Discover and read the best of Twitter Threads about #FEd

Most recents (24)

@naihhi @atBenBradbury welt.de/politik/articl…

sehr interessant. er hat sein recht zur konstruktiven kritik immer & überall genutzt, nur es gibt zu heute einen unterschied. in jedem staat sitzt eine weltweit operierende struktur drin, die sich in die bestehende struktur eingearbeitet hat.

nehmen wir 1)

sehr interessant. er hat sein recht zur konstruktiven kritik immer & überall genutzt, nur es gibt zu heute einen unterschied. in jedem staat sitzt eine weltweit operierende struktur drin, die sich in die bestehende struktur eingearbeitet hat.

nehmen wir 1)

@naihhi @atBenBradbury 2) das beispiel america. Sie haben schon genug zu kämpfen, das überall die #CIA #FBI drin sitzt & in firmen die #kpc . warum ist das so? weil eine gruppe von menschen das so will. sie haben nämlich ihre weltweite struktur in allen ländern und wollen, dass sie beschaftigt sind. 3)

On CPI

1. CPI #Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

1. CPI #Inflation increased by 0.12% in May, surprising consensus expectations of 0.1%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

2. Above we show the monthly evolution of the data relative to its 12-monthly trend and consensus expectations.

3. At the subcomponent level, the primary drivers of this print were #Motor fuel (-0.2%), #Energy Services (-0.05%), Transportation Commodities Less Motor Fuel (0.11%), #Shelter (0.19%), & #Transportation Services (0.05%). Below, we show the top 10 drivers of the monthly change:

As was widely expected, the @federalreserve today halted the most aggressive policy rate #HikingCycle since 1980, leaving the Fed Funds range unchanged at 5.0% to 5.25%, a level that appears clear to us to be finally having an impact on the #economy.

We think today’s actions represent a “Hawkish skip,” which implies that #policy makers are seeking more #data before potentially hiking rates again in July, or September.

For our part, we think #ChairPowell’s comments at the press conference made it clear that the #FOMC is seeking to balance increasingly restrictive monetary policy with the high degree of uncertainty around the tightening of #CreditConditions…

La #FederalReserve sospende gli aumenti dei tassi di interesse, si rimane al 5,25% - 5,00%.

Cosa ci si può aspettare ora?

#FED #Bitcoin

Cosa ci si può aspettare ora?

#FED #Bitcoin

Today’s #CPI report for May showed another very firm depiction of where #inflation currently resides in the U.S., with #coreCPI (excluding volatile food and energy components) printing at 0.44% month-over-month and 5.33% year-over-year.

Meanwhile, #headlineCPI data printed 0.12% month-over-month and came in just above 4% year-over-year, with declines in #energy components and some food prices being offset by gains in #shelter and used cars and trucks.

Overall, headline #inflation does appear to be moderating at a faster pace and we believe that the trend in inflation (despite the firmness of core measures in today’s report) is broadly heading in the right direction, relative to the @federalreserve’s inflation target.

NEXT WEEK

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

NEXT WEEK

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

NEXT WEEK

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

In webcast “Dust in the Crevices,” Jeffrey Gundlach shares his macro and market views and makes the case for an imminent dust-up, “in the next few years,” in Washington’s decades-long use of debt finance to skirt hard fiscal decisions.

#macro #markets #Fed #inflation #rates

#macro #markets #Fed #inflation #rates

1/ Die #Inflation ist zuletzt global gefallen und in der letzten Woche in Europa sogar stärker als erwartet.

Dies wird nun teilweise als das Ende der Inflation gefeiert.

Ist das so?

Ein Thread 🧵der meine Sichtweise beschreiben soll.

Dies wird nun teilweise als das Ende der Inflation gefeiert.

Ist das so?

Ein Thread 🧵der meine Sichtweise beschreiben soll.

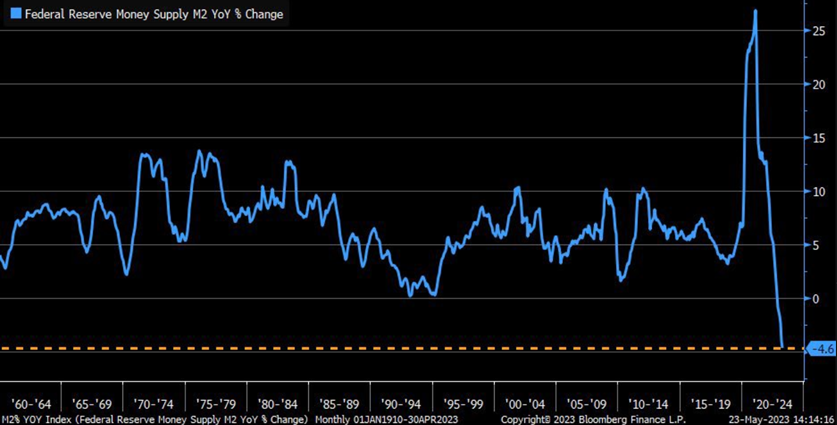

2/ Die fallende Geldmenge ist definitiv ein Argument für eine weiter zurück kommende #Inflation in den kommenden Monaten.

@DiegoFassnacht hat das zuletzt mehrmals angesprochen und erklärt. Vielen Dank!

@DiegoFassnacht hat das zuletzt mehrmals angesprochen und erklärt. Vielen Dank!

3/ Ein weiteres Argument sind die kontinuierlich fallenden Produzentenpreise, die gerne als Vorläufer für den #CPI dienen.

Diesen Zusammenhang verdeutlicht die Graphik von @AndreasSteno eindrucksvoll. Mange tak!

Diesen Zusammenhang verdeutlicht die Graphik von @AndreasSteno eindrucksvoll. Mange tak!

We’ve seen the pace of #payroll gains decelerate to roughly the monthly trend pace from the last expansion; consensus has been waiting for this moment and expected a 195,000 job gain in May, but the data printed considerably stronger at 339,000 #jobs gained.

The three-month moving average of #nonfarm payrolls sits at 283,000, down from 334,000 jobs at the start of the year, but what the #LaborMarket imbalance needs is more supply and more slack.

The #unemployment rate ticked up to 3.65%, close to its 12-month average level, and average hourly #earnings (a volatile figure) gained 0.33% month-over-month and 4.3% on a year-over-year basis.

May employment report came in mixed with both NFP and UR increasing.

Again, no Wall Street analyst came nowhere close to guessing the headline number with the highest estimate missing it by 129K.

What does that all mean for the #Fed?

A thread.

1/11

Again, no Wall Street analyst came nowhere close to guessing the headline number with the highest estimate missing it by 129K.

What does that all mean for the #Fed?

A thread.

1/11

NFP rose for the 29th M in a row with +339K which is 149K above consensus (+190K).

Apr number was revised up by 41K from +253K to +294K.

Total gain in Apr and May is +633K, 190K higher than expected (+443K).

#employment

2/11

Apr number was revised up by 41K from +253K to +294K.

Total gain in Apr and May is +633K, 190K higher than expected (+443K).

#employment

2/11

At the same time UR jumped from 3.4% (cycle low) to 3.7%, the highest since Feb 2022 and the same as in Aug and Oct 2022.

#unemployment

3/11

#unemployment

3/11

On Wages, Profits & Interest Expense

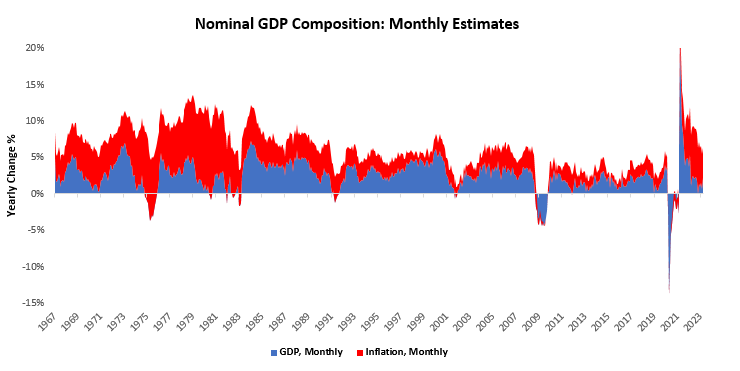

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

2. We think these dynamics will

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

3. Therefore, the key to understanding whether the Fed's hiking cycle has been adequate is

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

2022 senesinde #FED dünyayı faiz söylemleri

ile faiz artışlarına zorladı.

Buradaki amaçla şu an yaptıkları farklıdır.

Bu sefer ki faiz söylemleri birilerini zorlamak değil de

aşağı çakılmaya müsait faizleri çakılmaktan kurtarmaktır.

Yani diyorlar ki; birileri yükselen faizlere

ile faiz artışlarına zorladı.

Buradaki amaçla şu an yaptıkları farklıdır.

Bu sefer ki faiz söylemleri birilerini zorlamak değil de

aşağı çakılmaya müsait faizleri çakılmaktan kurtarmaktır.

Yani diyorlar ki; birileri yükselen faizlere

girmeye çalışıyor bunun önüne geçmeye çalışıyorum

dünyaya zaman kazandırmaya çalışıyorum.

Yoksa onlarda biliyorlar ki faiz söylemlerinin bir kıymeti

kalmadı. Yani derdim faiz değil bu konuyu ısıtıp masaya getirmemiş olsam faizler düşecektir.

dünyaya zaman kazandırmaya çalışıyorum.

Yoksa onlarda biliyorlar ki faiz söylemlerinin bir kıymeti

kalmadı. Yani derdim faiz değil bu konuyu ısıtıp masaya getirmemiş olsam faizler düşecektir.

#REEF

Şimdi bir arkadaş mail atmış abi reef ne olur diye ?

32 den aldım 22 ye düştü. Arkadaşlar; teknik orada

enstrüman yalıyor mu kırmızı çizgiyi ? Tam Nisandan beri yalıyor. Önünü açmıyorlar ki, açacak ki enstrüman yürüsün. Yürüyemezse düşmek zorunda kalıyor.

Şimdi bir arkadaş mail atmış abi reef ne olur diye ?

32 den aldım 22 ye düştü. Arkadaşlar; teknik orada

enstrüman yalıyor mu kırmızı çizgiyi ? Tam Nisandan beri yalıyor. Önünü açmıyorlar ki, açacak ki enstrüman yürüsün. Yürüyemezse düşmek zorunda kalıyor.

Neden düşmek zorunda kalıyor ?

Enstrümana bazen teknik orta yol bırakmaz.

Der ki; ya düşeceksin, ya çıkacaksın. Bu bölgede fiyat olaraktan yatamazsın.

Enstrüman da yukarı kırmaya çalışıyor ama, negatif haber basıyorlar. BTC ETH boynunu büküyor.

Bunun elinden bir şey gelmez ki.

Enstrümana bazen teknik orta yol bırakmaz.

Der ki; ya düşeceksin, ya çıkacaksın. Bu bölgede fiyat olaraktan yatamazsın.

Enstrüman da yukarı kırmaya çalışıyor ama, negatif haber basıyorlar. BTC ETH boynunu büküyor.

Bunun elinden bir şey gelmez ki.

Elinden bir şey gelmeyince sürüne sürüne tutunmaya çalışıyor çaresiz. Bu sebeple bu işlere bulaşacaksanız riskinizi bileceksiniz. Bir önceki twette anlattım mal canın yongasıdır. Adam malını korumaya çalışıyor.

Teknik sıkıntıyı görüyor bunları kim koruyacak ?

Teknik sıkıntıyı görüyor bunları kim koruyacak ?

2021 senesinde Nisan Mayıs aylarında #SP500

4150 bölgesindeydi. #DOW 33.300 civarındaydı, #DAX 16.000 civarıydı

Bu üçü bu bölgedeler aylardır sabit bekliyorlar

Bunlardan ayrışan biri vardı #NASDAQ burası

2021 senesi Nisan Mayıs aylarında 14000 yakınıydı

Burayı da eşitlediler.

4150 bölgesindeydi. #DOW 33.300 civarındaydı, #DAX 16.000 civarıydı

Bu üçü bu bölgedeler aylardır sabit bekliyorlar

Bunlardan ayrışan biri vardı #NASDAQ burası

2021 senesi Nisan Mayıs aylarında 14000 yakınıydı

Burayı da eşitlediler.

2021 Nisan Mayıs ayına gittiğimiz de Virüsün tam ortalarıydı. FED aşağıdan dünyayı kaldırmıştı ama coşku vermemişti. Coşkuyu ne zaman verdi?

2021 Nisandan sonra ve #coinleri devreye aldılar

#ETH de 2021 Nisan da 1800 civarıydı şu an aylardır buradadır. Tabela kriptoda da eşit

2021 Nisandan sonra ve #coinleri devreye aldılar

#ETH de 2021 Nisan da 1800 civarıydı şu an aylardır buradadır. Tabela kriptoda da eşit

Tarihler 30 Mart 2021 gösteriyordu aşağıdaki tweti attım. #DAX hikaye bitti diyebilir. Bunu başka savaş

ile alakalı twetlerim de anlattım bu adamları sabitlediler piyasa olarak. Peki #FED bu sıkışıklığı

2021 Nisan Mayıs Haziran dönemin de nasıl aştı ?

#Kriptolarla aştılar.

ile alakalı twetlerim de anlattım bu adamları sabitlediler piyasa olarak. Peki #FED bu sıkışıklığı

2021 Nisan Mayıs Haziran dönemin de nasıl aştı ?

#Kriptolarla aştılar.

📈 Se la #recessione sarà dura come si comporterà il nostro amato #bitcoin? 📉

Abbiamo affrontato la questione nell'ultimo #CryptoPub insieme a @AlexOttaBTC 🍻

Qui il link per il Podcast👇

open.spotify.com/episode/1GvF3Y…

Vediamo un po' di riflessioni a questo riguardo 🧵🔥

Abbiamo affrontato la questione nell'ultimo #CryptoPub insieme a @AlexOttaBTC 🍻

Qui il link per il Podcast👇

open.spotify.com/episode/1GvF3Y…

Vediamo un po' di riflessioni a questo riguardo 🧵🔥

1/ La famiglia reale di Abu Dhabi è pesantemente short sull'azionario USA 🩸

@markets ha riportato la notizia che il fondo della Famiglia Reale è fortemente ribassista nei confronti del mercato USA.

bloomberg.com/news/articles/…

@markets ha riportato la notizia che il fondo della Famiglia Reale è fortemente ribassista nei confronti del mercato USA.

bloomberg.com/news/articles/…

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

a 🧵🪡

1/

Update on our upgrade of Regional Banks "tactical buy" which we initiated on 5/7

- rationale on 5/7 was failure of $FRC created "temporary Fed put" for regional banks

- #Fed then paused

$KRE $NYCB $EWBC $WAL $BANC $CNOB

1/

Update on our upgrade of Regional Banks "tactical buy" which we initiated on 5/7

- rationale on 5/7 was failure of $FRC created "temporary Fed put" for regional banks

- #Fed then paused

$KRE $NYCB $EWBC $WAL $BANC $CNOB

2/

Technical picture for $KRE regional banks has since strengthened sharply

- Regional banks registered "13" buy setup on @DeMarkAnalytics daily and weekly charts

- flagged by @MarkNewtonCMT

- and yesterday, we got the necessary "price flip" higher on $KRE

Technical picture for $KRE regional banks has since strengthened sharply

- Regional banks registered "13" buy setup on @DeMarkAnalytics daily and weekly charts

- flagged by @MarkNewtonCMT

- and yesterday, we got the necessary "price flip" higher on $KRE

【宏观和投资思路:美联储 6 月 15 号加息预测】

6月15号将发布下一次的利率决议,目前观测器的数据显示,市场对美联储停止加息(当前利率为 5.25%)的概率为 77.5%,继续加息25个基点的概率为 22.5%。这个 thread 会写一下我的预测以及调仓的思路,不做投资建议。

#btc #crypto #trading #交易 #fed

6月15号将发布下一次的利率决议,目前观测器的数据显示,市场对美联储停止加息(当前利率为 5.25%)的概率为 77.5%,继续加息25个基点的概率为 22.5%。这个 thread 会写一下我的预测以及调仓的思路,不做投资建议。

#btc #crypto #trading #交易 #fed

1/4 5月美国 CPI 数据会在 6月13号公布,这当然会对 2 天后的利率决议产生影响,但我个人认为,此前美联储持续加息的影响已经逐步显现,目前美国已经出现了衰退迹象且会越来越明显,所以我判断 CPI 数据会持续走低。

2/4 CPI 的走低说明通货膨胀问题得到缓解,所以个人判断 6 月的美联储利率决议将会停止加息,对 crypto 来说是不错的消息。

#ES close almost 4,149 resistance, $RSP $IWM improvements are key bullish achievements, but I doubt would be confirmed by rising #bonds.

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

2. "I'm ooking for a meaningful undershoot on Tuesday, especially in core #retailsales turning even slightly negative".

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

3. Looking at the relative $XLY direction, I'm afraid #discretionaries are starting to lose their leading shine.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

İkisine de bakıyor musunuz ? ikisi de Nasıl çıkıyor ?

😎

😎

ABD faizleri 3.50 dedi. Ne oldu ? Pozitif hava ile yukarı aldılar. Geçen hafta anlattığım olay..

A short 🧵🪡

1/

On why this plunge in #FINRA margin debt matters more you one realizes

👇

- margin debt tanked -35% off peak and -$330 billion

- greater than GFC peak to trough

- and 1.59% (% market cap) lowest since dot-com low

1/

On why this plunge in #FINRA margin debt matters more you one realizes

👇

- margin debt tanked -35% off peak and -$330 billion

- greater than GFC peak to trough

- and 1.59% (% market cap) lowest since dot-com low

2/

2023 equity market has been a game of “inches” but bullish case has gained #anygivensunday

- this week’s soft side inflation readings strengthened case for #Fed pause

- and a “pause” reduces risk of a hard landing

So that’s a good thing

2023 equity market has been a game of “inches” but bullish case has gained #anygivensunday

- this week’s soft side inflation readings strengthened case for #Fed pause

- and a “pause” reduces risk of a hard landing

So that’s a good thing

Today’s #CPI report continues to depict #inflation that is just too high for most people’s good, especially the @federalreserve’s.

In fact, the report showed that #inflation remains remarkably sticky, which doesn’t correspond to virtually any practical thinker’s timeline of when it might be expected to start to come down further.

These elevated levels of inflation continue to be remarkably high relative to the many months with which the #economy has now operated with persistently higher #InterestRates.

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

🧵本周FED完成了2022-23年度第十次加息,并且暗示本轮加息周期已达到一个相对阶段,市场随机预测最早的降息可能于今年9月开始,相较于20-21年度的狂暴大牛市,过去的一年半无疑是一个相对低迷的bear market,然而市场仍然以每个月2-3个的速度产生一些有意思的 #ALPHA 热点。

🧵得益于一些alpha小群或者朋友的指导,我或多或少抓住了一些收益不错的项目,当然如果不卖飞的话,收益就更不错了。因此写一个10次加息会议周期间的热点or大事件回顾,不一定能够全部覆盖,以期能够从卖飞的经验中总结如何减少卖飞(套娃