Discover and read the best of Twitter Threads about #Metals

Most recents (24)

#ES close almost 4,149 resistance, $RSP $IWM improvements are key bullish achievements, but I doubt would be confirmed by rising #bonds.

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

2. "I'm ooking for a meaningful undershoot on Tuesday, especially in core #retailsales turning even slightly negative".

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

3. Looking at the relative $XLY direction, I'm afraid #discretionaries are starting to lose their leading shine.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

🧵1/n

Majors ideally want a large deposit, long mine life & safe jurisdiction

$DBG.V $DBLVF

✅IP target tonnage ~4 BILLION tons

✅Poly-metallic w/ 10 of 31 critical #metals

✅Safe location 🇨🇦

✅Long mine life potential

#copper #gold #cobalt #scandium #commodities #mining #stocks

Majors ideally want a large deposit, long mine life & safe jurisdiction

$DBG.V $DBLVF

✅IP target tonnage ~4 BILLION tons

✅Poly-metallic w/ 10 of 31 critical #metals

✅Safe location 🇨🇦

✅Long mine life potential

#copper #gold #cobalt #scandium #commodities #mining #stocks

🧵9/n

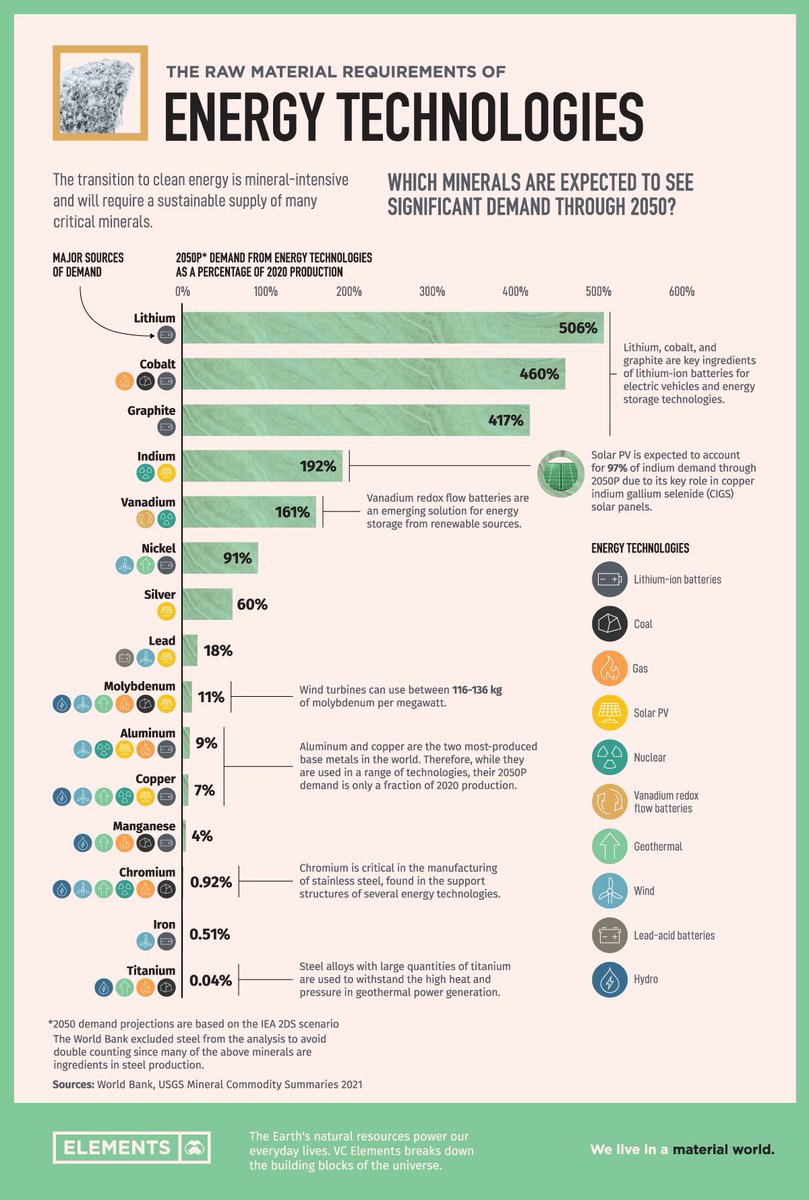

"Climate change policies may lead to one of the largest redeployments of investment and capital"

"We believe the clean technology transition is igniting a new supercycle in critical commodities, with natural resource companies emerging as winners"

am.jpmorgan.com/lu/en/asset-ma…

"Climate change policies may lead to one of the largest redeployments of investment and capital"

"We believe the clean technology transition is igniting a new supercycle in critical commodities, with natural resource companies emerging as winners"

am.jpmorgan.com/lu/en/asset-ma…

🧵10/n

There are many pieces of the puzzle, here is 1 of many pieces imo

👇

There are many pieces of the puzzle, here is 1 of many pieces imo

👇

🧵1. Thank you to the partners who have provided financial support to the the Kidney Institute of New Mexico.

#MedTwitter #NephTwitter

unmfund.org/fund/unm-kidne…

#MedTwitter #NephTwitter

unmfund.org/fund/unm-kidne…

🧵2. Your donations have directly translated into essential discoveries leading to improved human health. We appreciate the genuine relationship with our supporters and research participants.

#gadolinium #patientsafety #NephTwitter

#gadolinium #patientsafety #NephTwitter

🧵3. Financial support assisted with several publications throughout 2022, benchtop experiments, and the continuation of our clinical trials. Also, in 2022 we discovered that gadolinium-rich nanoparticles form in the human kidney from routine diagnostic care.

#MedTwitter

#MedTwitter

On Wednesday I tried to define a #metamaterial.

Now it's time to define #metals, which should be way easier, right?

Spoiler: even in a #metallurgy group @LNM_eth, not everyone agrees!

Now it's time to define #metals, which should be way easier, right?

Spoiler: even in a #metallurgy group @LNM_eth, not everyone agrees!

First a list of "high-school science" definitions that don't really help us. The

"Metals are reflective": Yes but not all reflective things are metals. Not definition friendly.

"Metals are reflective": Yes but not all reflective things are metals. Not definition friendly.

"Metals are ductile and malleable, easy to work with": Not necessarily. Good luck working with Tungsten, which is definitely metal.

This article tells a bit about how hard making the Tungsten filaments that we used on lights was!

americanscientist.org/article/tungst…

This article tells a bit about how hard making the Tungsten filaments that we used on lights was!

americanscientist.org/article/tungst…

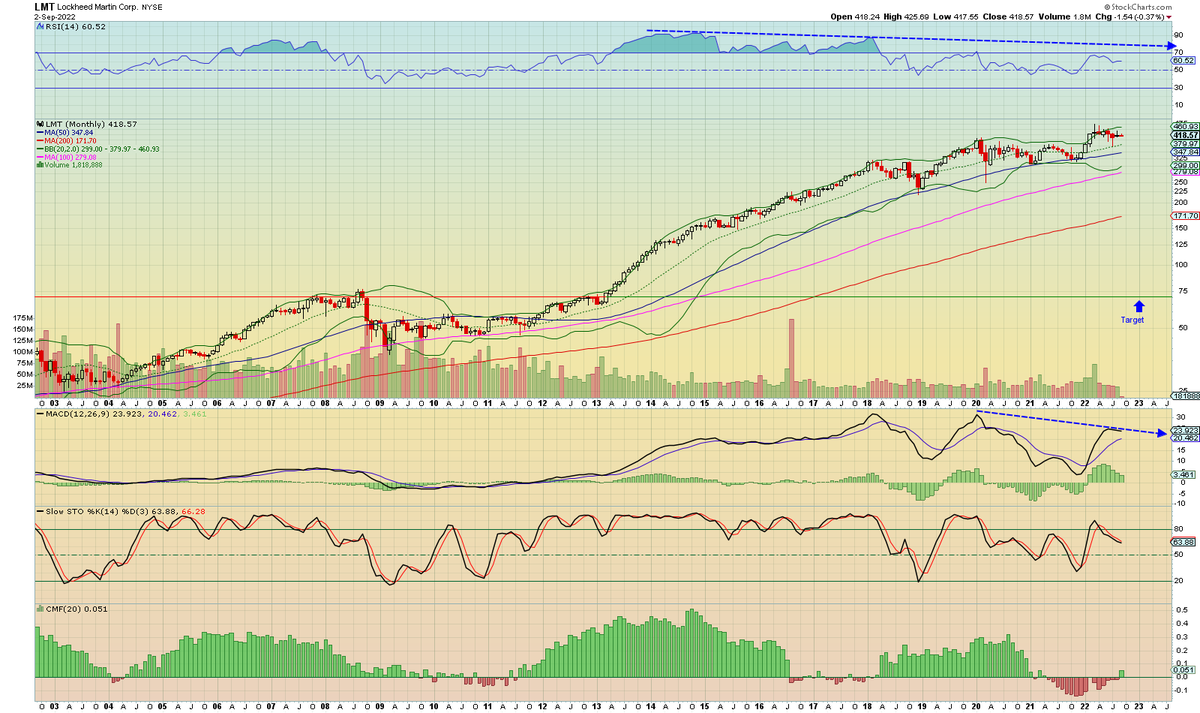

In every one of these articles I keep reading about the upcoming #metals shortage, they mention defense industries. Aircraft, missiles, etc.

This is fitting into what I'm seeing across defense stocks...

This is fitting into what I'm seeing across defense stocks...

Lockheed Martin $LMT is showing one of the biggest negative divergences I've ever seen.

What does that mean? It's the signal of an incoming change in trend. These can be spotted before the trigger happens.

I was wondering what the trigger would be. Maybe this is it...

What does that mean? It's the signal of an incoming change in trend. These can be spotted before the trigger happens.

I was wondering what the trigger would be. Maybe this is it...

I had thought a ceasefire in Ukraine, but that doesn't seem likely.

But what if the main material inputs to weaponry became 10x more expensive in a matter of months?

The military has placed orders to restock munitions sent over to Ukraine. Are those contracts price fixed?...

But what if the main material inputs to weaponry became 10x more expensive in a matter of months?

The military has placed orders to restock munitions sent over to Ukraine. Are those contracts price fixed?...

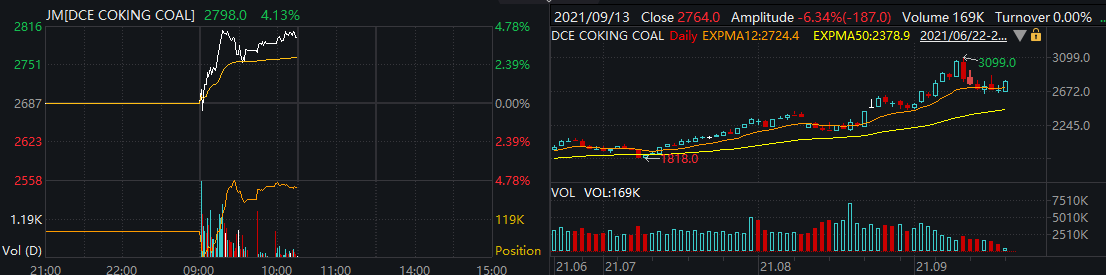

China's most-traded #IronOre futures plunge 5.9% at night open, coke down 4.8%, coking #coal down 2.8%, hot rolled coils down 2.7%, #SteelRebar down 1.8%.

Benchmark Dalian #IronOre futures extend losses to 6.8% at 669 yuan/ton amid property sector turmoil.

⚡China's most-traded coking coal, coke, iron ore futures extend declines at night opening. Coking coal down 4.3%, coke down 3.8%, iron ore down 3.7%.

#coal #ironore #CoalTwitter #China

#coal #ironore #CoalTwitter #China

⚡Shanghai low sulfur fuel oil futures dop 1.7%, fuel futures down 1.6%, crude oil futures down 1.4%. #OOTT

I'd recommend everyone listen to this. Not directly related to #VLRM in terms of the #GSX, but in terms of the 20% option on GSX group! Very exciting indeed! this is very exciting.

If you listen to some of the concepts talked about linking different trading groups together such as FIAT, #Crypto, #Metals #Carbon etc then GSX can do ALL of that.

The story is unfolding nicely, becoming more clearer with each passing week about how this deal came about now and the option on both companies, essentially this is Patrick's vision from his previous works but GSX have the technology to make it happen.

(1/17) We've been talking a lot about #carbonmarkets — which has felt like a shift for some of our trad #commodities, #metals, #privacy and #tech listeners. We wanted to share how we see #smartermarkets as the thread stringing them together, in this 🧵:

(3/17) Globally, we've had since the 1800s to understand commodity #markets. #CarbonTrading didn't start until 1997 when 180 countries signed the #KyotoProtocol. With it — 4 types of #carboncredits were created: AAU, RMU, ERU and CER.

🆕 Economic and Social Impacts and Policy Implications of the War in #Ukraine 🇺🇦:

#OECD calls for well targeted support to the vulnerable as war undermines global #recovery.

Read full press release⤵️

oe.cd/4nK

#OECD calls for well targeted support to the vulnerable as war undermines global #recovery.

Read full press release⤵️

oe.cd/4nK

Global economic #growth will be more than 1⃣ percentage point lower this year as a result of this #conflict.

#Inflation could be at least a further 2⃣.5⃣ percentage points higher on aggregate than it would otherwise have been.

👉🔎 oe.cd/4nK

#Inflation could be at least a further 2⃣.5⃣ percentage points higher on aggregate than it would otherwise have been.

👉🔎 oe.cd/4nK

#OECD calls for greater #EU solidarity in providing help to 🇺🇦 refugees:

Already some 3⃣ million people have fled #Ukraine with more waves of refugees expected in the weeks ahead.

This is far higher than in wake of the recent Syrian refugee crisis. 👇

oecd.org/economic-outlo…

Already some 3⃣ million people have fled #Ukraine with more waves of refugees expected in the weeks ahead.

This is far higher than in wake of the recent Syrian refugee crisis. 👇

oecd.org/economic-outlo…

1) Good Afternoon. MDT Sell Signal was issued at approx 90 min. before closing bell. This was because there was very little chance of a rally that would bring us back to "hold" again. Normally, this would come after close and then sell Monday. But I don't trust weekends

2) This was a real nail biter and certainly white knuckling for the last week or so. We had so many chances to rally but when the Canary Indicator went into "correction mode" as a heads up and only 2.3% left until the MDT fell into a sell signal, I knew it was going to be tough.

3) It's one thing if the Canary signals correction and we have 10% before an MDT confirming signal, another with such a slim margin. To be clear there simply are too many head winds and more coming up every day. Now let's talk about what this means now that we are out.

DoubleLine founder and CEO Jeffrey Gundlach presents:

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Jeffrey Gundlach: 2021 might end up running 7% year on the CPI

#inflation #QE #Powell #fed #hikes #rates

#inflation #QE #Powell #fed #hikes #rates

Jeffrey Gundlach: Low interest rates coupled with inflation generating negative interest rate.

#JustMarkets2022 #CPI #QE #Fed

#JustMarkets2022 #CPI #QE #Fed

Wood Mackenzie #COP26 briefing: 6 Oct 2021

"Mission impossible"

"delivering the base #metals to meet [#NetZero 2050] pathways strains project delivery beyond breaking point from people & plant to financing & permitting."

woodmac.com/news/opinion/c…

"Mission impossible"

"delivering the base #metals to meet [#NetZero 2050] pathways strains project delivery beyond breaking point from people & plant to financing & permitting."

woodmac.com/news/opinion/c…

Nov 6, 2021 "The 19 million tonnes of additional #copper that need to be delivered for net-zero 2050 implies a new La Escondida must be discovered & enter production every year for the next 20 years."

mining.com/un-at-cop26-en…

Escondida mine. (Photo: BHP) 👇

mining.com/un-at-cop26-en…

Escondida mine. (Photo: BHP) 👇

"Even if you focus on just one of the obstacles bringing new copper supply online – the time it takes to build a new mine – and leave aside all other factors, #NetZero 2050 has zero chance."

#COP26 #4IR #technology

mining.com/un-at-cop26-en…

#COP26 #4IR #technology

mining.com/un-at-cop26-en…

💸 Is hyperinflation a reality? How to protect yourself?

Money may well depreciate at times. This has already happened before, even in developed countries. #Inflation in developed world is accelerating, and the authorities are carried away by populism.

Money may well depreciate at times. This has already happened before, even in developed countries. #Inflation in developed world is accelerating, and the authorities are carried away by populism.

• In the #US, inflation has already accelerated to 6.2%

• In #Germany, it reached a 28-year high of 4.5%.

Authorities of developed countries put above #inflation problems of #SocialJustice in labor market (employment in all minority groups is important) and #climate warming.

• In #Germany, it reached a 28-year high of 4.5%.

Authorities of developed countries put above #inflation problems of #SocialJustice in labor market (employment in all minority groups is important) and #climate warming.

Populist views are capturing the minds of monetary authorities, which only fuels #inflation. This was the case in the #USA in the 1970s: prices almost tripled.

And sometimes it was much worse: in Israel in the 1980s, prices for goods jumped ~10,000 times.

And sometimes it was much worse: in Israel in the 1980s, prices for goods jumped ~10,000 times.

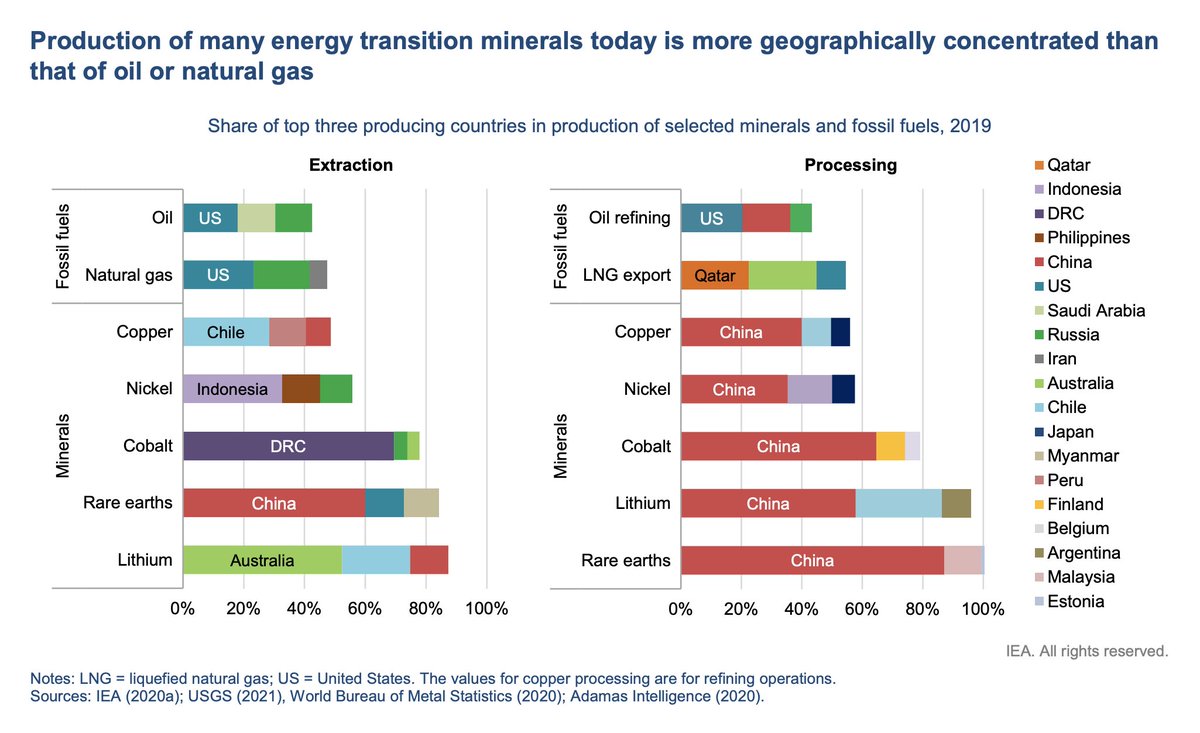

Renewables require production boom of rare earth materials for clean energy transition. @IEA Critical Minerals Report 2021: Mineral demand for clean energy techn. would rise by 4X by 2040 to meet climate goals. Energy transitions will have far-reaching consequences for mining!

Meanwhile mining Capex... Large future deficits in metals expected. #metals #miners #EnergyTransition

Daily Bookmarks to GAVNet 10/02/2021 greeneracresvaluenetwork.wordpress.com/2021/10/02/dai…

‘Mini psyches’ give insights into mysterious metal-rich near-Earth asteroids

phys.org/news/2021-10-m…

#NearEarthAsteroids #SpaceMining #metals

phys.org/news/2021-10-m…

#NearEarthAsteroids #SpaceMining #metals

The Culture War is Coming for Your Genes

quillette.com/2021/09/30/the…

#BookReview #OpEd #genetics #equality #CultureWars

quillette.com/2021/09/30/the…

#BookReview #OpEd #genetics #equality #CultureWars

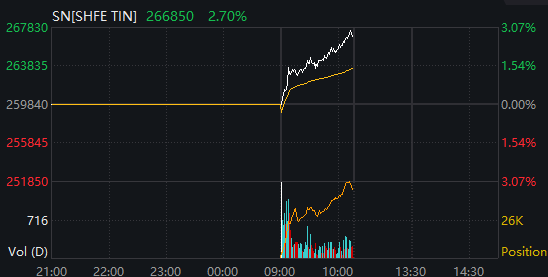

#China's most active manganese-silicon futures contract and ferrosilicon futures contract in Zhengzhou open 8% higher and hit the limit-up.

#Ferro #silicon

#Ferro #silicon

Private #Capex announcements for #Metals, Electronics, ITES, Pharma well above pre-pandemic levels. Nearly 50% of these capex announcements post-#COVID19 have come from BSE200 companies (exBFSI and IT); pointing to the formal sector. Capex announcements...(1/3)

...for the private sector show a concentration in metals (35%), electronics (14%), ITES/data centres (9%) and drugs/pharma (4%). These shares are much higher than their shares in FY19. Metals stand out with their 35% share in total announcements, mentioned above, up...(2/3)

...from 10% in FY19, largely on the global metal cycle upturn. The PLI has led to an increase in announcements in electronics from 9%. The COVID19 led push in ITES/data centres from 2.4% and drugs/pharma from 1% in FY19 on favourable global positioning.(3/3)

@TeresaJohn7

@TeresaJohn7

1/n

We will understand why Logarithmic charts should be used for Technical Analysis over Arithmetic charts

Traders looking to capture short-term price movement may prefer Arithmetic(linear) scale charts.

#TechnoFunda

#StockMarket

#metals

#StockMarketindia

#stocks

We will understand why Logarithmic charts should be used for Technical Analysis over Arithmetic charts

Traders looking to capture short-term price movement may prefer Arithmetic(linear) scale charts.

#TechnoFunda

#StockMarket

#metals

#StockMarketindia

#stocks

2/n

The problem with linear scale is when zoomed out to view long-term price history it can make the chart look parabolic or scary to retail investors. Commonly, when a security's price range over the period being studied is greater than 20%, a log scale chart should be used.

The problem with linear scale is when zoomed out to view long-term price history it can make the chart look parabolic or scary to retail investors. Commonly, when a security's price range over the period being studied is greater than 20%, a log scale chart should be used.

3/n

Long-term charts consisting of X years should also be plotted on the log scale. This becomes even more important when charting growth stocks. Log scale help investors visualize a nice consistent uptrend while softening chart volatility which in turn helps take out emotion.

Long-term charts consisting of X years should also be plotted on the log scale. This becomes even more important when charting growth stocks. Log scale help investors visualize a nice consistent uptrend while softening chart volatility which in turn helps take out emotion.

Daily Bookmarks to GAVNet 06/03/2021 greeneracresvaluenetwork.wordpress.com/2021/06/03/dai…

Luring bacteria into an evolutionary trap to reduce treatment resistance

phys.org/news/2021-06-l…

#bacteria #evolution #resistance #VaccineEfficacy

phys.org/news/2021-06-l…

#bacteria #evolution #resistance #VaccineEfficacy

New Mission at CSPI

cspicenter.org/blog/cspi/new-…

#technology #science #innovation #research #progress #policy

cspicenter.org/blog/cspi/new-…

#technology #science #innovation #research #progress #policy

On May 26th @StateBank_Pak released #Pakistan's disaggregated #trade statistics for April '21. We now have 10 months of the FY21. Some analysis in #thread below. 👇👇👇

By #destination: substantial increases of shipments to #China and the #USA. Stability with #Afghanistan, and contractions in shipments to #UAE.

[#export growth to China and USA is confirmed by mirror data analysis] (3/n)

[#export growth to China and USA is confirmed by mirror data analysis] (3/n)

Yesterday, @IEA gave a presentation to explain what we already know - we need a LOT of #metals & #minerals to "come clean" and regardless of timing as we are hooked on #oil & #gas for our modern lifestyle. In this thread, I'll share their slides & add some of mine...

2/ According to the @IEA, an EV requires 6x minerals and metals input of a conventional "Otto engine" car.

@Herbert_Diess #Tesla @elonmusk #oott

@Herbert_Diess #Tesla @elonmusk #oott

Gold is dead.

And that’s exactly why I am positioned.

The turn is in, a wrap-up of evidence here in this thread ⬇️

#preciousmetals #metals #gold #silver

1.

And that’s exactly why I am positioned.

The turn is in, a wrap-up of evidence here in this thread ⬇️

#preciousmetals #metals #gold #silver

1.

the dominant intermediate #gold cycle in the new bull market runs 1y (it was shorter last bull)

while we claimed the 2 bottom 'live'when it happend, Nov 30 and mid March, this yearly cycle retraced 0.618 to the tick, while indicators are all turning UP on weekly levels

2.

while we claimed the 2 bottom 'live'when it happend, Nov 30 and mid March, this yearly cycle retraced 0.618 to the tick, while indicators are all turning UP on weekly levels

2.

#gold with 3 trading days left, the monthly candle is shaping up as a reversal.

watching close early next week

3.

watching close early next week

3.