Discover and read the best of Twitter Threads about #SwingTrading

Most recents (17)

Basics OF Swing Trading

1.

"Master the art of #SwingTrading and ride the waves of short-term price movements in financial markets! 📈💰 #TradingStrategies #FinancialMarkets"

1.

"Master the art of #SwingTrading and ride the waves of short-term price movements in financial markets! 📈💰 #TradingStrategies #FinancialMarkets"

2.

"Capture profits in the swing of things with #SwingTrading! 📉📈 Spot potential price swings, time your entries and exits, and make the most of short-term market movements. #ProfitOpportunities #TradeSmart"

"Capture profits in the swing of things with #SwingTrading! 📉📈 Spot potential price swings, time your entries and exits, and make the most of short-term market movements. #ProfitOpportunities #TradeSmart"

3.

"Ready to swing into action? 🕺💹 Learn the ins and outs of #SwingTrading and discover how to navigate short-term price fluctuations like a pro. #TradingSkills #MarketSwings"

"Ready to swing into action? 🕺💹 Learn the ins and outs of #SwingTrading and discover how to navigate short-term price fluctuations like a pro. #TradingSkills #MarketSwings"

I've made my living off the markets since 2005.

Here are 12 Lessons for #SwingTrading Stocks, including:

-capital needed

-strategies

-position sizing

-when to avoid trading

-scanning for stocks

-And Much More...

A thread 👇📷 👇

Here are 12 Lessons for #SwingTrading Stocks, including:

-capital needed

-strategies

-position sizing

-when to avoid trading

-scanning for stocks

-And Much More...

A thread 👇📷 👇

1. How Much Capital to Swing Trade #Stocks

If you pay commissions, start with $5,000+. Need bigger profits to compensate for commissions (often a flat fee).

If you don't pay commissions, can start with $1000 or less.

To earn a decent side income, you'll need more.

If you pay commissions, start with $5,000+. Need bigger profits to compensate for commissions (often a flat fee).

If you don't pay commissions, can start with $1000 or less.

To earn a decent side income, you'll need more.

2. Leverage:

Open a "margin" stock trading account to access leverage.

For swing trading, you can often access 2x leverage AKA 50% margin.

This means you can buy positions worth twice your capital. $10K deposit, trade up to $20K.

Bigger potential profits...and losses.

Open a "margin" stock trading account to access leverage.

For swing trading, you can often access 2x leverage AKA 50% margin.

This means you can buy positions worth twice your capital. $10K deposit, trade up to $20K.

Bigger potential profits...and losses.

Are we heading toward a Bull Run?🐮

After the continued bear market of 2022, the investor sentiment is that the #crypto industry is entering the bull run in 2023.

In today's 🧵, we explore strategies that traders can make a profit from crypto trading in the bull market.

After the continued bear market of 2022, the investor sentiment is that the #crypto industry is entering the bull run in 2023.

In today's 🧵, we explore strategies that traders can make a profit from crypto trading in the bull market.

2/ Bull Run: The price of an asset generally increases, typically for several weeks or months. Traders expect prices to continue to rise & increase in value for the foreseeable future. 📈 This can be an exciting time for investors if they exit before prices start to decline.

3/ ➡️Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals to benefit from market volatility & accumulate assets over time. It spreads out risk, allowing traders to benefit from the bull market without taking on too much risk.

1/23 It's easy to find bullish and bearish elements in the charts to fit you bias, but being a maxi can be risky. Remember:

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset.

3/23 The #GoldenCross printed and the #DeathCross between the 200 & 50 WMA's is coming on the next candle. Knowing why we have conflicting signals isn't as critical as knowing how price will react, but if I had to guess, I'd say, short term manipulation.

Use the 80/20 rule to trade more efficiently.

Swing trading or day trading.

👇👇👇

Swing trading or day trading.

👇👇👇

If you trade all day, likely 80% of the profits will come from 20% of that time spent.

Trade for 1 hour instead of 5 or 6.

Make 80% of what you were making but save 80% of your time.

Trade for 1 hour instead of 5 or 6.

Make 80% of what you were making but save 80% of your time.

I found this when I started #daytrading in 2005. I traded all day, but nearly all my profit came in the 1st hour. I tended to lose a bit around lunch and then made a bit into the close.

Much more efficient to only trade when the most $$ is coming in. Keep it to 2hrs or less.

Much more efficient to only trade when the most $$ is coming in. Keep it to 2hrs or less.

BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

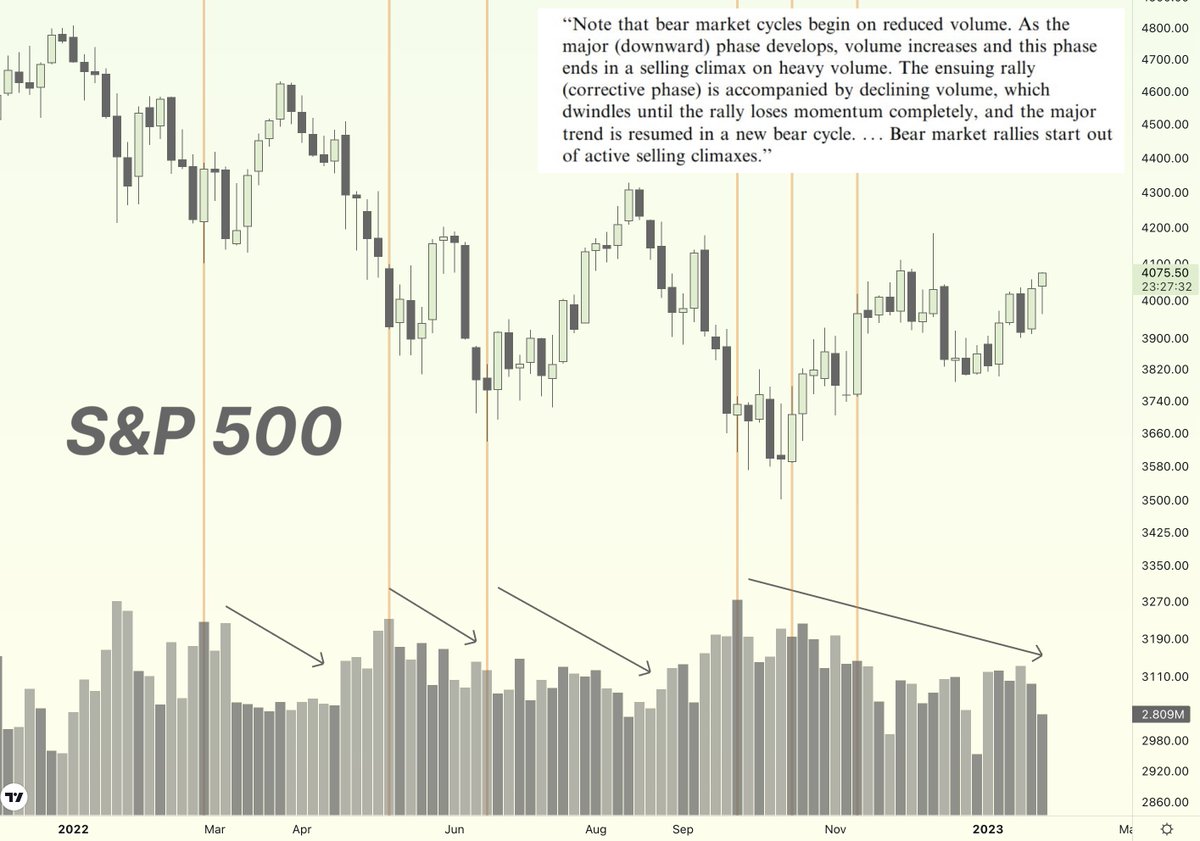

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

$OHMI +46% 24h.

During the price up, it is essential to track through #signal to exit at a better price if you are not #diamondhand (prefer #SwingTrading ).

$OHMI supply mainly on #DEX, track:

- Turnover Rate

- Net Buy Value

to better decide your exit.

Thread

During the price up, it is essential to track through #signal to exit at a better price if you are not #diamondhand (prefer #SwingTrading ).

$OHMI supply mainly on #DEX, track:

- Turnover Rate

- Net Buy Value

to better decide your exit.

Thread

$OHMI #DEX Turnover Rate peaks at around $0.20. (p1)

bit.ly/ohmi-turnover-…

At the same time, #DEX large sell triggers. (p2)

bit.ly/ohmi-net-buy-v…

A #topping #signal as we shared before (candlestick.io/blog/trader-ti…)

bit.ly/ohmi-turnover-…

At the same time, #DEX large sell triggers. (p2)

bit.ly/ohmi-net-buy-v…

A #topping #signal as we shared before (candlestick.io/blog/trader-ti…)

@AltMasterRoshi @CrossChainAlex @CanuckCryptDoc @LongOnMong @kkang4ma @Ethereumqueen @pbm_EATh @JoanJohn31 @LILBA_DEFI @james_amethyst Correct the typo: $OHMI #DEX Turnover Rate peaks at around $0.020. (p1)

Thank you @timothydej_eth !

Thank you @timothydej_eth !

1. The Double Bottom:

A trend reversal pattern.

Two lows of similar levels are formed.

ENTRY:

BO of the Neckline shows trend reversal by forming a Higher swing high which is also the entry point.

SL: LOD or swing low at a lower TF

TARGET:

Height of the NL to B1

Eg: #GRANULES

A trend reversal pattern.

Two lows of similar levels are formed.

ENTRY:

BO of the Neckline shows trend reversal by forming a Higher swing high which is also the entry point.

SL: LOD or swing low at a lower TF

TARGET:

Height of the NL to B1

Eg: #GRANULES

2. The Volatility contraction pattern, VCP by Mark Minervini

After a prior uptrend, a stock digests its gains, and profit taking happens. It then bases and gets ready for the next uptrend. VCP is a characteristic of a constructive base. It has the following characteristics:

1/n

After a prior uptrend, a stock digests its gains, and profit taking happens. It then bases and gets ready for the next uptrend. VCP is a characteristic of a constructive base. It has the following characteristics:

1/n

1/n

¿Cómo utilizar la estrategia #FDDE o formación después de #earnings?

👉 Esta es una pregunta muy frecuente y si también tienes esta duda, este hilo es para ti 🧵

Go Go Go ✏️📖🧠

#trading #SwingTrading #somosCDI 💚

¿Cómo utilizar la estrategia #FDDE o formación después de #earnings?

👉 Esta es una pregunta muy frecuente y si también tienes esta duda, este hilo es para ti 🧵

Go Go Go ✏️📖🧠

#trading #SwingTrading #somosCDI 💚

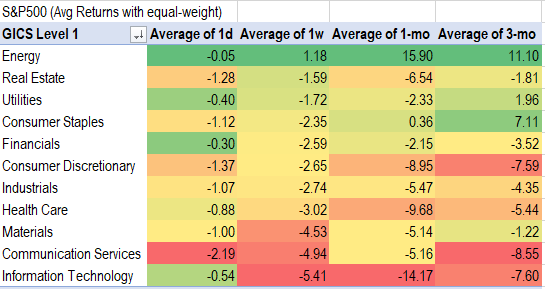

S&P 500 - avg returns of large cap index components by GICS Level 1 sector factor 1day, 1 week, 1 month, 1 quarter.

#Quant #momentum #investing #trading #SwingTrading #stocks #Equities

#Quant #momentum #investing #trading #SwingTrading #stocks #Equities

S&P 500 - avg returns of large cap index components by GICS Level 1 & Level 2 factors 1day, 1 week, 1 month, 1 quarter.

#Quant #momentum #investing #trading #SwingTrading #stocks #Equities #HedgeyeNation

#Quant #momentum #investing #trading #SwingTrading #stocks #Equities #HedgeyeNation

S&P 500 - avg returns of large cap index components by Interest Coverage Ratio Quartiles

(1=good cos and 4=vulnerable cos)

Colors continuum - shaded by columns

#Factor #Quant #momentum #investing #trading #SwingTrading #stocks #Equities #HedgeyeNation #Hedgeye

(1=good cos and 4=vulnerable cos)

Colors continuum - shaded by columns

#Factor #Quant #momentum #investing #trading #SwingTrading #stocks #Equities #HedgeyeNation #Hedgeye

1. Supertrend: The Simplest of all indicators. It is plotted on the price chart and the current trend can be determined by its placement vis-a-vis price👇

Generally, the default parameters are 10 for the #AverageTrueRange(ATR) (sedg.in/jd12hn59) and 3 for its multiplier👇

Important Things to Remember before Entering in #SwingTrading for success....

That I have followed and get succeed...

I will also explain each key notes Important....

Note:All key things apply in swing trading only....

It's my personal views not any suggestions..

That I have followed and get succeed...

I will also explain each key notes Important....

Note:All key things apply in swing trading only....

It's my personal views not any suggestions..

Swing Tranding means buy any things at lower Price and sell at higher price and get benefit of difference.

Ex:In retail Market we know the wheat trading ,Rice trading..

Same principle applies in #stockmarkets but here only difference is to check different perameters....

Ex:In retail Market we know the wheat trading ,Rice trading..

Same principle applies in #stockmarkets but here only difference is to check different perameters....

Mainly I have working upon two Categories

1)Large caps

2)Mid caps

I always try to avoid small caps for Swing trading....

In this thread I will explain about #largecaps swing trading

1)Large caps

2)Mid caps

I always try to avoid small caps for Swing trading....

In this thread I will explain about #largecaps swing trading

#DhampurSugar - Short Term Swing Trading Opportunity !

CMP – 287.85 (11/8/2021)

(Must read Thread Thread for #TA learners)

@rohanshah619 @caniravkaria 👉#TechnoFunda Views Invited.

CMP – 287.85 (11/8/2021)

(Must read Thread Thread for #TA learners)

@rohanshah619 @caniravkaria 👉#TechnoFunda Views Invited.

1⃣

#DhampurSugar is first & largest producer of refined sulphurless sugar in country.

Company's sugarcane co-generation capacity is one of the largest in the country & it has perhaps highest ethanol manufacturing capacity relative to it’s cane crushing capacity in country.

#DhampurSugar is first & largest producer of refined sulphurless sugar in country.

Company's sugarcane co-generation capacity is one of the largest in the country & it has perhaps highest ethanol manufacturing capacity relative to it’s cane crushing capacity in country.

2⃣

#DhampurSugar Capacity 👉

Crush 45,500 metric tonnes of cane per day

Refine 1,700 metric tonnes of sugar per day

Generate 209 MWH of renewable power

Export upto 125 MWH of renewable power to the grid

Produce 300,000 liters of alcohol/fuel ethanol per day

#StockMarket

#DhampurSugar Capacity 👉

Crush 45,500 metric tonnes of cane per day

Refine 1,700 metric tonnes of sugar per day

Generate 209 MWH of renewable power

Export upto 125 MWH of renewable power to the grid

Produce 300,000 liters of alcohol/fuel ethanol per day

#StockMarket

#IOLCP - Short Term Swing Trading Opportunity !

CMP – 644.40 (9/8/2021)

(Must read Thread Thread for #TA learners)

@caniravkaria @Arpit1223 Fundamental Views Invited.

CMP – 644.40 (9/8/2021)

(Must read Thread Thread for #TA learners)

@caniravkaria @Arpit1223 Fundamental Views Invited.

1⃣

#IOLCP manufactures & sells bulk drugs & organic -inorganic chemical compounds in India & internationally.

Company offers APIs such as ibuprofen, metformin hydrochloride, lamotrigine, fenofibrate & clopidogrel bi sulphate.

It also provides specialty industrial chemicals.

#IOLCP manufactures & sells bulk drugs & organic -inorganic chemical compounds in India & internationally.

Company offers APIs such as ibuprofen, metformin hydrochloride, lamotrigine, fenofibrate & clopidogrel bi sulphate.

It also provides specialty industrial chemicals.

2⃣

After a massive run from March 2020 to December 2020, #IOLCP has gone into consolidation phase.

#TechnicalAnalysis #IOLCP #StockMarket #Trading #SwingTrading

After a massive run from March 2020 to December 2020, #IOLCP has gone into consolidation phase.

#TechnicalAnalysis #IOLCP #StockMarket #Trading #SwingTrading

𝗛𝗢𝗪 𝗧𝗢 𝗦𝗘𝗟𝗘𝗖𝗧 𝗦𝗧𝗢𝗖𝗞𝗦 𝗙𝗢𝗥 𝗦𝗪𝗜𝗡𝗚 𝗧𝗥𝗔𝗗𝗜𝗡𝗚

𝐀 𝐓𝐡𝐫𝐞𝐚𝐝 🧵

ᴘʟᴇᴀꜱᴇ ʟɪᴋᴇ & ʀᴇᴛᴡᴇᴇᴛ ɪꜰ ʏᴏᴜ ꜰɪɴᴅ ᴛʜɪꜱ ᴜꜱᴇꜰᴜʟ

@Puretechnicals9

@caniravkaria

@PAlearner

@SandeepKrJainTS

@rohanshah619

ʏᴏᴜʀ ᴠɪᴇᴡꜱ ᴀʀᴇ ᴡᴇʟᴄᴏᴍᴇ

𝐀 𝐓𝐡𝐫𝐞𝐚𝐝 🧵

ᴘʟᴇᴀꜱᴇ ʟɪᴋᴇ & ʀᴇᴛᴡᴇᴇᴛ ɪꜰ ʏᴏᴜ ꜰɪɴᴅ ᴛʜɪꜱ ᴜꜱᴇꜰᴜʟ

@Puretechnicals9

@caniravkaria

@PAlearner

@SandeepKrJainTS

@rohanshah619

ʏᴏᴜʀ ᴠɪᴇᴡꜱ ᴀʀᴇ ᴡᴇʟᴄᴏᴍᴇ

𝐒𝐭𝐞𝐩 1⃣: ꜱᴇᴄᴛᴏʀ ᴀɴᴀʟʏꜱɪꜱ

(A)Identify sectors that are in an established uptrend.

(B)Did the specific sector give a pullback? If yes, has it given any confirmation?

#SwingTrading

(A)Identify sectors that are in an established uptrend.

(B)Did the specific sector give a pullback? If yes, has it given any confirmation?

#SwingTrading

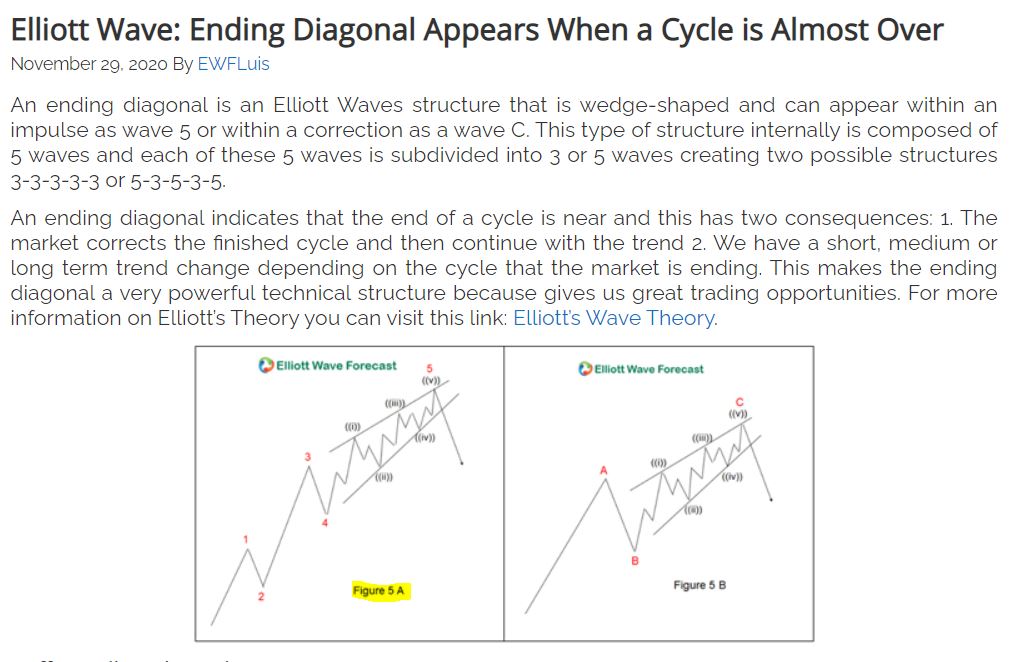

$PENN #Trading Idea Updated: Another ABC, another ATH... PPO still bearish on daily. Approaching final PT. Weekly beautiful long term trend. Watch for chances to add @ SMA20. When Super bowl ends, consolidation on weekly begins.

Invalidation: $76.62

PT: $112

#tradingpsychology

Invalidation: $76.62

PT: $112

#tradingpsychology

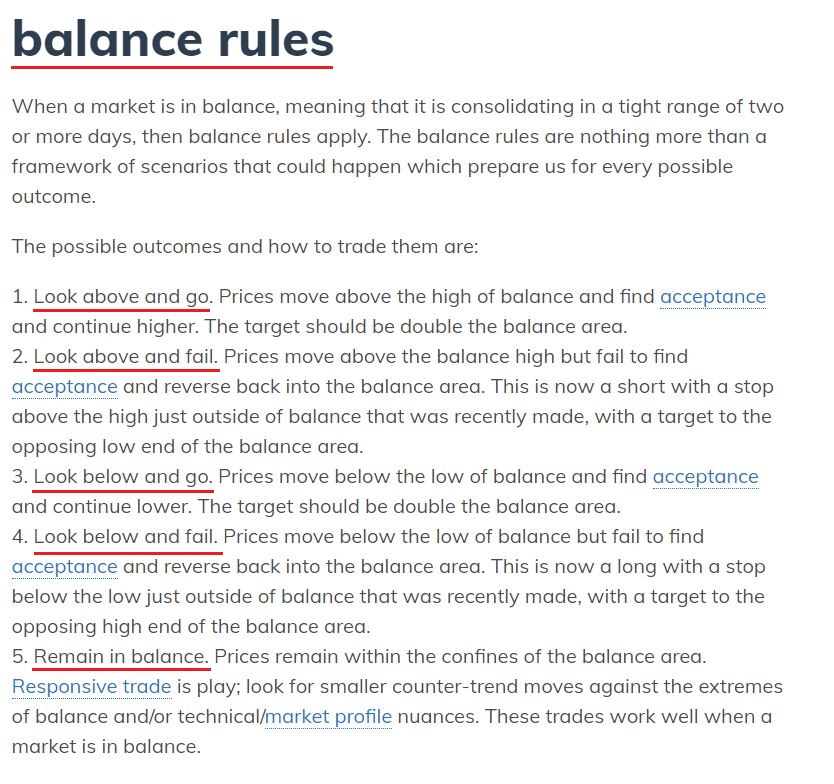

$PENN #Trading Idea Updated: Ending diagonal setting up? $112 is the balance area PT. Bearish PPO divergence on weekly. NFL Season ends in a few weeks. Will an end of the NFL season & the January effect cause daily/weekly consolidation?

#tradingpsychology

#tradingpsychology

$PENN #Trading Idea Updated: Ending diagonal setting up? $112 is the balance area PT. Started to break down yesterday but was saved by an upgrade this morning.

#tradingpsychology

#tradingpsychology

$SPY journal everything.

What price did we buy yesterday?

Do you think it holds as resistance today?

Or was that a sick dip buy called out in advance with time for you to take the second chance entry and lock in faster gains?

We never know.

Have a plan ✌️

What price did we buy yesterday?

Do you think it holds as resistance today?

Or was that a sick dip buy called out in advance with time for you to take the second chance entry and lock in faster gains?

We never know.

Have a plan ✌️

$SPY auto sold into $278 #tradernap