Discover and read the best of Twitter Threads about #Traders

Most recents (24)

1/6 #OrderBookAnalysis 🧵

TLDR: Liquidity=Sentiment

Liquidity placement in the order book reveals #Sentiment for a price range! 📊📈

💧 When more liquidity is concentrated around a particular price level, it indicates increased confidence or interest from #traders...

TLDR: Liquidity=Sentiment

Liquidity placement in the order book reveals #Sentiment for a price range! 📊📈

💧 When more liquidity is concentrated around a particular price level, it indicates increased confidence or interest from #traders...

2/6 Analyzing the order book with a #DataViz tool like #FireCharts helps you mitigate risk by replacing speculative decisions with data based decisions.

No reason to speculate when you can literally see where higher concentrations of liquidity mark resistance and support.

No reason to speculate when you can literally see where higher concentrations of liquidity mark resistance and support.

3/6 Knowing where liquidity ISN'T, is as important as knowing where it is. Thin liquidity indicates zones with greater potential for volatility since price moves through them with less friction.

But there is one more aspect of #OrderBookAnalysis I personally value the most...

But there is one more aspect of #OrderBookAnalysis I personally value the most...

गेल्या ९ महिन्यात तब्बल ५३ लाख ॲक्टिव ट्रेडर्सने एनएसईवर ट्रेड करणं बंद केलंय. काय असेल कारण? जाणून घेऊयात या थ्रेडच्या माध्यमातून...

Thread 👇

नक्की RT द्या.

#ShareMarket #StockMarket #Traders #Marathi #म #मराठी

Thread 👇

नक्की RT द्या.

#ShareMarket #StockMarket #Traders #Marathi #म #मराठी

@MarathiRT @MarathiBrain @Mazi_Marathi @BeyondMarathi @Marathi_HashTag @HashMarathi @HashTagMarathi जुन २०२२मध्ये एनएसईवर ३.८ कोटी ॲक्टिव ट्रेडर्स होते, जे ५३ लाखांनी कमी होऊन मार्च २०२३ पर्यंत ३ कोटी २७ लाखांवर आले आहेत. हळू हळू परंतू सातत्याने हे ॲक्टिव ट्रेडर्स एनएसईवरुन कमी होत आहेत.

#ShareMarket #StockMarket #Traders #Marathi #म #मराठी

1/n

#ShareMarket #StockMarket #Traders #Marathi #म #मराठी

1/n

@MarathiRT @MarathiBrain @Mazi_Marathi @BeyondMarathi @Marathi_HashTag @HashMarathi @HashTagMarathi जुन २०२२चा एनएसईवरील ॲक्टिव ट्रेडर्सचा आकडा हा आजपर्यंतचा सर्वोत्तम होता. मग मार्केड साईडवेज व डाऊनट्रेंडमुळे अनेक ॲक्टिव ट्रेडर्स मार्केटमधून बाहेर पडत आहेत. यातील बहुतांश ट्रेडर आहेत, जे मार्केटमध्ये नुकतेच आलेले आहेत किंवा त्यांच्याकडे तेवढा स्किलसेट नाही. #ShareMarket… twitter.com/i/web/status/1…

New iOS in #Markets

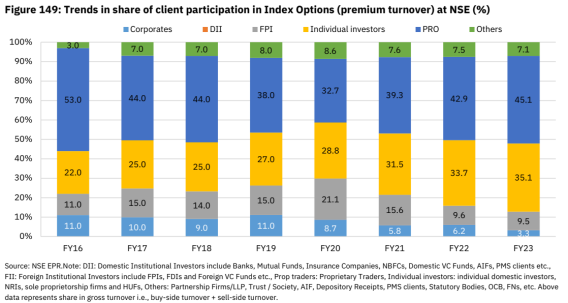

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Well, time to explain what we do with coins and why we deposit most of them on exchanges. Even #floki holders believe that we dump all the purchased coins, because we bought 81B #floki from and send them to exchanges. We just sent 57B floki to the on-chain wallet. @RealFlokiInu

The rest sit across exchanges, because as MM we must provide liquidity 24/7. Link to the wallet, feel free to check. bscscan.com/address/0x073A…

Whether you like it or not, we're in an #economic #reset & nothing can stop it

The #macro chart of the #USA #economy reveals a crucial insight everyone should pay attention to

US #GDP & M2 money supply in #USD tn

Read on...

#tradingview chart👉bit.ly/3IwTBrt

1/🧵

The #macro chart of the #USA #economy reveals a crucial insight everyone should pay attention to

US #GDP & M2 money supply in #USD tn

Read on...

#tradingview chart👉bit.ly/3IwTBrt

1/🧵

Untill 2011, money supply M2 consistently remained below 60% of #GDP

#Growth in M2 kept pace with GDP growth

Enabling low #inflation secular growth #economy

Despite popular #fintwit narrative, even GFC of 2008 did not upset M2 GDP⚖️balance

This is what GFC did...

2/🧵

#Growth in M2 kept pace with GDP growth

Enabling low #inflation secular growth #economy

Despite popular #fintwit narrative, even GFC of 2008 did not upset M2 GDP⚖️balance

This is what GFC did...

2/🧵

The Nifty Financial Services Index, also known as the #FinNifty, is an index that tracks the performance of the financial services sector in India. @bbrijesh explains about the index in detail.

#FinNifty is an index that tracks the performance of the financial services sector in India, which includes #banks, #insurance companies, #housingfinance, and Non-Banking Financial Companies (NBFCs). #FinancialServicesSector #India

The financial services sector in India is one of the largest and most diverse in the world, and FinNifty provides a way to track the performance of this sector. #FinancialServicesSector #GrowthPotential

✨Crisp Observations😉

#Traders v/s #Investors:

Traders look at Price,

Investors look at Value.

Traders watch CNBC,

Investors Read Books.

Traders Book Profits,

Investors Book Losses.

Traders make Brokers Rich,

Investors make themselves Rich .

(cont...)🧵

#Traders v/s #Investors:

Traders look at Price,

Investors look at Value.

Traders watch CNBC,

Investors Read Books.

Traders Book Profits,

Investors Book Losses.

Traders make Brokers Rich,

Investors make themselves Rich .

(cont...)🧵

Traders may sleep anxiously,

Investors usually sleep deep.

Traders average on Downside,

Investors average on Upside.

Traders look at 10% Profit,

Investors look at 10x Profits.

Trading is a Maths,

Investing is an Art.

Traders ride on Tips,

Investors ride on Research.

(cont...)

Investors usually sleep deep.

Traders average on Downside,

Investors average on Upside.

Traders look at 10% Profit,

Investors look at 10x Profits.

Trading is a Maths,

Investing is an Art.

Traders ride on Tips,

Investors ride on Research.

(cont...)

1/23 It's easy to find bullish and bearish elements in the charts to fit you bias, but being a maxi can be risky. Remember:

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

Markets ebb and flow

Data constantly changes

Your bias only needs to match the TF you are trading

A 🧵 on the #data influencing the #BTC trend and PA.

#NFA

2/23 Before we dive into the macro for #Bitcoin, let's look at what's happening this week. It's rare to have a Daily MA #GoldenCross and a Weekly MA #DeathCross happening on the same asset.

3/23 The #GoldenCross printed and the #DeathCross between the 200 & 50 WMA's is coming on the next candle. Knowing why we have conflicting signals isn't as critical as knowing how price will react, but if I had to guess, I'd say, short term manipulation.

One of the crucial trading practices that experienced traders vouch for is maintaining a trading journal ✍️

In today's 🧵, we explore what a trading journal is and how it helps #traders to stay disciplined and organized.

#TradingJournal #cryptofutures

In today's 🧵, we explore what a trading journal is and how it helps #traders to stay disciplined and organized.

#TradingJournal #cryptofutures

2/ It is important for any trader to have a trading journal to review their trades & identify what works and what doesn't. The planning of futures trades, documentation of existing positions, and recording of emotions are all important aspects of a successful trading strategy.

3/ Components of a trading journal include risk management, trade analysis, trade execution, and strategy execution. By tracking these components, you can get a better understanding of how your strategy is performing. 📈

#cryptotraders

#cryptotraders

BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

How do you feel about this?

If you watch his video he specifically says it is to make people feel heard, the ai then uses that as it’s opener, “I hear you”.

How does this sit with you? I think if participants were informed about it, ok, great even. If they were uninformed 🤮

If you watch his video he specifically says it is to make people feel heard, the ai then uses that as it’s opener, “I hear you”.

How does this sit with you? I think if participants were informed about it, ok, great even. If they were uninformed 🤮

Here’s a few tweets about it I’ve seen

1/3

1/3

2/3

(1/6) Hi everyone! This is the thirteenth (13th) update on this final stage of the evolution of Profit Sharing 2.0 and the first of the year 2023! This first quarter will be full of news for #Zignaly and #ProfitSharing 2.0. 🤩🥳

Read more below🧵

Read more below🧵

(2/6) Today, we will start contacting the biggest services in the #marketplace in order to start coordinating the migration of their services to PS 2. So if you’re a trader, you can schedule your migration through email, where all instructions have already been sent to you! 🎯💪🏻

(3/6) We are also integrating the possibility for traders to create customized #APIs for their #ProfitSharing 2.0 services directly from the new interface, without the need for us to do it for them. ⚒️🤝🏼

(1/6) Are you looking to get into #trading but don't know where to start? Here is an overview of the longer-time frame trading strategy which is one of the widely recognized strategies! 🧵

Read more at medium.com/zignaly/llts65…

Read more at medium.com/zignaly/llts65…

(2/6) Understand what the longer-time frame #tradingstrategy is - it uses charts with a more significant time frame from one hour to one day and has slower price changes. 📈⏳

(3/6) Benefits of #trading this way - you don't have to spend the entire trading day in front of a computer and it helps control emotions as you can make better trading decisions when not as emotional. 🤯

Hey everyone, let's talk about economic calendars! An #economiccalendar is a tool that helps traders and investors keep track of important financial events and data releases. 1/n

This includes things like central bank meetings, #GDP reports, and #employment figures. By knowing when these events are happening, you can make informed decisions about your investments.

2/n

2/n

Most economic calendars also provide information on the expected impact of each event. This can help you gauge how markets are likely to react to certain news. I loved the way @Investingcom explains the impact.

3/n

3/n

Explaining open interest in simple terms …

#OpenInterest is a measure of the number of outstanding #derivative contracts in a particular market.

#OpenInterest is a measure of the number of outstanding #derivative contracts in a particular market.

It reflects the number of contracts that have not been closed or settled, and helps to show the level of activity in a market.

When open interest increases, it can indicate that new #money is entering the market.

In a #Bull #Market, new stocks break out on high #Volume every day. One of the challenges of a #breakout trader is find the best #BreakoutStocks to buy because they go up so fast that often it is hard to get a low-risk entry.

Here's a thread on one way to go about doing it.

Here's a thread on one way to go about doing it.

1) To find the best #breakoutstocks, one has to focus on the right sector and then monitor #stocks within that sector for #volume #breakouts. Eg. #PSU Banks did a very strong #breakout recently with most of the stocks within #NIFTYPSUBANK index giving a 50% gain in a short time!

2) First let’s see what happened in this sector in terms of the sequence of #breakouts. #NIFTYPSUBANK broke out of a sound base on 24th Oct, 22 as below. The leaders within this sector broke out even before the index broke out, e.g. INDIANBK, CANBK, UNIONBANK, BANKBARODA.

(1/8) This is the eighth update on this final stage of the evolution of Profit Sharing 2.0. 📢 📢

This week we are very excited. Users have been testing the interface for more than a week, and we are giving access to more users every day! ⚙️📅 💪

This week we are very excited. Users have been testing the interface for more than a week, and we are giving access to more users every day! ⚙️📅 💪

(2/8) Hear the good news out loud: So far, #everything is working as planned and the feedback have been very positive! As we mentioned before, another positive thing is that all the visual work is complete since everything is finished from the #backend 🤫✨

(3/8) This week, we concentrated on four things. i) moving forward with the first #metrics for the service profiles. #Investors are now able to see the #evolution of the strategies before they start investing. We plan to add a lot of metrics going ahead ⌚ 🚀

Great Depression in a single tweet. 1920-1928 was a period of avg growth including 2 recessions. The stock market did 4x between 1921-1929(leveraged purchases). Valuations did not reflect economic reality. Fed hikes-stocks collapse-aggregate demand collapses & rest is, history.

(1/8) The wait is over!! We announce an update on #Zignaly’s Flagship #ProfitSharing Services.

Disrupting the social investing space, our Private Beta version of PS2.0 services goes live today!

Follow this thread to get further insight! 🧵🤩

Disrupting the social investing space, our Private Beta version of PS2.0 services goes live today!

Follow this thread to get further insight! 🧵🤩

(2/8) We call #PS2.0 our biggest transformation to date.

Our focus is on providing a seamless user experience, freedom of choice (backed by the addition of new #traders, agile balance management, and hard disconnection), and #transparency. 💪💸

Our focus is on providing a seamless user experience, freedom of choice (backed by the addition of new #traders, agile balance management, and hard disconnection), and #transparency. 💪💸

(3/8) All shortlisted community members who applied for using P2.0 services will be the first ones to use our new platform! 🥇🏁

Very high % aim constantly on investments is biggest trap one can set him/herself for in markets. We have seen frenzy in #crypto and #smallcaps over past 1.5 year, which caused many of bagheld positions.

The higher your % aim is, the bigger the need to be close to market.

1.

The higher your % aim is, the bigger the need to be close to market.

1.

Aiming small % in any speculative market is not as difficult, as % are ramped 10 fold, the difficulty increases massively and your chances of failure too.

Reason: Need for timing increases as well. To get high % movers the timing on cycle start/finish has to be excellent.

2.

Reason: Need for timing increases as well. To get high % movers the timing on cycle start/finish has to be excellent.

2.

Extracting 10 500% rallying tickers out of one strong cycle requires a great cycle timing skills, knowing when aprox the cycle really has started and how much longer can it aprox still have. Why beginners fail here? Because this takes (2-5) years of training to develop.

3.

3.

Zeit für die nächste Mindmap-Auskoppelung:

#DSA und der #Datenschutz

Bekanntlich lässt der DSA ja die #DSGVO unberührt ("without prejudice"). Aber: Es wimmelt im DSA nur so von datenschutzrelevanten Regelungen. Fangen wir mit den Rechtsgrundlagen an:

DSGVO lila↙️ DSA gelb↘️

#DSA und der #Datenschutz

Bekanntlich lässt der DSA ja die #DSGVO unberührt ("without prejudice"). Aber: Es wimmelt im DSA nur so von datenschutzrelevanten Regelungen. Fangen wir mit den Rechtsgrundlagen an:

DSGVO lila↙️ DSA gelb↘️

#DSA und der #Datenschutz

DSA enthält DatenverarbeitungsVERBOTE, durch die Rechtsgrundlagen der #DSGVO (insbes. #Einwilligung, #Vertrag und #berechtigtesInteresse) ausgeschlossen werden.

DSA enthält DatenverarbeitungsGEBOTE, also rechtliche Verpflichtungen zur Verarbeitung pbD.

DSA enthält DatenverarbeitungsVERBOTE, durch die Rechtsgrundlagen der #DSGVO (insbes. #Einwilligung, #Vertrag und #berechtigtesInteresse) ausgeschlossen werden.

DSA enthält DatenverarbeitungsGEBOTE, also rechtliche Verpflichtungen zur Verarbeitung pbD.

Der #DSA nimmt insbesondere Art. 6 Abs. 1 lit. c #DSGVO für datenschutzrechtliche Regelungen in Anspruch:

dsgvo-gesetz.de/art-6-dsgvo/

Anders sind mE die zahlreichen Verpflichtungen des DSA jedenfalls nicht zu erfüllen👇

dsgvo-gesetz.de/art-6-dsgvo/

Anders sind mE die zahlreichen Verpflichtungen des DSA jedenfalls nicht zu erfüllen👇

#Fundamental and #chart analysis of leader of #cement sector #ULTRATECH #cement #Limited which has delivered good profit growth of 21.9% CAGR over last 5 years

#Chart analysis of #ULTRATECH CMP 6903

✅Reason 1

➡️#ULTRATECH was in downtrend with fall from 8269

➡️This fall had formed very strong and textbook Head & Shoulder Pattern which is getting negated with breakout of equally strong inverse Head & Shoulder Pattern.

✅Reason 1

➡️#ULTRATECH was in downtrend with fall from 8269

➡️This fall had formed very strong and textbook Head & Shoulder Pattern which is getting negated with breakout of equally strong inverse Head & Shoulder Pattern.

✅Reason 2

➡️Downtrend of #ULTRATECH with fall from 8269 was over after hitting 61.8% Fibonacci retracement level

➡️Stock has regained price above 23.6% level and next is ATH level

✅Reason 3

➡️Stock is above all moving averages

➡️Downtrend of #ULTRATECH with fall from 8269 was over after hitting 61.8% Fibonacci retracement level

➡️Stock has regained price above 23.6% level and next is ATH level

✅Reason 3

➡️Stock is above all moving averages

'Global food prices are once again facing upward pressure due to the record cost for shipping grain in the U.S., the source of about 20% of world exports...drought conditions have caused water levels in the Mississippi River to drop' increasing costs

asia.nikkei.com/Economy/Inflat…

asia.nikkei.com/Economy/Inflat…

2/x

And not just the Mississippi-

Drought has been a huge problem for shipping across large swaths of the northern hemisphere in 2022, impacting distribution of crops & other commodities.

#ClimateCrisis #drought #heatwave #trade

splash247.com/fiercely-hot-s…

And not just the Mississippi-

Drought has been a huge problem for shipping across large swaths of the northern hemisphere in 2022, impacting distribution of crops & other commodities.

#ClimateCrisis #drought #heatwave #trade

splash247.com/fiercely-hot-s…

3/x

"An unsettling drop in water levels in key European waterways has resulted in immensely strained logistics in shipping commodities throughout the continent, with barges only able to carry one-third or one-quarter of their usual cargo."

#Europe #trade

splash247.com/fiercely-hot-s…

"An unsettling drop in water levels in key European waterways has resulted in immensely strained logistics in shipping commodities throughout the continent, with barges only able to carry one-third or one-quarter of their usual cargo."

#Europe #trade

splash247.com/fiercely-hot-s…

Here are the top 5 learning threads 🧵 that can help you in your trading journey.

A master thread:

A master thread:

1/ Generating extra returns on trading capital:

A simple guide on how a trader can generate additional returns on their trading capital apart from active trading returns.

A simple guide on how a trader can generate additional returns on their trading capital apart from active trading returns.