Discover and read the best of Twitter Threads about #REITS

Most recents (24)

As per NASSCOM report 100 GCC’s were set up in CY2022.

Was reminded of a 2022 report from Morgan Stanley and Ridham Desai spoke eloquently about this Megratrend last year :

INDIA is going to be the “Office of the World”🎯 @rndx1

Are you playing this theme ?

Was reminded of a 2022 report from Morgan Stanley and Ridham Desai spoke eloquently about this Megratrend last year :

INDIA is going to be the “Office of the World”🎯 @rndx1

Are you playing this theme ?

Having worked in a GCC 8 years ago, it did help me connect the dots .

I am playing this theme via #REITS

How the tables have turned 👇🏻

2019 it was IT/ITES that led this space , in 2023 it’s GCC.

Nothing is PERMANENT!🎯

#Office #changingIndia

Observe . Learn . Evolve .

I am playing this theme via #REITS

How the tables have turned 👇🏻

2019 it was IT/ITES that led this space , in 2023 it’s GCC.

Nothing is PERMANENT!🎯

#Office #changingIndia

Observe . Learn . Evolve .

Here’s the kicker though:

500 more GCCs are expected to come to 🇮🇳 over the next few years !

500 more GCCs are expected to come to 🇮🇳 over the next few years !

First thoughts :

#Nexus #REIT opportunity looks great .

India has 100 Grade A Malls - 17 of them are with BLACKSTONE backed NEXUS.

They aspire to take this number to 35 in the next few years .

They DONT build Malls - They just ACQUIRE 😃

#Nexus #REIT opportunity looks great .

India has 100 Grade A Malls - 17 of them are with BLACKSTONE backed NEXUS.

They aspire to take this number to 35 in the next few years .

They DONT build Malls - They just ACQUIRE 😃

During COVID, they snapped 7 Malls in South from the Prestige Group .

Folks in Bangalore would have seen FORUM Mall in Koramangala becoming NEXUS .

I saw last year Westend Mall becoming Nexus in Pune .

Trend is clear . #REITS #Nexus

Folks in Bangalore would have seen FORUM Mall in Koramangala becoming NEXUS .

I saw last year Westend Mall becoming Nexus in Pune .

Trend is clear . #REITS #Nexus

What makes it interesting is : They have access to 1000 Brands - ZARA , PUMA , LEVIS , QSR Giants etc .

With all they have a Revenue Share Deal !!

So this is a CONSUMPTION Play on India and less of a Real Estate Bet !

The 8.5% Dividend Yield is the Cherry 🍒 on the Cake !

With all they have a Revenue Share Deal !!

So this is a CONSUMPTION Play on India and less of a Real Estate Bet !

The 8.5% Dividend Yield is the Cherry 🍒 on the Cake !

Thought of the day: A reminder for our followers, each new asymmetric theme should be restricted to a 5-7% portfolio weighting with around 5 stocks positions to mitigate stock specific risks in each theme. Incoming themes over the next 6 months: #regionalbanks #REITs etc

Rules of engagement for #regionalbanks & #REITs

- we are approaching entry into the eye of the storm, this will likely need to play out 75% prior to serious capital deployment (6 months +).

- shoes to drop include freezing lending markets, deposits moving to higher yields etc

- we are approaching entry into the eye of the storm, this will likely need to play out 75% prior to serious capital deployment (6 months +).

- shoes to drop include freezing lending markets, deposits moving to higher yields etc

Let some bottoming clarity take place...as in the short term, what was strong yesterday, may not be tomorrow, the rate of change can be swift until the environment settles.

Seven years ago, I called #LeonardCohen's *Everybody Knows* "the perfect anthem for our times."

> Everybody knows the fight was fixed

> The poor stay poor, the rich get rich

> That’s how it goes

> Everybody knows

memex.craphound.com/2016/11/11/leo… 1/

> Everybody knows the fight was fixed

> The poor stay poor, the rich get rich

> That’s how it goes

> Everybody knows

memex.craphound.com/2016/11/11/leo… 1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/03/16/com… 2/

pluralistic.net/2023/03/16/com… 2/

That was just after Cohen died, and while the world seems to want to settle on *Hallelujah* as his totemic song, *Everybody Knows* keeps inserting itself into the discourse, in the most toxic, hope-draining way possible. 3/

1/n Higher/rising rates $TLT & 2023/24 unit deliveries have weighed on #multifamily #REITs $AVB $CPT $EQR $ESS $MAA $UDR over the past year. I see the credit events $SIVB $FRC $SBNY $KBE of the past week being a positive for the sector as:

2/n Small/Med banks are a key lender to developers. Last week (prior to bank crisis), at Citi conf $MAA CEO said that new MF permitting had come to a halt due to rising rates/spreads/const costs. Bank crisis will further curtail development. LOWER SUPPLY

What's the opposite of $SIVB $BAC $WFC $FRC large MTM losses on HTM securities? Long-term, low fixed rate debt $ARE #REITs

Ugly week for #REITs. Bought the CA heavy stuff hard today:

$KRC -10.7% overall cap. Office is 13+% stripping out MF/LifeSci @ 6.

$ARE -6.5%

$ESS -5.9%; 370k/door

$EQR -6.1%; $372k/d

I $SIVB $FRC $SBNY $PACW doesn't sink the SF Bay/CA economy

non CA:

$MAA -5.9%; $218k/d

$KRC -10.7% overall cap. Office is 13+% stripping out MF/LifeSci @ 6.

$ARE -6.5%

$ESS -5.9%; 370k/door

$EQR -6.1%; $372k/d

I $SIVB $FRC $SBNY $PACW doesn't sink the SF Bay/CA economy

non CA:

$MAA -5.9%; $218k/d

I'm implicitly betting the the troubled banks don't F up the golden goose of the SF Bay /LA VC ecosystem. Yes many wannabe unicorns had deposits there but I believe recoveries will be 80%+ of funds. Might lead to some incremental job losses but not the end of the world

I am concerned about general banking problems (which could continue to spill into RE and/or REIT). $BAC appears to have $100+ BN in unrecognized Held to Maturity securities. Others must as well. Could get ugly out there.

Today's Twitter threads (a Twitter thread).

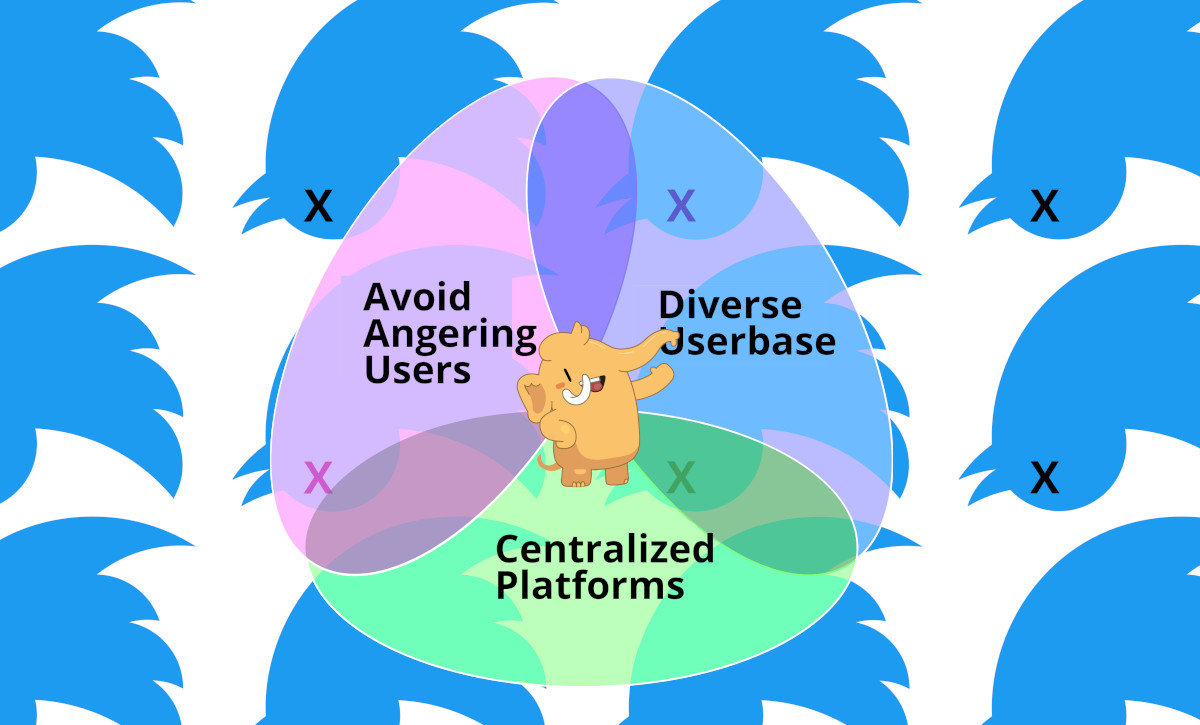

Inside: Solving the Moderator's Trilemma with Federation; and more!

Archived at: pluralistic.net/2023/03/04/pic…

#Pluralistic 1/

Inside: Solving the Moderator's Trilemma with Federation; and more!

Archived at: pluralistic.net/2023/03/04/pic…

#Pluralistic 1/

On 3/7 I'm doing a remote talk for #TUWein:

informatics.tuwien.ac.at/news/2373

On 3/9, I'm in person in #Austin at @utsdct:

eventbrite.com/e/the-buckman-…

And remote at #UManitoba:

eventscalendar.umanitoba.ca/site/science/e…

On 3/10, @Rgibli and I kick off the @SXSW reading series:

schedule.sxsw.com/2023/events/PP… 2/

informatics.tuwien.ac.at/news/2373

On 3/9, I'm in person in #Austin at @utsdct:

eventbrite.com/e/the-buckman-…

And remote at #UManitoba:

eventscalendar.umanitoba.ca/site/science/e…

On 3/10, @Rgibli and I kick off the @SXSW reading series:

schedule.sxsw.com/2023/events/PP… 2/

Thought of the day: Locating a 50 bagger for 2023 entry through 2026 exit, likely characteristics, down 95%+ from 2021 peak, volume growth +2-3x, selling price price +1-2x through 2026. Examples: commodity micro cap, a tech turnaround, a crypto token, a REIT or durable goods cap.

#bitcoin miners bottom incoming:

#Bitcoin 12.5k = -30% from here = -93-98.5% = +7-15x

#Bitcoin 10k = -50% from here = -95-99% from peak = +10-20x

#Bitcoin 5k = -75% from here = -97-99.9% from peak = +15-30x

#Survivability test in play, liquidity runway requirements

#Bitcoin 12.5k = -30% from here = -93-98.5% = +7-15x

#Bitcoin 10k = -50% from here = -95-99% from peak = +10-20x

#Bitcoin 5k = -75% from here = -97-99.9% from peak = +15-30x

#Survivability test in play, liquidity runway requirements

#REITs & Durable goods (#USHomebuilders) bottoming likely 2H 2023, where 12 month balance sheet liquidity is under pressure due to frozen credit markets (inability to refinance = elevated default risk)

Very Tight credit conditions = -70% move from here

Frozen Credit = -90% move

Very Tight credit conditions = -70% move from here

Frozen Credit = -90% move

#vanre #tore #cdnre #usre #EU #REITS #ItsSpeculationStupid #financialization #commodification #cdnpoli #uspoli

"Institutional investors...have squeezed residential markets in many parts of the world, can be expected to pick up a purchasing pace that has turned them into the world’s biggest private landlords and transformed rental housing into a go-to global asset class."

“Institutional ownership threatens to accelerate the trends unleashed by the financialization of housing”

"...automated digital platforms have made it easier and cheaper to track, price, acquire and manage large swaths of homes in multiple communities."

"...automated digital platforms have made it easier and cheaper to track, price, acquire and manage large swaths of homes in multiple communities."

Hard Reit Portfolio (#REITs + #BTC)

2021 Returns : +60% 🚀

My Holiday Gift to you: a unique portfolio that beats #inflation, outperforms $SPY, and yields a juicy monthly income.

Let me show you this magic portfolio designed to beat inflation and manage volatility...🧵 1/10

2021 Returns : +60% 🚀

My Holiday Gift to you: a unique portfolio that beats #inflation, outperforms $SPY, and yields a juicy monthly income.

Let me show you this magic portfolio designed to beat inflation and manage volatility...🧵 1/10

PORTFOLIO STRUCTURE

The portfolio uses a Barbell Structure (h/t @nntaleb).

80% Long Value #REITs

20% Long #BTC

40% Short $CAD (Leverage)

2/10

The portfolio uses a Barbell Structure (h/t @nntaleb).

80% Long Value #REITs

20% Long #BTC

40% Short $CAD (Leverage)

2/10

ALLOCATION

[53%] #RioCan $REI.UN

[27%] @DreamOfficeREIT $D.UN

[20%] #BTC

[40%] Leverage [Short $CAD]

Income [4.25% Dividend] from the 80% allocation to #REITs services and pays down the 40% leverage with monthly dividend payments.

3/10

[53%] #RioCan $REI.UN

[27%] @DreamOfficeREIT $D.UN

[20%] #BTC

[40%] Leverage [Short $CAD]

Income [4.25% Dividend] from the 80% allocation to #REITs services and pays down the 40% leverage with monthly dividend payments.

3/10

When will PPFAS will launch a new scheme?

Only if, PPFAS is excited about putting their own money & can add value to investors

Right now, there is no plan to cut any more expense ratio.

#PPFAS

#NewFundoffer? nops

Only if, PPFAS is excited about putting their own money & can add value to investors

Right now, there is no plan to cut any more expense ratio.

#PPFAS

#NewFundoffer? nops

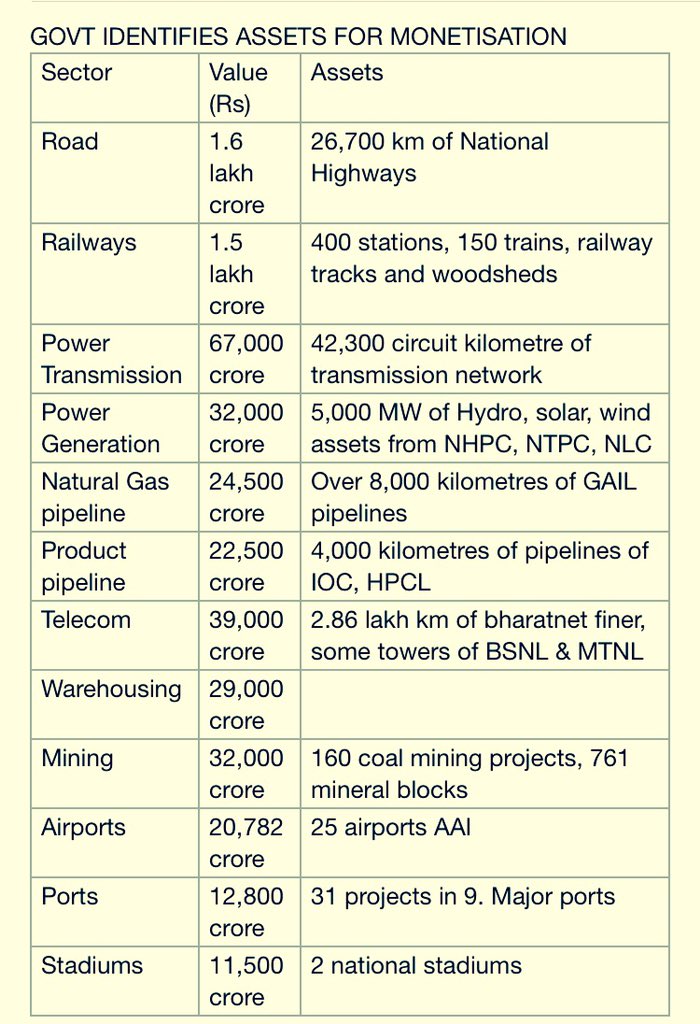

@narendramodi govt to raise 6 lakh Cr by monetising assets

Funds to be used to build new infrastructure,spur economic growth

Govt will raise 88000Cr this year by leasing infra assets of central govt ministries&state-run companies via #NationalMonetizationPipeline,NMP

Details👇

Funds to be used to build new infrastructure,spur economic growth

Govt will raise 88000Cr this year by leasing infra assets of central govt ministries&state-run companies via #NationalMonetizationPipeline,NMP

Details👇

Annual targets under 4 year NMP have been set at 👇

1.62 lakh Cr for FY23

1.79 lakh Cr for FY24

1.67 lakh Cr in FY25

Top 5 sectors by value under this #AssetMonetization programme are

Roads (27%),

Railways (25%),

Power (15%),

Oil and Gas pipelines (8%)

Telecom (6%)

#Economy

1.62 lakh Cr for FY23

1.79 lakh Cr for FY24

1.67 lakh Cr in FY25

Top 5 sectors by value under this #AssetMonetization programme are

Roads (27%),

Railways (25%),

Power (15%),

Oil and Gas pipelines (8%)

Telecom (6%)

#Economy

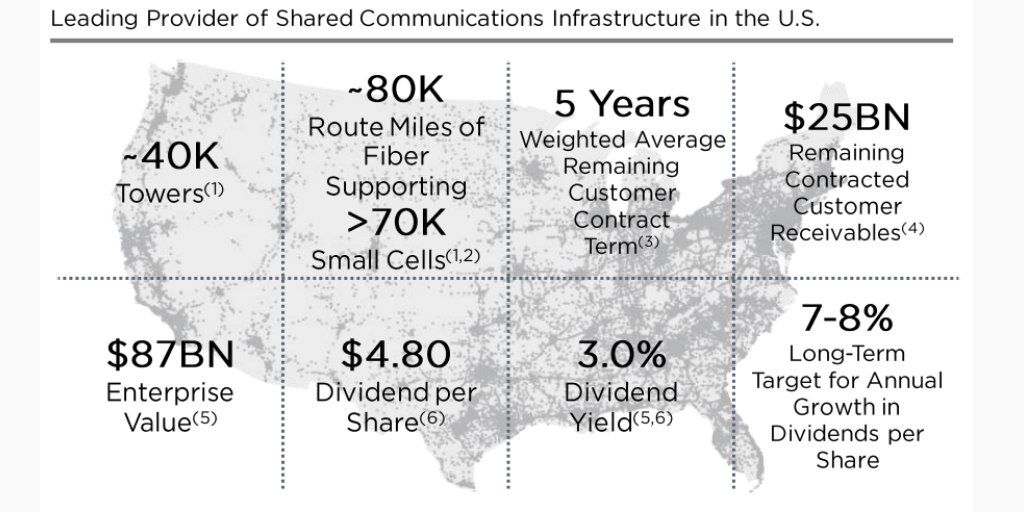

Among projects @narendramodi govt plans to lease are👇

26700km of roads

90 passenger trains

400 railway stations

28608 circuit km transmission lines 286000km of #Bharatnet fibre network&

14917 towers owned by Bharat Sanchar Nigam Ltd,#BSNL& Mahanagar Telecom Nigam Ltd,#MTNL

26700km of roads

90 passenger trains

400 railway stations

28608 circuit km transmission lines 286000km of #Bharatnet fibre network&

14917 towers owned by Bharat Sanchar Nigam Ltd,#BSNL& Mahanagar Telecom Nigam Ltd,#MTNL

I am doing my master's thesis on alternative option pricing models with applications to risk management (e.g. #VaR measures, hedging).

I have a good background in finance and econometrics.

What kind of new and valuable insight could I bring to this topic?

@GARP_Risk @PRMIA

I have a good background in finance and econometrics.

What kind of new and valuable insight could I bring to this topic?

@GARP_Risk @PRMIA

VaR - Value at Risk is not an Option Pricing model!

BSOP Greeks enable the Options trader to understand and hedge against Market Risk in various forms.

BSOP Greeks enable the Options trader to understand and hedge against Market Risk in various forms.

You cannot really use VaR to price options on its own.

A RAROC / RARORAC / RORAC/ ROVAR Type Model might do the trick, but that is beyond the scope of your question and this discussion,

A RAROC / RARORAC / RORAC/ ROVAR Type Model might do the trick, but that is beyond the scope of your question and this discussion,

$KRC CEO John Kilroy says he believes the stock is trading at a 1/3 discount to NAV on $C Citi Property CEO conference. Kilroy Oyster Point Ph 2 (Life sciences $ARE) to start this summer. Will also start development of new life sciences project in San Diego. KRC has plenty of $

for development. May also repurchase shares/pay special dividend. #reits #dividends #dividendstocks Great track record of value creation via development - should trade at a premium to NAV. I think this is worth $100-120 per share.

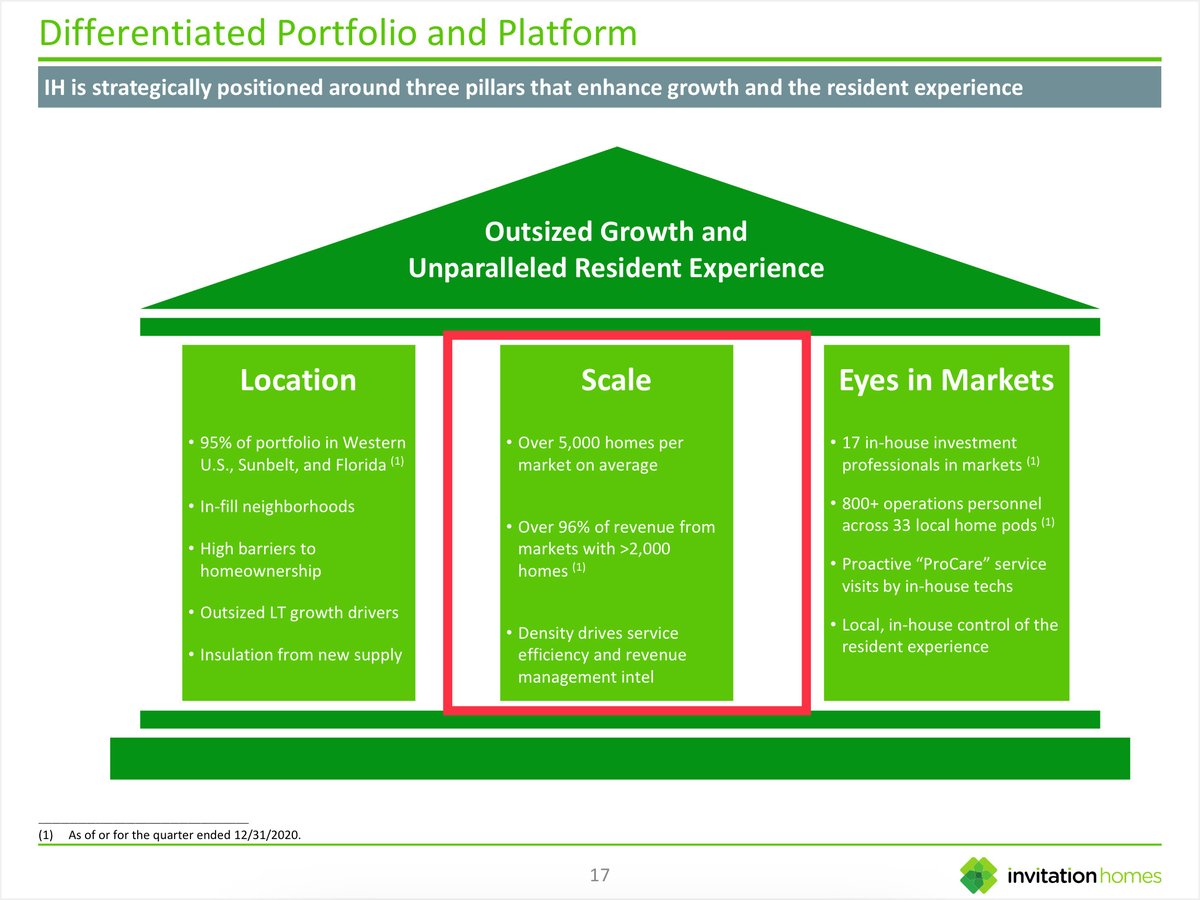

Inflation $TLT worries=opportunity to invest in single family rental leader Invitation Homes $INVH. At $28/sh implies 4.8% 2021 cap rate. Trades at ~5-10% discount to NAV.

$AVB $EQR $CPT $MAA $ESS $VNQ $AMH $XLRE #reits #dividends

SHOULD trade at premium to NAV->Platform value:

$AVB $EQR $CPT $MAA $ESS $VNQ $AMH $XLRE #reits #dividends

SHOULD trade at premium to NAV->Platform value:

2/While anyone can buy a home and become a landlord, this is a scale/density business. To effectively manage single family homes bigger is MUCH better. Scale allows for in-house provision of services (hire a plumber full time for $200/day rather than pay $150 for each visit).

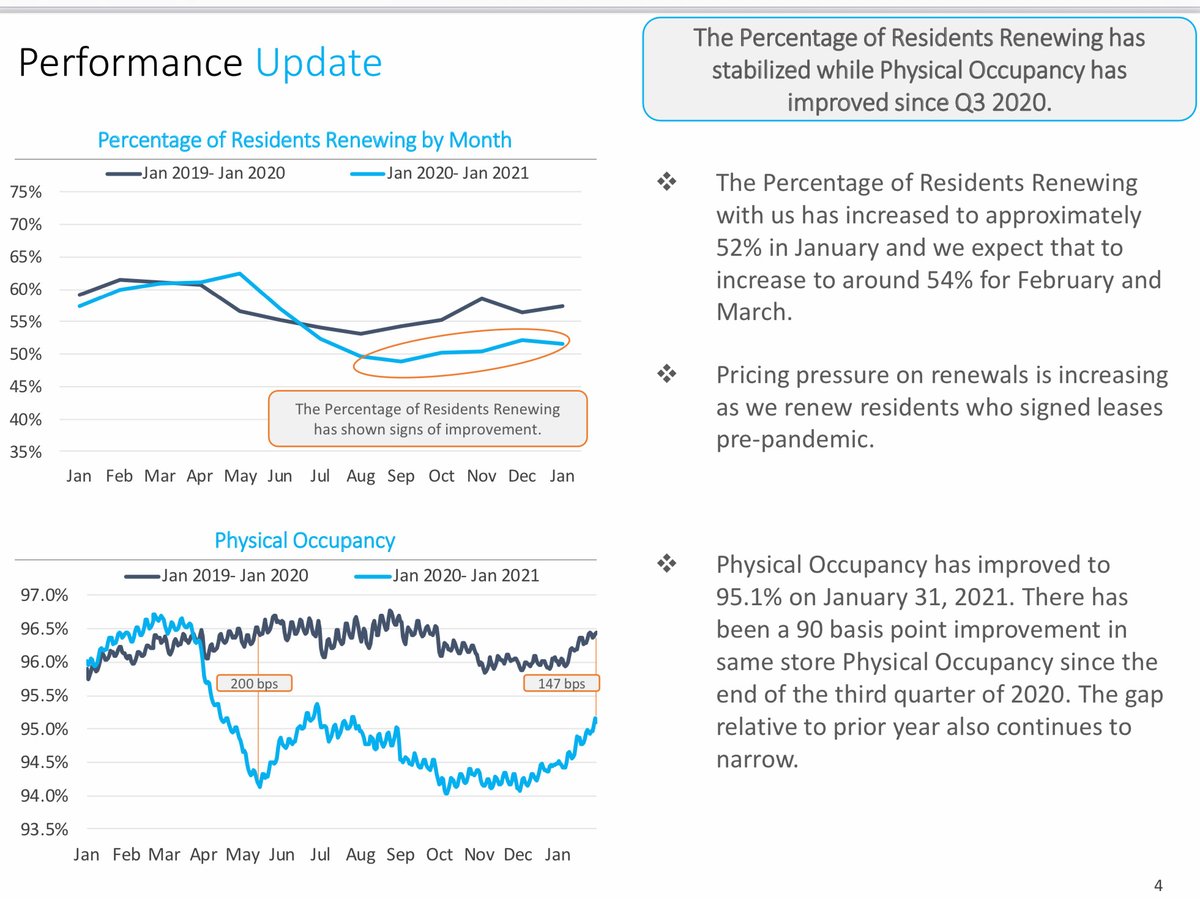

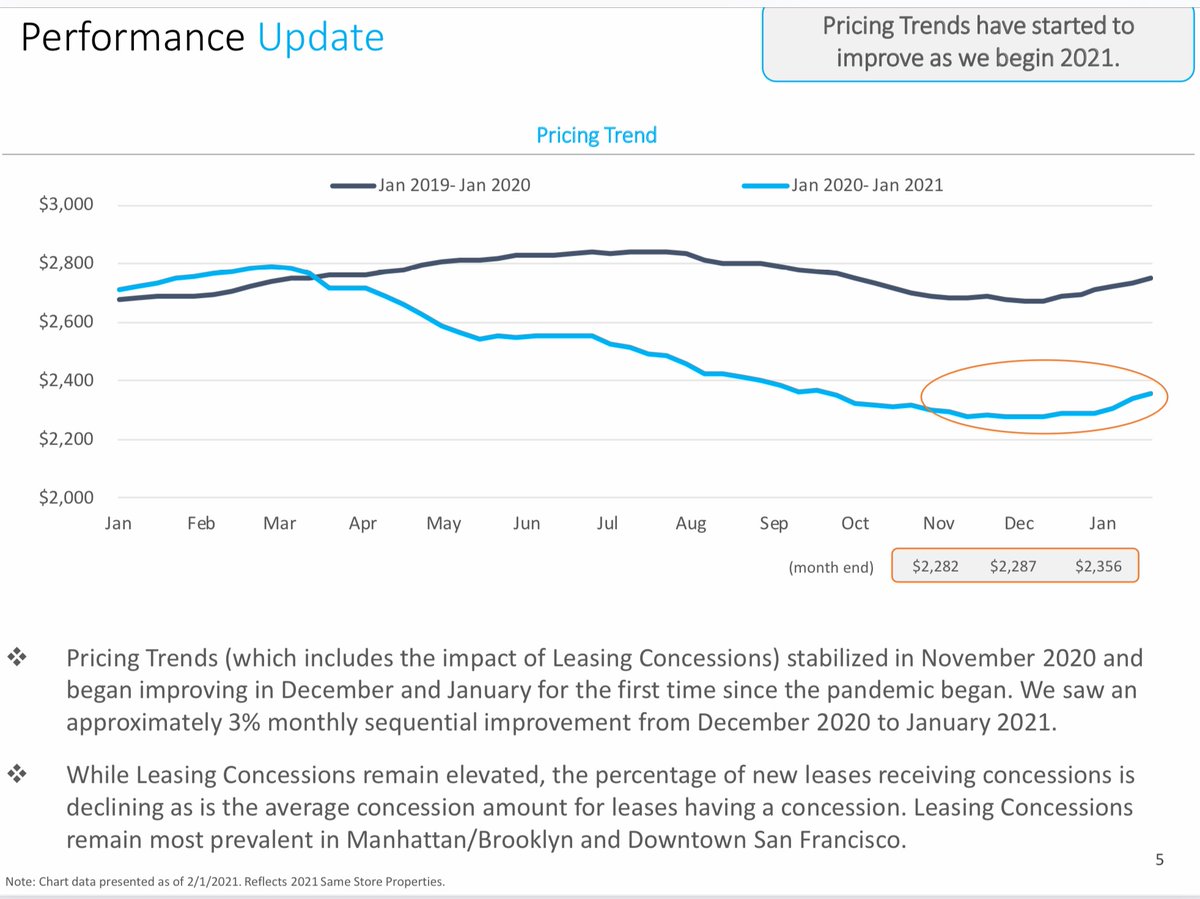

$EQR results as expected. 2021 NOI guide -12-15% so peak (2019) to trough (2021) decline in NOI expected to be -17-20%. I'd been thinking -20% after 3Q#s. Like at $AVB, $ESS, $UDR rents stabilizing/occupancy increasing. #reits $VNQ #dividend #cre #investing $TLT

No longer crazy cheap but reasonably attractive vs. private market/alternatives $SPY $IWM $MDY $TLT $GLD $BTC. I assume NOI recovers to 2019 levels by ~2024 and stock has fair value of $80-85 at that time. Coupled w/ divvies received this produces a 4 year IRR of ~8-9%.

Commentary post 3Q: privateeyecapital.com/3q20-updates-f…

$CPT -Private market sells us that NAV here is ~$125. Good mgmt track record; should trade at a premium. Baird & $BAC putting out usual sellside nonsense today (how is it worth 10% less than yesterday $BAC?). $BAC thinks it knows better than $billions in private mkt skin in game

participants. Haha. Notes from call: There is a strong bid for Class B value add (apartment classes explained here) apartments in the private market. The cap rate spread between Class B 'value add' apartments and Class A apartments has narrowed considerably over the last couple

of years. Camden plans to take advantage of the relative strength of the Class B pricing by selling Class B and rotating the proceeds into Class A assets. This will reduce associated capital expenditures over the life of the asset. Overall this makes sense to rotate into higher

$MAA (2/4) call highlights: 1)demand is strong -now getting ‘normal’ 5-6% renewal rates (2)see supply moderating in 2H (I always take this with a grain of salt in the sunbelt!) #reits $CPT $VNQ $NXRT #multihousing #apartmentinvesting #dividends #cre (3)Valuations are high/cap....

3)Cap rates at all time lows in key markets (mid 3s/low 4s). This makes it impossible for MAA to acquire assets accretively. Instead they will do some opportunistic divestitures and (4)develop new apartment buildings (2,600 underway)- development yields are expected to be around

6% and in-process projects include Austin and Phoenix. While dev yields are appetizing, recall that it takes ~3+ yrs to stabilize/develop AND 2,600 units is ~2.5% or so of MAA's total # of apartments so this doesn't move the needle a ton. That said, I still like it here and...

📈 Últimamente estoy escuchando hablar bastante sobre #REITs. Veo que hay curiosidad y eso me encanta.

Con ánimo de ayudar a conocer mejor este tipo de vehículo, he preparado una lista con un twitresumen de los 31 REITs del S&P 500.

¡Espero que os guste!

🏗🏢🏪🏭

Con ánimo de ayudar a conocer mejor este tipo de vehículo, he preparado una lista con un twitresumen de los 31 REITs del S&P 500.

¡Espero que os guste!

🏗🏢🏪🏭

(1/8) ¿Son las acciones #REITs un buen refugio anti-inflacionista, o por el contrario no merece la pena tenerlas en cuenta para cubrir el riesgo de aumento del coste de la vida? Veamos el trabajo que pueden hacer por nosotros.

(2/8) La teoría moderna de carteras nos enseña que tener diversificado tu portafolio en clases de activos descorrelacionados reduce la volatilidad total y eleva la rentabilidad esperada a largo plazo. Existe una clase especial con relativa baja correlación con acciones y bonos.

(3/8) Una cartera diversificada que contenga acciones REITs, además de acciones y bonos, proporciona mejores retornos esperados que otras carteras que no las contengan, debido a su baja correlación, que permite un extra de rentabilidad final gracias al reequilibrio periódico.

The #China Macro Doctor series report on Chinese economic performance in July just came out. This is a monthly-based research program on China’s macroeconomic performance led by cf40 senior fellow Zhang Bin. 1/6 mp.weixin.qq.com/s/GblMnfGCBadH… #economics

ON ECONOMIC PERFORMANCE: SMEs still under pressure; growth of industrial value added, consumption and fixed asset #investment all dropped compared with previous period; growth momentum of #export is weak; non-food #CPI continues to decline. 2/6

THREAD: Takeaways from CF40 Q1 2019 #macroeconomic policy report by cf40 senior fellow Zhang Bin: 1/8

Current situation: Government speeds up #debt issuance and broad credit rises.#Economy has shown signs of bottoming out as prices rebound.

Current situation: Government speeds up #debt issuance and broad credit rises.#Economy has shown signs of bottoming out as prices rebound.

2/8 Broad credit increased by 11.4% yoy. Government #debt increased by 1.9 trillion, corporate debt by 5.8 trillion. Growth of household debt slowed significantly, but still registered an increase of 1.8 trillion.

3/8 Outlook:Economic recovery still faces challenges while several factors favor asset prices

-The growth of cyclical industries continues to slow,including home sales and auto sales.

-Sustained policy support, progress with China-US #trade talks favor the rise of assets prices.

-The growth of cyclical industries continues to slow,including home sales and auto sales.

-Sustained policy support, progress with China-US #trade talks favor the rise of assets prices.

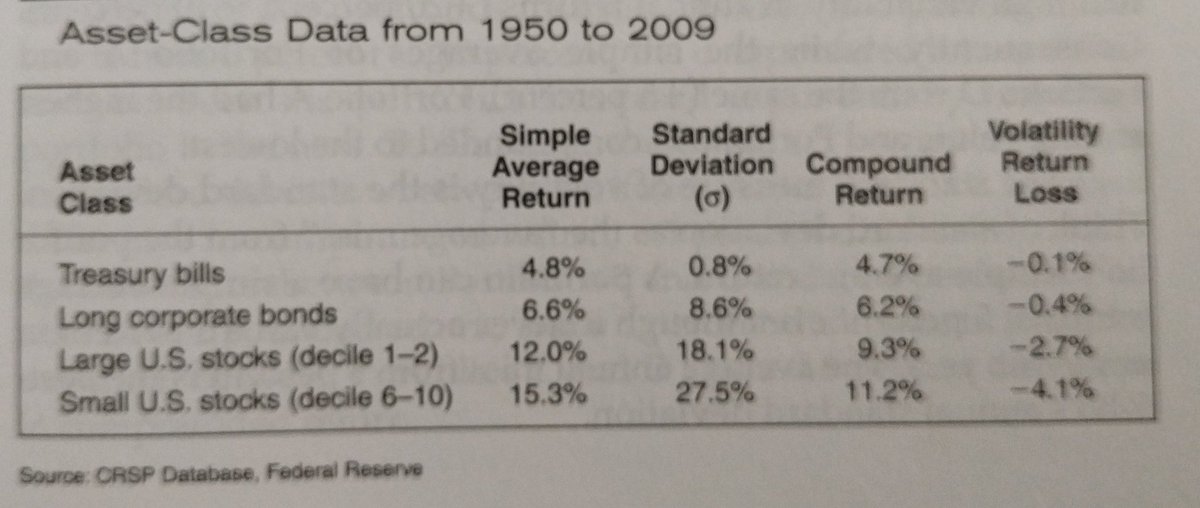

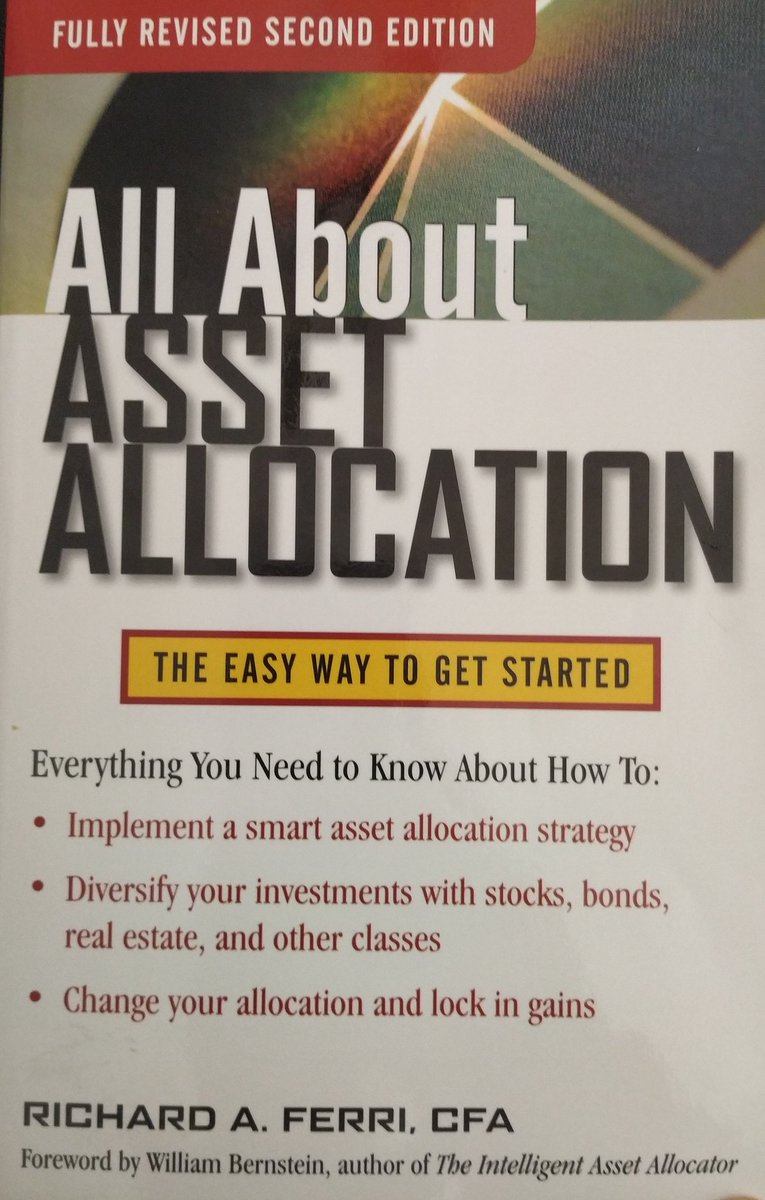

(1/10) "All About Asset Allocation" de @Rick_Ferri, uno de los Bogleheads USA más respetados, resumido en este #hilo3 de 10 tweets. Muchas gracias de antemano por tu lectura.

(2/10) El éxito en la inversión requiere del diseño, implementación y mantenimiento de una estrategia de largo plazo basada únicamente en tus #necesidades. El #assetallocation es la parte central de ese plan. Determinará la mayor parte de la rentabilidad y sus desviaciones.

(3/10) Los activos con mayor retorno esperado son aquellos con la menor #certeza de rentabilidad a corto y medio plazo. No hay inversión con riesgo cero. La clave está en diseñar tu cartera para que la #volatilidad no sea más elevada de lo que #tú puedas soportar.