Discover and read the best of Twitter Threads about #Leverage

Most recents (24)

1. OUR SUBSISTENCE ECONOMY IS COLLAPSING.

WILL THIS FREE OR DESTROY OUR REPUBLIC AS FOUNDED!?

WHAT IS A SUBSISTENCE ECONOMY?

An economy where the majority of the population live “hand to mouth” or in modern language, paycheck to paycheck. twitter.com/i/web/status/1…

WILL THIS FREE OR DESTROY OUR REPUBLIC AS FOUNDED!?

WHAT IS A SUBSISTENCE ECONOMY?

An economy where the majority of the population live “hand to mouth” or in modern language, paycheck to paycheck. twitter.com/i/web/status/1…

2. The first thing people need to realize as they grow more & more AWARE of just how

e-v-e-r-y-t-h-i-n-g in our lives is manipulated by these Ghoulish Shitbags, your money & access to it is the most manipulated thing of all.

SIXTY PER CENT of working Americans are now living… twitter.com/i/web/status/1…

e-v-e-r-y-t-h-i-n-g in our lives is manipulated by these Ghoulish Shitbags, your money & access to it is the most manipulated thing of all.

SIXTY PER CENT of working Americans are now living… twitter.com/i/web/status/1…

3. Sixty per cent of American families are just ONE economic hiccup or event away from being unable to feed, clothe and house themselves.

And as we have clearly seen recently, the hiccups are beginning to come hard and fast.

The Silvergate, Silicon Valley and Signature Banks… twitter.com/i/web/status/1…

And as we have clearly seen recently, the hiccups are beginning to come hard and fast.

The Silvergate, Silicon Valley and Signature Banks… twitter.com/i/web/status/1…

1/ 🍝 In an open marketplace, in which IP is free and anyone can copypasta code and spin up a fork of a successful dApp.

Staying ahead of the real Zero-to-One innovations in #DeFi can be the difference between making it and not

A 🧵 on the first of these game changers Im eyeing

Staying ahead of the real Zero-to-One innovations in #DeFi can be the difference between making it and not

A 🧵 on the first of these game changers Im eyeing

2/📊 Keeping track of every project, let alone identifying key innovations and opportunities in this crowded space can often feel overwhelming.

Luckily for you, I’ve dug through a tonne of VC portfolios, seed round announcements and twitter threads to deliver u the alpha 4 free!

Luckily for you, I’ve dug through a tonne of VC portfolios, seed round announcements and twitter threads to deliver u the alpha 4 free!

3/♾️ @InfPools aka InfinityPools is a real zero-to-one project

that allows for the trading of any on-chain asset with almost unlimited leverage, no liquidations, no counterparty risk and no oracles

I know what ur thinking - sounds too good to be true, right?

Let’s find out

that allows for the trading of any on-chain asset with almost unlimited leverage, no liquidations, no counterparty risk and no oracles

I know what ur thinking - sounds too good to be true, right?

Let’s find out

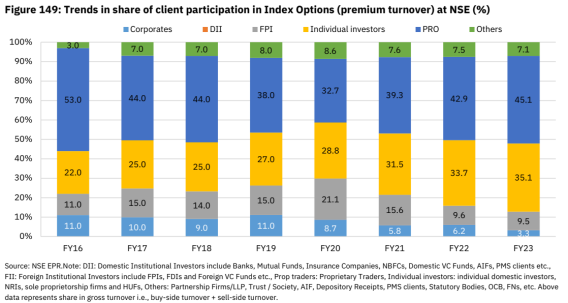

New iOS in #Markets

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

10 important ratios used to understand leverage:

Debt-to-Equity

Debt-to-Assets

Debt-to-Capital

Interest Coverage

Fixed Charge Coverage

Debt Service Coverage

Total Debt-to-EBITDA

Operating Leverage

Financial Leverage

Degree of Operating Leverage

Please RT for reach!♻️

Debt-to-Equity

Debt-to-Assets

Debt-to-Capital

Interest Coverage

Fixed Charge Coverage

Debt Service Coverage

Total Debt-to-EBITDA

Operating Leverage

Financial Leverage

Degree of Operating Leverage

Please RT for reach!♻️

Debt-to-Equity Ratio: This ratio measures a company's debt in relation to its equity. It's calculated by dividing total debt by total equity. A higher ratio suggests that the company is more heavily reliant on debt financing.

Debt-to-Assets Ratio: This ratio measures a company's debt in relation to its total assets. It's calculated by dividing total debt by total assets. A higher ratio indicates that the company has a larger percentage of debt financing.

10th thread 🧵 of 2023 :

Lets talk about @ArchimedesFi - One of the innovative DeFi project out there.

Lets go abit deeper 👇👇

Lets talk about @ArchimedesFi - One of the innovative DeFi project out there.

Lets go abit deeper 👇👇

1/

In this thread i will be sharing :

1⃣ What is @ArchimedesFi ?

2⃣ Why provide Liquidity with ArchimedesFi?

3⃣ Why take Leverage with ArchimedesFi?

4⃣ Tokenomics

5⃣ Social media channels & Audits

6⃣ What next for them?

$ARCH #ArchimedesFi #liquidity #leverage #DeFi

In this thread i will be sharing :

1⃣ What is @ArchimedesFi ?

2⃣ Why provide Liquidity with ArchimedesFi?

3⃣ Why take Leverage with ArchimedesFi?

4⃣ Tokenomics

5⃣ Social media channels & Audits

6⃣ What next for them?

$ARCH #ArchimedesFi #liquidity #leverage #DeFi

2/

1⃣ What is @ArchimedesFi ?

ArchimedesFi is a lending and borrowing platform that built on top of @CurveFinance

> Lenders (LPers) to earn sustainable higher APYs

> Borrowers (Leverage Takers) to earn up to 10x yield of what yield-bearing stablecoins such as OUSD offer.

1⃣ What is @ArchimedesFi ?

ArchimedesFi is a lending and borrowing platform that built on top of @CurveFinance

> Lenders (LPers) to earn sustainable higher APYs

> Borrowers (Leverage Takers) to earn up to 10x yield of what yield-bearing stablecoins such as OUSD offer.

#Arbitrum has been gaining a lot of traction in the last few months, with a steady growth in activity and new tokens being launched within the ecosystem every day.

Thought you missed the boat? Here are 12 new projects coming to Arbitrum 🧵👇

Thought you missed the boat? Here are 12 new projects coming to Arbitrum 🧵👇

1/12 @FactorDAO: a self-custodial protocol allowing creators to launch tokenized baskets, fully controlling their assets held in tokens minted by the platform. $FCTR's public sale will begin on 20 February 2023.

🧵🐸 Thread continued:

All The New Protocols We Highlighted In The Last Week (part 2 of 2)

(will link back to first tweet at end of thread if you missed it!)

25/x

All The New Protocols We Highlighted In The Last Week (part 2 of 2)

(will link back to first tweet at end of thread if you missed it!)

25/x

Something called @AestusRelay has officially launched on mainnet.

Twitter bio states “The Aestus MEV-Boost Relay on Ethereum.”

26/x

Twitter bio states “The Aestus MEV-Boost Relay on Ethereum.”

26/x

New protocol called @HadoukenFinance.

Twitter bio states “An integrated borrowing/lending platform and DEX on @NervosNetwork #Godwoken.”

27/x

Twitter bio states “An integrated borrowing/lending platform and DEX on @NervosNetwork #Godwoken.”

27/x

#reflexivity between #bubbles vs #antibubbles once again distorting markets

Artificially low #VIX forces quant strategies (trend, risk parity, vol target) to buy #SPX, squeezes weak shorts

#insurance tends to be cheapest when we need it the most

Anti-bubble framework 👇

Artificially low #VIX forces quant strategies (trend, risk parity, vol target) to buy #SPX, squeezes weak shorts

#insurance tends to be cheapest when we need it the most

Anti-bubble framework 👇

1) Embrace #volatiltiy. Don’t fight it.

2) avoid #leverage, your enemy responsible for financial and emotional distress.

3) Seek negative #correlation and avoid risk of false #diversification. Remember that a portfolio with many holdings is not necessarily diversified.

2) avoid #leverage, your enemy responsible for financial and emotional distress.

3) Seek negative #correlation and avoid risk of false #diversification. Remember that a portfolio with many holdings is not necessarily diversified.

4) Seek #Emotional indifference. If your trading makes you overly happy or sad, you are trading too big.

5) #Rebalance Portfolio = sell high, buy cheap. Now is time to trim risk, add insurance

6) #compound on capital preservation. Goalkeeper most important player in any team.

5) #Rebalance Portfolio = sell high, buy cheap. Now is time to trim risk, add insurance

6) #compound on capital preservation. Goalkeeper most important player in any team.

The Bank for International Settlement #BIS's annual economic report (june22 of 138 pages) proves every single word in the #Bitcoin white paper ⚡️bitcoin.org/en/bitcoin-pap…

If you think the fiat world is ugly now.

It's only getting uglier.

🧻bis.org/publ/arpdf/ar2…

🧵My views👇🏽

If you think the fiat world is ugly now.

It's only getting uglier.

🧻bis.org/publ/arpdf/ar2…

🧵My views👇🏽

The number of times these words were mentioned (order per #) within 138 pages.

#Web3 1

#USDT 3

#binance 6

#leverage 6

#Coinbase 10

#ethereum 12

#Tether 15

#luna 27

#bitcoin 28

#decentralised 30

#terra 37

#centralised 53

#DeFi 63

#stablecoin 71

#cbdc 110

#crypto 214

#Web3 1

#USDT 3

#binance 6

#leverage 6

#Coinbase 10

#ethereum 12

#Tether 15

#luna 27

#bitcoin 28

#decentralised 30

#terra 37

#centralised 53

#DeFi 63

#stablecoin 71

#cbdc 110

#crypto 214

OK info about this report:

+ Highlighted some of the risks within the shitcoinery world (stable coins, crypto, Defi)

+ Confirmed that all shitcoins are copying #Bitcoin and following its behavior

+ Attacking lack of regulations leading to rug pulls like Terra Luna

+ USDT risk

+ Highlighted some of the risks within the shitcoinery world (stable coins, crypto, Defi)

+ Confirmed that all shitcoins are copying #Bitcoin and following its behavior

+ Attacking lack of regulations leading to rug pulls like Terra Luna

+ USDT risk

📢THE COLLAPSE OF THE WORLD ECONOMY AND THE SOLUTION IN THE FORM OF CRYPTO! 📢

In this little story I summarize how Covid, Supply Chain, Debt, Wages, Inflation, a Eecession, Insolvency and an aging population come together to form a common solution: Crypto Assets

1) ...

In this little story I summarize how Covid, Supply Chain, Debt, Wages, Inflation, a Eecession, Insolvency and an aging population come together to form a common solution: Crypto Assets

1) ...

So much is happening in the world. War, High #inflation, Covid, #recession, insolvancy, a debt bubble and Supply Chain problems.

All of these causes have a large impact on the world economy and therefore on your portfolio, which makes it important to understand what is going on.

All of these causes have a large impact on the world economy and therefore on your portfolio, which makes it important to understand what is going on.

One word @CaitlinLong_: GREED.

You’ve been spot on. I struggled w/ noticing the same issue of #derivative and #TradFi games infecting #bitcoin & #Crypto over the last 1.5yrs or so.

Structurally it was quite easy to see. But...

/1 👉🧵 on a few thoughts.

You’ve been spot on. I struggled w/ noticing the same issue of #derivative and #TradFi games infecting #bitcoin & #Crypto over the last 1.5yrs or so.

Structurally it was quite easy to see. But...

/1 👉🧵 on a few thoughts.

you have to know how these things have played out in other markets as well as how intermarket relationships work within markets in general. And, you never really know how the change will play out. Especially, in new asset classes like #DigitalAssets.

/2

/2

It felt like most in the space chose not to acknowledge the changes & continue to pump the narrative of NGU and BTFD with little regard for what’s *actually* happening w/ the fundamental picture. Time horizon matters. All participants have different goals.

/3

/3

Time for a 🧵 on two charts (at the end) that seem to tell an interesting #Bitcoin story.

For several yrs @CaitlinLong_ has openly discussed the potential negative impact of #rehypothecation of #bitcoin by banks, wall street, hedge funds & the broader #tradfi community.

For several yrs @CaitlinLong_ has openly discussed the potential negative impact of #rehypothecation of #bitcoin by banks, wall street, hedge funds & the broader #tradfi community.

@saylor has discussed and shown the need for sound money and the value that having a savings mechanism brings to the system.

@JeffBooth has shed light on the fact that #deflation isn’t such a bad thing when #technology is actually making our lives better and costs cheaper.

@JeffBooth has shed light on the fact that #deflation isn’t such a bad thing when #technology is actually making our lives better and costs cheaper.

@saifedean taught the 🌏 the importance of time, effort, and energy & the value that living by the #Bitcoin Standard can bring to individuals and countries across the globe.

@FossGregfoss has done a phenomenal job helping to #educate on the benefits of owning #volatile #assets.

@FossGregfoss has done a phenomenal job helping to #educate on the benefits of owning #volatile #assets.

According to a @FastCompany #article & an @indeed #poll, in the #techindustry, I'm old.

And not just a little old, a LOT old. I've been in #tech longer than many of my colleagues have been alive!

But that's OK & here's why (🧵):

#fastcompany

fastcompany.com/90504623/tech-…

And not just a little old, a LOT old. I've been in #tech longer than many of my colleagues have been alive!

But that's OK & here's why (🧵):

#fastcompany

fastcompany.com/90504623/tech-…

1. You can't gain experience from a book (or website or app or ...)

The only way you gain #experience is by doing things over time.

That's it!

No shortcuts!

No cheat codes!

And I've had the time to gain the experience which shows on my #resume & portfolio.

The only way you gain #experience is by doing things over time.

That's it!

No shortcuts!

No cheat codes!

And I've had the time to gain the experience which shows on my #resume & portfolio.

2. I grew up before the Internet!

The Internet's biggest #advantage can also be its biggest failure. "Just Google it!" has become the modern mantra because it's easier to find a #solution than to figure it out.

My ability to problem solve is becoming rare! And marketable!

The Internet's biggest #advantage can also be its biggest failure. "Just Google it!" has become the modern mantra because it's easier to find a #solution than to figure it out.

My ability to problem solve is becoming rare! And marketable!

I've been studying Alberta political culture & public opinion for over a decade. I've learned that a lot of Albertans feel personally & collectively "left behind" by their governments, and by the pace of economic & social change that is challenging the "Alberta way of life." +

Acknowledegment is important. The continual airing of grievances by politicians who claim to be "standing up for Albertans" may feel good at the time. +

So, too, might spending billions of dollars on failed pipeline bets, war rooms, and public inquiries to identify and target "the bad guys."+

🧵I love #football

Have done since the 1980's ⚽️

Nowadays though, the off-field stuff seems to get as much coverage & column inches as the game itself 🗞️📺📱

Competition isn't just about trophies - it's about eyeballs, soft power, geo-politics, PR and #money

Quick tale...

Have done since the 1980's ⚽️

Nowadays though, the off-field stuff seems to get as much coverage & column inches as the game itself 🗞️📺📱

Competition isn't just about trophies - it's about eyeballs, soft power, geo-politics, PR and #money

Quick tale...

Did you see that news report from the #US this week about the #billionaire financier #TomBarrack being arrested? ($250m bail)

In the weird (but fun) world we live in, that incident ties to #NewcastleUnited & the #PremierLeague

Say what?! 🧐

#FollowTheMoney #Networks #Power 💸

In the weird (but fun) world we live in, that incident ties to #NewcastleUnited & the #PremierLeague

Say what?! 🧐

#FollowTheMoney #Networks #Power 💸

1/ I produce a lot of content. It's difficult for some to keep up with at times. Below, a list of some of my threads & important tweets for $EGLD & $CEL The Crypto Industry & Banking/Federal Reserve & Investing. Education is Freedom & Crypto is Financial Freedom. #cryptocurrency

2/ Who am I:

3/ “Is @ElrondNetwork The Future Smart Contract Blockchain Market Leader?” (44 Page Research & Investment Thesis) $EGLD ⚡️

(1\13) The next time someone says #crypto is the one with #leverage tell them they have ZERO understanding of the existing legacy banking & financial system. Historically banks were required to hold 10-13% in reserves. Federal Reserve moved it to 0% on March 15, 2020 $EGLD $CEL

(2\13) federalreserve.gov/monetarypolicy… When I used to teach banking I would have my students perform #UBPR which are essentially an analytical tool for assessing banks health & performance. NEVER has the banking system allowed 0% reserve. Let me

(3\13) give you a mathematical example of how #FractionalReserves are essentially implicit leverage. If banks historically had to hold say 10% than the way you would understand how much leverage is by 1*1/R. You deposit $100 *(1/R) R=10% = $1,000, so they can lend out $900 for

Lots of people asking me to provide a summary of yesterdays Wigglesworth Memorial Lecture. In the lecture I discussed 10 lessons that I have learned about Occupational Health and Safety (OHS) through 20 years of applied #humanfactors research. Here they are!

Lesson 1. A human error lens is useless and can be dangerous. I talked here about how using the term in OHS can be misleading and prevent learning. Errors are a consequence of systemic issues, not a cause of anything!

Lesson 2. All accidents/safety compromising incidents are caused by multiple interacting contributory factors. There is no such thing as a root cause

Some metrics from our @QCAlphaOne #AAM system of #momentum investing with #ETFs

No #Leverage.

#Equity, #Gold, #GILT or #Cash.

#AssetAllocationModel

1/n

No #Leverage.

#Equity, #Gold, #GILT or #Cash.

#AssetAllocationModel

1/n

1) I think this is a prudent moment to talk about leverage and #BTC ;

Most new traders use leverage to increase their position size,

Experienced traders use leverage to increase their buying power.

Here's a breakdown;

Most new traders use leverage to increase their position size,

Experienced traders use leverage to increase their buying power.

Here's a breakdown;

2) When planning a trade, one of the first steps is deciding how much to risk.

The most widely accepted method for determining risk is to use a % of your total account balance,

eg. $10,000 account, risk less than <3% per trade = <$300 max loss per trade;

The most widely accepted method for determining risk is to use a % of your total account balance,

eg. $10,000 account, risk less than <3% per trade = <$300 max loss per trade;

3) Most new traders ignore this, and go straight to "how much can I buy with the leverage at 10x?, 20x?, 100x?, etc.

Where as experienced traders use an amount where the max loss on that position represents their predetermined risk per trade amount;

Where as experienced traders use an amount where the max loss on that position represents their predetermined risk per trade amount;

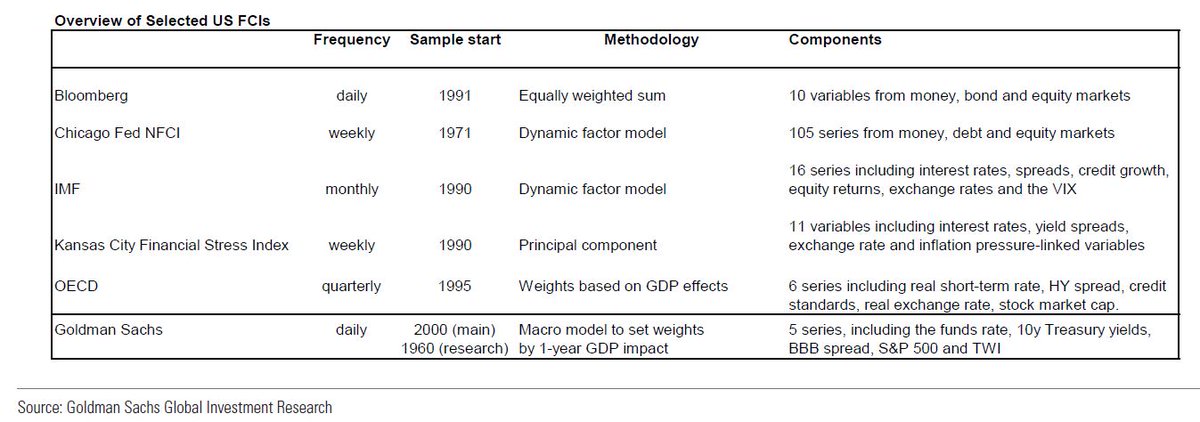

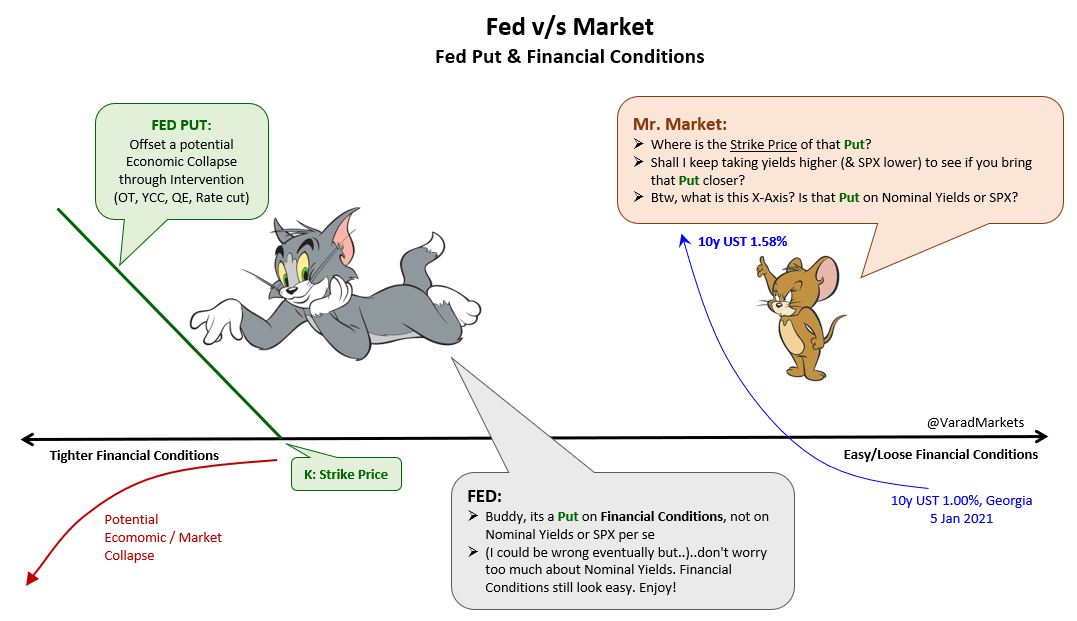

#Fed Put & Financial Conditions Index (#FCI):

#Powell: “…would be concerned by…persistent tightening in financial conditions…”

🚩Just-for-fun graphic: Fed Put - Market’s search for Put’s Strike Price = Fed’s intervention threshold

🚩#DiveIn: FCI & Macro

1/12

#Powell: “…would be concerned by…persistent tightening in financial conditions…”

🚩Just-for-fun graphic: Fed Put - Market’s search for Put’s Strike Price = Fed’s intervention threshold

🚩#DiveIn: FCI & Macro

1/12

Financial spread betting might be a tax efficient and the right instrument to use in the UK and Ireland but witiout knowledge it can be disasterous.

Spread betting for beginners is a good start and then the learning curve.

#spreadbetting #trading

independentinvestor.com/spread-betting…

Spread betting for beginners is a good start and then the learning curve.

#spreadbetting #trading

independentinvestor.com/spread-betting…

Did you know that financial spread betting is tax free? It means you've got to pay no tax... no Capital Gains Tax, No Stamp Duty, No tax at all.

#tax #trade

independentinvestor.com/spread-betting…

#tax #trade

independentinvestor.com/spread-betting…

Financial spread betting envolves trading on leverage.

Yes, it could be good and benefit you but once you lose control of the leverage you might run into serious troubles. Make sure you treat leverage with respect and remember... it can hurt.

#leverage

independentinvestor.com/spread-betting…

Yes, it could be good and benefit you but once you lose control of the leverage you might run into serious troubles. Make sure you treat leverage with respect and remember... it can hurt.

#leverage

independentinvestor.com/spread-betting…

This thread is to cover one of the most important topics for those involved in financial spread betting or any other form of trading.

Let's be honest and see 3 most common reasons why many lose and what part spread betting plays there.

#spreadbetting

independentinvestor.com/spread-betting…

Let's be honest and see 3 most common reasons why many lose and what part spread betting plays there.

#spreadbetting

independentinvestor.com/spread-betting…

1. Over-leveraging.

Probably the most common mistake out-there - don't over leverage; yes, potential returns might be tempting but you want to use spread betting as a trading platform rather than a gambling one so keep your leverage in check.

#Leverage

independentinvestor.com/spread-betting…

Probably the most common mistake out-there - don't over leverage; yes, potential returns might be tempting but you want to use spread betting as a trading platform rather than a gambling one so keep your leverage in check.

#Leverage

independentinvestor.com/spread-betting…

2. Over-trading.

Over-trading is another common mistake novice spread bettors make. Don't trade just for the sake of trading but spend more time learning and analysing your potential positions. More learning = more profit.

Over-trading is another common mistake novice spread bettors make. Don't trade just for the sake of trading but spend more time learning and analysing your potential positions. More learning = more profit.

1/14

* Some practical tips on #PersonalFinance & #Investment *

Met someone who lost heavily in markets( sizeable amt) which makes me write this thread .

DISCLAIMER : There are exceptions always.However the chances of us being in that exception is rare !🤷 Hence the thread.

* Some practical tips on #PersonalFinance & #Investment *

Met someone who lost heavily in markets( sizeable amt) which makes me write this thread .

DISCLAIMER : There are exceptions always.However the chances of us being in that exception is rare !🤷 Hence the thread.

2/14

Pls DON'T ENTER markets without ensuring you have

- An Emergency Fund in place

- A good comprehensive Life & Health insurance policy for all .

- Term Insurance ( especially if taken a house on loan)

More details given in the old tweet.

Pls DON'T ENTER markets without ensuring you have

- An Emergency Fund in place

- A good comprehensive Life & Health insurance policy for all .

- Term Insurance ( especially if taken a house on loan)

More details given in the old tweet.

3/14

* INVEST SURPLUS ONLY *

Consider investing in markets as money locked in ( like in a PPF account) for a few years atleast & THEN decide how much money you CAN AFFORD TO LOCK IN.

Else we may have to sell ( even a good)stock at lower price BECAUSE we need money urgently .

* INVEST SURPLUS ONLY *

Consider investing in markets as money locked in ( like in a PPF account) for a few years atleast & THEN decide how much money you CAN AFFORD TO LOCK IN.

Else we may have to sell ( even a good)stock at lower price BECAUSE we need money urgently .