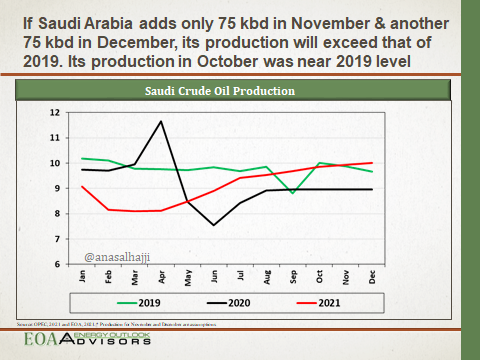

3-8

Saudi crude oil production is almost back to normal and will exceed 2019 levels soon.

#SaudiArabia

Saudi crude oil production is almost back to normal and will exceed 2019 levels soon.

#SaudiArabia

1/ U.S. #energy policy is in serious need of a rethink. Energy policy is not just climate policy, it's #economic policy and it's #foreignpolicy. Our European allies' dependence on #Russian gas supplies is geopolitical malfeasance.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

2/ For decades, the U.S. was reliant on energy supplies from the Middle East, which dictated our foreign policy decisions in the region. The #shale revolution provided a brief, decade-long reprieve from the mercy of #OPEC.

3/ But rather than use our energy abundance as a geopolitical and national/economic security tool, we are ceding power back to those whose national interests are not aligned with those of the U.S.

1/4

That this is such a minor story in the #UnitedStates is a testament to how little the United States cares about global #energysecurity

bloomberg.com/news/articles/…

That this is such a minor story in the #UnitedStates is a testament to how little the United States cares about global #energysecurity

bloomberg.com/news/articles/…

2/4

With #oilprices back above $70 we will see a big surge of activity in the #shale fields. At a minimum there will be 500 KBPD that comes from the #Fracklog in short order.

With #oilprices back above $70 we will see a big surge of activity in the #shale fields. At a minimum there will be 500 KBPD that comes from the #Fracklog in short order.

3/4

The attack came from #Yemen - which is much farther away from #RasTanura (the worlds largest oil loading facility) than #Iran. #SaudiArabia now has no option but to significantly expand its strike capabilities.

The attack came from #Yemen - which is much farther away from #RasTanura (the worlds largest oil loading facility) than #Iran. #SaudiArabia now has no option but to significantly expand its strike capabilities.

Oil Market 101

1-4

- Shale produces light sweet crude. The most economic products are gasoline & naphtha.

- To get other products economically like diesel & fuel oil, imported heavier crude is needed from #Canada, #Mexico, Venezuela, Colombia & Iraq.

1-4

- Shale produces light sweet crude. The most economic products are gasoline & naphtha.

- To get other products economically like diesel & fuel oil, imported heavier crude is needed from #Canada, #Mexico, Venezuela, Colombia & Iraq.

2-4 Latin American countries' exports to the US are maxed out. The only way US refiners can compensate for loss of Candian crude is to import from Venezuela. They cannot because of sanctions. The only way US refiners can get additional crude from Latin America to bid prices up!

3-4 The US will become more dependent on Iraqi crude. Boy! Let conspiracy theories fly again! From Bush to Biden! (Blame on the B)

Here are more fireworks: Americans will pay the Iraqis who take the dollars and pay Iran for imported electricity natural gas, and gasoline!

Here are more fireworks: Americans will pay the Iraqis who take the dollars and pay Iran for imported electricity natural gas, and gasoline!

1/n This thread will argue that the unique “triple-dip” nature of the 2014-2020 #Oil Bust has given #energy markets a false sense of security about the ability of #shale to meet any material Supply shortfall. It will also assess what this means for 2022-24. #OOTT #OPEC #Saudi

/2 The explosive growth in US tight oil & gas production from ~2011-14 is not w/out historical precedent: the best analogue is perhaps the famous East TX field coming online circa 1930 & causing a (positive) supply shock just as the country entered the Depression. The comp is

1/n This thread will address some of the most frequent fallacies that are encountered in #energy investing.

While timing any commodity market is notoriously challenging, it is important to have guidelines & a basic framework of understanding.

#OOTT #EFT #Oil #shale

While timing any commodity market is notoriously challenging, it is important to have guidelines & a basic framework of understanding.

#OOTT #EFT #Oil #shale

/2 Myth: The transition away from #fossilfuels means that #Oil prices are permanently capped. Reality: oil is a depleting physical asset, with high capital intensity. When prices are high, producers expend significant time & capital exploring for oil & gas. When prices are low,

/3 exploration is reduced. This ebb & flow means that oil remains a boom & bust commodity, despite the best efforts of companies, countries, & cartels to dampen the amplitudes. No one country, or bloc, sets the price. Not ‘Big Oil,’ not #Saudi, not ‘speculators.’ Oil Demand is a

All right, #contest time. Give me your best public energy stock(s) for 2021. Winner will be determined based on calendar ‘21 performance. Two stocks per entrant, blended return; if multiple ppl pick same companies, first entry wins. I’ll start: $FANG & $SLCA

#OOTT #Oil #shale

#OOTT #Oil #shale

2/2 Winner gets $250 dinner at restaurant of your choice. And let’s not forget our $CHK bankruptcy co-winners 🏆 @AndUpstream & @EnergyMatters3, both of whom still have @PinkertonsBBQ in their post-Covid future ✅ #OOTT #EFT #oilandgas #oil

zerohedge.com/energy/why-sau…

Interesting read; and falls in line with how i'd expect oil to behave going into 2021.

The only thing i find missing is the perspective that War is good for the price of oil, US Shale *also* needs higher prices = more motive for the US-China war path.

Interesting read; and falls in line with how i'd expect oil to behave going into 2021.

The only thing i find missing is the perspective that War is good for the price of oil, US Shale *also* needs higher prices = more motive for the US-China war path.

Just to clarify, if we look at a #China-#USA conflict through the lens of #oil prices, i see:

1. The price of oil rises.

2. US #Shale needs higher oil prices.

3. China, being the worlds largest importer of oil by far, needs lower oil prices.

4. #SaudiArabia needs higher prices.

1. The price of oil rises.

2. US #Shale needs higher oil prices.

3. China, being the worlds largest importer of oil by far, needs lower oil prices.

4. #SaudiArabia needs higher prices.

Thread on #OPEC and OPEC+ meetings today:

(Media: please feel free to quote)

1- What is the importance of this meeting? 1-

First, Deepening the production cuts from what was previously agreed upon for the month of July, which would accelerate the rebalancing of the markets

(Media: please feel free to quote)

1- What is the importance of this meeting? 1-

First, Deepening the production cuts from what was previously agreed upon for the month of July, which would accelerate the rebalancing of the markets

2- Second, the unprecedented focus on the commitment of all members & the establishment of a monthly monitoring system for the production of member states & the #oil market. This means that the possibility of a monthly renewal of the agreement exists if there is a need for it.

3- Third, establishing a new system used for the first time by OPEC: reduction of future production quota if countries violate their current quota. This system has been historically adopted by world commodity organizations such as the Tin, Bauxite a& Coffee organizations.

My take on the week that was, and what’s next. #OOTT #EFT #shale #OilPrice #crudeoil #OPEC

When oil became waste: a week of turmoil for crude, and more pain to come reut.rs/2xYTiFz

When oil became waste: a week of turmoil for crude, and more pain to come reut.rs/2xYTiFz

So a bit more on this. A lot right now rests on what happens next, both in terms of various economic regions trying to recover a bit and find ways to do a bit more business - and whether that's possible. #OOTT #OPEC

After all it's not often you see a nation like Azerbaijan tell a BP-led consortium that yes, you have to stop producing. Usually the big oil companies are exempt from this sort of thing. #OOTT #OPEC

Not anymore. @dmitryZ_reuters

Not anymore. @dmitryZ_reuters

Lets talk about #Oil and why the price of the #US benchmark #WTI West Texas Intermediate has turned negative FOR THE FIRST TIME EVER...

Some of you are waking up to what might read or sound like another disaster. Just when you were learning how to deal with #COVID19, you hear about a so called plunge in the #Price of #Oil. But what does it mean to have oil in negative territory & why is that the case? Lets see...

In the main we will talk a bit about simple matters of #supply & #demand while touching on the #future as far as #consumer outlooks & #perception / #confidence are concerned. I would like us to start in 2016, a quick recap...what happened to #Oil?

#WTI #CrudeOil futures for May,expiring tomorrow,tanked 57%,to $7.98 per barrel

June contract,expiring on 19thMay, traded@ $26.62/barrel

July futures,traded@ $28/barrel

And all this,despite #OPEC's decision to cut supply by 9.7 million barrels a day,wef 1st May2020

#OilCrash

June contract,expiring on 19thMay, traded@ $26.62/barrel

July futures,traded@ $28/barrel

And all this,despite #OPEC's decision to cut supply by 9.7 million barrels a day,wef 1st May2020

#OilCrash

Sovereign Credit Risk is on the rise, where are the opportunities?

We’re hosting a call with @ACGAnalytics at 2pm ET, inquiries here

thebeartrapsreport.com

We’re hosting a call with @ACGAnalytics at 2pm ET, inquiries here

thebeartrapsreport.com

Hosted a solid client call, meaningful takeaways covering political implications for oil prices, Saudi / Russia EM Credit risk and the IMF's heavy load.

*IEA SAYS OPEC+ 10M B/D CUT NOT ENOUGH TO STABILIZE OIL MARKET

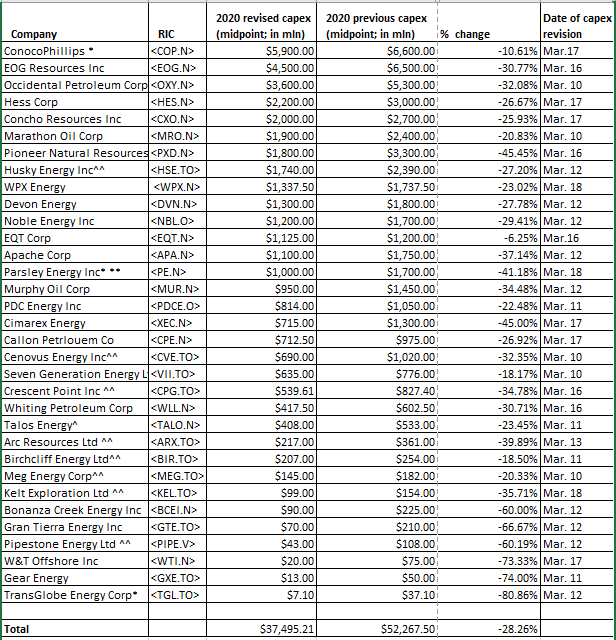

THREAD: Since March 9, when oil prices started plunging, my team and I have been compiling data on the budget cuts announced by N.American E&Ps.

They have cut more than 28% of their 2020 capex. See below for list:

Compiled by @arooneyma @shanti_2594 and @Arundhati_05

They have cut more than 28% of their 2020 capex. See below for list:

Compiled by @arooneyma @shanti_2594 and @Arundhati_05

These include only the ones that have given hard numbers. Some others have said they will cut, but did not provide specific details.

Oil major @exxonmobil $XOM on Monday said it will make "significant" cuts to spending, but did not provide details. Rival @Chevron $CVX said it was looking at ways to trim spending that could lead to lower near-term oil production

In light of recent events...here is #SechinsMap and strategic thoughts from my look at #Russia's moves in #Africa last year...(HT to @MacaesBruno who 1st brought the map to my attention) #Eurasia #MENA #SaudiArabia #China #GeoStrategy #Energy

This is also instructive...#Oil break even levels inc. fiscal spending for key exporters...(Visual: @EurasiaGroup)

As is this on #US #Shale and the mountain of #Energy #Credit that is sinking into junk territory with potentially damaging consequences for the US economy from the always insightful @bethanymac12... #MacroRisk

OPEC was formed in the 1970s and the cartel could control prices - because the global economy runs on oil, and bulk of the reserves were in the Middle East.

They figured out, Oil Demand is inelastic. People have to buy no matter what price. It’s the most dense form of energy.

They figured out, Oil Demand is inelastic. People have to buy no matter what price. It’s the most dense form of energy.

Price Elasticity if Demand in the short run was 8x.

1% cut in Oil production would lead to 8% rise in price.

But if prices are too high, then people start saving energy and demand falls.

1% cut in Oil production would lead to 8% rise in price.

But if prices are too high, then people start saving energy and demand falls.

We have all been witness to the recent volatility in the #Global #Oil markets. We have seen how disruptions in oil #Supply, be it from #SaudiArabia, #Nigeria, #Venezuela, #Iran or #Libya can cause upticks in the global #Price of oil...