Discover and read the best of Twitter Threads about #Gasoline

Most recents (24)

Future of Russian Oil: 5 Key Trends

#Russia's oil industry transitions from chaos to relative stability in 2023, with India emerging as the largest seaborne buyer. Let's explore the industry's outlook for the next 2-3 years, from refinery upgrades to a shadow tanker fleet.👇

#Russia's oil industry transitions from chaos to relative stability in 2023, with India emerging as the largest seaborne buyer. Let's explore the industry's outlook for the next 2-3 years, from refinery upgrades to a shadow tanker fleet.👇

Russia's refinery upgrades increase gasoline production

Despite overall throughputs not reaching pre-sanction levels, there's a hidden growth story. Jan-April 2023 saw record-high monthly #gasoline production. Dec 2022-Feb 2023 saw the highest-ever production rate of 124 kt/day.

Despite overall throughputs not reaching pre-sanction levels, there's a hidden growth story. Jan-April 2023 saw record-high monthly #gasoline production. Dec 2022-Feb 2023 saw the highest-ever production rate of 124 kt/day.

Operational setbacks for refinery upgrades

Nizhny Novgorod refinery faces setbacks due to fire. Moscow, Yaroslavl, Novoshakhtinsk refineries to halt fuel #oil output by 2025-2026, reducing production by 150 kbd. 🇷🇺-🇺🇦 conflict hinders Kirishi refinery's modernization.

Nizhny Novgorod refinery faces setbacks due to fire. Moscow, Yaroslavl, Novoshakhtinsk refineries to halt fuel #oil output by 2025-2026, reducing production by 150 kbd. 🇷🇺-🇺🇦 conflict hinders Kirishi refinery's modernization.

It's impossible to retweet this too many times.

- The #RoadOfDeath And a #DarkPlace | Apr 8

@POTUS @vonderleyen @ZelenskyyUa

- The #RoadOfDeath And a #DarkPlace | Apr 8

@POTUS @vonderleyen @ZelenskyyUa

@POTUS @vonderleyen @ZelenskyyUa #Rand Co | Jan 25

- 'The key objective described in the doc is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent'

- The entire #EU #economy will #collapse

- 'The key objective described in the doc is to #divide #EU by placing #UsefulIdiots in political positions in order to stop #Russian #energy supplies from reaching the continent'

- The entire #EU #economy will #collapse

At first glance, Nov #CPI was somewhat better-than-expected report (headline MoM slightly lower than expectations -0.1% vs 0%) and mostly in line (YoY headline, as well as MoM&YoY core).

But in the details #inflation is much weaker than gets recognized.

A thread.

1/17

But in the details #inflation is much weaker than gets recognized.

A thread.

1/17

Unadjusted headline #CPI is down for the 2nd M in a row with -0.31% which is the lowest print since Apr 2020 (-0.67%).

In the last 8 yrs there were only 2M with materially lower prints (Apr 2020 and Jan 2015 -0.47%)!

2/17

In the last 8 yrs there were only 2M with materially lower prints (Apr 2020 and Jan 2015 -0.47%)!

2/17

Unadjusted headline in Dec 2022 (-0.31%) is the 6th lowest in 8 yrs but 3 of these prints were almost identical (Dec 2018 -0.32%, Nov 2018 -0.33% and Dec 2015 -0.34%).

In Apr 2020 the economy was on forced lockdown, and in 2015/late 2018 #deflation was a problem.

3/17

In Apr 2020 the economy was on forced lockdown, and in 2015/late 2018 #deflation was a problem.

3/17

Thread on California Gasoline Crisis:

1- I wish I was still teaching at the university. I would have used the recent Valero letter to the #California Energy Commission as the main reference for a two-hour lecture on the impact of public policy on the oil sector. $VLO #Oil #OOTT

1- I wish I was still teaching at the university. I would have used the recent Valero letter to the #California Energy Commission as the main reference for a two-hour lecture on the impact of public policy on the oil sector. $VLO #Oil #OOTT

Probably President Biden should not talk about gasoline prices again. He just said something and we lost three refineries in 24 hours!

#Oil #OOTT #COM #EFT

#Oil #OOTT #COM #EFT

could you please post the link? thanks

- W SEP ISSUE FEATURE: KEY'S STORY -

interview translation thread

#KEY

#SHINee

@SHINee

#Gasoline

#KEY_GASOLINE

interview translation thread

#KEY

#SHINee

@SHINee

#Gasoline

#KEY_GASOLINE

The headline #inflation data today moderated a bit on the back of falling #gasoline prices, but it’s still running at a worryingly high rate.

Over time, we think the slowdown in #economic growth, the continuation of the @federalreserve’s assertive #HikingCycle and the possibility of resolution with several persistent supply chain issues should influence broad #inflation lower.

Still, while #CorePCE inflation (the #Fed’s favored measure) is likely to moderate in the coming months, it’ll still remain well-above the Fed’s 2% #inflation target.

Thread: What are the Biden Administration’s choices to reduce oil and fuel prices? #OOTT #Oil

1- What has been done?

Asked OPEC members, US oil producers & refiners to increase production. All failed.

OPEC members were not interested. US producers & refiners cannot do so.

1- What has been done?

Asked OPEC members, US oil producers & refiners to increase production. All failed.

OPEC members were not interested. US producers & refiners cannot do so.

2- What are the current choices?

a- Restrict crude oil exports

b- Restrict fuel exports

c- Suspend environmental regulations temporarily

d- Suspend federal fuel tax

e- Remove sanctions on Iran & Venezuela

f- Resurrect relations with Saudi Arabia

g- Withdraw more from the SPR

a- Restrict crude oil exports

b- Restrict fuel exports

c- Suspend environmental regulations temporarily

d- Suspend federal fuel tax

e- Remove sanctions on Iran & Venezuela

f- Resurrect relations with Saudi Arabia

g- Withdraw more from the SPR

3- None of the choices above can reduce shortages or lower prices meaningfully before the US mid-term elections. Only a recession would reduce fuel prices and allow for inventories to rise.

Regardless, a recession might flip both houses to republicans. Democrats are stuck!

Regardless, a recession might flip both houses to republicans. Democrats are stuck!

1-5 Now it is official: President Biden to visit #SaudiArabia on July 15 and 16, during his Middle East tour.

After meeting with the Saudi leadership, he will meet with the leaders of what some experts call “the Arab NATO”: GCC leaders, Egypt, Jordan, (& Iraq). #OOTT #COM #EFT

After meeting with the Saudi leadership, he will meet with the leaders of what some experts call “the Arab NATO”: GCC leaders, Egypt, Jordan, (& Iraq). #OOTT #COM #EFT

2-5 Oil is not among top issues given the importance of security issues in the region. My guess is that Saudis are more interested in highlighting their climate change plans & efforts while showing that they actually have been increasing oil production & will continue to do so

3-5 While mega commercial deals are expected, nuclear deals will attract media attention. Saudi Arabia, in its carbon reduction efforts, needs nuclear energy. It remains to be seen if Saudis will continue to invest in the US refining sector

Beginning now, the CEOs of ExxonMobil, BP America, Chevron, Shell, Devon, and Pioneer Energy will testify before the U.S. House Committee on Energy & Commerce, addressing questions of price gouging and war profiteering.

Of concern to the committee is skyrocketing profits at a time of rising gas prices and war. In the first quarter of 2022 vs 2021, the profits of the leading oil companies increased by 288% ExxonMobil, 540% Chevron, 201% ConocoPhillips, 50% BP, 4872% Marathon, and

134% Shell.

134% Shell.

Chairman Pallone reminds the oil company CEOs testifying at today's hearing on price gouging that they cannot claim that they have no control over gas prices, explaining: "You set the wholesale price and that sets the retail price."

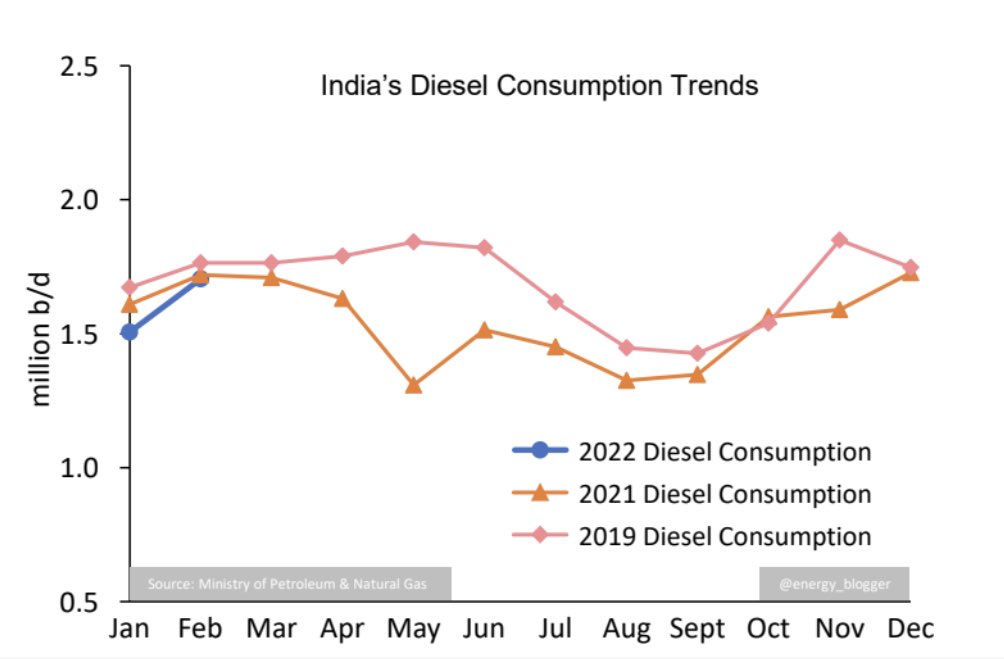

India’s overall fuel consumption in Feb-22 was 2nd highest ever in its history

This despite Jet Fuel being well below pre-pandemic.

A sharp increase in Gasoline & LPG consumption pushed it up

Consumption

Feb-22: 4.60 million b/d

Jan-22: 4.16 mb/d

Feb-21: 4.36 mb/d

#OOTT #Oil

This despite Jet Fuel being well below pre-pandemic.

A sharp increase in Gasoline & LPG consumption pushed it up

Consumption

Feb-22: 4.60 million b/d

Jan-22: 4.16 mb/d

Feb-21: 4.36 mb/d

#OOTT #Oil

Alright folks, here's a little lecture from my book, The Tyranny of Oil, about how #gasoline prices are set in the U.S., and yes, it's largely under the control of the largest oil companies -- Exxon, Chevron, BP, Shell, etc, -- even though it's not legally supposed to be. a 🧵

1. The major oil companies in the U.S. are vertically integrated, controlling production, refining, & sales.

2) They set the price of #gasoline at stations they own. But most stations are "independently owned" & branded- ie selling the major brands "Exxon" "Shell" "Chevron" etc.

2) They set the price of #gasoline at stations they own. But most stations are "independently owned" & branded- ie selling the major brands "Exxon" "Shell" "Chevron" etc.

3) It is illegal for oil companies to set prices at

gas stations they do not own, but they've has found several ways to get around the law—by controlling the prices charged at its branded stations through the wholesale price for gas, "suggested" retail prices, & zone pricing./3

gas stations they do not own, but they've has found several ways to get around the law—by controlling the prices charged at its branded stations through the wholesale price for gas, "suggested" retail prices, & zone pricing./3

I heard a story on the news today about calls to cut the federal #gas tax in response to rising prices. This is really bad idea. The gas tax supplies money to the federal government to do things like fund public transit. IF you want lower gas prices (IF), focus on companies.

First: there's been no reduction in overall exports of #oil & #gas from Russia since its war against #Ukraine, incl via #NordStream1 (c/o S&P Global). Russia did cut gas supply before invasion, not since. Energy traders are driving soaring global prices; not actual supply.

The major oil companies, all of which employ energy traders & make a profit off trading, not just selling, oil & gas, are currently making record profits due to the war. In the U.S., just a few Big Oil companies control oil & gasoline refining, distribution, marketing, & sales.

Still no reduction in overall exports of #oil & methane (ie natural) #gas from Russia since its war against #Ukraine, incl via #NordStream1 (c/o S&P Global). Russia did cut gas supply before invasion, not since. Energy traders are driving soaring global prices; not actual supply.

The major oil companies, all of which employ energy traders & make a profit off trading, not just selling, oil & gas, are currently making record profits due to the war. In the U.S., just a few Big Oil companies control oil & gasoline refining, distribution, marketing, & sales.

Thus, U.S. oil companies could be asked to limit gasoline price spikes to demonstrate a desire not to profit off of #RussiaWarOnUkraine. Alternatively, they could be told not to pass the price spike onto consumers by federal and state governments.

"Delivery vans, 1942 style" (Greenbelt, MD) "grocery store"..."Tire scarcity and gasoline rationing have placed such service at a premium...youngsters who are using their express wagons to carry home Mrs. America's purchases are doing their country a real service" #gasoline

Photo by Ann Rosener via the U.S. Library of Congress: loc.gov/pictures/item/…

"How to keep warm and save fuel in wartime", 1942. google.com/books/edition/…

A few months ago, #markets expected U.S. #inflation to peak by mid-2022 at around 7% to 8% at the headline level and then anticipated that generalized #price gains would decline into year end, closing the year around 4%.

However, the tragic war now unfolding with Russia’s attack upon Ukraine has not only sent #energy prices skyrocketing but it has led to much greater uncertainty over #economic growth and #MonetaryPolicy reaction functions, in Europe and indeed around the world.

Random thoughts on what cities should (but won't) do to transition out of a #gasoline dependent world. 1. separated bike lanes everywhere, particularly in working class neighborhoods that already heavily bicycle/pedestrian.

2. Bicycle racks at local stores and shopping centers. At least in my suburban area, even if you bicycle there, you can't lock up your bicycle anywhere!

3. Removing/repealing bicycle unfriendly laws, which often are used more as pretext to snag people using bicycles for work, rather than pleasure. tampabay.com/news/publicsaf…

#EIA #oil data: #crude -1.9 mln bbls; at 411.6 mln; -13% v 5-yr avg for period

#gasoline -1.4 mln bbls; +1% v 5-yr avg

#distillate -5.2 mln bbls; -18% v 5-yr avg

#propane -1.6 bbls; -21% v 5-yr avg

Total commercial stocks -8.1 mln bbls

#OOTT #OPEC #diesel #shipping #energy

#gasoline -1.4 mln bbls; +1% v 5-yr avg

#distillate -5.2 mln bbls; -18% v 5-yr avg

#propane -1.6 bbls; -21% v 5-yr avg

Total commercial stocks -8.1 mln bbls

#OOTT #OPEC #diesel #shipping #energy

1/10 🧵

An obvious patriotic deed for U.S. citizens wanting to protect the nation's economy, support #Ukraine, weaken Putin, is to use even ONE gal/week less #gasoline. It was an obvious way to help curb inflation from start of reopening #oil demand surge, before any war.

#OOTT

An obvious patriotic deed for U.S. citizens wanting to protect the nation's economy, support #Ukraine, weaken Putin, is to use even ONE gal/week less #gasoline. It was an obvious way to help curb inflation from start of reopening #oil demand surge, before any war.

#OOTT

2/10

But #oil/fossil industry's crisis response has been to taunt U.S./EU citizens about a fossil dependence imposed on them via decades of organized political and economic power deployed to stifle #renewables and enrich oil oligarchs & tyrants, both domestic and foreign.

#OOTT

But #oil/fossil industry's crisis response has been to taunt U.S./EU citizens about a fossil dependence imposed on them via decades of organized political and economic power deployed to stifle #renewables and enrich oil oligarchs & tyrants, both domestic and foreign.

#OOTT

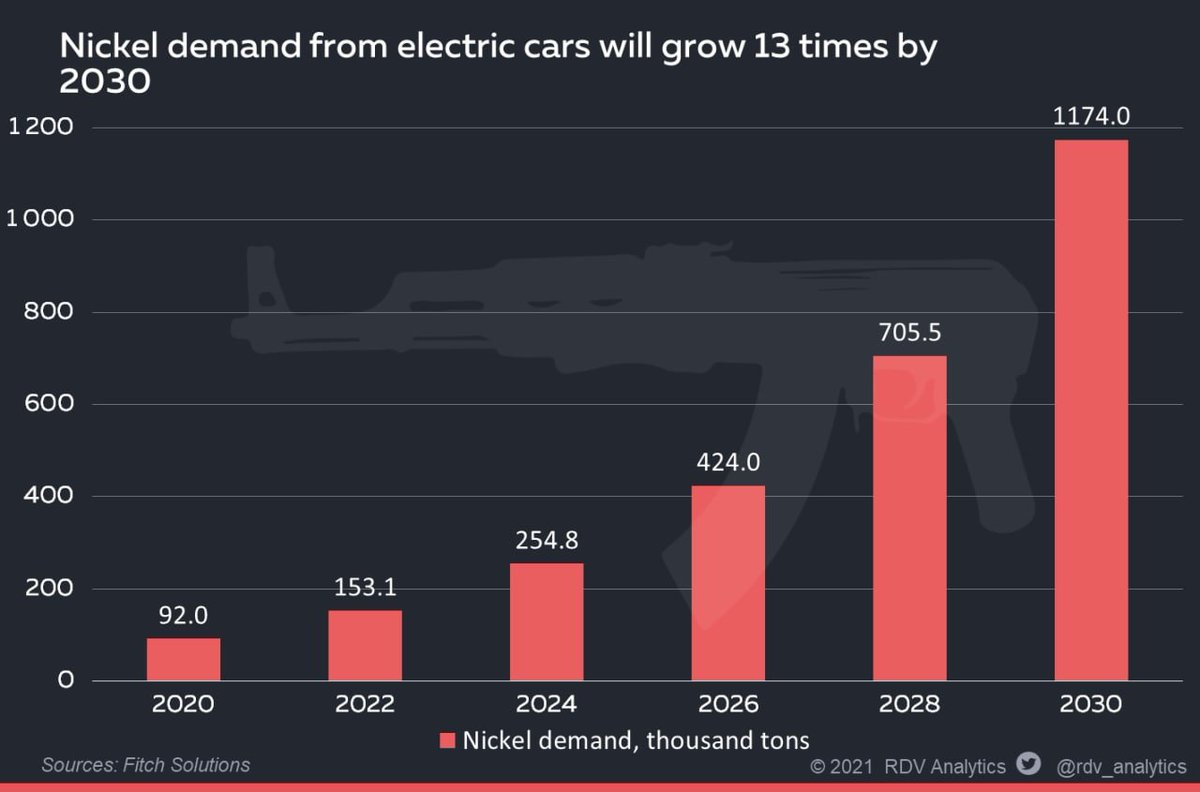

Demand for #nickel from #ElectricVehicles will grow 13 times by 2030. #NorilskNickel benefits from the trend of long-term growth in demand for nickel: the company earns 21% of its revenue from this metal.

$GMKN $MNOD $NILSY #NorNickel

$GMKN $MNOD $NILSY #NorNickel

Nickel is one of the most important elements of batteries for #ElectricCars. Nickel will be in high demand over the next few decades as #gasoline cars are replaced by electric ones. #Nickel demand from electric cars can grow at a rate of 29% per year.

greencarcongress.com/2021/03/202103…

greencarcongress.com/2021/03/202103…

Aggregate demand for #nickel could grow 36% by 2024. In 2026, this will lead to a deficit of 560 thousand tons. Scarcity means higher prices, metal miners will benefit from this.

globalminingreview.com/special-report…

globalminingreview.com/special-report…

Thread on why the Biden Administration is wrong in asking OPEC for more crude oil supplies & why #OPEC was right sticking to its planned increases:

1- There are no crude shortages. There are no refiners who need oil and cannot get it. #OOTT #SaudiArabia

spglobal.com/platts/en/mark…

1- There are no crude shortages. There are no refiners who need oil and cannot get it. #OOTT #SaudiArabia

spglobal.com/platts/en/mark…

2- Demand is NOT higher than “supply”. Several media outlets and analysts are confusing “supply” with “production”.

US crude oil inventories increased by about 20 mb in recent weeks. They are about 40 mb above the level that would support a bullish case.

US crude oil inventories increased by about 20 mb in recent weeks. They are about 40 mb above the level that would support a bullish case.

Where is my coal?

With shortages and high prices, theft increases throughout the world.

#coal #India

indianexpress.com/article/cities…

With shortages and high prices, theft increases throughout the world.

#coal #India

indianexpress.com/article/cities…

This is all tine favourite… stories like this have been circulating for decades.. some true, others are not

#Gasoline

710keel.com/thieves-try-to…

#Gasoline

710keel.com/thieves-try-to…