Discover and read the best of Twitter Threads about #ECONOMY

Most recents (24)

As was widely expected, the @federalreserve today halted the most aggressive policy rate #HikingCycle since 1980, leaving the Fed Funds range unchanged at 5.0% to 5.25%, a level that appears clear to us to be finally having an impact on the #economy.

We think today’s actions represent a “Hawkish skip,” which implies that #policy makers are seeking more #data before potentially hiking rates again in July, or September.

For our part, we think #ChairPowell’s comments at the press conference made it clear that the #FOMC is seeking to balance increasingly restrictive monetary policy with the high degree of uncertainty around the tightening of #CreditConditions…

Today’s #CPI report for May showed another very firm depiction of where #inflation currently resides in the U.S., with #coreCPI (excluding volatile food and energy components) printing at 0.44% month-over-month and 5.33% year-over-year.

Meanwhile, #headlineCPI data printed 0.12% month-over-month and came in just above 4% year-over-year, with declines in #energy components and some food prices being offset by gains in #shelter and used cars and trucks.

Overall, headline #inflation does appear to be moderating at a faster pace and we believe that the trend in inflation (despite the firmness of core measures in today’s report) is broadly heading in the right direction, relative to the @federalreserve’s inflation target.

@iltalehti_fi "-länsimaiset '#poliitikot' ”eivät aja omien maidensa etuja, vaan ovat #marionetteja globaalien #eliitti'en käsissä”:

#Zdokumentti eli #SateenkaariSanna

rumble.com/v2sqac2-z-doku…

#Zdokumentti eli #SateenkaariSanna

rumble.com/v2sqac2-z-doku…

@iltalehti_fi #Kusetus

@kokoomus

@Demarit

@vasemmisto

@persut

@keskusta

@KDpuolue

@sfprkp

@vihreat

cc: @ odefinn

Johan oli.. meidän onnemme että #Venäjä näkee läpi tuon Suomen valtiovallan kansan kusettamisen, ilman sitä olisimme todella #kusessa.

@kokoomus

@Demarit

@vasemmisto

@persut

@keskusta

@KDpuolue

@sfprkp

@vihreat

cc: @ odefinn

Johan oli.. meidän onnemme että #Venäjä näkee läpi tuon Suomen valtiovallan kansan kusettamisen, ilman sitä olisimme todella #kusessa.

@iltalehti_fi @kokoomus @Demarit @vasemmisto @persut @keskusta @KDpuolue @sfprkp @vihreat #Zdokumentti eli #SateenkaariSanna

- "länsimaiset '#poliitikot' ”eivät aja omien maidensa etuja, vaan ovat #marionetteja globaalien #eliitti'en käsissä”:

- "länsimaiset '#poliitikot' ”eivät aja omien maidensa etuja, vaan ovat #marionetteja globaalien #eliitti'en käsissä”:

Sector rotation(s) should be a sign of “healthier” market participation, however only time will tell… 🔄📊

$SPY $SPX $IWM $RUT $QQQ $NDX $DIA $DJIA #stocks #macro #economy #earnings

$SPY $SPX $IWM $RUT $QQQ $NDX $DIA $DJIA #stocks #macro #economy #earnings

Has the $IWM / $SPY ratio (S&P 500/Russell 2000 Small Caps) finally reached oversold territory, as #tech takes a breather & the broader market looks to soak up some of the liquidity flows? 🔄📈

📊h/t @OnTheTapePod @RiskReversal_ @GuyAdami @CarterBWorth for the chart note💡

$SPX… twitter.com/i/web/status/1…

📊h/t @OnTheTapePod @RiskReversal_ @GuyAdami @CarterBWorth for the chart note💡

$SPX… twitter.com/i/web/status/1…

1/10 *Thread* 🧵

🚀 US Labor Market: May payrolls rise by 339K, surpassing the 190K Dow Jones estimate, and marking the 29th straight month of positive job growth. Unemployment rate increases slightly to 3.7% - still near the lowest since 1969. #LaborMarket #JobGrowth

🚀 US Labor Market: May payrolls rise by 339K, surpassing the 190K Dow Jones estimate, and marking the 29th straight month of positive job growth. Unemployment rate increases slightly to 3.7% - still near the lowest since 1969. #LaborMarket #JobGrowth

2/10

📈 This surge in job creation reveals a resilient labor market despite various challenges. Average hourly earnings, a key inflation indicator, rose 0.3% for the month, and wages increased 4.3% annually. #EconomicGrowth #Inflation

📈 This surge in job creation reveals a resilient labor market despite various challenges. Average hourly earnings, a key inflation indicator, rose 0.3% for the month, and wages increased 4.3% annually. #EconomicGrowth #Inflation

3/10

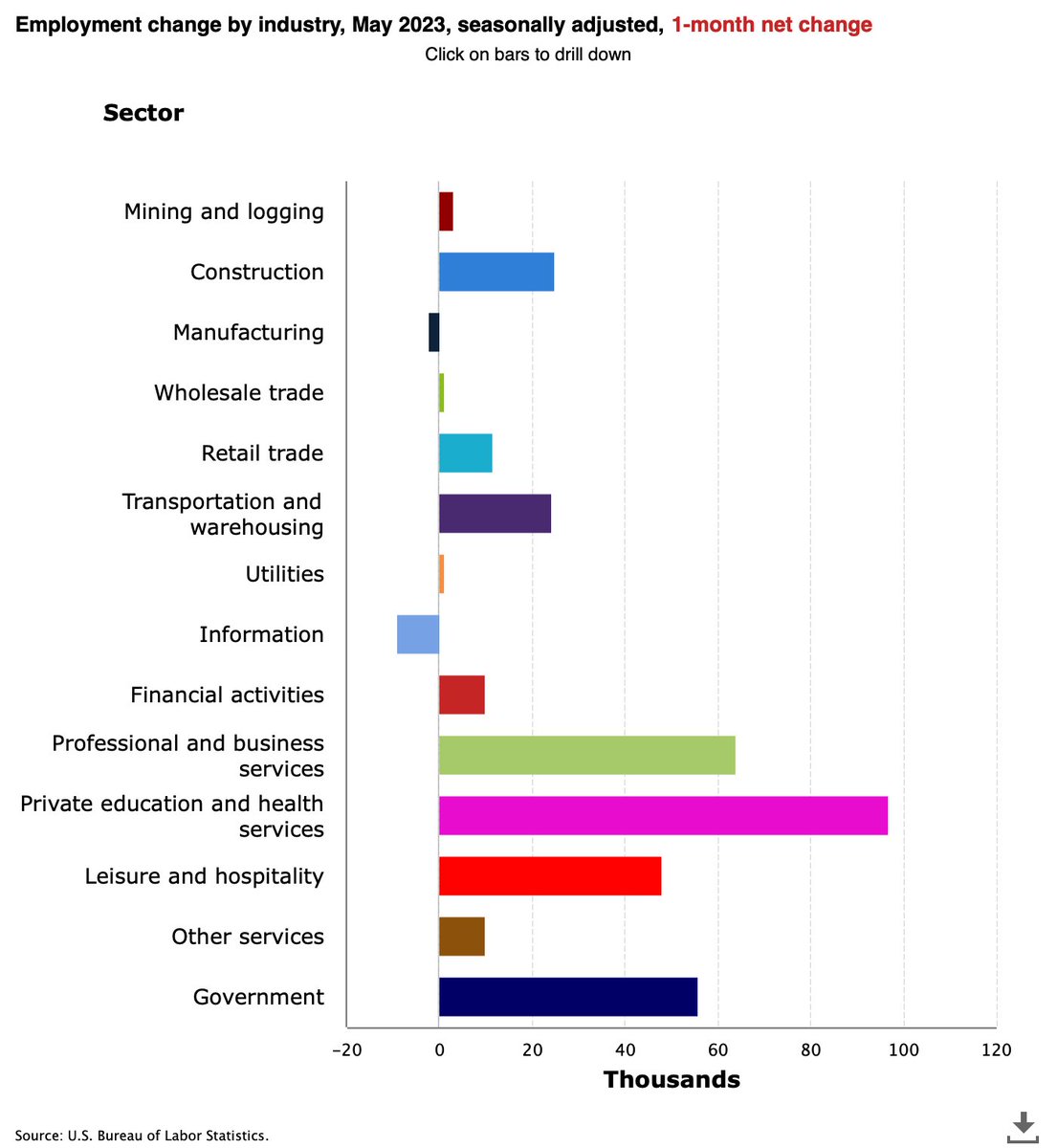

💼 Job creation is led by professional and business services (64K new hires), followed by government (56K) and healthcare (52K). Other notable sectors include leisure and hospitality (48K), construction (25K), and transportation and warehousing (24K). #JobCreation

💼 Job creation is led by professional and business services (64K new hires), followed by government (56K) and healthcare (52K). Other notable sectors include leisure and hospitality (48K), construction (25K), and transportation and warehousing (24K). #JobCreation

We’ve seen the pace of #payroll gains decelerate to roughly the monthly trend pace from the last expansion; consensus has been waiting for this moment and expected a 195,000 job gain in May, but the data printed considerably stronger at 339,000 #jobs gained.

The three-month moving average of #nonfarm payrolls sits at 283,000, down from 334,000 jobs at the start of the year, but what the #LaborMarket imbalance needs is more supply and more slack.

The #unemployment rate ticked up to 3.65%, close to its 12-month average level, and average hourly #earnings (a volatile figure) gained 0.33% month-over-month and 4.3% on a year-over-year basis.

May employment report came in mixed with both NFP and UR increasing.

Again, no Wall Street analyst came nowhere close to guessing the headline number with the highest estimate missing it by 129K.

What does that all mean for the #Fed?

A thread.

1/11

Again, no Wall Street analyst came nowhere close to guessing the headline number with the highest estimate missing it by 129K.

What does that all mean for the #Fed?

A thread.

1/11

NFP rose for the 29th M in a row with +339K which is 149K above consensus (+190K).

Apr number was revised up by 41K from +253K to +294K.

Total gain in Apr and May is +633K, 190K higher than expected (+443K).

#employment

2/11

Apr number was revised up by 41K from +253K to +294K.

Total gain in Apr and May is +633K, 190K higher than expected (+443K).

#employment

2/11

At the same time UR jumped from 3.4% (cycle low) to 3.7%, the highest since Feb 2022 and the same as in Aug and Oct 2022.

#unemployment

3/11

#unemployment

3/11

When asked about the important issues facing the UK today, the most reported issues continue to be:

▪️ the #CostOfLiving (92%) 🛒

▪️ the #NHS (87%) 🏥

▪️ the #economy (73%) 💷

▪️ climate change and the #environment (60%) 🌍

➡️ ons.gov.uk/peoplepopulati…

▪️ the #CostOfLiving (92%) 🛒

▪️ the #NHS (87%) 🏥

▪️ the #economy (73%) 💷

▪️ climate change and the #environment (60%) 🌍

➡️ ons.gov.uk/peoplepopulati…

Around 3 in 10 (29%) working adults reported they would describe any part of their job as a “green job”, (for example, a job that helps to protect or contribute towards the environment, such as helping to combat climate change or improve the natural environment) 🌳

Around 1 in 7 (15%) working adults reported that they work for an organisation that does specific green activities, but their own work was not directly related ♻️

Why 2024 isn't in a favorable position to @BJP4India and @narendramodi

#1 Selfishness

a) Modi's attitude of I, me and myself

b) Hijackijng a democratic party and doing hit job on own party leaders of tall stature

c) promotion of Crony Capitalism and selective corruption

1/n

#1 Selfishness

a) Modi's attitude of I, me and myself

b) Hijackijng a democratic party and doing hit job on own party leaders of tall stature

c) promotion of Crony Capitalism and selective corruption

1/n

#1 Selfishness

d) Always on self promotion mode and blame Congress for BJP govt failures

e) Always on Election campaign mode and destroying local state leaders to promote own image. (Ex: Karnataka loss)

f) cheaply claiming credit for others' work

2/n

d) Always on self promotion mode and blame Congress for BJP govt failures

e) Always on Election campaign mode and destroying local state leaders to promote own image. (Ex: Karnataka loss)

f) cheaply claiming credit for others' work

2/n

#2 Hindutwa

#Hindutwa

g) Modi promised to end Cow Slaughter but even after 2nd term didn't bring the bill

h) Modi delays declaring RamSethu as National Heritage site but spends on Islamic tyrants tombs

i) Playing cheap politics over Ram Mandit by delaying it.

3/n

#Hindutwa

g) Modi promised to end Cow Slaughter but even after 2nd term didn't bring the bill

h) Modi delays declaring RamSethu as National Heritage site but spends on Islamic tyrants tombs

i) Playing cheap politics over Ram Mandit by delaying it.

3/n

A friend sent me a video that is apparently making the rounds. It's titled "#Modi the Boss," and features various world leaders praising Modi's popularity and greeting him.

Modi's #Bhakts are clearly in orgasmic bliss with this, and opponents say it's pure propaganda.

(1/)

Modi's #Bhakts are clearly in orgasmic bliss with this, and opponents say it's pure propaganda.

(1/)

But there's more to this than meets the eye.

1. It's a fact that Modi's popularity fills world leaders with awe. They would give an arm and a leg to be as popular in their countries as Modi is in India. He can screw up worse than anyone can imagine and still be popular.

(2/)

1. It's a fact that Modi's popularity fills world leaders with awe. They would give an arm and a leg to be as popular in their countries as Modi is in India. He can screw up worse than anyone can imagine and still be popular.

(2/)

2. In contrast, leaders of most world democracies have to worry about the #economy, #jobs, #Unemployment, #prices, #inflation, #recession, etc. If anything goes wrong with these, they might lose the next #election.

(3/)

(3/)

#9YearofModiGovt

#Economy

1-External debt of India

>From 2004-2014:-total External debt taken by UPA $333.525billion & External debt to GDP ratio inc. from 17.7%(2004) to 23.9%(2014) (pic.1)

>2014-2022:- total external debt take by NDA $174.559Billion(in 8 years) 1/n

#Economy

1-External debt of India

>From 2004-2014:-total External debt taken by UPA $333.525billion & External debt to GDP ratio inc. from 17.7%(2004) to 23.9%(2014) (pic.1)

>2014-2022:- total external debt take by NDA $174.559Billion(in 8 years) 1/n

External debt to GDP ratio fall from 23.9%(2014) to 19.9%(2022) (pic2)

2- FDI in 🇮🇳

>2004-05 to 2013-14:- total gross FDI inflow to 🇮🇳 was $305.227 Billion...Net FDI inflow to 🇮🇳 $145.949 billion (pic.3)

>2014-15 to 2021-22:-total gross FDI inflow to 🇮🇳 is $525.117Billion(. 2/n

2- FDI in 🇮🇳

>2004-05 to 2013-14:- total gross FDI inflow to 🇮🇳 was $305.227 Billion...Net FDI inflow to 🇮🇳 $145.949 billion (pic.3)

>2014-15 to 2021-22:-total gross FDI inflow to 🇮🇳 is $525.117Billion(. 2/n

In 8 years)Net FDI inflow to 🇮🇳 is $288.846billion( in 8 years) (pic.4)

3-Foreign Exchange Reserves

2003-04:-$112.959Billion

2013-14:-$304.223Billion(in 10 year of Manmohan govt It inc. to $191.264 billion)

2021-22:-$607.309billion( in 7 year of Modi govt It inc. to $303B) 3/n

3-Foreign Exchange Reserves

2003-04:-$112.959Billion

2013-14:-$304.223Billion(in 10 year of Manmohan govt It inc. to $191.264 billion)

2021-22:-$607.309billion( in 7 year of Modi govt It inc. to $303B) 3/n

We found ourselves in the midst of another US debt ceiling debate.

A recurrent event that has significant implications for the global economy, including the financial markets.

Let's unpack this complex issue🧵

RT's appreciated!🙏

#economy #crypto #Bitcoin #stocks

/1

A recurrent event that has significant implications for the global economy, including the financial markets.

Let's unpack this complex issue🧵

RT's appreciated!🙏

#economy #crypto #Bitcoin #stocks

/1

The US debt ceiling is a legislative limit on the amount of national debt that can be incurred by the US #Treasury.

It's a cap on how much money the federal government may borrow to pay off the debt it has already borrowed.

/2

It's a cap on how much money the federal government may borrow to pay off the debt it has already borrowed.

/2

Interestingly, the debt ceiling does not directly limit government deficits.

While it can restrain the Treasury from paying for expenditures after the limit has been reached, these are expenditures that have already been approved and appropriated.

/3

While it can restrain the Treasury from paying for expenditures after the limit has been reached, these are expenditures that have already been approved and appropriated.

/3

Tack @Kvalitetsaktie för er ovärderliga utbildning och inspiration. Satt i helgen lyssnade, antecknade & njöt när ni diskuterade er filosofi (avs 108), världsklass! Tänkte dela med mig av en summering av KAP-filosofin. OBS: är en glad amatör så res för div fel & misstolkningar

#Dhabriya #Polywood #Ltd

#Green #Economy

#NewOrder

#Mukul #Agarwal sir

⭐️Yet another "ORDER WIN”in a series in last few months. This time from #DLF

⭐️Mukul Agarwal Sir holding 10% of company

⭐️POLYWOOD Window & Doors are environment friendly & completely recyclable

1/

#Green #Economy

#NewOrder

#Mukul #Agarwal sir

⭐️Yet another "ORDER WIN”in a series in last few months. This time from #DLF

⭐️Mukul Agarwal Sir holding 10% of company

⭐️POLYWOOD Window & Doors are environment friendly & completely recyclable

1/

⭐️Co is engaged in the manufacturing of PVC & UPVC based products for a wide range of building interior & exterior applications.

⭐️Co has 6 Manufacturing Plants & 8 Warehouses. Production capacity of 10K MT of PVC Profiles annually

⭐️Network of 500+dealers across India

2/

⭐️Co has 6 Manufacturing Plants & 8 Warehouses. Production capacity of 10K MT of PVC Profiles annually

⭐️Network of 500+dealers across India

2/

⭐️Revolutionary Product

#artificial #Marble

#Dstona, owned by the company

It costs around 1/10 of original Italian marble

⭐️Growth driver for the future

⭐️Dhabriya is the only manufacturer in India

⭐️CAPEX ₹5cr done initially to set up this division of Dstona

3/

#artificial #Marble

#Dstona, owned by the company

It costs around 1/10 of original Italian marble

⭐️Growth driver for the future

⭐️Dhabriya is the only manufacturer in India

⭐️CAPEX ₹5cr done initially to set up this division of Dstona

3/

Excellent talk by Simon Sharpe @INETOxford just now, pointing out how the #climate crisis challenges economic #orthodoxy in several ways. Spoiler 🔥"Economics as a discipline has forgotten what the scientific method is" (@camjhep pointing to #heterodox ideas in defense)🧵

💡The premise: To meet our #climate goals, we need to reduce emissions globally by about 8% per year by 2030, as compared to the 1,5% p.a. achieved so far - hence the title of his book #FiveTimesFaster

1⃣ An #economy going through the rapid and far-reaching systems #transition this requires (acc. to @IPCC_CH) cannot be analysed in terms of #equilibrium, a sitation in which "nobody has any immediate reason to change their actions" according to the Oxford Dictionary of Economics.

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

1/4🧵 Introducing the concept of: Dictamocracy

Dictamocracy: any type of government whose leadership, policies, agreements & socioeconomics which serves the dictated-interests of outside democracies or the directed geopolitical aims of expansionist hegemonies. #Democracy #World

Dictamocracy: any type of government whose leadership, policies, agreements & socioeconomics which serves the dictated-interests of outside democracies or the directed geopolitical aims of expansionist hegemonies. #Democracy #World

2/4 Democracy: any type of government whose authority represents the values of the governing country through the social norms, prosperity, welfare, security & economic needs of its own citizens.

Diff Democracies:

Western Democracy

Chinese democracy

Russian democracy

#freedom

Diff Democracies:

Western Democracy

Chinese democracy

Russian democracy

#freedom

3/4 Dictatorship: the opposite of Western democracy or typically any single-party government that rules with an iron fist against outside interferences/collaborations.

Capitalism: the worst form of democracy

Undemocratic: depends on which side you support

#economy #capitalism

Capitalism: the worst form of democracy

Undemocratic: depends on which side you support

#economy #capitalism

Here is this Week’s Market Wrap 'Politics Returns' written by @shyamsek

A Thread (1/n)

#stockmarket #investments #politics #personalfinance #marketwrap

A Thread (1/n)

#stockmarket #investments #politics #personalfinance #marketwrap

The markets have intense spells when politics prevails over everything else in directing sentiment. Closer to every general election, this trend returns to haunt the markets. (2/n)

#markets #indiangovernment #elections

#markets #indiangovernment #elections

But, the ability of politics to drive sentiment is influenced by how much the outcome of the election will drive change. If change is likely to be significant and for the better, the markets can run up ahead of elections. (3/n)

#stockmarket #politics #investors

#stockmarket #politics #investors

Today’s #CPI report continues to depict #inflation that is just too high for most people’s good, especially the @federalreserve’s.

In fact, the report showed that #inflation remains remarkably sticky, which doesn’t correspond to virtually any practical thinker’s timeline of when it might be expected to start to come down further.

These elevated levels of inflation continue to be remarkably high relative to the many months with which the #economy has now operated with persistently higher #InterestRates.

“One of the main prerequisites for enabling normal life for our clergy, monastics, and faithful people in Kosovo and Metohija is the need to ensure a special legal status for our Church.” serb-orthodox-kosovo.com/post/the-place…

“It should be granted under internationally guaranteed protection . . . of our identity, religious freedom, and property rights, ensuring in the meantime economic sustainability, since our communities live on their own hands and labor.”

#freedom #propertyrights #economy

#freedom #propertyrights #economy

“These solutions are not political issues in themselves, but rather general civilizational matters. [—]. Such an initiative should serve to strengthen religious freedoms for everyone in Kosovo and Metohija.”

#WeeklyRecap: Markets Remain Unstable Amidst Encouraging and Concerning Economic Data

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

Mixed data created uncertainty for investors. Inflation may be moderating, but retail sales contraction raises concerns for a potential recession. The Fed may pause its rate hike cycle, which could positively impact the stock market. #Investing #Economy #MarketVolatility

📈 Major benchmarks defy recession concerns, posting weekly gains. DJI up 1.34%, SPX up 1.42%, NDX up 1.18%. #stockmarket #investing

⭐️Rising Interest Rates Threaten the Global Financial System

U.S. banks’ lending capacity will decline by 1% this year due to the fall in the value of many bank stocks as investors reassess the health of midsize banks, International Monetary Fund (IMF) says that a reduction in… twitter.com/i/web/status/1…

U.S. banks’ lending capacity will decline by 1% this year due to the fall in the value of many bank stocks as investors reassess the health of midsize banks, International Monetary Fund (IMF) says that a reduction in… twitter.com/i/web/status/1…

1. A severe flare-up of financial system turmoil could slash output to near recessionary levels after the failures of two U.S. regional banks and the forced merger of Credit Suisse. The collapses prompted fears among some depositors about the health of small and midsize banks.… twitter.com/i/web/status/1…

2. The American economy would expand 1.6% this year, down from 2.1% in 2022, while the global economy would grow 2.8% this year, a slowdown from 3.4% last year, as nations continue recovering from slumps caused by the pandemic and the war in Ukraine, the IMF estimates.

#USA #IMF… twitter.com/i/web/status/1…

#USA #IMF… twitter.com/i/web/status/1…

We’ve built the world’s first AI-driven, personalized investment coach. Now we’re launching a direct #ChatGPT plugin that will help us bring this powerful tool to millions!

Our mission is to democratize access to hedge-fund caliber models for all self-directed investors. 🧵👇

Our mission is to democratize access to hedge-fund caliber models for all self-directed investors. 🧵👇

In addition to asking for a portfolio analysis by our Recommendation Engine, you can ask questions about what our models think is going to happen, including a security’s expected return or the performance of a segment of the market, like the #SP500 or $AAPL.

For us, it’s an obvious fit for @worldpred to leverage #GenerativeAI to improve the experience of our users. @portfoliopilot is already helping investors improve their portfolios.

👨👩👧👦3k+ users

🏦Connecting brokerages, 401k, real estate, crypto, PE, etc.

💰$2.1B assets on platform

👨👩👧👦3k+ users

🏦Connecting brokerages, 401k, real estate, crypto, PE, etc.

💰$2.1B assets on platform

It's impossible to retweet this too many times.

- The #RoadOfDeath And a #DarkPlace | Apr 8

@POTUS @vonderleyen @ZelenskyyUa

- The #RoadOfDeath And a #DarkPlace | Apr 8

@POTUS @vonderleyen @ZelenskyyUa

@POTUS @vonderleyen @ZelenskyyUa #Rand Co | Jan 25

- 'The key objective described in the doc is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent'

- The entire #EU #economy will #collapse

- 'The key objective described in the doc is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent'

- The entire #EU #economy will #collapse