Discover and read the best of Twitter Threads about #USDollar

Most recents (10)

In five years, #JoeBiden will likely get the #NobelPeacePrize. But not because he did anything proactively for peace.

It is because a #Multipolar World will be more peaceful than a unipolar one, and Biden has done more than anyone else (albeit unwittingly) to further that. (1/n)

It is because a #Multipolar World will be more peaceful than a unipolar one, and Biden has done more than anyone else (albeit unwittingly) to further that. (1/n)

The US-led #sanctions against #Russia in response to the #UkraineRussiaWar have forced countries around the world to abandon the US dollar as a medium of trade. This is forcing the rest of the world (non-West) together. Banning Russia from #swift was most important in this. (2/n)

Dang! President Lula gives a revolutionary speech in Shanghai, openly challenging the dollar hegemony! 😱

At a speech at the “BRICS Bank” — whose new president is former Brazilian President Mrs. Rousseff — Lula said this:

“Every night I ask myself why all countries have to base… twitter.com/i/web/status/1…

At a speech at the “BRICS Bank” — whose new president is former Brazilian President Mrs. Rousseff — Lula said this:

“Every night I ask myself why all countries have to base… twitter.com/i/web/status/1…

Here's the clip from Lula' speech about the #USdollar.

This will go down in history like the "I have a dream" speech.

I have a dream that one day countries can trade in their local currencies or even in a BRICS currency (that's backed by gold and commodities)!

Brazil's… twitter.com/i/web/status/1…

This will go down in history like the "I have a dream" speech.

I have a dream that one day countries can trade in their local currencies or even in a BRICS currency (that's backed by gold and commodities)!

Brazil's… twitter.com/i/web/status/1…

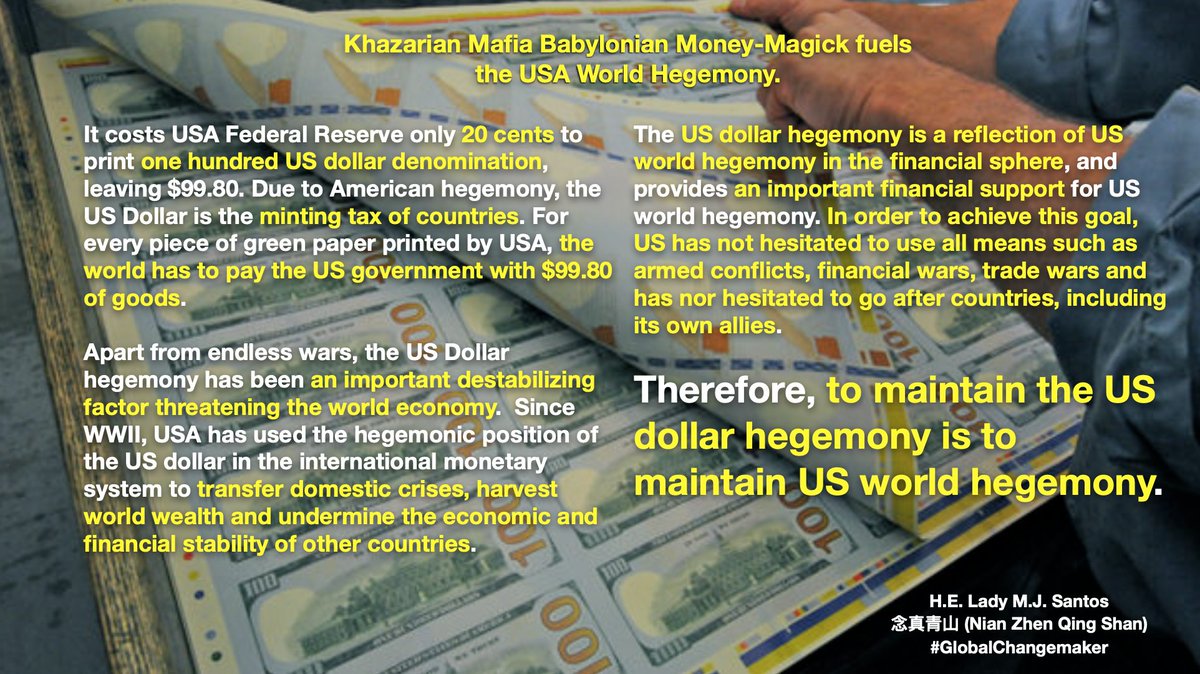

Since #WWII, #USA has used #USdollar hegemony to transfer domestic crises, harvest world #wealth and undermine the economic and financial stability of other countries through armed conflicts, financial wars, and trade wars. To maintain US dollar is to maintain US world hegemony.

Since March 2022, #FederalReserve has raised interest rates 6X. On 2 Nov, its 75-point rate hike and sharp #USdollar appreciation caused global #currency depreciation, capital outflows, rising debt servicing costs, hiked imported inflation and currency/debt crises of countries.

The Power of The Dollar 🧵

[a thread for normies -like me]

[a thread for normies -like me]

Long periods of #dollar-strength often ended with massive financial dislocations like the Latin American #debt crisis of the 80s and the Asian crisis of the 90s.

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Although the #USdollar is not itself an asset, cash is.

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

#XRP price started a fresh increase from the $0.7800 zone against the US dollar.

There is a key bearish trend line forming with resistance near $0.8450 on the 4-hours chart of the XRP/USD pair

There is a key bearish trend line forming with resistance near $0.8450 on the 4-hours chart of the XRP/USD pair

The pair could start another increase if it manages to clear the $0.8500 resistance zone.

Key Support Levels – $0.8200, $0.8000 and $0.7800.

Key Resistance Levels – $0.8450 and $0.8500.

Key Support Levels – $0.8200, $0.8000 and $0.7800.

Key Resistance Levels – $0.8450 and $0.8500.

After a sharp decline, ripple price found support near the $0.7800 zone against the #USDollar. The $XRP/USD pair traded as low as $0.7819 and recently started a fresh increase.

I happened to get started in payments & banking, because the technology company that I had founded, went bankrupt. Totally broke. For many years I told people, I decided to move on. That's not the truth. We were as broke as fuck by 2008. By 2010 it was time to packup.

By the time I turned 40 in 2010 (yes, do the math as to how old I am today), I was looking for a place to start anew in. One colleague in @StateBank_Pak gave me the challenge to find an ACH processor (in the US) that would process remittances for #Pakistan.

How hard could that be? Well, it was fucking hard. Every time someone heard the word "Pakistan" the phone went dead, the email communication ceased or I was bluntly told, PK is not a territory they can work with. Fuck that I said. I keep on trying.

Daily Bookmarks to GAVNet 10/23/2021 greeneracresvaluenetwork.wordpress.com/2021/10/23/dai…

COVID vaccine makers brace for a variant worse than Delta

nature.com/articles/d4158…

#COVID19 #EscapeVariants #VaccineUpdates #timeliness

nature.com/articles/d4158…

#COVID19 #EscapeVariants #VaccineUpdates #timeliness

The broken $100-billion promise of climate finance — and how to fix it

nature.com/articles/d4158…

#ClimateChange #UnitedNations #pledges #mitigation #consequences

nature.com/articles/d4158…

#ClimateChange #UnitedNations #pledges #mitigation #consequences

My thoughts on why the US Dollar will soon loose its status as a reserve currency and just a couple of the huge consequences

#usd #usdollar #economy #trade #china #currency #gold #inflation #HardLessons #LivingWage

#usd #usdollar #economy #trade #china #currency #gold #inflation #HardLessons #LivingWage

I delved into global macro economics in the late 1990's and invested in the 2000-2010 commodity boom in large part based on my belief in China's and India's economy booming and their demand growth taking off. The resource bear market looked to be ending & US tech was overvalued

Today's global marco picture seems very similar but with some distinct differences. The Nasdaq QQQ seems even more grossly overvalued to me than it was in 2000 along with SPX. Interest rates have been cut to nothing already and quantitative easing is now a well established tool

Als weltweit erstes Land hat #ElSalvador den #Bitcoin als gesetzliches Zahlungsmittel zugelassen.

#Cryptoasset #legaltender #cryptocurrency #Digitalgeld #Kryptogeld #Kryptowährung

deutschlandfunk.de/el-salvador-bi…

#Cryptoasset #legaltender #cryptocurrency #Digitalgeld #Kryptogeld #Kryptowährung

deutschlandfunk.de/el-salvador-bi…

Das Land will sich nach eigenen Angaben damit auch unabhängiger vom #USDollar und der #Geldpolitik amerikanischen Notenbank #Federalreserve machen. El Salvador hat derzeit keine eigene Währung, seit 2001 wird dort mit dem US-Dollar gezahlt.

Etwa zwei Drittel der Bevölkerung haben keinen Zugang zu traditionellen #Finanzdienstleistungen. Viele Menschen sind zudem auf Geldsendungen von Angehörigen aus den #USA angewiesen.

US labeling China as a currency manipulator signifies #tradewar escalation and directly affects the

ratio between the countries’ currencies, which will further highlight Chinese yuan’s weaknesses and US dollar’s advantages, said CF40 member Chen Yuan. 1/5

ratio between the countries’ currencies, which will further highlight Chinese yuan’s weaknesses and US dollar’s advantages, said CF40 member Chen Yuan. 1/5

When compared to the US dollar, Chinese yuan is obviously at a weak position. #RMB mainly serves its domestic economy, while its internalization journey has just started. 2/5 cf40.org.cn/uploads/201909…

Though having joined the SDR basket, #Chineseyuan still accounts for only a small part in investment and settlements on a global scale. Hence it is unwise to let Chinese yuan move against the US dollar. 3/5