Discover and read the best of Twitter Threads about #qe

Most recents (24)

Tweet mañanero y Cuenta atrás.

OBSOLENCIA PROGRAMADA

La inflación se combate con calidad

y no con cantidad

OBSOLENCIA PROGRAMADA

La inflación se combate con calidad

y no con cantidad

En las últimas semanas, esa ofensiva contra cripto ha ido ganando adeptos y ha destrozado bastantes infraestructuras. Por un lado, estaría totalmente justificada, por el otro, no son precisamente salvadores quienes levantan el hacha una y otra vez.

Es la guerra de las familias contra todas las #criptos que no puedan controlar o que podrían representar independencia económica a nivel individual. También está la otra guerra, la de las familias de la agenda pulverizada contra opciones contrarias en plan de tierra quemada.

1/17-💭What we're facing is a #TRUST crisis rather than a #BalanceSheet crisis. There’s been a lot of amalgamation between #BTFP and #QE, but they are different, and their consequences will be different as well. My thoughts 👇

#CreditSuisseBankruptcy #BankingCrisis #AllianceBlock

#CreditSuisseBankruptcy #BankingCrisis #AllianceBlock

2/17- 🏦 #BTFP (1):

- Involves banks depositing HTM bonds and AFS securities at the Fed as collateral against borrowing the At Par Value for 1 year

- Funds are likely to be used for immediate liquidity needs, backstopping bank runs and making depositors whole

- Involves banks depositing HTM bonds and AFS securities at the Fed as collateral against borrowing the At Par Value for 1 year

- Funds are likely to be used for immediate liquidity needs, backstopping bank runs and making depositors whole

3/17- 🏦 #BTFP (2) : Unlikely to result in new credit being extended, and banks are likely to tighten lending standards until the dust settles

- Velocity of money in the banking system should instead decrease, offsetting any increase in reserves

- Velocity of money in the banking system should instead decrease, offsetting any increase in reserves

BTC Price Skyrockets 🚀– What's Next for Bitcoin?

Click "like" and RT for more content 🧵

1/ The Fed signaled that it tightened too hard and may need to pause or cut rates, which has to #bitcoin hitting $27K over night.

But where next for bitcoin? Lets dive in...

Click "like" and RT for more content 🧵

1/ The Fed signaled that it tightened too hard and may need to pause or cut rates, which has to #bitcoin hitting $27K over night.

But where next for bitcoin? Lets dive in...

2/ 📊 Recent data from Cointelegraph and TradingView revealed BTC/USD hitting $27,025 before consolidating. At the time of writing, the pair is around $26,500 , but WHY the sudden surge....? #BitcoinPriceMovement

3/ 🚀 A catalyst for this fresh upside came from the Federal Reserve's balance sheet data, showing almost $300 billion being injected into the economy as part of the banking crisis response. This further fueled the price movement for Bitcoin. #FederalReserve #BTC

Today’s #JobsReport was very solid, but like is often the case in the movies, it’s very hard for the sequel (today’s report) to match such an unexpected hit (January’s revised 504,000 jobs gained).

Still, a nonfarm #payroll gain of 311,000 jobs is quite good and having 815,000 jobs created so far this year after the #economy has already created 12 million #jobs over the past two years is pretty amazing in its own right.

Further, the 3-month moving average of 351,000 jobs, after a 12-month moving average of 362,000 jobs gained per month is also pretty remarkable, particularly after the market-implied pricing of the terminal #FedFunds rate has move up 500 basis points (bps) in a year.

Agreed. The singular advantage of money as a near-universally acceptable, reliable medium of exchange is that it breaks the need to know and trust counterparts all along the chain of trade & production. 1/x

This not only expands -and hence enriches- the network of exchange (think Adam Smith or “I, Pencil”) but removes node-occupying middlemen and toll-exactors. Efficiency increases, but transparency and fairness, too. 2/x

Once we have #CBDC-s -coupled to #Agenda2030 #IoT tracking of ‘#carbon’, meat protein, ‘circular economy’, low food miles, etc, we will have subjected ourselves to an intrusive, permanent rationing where a tax collector, a camp guard, and a Levitican Inquisitor...

3/x

3/x

It seems that #Zoltan has been quite busy lately!

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

The newest, already 5th part of his "War"-series, was published on January 6th.

In this little #thread i've summarized some of the highlights of his piece "War and Peace:

🧵

"... four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (..) in “macro-land” () where Great Powers were going “at it” in 2022:

"the G7’s financial blockade of Russia, Russia’s energy blockade of the EU, the U.S.’s technology blockade of China, China’s naval blockade of Taiwan, the U.S.’s “blockade” of the EU’s EV sector with the Inflation Reduction Act,

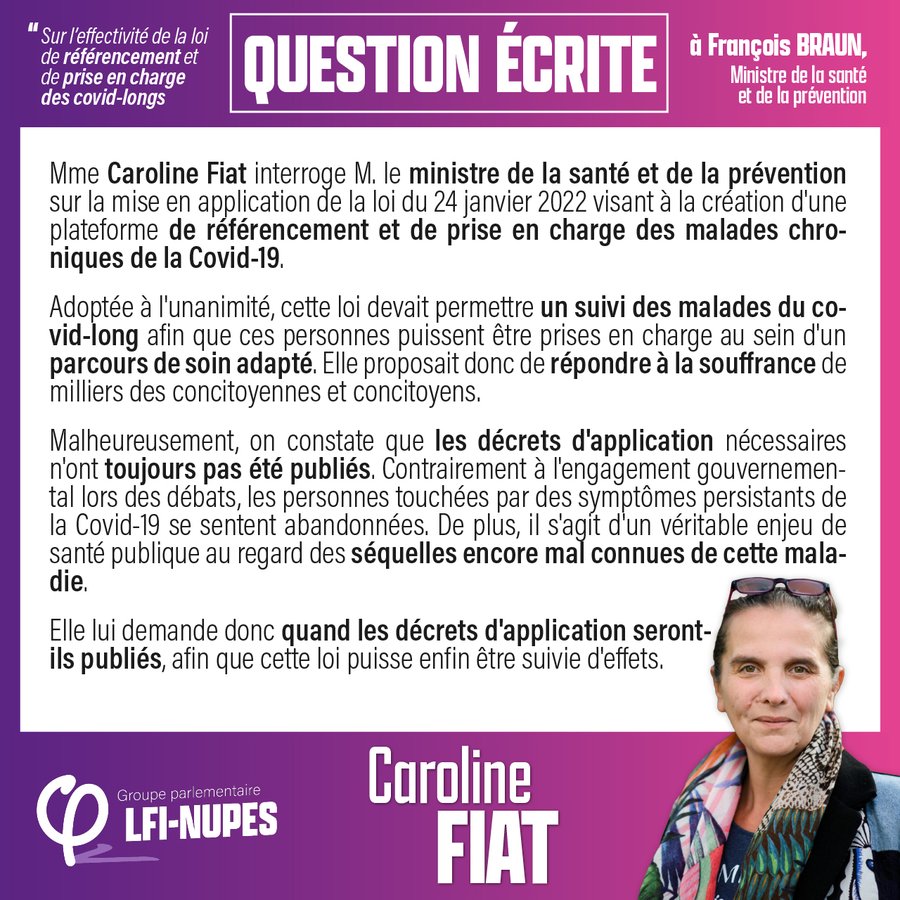

#covidlong : @CarolineFiat54 vient d'adresser une #QE au ministre de la @Sante_Gouv @FrcsBraun pour disposer d'une visibilité sur la prise des décrets d'application permettant de rendre effective la loi @MichelZumkeller visant création d'une plateforme de référencement et de

1/

1/

prise en charge des malades chroniques de la #covid19 (vie-publique.fr/loi/282605-loi…).

S'il s'agit effectivement d'un marqueur politique fort, cette loi appelle encore de nombreux travaux notamment sur le périmètre de cette PF, sa définition exacte etc. mais pas que.

2/

S'il s'agit effectivement d'un marqueur politique fort, cette loi appelle encore de nombreux travaux notamment sur le périmètre de cette PF, sa définition exacte etc. mais pas que.

2/

Le cahier des charges du SI est certes à approfondir, mais d'autres questions structurantes se posent à la lecture notamment de l'article 2 (attendus concernant les #ARS et le volet prise en charge des analyses et soins).

3/

3/

1) #TheEconomist 26/11/2022

Kapak resminde Türkiye’nin, Avrupa haritasında gösterilmesi içerikten daha çok dikkat çektiği hâlde söz konusu makalede Türkiye üzerine hiçbir yorum bulunmamaktadır.

➡️ Ancak #enerji krizi ve sert #kış şartları önemli olduğundan buradan başlayalım.

Kapak resminde Türkiye’nin, Avrupa haritasında gösterilmesi içerikten daha çok dikkat çektiği hâlde söz konusu makalede Türkiye üzerine hiçbir yorum bulunmamaktadır.

➡️ Ancak #enerji krizi ve sert #kış şartları önemli olduğundan buradan başlayalım.

2) Ukrayna’ya desteği ile hayranlık uyandıran #Avrupa için madalyonun diğer yüzünde ekonomik daralma görülmektedir.

Sorun sadece ekonomik de değildir. Putin’in enerji silahı ve soğuk hava şartları Avrupa’da 100.000 ilave ölüme işaret etmektedir.

Sorun sadece ekonomik de değildir. Putin’in enerji silahı ve soğuk hava şartları Avrupa’da 100.000 ilave ölüme işaret etmektedir.

3) Şirketler açısındansa artan enerji maliyetleri üretim bakımından yeni arayışlara neden olmaktadır. Avrupa’nın yatırımları çekmek bir yana elindekileri kaybetme riski ise hiç istenmeyen bir durumdur.

Teşvik ve desteklerse ilave yük anlamına gelecektir.

Teşvik ve desteklerse ilave yük anlamına gelecektir.

▶️Le FBI chercherait à l'identifier, pendant que la légende #Satoshi, 20° fortune mondiale, continue à faire couler beaucoup d’encre.

Toute hypothèse reste possible...

- Thread que Musk, Biden, Macron, BFM & Goldman Sachs aimeraient pouvoir interdire

Censuré une 1° fois, RT♻️

Toute hypothèse reste possible...

- Thread que Musk, Biden, Macron, BFM & Goldman Sachs aimeraient pouvoir interdire

Censuré une 1° fois, RT♻️

- Et si un lobby technologique & industriel, la CIA ou le WEF se cachait derrière cette légende ?

Comment ? Pourquoi ?

▶️Revenons aux origines de l’émergence de la cryptographie :

#Bitcoin est né dans les méandres de la crise financière de 2008...

Comment ? Pourquoi ?

▶️Revenons aux origines de l’émergence de la cryptographie :

#Bitcoin est né dans les méandres de la crise financière de 2008...

The @federalreserve’s #FOMC has now moved in 75 basis point increments four times this year to get to a sought-after #policy destination very quickly.

Yet, the destination seems to have moved further away with each subsequent elevated #inflation print, and with #employment in the country remaining very tight.

Hence, while moving the #FederalFunds rate at a very fast 75 bps increment seemed almost inconceivable several months ago, especially as the #Fed was still undertaking quantitative easing (#QE) in March, we have become used to this extraordinary increment.

▶️Le FBI et la CIA chercheraient à découvrir son identité, pendant que la légende #SatoshiNakamato, 20° fortune mondiale, continue à faire couler beaucoup d’encre

Toute hypothèse est possible à ce sujet

Étudions donc le phénomène avec un esprit cryptique.

@Jokaver x @0xTwareg

Toute hypothèse est possible à ce sujet

Étudions donc le phénomène avec un esprit cryptique.

@Jokaver x @0xTwareg

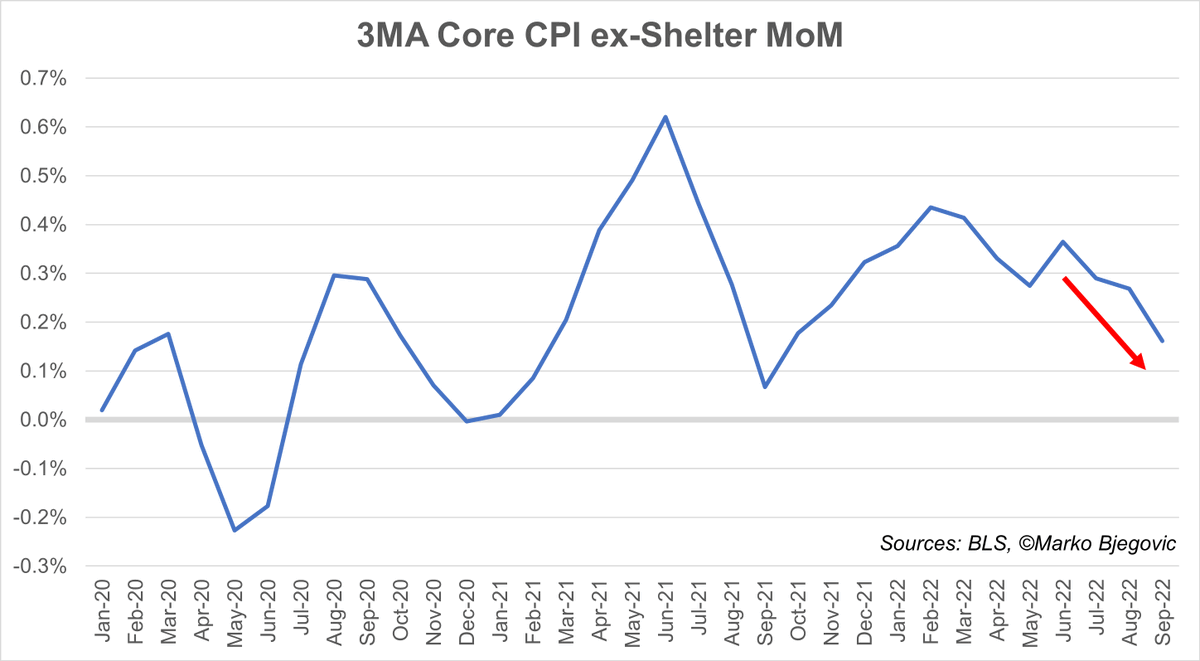

There have been lots of talks around easing rent #inflation and how lagging the Shelter #CPI really is.

Its 12M (or longer) lag makes it difficult to use in assessing current/future #inflation.

So what can the #Fed do?

Let's take a look at some other measures.

A thread.

1/14

Its 12M (or longer) lag makes it difficult to use in assessing current/future #inflation.

So what can the #Fed do?

Let's take a look at some other measures.

A thread.

1/14

Lots of recent comments by the #Fed have been about "sticky" and "high" #inflation.

But #inflation is neither sticky nor high as evidenced by the headline #CPI in the last 3M (unadjusted).

2/14

But #inflation is neither sticky nor high as evidenced by the headline #CPI in the last 3M (unadjusted).

2/14

Then the #Fed tries to spin it by saying core #inflation is "sticky" and "high".

If we exclude the shelter component (unadjusted), core #CPI is quite low and in a downtrend.

Now obvious Q is what if it reverses its course just like it did in 2021 and heads up again?

3/14

If we exclude the shelter component (unadjusted), core #CPI is quite low and in a downtrend.

Now obvious Q is what if it reverses its course just like it did in 2021 and heads up again?

3/14

Without seasonal adjustments there are many things to cheer for with Sep #CPI report.

3MA #CPI unadjusted is only +0.06%, the lowest since Dec 2020! (+0.02%).

3MA is even lower than in Mar 2020 when the #Fed started the latest QE.

Details follow in a thread.

1/9

3MA #CPI unadjusted is only +0.06%, the lowest since Dec 2020! (+0.02%).

3MA is even lower than in Mar 2020 when the #Fed started the latest QE.

Details follow in a thread.

1/9

1) Food decelerated a bit to +0.7% MoM from +0.8% in Aug

2) Energy a bit slower downward than one would expect due to unexpectedly higher gas prices (+2.6% vs -10.6% Henry Hub Natural Gas Spot Price - this would need to be reflected in Oct)

3) Core mixed but positive bias

2/9

2) Energy a bit slower downward than one would expect due to unexpectedly higher gas prices (+2.6% vs -10.6% Henry Hub Natural Gas Spot Price - this would need to be reflected in Oct)

3) Core mixed but positive bias

2/9

ONLY 2 categories with faster MoM #inflation:

a) Apparel (surprising rise from +1.7% in Aug to +2.2%) and

b) Transportation Services (decline in airline fares ended which couldn't offset faster vehicle maintenance and insurance #inflation - trans.serv. +1.7% vs -0.2% in Aug)

3/9

a) Apparel (surprising rise from +1.7% in Aug to +2.2%) and

b) Transportation Services (decline in airline fares ended which couldn't offset faster vehicle maintenance and insurance #inflation - trans.serv. +1.7% vs -0.2% in Aug)

3/9

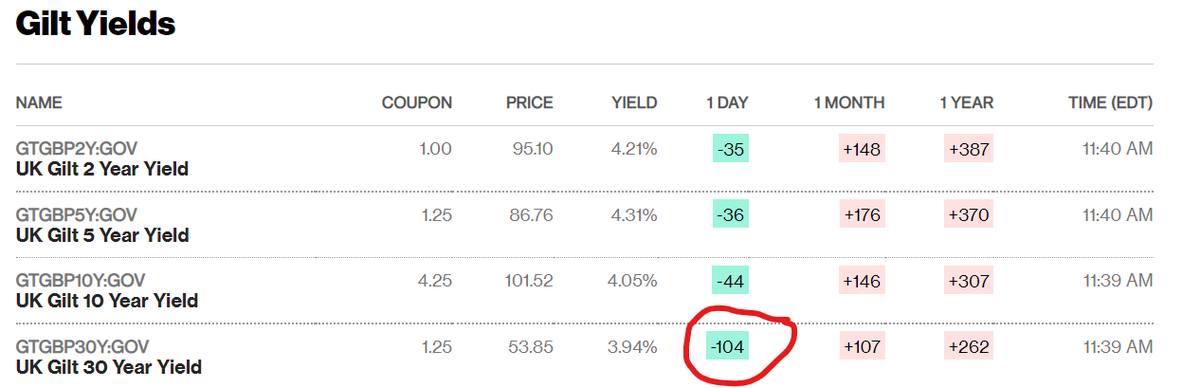

Thoughts on the #BankofEngland intervention… 🧵

The Bank will carry out *temporary* purchases of long-dated UK government bonds from 28 Sep to 14 Oct to stabilise the market.

The purchases ‘will be carried out on whatever scale is necessary’, but are *strictly time-limited*…

The Bank will carry out *temporary* purchases of long-dated UK government bonds from 28 Sep to 14 Oct to stabilise the market.

The purchases ‘will be carried out on whatever scale is necessary’, but are *strictly time-limited*…

Welcome to the Most Anticipated Recession in History–Part 2 -It's a #GlobalRecession & #LiquidityCrisis. Consumer perspective shaped by what’s going on in their own world despite politicos ignoring the chaos - by @TraderStef for @crushthestreet #Recession

crushthestreet.com/articles/break…

crushthestreet.com/articles/break…

#YouAskedUs if we printed cash to finance the federal gov’t.

We didn't.

👇 Keep reading to learn how we supported the economy from the shock of the pandemic. #CdnEcon #AskTheBoC

1/6

We didn't.

👇 Keep reading to learn how we supported the economy from the shock of the pandemic. #CdnEcon #AskTheBoC

1/6

The pandemic has been a crisis like no other.

As a result, we took various measures, like buying bonds, to support and ensure a strong and stable #economy.

2/6

As a result, we took various measures, like buying bonds, to support and ensure a strong and stable #economy.

2/6

We bought existing gov't bonds from banks on the open market.

Why?

This helped unblock frozen markets at the start of the #pandemic.

It let households, companies and governments access funding when they really needed it.

3/6

Why?

This helped unblock frozen markets at the start of the #pandemic.

It let households, companies and governments access funding when they really needed it.

3/6

📢THE COLLAPSE OF THE WORLD ECONOMY AND THE SOLUTION IN THE FORM OF CRYPTO! 📢

In this little story I summarize how Covid, Supply Chain, Debt, Wages, Inflation, a Eecession, Insolvency and an aging population come together to form a common solution: Crypto Assets

1) ...

In this little story I summarize how Covid, Supply Chain, Debt, Wages, Inflation, a Eecession, Insolvency and an aging population come together to form a common solution: Crypto Assets

1) ...

So much is happening in the world. War, High #inflation, Covid, #recession, insolvancy, a debt bubble and Supply Chain problems.

All of these causes have a large impact on the world economy and therefore on your portfolio, which makes it important to understand what is going on.

All of these causes have a large impact on the world economy and therefore on your portfolio, which makes it important to understand what is going on.

All you pointy-head PhD types and other academics now issuing mea culpas for ‘not understanding’ the #inflation dynamic: we warned you from the very off that more $$ + less supply + capital destruction/impairment would only NOT lead there if the QE/fiscal flood ...

1/5

1/5

..held perforce partly in abeyance, were later, upon cessation of ‘house arrest’, used to pay down debt & so self-extinguish itself.

If that unlikelihood did NOT eventuate - if Hyper-#QE were not terminated/reversed -how was the present bleak situation NOT to be foreseen??

2/5

If that unlikelihood did NOT eventuate - if Hyper-#QE were not terminated/reversed -how was the present bleak situation NOT to be foreseen??

2/5

As for the belated recognition that the disease has now metastasized to a wide range of raw inputs & production goods -increasingly to now-operative services as well as classic #inflation outlets- we were emphasising this well over a year ago while you were all “#transitory”

3/5

3/5

With respect to the data, #coreCPI (excluding volatile food and #energy components) came in at 0.6% month-over-month and at a high 6% year-over-year.

Meanwhile, headline #CPI data printed at a strong 0.6% month-over-month and came in at 7.5% year-over-year, the greatest increase over a 12-month period since February 1982.

Additionally, the @federalreserve’s favored measure of #inflation, #corePCE, increased 0.5% in December, bringing the year-over-year figure for the measure to 4.9%, as of that month.

Part of a common misconception: Europeans have always had a coherent strategy, that is NOT to become militarily independent. That makes sense, but not at the force-on-force level: (/) @Halsrethink @nglinsman @RobertMCutler @vtchakarova @pietercleppe @Danjsalt @moutet

Ostensibly this enabled them to quieten the leftist/pacifist part of their political spectrum (remember the Euromissiles fracas?) but again, that was only a superficial issue. There was a real one tough. (/)

Economically and on a technological level, Europe was perfectly capable of producing a military instrument on a par with WHATEVER US contingent was planned to be deployed to Europe in a conflict.(/)

Today’s #inflation report continued to reinforce the theme that gaudy #price gains are not standing in the way of demand.

It is a very rare time in history, in fact, most people operating in #markets haven’t seen this sort of demand outstripping supply in the real #economy in their careers, with some areas seemingly depicting a dynamic suggesting that “price is no object.”

Clearly, #inflation has been escalating for a number of months due to #shortages of supply in areas such as #housing, #commodities, semiconductors, new and used cars, etc., and those supply shortages are mostly still in place today.

DoubleLine founder and CEO Jeffrey Gundlach presents:

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Jeffrey Gundlach: 2021 might end up running 7% year on the CPI

#inflation #QE #Powell #fed #hikes #rates

#inflation #QE #Powell #fed #hikes #rates

Jeffrey Gundlach: Low interest rates coupled with inflation generating negative interest rate.

#JustMarkets2022 #CPI #QE #Fed

#JustMarkets2022 #CPI #QE #Fed

1

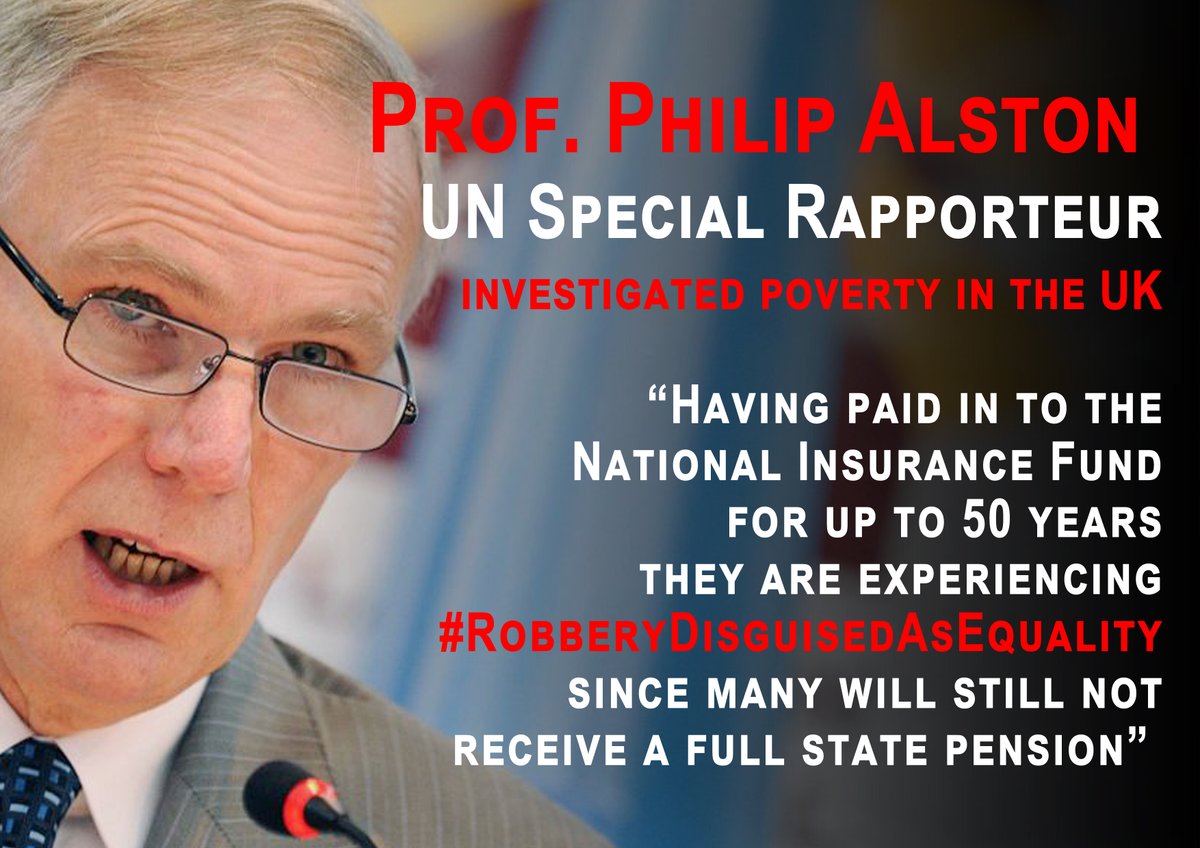

In 1995 State Pension Age for #50sWomen was increased from 60 to 66 in one fell swoop

It was decided that those women were NOT entitled to be informed of such a life-changing decision

Resulting in:

💥Retirement Annihilated

💥Stress / Illness

💥Heat Or Eat

💥No Dignity

In 1995 State Pension Age for #50sWomen was increased from 60 to 66 in one fell swoop

It was decided that those women were NOT entitled to be informed of such a life-changing decision

Resulting in:

💥Retirement Annihilated

💥Stress / Illness

💥Heat Or Eat

💥No Dignity

The fastest-growing developed economy in the West, the US, has just released #growth figures for Q3: 2% annualized (down from Q2 recovery of 6.7%).

[Reminder: growth<0 is #recession, low growth is #stagnation.]

It also released the corresponding #inflation of 5.7%.

#stagflation

[Reminder: growth<0 is #recession, low growth is #stagnation.]

It also released the corresponding #inflation of 5.7%.

#stagflation

Everything is temporary, depending on chosen timescale!

cnbc.com/2021/11/03/fed…

[#Fed] statement kept the word “transitory” to describe price increases that are running at a 30-year high, though it qualified the term somewhat by saying pressures are “expected to” be temporary.

cnbc.com/2021/11/03/fed…

[#Fed] statement kept the word “transitory” to describe price increases that are running at a 30-year high, though it qualified the term somewhat by saying pressures are “expected to” be temporary.

Today’s US data for Q3:

Unit labour costs (QoQ) is +8.3% (vs 1.1% in Q2).

Unit labour costs (QoQ) is +8.3% (vs 1.1% in Q2).