Discover and read the best of Twitter Threads about #chART

Most recents (24)

6 Must have line charts for business data analysis 📈👌 💯

🧵

🧵

1. Indexed chart for comparing trend

2. #Sparkline for tiny insight

3. Spaghetti line #chart for bringing focus

4. Smoothed line chart for evening out edge

5. Forecast chart to predict future value based on trend & seasonality

6. Line chart combination when just a line won't do

2. #Sparkline for tiny insight

3. Spaghetti line #chart for bringing focus

4. Smoothed line chart for evening out edge

5. Forecast chart to predict future value based on trend & seasonality

6. Line chart combination when just a line won't do

▶ Line charts are similar to #scatterplots except that they connect the data points with lines. Choose a line chart when ordering and joining the #data points by their X-axis values highlights meaningful changes in the vertical Y-axis variable.

🚨ADOTTA ANCHE TU UN CHAIR #FED🚨

🎉 Lo ammetto, sono esaltato da questo mese di Gennaio che mi ha regalato forti emozioni e ottimi profit 🤑

Ma stamattina ho sentito un certo rimorso verso quel povero chair della #FED.

Questo thread è per te, Jerome 💙 🧵

🎉 Lo ammetto, sono esaltato da questo mese di Gennaio che mi ha regalato forti emozioni e ottimi profit 🤑

Ma stamattina ho sentito un certo rimorso verso quel povero chair della #FED.

Questo thread è per te, Jerome 💙 🧵

Our ace chartist @bbrijesh posts the Index chart in his video. Let us understand on how he creates this index in Tradingview to analyze the charts. #Index #TechnicalAnalysis #charting

[1/🧵] With all of the #XRPBuyback debate going on, there is one aspect that frequently gets misrepresented

▶️ People conflating the terms "#price" and "#value"

Because the definitions differ, it is essential to comprehend the distinctions

Let us evaluate it more closely. 👇🧵

▶️ People conflating the terms "#price" and "#value"

Because the definitions differ, it is essential to comprehend the distinctions

Let us evaluate it more closely. 👇🧵

2022 was another challenging year for the @ecb. My personal review of the year collects some of my speeches and a few striking charts. All speeches and accompanying slides can be found on the @ecb’s website. A special thanks goes to #ECBstaff for their continuous support! 1/19

The speech “Looking through higher energy prices? Monetary policy and the green transition” (8 Jan 2022) argued that monetary policy cannot afford to look through higher energy prices if they pose a risk to medium-term price stability. #ClimateChange 2/19 ecb.europa.eu/press/key/date…

#Chart US shale oil production has been responding more slowly to rising oil prices, as fossil investments may no longer prove profitable to investors over the medium term. 3/19

1/6 It's not that complicated. When a company issues #stock to employees or the public, it increases shares outstanding and dilutes #earnings per share.

2/6 Give the #stock to the employee, and the cash doesn’t show up on the balance sheet. Robbing Peter to pay Paul. In #broaddaylight

3/6 In the run-up to the peak of the dot com bubble, #stockcomp felt good. Until the stocks started going down and it felt awful. That is precisely where we are today. It tends to be a self-reinforcing spiral.

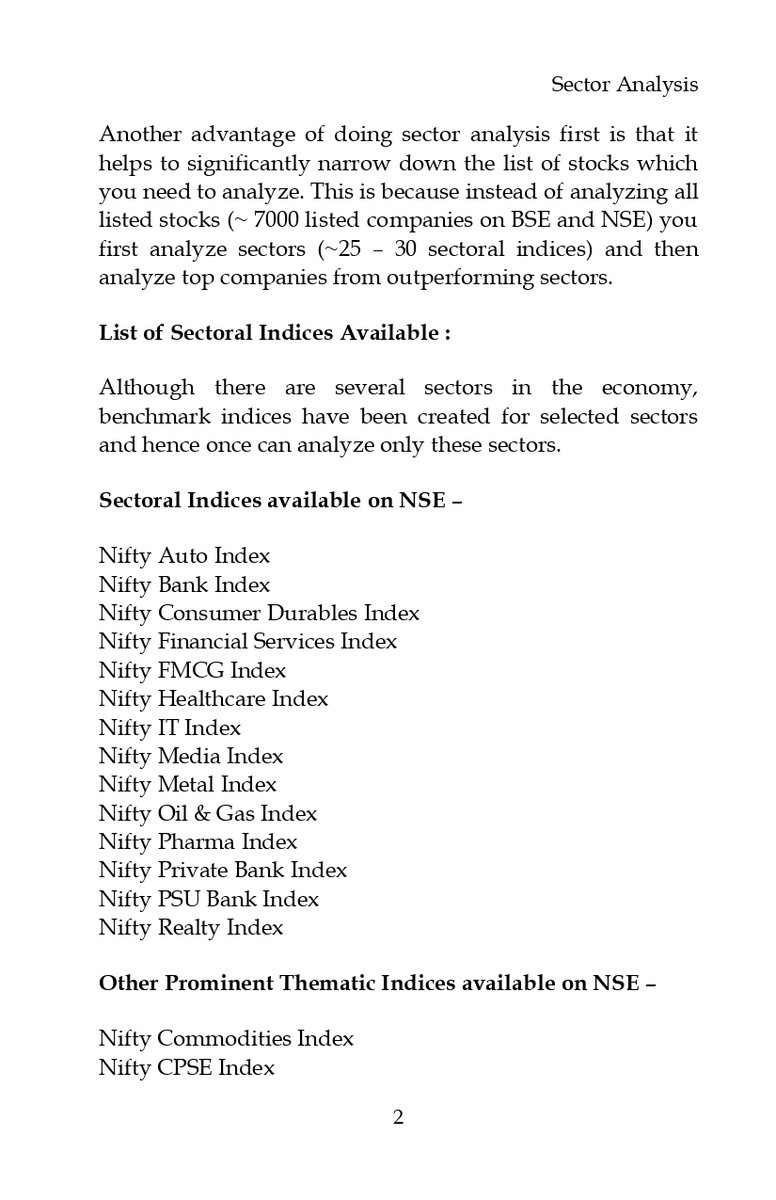

Thread 🧵Sector Analysis

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️ to spread learning with all.

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️ to spread learning with all.

1⃣ Why Sector Analysis is Must ?

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

2⃣ NIFTY MIDCAP 50

Good resistance is seen ~ 8930 - 40 level. A good Cup shape breakout expected soon. Once breakout is done we can expect the midcap index and many midcap stocks joining the rally in couple of weeks

#NiftyMidcap #Midcaps #TechnicalAnalysis

Good resistance is seen ~ 8930 - 40 level. A good Cup shape breakout expected soon. Once breakout is done we can expect the midcap index and many midcap stocks joining the rally in couple of weeks

#NiftyMidcap #Midcaps #TechnicalAnalysis

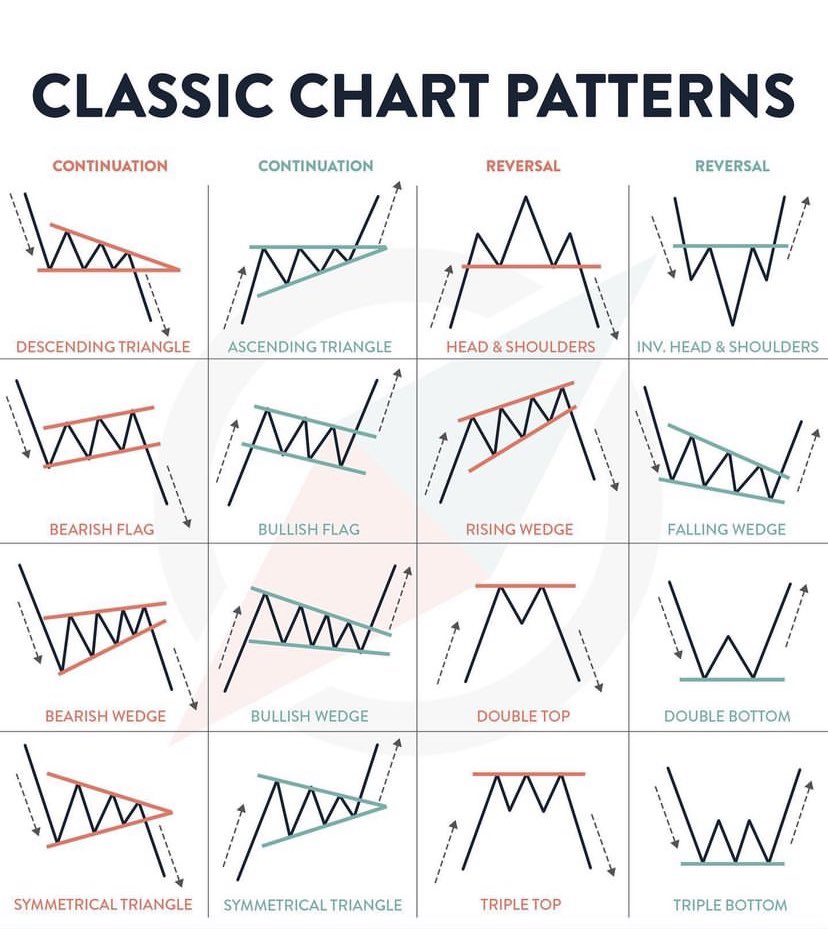

#Fundamental and #chart analysis of leader of #cement sector #ULTRATECH #cement #Limited which has delivered good profit growth of 21.9% CAGR over last 5 years

#Chart analysis of #ULTRATECH CMP 6903

✅Reason 1

➡️#ULTRATECH was in downtrend with fall from 8269

➡️This fall had formed very strong and textbook Head & Shoulder Pattern which is getting negated with breakout of equally strong inverse Head & Shoulder Pattern.

✅Reason 1

➡️#ULTRATECH was in downtrend with fall from 8269

➡️This fall had formed very strong and textbook Head & Shoulder Pattern which is getting negated with breakout of equally strong inverse Head & Shoulder Pattern.

✅Reason 2

➡️Downtrend of #ULTRATECH with fall from 8269 was over after hitting 61.8% Fibonacci retracement level

➡️Stock has regained price above 23.6% level and next is ATH level

✅Reason 3

➡️Stock is above all moving averages

➡️Downtrend of #ULTRATECH with fall from 8269 was over after hitting 61.8% Fibonacci retracement level

➡️Stock has regained price above 23.6% level and next is ATH level

✅Reason 3

➡️Stock is above all moving averages

RBI is playing with FIRE abt intervention in the FWD USDINR market…. Your sins with come back to haunt you … unlike Equities which can be manipulated for years, you can’t do that same with FX and RATES

@RBI EXTENT Of Forward Intervention is #MindBoggling in one #CHART. You can see INR 2yr & 3yr Implied Forward Premium is 7.8% & 7.59% Respectively

& has Actually Increased while the near term 12 Month INR forward is just 2.5%. This kind of DIVERGENCE is SCARY.#RETWEET #MUSTREAD

& has Actually Increased while the near term 12 Month INR forward is just 2.5%. This kind of DIVERGENCE is SCARY.#RETWEET #MUSTREAD

Are you a good stock market trader?

Become better & improve yourself

😎💡📈📊💰 #Thread with @Stocktwit_IN

#trading #learning #StockMarket

Become better & improve yourself

😎💡📈📊💰 #Thread with @Stocktwit_IN

#trading #learning #StockMarket

Are you a good stock market trader?

Become better & improve yourself

😎💡📈📊💰

with @Stocktwit_IN @TradingView_IN

#trading #learning #StockMarket

Become better & improve yourself

😎💡📈📊💰

with @Stocktwit_IN @TradingView_IN

#trading #learning #StockMarket

Are you a good stock market trader?

Become better & improve yourself

😎💡📈📊💰

#trading #learning #StockMarket

Become better & improve yourself

😎💡📈📊💰

#trading #learning #StockMarket

[#THREAD]

Vous êtes vous déjà dit : "J'ai acheté trop tard" ou "J'ai vendu trop tôt"!

Rationalisez votre stratégie d'investissement grâce à la plateforme 4kings.xyz

Venez découvrir cet outil d'aide à l'investissement et rendez vos positions lucratives sans stress

Vous êtes vous déjà dit : "J'ai acheté trop tard" ou "J'ai vendu trop tôt"!

Rationalisez votre stratégie d'investissement grâce à la plateforme 4kings.xyz

Venez découvrir cet outil d'aide à l'investissement et rendez vos positions lucratives sans stress

[DISCLAIMER]

Les méthodes et #outils présentés dans ce #thread ne constituent pas un conseil en #investissement.

Par ailleurs, s'appuyer sur cet outil ne vous dispense pas de réaliser des recherches sur les fondamentaux des projets.

Les méthodes et #outils présentés dans ce #thread ne constituent pas un conseil en #investissement.

Par ailleurs, s'appuyer sur cet outil ne vous dispense pas de réaliser des recherches sur les fondamentaux des projets.

$LUNA has added more than 13,800% to its value over the past 12 months, and predicted to grow 350% by the end of 2022.

Easy and simple explanation on why you should not underestimate the 2nd largest blockchain in #DeFi Today ! ⬇️🧵

Easy and simple explanation on why you should not underestimate the 2nd largest blockchain in #DeFi Today ! ⬇️🧵

1. The decentralized finance space is one of the biggest winners this year.

A recent report revealed that the total value locked (TVL) in DeFi #protocols rose by $100 billion in 2021. While $ETH remains the leading DeFi blockchain, Terra is the biggest winner.

A recent report revealed that the total value locked (TVL) in DeFi #protocols rose by $100 billion in 2021. While $ETH remains the leading DeFi blockchain, Terra is the biggest winner.

2. @terra_money is an algorithmic #stablecoin platform that works on a Proof of Stake (PoS) #blockchain infrastructure.

$LUNA is the native #token of Terra and is used in the issuance of stablecoins, as a price stability mechanism, and also for staking and network governance.

$LUNA is the native #token of Terra and is used in the issuance of stablecoins, as a price stability mechanism, and also for staking and network governance.

#mirza #International

#MIRZAINT

So, finally MIRZA has outlined the scheme of demerger of its biz. verticals in to 'Redtape' & 'Mirza'.

In this #Thread 🧵we will share:

1. About Mirza Int.

2. Merger/De-merger proposal

3. Redtape-valuation & comparison w/ peer

Let's start

1/

#MIRZAINT

So, finally MIRZA has outlined the scheme of demerger of its biz. verticals in to 'Redtape' & 'Mirza'.

In this #Thread 🧵we will share:

1. About Mirza Int.

2. Merger/De-merger proposal

3. Redtape-valuation & comparison w/ peer

Let's start

1/

2/🧵

#MIRZAINT

⭐️Founded in 1979, Mirza is India’s leading leather footwear manufacturer

⭐️ It is preferred supplier of leather footwear to international brands.

⭐️One of the largest Indian suppliers of finished leather to overseas markets.

⭐️Own 'Red Tape' brand

#stockmarkets

#MIRZAINT

⭐️Founded in 1979, Mirza is India’s leading leather footwear manufacturer

⭐️ It is preferred supplier of leather footwear to international brands.

⭐️One of the largest Indian suppliers of finished leather to overseas markets.

⭐️Own 'Red Tape' brand

#stockmarkets

3/🧵

#mirzaint

Mirza has integrated operation through vast infra:

Raw materials from their own tannery ➡️Inhouse design ➡️Manufacturing the footwear in-house ➡️Brands are marketed through a pan-India network of company-owned outlets/E-comm.

#investing #stockmarkets #stocks

#mirzaint

Mirza has integrated operation through vast infra:

Raw materials from their own tannery ➡️Inhouse design ➡️Manufacturing the footwear in-house ➡️Brands are marketed through a pan-India network of company-owned outlets/E-comm.

#investing #stockmarkets #stocks

Writing threads on #Fundamentals of a stock has been trending so why not thread on explaining #Technicals of a stock!

"Here is a thread analyzing Technical charts of #Cignitech" - Answer of #chart kya bolta hai.

It gave a rounding bottom + 7 yrs of consolidation breakout!

1/n

"Here is a thread analyzing Technical charts of #Cignitech" - Answer of #chart kya bolta hai.

It gave a rounding bottom + 7 yrs of consolidation breakout!

1/n

Whys #NavPancham considered generally good?#NavPancham is #Genesis, #Progression, #CauseEffect relations. In #KaalPurush #Kundali, if #Jaatak is denoted by #Lagan, his/her progeny is denoted by the #PanchamBhaav while the father of this #Jaatak is the #NavamBhaav of the #Chart...

Many ancient #Astrologers have expressed that a #Bhaav can find #Catalyst 5 houses behind itself or 9 houses away from itself (same thing).

So in effect if there is any good connection of the #Navam #Bhaav with the #Lagan (or #Navam #Bhaav from any other #Bhaav) ...

So in effect if there is any good connection of the #Navam #Bhaav with the #Lagan (or #Navam #Bhaav from any other #Bhaav) ...

the particular #Bhaav in question can get #SuPrabhaav. The #Lagan or any other #Bhaav is always the #PanchamBhaav from the #Navam.Hence the theory- #NavPancham, is generally considered #YogKaarak.

Basic theories apply as always...

Explaining #Shadow #Grah #Rahu...

Basic theories apply as always...

Explaining #Shadow #Grah #Rahu...

The Best of #Finance #Twitter

.

#Thread

.

Thanks @VolQuant for sharing (!) 👍 and @HSBC trading desk for preparing 👏

.

#EmergingMarkets #forex #cryptocurrency #bitcoin #Macroeconomics #fx #trading #chart #equities #vol

.

Updates at the end of the thread

.

#Thread

.

Thanks @VolQuant for sharing (!) 👍 and @HSBC trading desk for preparing 👏

.

#EmergingMarkets #forex #cryptocurrency #bitcoin #Macroeconomics #fx #trading #chart #equities #vol

.

Updates at the end of the thread

Thread 🧵on how to read #Candlestick Chart.

Most basic thing to learn first if you are thinking to learn #TechnicalAnalysis

🙏RT to maximize reach 🙏

@rohanshah619 @chartmojo @ArjunB9591 @Puretechnicals9 @RTSTOCKVIEW views welcome

Most basic thing to learn first if you are thinking to learn #TechnicalAnalysis

🙏RT to maximize reach 🙏

@rohanshah619 @chartmojo @ArjunB9591 @Puretechnicals9 @RTSTOCKVIEW views welcome

A #candlestick is a type of price #chart used in #technicalanalysis that displays the high, low, open, and closing prices of a security for a specific period.

#CandlestickCharts were originally used by 17th century rice traders in Japan, today they are used by traders and investors around the world to trade in securities.

#TechnicalAnalysis

#TechnicalAnalysis

Was doing #Gochar #Transit analysis for a #Libra #Jaatak #Kundali when I stumbled upon a very powerful #Astro event taking place in ALL #Libra #Charts but also potentially quite damaging for the #Jaatak if their #Natal #Chart or #Lagnesh is weak...

#deepaknitrite

@nishkumar1977

Info Thread on DN

Deepak Nitrite Upcoming Expansion Plans for next 6 months

1/Large CoGen Plant to help margins.

2/ Brownfield expansion for Pharma and Agro intermediaries

3/ New Phenol Derivative products.

4/ IPA Capacity to double 60,000 TPA.

@nishkumar1977

Info Thread on DN

Deepak Nitrite Upcoming Expansion Plans for next 6 months

1/Large CoGen Plant to help margins.

2/ Brownfield expansion for Pharma and Agro intermediaries

3/ New Phenol Derivative products.

4/ IPA Capacity to double 60,000 TPA.

Important Event -> Anti Dumping Duty on Phenol can be a huge game changer (Currently provisional anti dumping duty has been imposed ). Can add about 100 - 150 crores to bottom line if it gets approved.

Deepak nitrite already has bough 125 acres of land for future expansion.

Deepak nitrite already has bough 125 acres of land for future expansion.

Technically currently its bearish but right at support levels of 750 - 755.

Q2 numbers should be healthy with speciality chemicals and phenolics perfroming well . Performance products should be laggard again but better than Q1. Expecting an eps of 10 plus this quarter.

#Chart

Q2 numbers should be healthy with speciality chemicals and phenolics perfroming well . Performance products should be laggard again but better than Q1. Expecting an eps of 10 plus this quarter.

#Chart

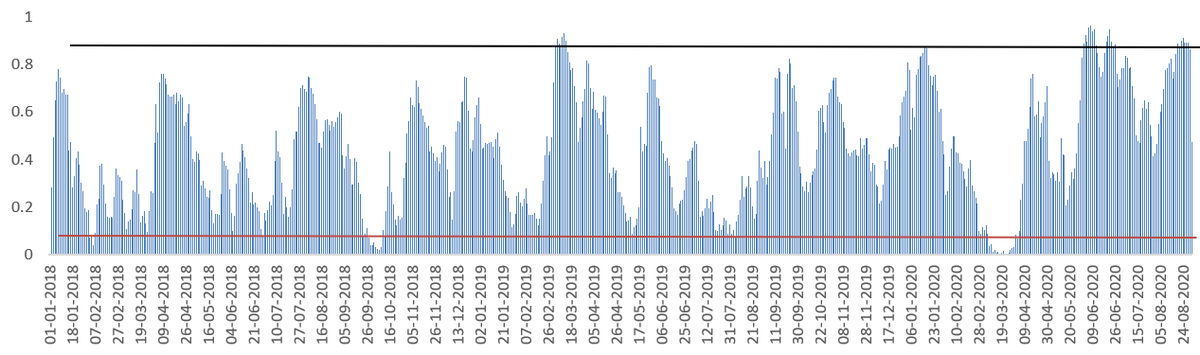

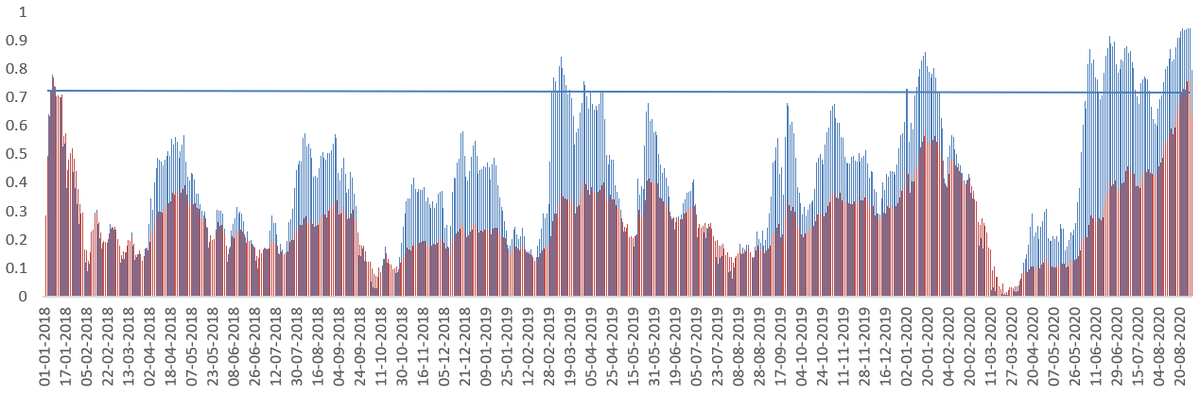

I track universe of these ~900 companies (by market cap). Below are some charts to give a sense of how things of moved in last few year and last few weeks. Data is from 1st Jan 2018 to 31st Aug 2020

#chart1 : % of stocks closed above 50 DEMA n 200 DEMA. Insight: After Jan 1, 2018, last week was 2nd occasion when >70% of stocks have hit closing price > 200 DEMA

Blue bar: Close>50 DEMA, Red: Close>200 DEMA (DEMA: Day Exponential Moving Average)

Blue bar: Close>50 DEMA, Red: Close>200 DEMA (DEMA: Day Exponential Moving Average)

#Chart2: Close > 20 DEMA. Extreme behavior <10% and >90% are rare. In last 2.8 year, <10% has happened across only 2 months (ILFS Crisis and Corona Crisis). However, in last 3 years, this is longest continuous occasion of 2-3 months when close price > 20 DEMA for >90% of stocks