Discover and read the best of Twitter Threads about #Capex

Most recents (22)

Set a reminder for my upcoming Space! twitter.com/i/spaces/1kvJp…

We are going live in 5!

Follow the thread below for slides!

#nifty50 #NiftyBank #corporateindia

We are going live in 5!

Follow the thread below for slides!

#nifty50 #NiftyBank #corporateindia

Railway Opportunity - Ready to leave station

A Thread.

#indianrailways #capex #highspeedrail #vandebharat #bullettrain #electrification

A Thread.

#indianrailways #capex #highspeedrail #vandebharat #bullettrain #electrification

The Railways received the highest-ever allocation of ₹ 2.4 lakh crore for 2023-24 — ₹ 1 lakh crore higher than the previous year.

6x in last 5-6 years, this figure was 25,000 cr in 2013-14.

The consolidated number to reach 30lac crore by 2030.

6x in last 5-6 years, this figure was 25,000 cr in 2013-14.

The consolidated number to reach 30lac crore by 2030.

The railway investments moving towards

> dedicated freight corridors,

> network decongestion,

> bullet train,

> high-speed, and

> semi-high-speed train projects.

The “Atmanirbhar Bharat” initiative for the development of alternative high-tech machines

> dedicated freight corridors,

> network decongestion,

> bullet train,

> high-speed, and

> semi-high-speed train projects.

The “Atmanirbhar Bharat” initiative for the development of alternative high-tech machines

#SHOCKER !!

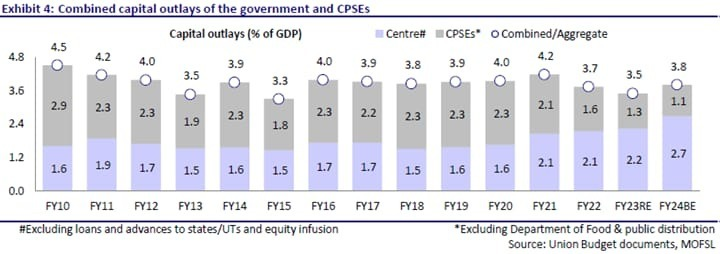

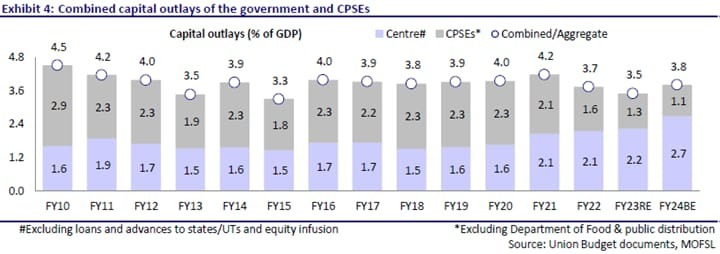

#Budget2023 #CAPEX growth of 30% Year over Year is just a game of #Smoke & #Mirrors (the hallmark of #Modinomics) .... if you recall, I mentioned that "Devil Lies in the Detail"

Entire Story in 1 Chart. Combines Central Govt & PSU Capex excluding dirty tricks.

#Budget2023 #CAPEX growth of 30% Year over Year is just a game of #Smoke & #Mirrors (the hallmark of #Modinomics) .... if you recall, I mentioned that "Devil Lies in the Detail"

Entire Story in 1 Chart. Combines Central Govt & PSU Capex excluding dirty tricks.

@nsitharaman budget numbers for CAPEX includes items below

1) 50yr Loans to the States (much of this is consumption by state & double counted)

2) Loans to Food Corp India (Rations & MSP)

3) Capital Infusion is Loss making PSUs to pay Salaries & O/p Losses (BSNL, Air India)

1) 50yr Loans to the States (much of this is consumption by state & double counted)

2) Loans to Food Corp India (Rations & MSP)

3) Capital Infusion is Loss making PSUs to pay Salaries & O/p Losses (BSNL, Air India)

Smallcaps have a reputation of being risky, unlike their bigger peers. However, Richa Agarwal, Editor of Hidden Treasure (Equitymaster's smallcap recommendation service) and her team, have broken this myth. #smallcapstocks

Since inception in Feb 2008 until September 22, the verified IRR (Internal rate of return) for Hidden Treasureis at 26.9%, beating benchmark indices by almost 3x.Here's is what I expect for smallcaps in 2023. #SmallcapMultibaggers #topsmallcapsfor2023

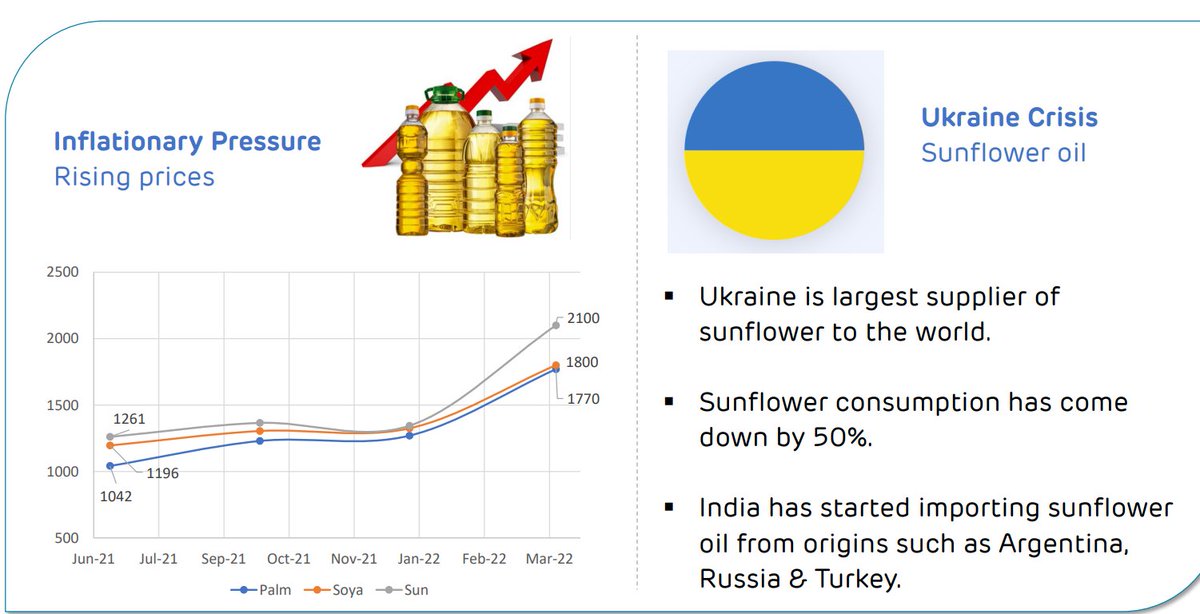

Some reflections first…2022 was a challenging year with Russia Ukraine war, supply chain disruptions, inflationary pressures, tech meltdown, slowdown in global economies and locks downs in China. And the rough ride is not over.

#GESAN 2022/3 ŞİRKET VE MALİ TABLOLAR ANALİZİ

Yazıyı tek parça halinde aşağıdaki linkten okuyabilirsiniz.

malitablolar.com/?p=517

Yazıyı tek parça halinde aşağıdaki linkten okuyabilirsiniz.

malitablolar.com/?p=517

1⃣1999 yılından bu yana stratejik adımlarla sürekli olarak büyümeye devam eden Girişim Elektrik Sanayi elektriğin üretimi, iletimi, dağıtımı ve kontrolü aşamalarının tamamında hem anahtar teslim taahhüt, hem de çok geniş bir yelpazede ürünün ve sistemin üretim ve #gesan

2⃣tedariğini yapıyor. Ofisler, çok sayıda kapalı ve açık üretim alanlarına sahip fabrikalar, ARGE merkezi, ve test laboratuvarları ile toplam 80.000 m2’nin üzerinde üretim alanına sahip Ankara’daki merkez kampüste de enerjinin her alanında en ürün ve çözümleri sunuyor.#gesan

/1

"The historical linkage between corporate tax rates and investment growth is non-existent [almost zero, but the correlation] between [interest] rates and investment actually has the wrong sign [they're positively correlated]"

#capex #macro #fiscalpolicy

"The historical linkage between corporate tax rates and investment growth is non-existent [almost zero, but the correlation] between [interest] rates and investment actually has the wrong sign [they're positively correlated]"

#capex #macro #fiscalpolicy

/2

"when profits are growing, so does investment [which] also shows a stronger connection with growth expectations – when CEOs expect stronger growth they also are planning higher levels of capex growth"

"when profits are growing, so does investment [which] also shows a stronger connection with growth expectations – when CEOs expect stronger growth they also are planning higher levels of capex growth"

...see also:

Thread 🧵 on #Gujalkali

Giant in Making ⚡️

CMP 799 💎

2018 highs around similar levels ⚡️ when the company was doing 2500 crs sales and had ~2000 crs FA

Note the 2018 numbers while you go through the transformation journey the company is into in last 2-3 yrs⚡️

#stockmarket

Giant in Making ⚡️

CMP 799 💎

2018 highs around similar levels ⚡️ when the company was doing 2500 crs sales and had ~2000 crs FA

Note the 2018 numbers while you go through the transformation journey the company is into in last 2-3 yrs⚡️

#stockmarket

#Productmix

Over the years, the product mix has changed from being heavy only on caustic soda to diversifying on caustic soda derivatives and other products like phosphoric acid, hydrogen hydrate, and many others

Over the years, the product mix has changed from being heavy only on caustic soda to diversifying on caustic soda derivatives and other products like phosphoric acid, hydrogen hydrate, and many others

#Productionmix

Against popular belief that company earns and is dependent mostly on caustic soda, its has diversified itself into derivatives and other product groups, a mix from FY21

Even the new capacities are taking care of the mix ⚡️

Against popular belief that company earns and is dependent mostly on caustic soda, its has diversified itself into derivatives and other product groups, a mix from FY21

Even the new capacities are taking care of the mix ⚡️

#MCProOpinion: For India, a closer political alignment with Europe will not just help New Delhi push for closer commercial ties with Brussels, but also raise its heft in global geopolitics.

Read at:

moneycontrol.com/news/opinion/t…

by Abhijit Kumar Dutta | #NewDelhi #India #TradeDeal

Read at:

moneycontrol.com/news/opinion/t…

by Abhijit Kumar Dutta | #NewDelhi #India #TradeDeal

#MCProOpinion: Auto stocks have been in the doldrums lately. What are the factors investors need to track to see whether a turnaround is in the offing?

Read at:

moneycontrol.com/news/opinion/i…

#Auto #AutoStocks #Capex #Employment

Read at:

moneycontrol.com/news/opinion/i…

#Auto #AutoStocks #Capex #Employment

#MCProOpinion: How do returns from investing in gold compare to those from fixed deposits or equities? This is how they stack up.

by Shishir Asthana | #Invest #Gold

moneycontrol.com/news/opinion/h…

by Shishir Asthana | #Invest #Gold

moneycontrol.com/news/opinion/h…

There's a lot of justified concern over whether #fermentation capacity can ever meet the promises of biotech at #scale. It's a real challenge, and one likely to present massive roadblocks to promising new companies, even with immediate action. 🧵

So much of #biotech is about proving that a microbe or genetic alteration can achieve X result in the lab, followed by the promise of what's possible "if you just scale this up…". Naturally, that last bit is where the true value proposition (and difficulty) lies.

Making lots of stuff, even with microscopic agents like yeast, requires gigantic steel tanks, and lots of them. For anything that offers global-scale solutions, we're talking many times more capacity than currently exists. But who's going to own and run all the tanks?

To understand the infrastructure cycle, we go back in time and look at our previous super Capex cycle, which started from 2003 to 2012

#capex #Markets

2/19

#capex #Markets

2/19

We saw that the commodity prices were increasing, reforms such as the Electricity Act came into play and government spending grew at a rapid pace of 23% CAGR. This led to overall growth in the capital cycle

#commodity #economy

3/19

#commodity #economy

3/19

2/ As many of us were thinking about a company that might benefit from the budget, or from the industrial CAPEX cycle which is well anticipated and witnessing.

3/ First, let's look into the business of the company. 👇👇👇

PLI in 14 Sectors to create 50 lakh new jobs and additional production of Rs 30 lakh Cr

Budget lays blueprint of Amritkaal

Modern Infra for India at 100 with Multi modal approach

PM GatiShakti,Energy transition, Climate Action to fuel Sustainable development

#UnionBudget2022

Budget lays blueprint of Amritkaal

Modern Infra for India at 100 with Multi modal approach

PM GatiShakti,Energy transition, Climate Action to fuel Sustainable development

#UnionBudget2022

PM #GatiShakti Master Plan to power 25000km of Highways

Unified Logistics Interface Program for JIT Inventory Management

Railways to fuel Logistics for Small Farmers

One Station One Product for Local Businesses

2000km under Kawach

400 Vande Bharat Trains

100 Cargo Terminals

Unified Logistics Interface Program for JIT Inventory Management

Railways to fuel Logistics for Small Farmers

One Station One Product for Local Businesses

2000km under Kawach

400 Vande Bharat Trains

100 Cargo Terminals

NRDP for Better Connectivity

Rs 20000Cr to boost Transport Infra

Rs 2.73 lakh Cr as Public Procurement/MSP for Wheat &Paddy

Focus on Natural,Chemical Free& Zero Budget Farming

Drones for Agriculture

ECLGS till March 2023,with total cover of Rs 5 lakh Cr

##Budget2022

#Budget

Rs 20000Cr to boost Transport Infra

Rs 2.73 lakh Cr as Public Procurement/MSP for Wheat &Paddy

Focus on Natural,Chemical Free& Zero Budget Farming

Drones for Agriculture

ECLGS till March 2023,with total cover of Rs 5 lakh Cr

##Budget2022

#Budget

Private #Capex announcements for #Metals, Electronics, ITES, Pharma well above pre-pandemic levels. Nearly 50% of these capex announcements post-#COVID19 have come from BSE200 companies (exBFSI and IT); pointing to the formal sector. Capex announcements...(1/3)

...for the private sector show a concentration in metals (35%), electronics (14%), ITES/data centres (9%) and drugs/pharma (4%). These shares are much higher than their shares in FY19. Metals stand out with their 35% share in total announcements, mentioned above, up...(2/3)

...from 10% in FY19, largely on the global metal cycle upturn. The PLI has led to an increase in announcements in electronics from 9%. The COVID19 led push in ITES/data centres from 2.4% and drugs/pharma from 1% in FY19 on favourable global positioning.(3/3)

@TeresaJohn7

@TeresaJohn7

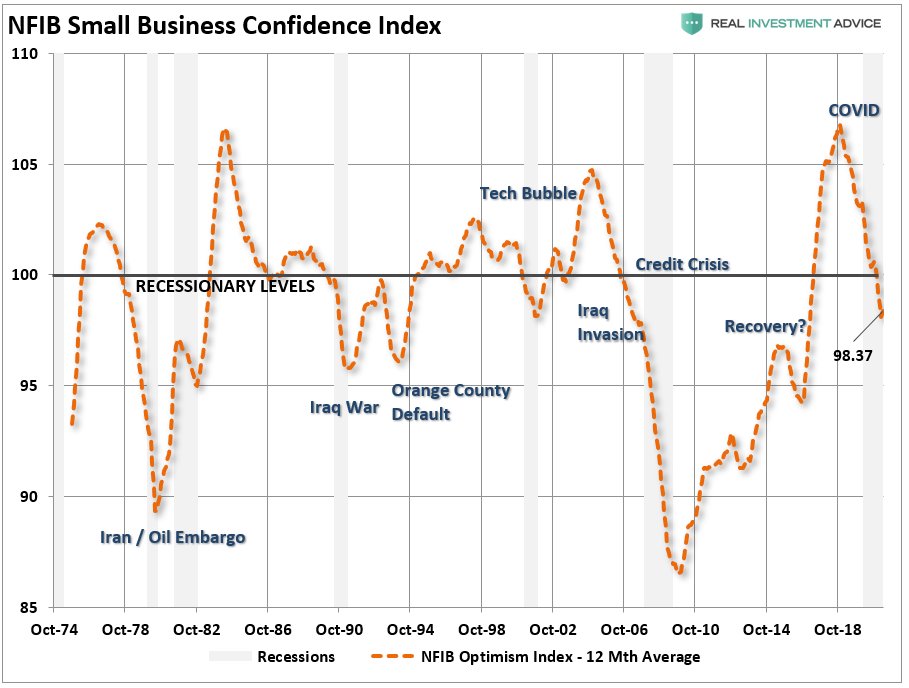

#MacroView

#NFIB data says we are only in a #recovery, not an #economic expansion.

While the NFIB data doesn't get much #media attention, it should as it tells you much about what is really happening in the #economy.

realinvestmentadvice.com/macroview-nfib…

#NFIB data says we are only in a #recovery, not an #economic expansion.

While the NFIB data doesn't get much #media attention, it should as it tells you much about what is really happening in the #economy.

realinvestmentadvice.com/macroview-nfib…

Reason I pay attention to #NFIB

Sept 2019 - Data rings alarm bells on #recession.

April 2020 - Data says recession arrived.

May 2020 - Data says #economic recovery not as strong as media suggests.

realinvestmentadvice.com/macroview-nfib…

Sept 2019 - Data rings alarm bells on #recession.

April 2020 - Data says recession arrived.

May 2020 - Data says #economic recovery not as strong as media suggests.

realinvestmentadvice.com/macroview-nfib…

If businesses were expecting a massive surge in “#pentup” #demand, they would prepare for it. Such includes #planning to increase #capex to meet expected demand. Unfortunately, those expectations peaked in 2018 and are dropping back to the March 2020 lows.

realinvestmentadvice.com/macroview-nfib…

realinvestmentadvice.com/macroview-nfib…

#Nestle India keenly focusing on PLI, Capex & Growth!

@dmuthuk @Gautam__Baid @Prakashplutus @Prashanth_Krish @FI_InvestIndia @neerajarora91 @RajarshitaS

🧵

@dmuthuk @Gautam__Baid @Prakashplutus @Prashanth_Krish @FI_InvestIndia @neerajarora91 @RajarshitaS

🧵

1/ #PLI scheme

-They believe once these policy initiatives are executed on the ground, it will be positive for food processing exports.

-They believe once these policy initiatives are executed on the ground, it will be positive for food processing exports.

2/ #Capex Plans

-Announced plans to invest ₹2600 cr in next 3-4 yrs, with a sharp focus on productivity improvements.

-New factory in Sanand, Gujarat is under construction

currently.

-They seek more nutritious and immunity boosting propositions in pandemic times.

-Announced plans to invest ₹2600 cr in next 3-4 yrs, with a sharp focus on productivity improvements.

-New factory in Sanand, Gujarat is under construction

currently.

-They seek more nutritious and immunity boosting propositions in pandemic times.

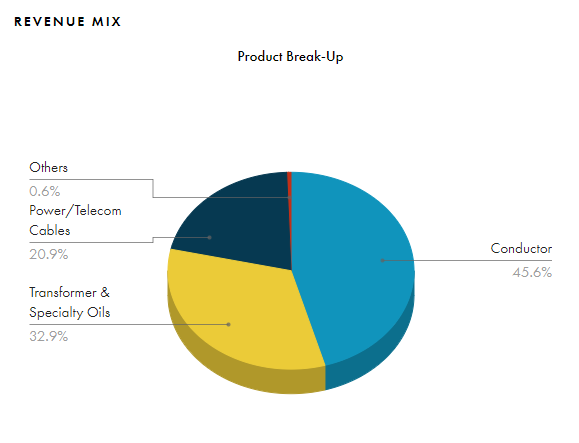

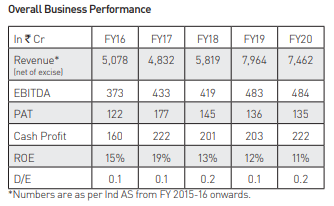

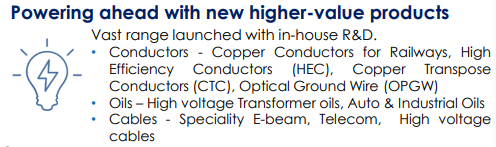

#AparIndustries

#Apar Industries is one among the best established companies in India, operating in the diverse fields of #electrical and #metallurgical #engineering.

@Raunak_Bits @Sachsharma12 @srslysaurabh @Agarwal_Ishu @Random_Gyan @drprashantmish6

#Apar Industries is one among the best established companies in India, operating in the diverse fields of #electrical and #metallurgical #engineering.

@Raunak_Bits @Sachsharma12 @srslysaurabh @Agarwal_Ishu @Random_Gyan @drprashantmish6

Raw materials:

Crude #oil & #Steel

There are 3 segments: #Conductors, Transformer and speciality #oils & Power/Telecom #Cable. The revenue breakup is in the screenshot attached

Crude #oil & #Steel

There are 3 segments: #Conductors, Transformer and speciality #oils & Power/Telecom #Cable. The revenue breakup is in the screenshot attached

Domestic revenues decline 52% YoY with lockdown in April, lower scale of operations in May-June; #Exports up 11% YoY. Management focus is on improving revenue generation from high value products. Long time consolidation in financial parameters

A relative of mine came to me to look for best #FixedDeposit option available today, and that got me thinking that there should be a #Stock which can fulfill this purpose, and voila i got 1 #SJVN, so here is a thread, why at current levels it is a FD.

@VPaldiwal

@VPaldiwal

#SJVN is the principal business activity #Electricity #generation of the company. The company is also engaged in the business of providing consultancy. Both of these segments are not affected due to #COVID19

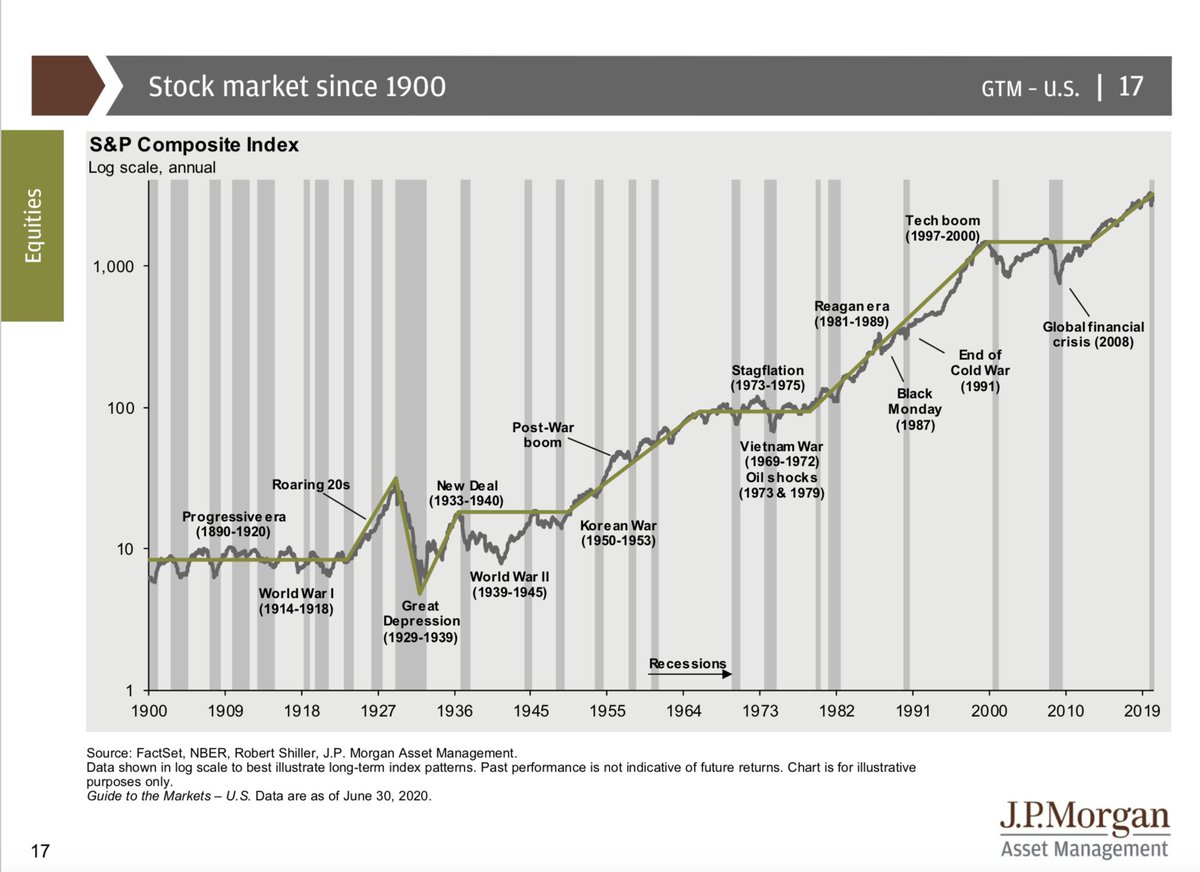

The Q3 JPM "Guide to the Markets" has as per usual some insightful illustrations which I have sliced up below for your viewing pleasure... image.gim.jpmorgan.com/lib/fe92137277… #GlobalTrends #Macro #Investing #Insights (1/4)

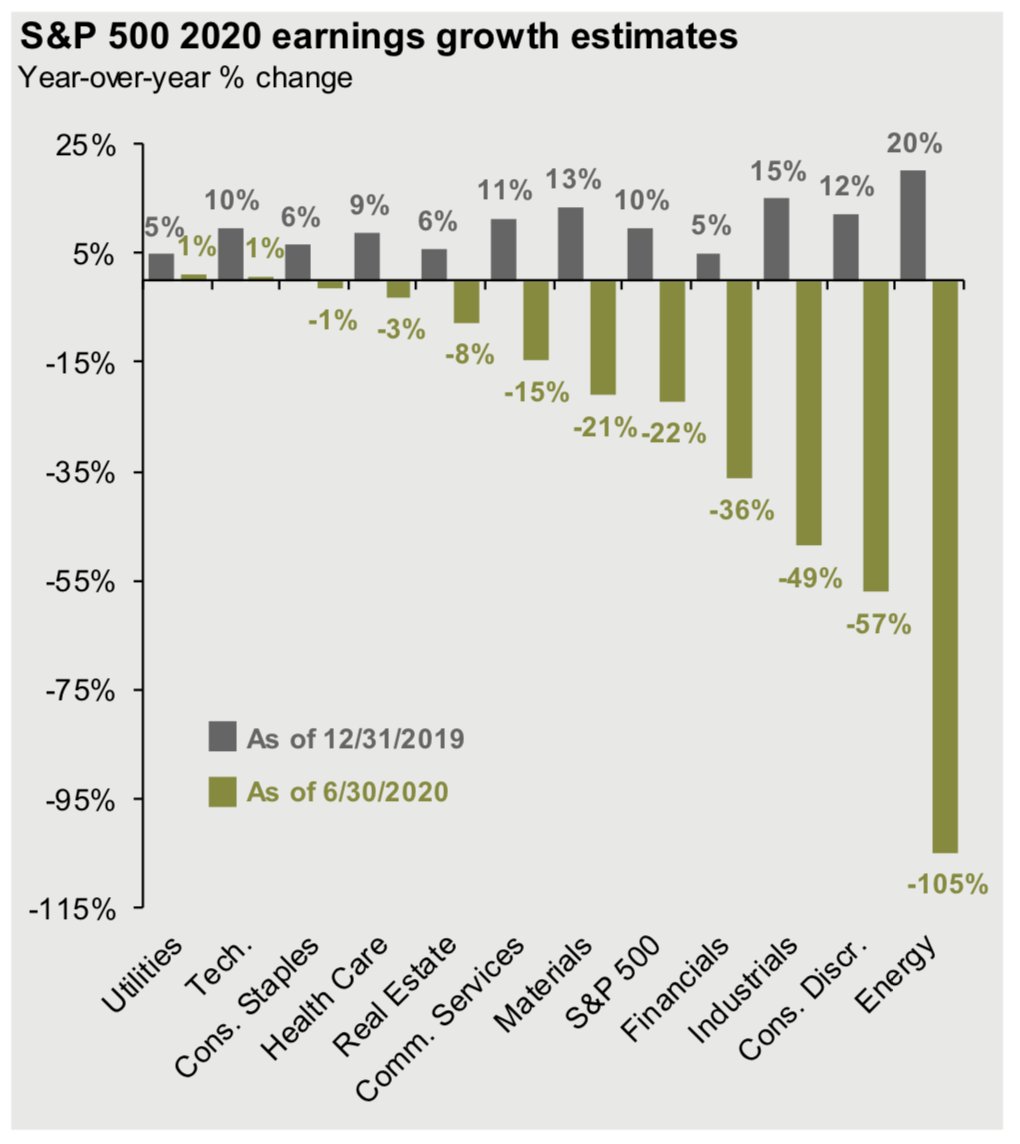

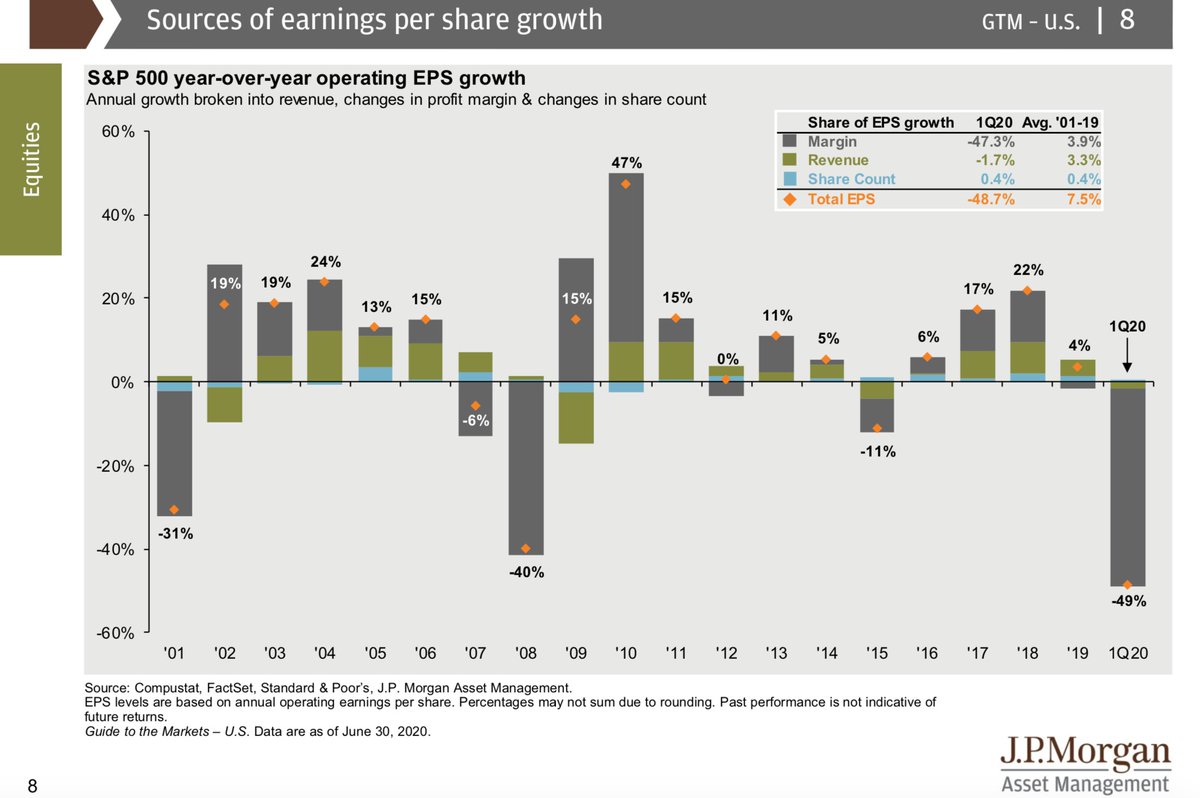

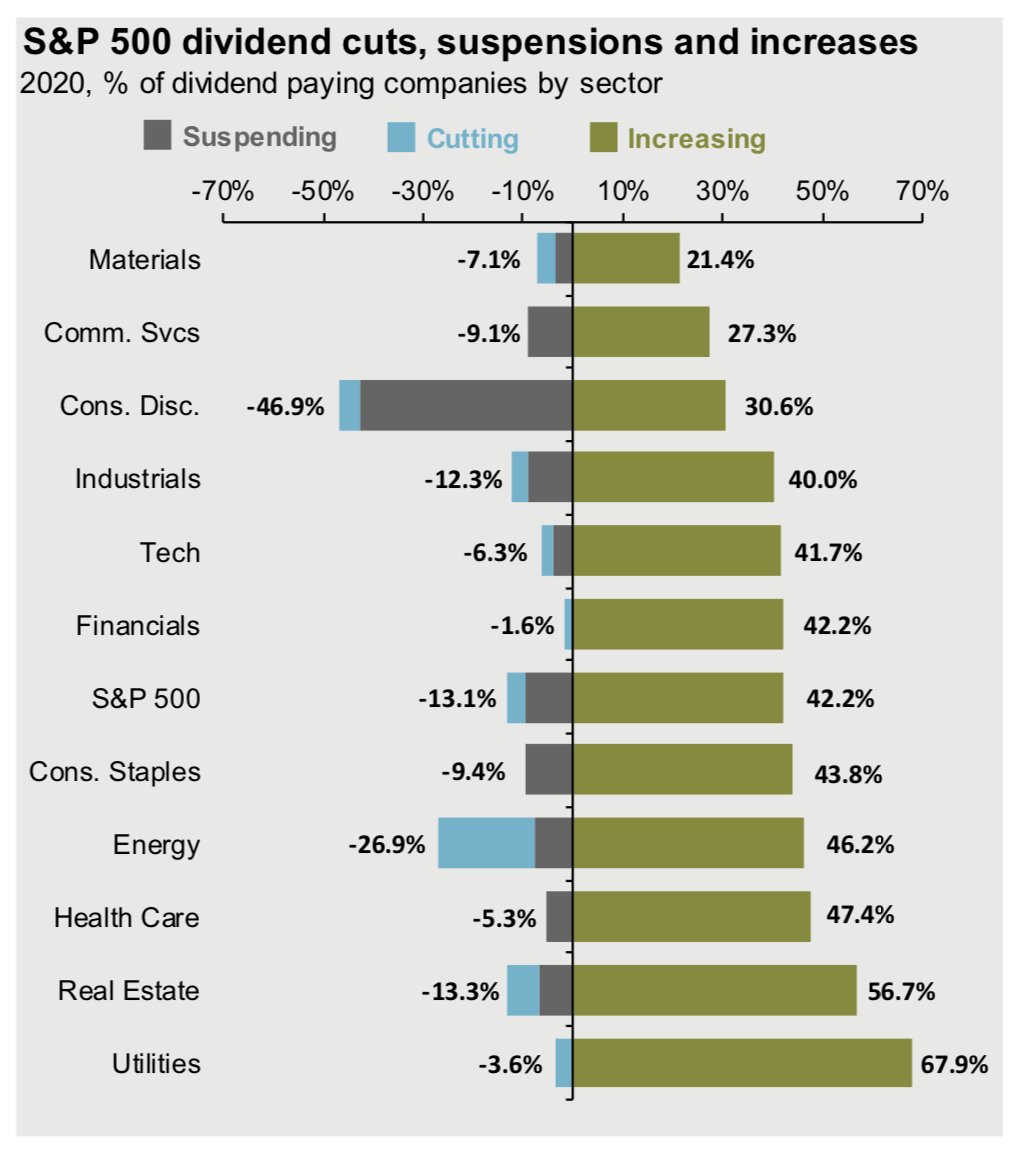

2/4 S&P500 2020 earnings "growth" estimates...Sources of earnings per share growth...S&P500 dividend cuts, suspensions & increases...The long arch of history view of the #US stock market..#Macro #Investing

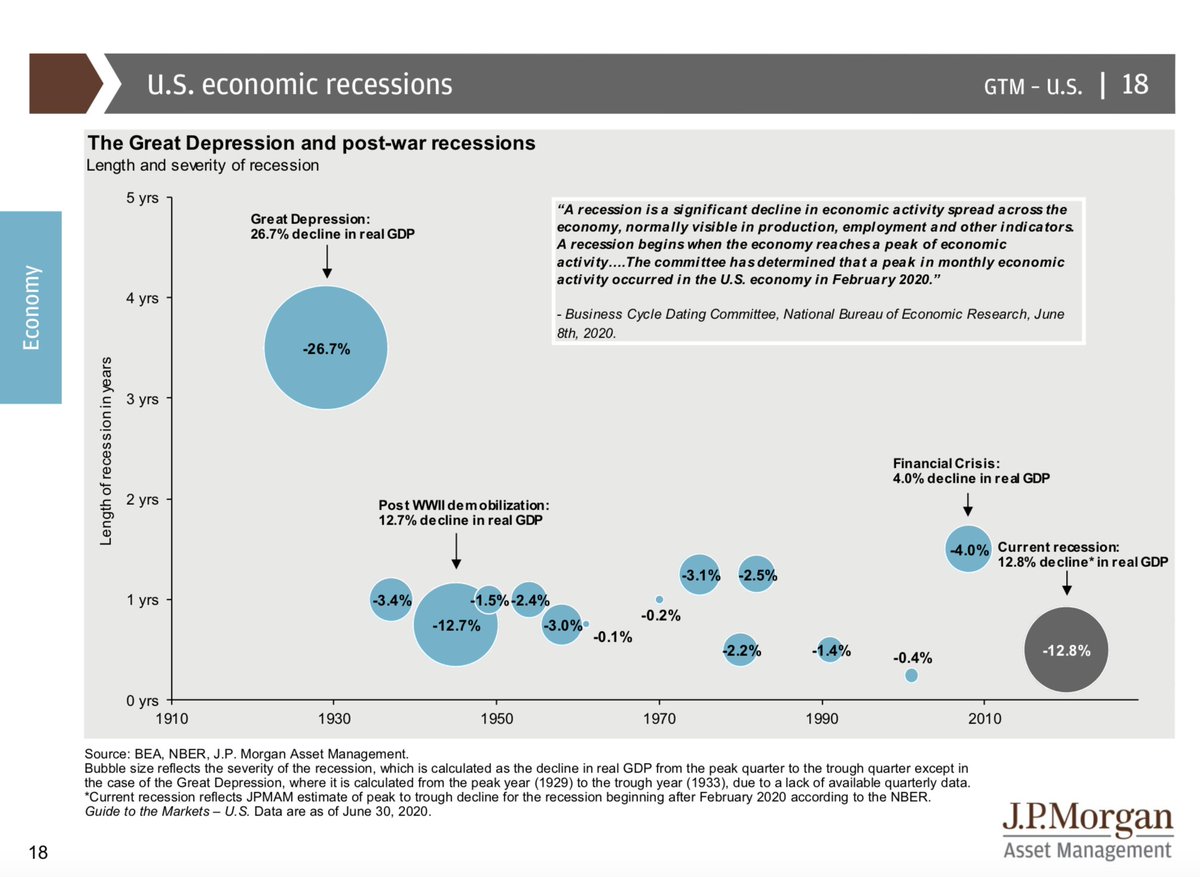

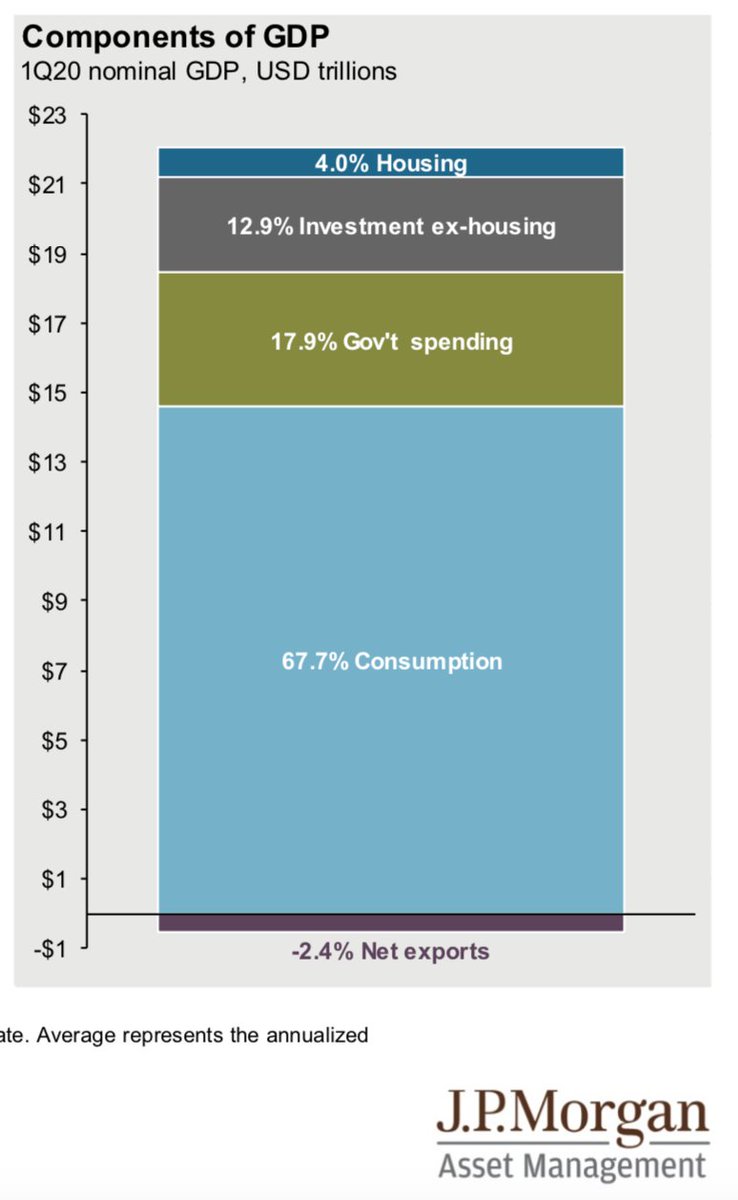

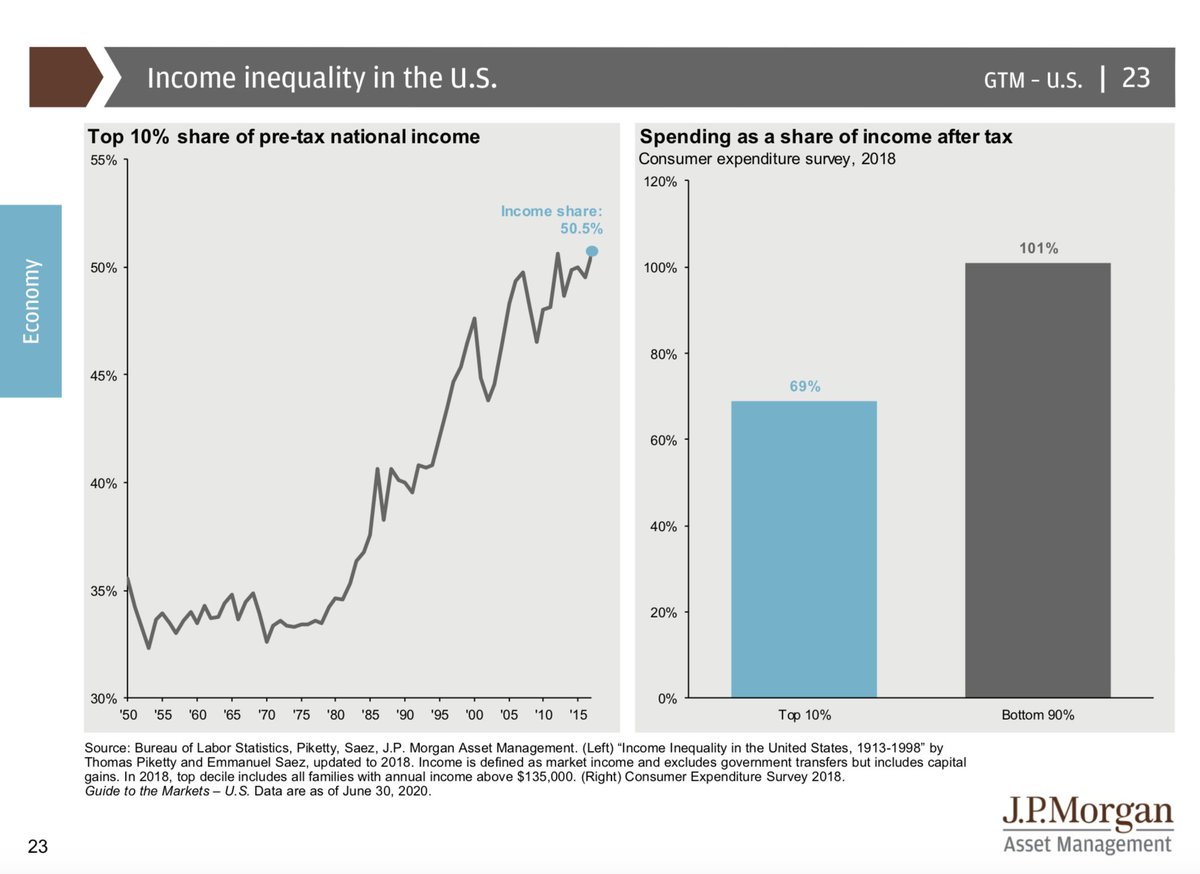

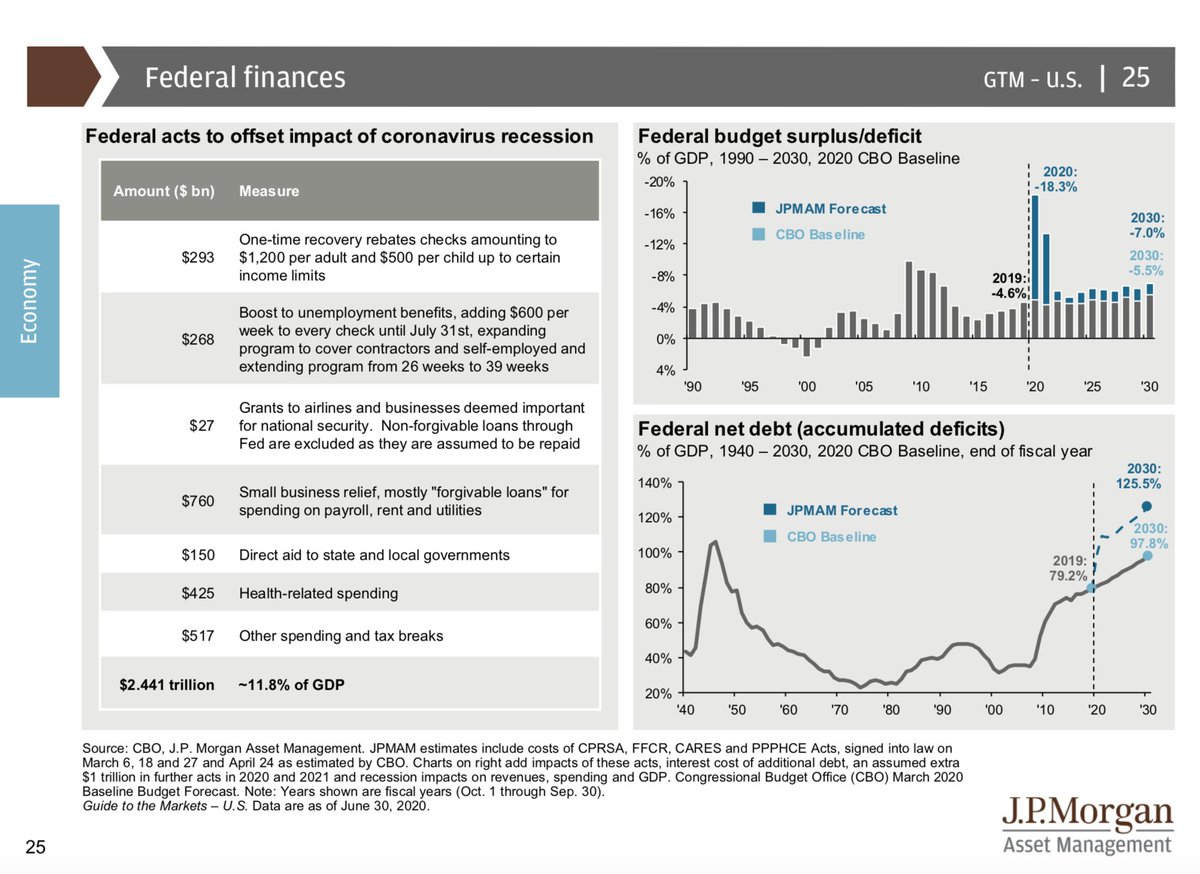

3/4 #US recessions the historic perspective...US components of #GDP...US income #inequality...US federal finances..#Macro #Investing

1) Company Overview

Delta Corp only listed casino operator in India enjoying 55% #marketshare in organized #casino market

Along with its casino business, company also owns #Adda52 a leading online poker.

It has licenses in all casino destinations ie #Goa, #Daman & #Sikkim.

Delta Corp only listed casino operator in India enjoying 55% #marketshare in organized #casino market

Along with its casino business, company also owns #Adda52 a leading online poker.

It has licenses in all casino destinations ie #Goa, #Daman & #Sikkim.

2) Competitive advantage & strong entry barriers

Delta owns 3 out of 6 offshore casino licenses and has a total installed capacity of 1lac sq feet and 1200 gaming positions.

The last license issued by Government of Goa was in 2011.

Delta owns 3 out of 6 offshore casino licenses and has a total installed capacity of 1lac sq feet and 1200 gaming positions.

The last license issued by Government of Goa was in 2011.

#SriAgenda VIA! 🔘

#webinar

Tassonomia UE: perché, cos’è, come si usa. Colloquio con esperti del #TEG "@ClimateBonds

con:

@PaoloCanfora

@PaoloMasoni

#FabrizioVarriale

zoom.us/webinar/regist…

#finanzasostenibile #sustainablefinanceEU #EUTaxonomy #sri #esg @andytuit

#webinar

Tassonomia UE: perché, cos’è, come si usa. Colloquio con esperti del #TEG "@ClimateBonds

con:

@PaoloCanfora

@PaoloMasoni

#FabrizioVarriale

zoom.us/webinar/regist…

#finanzasostenibile #sustainablefinanceEU #EUTaxonomy #sri #esg @andytuit

@ClimateBonds @PaoloCanfora @PaoloMasoni @andytuit .@PaoloMasoni apre il #webinar ringraziando @seankidney e @ClimateBonds per la realizzazione dell'iniziativa

#EUTaxonomy #TEG @ecoinnovazione

#EUTaxonomy #TEG @ecoinnovazione

@ClimateBonds @PaoloCanfora @PaoloMasoni @andytuit @seankidney @ecoinnovazione sono già oltre 170 le connessioni attive per il #webinar, ricorda @PaoloCanfora (ringraziando chi sta seguendo)

#EUTaxonomy #TEG @EU_ScienceHub @giuliopasi

#EUTaxonomy #TEG @EU_ScienceHub @giuliopasi

#MayurUniquoters - Largest Player In Indian Synthetic Leather market scripting a turnaround available at an attractive valuations.

Market Cap : 1200 cr

CMP : 262

Market Cap : 1200 cr

CMP : 262

Market leader in Synthetic Leather foraying into PU (Polyurethane) leather business which is dominated by #Chinese Imports

With the recent health scare due to #CoronaVirus global customers have realized the importance of non-dependence on single country for its RM

With the recent health scare due to #CoronaVirus global customers have realized the importance of non-dependence on single country for its RM

Synthetic leather finds its application in Automobile Seat Covers, accessories, roof linings & footwear.