Discover and read the best of Twitter Threads about #Spy

Most recents (24)

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 👇

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 👇

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

HOW TO TRADE #FOMC

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️ 👇🏼

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️ 👇🏼

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

🧵 How I mastered 90% win rate option trading.

DJ Khaled - They don’t want you to win.

Success is not given overnight , it is a mindset.

Basic overview, strategies & guidance , most common mistakes!

Education ⬇️

DJ Khaled - They don’t want you to win.

Success is not given overnight , it is a mindset.

Basic overview, strategies & guidance , most common mistakes!

Education ⬇️

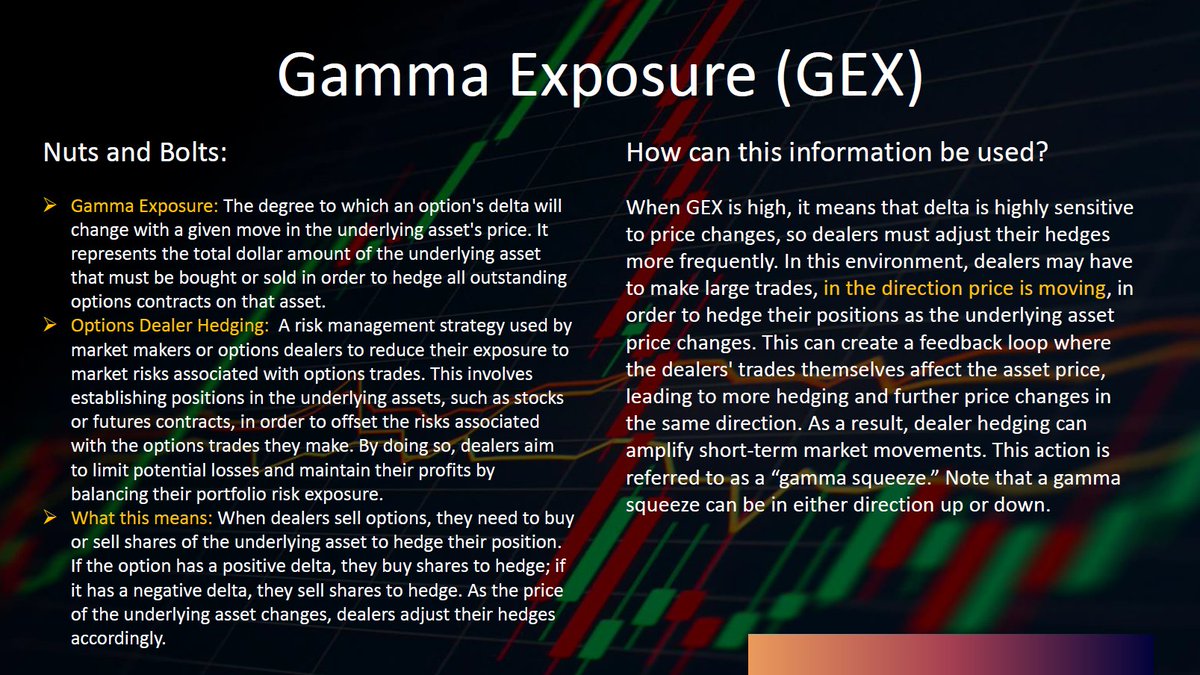

Gamma: (GEX) , which is a dollar-denominated measure of option market-makers' hedging obligations.

Things to remember/bookmark:

▪️High GEX env = lot of hedging needed = liquidity is added(+ GEX) or subtracted (- GEX)

▪️+ GEX = + gamma = Long calls go 1.0(delta) as they… twitter.com/i/web/status/1…

Things to remember/bookmark:

▪️High GEX env = lot of hedging needed = liquidity is added(+ GEX) or subtracted (- GEX)

▪️+ GEX = + gamma = Long calls go 1.0(delta) as they… twitter.com/i/web/status/1…

Delta: Measurement of change in option price as stock moves ⬆️ or ⬇️

▪️Between -1 and 1 for every option

▪️-1 to 0 for Puts

▪️0 to 1 for Calls

▪️More “in the money” the strike moves to option, more value it gains, closer it gets to -1 for Puts or +1 for Calls

▪️>90% options… twitter.com/i/web/status/1…

▪️Between -1 and 1 for every option

▪️-1 to 0 for Puts

▪️0 to 1 for Calls

▪️More “in the money” the strike moves to option, more value it gains, closer it gets to -1 for Puts or +1 for Calls

▪️>90% options… twitter.com/i/web/status/1…

1a- Contextual understanding

#Macro level

I posted this last night. The rotation from tech to Financial sector was the intervening variable pushing spy & QQQ down. QQQ bottomed at $308 that's when $SPY started to move up:

#Macro level

I posted this last night. The rotation from tech to Financial sector was the intervening variable pushing spy & QQQ down. QQQ bottomed at $308 that's when $SPY started to move up:

This is the start of Drip Drops Knowledge!

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

The first official Knowledge Drop. $GME reported earnings last night and is up over 50% this morning. A short float of 24% (as reported by #Ortex) might have something to do with that. Breakdown in slide, follow me for weekly Knowledge Drops!

#GME #ShortSqueeze

#GME #ShortSqueeze

Last week, I discussed the concept of a “short squeeze.” This week let’s look at the dynamics of dealer hedging and the concept of a “gamma squeeze.”

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

Somehow our pinned tweet disappeared, so here it is again

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

Market overview, key $SPX level to watch and info this week, CTA position info, general trends market, economic calendar, and various other info.

A short thread 🧵

Please ❤️ and 🔄 if you like this education information.

A short thread 🧵

Please ❤️ and 🔄 if you like this education information.

$SPX: As mentioned many times in previous tweets, 3950 has been held as a support from gamma, vanna, & as well as being 200 SMA. It all adds up from TA & PA perspective.

🔑 level to watch: $VIX- >22, bearish. 22-21 is chop. <20.60 for squeeze to 4040/4080.

RES @ 4065.

🔑 level to watch: $VIX- >22, bearish. 22-21 is chop. <20.60 for squeeze to 4040/4080.

RES @ 4065.

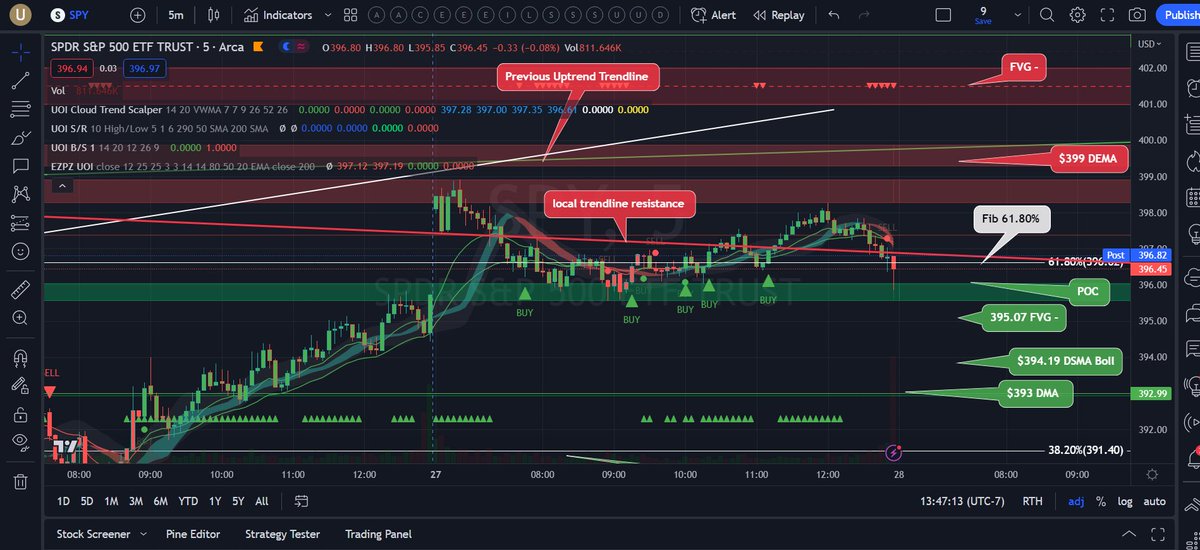

#SPY:

This is gamma (GEX) total profile for the next 2 expirations- mark 🔑 levels.

How to read this: MOST $$$ at $400 spy. (C/P). This means most hedging by MM.

Surprise? No. Major psych level & major 🧲 months!

Predominately bearish 395-390.

This is gamma (GEX) total profile for the next 2 expirations- mark 🔑 levels.

How to read this: MOST $$$ at $400 spy. (C/P). This means most hedging by MM.

Surprise? No. Major psych level & major 🧲 months!

Predominately bearish 395-390.

Here's a thread of (6) charts 📊 that are worth nothing from this last week's @MorganStanley Global Investment Committee (GIC) Weekly Report (01/30/23)... 🧵/👇🏼

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

1/🧵 "In the short run, flows, sentiment, positioning & technicals can be powerful drivers, while over the longer term, fundamentals like growth, profitability & productivity are critical, as are earnings surprises." @MorganStanley

#macro #earnings #stocks #StockMarket #bonds

#macro #earnings #stocks #StockMarket #bonds

2/🧵 "But sometimes, & for extended periods, markets can settle on one particular thesis, no matter how narrow or implausible." 📊h/t @MorganStanley @GoldmanSachs $MS $GS @Bloomberg

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

#US #military to test high-flying #surveillance #balloons that use #radar and #video to #track #people's movements | Aug 2, 2019

- Six states will act as a testing ground for a new wave of #balloon-based surveillance beacons

- Docs filed with the #FCC

dailymail.co.uk/sciencetech/ar…

- Six states will act as a testing ground for a new wave of #balloon-based surveillance beacons

- Docs filed with the #FCC

dailymail.co.uk/sciencetech/ar…

The regular flat grid chart is misleading to retail. The big money uses diamonds. It works on any minute chart and on a daily as well. that is how they communicate/coordinate beating retail. I discovered this 3 -4 month ago and it never fails.

The fight is now on the downward channel the bulls wanted to stop the cycle of down trends pushing it artificially higher to prevent $300. A downtrend channel is inevitable but what channel is the important question. because the next bottom moves higher.

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF! 🚀

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

My Strategy Rules in a Tweet...

#1 Short Below VWAP Long Above VWAP.

The VWAP is a great tool to always be aware of the trend even during the pull back are we pulling back to VWAP or breaking below? Little things here and there with the VWAP can save you a lot of issues

#1 Short Below VWAP Long Above VWAP.

The VWAP is a great tool to always be aware of the trend even during the pull back are we pulling back to VWAP or breaking below? Little things here and there with the VWAP can save you a lot of issues

#2 3 Minute Chart Setup

3 Minute Time frame with 3 EMAS.

8EMA 21EMA 51 EMA

We are looking for these 3 EMAS to be spaced/fanned out nicely showing the overall trend. Would love for Price to stay above 8EMA during a move higher and stay above 21 EMA during pull backs.

3 Minute Time frame with 3 EMAS.

8EMA 21EMA 51 EMA

We are looking for these 3 EMAS to be spaced/fanned out nicely showing the overall trend. Would love for Price to stay above 8EMA during a move higher and stay above 21 EMA during pull backs.

#3 MACD

The MACD is on my 3minute Chart. I am looking at MACD cross for Bullish/Bearish Bias. A downward move with a Bullish MACD normally results in choppy action. Same with Upward Bearish MACD. This can save you from buying a failed break out!

The MACD is on my 3minute Chart. I am looking at MACD cross for Bullish/Bearish Bias. A downward move with a Bullish MACD normally results in choppy action. Same with Upward Bearish MACD. This can save you from buying a failed break out!

BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

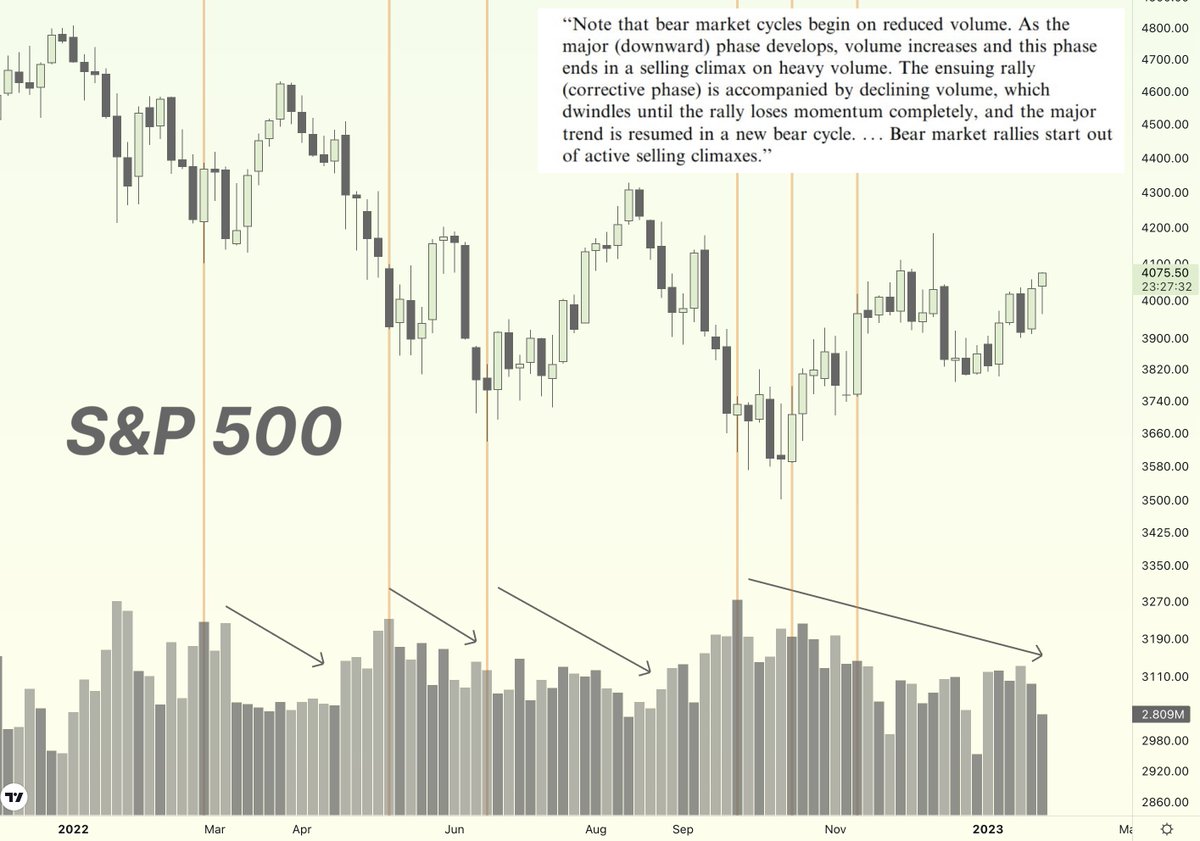

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Interested in learning about a new BACKTESTED metric with an edge?

We've produced one at GammaEdge (GE) we know you'll like.

Our traders think it's one of the most powerful & actionable metrics we provide.

Ready to learn how it can make you money?

Let's get to work🧵👇

We've produced one at GammaEdge (GE) we know you'll like.

Our traders think it's one of the most powerful & actionable metrics we provide.

Ready to learn how it can make you money?

Let's get to work🧵👇

1/ Before we get going, here is what you'll be able to answer by the end:

· What is Gamma?

· What is Gamma Exposure (GEX)?

· What is the GammaEdge GEX Ratio (GR)?

· How is the GR different from Put-Call Ratio (PCR)?

· How to make the GR actionable?

Sound good? 👇

· What is Gamma?

· What is Gamma Exposure (GEX)?

· What is the GammaEdge GEX Ratio (GR)?

· How is the GR different from Put-Call Ratio (PCR)?

· How to make the GR actionable?

Sound good? 👇

2/ A common gauge of fear in the market is the Put-Call Ratio (PCR).

However, this gauge is flawed.

Why?

Because it does not have a time component.

However, this gauge is flawed.

Why?

Because it does not have a time component.

$SPX has been trapped in a Noise Box for the past 14 days

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

Price Relationship to Gamma Levels: What does it Mean, How to Watch, & Where Should We Pay Attention?

We know there is considerable noise and confusion regarding gamma, and we work hard to clear the fog for you.

We provide a high-level answer to those questions here in this 🧵

We know there is considerable noise and confusion regarding gamma, and we work hard to clear the fog for you.

We provide a high-level answer to those questions here in this 🧵

1/ By the end of this thread, you'll have answers to the following:

· What is gamma?

· What are some of the key levels tracked by GammaEdge?

· What % of the time are we above/below a given gamma level?

· How do I track these levels and price relationships?

Let's dive in!

· What is gamma?

· What are some of the key levels tracked by GammaEdge?

· What % of the time are we above/below a given gamma level?

· How do I track these levels and price relationships?

Let's dive in!

2/ Gamma is a measure of how fast option delta changes when the price of a stock or ETF changes.

💡Delta can be thought of as shares of a stock or ETF, so if there is a large change in gamma (which directly impacts delta), your exposure to the market changes quickly.

💡Delta can be thought of as shares of a stock or ETF, so if there is a large change in gamma (which directly impacts delta), your exposure to the market changes quickly.

Market Commentary-

Disclaimer: I don't claim to know everything, as I have MUCH MORE learning left to do.

That said, I think beginners need to see bigger 🖼️ of markets instead of thinking ⬆️⬇️

#SPY , #SPX , #ES

ELI5 friendly. Info derived from @jam_croissant

See below:

Disclaimer: I don't claim to know everything, as I have MUCH MORE learning left to do.

That said, I think beginners need to see bigger 🖼️ of markets instead of thinking ⬆️⬇️

#SPY , #SPX , #ES

ELI5 friendly. Info derived from @jam_croissant

See below:

1/

Market has gone essentially NOWHERE from November 10th onwards. We've been stuck in a range anywhere from 3850 - 4100 on $SPX (~385 - ~410 $SPY) for the past month. A day trader's dream.

A perma 🐻 and perma 🐂worst nightmare.

Indecisive, rangebound, sideways market.

⬆️⬇️?

Market has gone essentially NOWHERE from November 10th onwards. We've been stuck in a range anywhere from 3850 - 4100 on $SPX (~385 - ~410 $SPY) for the past month. A day trader's dream.

A perma 🐻 and perma 🐂worst nightmare.

Indecisive, rangebound, sideways market.

⬆️⬇️?

2/

What if I told you that there's a structural "method behind the madness?"

That structure is 🦍 aka "Gary" aka Dealers/MM (and in this context: specific to implied vol positioning)!

Now, you may be asking:

"WTF does that have to do with markets being in a range?"

EVERYTHING.

What if I told you that there's a structural "method behind the madness?"

That structure is 🦍 aka "Gary" aka Dealers/MM (and in this context: specific to implied vol positioning)!

Now, you may be asking:

"WTF does that have to do with markets being in a range?"

EVERYTHING.

TODAY IN THE MARKETS

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF! 🚀

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF! 🚀

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

The market today:

$SPX / $SPY / $ES

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#SPX #ES_F #trading #options #futures #daytrading #TradingSignals

$SPX / $SPY / $ES

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#SPX #ES_F #trading #options #futures #daytrading #TradingSignals

$DIA / $DJI / $YM

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#DIA #DJIA #DowJones #trading #options #Futures #OptionsTrading #DayTrading #TradingSignals #YM_F

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#DIA #DJIA #DowJones #trading #options #Futures #OptionsTrading #DayTrading #TradingSignals #YM_F

$QQQ / $NDX / $NQ

It closed below the key 20DMA in higher volume than yesterday

It's still in its short-term upward trending channel and its mid-term downward channel

It bounced near channel support

#QQQ #NASDAQ #IXIC #NDX #trading #OptionsTrading #Futures #NQ_F #daytrading

It closed below the key 20DMA in higher volume than yesterday

It's still in its short-term upward trending channel and its mid-term downward channel

It bounced near channel support

#QQQ #NASDAQ #IXIC #NDX #trading #OptionsTrading #Futures #NQ_F #daytrading

Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out tomorrow morning before the open

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out tomorrow morning before the open

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

•High rates, inflation, dollar

•Powell, and 8 more FEDs are coming

•Geopolitical tensions

• $VIX, $VVIX extremely oversold

• $FAANG struggling with 50DMA

• #Nasdaq rejected at 100DMA

• $RUT under 200DMA

• Short sellers at $SPX 200DMA

$ES_F

The Bear's take:

•High rates, inflation, dollar

•Powell, and 8 more FEDs are coming

•Geopolitical tensions

• $VIX, $VVIX extremely oversold

• $FAANG struggling with 50DMA

• #Nasdaq rejected at 100DMA

• $RUT under 200DMA

• Short sellers at $SPX 200DMA

$ES_F