Discover and read the best of Twitter Threads about #WallSt

Most recents (21)

1. IPCC presser.

@LeonSimons8 is right—climate-aerosol dynamics are explained incorrectly.

@RealTadzioM @ReiSteurer @JKSteinberger are right—natural scientists do stunning work, but are unfit for social science/#polsci or scicomm.

@LeonSimons8 is right—climate-aerosol dynamics are explained incorrectly.

@RealTadzioM @ReiSteurer @JKSteinberger are right—natural scientists do stunning work, but are unfit for social science/#polsci or scicomm.

@LeonSimons8 @RealTadzioM @ReiSteurer @JKSteinberger Julia blocked me for some reason; it's rare for a thread of hers to appear in my timeline. Well worth reading.

1/ MY SUMMARY🧵re: today's SEC #Custody Rule proposal, which is here: sec.gov/rules/proposed…

*NONE OF THIS IS LEGAL ADVICE*

tl;dr--it doesn't kill #crypto custody; it's a move against state-chartered trust companies; there's one big issue, tho, which will trigger huge pushback

*NONE OF THIS IS LEGAL ADVICE*

tl;dr--it doesn't kill #crypto custody; it's a move against state-chartered trust companies; there's one big issue, tho, which will trigger huge pushback

2/ THE BIG ISSUE (& I haven't seen anyone point this out yet)=the rqmt for custodians to indemnify for "negligence, recklessness or willful misconduct." All the banking, #WallSt, commodities & #crypto industries will push back together on this bc it could kill custody biz broadly

3/ What's the issue? Proposal wld apply Custody Rule to all asset classes incl commodities & #crypto (ie, not just securities)--OK, fine. But SEC also wants custodians to indemnify FULL asset value for losses in which custodian played ANY role (eg, an oil tanker sinks; cows die).

1/ THINKING ABOUT all things bond mkt after catching up on morning reading☕️. 15yrs of my #WallSt career was helping pension plans/life insurers fix their past mistakes (most of which made them inherently short vol). Fundamental probs w/ bond mkt structure exacerbated this prob.

2/ The underlying issue pertains to how fin mkts deal with duration. Pensions & life insurers have the longest-duration liabilities in the fin system & yet they scramble to find duration-matched assets to buy bc there’s either a structural shortage of them, or they’re in banks.

3/ In the UK, where mortgages are mostly floating-rate, UK govt issuing long-duration gilts is the primary source of long-duration assets for pension funds. High % of UK pension liabs are inflation-indexed too (far more than in US) & again the offsetting asset comes from UK govt.

1/ WOW--pageviews on this kinda viral. Thanks all!🙏 2 reactions to comments:

A) ppl seem surprised that I'm talking abt #bitcoin as pymt tech, not as an asset. Not new. I've always said price is the LEAST interesting aspect of #BTC + been critical of its leveraged financializers

A) ppl seem surprised that I'm talking abt #bitcoin as pymt tech, not as an asset. Not new. I've always said price is the LEAST interesting aspect of #BTC + been critical of its leveraged financializers

2/ Leverage-based financializers & esp criminals & fraudsters set the industry back + manipulated secondary market price (#bitcoin became #WallSt's latest plaything🤮). "Play stupid games win stupid prizes" as saying goes. Hope everyone learns. Innocents: sorry for your losses.

3/ More interesting=those asking me "why warn the banks?" 3 things: on/off ramps btwn USD & #BTC still matter (there aren't many & they're at some risk of regulatory crackdown); banks aren't going away as fee-based service providers/safeguarders of property; & we're not ready yet

1/ I'VE BEEN THINKING MORE abt the #bitcoin ETF. For yrs, I've said ETFs are a double-edged sword for bitcoin (bc ETF mkt makers are permitted by law to create more claims to the underlying asset than the quantity of the underlying, which distorts the price of the underlying).

2/ But, as I wrote in @Newsweek this week, the SEC's decisions to reject spot #bitcoin ETFs don't exist in a vacuum. They must be viewed in context of the SEC's decisions in 2015 to approve 1 (& only 1) fund structure for bitcoin--& not another until 2021.

newsweek.com/crypto-crash-w…

newsweek.com/crypto-crash-w…

1/ I'VE BEEN THINKING--#bitcoin may prove to be the exact opposite of #tradfi where cost of debt is < cost of equity. On-chain #bitcoin will prove over time to have a cheaper cost of capital than #bitcoin-denominated debt--bc #bitcoin isn't an IOU & has no lender of last resort.

2/ This may take time to play out & all the leverage-based financialization games being played by the fast-money crowd need to be flushed first. To be clear, such games are increasing the cost of capital for the whole ecosystem now (by increasing #bitcoin's price volatility).

3/ But that flush will happen (& good riddance to the games when it does). That's when #WallSt crowd will figure out just how different bitcoin is.

Per @TraceMayer, #bitcoin is the apex predator of finance.

Reminder: if you don't own on-chain #bitcoin, you don't own bitcoin.

Per @TraceMayer, #bitcoin is the apex predator of finance.

Reminder: if you don't own on-chain #bitcoin, you don't own bitcoin.

One word @CaitlinLong_: GREED.

You’ve been spot on. I struggled w/ noticing the same issue of #derivative and #TradFi games infecting #bitcoin & #Crypto over the last 1.5yrs or so.

Structurally it was quite easy to see. But...

/1 👉🧵 on a few thoughts.

You’ve been spot on. I struggled w/ noticing the same issue of #derivative and #TradFi games infecting #bitcoin & #Crypto over the last 1.5yrs or so.

Structurally it was quite easy to see. But...

/1 👉🧵 on a few thoughts.

you have to know how these things have played out in other markets as well as how intermarket relationships work within markets in general. And, you never really know how the change will play out. Especially, in new asset classes like #DigitalAssets.

/2

/2

It felt like most in the space chose not to acknowledge the changes & continue to pump the narrative of NGU and BTFD with little regard for what’s *actually* happening w/ the fundamental picture. Time horizon matters. All participants have different goals.

/3

/3

MORE on the below 🧵. There's so much inconsistency in #tradfi collateral posting rqmts (eg, most govts & corporates aren't req'd to post while trading firms are but with v diff collateral thresholds). It's all obfuscated. I lament that these derivative games are now in #crypto😢

There's no question derivatives games put a lid on #bitcoin's price appreciation in recent cycle, just as the same #WallSt derivatives games do same to #tradfi mkts. But when the epic short squeeze inevitably finally hits you get #LME-type games (yep, even in regulated mkts).

And derivatives can debauch otherwise strong balance sheets VERY fast in unexpected ways when BIG moves happen.

Little known fact: big banks' interest rate trading books often have BIG swaps receivables from state/local govts & swaps payables to corporates--UNCOLLATERALIZED.

Little known fact: big banks' interest rate trading books often have BIG swaps receivables from state/local govts & swaps payables to corporates--UNCOLLATERALIZED.

1/ FED's NEW PAPER ON STABLECOINS today deserves both praise & a response. It contains something BIG (1st time I've seen the Fed say this🚨🔥) but it misses things too. Wonky topic: how #stablecoins fit into plumbing of #tradfi, which is right up my alley. libertystreeteconomics.newyorkfed.org/2022/02/the-fu…

2/ The NYFed's 3 conclusions + my reactions here:

1. Stablecoins tie up liquidity unnecessarily💯✅🎯

2. Stablecoins that do not tie up liquidity are risky & less fungible❌🤔

3. We already have an efficient form of digital money/just need to adapt it to a new environment: ✅&❌

1. Stablecoins tie up liquidity unnecessarily💯✅🎯

2. Stablecoins that do not tie up liquidity are risky & less fungible❌🤔

3. We already have an efficient form of digital money/just need to adapt it to a new environment: ✅&❌

3/ Let's dig in. First, in this🧵we're talking abt fiat-collateralized #stablecoins, not algo or #crypto-collateralized ones that never touch USD payment systems. Central bankers' real concern has (rightly) always been impact of fiat-backed #stablecoins on trad system plumbing.

QUESTIONS ANSWERED here about this🧵(thx for all the engagement!)

1) what do u mean by paper #bitcoin?

2) is all leverage bad?

3) why so sure that a leverage-flush reckoning day will come for bitcoin? Gold investors have waited forever.

4) can't traders hedge the risk? (haha, no)

1) what do u mean by paper #bitcoin?

2) is all leverage bad?

3) why so sure that a leverage-flush reckoning day will come for bitcoin? Gold investors have waited forever.

4) can't traders hedge the risk? (haha, no)

2/ PAPER BITCOIN=a promise by an intermediary, such as an exchange, to deliver real #bitcoin. Unless you hold the private keys, you don't own bitcoin--what you own is a CLAIM to bitcoin (an IOU). Does your intermediary own enuf on-chain bitcoin to make good on all such claims???

3/ The honest truth is that probably no one other than your intermediary itself really knows & many intermediaries are likely running fractional. It is certain that the quantity of paper #bitcoin outstanding > the 18.9m on-chain bitcoins that exist, but by how much is unknowable.

@kwerb 1/ Well said @kwerb. When I started writing in 2016 abt the dangers of leverage-based financialization in #bitcoin mkts for @ForbesCrypto, I was worried abt #WallSt banks bringing it. What I missed was that #crypto peeps wld beat the big banks to it—& wld do it MUCH bigger. How?

@kwerb @ForbesCrypto 2/ bc they did it offshore. They beat #WallSt to it bc (1) regulators held back big banks/regulated derivatives exchanges & (2) onshore firms are capped on leverage they can offer. Example: onshore US #BTC futures can be leveraged ~2.5x but offshore can be 20x (was 125x until…

@kwerb @ForbesCrypto 3/ …some offshore exchanges voluntarily reduced it to 20x after much criticism of the practice—deserved, IMHO—but 20x is still much higher than regulators would allow onshore). The recent bull market brought in many speculators (incl many w/ WallSt trading backgrounds). I’d…

1/ ~FIVE YEARS AGO, I first said #bitcoin cld take down a GSIB (global systemically important bank)--NOT because of anything wrong w/ Bitcoin, but bc the banks just aren't set up to handle an asset that settles in minutes & is irreversible. @ChrisBrummerDr rollcall.com/podcasts/finte…

2/ If banks are going to start owning #bitcoin/#crypto on their books(ie, not just being custodians like w/ stocks), banks need special rules to deal w/ the huge differences in settlement terms. Banks use systems set up ~40yrs ago (esp in US),most of which reconcile only 1x/day😱

3/ Again-issue is w/ banks' IT & operational systems, not w/ #Bitcoin (which I consider the most significant financial technology invention of human history. Yep, really💪). In this @ChrisBrummerDr podcast w/ former Fed Governor Dan Tarullo, we discuss how bank capital rules work

1/ IT MAY SURPRISE YOU that, as a #bitcoiner, I think @BIS_org's proposed 1:1 capital rqmnt for #bitcoin is TOO LOW & view banks entering bitcoin trading as bad for banks & bitcoin's price volatility. The problem isn't Bitcoin--it's the banks.@ForbesCrypto

forbes.com/sites/caitlinl…

forbes.com/sites/caitlinl…

2/ @BIS_org's capital proposal completely missed biggest issue w/ banks holding #bitcoin on-balance sheet: settlement risk. Traditional banks are simply not set up operationally or technologically to hold on-balance sheet assets that settle in minutes w/ irreversibility.

3/ Many spoke out that the 1:1 capital rqmt was too high. But the opposite is true. The Basel III framework isn't set up to assess settlement risk. It doesn't have to, bc there are all kinds of operational fault tolerance mechanisms built into traditional financial markets.

1/ WELL WRITTEN article--thx @Vlajournaliste. A couple of key points: "The assumption that #WallSt matters to #bitcoin is a fallacy because the information frontier is not in New York. It's not in Silicon Valley either. These mkts are decentralized."

businessinsider.com/bitcoin-invest…

businessinsider.com/bitcoin-invest…

2/ "It means at the end of the day that Wall Street will never be able to have [central] clearing for digital assets," she said, "because Wall Street will never be able to get its hands on a sufficient amount of the collateral to create a true clearinghouse."

3/ "She explains that 75% to 80% of #bitcoin and ether, on average, are held by individuals rather than intermediaries, and during bull markets, even less crypto is held by intermediaries." (h/t @nic__carter)

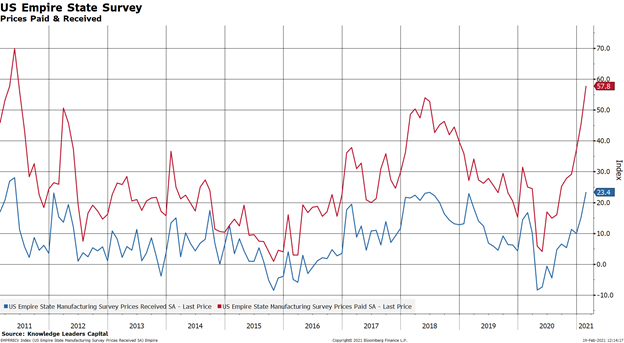

(1/n) The #inflation data just keeps coming in hot. Today it was the #Markit #PMIs that showed input prices rising to a record...by a long shot.

(2/n) Earlier in the week it was the core PPI data, which came in at 2%, fully twice the #WallSt estimates.

(3/n) On Monday the #Fed's Empire State manufacturing survey showed prices paid at the highest level in 10 years.

1/ STUNNED but not surprised by #Bitfinex #Tether news out of #NewYork. I'll let other cryptolawyers analyze it but here are two macro thoughts: (1) There's a big double standard here. (2) Exchanges, clean up your act--cryptographically prove your solvency

2/ First, the double-standard. Why didn't the NY AG throw the Martin Act at Merrill Lynch for doing something actually quite similar from 2009-12? Seriously, why the double standard??? Quoting the SEC's press release here: sec.gov/news/pressrele…

3/ "The maneuver freed up billions of dollars per week from 2009-12 that Merrill Lynch used to finance its own trading activities. Had Merrill Lynch failed in the midst of these trades, the firm’s customers would have been exposed to a massive shortfall in the reserve account."

1/ BOOM! #Wyoming just recognized clear, direct property rights for #digitalassets by passing SF125! This means #blockchain cos will prob want to apply WY law to your contracts, domicile here, &/or have a physical presence here. Thx again to the army of ppl who helped over months

2/ As @TraceMayer says, v impt for broad adoption of #crypto that it be “backwards-compatible w/ law.” SF125 enables that. Bill was amended w/ improvements & latest is here: wyoleg.gov/Legislation/20…. Goes to @GordonGovernor for signature & could officially become law next week

3/ I'll publish analysis after it officially becomes law, but here's the key: #Wyoming law recognizes property rights in the DIRECT ownership of #digitalassets. Property law in US is determined by states, not the feds. WY not only did it first but did it right!! This applies to

I've been reading the e-mail from @wikileaks #Podesta hack which contains 3 attachments of transcriptions of Q & A sessions #HRC did with Goldman Sachs. wikileaks.org/podesta-emails… @BernieSanders had asked her to release transcripts or recordings. She had received hefty speaker fees.

I'm wondering, if the documents in this e-mail are an accurate representation of her appearances, why she didn't release them. There weren't any particularly "gotcha" moments where she thanked #WallSt for making her & her husband rich or where she promised to protect their

interests. A lot of what she said was uninspiring centrism, which is her brand. Several times she called for fixing #immigration, but without specifics. As part of the unwashed masses, I didn't see six figures worth of value in these words, but what do I know? Maybe they were

1/ Great morning for a tweetstorm updating the latest on the interaction of #WallSt & #bitcoin, drinking coffee from my new BitMug (thanks AC Fenton!) @brucefenton

2/ The most significant news--maybe most important news to date on the #WallSt front--was @tzeroblockchain's token generation event on 10/12 (a fully-compliant #STO on the public #Ethereum mainnet of true preferred stock, issued by an SEC registrant). Investor letter captures...

3/ ...perfectly the true benefit of owning #cryptoassets (which defenders of the legacy system love to ignore): investors have the option to opt out of the legacy system, which is unstable & unfair. Owners can either hold tokens at a broker/dealer OR IN A PERSONAL WALLET at...

1/ What an honor to be part of this lively debate about #bitcoin vs #WallSt (incl #ETFs & @Bakkt) w/ @GamerAndy, @aantonop, @JonathanMohan & @S_Murphy_PhD. Mainstreaming, rehypothecation, price suppression, privacy, early adoption, Trojan horses, Black Monday, custodian theft...

2/ ...hear @aantonop & I talk about rehypothecation coming to #bitcoin & #crypto, whether it's legal vs fraud vs merely unethical, how it's a form of #fractionalreservebanking, how it relates to @OverstockCEO's prior discussions of #WallSt's "bezzle" & how big that bezzle is...

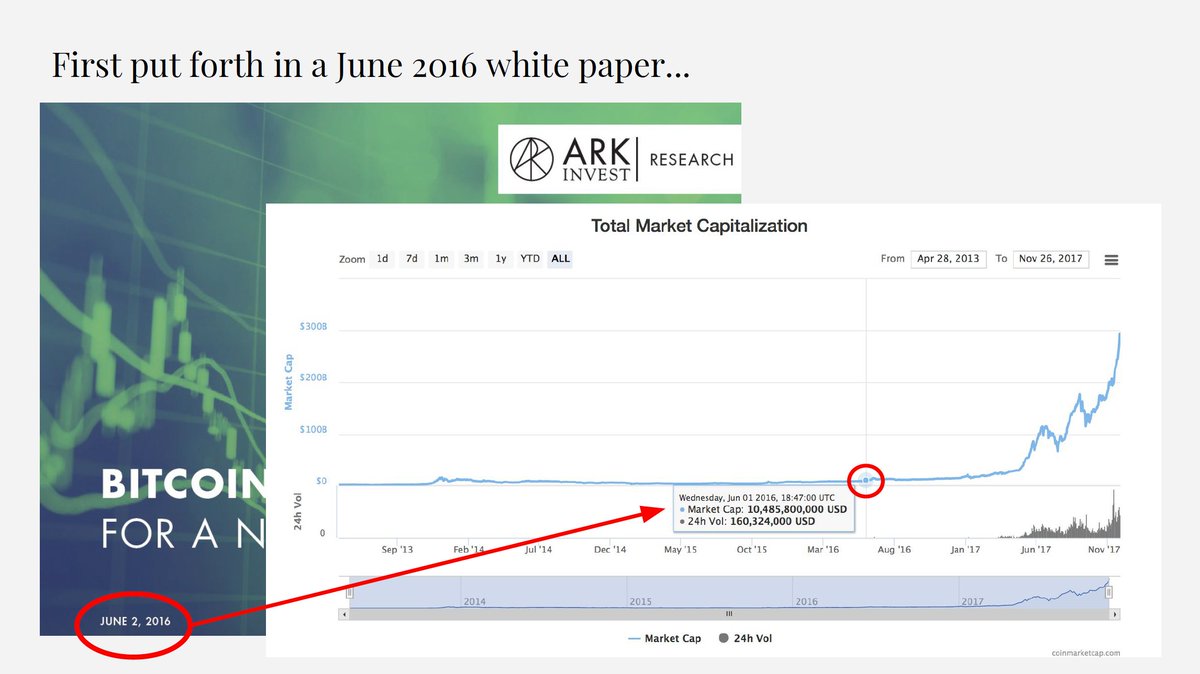

2/ The presentation was inspired by the 2016 white paper put out by @ARKInvest & @coinbase, which involved @WhiteAdamL, @wintonARK, @CathieDWood & myself. Link to whitepaper here: research.ark-invest.com/bitcoin-asset-…

3/ When the white paper came out in July 2016, it got fanfare from the #cryptocommunity, but many from #WallSt dismissed it b/c the aggregate network value of #cryptoassets was $10.5B at the time. Asset classes store trillions, #crypto would never get there...