Discover and read the best of Twitter Threads about #DHFL

Most recents (22)

Biggest month ever!

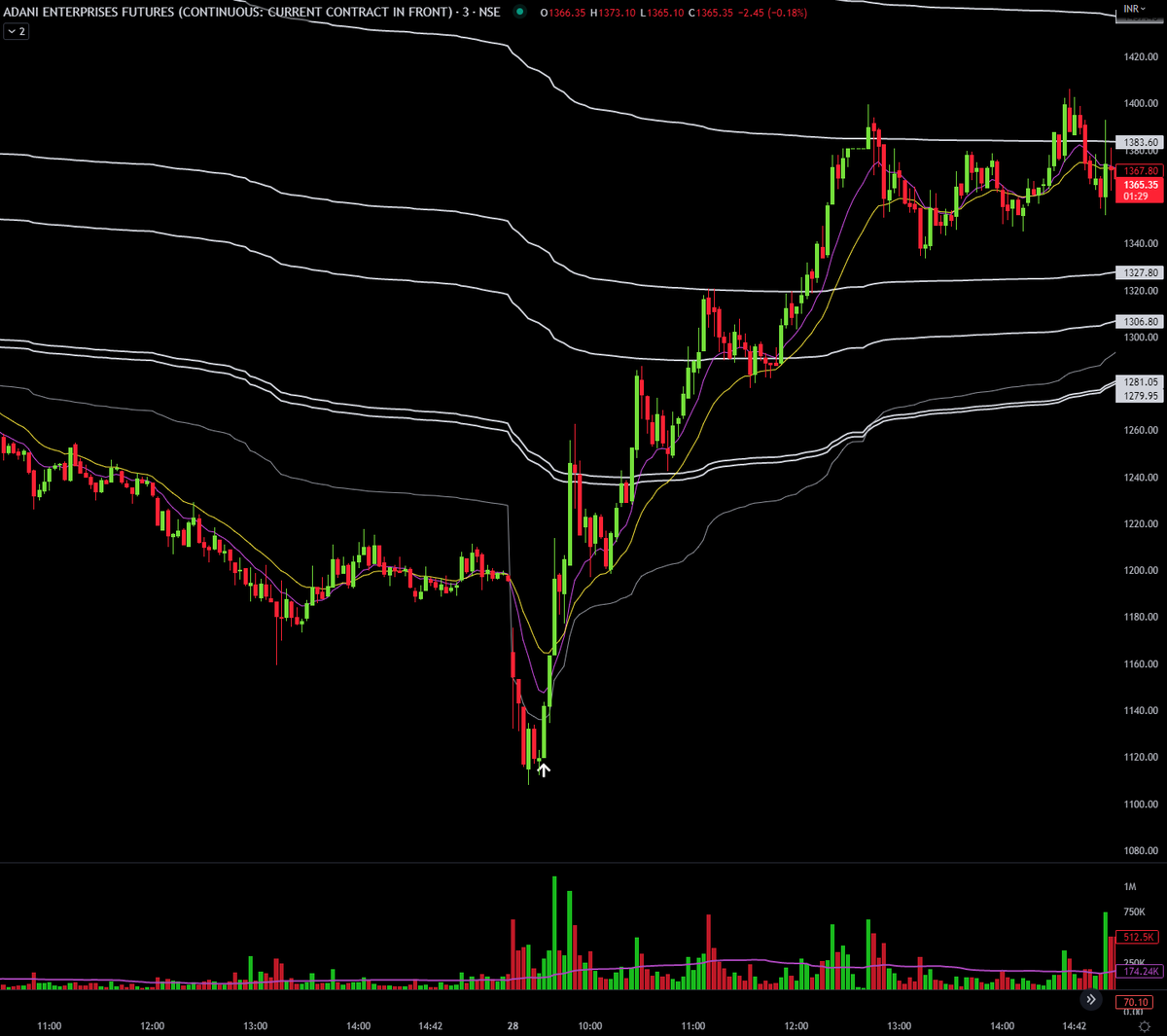

#ADANIENT - Trading this beast whole month. Both LONG & SHORT

Was way late to the party, should have been on this thing way earlier.

Gross return : 30%

Net return: 26.75% (excluding brokerage, taxes and losses from other trades)

// timeline of news events

#ADANIENT - Trading this beast whole month. Both LONG & SHORT

Was way late to the party, should have been on this thing way earlier.

Gross return : 30%

Net return: 26.75% (excluding brokerage, taxes and losses from other trades)

// timeline of news events

I was about to tweet something similar earlier.

Ask yourself: why are TradFi gurus suddenly so concerned about investor protection and education when it comes to #crypto? If you dive into their history, you’d see many of them have had a fairly muddy past.

Large scams were

Ask yourself: why are TradFi gurus suddenly so concerned about investor protection and education when it comes to #crypto? If you dive into their history, you’d see many of them have had a fairly muddy past.

Large scams were

unfolded in front of them, many have been privy to insider news etc but they’ve never cared much for the normal retail investor.

Why then, have they become so fatherly all of a sudden? Many of them were privy to what happened at #YesBank, #dhfl etc. They even shilled them!

Why then, have they become so fatherly all of a sudden? Many of them were privy to what happened at #YesBank, #dhfl etc. They even shilled them!

Here’s one instance. Calling him out because he’s been taking a dig at #crypto investors all over Twitter.

The comments to this article show the frightening lack of financial literacy+ awareness in India. DHFL FD Investors are still clueless about resolution!! How does one tackle this? @MoneylifeIndia has reported this relentlessly & these are our readers! moneylife.in/article/dhfl-f…

@MoneylifeIndia Some FD holders were mindlessly abusing us because they received 23%, we finally blocked them. Many equity investors are clueless their shares have long been extinguished! Some are still in the process of waking up from deep slumber! @MoneylifeIndia

What we need is for people to get together to have challenged this: moneylife.in/article/dhfl-r… but UNLESS #DHFL investors or ALL investors WAKE UP, how does one fight anything? @MoneylifeF

Thread

#YesBank Story

How Rana Kapur gobbled 5000 crore in kickbacks

Give out loans to doubtful Co's

They become NPA's

Instead of declaring em NPAs & initiating recovery proceedings, Kapoor conspired with the companies & got them to invest in firms run by his wife & daughters.

#YesBank Story

How Rana Kapur gobbled 5000 crore in kickbacks

Give out loans to doubtful Co's

They become NPA's

Instead of declaring em NPAs & initiating recovery proceedings, Kapoor conspired with the companies & got them to invest in firms run by his wife & daughters.

In 2015, @RBI, under asset quality review, the RBI inspectors found that #YesBank had suppressed its NPAs — reportedly underreporting the same by Rs 2,299 crore in 2018-19, Rs 6,355 crore in FY 2017 and over Rs 4,000 crore in FY2016 —as well as it had cooked up its balance sheet.

Rana Kapoor continued his rein till 2019, when he was shown the door, but by then, it was already too late

Meanwhile, the bank’s bad loans kept growing. Following the RBI’s asset quality review in 2019, its gross #NPA's surged 87% from a year ago, Its net NPAs more than doubled.

Meanwhile, the bank’s bad loans kept growing. Following the RBI’s asset quality review in 2019, its gross #NPA's surged 87% from a year ago, Its net NPAs more than doubled.

Many traders follow different types of moving average crossover #TradingStrategy but the main problem with such MA/EMA cross over system is whipsaws. How one could reduce such false breakouts and also gain from large trend ?

The answer is move to larger time frame.

Buy rules: Go long when 10 EMA is greater than 50 EMA

Sell rules: Exit when 10 EMA is lesser than 50 EMA

Time frame: Weekly

Buy rules: Go long when 10 EMA is greater than 50 EMA

Sell rules: Exit when 10 EMA is lesser than 50 EMA

Time frame: Weekly

When #DHFL cracked -42% in a day on 21st sept 2018, next day I wrote an article in #Quora. I analyzed what are the other stocks that has fallen huge in just one day which were once fundamentally strong company, what happened to them after that big fall.

*Game over for #DHFL* @finshots

After many twists and turns, it seems as if the DHFL saga is finally coming to a close. But before we get to the story here’s a quick recap

Back in September 2018, DSP, a mutual fund house offloaded DHFL’s bonds at a discount.

After many twists and turns, it seems as if the DHFL saga is finally coming to a close. But before we get to the story here’s a quick recap

Back in September 2018, DSP, a mutual fund house offloaded DHFL’s bonds at a discount.

I know you’re not following this. So here’s a nice translation- DSP had loaned out considerable sums of money to DHFL. And then one day there was an epiphany it seems. They no longer wanted to wait for DHFL to pay them back.

So they begged someone else to take the burden off of them by offering a huge discount. They said this was routine. But come on. Who are we kidding right?

When news of the sale spread, DHFL stock crashed 60%🔻.

When news of the sale spread, DHFL stock crashed 60%🔻.

#Moodys has pulled down its growth forecast for FY19 to 5.8%. Only surprise is why it’s not even lower. In the past year growth has collapsed from 8% to 5%. /1

@threadreaderapp

#India #CPI #GDP #RBI #bonds #inflation #ratecut #NBFC #jobs #credit #NPA #NCLT #growth

@threadreaderapp

#India #CPI #GDP #RBI #bonds #inflation #ratecut #NBFC #jobs #credit #NPA #NCLT #growth

thread

On June 4, 2019, DHFL had interest and principal payments due to the tune of ~Rs. 1,100 crores and the company failed to repay on the scheduled date

On June 4, 2019, DHFL had interest and principal payments due to the tune of ~Rs. 1,100 crores and the company failed to repay on the scheduled date

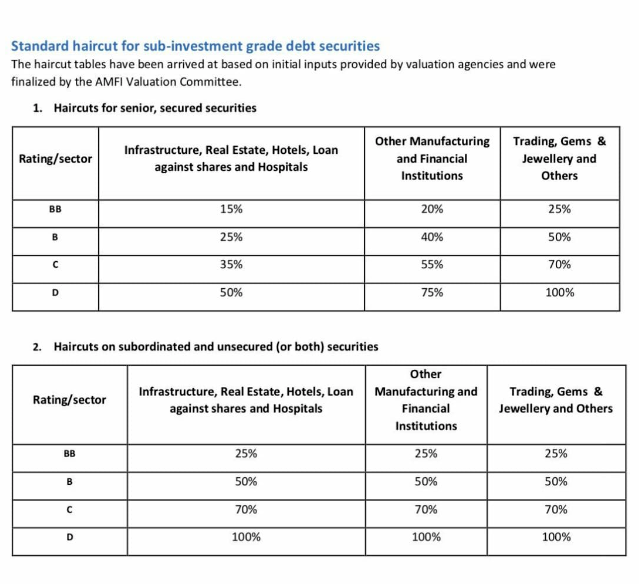

As per the standard haircut table for sub-investment grade debt securities which has been provided/ finalized by valuation agencies (CRISIL and ICRA) and AMFI, affected AMCs had taken a 75% mark down to DHFL debt securities in the schemes which have an exposure to #DHFL.

Very interesting read and covers many angles.

#dhflscam #DHFLघोटाला #DHFL

#HDIL #PMC_BANK #scam

#NBFC #HousingCrisis

#realestateinvestor

#realestateinvestor

economictimes.indiatimes.com/news/company/c…

#dhflscam #DHFLघोटाला #DHFL

#HDIL #PMC_BANK #scam

#NBFC #HousingCrisis

#realestateinvestor

#realestateinvestor

economictimes.indiatimes.com/news/company/c…

उत्तर प्रदेश में बिजली विभाग के कर्मचारियों की जिंदगी भर की कमाई भाजपा सरकार में DHFL में निवेश करके फँसा दी।

चुनाव के दौरान मुझे तमाम सरकारी कर्मचारियों ने मिलकर नई पेंशन स्कीम को लेकर अपनी चिंता बताई थी। आज उनके शक जायज़ साबित हो रहे हैं।

#DHFL

चुनाव के दौरान मुझे तमाम सरकारी कर्मचारियों ने मिलकर नई पेंशन स्कीम को लेकर अपनी चिंता बताई थी। आज उनके शक जायज़ साबित हो रहे हैं।

#DHFL

पैसा कर्मचारियों का और संदिग्ध जगह निवेश का फ़ैसला सरकार का।

गुनाहगार कौन?

जिस व्यक्ति ने ईमानदारी से अपनी ज़िंदगी भर की कमाई आपके हाथों में भरोसे से डाली उसके लिए आपका क्या जवाब है?

और कितने विभागों के कर्मचारियों की गाढ़ी कमाई ऐसी संदिग्ध कंपनियों में लगाई गई है?

गुनाहगार कौन?

जिस व्यक्ति ने ईमानदारी से अपनी ज़िंदगी भर की कमाई आपके हाथों में भरोसे से डाली उसके लिए आपका क्या जवाब है?

और कितने विभागों के कर्मचारियों की गाढ़ी कमाई ऐसी संदिग्ध कंपनियों में लगाई गई है?

छोटी मछलियों को पकड़कर ध्यान भटकाने से नहीं, असली गुनाहगारों को सामने लाना होगा।

I am revisiting the topic of Public Issue of Non-Convertible Debentures (NCDs) covered a couple of days back. Only this time, I am focusing on Subordinated (Tier II) NCDs that are slipped in (sometimes slyly) along with senior secured NCDs of NBFCs. Thread (1/9)

Refer to the picture, below (the pic is representative only). A subordinated NCD (circled in red) appears as one of the many maturity options. A naive investor may think that it is similar to other NCDs on offer, just that it has a longer maturity. (2/9)

What many investors are unaware of is the fact that subordinated NCDs are paid after senior NCD holders in-case the company goes into liquidation i.e. subscribers to option I to VIII NCDs, in the pic above, would be paid before payments are made to option IX to XI NCDs. (3/9)

Here is a list of lemons (troubled assets) held by debt schemes of various Mutual Funds -

Qualification - at least 3 lemons post Aug 2018

1. BoI AXA - 6

a) Sintex

b) DHFL

c) Kwality

d) ILFS

e) Coffee Day

f) Avantha Holdings

Thread (1/10)

Qualification - at least 3 lemons post Aug 2018

1. BoI AXA - 6

a) Sintex

b) DHFL

c) Kwality

d) ILFS

e) Coffee Day

f) Avantha Holdings

Thread (1/10)

2. Reliance Nippon - 6

a) ZEE LAS

b) DHFL

c) Morgan Credit (Yes Bank promoter)

d) Reliance Commercial Finance (ADAG)

e) Reliance Home Finance (ADAG)

f) Avantha Realty

(2/10)

a) ZEE LAS

b) DHFL

c) Morgan Credit (Yes Bank promoter)

d) Reliance Commercial Finance (ADAG)

e) Reliance Home Finance (ADAG)

f) Avantha Realty

(2/10)

3. Birla Sunlife - 5

a) ZEE LAS

b) Wadhawan Global (DHFL Promoter)

c) ILFS Tamil Nadu Power

d) Jharkhand Road Project (ILFS)

e) ILFS Education

(3/10)

a) ZEE LAS

b) Wadhawan Global (DHFL Promoter)

c) ILFS Tamil Nadu Power

d) Jharkhand Road Project (ILFS)

e) ILFS Education

(3/10)

Day 2 on Twitter. Coming to the next set of awards - The "Foot in Mouth" Awards. A clear winner in this category is DSP Mutual Fund. I have shortlisted them for their sheer cockiness. Thread. (1/10)

In September, 2018, the Fund House triggered a panic by selling DHFL bonds at distressed levels. It was a business call; and hence a benefit of doubt could be given. (2/10)

What cannot be forgiven though, is the brazenness with which the Fund house eulogised their portfolio selection capabilities. 3/10

Alright! Here I am, making my debut on Twitter. To mark the occasion, I am handing out the "Lemon of the Year" Award to one of the worst performing Debt Mutual Funds.

A clear winner in this category, by a mile, is BoI AXA Credit Risk Fund. Thread (1/9)

A clear winner in this category, by a mile, is BoI AXA Credit Risk Fund. Thread (1/9)

The fund has achieved a rare feat of burning almost 90% of its AUM within a span of last 11 months i.e. the AUM contracted from ~1700 Cr in Aug 2018 to ~200 Cr in Jul 2019.

The one year return is a whopping minus 48%. 2/9

The one year return is a whopping minus 48%. 2/9

The Fund Managers successfully caught all the lemons that fate threw at them viz DHFL, IL&FS, Kwality, Sintex, Cox & Kings, Coffee Day etc. 3/9

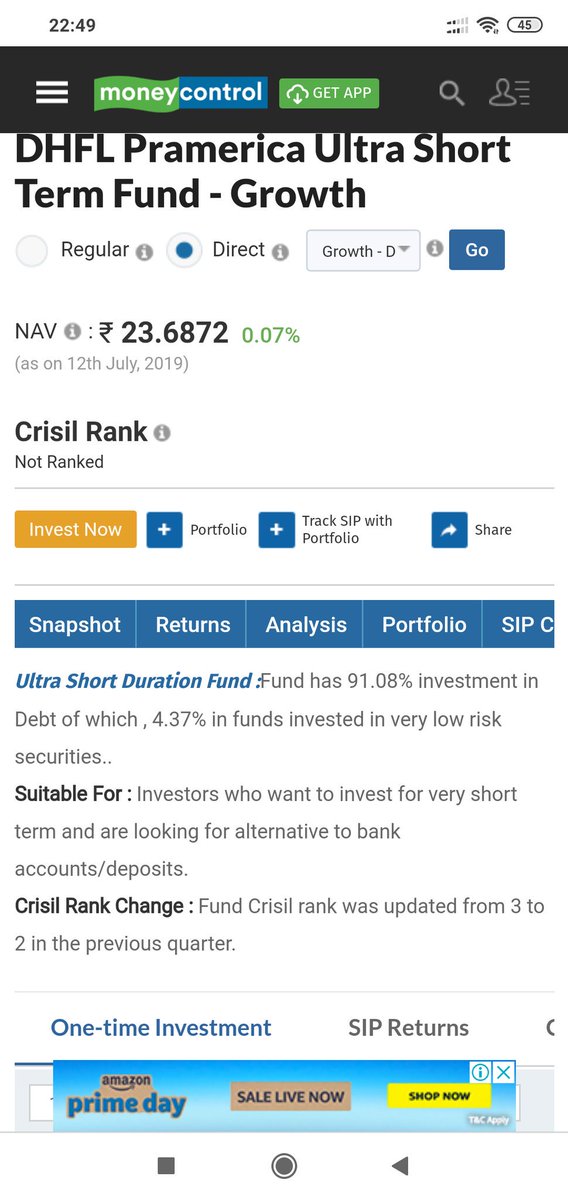

🧐🧐🧐 @ValueResearch puzzling! Maybe they also are not up to the mark evaluating. 87% exposure is a huge%!!

#DHFL #mutualfunds

#mutualfundssahihai #debt

#DHFL #mutualfunds

#mutualfundssahihai #debt

@CRISILLimited has updated the fund

rank in last qtr to 3 frm 2 & @in_morningstar has 5 star rating! Any answers?

@MstarKaustubh

#DHFL #mutualfunds #mutualfundssahihai

#debt

rank in last qtr to 3 frm 2 & @in_morningstar has 5 star rating! Any answers?

@MstarKaustubh

#DHFL #mutualfunds #mutualfundssahihai

#debt

@utimutualfund has taken #DHFL mark down to another level. Neither opted for side-pocketing nor has stopped fresh inflows. But, No Commission for #MFDs on affected Schemes w.e.f. from 13-06-19, for protecting #interest of existing #investors affected due to DHFL. @SEBI_India

#MFDs are fine if its about #investors #interest but stopping commissions in Treasury Advantage Fund, Short term income fund, Dynamic Bond Fund & Bond Fund is totally 'Unethical'! Have #MFDs proposed to add #DHFL Papers or Fund Management!! @cafemutual

@wealthforum_tv @livemint

@wealthforum_tv @livemint

As per communication from @utimutualfund Team, it is applicable only on New / Fresh Purchases till further notice. Not on existing assets or ongoing SIPs. @fifaindiaorg @SEBI_India @cafemutual @wealthforum_tv @ArthmitraG @livemint @kayezad @moneycontrolcom @CNBC_Awaaz @NDTVProfit

#DHFL #NBFC Had a conversation with a large institutional investor. Some interesting points

1.DHFL poses systematic risk which regulators are taking very lightly

2.The problem in DHFL if not checked in time can spill over to broader financial sector and have a cascading effect

1.DHFL poses systematic risk which regulators are taking very lightly

2.The problem in DHFL if not checked in time can spill over to broader financial sector and have a cascading effect

3.The next two big weak links – India bulls and Yes Bank

4.Cumulatively among the 3, there is a 5 lac crores exposure at risk.

4.Cumulatively among the 3, there is a 5 lac crores exposure at risk.

5.Sensible thing would be for the RBI to look at the books of DHFL

a. If no skeletons – then give them a line of credit to tide over any liquidity issues

b.If problem in the books – then takeover and run down the book in a way that does not put the whole system at risk.

a. If no skeletons – then give them a line of credit to tide over any liquidity issues

b.If problem in the books – then takeover and run down the book in a way that does not put the whole system at risk.

BIG BREAKING!

Kapil Wadhawan #DHFL to @CNBCTV18Live

- Delay in NCD payment is not a solvency issue

- Have underlying assets generating cashflow

- There was a sudden stoppage of availability of credit for DHFL post the Sep 2018 crisis

1/many

Kapil Wadhawan #DHFL to @CNBCTV18Live

- Delay in NCD payment is not a solvency issue

- Have underlying assets generating cashflow

- There was a sudden stoppage of availability of credit for DHFL post the Sep 2018 crisis

1/many

Kapil Wadhawan #DHFL to @CNBCTV18Live

- On track to pay 100 cr redemption due today

- Delayed 960 cr NCD payment due to asset-liability mismatch; something that banks could also face

- Can understand that investor confidence is shaken

2/many #mutualfunds

- On track to pay 100 cr redemption due today

- Delayed 960 cr NCD payment due to asset-liability mismatch; something that banks could also face

- Can understand that investor confidence is shaken

2/many #mutualfunds

Kapil Wadhawan #DHFL to @CNBCTV18Live

- Only source of funds for last 9 mths have been selling down of assets

- Since Sep 2018, have paid 35,000 cr of interest & principal

3/many #mutualfunds

- Only source of funds for last 9 mths have been selling down of assets

- Since Sep 2018, have paid 35,000 cr of interest & principal

3/many #mutualfunds

#FakeParadise

#ReversalSetup

Before i share this setup, let me tell you this is not a easy setup to trade without deep understanding.

So let's discuss the setup and what does it mean!!

(1/n)

#ReversalSetup

Before i share this setup, let me tell you this is not a easy setup to trade without deep understanding.

So let's discuss the setup and what does it mean!!

(1/n)

Rules For Sell

1. New 20 period high should have been made today.

2. Previous 20 period high should have been made minimum 3/4 days before.

3. Close above previous 20 day high or not is optional.

(2/n)

1. New 20 period high should have been made today.

2. Previous 20 period high should have been made minimum 3/4 days before.

3. Close above previous 20 day high or not is optional.

(2/n)

How to implement?

1. Once we get new 20 period high stock, on same day/ next day we place sell stoploss order few ticks below previous 20 period high.

2. Stoploss : few tick above Latest high

3. Target : 1:5 R:R achievable (trail stop after 1:2 R:R)

(3/n)

1. Once we get new 20 period high stock, on same day/ next day we place sell stoploss order few ticks below previous 20 period high.

2. Stoploss : few tick above Latest high

3. Target : 1:5 R:R achievable (trail stop after 1:2 R:R)

(3/n)

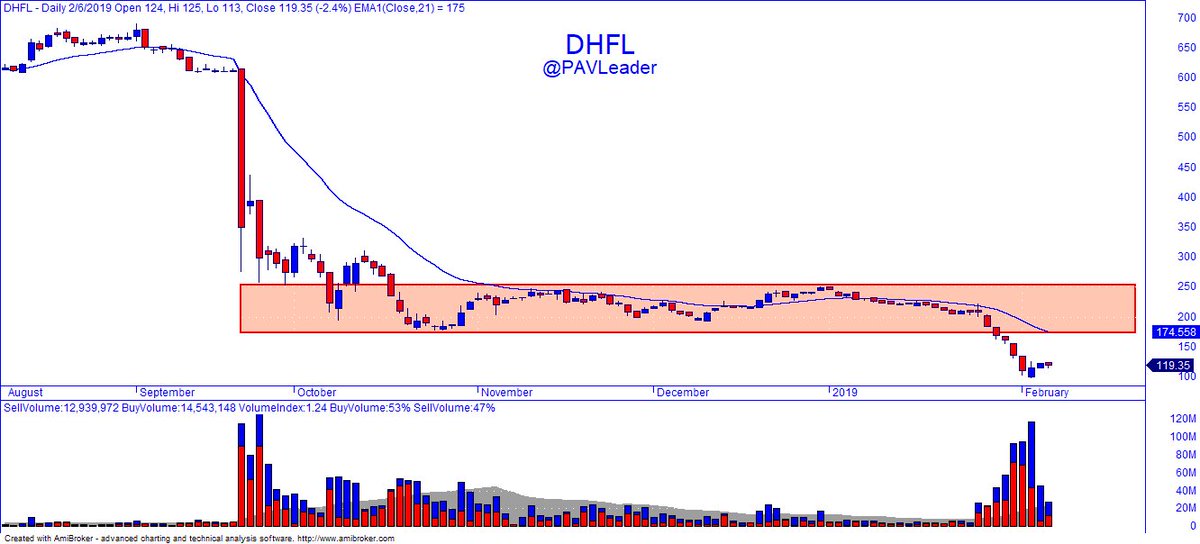

#DHFL broke down on 29th Jan from 4 months of rectangle consolidation & straight gave 60-70 points move. All the selling is "possibly" absorbed on 4th Feb (see the vol).

Above 127 it can shoot up swiftly & can 141/152/161. Watch out!

#TradeWithPAL

Above 127 it can shoot up swiftly & can 141/152/161. Watch out!

#TradeWithPAL

This view stands invalid below 113/112 range

This trade didnt trigger today. High made 122.75 & post that low made 114.55

#Breaking: Thread on the Anatomy of India’s biggest financial scam—Rs 31,000 cr, (not a notional value but actual, public money). Cobrapost Investigation reveals major financial scam by an NBFC, bigger than Mallya or NiMo.

Watch the video: bit.ly/2DIhpbB

#LooteraDewan

Watch the video: bit.ly/2DIhpbB

#LooteraDewan

Dewan Housing Finance Corporation Limited (#DHFL) has siphoned off Rs 31,000 crore into promoter companies to create private wealth through a network of shell companies. Probe reveals the NBFC under-reported Rs 20-cr donation to @BJP4India