Discover and read the best of Twitter Threads about #MSCI

Most recents (18)

२४ जानेवारीला हिंडेनबर्गने #AdaniGroup च्या विरोधात एक रिसर्च रिपोर्ट पब्लिश केला आणि या ग्रुपमधील स्टॉक्सच्या प्राईज धडाधड कोसळल्या. हा रिपोर्ट पब्लिश होऊन आता एक महिना उलटून गेला आहे. या एका महिन्यात घडलेल्या घडामोडींचा थोडक्यात गोषवारा. #Thread #HindenburgReport #म #मराठी

1/n

1/n

२४ जानेवारीला या अमेरिकन कंपनीने आपला रिसर्च रिपोर्ट पब्लिश करत अदानी ग्रुप दहा वर्षांपासून 'स्टॉक मॅनिप्युलेशन आणि अकाऊंटिंग फ्रॉड' करत असल्याचा दावा केला. #LIC ची #AdaniGroup मध्ये ३०,००० कोटी रुपयांची गुंतवणूक असल्यामुळे तेही यात ओढले गेले. #Thread #HindenburgReport

2/n

2/n

२६ जानेवारीपर्यंत अदानी ग्रुपमधील कंपन्यांचे शेअर्स मोठ्या प्रमाणात विकले गेले आणि ब्लूमबर्गनुसार त्यांनी १०० बिलियन डॉलरहून अधिक मार्केट व्हॅल्यू गमावली. त्यानंतरदेखील अदानी ग्रुपची संपत्ती घटतच राहिली आणि त्यांचा FPO फक्त १ टक्के सबस्क्राईब झाला. #Thread #HindenburgReport

3/n

3/n

#IMPORTANT The #MSCI Weight Reduction in #AdaniGroup is Just the Start of more events to come.

I highlighted the likelihood of #MSCI in the #THREAD BELOW

I highlighted the likelihood of #MSCI in the #THREAD BELOW

1/n what did MSCI Say ?

"MSCI has received feedback from a range of market participants concerning the eligibility"

“Characteristics of certain investors have sufficient uncertainty that they should no longer be designated as free float pursuant to our methodology.”

"MSCI has received feedback from a range of market participants concerning the eligibility"

“Characteristics of certain investors have sufficient uncertainty that they should no longer be designated as free float pursuant to our methodology.”

=> basically MSCI felt there is truth in what #Hindenburg portrayal of a "Close Relationship" with the FIIs

MSCI Also Said

"This determination has triggered a free float review of the Adani Group securities" which will be informed in Mid-feb and implemented by End-feb

MSCI Also Said

"This determination has triggered a free float review of the Adani Group securities" which will be informed in Mid-feb and implemented by End-feb

THIS IS BIG - IF #MSCI decides to cut the weight or Remove #AdaniGroup Stocks then, the entire house of cards will fall Down !!

Refer to my tweet below …. POINT 2

Refer to my tweet below …. POINT 2

👇Reffer point 2

Let me explain the time line …. As LIC KEPT BUYING #AdaniEnterprises given the low free float, the stock kept going up and hence #AdaniEnterprises entered the following indices

(1) FTSE

(2) MSCI - the BIG DEAL

(3) NIFTY50 - All your @socialepfo, @LICIndiaForever and #NPS money

(1) FTSE

(2) MSCI - the BIG DEAL

(3) NIFTY50 - All your @socialepfo, @LICIndiaForever and #NPS money

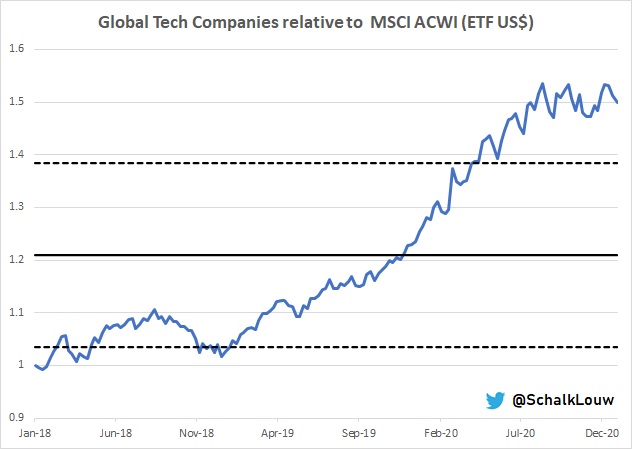

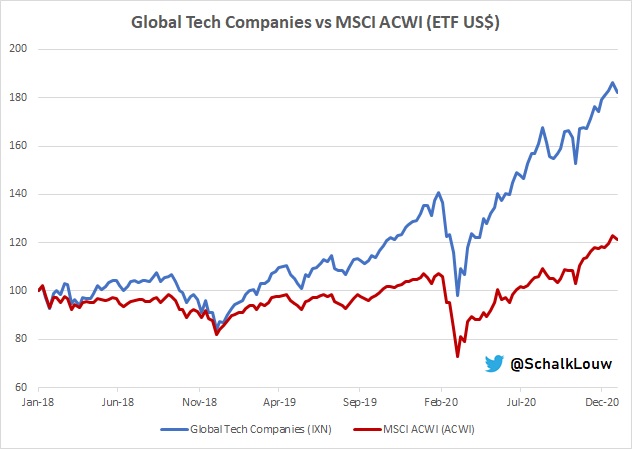

THREAD: A picture is worth a thousand words. Let's look at a few of the globe's largest #ETF's & their graphs & see if we can make some sense of the current market environment.

What a year it's been for #Oil & #Energy! Only positive YTD #MSCI #Sector.

$IXC

What a year it's been for #Oil & #Energy! Only positive YTD #MSCI #Sector.

$IXC

2/19

#Global #CleanEnergy #ETF relative to Global #Energy shows an interesting picture.

$ICLN vs $IXC

#Global #CleanEnergy #ETF relative to Global #Energy shows an interesting picture.

$ICLN vs $IXC

3/19

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might be down over 1YR, but $EZA performance in USD (-15.9%) is still way ahead of both $URTH (DM -22.2%) & $EEM (EM -28.9%) over the same period.

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might be down over 1YR, but $EZA performance in USD (-15.9%) is still way ahead of both $URTH (DM -22.2%) & $EEM (EM -28.9%) over the same period.

Mein 1. Jahr mit #ETF Sparplänen. Eine kurze Übersicht.

Seit über 15 J. investiere ich in Aktien und trade kurzfristig mit #Aktien, #CFDs und #Derivate.

Das Traden ist Hobby, Aktien und nun ETFs dienen hauptsächlich der Altersvorsorge und unseren Kids für d. späteren Start.

1/x

Seit über 15 J. investiere ich in Aktien und trade kurzfristig mit #Aktien, #CFDs und #Derivate.

Das Traden ist Hobby, Aktien und nun ETFs dienen hauptsächlich der Altersvorsorge und unseren Kids für d. späteren Start.

1/x

Meine Intention, warum nun ETFs:

1) Hochs im Herbst '21

2) weniger Risiko nun ab 40+

3) U.a. Regionen, die ich mit Einzelaktien nicht (mehr) abdecken möchte

Ein kleine Auswahl an ETFs, klassisch ein #MSCI World und/oder #SP500 sind mir jedoch zu langweilig und unflexibel.

2/x

1) Hochs im Herbst '21

2) weniger Risiko nun ab 40+

3) U.a. Regionen, die ich mit Einzelaktien nicht (mehr) abdecken möchte

Ein kleine Auswahl an ETFs, klassisch ein #MSCI World und/oder #SP500 sind mir jedoch zu langweilig und unflexibel.

2/x

Wir als Familie besparen eine Auswahl an 20 ETFs, bis gestern 19, heute ist ein weiterer hinzugekommen.

Die monatlichen Raten liegen zw. 25 und 200 EUR pro ETF. Im Hoch '21 gestartet, liegt die Performance insgesamt bei ca. 5%, was bei der Marktentwicklung ganz Okay ist.

3/x

Die monatlichen Raten liegen zw. 25 und 200 EUR pro ETF. Im Hoch '21 gestartet, liegt die Performance insgesamt bei ca. 5%, was bei der Marktentwicklung ganz Okay ist.

3/x

India is emerging as one of the relatively better-off economies in the post-COVID world.

#indianeconomy

(2/n)

#indianeconomy

(2/n)

Looking closely, we find that India’s inflation is well controlled, ATH FX reserves have acted well as a shock absorber against volatility, and our GDP growth expectations is one the highest in the world!

#inflation #volatility #GDP

(3/n)

#inflation #volatility #GDP

(3/n)

It's weekend and it's the end of the month. The #markets are closed.

So there is the perfect time to analyze the #momentum & relative #strength of the markets.

This information is relevant for all #investors, but especially for #trend #followers 📈📈📈

#marketresearch

🧵

So there is the perfect time to analyze the #momentum & relative #strength of the markets.

This information is relevant for all #investors, but especially for #trend #followers 📈📈📈

#marketresearch

🧵

The #momentum of the markets are one of the most powerful forces in the evolution of the #asset #prices.

The #reversion to the mean is the opposite force, which is equally powerful. Momentum works on a short and medium term (up to 3 to 5 years).

The #reversion to the mean is the opposite force, which is equally powerful. Momentum works on a short and medium term (up to 3 to 5 years).

Let’s understand if Indian Markets are currently overvalued or undervalued. A Thread 🧵

#macroeconomics #economy #India #MSCI #Nifty #SP500

@SahilKapoor @ankitapathak_ @avasthiniranjan @WeekendInvestng @virtual_kg @564pankaj @JustPunforfun @JustNifty @raggy_k @pprao

#macroeconomics #economy #India #MSCI #Nifty #SP500

@SahilKapoor @ankitapathak_ @avasthiniranjan @WeekendInvestng @virtual_kg @564pankaj @JustPunforfun @JustNifty @raggy_k @pprao

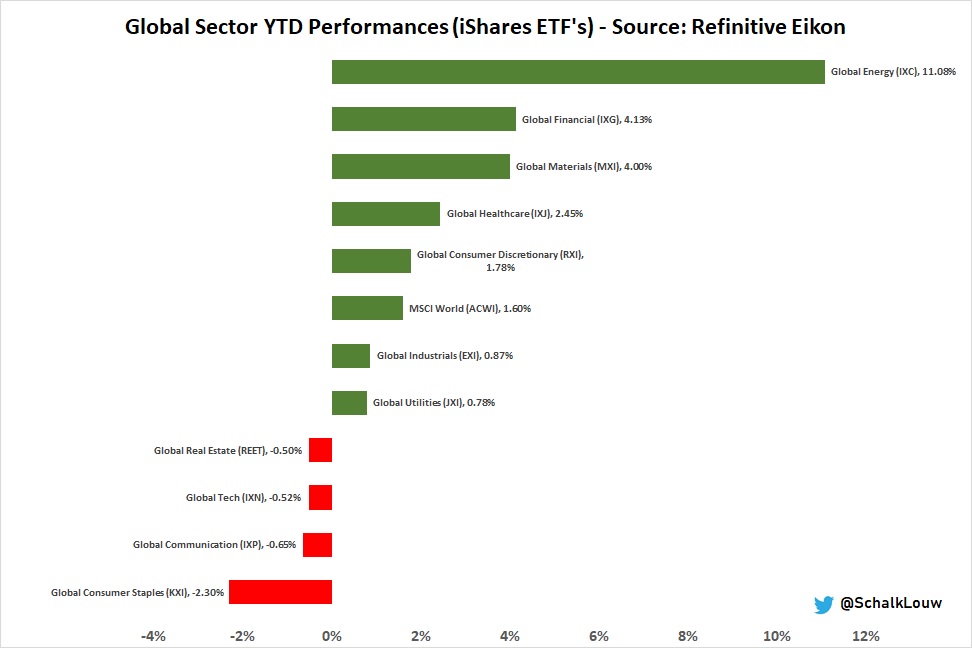

THREAD: A picture is worth a thousand words. Let's look at a few #ETF graphs & see if we can make some sense of the current market environment.

What a year it's been for #Oil & #Energy! Sharing only positive YTD #MSCI #Sector performance with #Financials.

$IXC $IXG

What a year it's been for #Oil & #Energy! Sharing only positive YTD #MSCI #Sector performance with #Financials.

$IXC $IXG

2/15

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA 1YR performance in USD (+9.9%) is still ahead of $EEM (-11.3%)

$URTH

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA 1YR performance in USD (+9.9%) is still ahead of $EEM (-11.3%)

$URTH

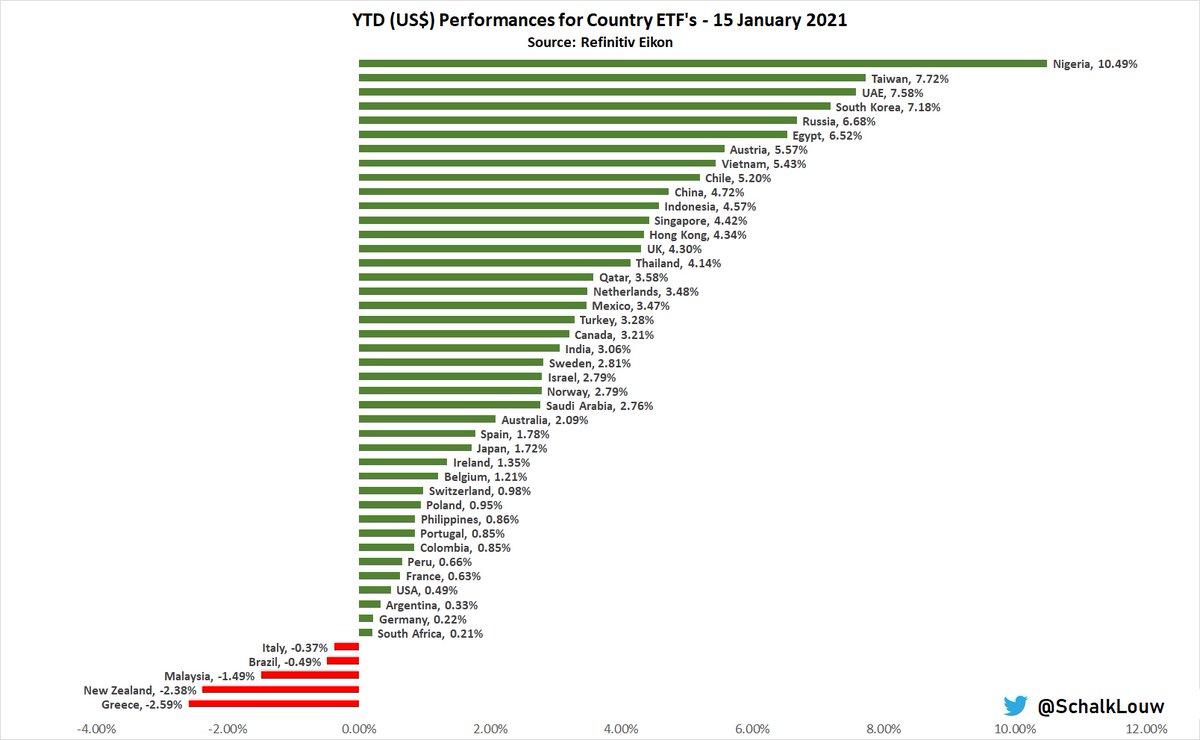

#Global #ETF (thread): 26 Aug 2021

- 2020 worst perf #sectors making still leading in 2021 $IXG $IXC

- This is helping #oil producing countries with #SaudiArabia & #UAE in top5 #Country ETF YTD performers in USD $KSA $UAE

- #SouthAfrica $EZA still in top30 YTD performers

- 2020 worst perf #sectors making still leading in 2021 $IXG $IXC

- This is helping #oil producing countries with #SaudiArabia & #UAE in top5 #Country ETF YTD performers in USD $KSA $UAE

- #SouthAfrica $EZA still in top30 YTD performers

2/12

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+8.2%) is still ahead of $EEM (-0.95%)

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+8.2%) is still ahead of $EEM (-0.95%)

FTSE China A50 Index futures extend decline to 1%.

#StockMarket

#StockMarket

Shanghai Composite Index -1%

Shenzhen Component Index -1.7%

ChiNext -2.4%.

Hang Seng Index -1.2%

#StockMarket #China

Shenzhen Component Index -1.7%

ChiNext -2.4%.

Hang Seng Index -1.2%

#StockMarket #China

The 10-year #Treasury note yield rose 5.6 basis points to 1.469% after ECB officials saw no need for drastic action to prevent bond yields from rising, as they felt changes to communications or maintaining the flexibility of its pandemic emergency purchase program: MarketWatch

Anybody feels like looking at a few #Global #ETF graphs? Or are you all sitting in front of a big fire, ready for that Sunday braai or potjie?

If there's interest, I'll be happy to show 1 graph for every like or retweet?

#MonthEnd #Markets

If there's interest, I'll be happy to show 1 graph for every like or retweet?

#MonthEnd #Markets

That's nr1 (5 likes & retweets). Nice one @RocknDad 😂- saw you sneak in both a like & retweet, but rules are rules.

#SouthAfrica dropping down to 10th in the #Country #ETF YTD rankings. #China losing the lead to #Taiwan. #Brazil new current holder of the wooden spoon.

#SouthAfrica dropping down to 10th in the #Country #ETF YTD rankings. #China losing the lead to #Taiwan. #Brazil new current holder of the wooden spoon.

That makes it 2.

#DevelopedMarkets (+2.5% in US$) making a bit of a comeback against #EmergingMarkets (+0.8% in US$) in February. #MSCI #SouthAfrica however outperformed both with 5.3% (in US$) over same period.

$URTH $EEM $EZA

#DevelopedMarkets (+2.5% in US$) making a bit of a comeback against #EmergingMarkets (+0.8% in US$) in February. #MSCI #SouthAfrica however outperformed both with 5.3% (in US$) over same period.

$URTH $EEM $EZA

#Global #ETF Weekly & Month-end (thread): 29 Jan 2021

- 2020 worst perf #sector making comeback in 2021 $IXC

- This is helping #oil producing countries with #Nigeria & #UAE in top5 #Country ETF YTD performers in USD $NGE $UAE

- #SouthAfrica $EZA moved into top15 YTD performers

- 2020 worst perf #sector making comeback in 2021 $IXC

- This is helping #oil producing countries with #Nigeria & #UAE in top5 #Country ETF YTD performers in USD $NGE $UAE

- #SouthAfrica $EZA moved into top15 YTD performers

2/12

#EmergingMarkets #ETF still storming ahead against #DevelopedMarkets ETF, still not relatively "overbought" yet, but getting close.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+0.2%) continued 2nd half on 2020 recovery against $URTH (-0.8%)

#EmergingMarkets #ETF still storming ahead against #DevelopedMarkets ETF, still not relatively "overbought" yet, but getting close.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+0.2%) continued 2nd half on 2020 recovery against $URTH (-0.8%)

#Global #ETF Weekly (thread): 15 Jan 2021

- 2020 worst perf #sector making comeback in 2021 $IXC

- This is helping #oil producing countries with #Nigeria, #UAE & #Russia in top5 #Country ETF YTD performers in USD $NGE $UAE $ERUS

- Few countries moving in red this week

- 2020 worst perf #sector making comeback in 2021 $IXC

- This is helping #oil producing countries with #Nigeria, #UAE & #Russia in top5 #Country ETF YTD performers in USD $NGE $UAE $ERUS

- Few countries moving in red this week

2/8

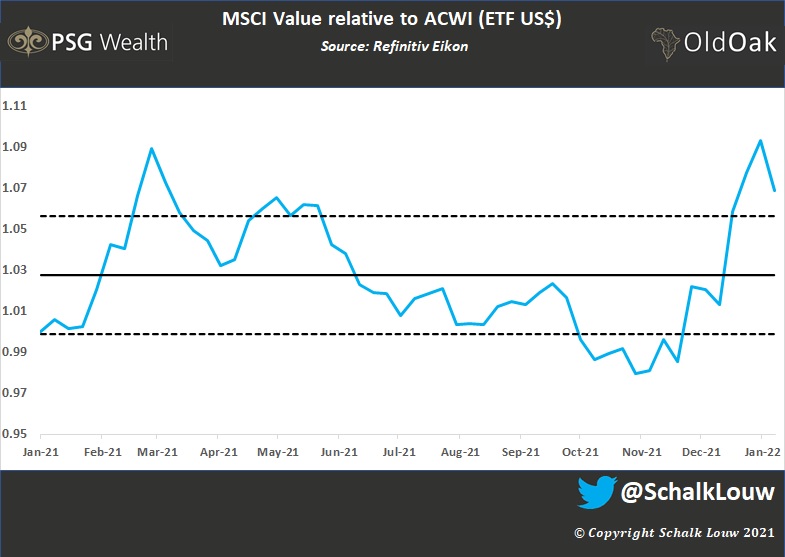

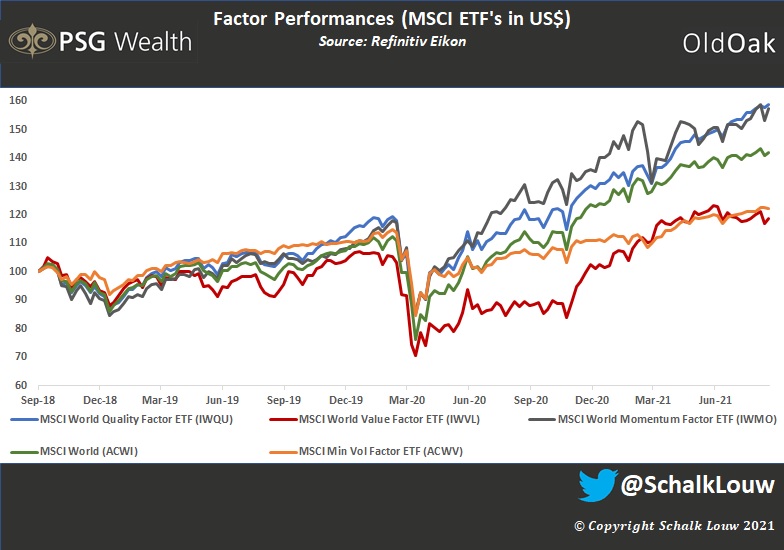

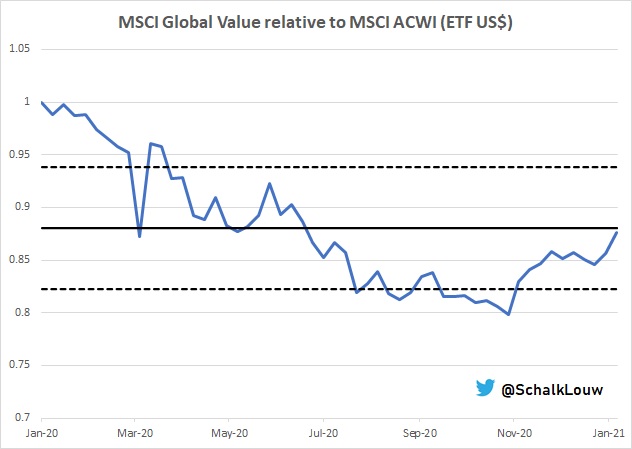

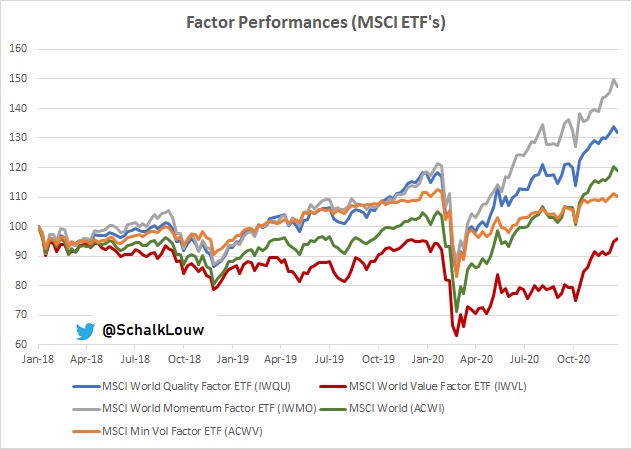

#Global #Value #stocks still making short-term recovery, with $IWVL #ETF still looking very strong relatively over the short-term. Over 3yr period it is however still lagging quite substantially.

This should be interesting for this months #OrbisvsSP500 unofficial challenge

#Global #Value #stocks still making short-term recovery, with $IWVL #ETF still looking very strong relatively over the short-term. Over 3yr period it is however still lagging quite substantially.

This should be interesting for this months #OrbisvsSP500 unofficial challenge

21 Stocks on 2021

2020 Recap of profitable stocks + unexpected bagger

2021 Stocks in Mind for Q1 only

There will be One for Everyone.

A thread.

2020 Recap of profitable stocks + unexpected bagger

2021 Stocks in Mind for Q1 only

There will be One for Everyone.

A thread.

Making money in #PSE is hard. When I realized that many of us are in this situation, I asked my friends to share ideas for Quarter 1 so that we will have something to begin with. Their ideas are varied because their trading strategies are different.

Find the one you relate to.

Find the one you relate to.

DMT @DMTagora teaches THE Vantage class and manages fund. If I won't have time to trade, he will be the only person I will go to.

His first buy will always be at the support. No to break out trade unless his existing shares has a low aep.

If unsure, he will sell.

His first buy will always be at the support. No to break out trade unless his existing shares has a low aep.

If unsure, he will sell.

UPDATE ON MARKETS: What a month! FTSE/JSE All Share improved by 10.5% during November, following 4.7% contraction during Oct & 1.6% decline in Sep. SA Property stocks made 17.5% recovery during Nov, bringing YTD performance to -43.6%. SA All Bond Index increased by 3.3% for month

2/13

South African Small Caps continued to perform well during November, growing by 15.56%. Mid-Caps and Large Caps grew by 10.05% and 10.37% respectively.

South African Small Caps continued to perform well during November, growing by 15.56%. Mid-Caps and Large Caps grew by 10.05% and 10.37% respectively.

3/13

FTSE/ JSE All Share ( $JALSH) again enjoyed a better month than the #MSCI All Country World Index in USD terms. The YTD performance for the JSE in USD-terms was -7.12% versus the MSCI ACWI’s performance of 11.10%.

FTSE/ JSE All Share ( $JALSH) again enjoyed a better month than the #MSCI All Country World Index in USD terms. The YTD performance for the JSE in USD-terms was -7.12% versus the MSCI ACWI’s performance of 11.10%.

福布斯:华盛顿准备和中国掀桌子

1、贸易谈判今年无结果;

2、若中国将RMB贬值到7.5,美国征另3000亿商品关税,并升税率到50%,中将RMB贬到8.5

3、更多中企被制裁

4、卢比奥提案冻结涉及危害南海和平的人资产(打台湾罚领导)

5、美将施压MSCI和彭博巴克莱全球综指踢出A股指数

forbes.com/sites/kenrapoz…

1、贸易谈判今年无结果;

2、若中国将RMB贬值到7.5,美国征另3000亿商品关税,并升税率到50%,中将RMB贬到8.5

3、更多中企被制裁

4、卢比奥提案冻结涉及危害南海和平的人资产(打台湾罚领导)

5、美将施压MSCI和彭博巴克莱全球综指踢出A股指数

forbes.com/sites/kenrapoz…

补充4

美国、日本、南韩和澳洲5月23日起在关岛附近3000人联合军演。

美国民主共和两党参议员重提“南海与东海制裁法”法案,惩罚在南海与东海从事“非法与危险”活动的中国个人和实体,责任人将遭美国政府查扣在美金融资产,及吊销或拒绝核发赴美签证,以遏制中国在南海扩张势力。

news.ltn.com.tw/news/world/pap…

美国、日本、南韩和澳洲5月23日起在关岛附近3000人联合军演。

美国民主共和两党参议员重提“南海与东海制裁法”法案,惩罚在南海与东海从事“非法与危险”活动的中国个人和实体,责任人将遭美国政府查扣在美金融资产,及吊销或拒绝核发赴美签证,以遏制中国在南海扩张势力。

news.ltn.com.tw/news/world/pap…

补充5

美国证监会推出新规,要求金融机构要代表客户“最佳利益”

细则应高度关注,因这描述象凯尔巴斯@Jkylebass 倡导的,美国基金经理不能买中国上市公司股票,因不透明及各种猫腻,基金经理买了就置客户利益于不顾,无职业操守

若真,影响中概股和MSCI、彭博巴克莱等指数基金

bloomberg.com/news/articles/…

美国证监会推出新规,要求金融机构要代表客户“最佳利益”

细则应高度关注,因这描述象凯尔巴斯@Jkylebass 倡导的,美国基金经理不能买中国上市公司股票,因不透明及各种猫腻,基金经理买了就置客户利益于不顾,无职业操守

若真,影响中概股和MSCI、彭博巴克莱等指数基金

bloomberg.com/news/articles/…

Pues se ha quedado una buena tarde para hablaros de los cajones de nuestro armario impasible, igual que se guarda ropa que vale para todo el año, nosotros guardamos activos que son deseables para toda la vida del inversor. #abrohilo #inversionimpasible #ImpassiveWealthFI

Los impasibles compramos los activos que consideramos deseables para la vida de un inversor, para ello nos gustan los ETFs de réplica física, líquidos, con comisiones ajustadas y, si es posible, de acumulación (re-inversión de dividendos). #inversionimpasible #ImpassiveWealthFI

Guardamos para siempre en nuestro armario impasible el #MSCI World, que sigue la evolución de las empresas grandes y medianas de los países desarrollados, y para ello compramos los siguientes ocho ETFs #inversionimpasible #ImpassiveWealthFI